-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(5): 154-158

doi:10.5923/j.ijfa.20170605.04

The Relationship between Interest Rate and Stock Market Index in Zambia –A Cointegration Analysis

Nsama Musawa, Clement Mwaanga

Department of Business Studies Mulungushi University, Kabwe, Zambia

Correspondence to: Nsama Musawa, Department of Business Studies Mulungushi University, Kabwe, Zambia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The Lusaka securities exchange is one of the developing stock market in Southern Africa. It is therefore imperative to study the factors that can contribute to its development. One of such factors is the interest rates. According to Ali (2014) the higher the interest rate, the lower the efficiency of the stock market, this is because if investors are getting higher returns from investments like bonds and treasury bills they will invest less in stocks. This implies that interest rates should have a negative relationship with the stock market performance. However, this relationship is not obvious because some studies have found a weak or no relationship between the interest rates and the stock price (Muthukumaran and Somasundaram, 2014; Khan et al, 2012; Chirchir, 2013). This study, therefore, sought to investigate the relationship between Interest rates and stock price index in Zambia. Cointegration analysis was used to estimate the long rung relationship and the Error Correction model was used to estimate the short term relationship on stock price index, and interest rates for the period 2004-2016. The results indicate the existence of cointegration (long run) and short run relationships between the stock price index, and Interest rate. The policy implication of this study is that if the interest rate is considerably controlled by reducing it, it will be of great benefit to the borrowers (companies and individuals) as they will access cheaper capital. Most importantly, it will be of great benefit to the development of the stock market in Zambia as this will act as a demand pull way of more investors from investing in debt to investing in stocks. In the long run this will result in economic growth. Among the ways that the Central bank can use to reduce the landing rates is by reducing the Minimum Rediscount Rate (MRR). Reducing the Minimum Rediscount Rate (MRR) will have a spillover effect on the reduction of lending rate as this is the rate at which the central lends to commercial banks hence, it sets the floor for the interest rate regime in the money market. Furthermore the central bank should consider reducing the Reserve Requirement of the deposit that commercial banks deposit with the central bank so as to increase the money supply which may contribute to the reduction of interest rates in the long run.

Keywords: Stock price index, Interest Rate, Cointergration, Error Correction mode

Cite this paper: Nsama Musawa, Clement Mwaanga, The Relationship between Interest Rate and Stock Market Index in Zambia –A Cointegration Analysis, International Journal of Finance and Accounting , Vol. 6 No. 5, 2017, pp. 154-158. doi: 10.5923/j.ijfa.20170605.04.

Article Outline

1. Introduction

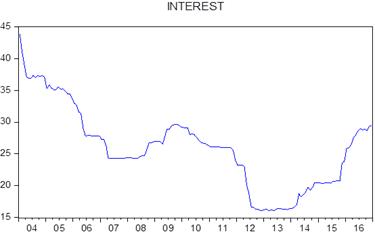

- The Lusaka stock Exchange (LuSE) price index has been fluctuating in the past decade; In 2016 it declined by an Average of 26% in local currency. Zambia’s lending interest rate has equally been fluctuating as shown in figure 1 below. According to Ali (2014) the higher the interest rate, the lower the efficiency of the stock market, this is because if investors are getting higher returns from investments like treasury bills they will invest less in stocks. Empirical studies on the relationship between interest rates and stock market have shown mixed results. Some have found a long run relationship (Alam and Uddin, 2009; Thang, 2009). While others have found a weak or no relationship all together (Muthukumaran and Somasundaram, 2014; Khan et al, 2012; Chirchir, 2013). Using, Cointegration analysis and the Error Correction model on stock price index, and interest rates for the period 2004-2016. This study sought to estimate the long and the short run relationship between Interest rates and the stock price index.

| Figure 1. Zambias lending rates (Source bank of Zambia) |

2. Literature Review

- Empirical findings testing the impact of interest rates on the stock market from developed and developing economies have shown mixed results. This is because the relationship between interest rates and stock returns can be time-varying depending on the countries' economic activities (Chen, and Hu, 2015). The study by Alam and Uddin (2009) which was done based on data from fifteen developed and developing countries showed that for all of the countries under study the interest rate had a significant negative relationship with the stock price. The study used data from January 1988 to March 2003 and used both time series and panel regressions to analyze it. A similar study from Bangladesh showed a negative relationship that the interest rate has on the stock market (Uddin, and Alam, 2010).Using the five year period from 2010 to 2014 and structural vector autoregressive Chen & Hu, (2015) confirmed the interaction between interest rates and stock returns in China.Thong (2009) applied the Johansen cointegration test, Vector Error Correction Model (VECM) and Granger Causality to search for the long run and short-run relationship in Malaysia. The results showed both a long run and the short run relationship between interest rates and stock price.Ali (2014) used Correlation and Regression analysis to assess the impact of interest rates on the Pakistani Stock market performance. He found that interest rate has a negative impact on the stock market.On the other hand, some studies have found a weak or no relationship. One such study is the one done by Muthukumaran and Somasundaram (2014). They estimated the causality relationship between interest rates and stock returns in India. They used monthly data from 1997 to 2014. The study revealed that there was no short run causality between interest rate and stock returns and concluded that the interest rate did not affect stock returns in India.Most studies from emerging and developing economies have revealed a cointergration between stock markets and other economic variables. One such study was done by Khan et al, (2012) from Kenya. Using regression and a ten years monthly data period, this study revealed a weak relationship between the stock performance and the interest rates. Stock performance was measured by the stock index while the interest rate by the Treasury bill rate. In another related study from Kenya Chirchir (2013) found no significant causal relationship between interest rate and share price. Obura and Anyango (2015) found similar results although they used a shorter period.Barakat, Elgazzar and Hanafy (2015) did a similar study from two emerging economies (Egypt and Tunisia) for the period from January 1998 to January 2014. The results revealed a co-integration and a causal relationship between market index, exchange rate, money supply, and interest rate.A study from Zimbabwe (Kganyago and Gumbo 2015) showed evidence of strong and statistically significant inverse causal relationship between money market interest and stock market returns. The research examined the long run relationship between the money market, interest rates and stock market returns in Zimbabwe from April 2009 to December 2013 using Johansen cointegration tests. Similar results were found by Mbulawa (2015) that used Vector Error Correction Model (VEC) to empirically examine the connection between stock market performance, exchange rates and interest rates.From Nigeria Osamwonyi and Evbayiro-Osagie (2012) attempted to determine the relationship between macroeconomic variables and the Nigerian capital market index. It considered the yearly data of several macroeconomic variables of interest rates, inflation rates, exchange rates, fiscal deficit, GDP and money supply from 1975 to 2005. They used the Vector Error Correction Model (VECM) to study the short-run dynamics as well as the long-run relationship between the stock market index and the six selected macroeconomic variables from the Nigerian economy. The major finding was that macroeconomic variables influence stock market index in Nigeria. Similar results were found by Nkoro Uko (2013) and Ayopo, Isola and Olukayode (2015).Laichena and Obwogi (2015). These studies sought to find out the effects of interest rates, currency exchange rate, inflation rate and GDP on stock returns on stock returns in East Africa. The study relied on fisher’s theory of interest rates, the purchasing power parity theory, the classical theory of growth, and the arbitrage pricing theory (APT). Using A panel data of 3 East African countries, Kenya, Uganda and Tanzania, over 2005 to 2014 and panel data regression analysis to analyse the data. They found a significant relationship between the macroeconomic variables in the study and stock returns in East Africa.A recent study from Zambia by Shula (2017) used regression analysis and found the negative impact between interest rate and stock price index. However, his study did not show a long run and short run relationship. Therefore this study would like to cover this gap by doing a cointergration analysis.In another recent study from Zambia, Musawa and Mwaanga (2017), used Auto regression Distribution Lag and Cointegration analysis and the Vector Error Correction model to investigate the effect of commodity prices interest rates, and exchange rates on the stock price index. The findings of the study revealed that jointly Interest rates, exchange rates, copper and Oil price have a long and short run impact on that Lusaka Stock Market.As can be observed from the foregoing, empirical findings investigating the impact of interest rates on the stock market from developed and developing economies have shown mixed results depending on the methodology used and economic activities of the countries involved.

3. Data and Methodology

- Comparable to Thang (2009), this study used a Johansen cointegration test methodology to estimate the long run relationship and Vector Auto Regression (VAR) to estimate the short run relationship. The study period was 2004 to 2016. The dependent variable was Lusaka Securities share price index (LuSE Price index) which was obtained from the Lusaka Securities Exchange and was used as a proxy to measure the stock market performance. The average lending rates obtained from the Bank of Zambia was used as the independent variable. The following hypotheses were tested.H1: There is no long run relationship between interest rates and the LuSE Price index.H2: There is no short run relationship between interest rates and the LuSE Price index.

4. Results

- Graphical analysis and econometric models were used to analyze the data on the LuSE price index, and Interest rates.

4.1. Graphical Analysis

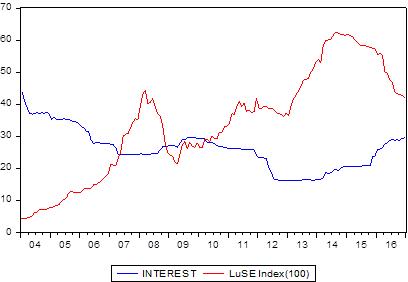

- Figure 2 below shows a graphical analysis of the LuSE Price Index and Interest Rate for the period 2004 to 2016. The two variables show a negative relation as they moved in the opposite direction.

| Figure 2. Graphs showing the Stock Index and Interest rates (Source: Bank of Zambia and Lusaka Securities Exchange) |

4.2. Econometric Modelling

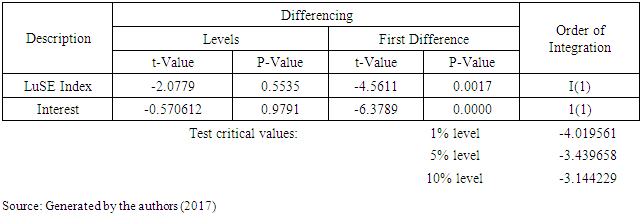

- This study used Johansen (1996) cointegration test methodology to estimate the long run relationship and Vector Auto Regression (VAR) to estimate the short run relationship between the Interest rates and the stock price index.Before the estimates were done some diagnostic tests were performed. The first was the test for of normality of the dependent variable stock price index. The normality test was satisfied as the Jarque-Bera statist of 5.9063 with the probability of 0.0521 was observed.The Augmented Dickey-Fuller (ADF) tests under trend and the intercept was used to test the stationarity of the data. The result in Table 1 below shows that both the LuSe price index and the interest rate were stationery after first differencing. This can be observed from the t-values of 4.5611 for the stock price index and the t-values of 6.3789 for interest rates which are both greater than all the critical values of 4.5611, 4.0195 and 3.1442 in absolute terms at all levels of significance.

|

4.2.1. Long Run Cointegration Test

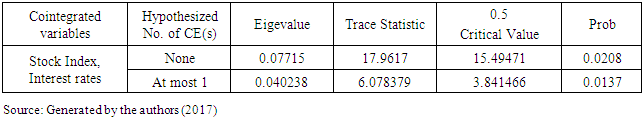

- Since the variables were stationary after the first difference, a cointegration test was done in order to estimate the long run relationship. Table 2 below shows the results for the Johansson cointegration test done using a leg length of seven which was selected as an appropriate based on the Final Prediction Error (FPE) and Akaike Information Criterion (AIC) of Eviews.

|

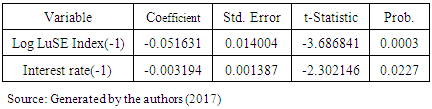

4.2.2. Auto Regression Distribution Lag Bound Tests

- Having established that the variables had a long run relationship, there was need to estimate the impact, hence Auto Regression distribution lag bound tests was done to establish the long run coefficients. Table 3 shows the results for the Auto Regression distribution lag bound tests.

|

4.2.3. Short Run Estimation Based on Error Correction Model (ECM)

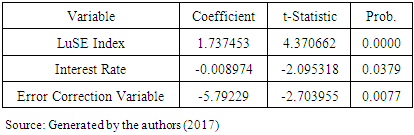

- The short run estimation was based on Error Correction Model (ECM). Table 4 shows the results, the coefficient of a constant is 1.737453 and is statistically significant. This shows that interest rate has a short run impact on the stock index. Hence the null hypothesis of no shot run relationship between interest rates and the LuSe Stock Price index was rejected. Similar results were observed (Alam and Uddin, 2009; Thang, 2009; Nordin et al, 2014).

|

5. Conclusions

- This study investigated the relationship between Interest rates and the Lusaka Securities and Exchange price index. The cointegration analysis shows the presence of the long run relationships. The Error Correction Model (ECM) also confirms the existence of short run relationships between the stock price index and Interest rates. The policy implication of this study is that, the central bank should control the interest rate by reducing it. One way the Central Bank could do this is to reduce the Minimum Rediscount Rate (MRR). Since this is the rate at which it lends to commercial banks it sets the floor for the interest rate regime in the money market, hence reducing it will have a spillover effect on the reduction of lending rates. Furthermore the central bank should consider reducing the Reserve requirement of the deposit that commercial banks should deposit with the central bank. This Fractional reserve limits the amount of loans banks can make to the domestic economy and thus limit the supply of money, so if this reserve is reduced it will increase the money supply hence reducing lending interest rates. If the interest rate is considerably controlled by reducing, it will be of great benefit to the stock exchange market in Zambia as this will act as a demand pull way of more investors from investing in debt to investing in stocks.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML