-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(5): 145-153

doi:10.5923/j.ijfa.20170605.03

Effect of Corporate Governance on Risk Management of Commercial Banks in Nigeria

Obasi Ama Ibiam1, Nkwagu Louis Chinedu2

1Akanu Ibiam Federal Polytechnic, Unwana, Nigeria

2Accountancy Department, Ebonyi State University, Abakaliki, Nigeria

Correspondence to: Obasi Ama Ibiam, Akanu Ibiam Federal Polytechnic, Unwana, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The main objective of the study is to examine the effect of corporate governance on risk management of commercial banks in Nigeria. Specifically, the study sought to ascertain the influence of board committees on the liquidity risk of banks in Nigeria. The study adopted ex-post facto research design. Simple random sampling had been applied in the selection of banks used in the study. The effect of independent variable on the dependent variable was examined using ordinary least square regression method. The result of the hypothesis tested in specific terms showed that board committees negatively but significantly influences the liquidity risk of commercial banks in Nigeria. This implies that increase in the number of board committees will result to decrease in the way commercial banks in Nigeria manage their liquidity risk. The study recommends that the number of board committees of commercial banks in Nigeria should be small in order to be effective and efficient in their risk management functions.

Keywords: Corporate Governance, Board Committees, Risk Management, Liquidity Risk

Cite this paper: Obasi Ama Ibiam, Nkwagu Louis Chinedu, Effect of Corporate Governance on Risk Management of Commercial Banks in Nigeria, International Journal of Finance and Accounting , Vol. 6 No. 5, 2017, pp. 145-153. doi: 10.5923/j.ijfa.20170605.03.

Article Outline

1. Introduction

- Financial institutions are usually faced with liquidity risk when they are unable to sale off their assets on time and on a price that is fair and reasonable without incurring or allowing a decline in their earnings. Liquidity gap may arise in a financial institution as a result of mass withdrawal of deposits by customers (Kumar, 2008). Massive withdrawal of deposit is not necessarily the primary source of liquidity risk in a financial institution as they are other various types of scenarios that could cause liquidity risk in a financial institution (Holmstrom and Tirole, 2000; Diamond and Rajan, 2005). Such scenarios involve long-term lending and large commitment base (Diamond and Rajan, 2005). This is due to the fact that large commitment and extensive long-term lending may push financial institutions into a liquidity risk especially in a period of liquidity pressure as they are bound to honour them as they become due. However, it is worthy to mention that when an asset or liability can be sold without any significant loss, financial institutions need not to be concerned about its asset-liability maturity transformation. Liquidity risk may also arise due to economic recession. Liquidity risk arising due to economic downturn can cause banks or the entire banking industry to fail. This is because of mass withdrawal of fund by depositors occasioned by low revenue generation during the period of severe economic crisis (Diamond and Rajan, 2005). Liquidity risk is also likely to occur when a project is terminated early or there is a breakdown or delay in cash flow from customers or borrowers (Diamond and Rajan, 2005). Moreover, Ahmed and Ahmed (2012:185) state that:Liquidity risk may also originate from the very nature of banking; macro factors that are exogenous and financing and operating policies that are endogenous. A severe liquidity crisis may cause massive drowning in form of bankruptcies and bank runs leading to a drastic financial crisis.Liquidity risk will affect both the reputation of a bank and its financial performance in any part of the world (Jenkinson, 2008). Depositors’ confidence may be lost especially if bank is not liquid enough to meet up with their demand as at when they required it thereby affecting the image of the bank negatively. For instance, the image of the Nigerian banking industry has been affected in recent years due to liquidity problem. Many commercial banks in Nigeria have faced different liquidity challenges which led to decrease in depositors’ confidence as well as massive withdrawal of funds and panic among bank customers and the general public. Most of the commercial banks published annual reports that suggest they were liquid and have the ability to attend to their numerous customers as at when due when they were not. In an attempt to address this problem, the Central Bank of Nigeria being the regulator of bank practices in the country started investigating the liquidity position of various commercial banks in Nigeria in a bit to improve the image of Nigerian banking industry and improve their capacity to satisfy the need of their numerous customers. During the exercise, some banks were found to have serious liquidity problem and they were dully penalized. This led to a spate of failures of nine banks. Bank PHB Plc, Equitorial Trust Bank Limited, Afribank Plc, Intercontinental Bank Plc, Spring Bank Plc, FinBank Plc, Unity Bank Plc, Union Bank, and Oceanic Bank International Plc were among the banks that failed the joint test which led to the removal of their Chief Executives and Managing Directors as well as bail-out of five (5) of the affected banks (Union Bank, FinBank Plc, Afribank Plc, Intercontinental Bank Plc and Oceanic Bank International Plc) in order to prevent a lot of depositors from losing their money (Uwuigbe, 2011; Ojeka, Iyoha and Ikpefan, 2014). Therefore, maintaining a sufficient liquidity is not an option to any bank in Nigeria but a necessity as failure to do so will lead to massive withdrawal funds by the depositors and penalties from CBN. Akhtar (2007:16) posits that:High competition for customer deposits, a wide array of funding products in wholesale and capital markets with technological advancements have changed the funding and risk management structure in the banking industry.The inability of a financial institution in Nigeria to maintain appropriate liquidity will result in failures or financial crisis irrespective of their strong earnings, capital base and the quality of its assets (Akhtar, 2007). It therefore, becomes imperative for financial institutions in Nigeria to put up measures that will help them to deal with the challenges that will arise due to fluctuations in monetary policy. It is expected that good corporate governance mechanisms such as board committees among others will positively influence the sector’s development and also plays a significant role in reducing their liquidity risk through better channeling of money circulation and other financial transactions. It is against this backdrop that the study seeks to determine the effect of board committees on liquidity risk management of commercial banks in Nigeria. Specifically, the study examines the influence of board committees on liquidity risk management of commercial Banks in Nigeria as a measure of risk management. The study makes contribution in different ways. First, whereas prior studies within Nigerian context have considered the effect of corporate governance on financial performance of banks none has considered the influence of board committees on liquidity risk management of commercial banks in Nigeria. This study makes contribution by bridging the literature gap. Secondly, it contributes to the literature on corporate governance and risk management in emerging markets like Nigeria. The rest of the study is organized as follows: conceptual review, theoretical review, empirical review, method, discussion of results, conclusion and recommendations.

2. Conceptual Review

- Corporate GovernanceSequel to the recent financial crisis witnessed all over the world especially in the banking sector, the issue of corporate governance has become a talk about both in non academic settings and academic environment. As result there is no clear and generally acceptable definition of corporate governance among scholars. Most of the studies reviewed have defined corporate governance in different ways especially as it concern power of owners, managers and providers of capital (Solomon, 2010). Shleifer and Vishny (1997) argued that corporate governance deals with the ways in which the returns on investment of shareholders of an organization are guaranteed. Similarly, Cadbury report (1992) and the Sarbanes-Oxley Act (2002) also narrowly described corporate governance as an arrangement through which the affairs of shareholders are managed and controlled. Furthermore, Hart (1995) defined corporate governance as the interaction involving shareholders and the senior management of companies with board of directors acting as the mediator. Pandey (2006) asserts that corporate governance is a process that ensures responsibility, transparency and accountability functions of management in order to maximize shareholders wealth and take decisions to boost its financial performance. A broader view of corporate governance entails incorporating the interest of stakeholders such as management, shareholders, customers, creditors, government and other stakeholders in the affairs of the organization. In this regard, corporate governance has been defined as a set of institutional arrangements for governing the interest of all the stakeholders who have contributed in one way or the other (Blair, 1995). Rogers (2008:4) opines that: Corporate governance is about building credibility, ensuring transparency and accountability as well as maintaining an effective channel of information disclosure that would foster good corporate performance. It is also about how to build trust and sustain confidence among the various interest groups that make up an organization.Similarly, Salvioni, Gennari and Bosetti (2016) posit that corporate governance is a combination of structures and processes. While the structure refers to all the bodies responsible for the firm’s direction and control, the processes consist in the activities developed to satisfy the stakeholders’ expectation. Corporate governance therefore specifies the ways by which corporations are directed and guarded. The structure of corporate governance outlines the way in which stakeholders’ rights and responsibilities are shared and distributed. Corporate governance provide a framework through which management and boards provide a transparent, fair and efficient environment that are needed to satisfy the interest of all the stakeholders (management, supplier of capital, government, creditors, the host communities, depositors and other stakeholders) as well as to achieve the long run goals of an organization while complying with the regulatory and legal requirements of the industry (Bairathi, 2009). Principles of Corporate GovernanceChris (2006) sees sincerity, dependence and reliability, straight forwardness, performance orientation, accountability and answerability, mutual revere and dedication to the organization as the basics of good corporate governance principle. However, for good corporate governance to be enhanced, it is important to obey the basic principles governing corporate governance all over the world. Oso and Semiu (2012) opined that privileges and equal handling of shareholders; concern of stakeholders; function and responsibilities of the board of directors; uprightness and moral conduct; and transparency and disclosure are the basic principles of corporate governance. These basic principles are as discussed below: 1. Rights and Equitable Treatment of Shareholders: The shareholders of an organization have certain fundamental rights and privileges which an organization must to their very best uphold and protect without any form of restriction whatsoever (Such rights include but not limited to: right to receive notice of annual general meeting, attend them and vote; rights to receive their share of the organization’s profit or loss; rights to receive consolidated annual reports and accounts of the organization; rights to audit or inspect the statutory books of the organization etc.). The organization is to ensure that these rights are given clear interpretation and are simplified enough to enable shareholders have a better understanding and a working knowledge of their involvement or participation in the activities of the organization via annual general meetings. There should be equality in the treatment of the various shareholders in an organization such as majority shareholders, minority shareholders foreign shareholders as contained in the framework of corporate governance. 2. Interest of Stakeholders: Stakeholders are those individuals or groups that have an interest in an organization and whose organizational activities are likely to affect them. Such individuals or groups include: shareholders who are concerned with the profit of an organization; employees who are interested in their job safety and payment of wages as at when due; government who are interested in tax payment; creditors who wants their money to be paid as at when due, depositors who want safety for their deposits etc. it therefore, become imperative for organizations to fulfill the interest of their stakeholders at all times through adequate recognition of their interest in their policies and operations. 3. Roles and Responsibilities of the Board of Directors: The board of directors is the highest decision making organ of an organization. Their roles and responsibilities include: ensuring that proper books of accounts are kept and maintained in an organization; that there is effective communications among the various stakeholders; maintain an effective system of internal control; determine and set appropriate strategy that an organization needs to pursue and how to achieve them; they are to ensure that the activities of the organization are well aimed at influencing its profitability while meeting the needs of the various stakeholders; the board of directors are also expected to deal with those issues that relate with corporate governance and risk etc. It therefore, becomes imperative for board members to have the required knowledge and expertise to effectively make good decisions that will enhance liquidity risk management. The size of the board should be sufficient enough with appropriate level of commitment to carry out their duties and responsibilities satisfactorily.Board committeesBoard committees are internal committees that supervise and regulate the activities of board of directors in a more effective way (RBZ, 2004 cited in Progress, Hlanganipai and Godfrey, 2014). Board committees is further defined as an additional mechanism usually employed by an organization in order to control and give confidence in the accountability function of management and the financial management of an organization so as to protect the interest of shareholders (Cadbury Report, 1992). They are calculated as the total number of board committees a bank has at the end of each accounting period. It was chosen as the proxy for corporate governance since it is in line with the literature. Bussoli (2013) opined that the establishment of board committees is the point of reference for better functioning of banks, as the number of board committees is statistically significant to banks liquidity risk. Bank failures in the past had been on the inadequacy of governance structures to take corrective actions by the boards of failed banks (George and Karibo, 2014). As a result boards should nominate sub-committees to aid in resolving this problem. However, the number of board committees that is operational in an organization will also affect board effectiveness as such Cadbury report, 1992; Sarbanes-Oxley Act, 2002; Uk Combined Code, 2006 suggested that an organization’s board that wants to perform effectively should have the following committees namely; a credit committee (which are both usually characterized by high competence and expertise; a board audit committee (which is typically independent) and a risk management committee. These committees contribute better to liquidity risk management than other committees such as a nomination committee. This is because the smaller the size of board the better as it will enable them to meet more regularly in order to promote effective decision making as well as attain reasonable discussion and analysis (Jegede, Akinlabi and Soyebo, 2013; Progress et al., 2014). However, Central bank of Nigeria code of corporate governance for financial institutions and discount house (2014) permitted Deposit Money Banks in Nigeria to have at least six board committees such as nomination committees; remuneration committees; risk management committees; board audit committees; board credit committees; finance and general purpose committees among others. A Nomination Committee should be established to make recommendations to the Board on all new Board appointments. A majority of the members of this Committee should be non-executive directors, and the Committee Chairman should be a non-executive director. The Nomination Committee should recommend an evaluation procedure for the Board and propose objective performance criteria, which should be approved by the Board. A Risk management Committee should be established to provide oversight of management’s activities in managing credit, market, liquidity, operational, legal and other risks of the institution. Audit Committees should consist of equal number of directors and shareholders representative. The majority of such director members should be non-executive, with written terms of reference that deal clearly with its authority and duties. The duties of the Audit Committee should include keeping under review the scope and results of the audit and its cost effectiveness and the independence and objectivity of the auditors. Where the auditors also supply a substantial volume of non –audit services to the institution, the Committee should keep the nature and extent of such services under review, seeking to balance the maintenance of objectivity and value for money. Laux and Laux (2009) opined that a board audit committees is one of the most important committee within the board of directors. It is responsible for ensuring compliance with regulations and supervising the bank’s operations and it ensures that a control system is in place and the financial data disclosed are accurate. The member in the committees should have sufficient experience in accounting, auditing and risk management to handle its responsibilities (Bates and Leclerc, 2009). This function is necessary to ensure that effective corporate governance and responsibilities to stockholders are satisfied. Remuneration Committees comprises mainly non-executive directors: the responsibility of this committee include but not limited to make recommendations to the Board on the institution’s policy framework of executive remuneration and its cost; to determine, on behalf of the Boards, specific remuneration packages for each of the Executive Directors, including pension rights and any compensation payments and to determine the compensation of senior executives. The Board should recommend to the General Meeting the remuneration of non-executive directors, including members of the Remuneration Committee. The remuneration Committee should be chaired by a non- executive director, who is independent of management and free from any business or other relationship which could materially interfere with the exercise of the director’s independent judgment. The Remuneration Committee should determine the packages needed to attract, retain and motivate executive directors of the quality required but should avoid offering more than is necessary for this purpose. Remuneration Committees should judge where to position their company relative to other institutions. They should be aware of what comparable companies are paying and should take account of relative performance. But they should use such comparisons with caution, in view of the risk that they can result in an upward ratchet of remuneration levels with no corresponding improvement in performance. The Board Credit Committee was set up to assist the Board of Directors to discharge its responsibility to exercise due care, diligence and skill to oversee, direct and review the management of the credit portfolio of the Group. Its terms of reference include determining and setting the parameters for credit risk and asset concentration and reviewing compliance within such limits; determining and setting the lending limits, reviewing and approving the Group’s credit strategy and the credit risk tolerance. The Committee also reviews the Loan portfolio of the Bank. It also reviews and approves country risks exposure limits. Risk Management Committee: The responsibilities of the Committee include to review and recommend risk management strategies, policies and risk tolerance for the Board’s approval; to review management’s periodic reports on risk exposure, risk portfolio composition and risk management activities; and to consider and examine such other matters as the Board requires, the Committee considers appropriate, or which are brought to its attention, and make recommendations or reports to the Board accordingly.Finance and general purpose committees: The purpose of the Finance and General Purpose Committee is to, amongst other things; discharge the Board’s responsibilities with regard to strategic direction and budgeting and to provide oversight on financial matters and the performance of the Group. Liquidity Risk Liquidity risk is a risk arising from a bank’s inability to meet its obligations when they come due without incurring unacceptable losses (Comptroller of the Currency, 2001 in Ahmed and Ahmed (2012). This risk can adversely affect both bank’s earnings and the capital. Therefore, it becomes the top priority of a bank’s management to ensure the availability of sufficient funds to meet future demands of providers and borrowers, at reasonable costs. According to SBP in Ahmed and Ahmed (2012) liquidity risk is the potential for loss to an institution, arising from either its inability to meet its obligations or to fund increases in assets as they fall due without incurring unacceptable cost or losses. It is the risk of being unable to liquidate a position timely at a reasonable price. Liquidity risk is one of the major risks faced by financial intermediaries in Nigeria and commercial banks in particular. This was cleared demonstrated in the recent financial crisis. The traditional functions of commercial banks are the transformation of maturity and the provision of liquidity. Banks transform short-term liquid liability to demand depositors and also to borrowers to whom they provide lines of credit. However, in performing these functions they are transferring liquidity risk from their customers to the banks, thus exposing the bank to this risk. In 2010 commercial banks in Nigeria encountered specific liquidity problems (withdrawal of funds) as well as “evaporation” of liquidity in the markets that created solvency problems. There were provided with liquidity by bailed out by the federal government or became insolvent and had to sell themselves. This demonstrated that liquidity is a major risk in banking and liquidity management should be a top priority for bank management and regulators to ensure the availability of sufficient funds to meet future demands of providers and borrowers, at reasonable costs. Maintaining effective liquidity risk will help banks to ensure cash flow obligations, which are uncertain as they are affected by external events and other agent behavior.Managing liquidity riskLiquidity risk is very important element in the financial risk management of the banking industry (Majid, 2003). In order to manage liquidity risk it is important for commercial banks to have a good mechanisms that will enable them to timely evaluate, recognize, observe and control their liquidity risk sources so as to avoid unacceptable losses (Comptroller of Currency, 2001 cited in Ahmed and Ahmed, 2012). The dependence of all the stakeholders of commercial banks upon the capital market and the ever increasing complexity in the statement of financial positions of commercial banks has resulted in making liquidity risk management of commercial banks more demanding (Guglielmo, 2008). Furthermore, Guglielmo (2008:185) opined that “banks having enhanced exposure in the capital markets must have a deep understanding of the risks involved”. This implies that those mechanisms required to managing liquidity risk more effectively needs to be developed by commercial banks. In order to manage liquidity risk, commercial banks in Nigeria may place emphasis on the ratio of cash and cash equivalent to total deposits. Moreover, liquidity risk could be alleviated when the cash reserve requirement is augmented. Ahmed and Ahmed (2012:186) further posit that: Liquidity risk of an asset should be based on its capacity to generate the liquidity, instead of its trading book classification or its accounting treatment. To uphold a liquidity buffer, comprising of cash and liquid assets. This buffer provides a cushion to withstand the liquidity stress in a survival period. Moreover, the central bank imposes the condition of cash reserve requirement (a least amount that a bank is required to maintain at all times of its operation) to overcome the liquidity problems. A bank always tries to avoid the capital injection from the government because this may place a given bank at the government’s mercy. Therefore, banks hold minimum cash balance to avoid liquidity problems.Gatev and Strahan (2003) submit that the central bank deposits requirements provide a natural hedge to commercial banks against liquidity risk. Njogo (2012) states that in order to manage liquidity risk, the following principles must be observed by commercial banks in Nigeria: 1. Financial institutions should establish a robust liquidity risk management framework that ensures it maintains sufficient liquidity, including a cushion of unencumbered, high quality liquid assets to withstand a range of stress events, including those involving the loss or impairment of both unsecured and secured funding sources. A framework for managing a sound and strong liquidity risk should be established by financial institutions in order to ensure with a high degree of confidence that financial institutions are in a position to both address its daily liquidity obligations and withstand a period of liquidity stress affecting both secured and unsecured funding. Also financial institutions especially commercial banks should ensure that they maintain a satisfactory level of assets that can easily be sold in order to ensure they are in a position to survive in a financial crisis period. Furthermore, liquidity risks management such as liquidity limit, cushion and control functions should not be hampered due to pressure from competitors. Bank regulators and other relevant agencies should careful supervise the industry in order to prevent them from minimizing their liquidity limit due to the likely assurance from depositors’ insurance and the central bank to provide liquidity support to them whenever they are in need of liquidity to meet their expectations. Supervisors should assess whether each bank manages liquidity risk robustly to maintain sufficient liquidity and should take supervisory action if a bank is not holding sufficient liquidity to enable it to survive a period of severe liquidity stress. 2. A liquidity risk benchmark in light of business objectives, strategic direction and overall risk appetite should be established by a bank. The liquidity risk position and its management is the responsibility of the board of directors as such the level of liquidity risk that will be acceptable to the board should be set by the board. 3. In order to ensure that a bank does not deviate from its liquidity benchmark, appropriate policies, strategies and practices that will maintain adequate bank liquidity risk needs to be developed by the high ranking management of the bank. Board of directors should ensure that they approve those strategies that have been accepted; it should also be reviewed from time to time and the board should further ensure that the strategy is well understood by members of the high ranking management to enable them translate the strategy into more specific guideline in the nature of procedures, control and guiding principle. The board should also ensure that the relevant skills, knowledge, and qualifications needed to monitor and regulate liquidity risk are possessed by the member of the organization that is the top management and other relevant staff. Theoretical FrameworkThe study is underpinned by the Agency theory as propounded by Jensen and Meckling in 1976. Agency theory involves the relationship or the interaction between the principal and the agent. Usually the principal; employ the agent to function in his or her behalf. The agent is expected to represent the principal in a specific business activities and he or she is expected to do so without compromising the interest of the principal (Namazi, 2013). Agency theory assumes that both the principal and the agent are motivated by self-interest. This assumption of self-interest dooms Agency theory to inevitable inherent conflicts. Thus, if both parties are motivated by self-interest, agents are likely to pursue self-interested objectives that deviate and even conflict with the goals of the principal. Yet, agents are supposed to act in the sole interest of their principals. The justification for the use of this theory is based on the fact that better performance of Nigerian commercial banks in terms of financial risk management can only be attained when agents (managers) of the banks are efficient and effective in their duties.Empirical reviewMohammed (2011) examined the impact of corporate governance on the performance of banks in Nigeria between the periods of five years (2003-2007). Inferential statistical method via chi square was employed in the study to analyze one hundred and fifty eight questionnaires that were returned by the respondents. The findings of the study showed that the independence of audit committees will significantly influence financial performance of banks in Nigeria. The study recommended an expanded external audit scope in order to encourage integrity and transparency in the financial reports of banks in Nigeria. The study further recommended that that the framework of corporate governance in the Nigeria banking industry needs to be enhanced as it will enable all the stakeholder to know their duties, rights and privileges towards promoting efficient and effective governance framework.Okougbo (2011) studied the connection that exists between corporate governance and firm performance of some selected companies quoted on the Nigerian Stock Exchange using Generalised Least Square (GLS) regression method. The intent of the study was to determine whether corporate governance mechanisms- CEO duality, board size, audit committees independence, and ownership concentration had an impact on firm performance surrogated by return on assets (ROA); return on equity (ROE), profit margin (PM). The results revealed that board size, audit committees independence, ownership concentration had a significant relationship with return on equity and profit margin. The study also observed that CEO duality had no impact on firm performance. The study recommended that the Securities and Exchange Commission to take into cognizance industry specific effects before formulating codes of corporate governance that determine the characteristic of the audit committees or the board structure. The study also recommended that the corporate governance committees of quoted companies in Nigerian Stock Exchange should endeavour to do a continuous appraisal of their compliance status in order to understand its effect on performance.Sanni and Abdul (2012) using OLS examined corporate governance and bank risk taking: a dynamic panel analysis of the Nigerian banking sector. The population of the study comprised of twenty five banks listed on the Nigerian Stock Exchange out of which a sample of twenty banks was selected. The study showed that bank ownership and the number of times board held meeting in a given year affected bank risk taking negatively. The study also found that there was no significant effect of board size and board composition on bank risk taking. The need to coordinate and strengthened corporate governance agencies to enhance sound performance in the banking sector was recommended by the study. In addition, there was also the need to put in place stringent punitive measure in order to enhance compliance with corporate governance and risk management framework, thereby promoting sound banking practices in Nigeria.Jegede, Akinlabi and Soyebo (2013) examined the corporate governance implication for banks performance in Nigeria. Secondary source of data collected for the study were analyzed using regression analysis. The finding of the study showed that size of a board was statistically significant to bank performance while bank age and board committees had negative effect on bank performance. The study recommended that board of directors of Nigerian banks should meet regularly to ensure that necessary problems of the banks were discussed and addressed, and that the number of boards should not be too many in order not to override its benefits.Progress, Hlanganipai and Godfrey (2014) investigated the impact of corporate governance on the performance of commercial banks in Zimbabwe using five banks in Zimbabwe between 2009 and 2012. The study used secondary data. Also multiple regression analysis was adopted to determine the influence of the size of the board; the composition of the directors’ board; internal committees of the board; and diversity or gender of the board on the financial performance of banks. The estimation of the developed model found that commercial banks’ board composition and board gender was positively related but not significantly determinant factors of bank’s performance. The study results further discovered that board size and board committees were negatively related to bank performance. The study recommended that, for better commercial bank performance in Zimbabwe, commercial banks should improve board structure; and embrace the fiduciary element in financial services of directors which include transparency, accountability, fairness and high ethical standard in order to promote corporate governance and enhance complete reliance of commercial bank’s clients on them. Abogun, Fagbemi and Balogun (2014) studied the effect of corporate governance on the liquidity of selected banks in Nigeria. The primary source of data was used and data were obtained through the use of questionnaire. Altogether, a total of one hundred (100) questionnaires were administered across the randomly selected banks out of which 70 were duly completed and returned. Using the Ordinary Least Square regression analysis, the study specifically found that banks liquidity was directly affected by audit committees independence and auditors’ independence in a positive way. It means that the more audit committees and auditors (internal and external) of banks gain independence, the more the liquidity position of banks improved. The study recommended that, for better bank liquidity performance in Nigeria, banks stakeholders should monitor and regulate the activities of bank’s audit committees and auditors very closely. Wangui (2014) examined corporate governance and enterprise risk management of commercial banks in Kenya. Primary data was collected using questionnaire and cross-sectional survey design was adopted in the study. Descriptive statistics was provided and data analysis was done using the multiple regression analysis. The study found that CEO presence in board of directors, banks board composition and board size had a significant and positive impact on the CAMEL rating, while the diversity of the board was negatively related on the CAMEL rating. The study recommended an increase in independent directors and expansion of the board size as these facets of corporate governance improved the banks’ enterprise risk management.

3. Methodology

- Data for this study consists of annual observations on 10 commercial banks in Nigeria. Simple random sampling method had been applied in the selection of the ten selected banks. The reason for the choice of simple random sampling method was because many banks were either liquidated or merged in Nigeria and in their place new banks emerged. It therefore, becomes difficult to choose those new banks as their financial statement could not provide us with the data needed for the study during the period covered. The data was obtained from annual reports and financial statement of ten selected commercial banks between 2006 through 2015. Because the data contains information on cross sectional units observed over time, a panel data estimation technique is adopted. This allows us to perform statistical analysis and apply inference techniques in either the time series or the cross−section dimension. The model takes the form: LRMit = α0 + βit NBCit + eit… (1) Where i = 10 cross sections and periods t =2006...2015. LRMit is a dependent variable which represents bank liquidity risk management measured by ratio of cash and cash equivalent to total deposits and NBCit is a vector of the independent variable which represents the total number of board committees a commercial bank have in each accounting year.

4. Discussion of Result

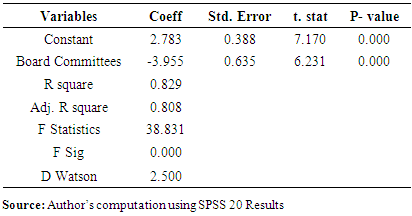

- Table 1 relates LRM (dependent variable) to NBC (independent variable). The estimated regression relationship for LRM model is: LRM = 2.783 – 3.955NBC. The equation shows that the independent variable (NBC) has significant impact on the LRM. The Durbin Watson statistics shows no auto correlation as the value is 2.500. The coefficient of the independent variable indicates negative impact on the LRM at 5 percent level of significance. The student t-test in the regression shows that number of board committees has the value of 6.231 which is significant at 5 percent while the adjusted coefficient of determination (R2) offers better explanation of the variations in liquidity risk management, as the value is 80.8 percent. Also, the value of the F-statistics is 38.831 with a p-value of 0.000. The standard error of 0.635 is less than half of the coefficients of the variables 1.9775; this shows that number of board committees does statistically affect liquidity risk management of Deposit Money Banks (DMBs) in Nigeria over the period 2006-2015. The implication of the findings is that an increase in number of board committees will cause 3.955% decrease in the liquidity risk management of Deposit Money Banks (DMBs) in Nigeria. The finding is further supported by the findings of Jegede, Akinlabi and Soyebo (2013); and Progress et al. (2014).

|

5. Conclusions and Recommendations

- The study has examined the influence of corporate governance on risk management of commercial banks in Nigeria. The study employed ordinary least square regression techniques to determine the extent to which board committees influenced liquidity risk commercial banks in Nigeria at 5% level of significance. The study reports a significant but negative influence of board committees on the liquidity risk commercial banks in Nigeria over the period 2006 to 2015. The implication of the findings is that an increase in board committees will cause decrease in the liquidity risk management of commercial banks in Nigeria. The study recommends that the number of board committees of commercial banks in Nigeria should be small in order to be effective and efficient in their risk management functions.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML