-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(5): 133-144

doi:10.5923/j.ijfa.20170605.02

An Investigation of Expectation Gap between Independent Auditors and Users from Auditing Services Related to the Quality of Auditing Services Based on Their Role and Professional Features in Auditing Process

Fatah Behzadian, Naser Izadi Nia

Department of Accounting, Islamic Azad University of Isfahan (Khorasgan), Isfahan, Iran

Correspondence to: Fatah Behzadian, Department of Accounting, Islamic Azad University of Isfahan (Khorasgan), Isfahan, Iran.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In this research, using an analytical framework on factors affecting the quality of auditing services, we consider factors that affect expectations gap in providers and users of auditing services related to factors affecting on auditing quality. Effective factors studied in this regard are professional features including the professional role of individuals in the auditing process (auditors against preparers of financial statements), professional experience of individuals, professional rating and size of auditing firms. The first statistical society consists of certified public accountants (CPA’s) working in the auditing organization and audit firms in Iran, and the second statistical society consists of all investment companies that operate under the supervision of Tehran Stock Exchange Organization. Based on the results of the research, the role of professionals in auditing process is not effective as an independent auditor or financial statements provider, as well as the professional experience of individuals in the expectations gap from factors affecting auditing quality. While the size and qualities of the auditing firms were influenced by the expectations gap of individuals in the field of auditing regulation.

Keywords: Audit Quality, Expectation Gap, Role in Audit Process, Professional Features

Cite this paper: Fatah Behzadian, Naser Izadi Nia, An Investigation of Expectation Gap between Independent Auditors and Users from Auditing Services Related to the Quality of Auditing Services Based on Their Role and Professional Features in Auditing Process, International Journal of Finance and Accounting , Vol. 6 No. 5, 2017, pp. 133-144. doi: 10.5923/j.ijfa.20170605.02.

Article Outline

1. Introduction

- The most basic role of an independent auditing profession can be accounted as its accreditation task. Financial reassignment is meant to ensure the reliability of presentation and the ability to rely on financial statements. The existence of an auditing not only determines the quality of reported financial information, but also improves the quality and provides certain economic benefits to the reporting organization and its outsourced members (Wallace, 1986). On the other hand, the quality of auditing services is important given the condition in which manager reports on organizational successes and achievements by providing information about the financial condition and the results of business units operations that are causing the suspicion and uncertainty of outsourced individuals. The inference of auditing service demanders from auditors' duties has undergone significant changes over time. The quality of the auditing, which determines the performance of the auditing, depends on several factors such as the ability of the auditors, including knowledge, experience, compliance power and technical efficiency, and professional implementation including independence, impartiality, professional care, conflict of interests, and professional judgment. Since auditors have to respond to the demand of a wide range of stakeholders in their service delivery, these changes have led to expectations gap, and it is the difference that arises from the public's expectation from the role of the auditing, and the goals that the auditing profession is expected to achieve, and how to infer the quality of auditing services is also one of the issues that form a part of this expectations gap. Therefore, consideration of the factors that can determine expectations gap from auditing role in suppliers and providers inferring from auditing services can be effective to reduce it. The research conducted in the field of auditing quality generally consider the factors affecting the quality of auditing services, and the framework or model is not presented in this regard. Despite the fact that standardized professional assemblies in developed countries have not emphasized on the requirement to measure, study and compare the judgments of professionals in the field of legislation, the researchers have been done to examine the impact of factors on auditing quality through the processing statistics data due to the performance of companies and in the stock market. Meanwhile in deductive studies, individuals' judgment based on their professional role in the auditing process is examined and expresses a topic that is defined as expectations gap based on individuals' role. Therefore, it seems that review and formulate factors affecting the quality of the auditing in the form of an analytical framework or a measurable conceptual model and the study of the individual characteristics of professionals, including their skills and experience, as well as the qualifications of the professional environment around them in order to establish a framework for sharing information in the form of an epistemic society and examine expectations gap between in the field of auditing quality over their role in the auditing process as an auditor or financial statements provider lead to the more reliable results of data processing based on the results and figures in financial reports.

2. Theoretical Fundamentals of Research

- The expectations gap between the auditing services has a long history and there is widespread concern about the existence of an expectation gap between the auditing profession and the public. The term "expectations gap" has been commonplace in research since the 1970s, and since then, evidence has increasingly shown that there is a gap between expectations.Dibia (2015) believes that there is an expectation gap between auditors and users of auditing services that express opinions about the duties and responsibilities of auditors and the messages transmitted in the auditing reports. Apparently, there is a gap between what the public expects from auditing performance and what they actually get. American Association of Accountants (2011) defined Expectations gap as the difference between what users expect from financial statements and actual performance of auditors. In other words, the expectation gap between the auditing services is the distance between the perception of auditors from their responsibility and others' perception from auditor's responsibilities, which are made up of two components of the performance gap and the reasonable distance. Since the late eighties, the association has been working to reduce the gap between expectations by issuing statements (from 53 to 61) on auditing standards. However, the association evaluates the effectiveness of these standards and concludes that the expectations gap, especially in the field of fraud tracking, continues to exist. It is mentioned a part of the expectation gap between the auditing performance and various perceptions that society can reasonably expect from auditors and what they achieve. Therefore, this categorization is presented on incomplete standards (the gap between what auditors should do in accordance with the requirements of the auditing standards and what the users expect to do in auditing financial statements- reasonable gap) and the incomplete performance (the gap between the predicted standard for the current auditor's performance and the perception from the performance of the auditors is provided by the community-distance performance. Therefore, the reasonable distance is known as the difference between what the community expects auditors to perform and what auditors reasonably expect to accomplish. In other words, this gap in expectations is related to the complexity and misunderstanding of the nature, purpose, and abilities of the auditing performance which is observed by the community (Porter, 1993). Humphrey (1997) states that the expectation gap is essentially due to the subjective nature of the concepts expressed in the auditing, such as fair judgment, reasonable assurance, the concept of importance, adequacy, and credibility that are not specifically defined in the accounting and auditing standards but are left to the judgment of the auditors. De Gabriel (2009) argues that one of the main shortcomings in previous studies of the expectation gap is that it focuses more on the overall auditing process than the challenges faced by auditors. He points out that, in order for auditors to effectively identify fraud cases, they must add basic accounting skills in the field of law to their auditing performance. The findings of this research show that lack of auditing skills in a particular domain can lead to a certain expectation gap.One way to understand the role of auditing and achieve the same expectations is based to look at the basic concepts behind the role of auditing. Auditing quality has also been considered as one of the main issues in the expectations of professional groups about the role of auditing in the accreditation process in recent years. Research reports provide an additional value to financial information provided by management. From point of view of the users, the auditing report is intended to provide assurance about the provision of information by management, although this assurance is not absolute. From the perspective of auditors, audited financial statements can be considered as the main bridge of contact with shareholders (Jill, 2004). This research investigates the factors affecting the quality of auditing services in the form of an analytical framework based on theoretical foundations of previous research and attempts to balance the expectations of auditors and auditing services users with regard to the role of these professionals in the auditing process as independent auditors or financial statements suppliers (financial managers) and other features other than the role of professionals in auditing process.Using a research that examines the factors affecting the quality of audit, a framework for auditing quality has been presented and attempts have been made to focus on the role of professionals in the auditing process. The gap between expectations of auditors and users of auditing services in the field auditing quality is explained. The qualitative qualities presented in this framework include 20 items that are presented in three aspects of auditing operation, auditing group and auditing rules, and analyzes professional inferences from factors affecting the quality of auditing in order to determine the probability gap. The qualitative features of the aforementioned factors are in tables 1 to 3. (Gantryr Basssir et al., 2016)

2.1. Effective Features of the Field of Audit Operations on Audit Quality

- Based on theoretical concepts resulting from the studies carried out, the characteristics of the factors affecting on audit quality can be explained based on the field of audit operations as follows:

2.1.1. Quality of Auditing Process and Documentation

- Compliance with audit standards in the field of the audit program to determine and evaluate internal controls and appropriate content tests based on the evidence and audit documents to offer comments is a great important matter in the quality of performing audit operations. According to the Audit Standard No. 230 entitled “documentation”, timely provision of sufficient and appropriate audit documents contributes to the enhancement of audit quality and facilitates the effective evaluation and investigation of the obtained audit evidence and achieved results prior to finalize the auditor's report. (Iranian Auditing Standards Committee, 2007).

2.1.2. Continuity of the Auditing

- Libya and Frederick (1990) stated that with an increase in auditors' experience, their perception in different types of possible distortions in financial statements increases. Therefore, the quality of the auditor's decision making improves with an increase in the auditor's experience of the employer's type of activity, which increases as a result of the increase in the auditor's tenure.

2.1.3. Making Use of Expert Services

- Using the results of the expert’s work as part of audit evidence leads to improve professional judgment and back up the audit opinion. Consumers may need to obtain expert evidence through expert examination. According to Audit Standard No. 620, an auditor must assess all cases including the importance of the intended heading, the risk of misrepresentation according to the nature and complexity of the subject matter, and the amount and quality of the other available audit evidence (Iranian Auditing Standards Committee, 2007).

2.1.4. Acceptance of the Auditors’ Recommendations by the Client

- Based on Iran's auditing standards, auditors evaluate the management's actions and the reasons for rejecting some of the recommendations after presenting a report on the internal control system and recommendations required for implementing corrective actions (Iranian Auditing Standards Committee, 2007). Therefore, acceptance of the auditor's recommendations and increasing the efficiency and effectiveness of internal controls lead to appropriate deduction of the client about the quality of audit services (apparent quality), and on the other hand, it could pave the way for auditors to identify the major distortions in the financial statements. It will also be effective in improving the quality of the audit report of the year or later years (Gonthier Besacier et al., 2016).

2.1.5. Appropriate Attendance of an Audit Partner in an Audit Operation

- The presence of an audit partner or audit technical manager during audit operations in order to assess the effectiveness and efficiency of the audit operations have been emphasized in areas such as recognizing the subject of the entity's activity, overall audit plan, the impact of new laws or standards on the audit work, the information required to estimate the audit risk, explanations, audit evidence and statements by the management of the auditing under review (Iranian Audit Standards Committee, 2007). This will make the quality control process effective on how audits are performed based on auditing standards and subject-matter regulations, and ultimately improving audit quality (Mojtahedzadeh and Aghaei, 2004).

2.1.6. Sufficient Knowledge of the Audit Partner of the Client's Industry

- Based on Iranian auditing standards, recognizing the activities of the client provides the ground for the auditor to judge professionally. Understanding the activity of the auditing and its proper use will help the auditor to assess internal controls, estimate the risks (inherent risk and control), identify the problems, prepare the overall audit plan, and plan and perform the audit effectively and efficiently (Iranian Auditing Standards Committee, 2007). With regard to the points mentioned above, obtaining relevant information from the owner's activity increases the technical capacity of the partner or the technical audit manager to assess the significant audit points and determine the type of proper audit comment (Francis, 2011).

2.1.7. The Quality of Relationship between the Audit Team and the Staff of the Auditing

- The proper and effective communication of the audit team in order to obtain knowledge of the industry is related to the client’s activity and increasing the power of professional judgment to assess internal controls and the possibility of discovering significant distortions within the framework of the professional conduct can be useful in terms of audit quality (Mc Enroe et al., 2001). In addition, the exchange of technical information in the field of accounting and auditing standards and regulations can be effective in reducing disagreements and, consequently, lowering expectation gap, and ultimately improving the quality of audit reports.

2.1.8. Management of the Audit Team’s Time Budget

- On the other hand, limited and high pressure budget will make the audit work ineffective because of the impossibility of detecting significant distortions, and the open budget will reduce the operational efficiency of time and personnel costs (Mehrani and Na'imi, 2003). The necessity of operating time management in Iran's auditing standards is taken into account in that time management makes the major issues be solved at the satisfaction of the executive director before the issuance of the report.

2.1.9. The Quality of the Audit Team Relationship with the Corporate Governance Group

- According to recent research, the existence of active and independent auditing committees in client firms is closely related to increase the audit quality. Accordingly, in line with brokerage theory, the existence of effective rules leads to the limitation of the scope in irresponsible actions for managers (Mojtahed Zadeh and Aghaei, 2004). Hence, the existence of a high-level audit committee will increase the quality of independent auditors by assuring that the auditor expresses the facts and does not fall under managerial tendencies. Therefore, the appropriate relationship between the audit group and the corporate governance group in the auditing will enhance the independence of the auditors and, as a result, improve the quality of the audit reports.

2.2. Effective Characteristics of the Audit Team on Auditing Quality

- The qualitative characteristics of the audit based on the qualitative framework provided in previous studies on the role of the audit team and its impact on the quality of audit are as follows:

2.2.1. Compliance with Professional Ethics outside the Audit Operations

- Ethical requirements for audit work usually include professional conduct, which has most of a deterrent effect. According to professional conduct, the basic principles of professional ethics include integrity, impartiality, professional competence, professional care, secrecy, and professional conduct.

2.2.2. Lack of Personal Problems of the Audit Team Members during the Operation

- This is about the lack of individual problems faced by the audit team members during running audit operations. Recent research has shown that such cases are not only effective in increasing the effectiveness and efficiency of audit operations, but also in improving the quality of audit (Knechel et al., 2013).

2.2.3. Information and Technical Capabilities of the Audit Partner

- Since, according to Iran's auditing standards, managing director must assume the responsibility for the quality of any delegated audit work, it is necessary to develop a model for audit quality of other members of the group at each stage in audit work. This template is usually provided for group members through the actions of the managing director and his appropriate messages. Such actions and messages include the importance of carrying out the work in accordance with the requirements of professional, legal and regulatory standards, the importance of adherence to the policies and methods of quality control of the institution in accordance with the working conditions, the importance of issuing the auditor's report, the suitability of the circumstances, and the fact that quality is necessary for auditing work. The presence of a high level of technical skills and abilities of the audit partner has also been taken into consideration in recent research (Gonthier Besacier et al., 2016).

2.2.4. Appropriate Training for the Audit Team to Obtain Information and Technical Capability

- Since the expected capabilities and competence of the audit team include recognition and practical experience of the audit work according to their nature and complexity, recognition of the requirements for professional, legal and regulatory standards, proper technical knowledge, recognition of the industry related to the activity of the client, ability to apply professional judgment, recognition of policies and methods of quality control of the Institute (Iranian Auditing Standards Committee, 2007), appropriate measures should be taken regarding to the appropriate training and supervision during the work group in order to obtain necessary qualifications.

2.2.5. Size of the Audit Firm

- De Angelo (1981) argues that larger audit firms offer higher audit services because they tend to boost their reputation in the audit services market. Providing an analytical method, he showed that the size of audit firms has a positive relationship with the quality of the audit because, from economic point of view, the loss resulting from failure in detecting and reporting significant distortions in large institutions is substantial. It is believed that such institutions provide higher audit services due to have access to the resources and more facilities for training their auditors and performing different tests.

2.2.6. Quality of Audit Team Management

- Management of the audit team is based on Iran's 220 auditing standard that involves performing work in accordance with the requirements of professional, legal and regulatory standards, identifying major issues that require further examination, proper consultation, documentation and implementation of the results of consultations, necessity of reviewing the nature, timing and amount of work performed, supporting the results obtained by the work performed and documentation of adequacy, sufficiency and appropriateness of the evidence obtained to support the auditor's report and achieve the objectives of the methods of carrying out the audit work (Iranian Auditing Standards Committee, 2007).

2.3. Effective Characteristics of the Audit Rules on the Audit Quality

- The qualitative characteristics of the audit based on the qualitative framework provided in previous studies on the role of audit regulations and its impact on audit quality are as follows:

2.3.1. Necessity of Auditor Rotation

- Several studies have been conducted in recent years on the relationship between the rotation of audit firms with audit quality, which generally show a significant relationship (Li, 2010) and (Arel et al., 2008). The effect of continuity of the auditor's selection or an increase in the auditor's term on audit quality can be verified from two perspectives. On the one hand, the auditor is familiar with the activities of the client, which increases the professional competence of the auditor and the quality of the audit, but on the other hand, the continuity of the auditor's selection leads him to overestimate the management of the owner and this may have a negative effect on his independence and distort the quality of auditing.

2.3.2. Limitation of Personal and Financial Communication with the Client

- Prohibition of any personal and financial communication between partners and members of the audit team with the auditing is among the factors that have been suggested in recent studies as factors influencing audit quality (Francis, 2011). Also, limitation on the level of auditor fees from a client in relation to the total income received by the audit firm during a financial period is also one of the factors mentioned in the current researches (Gonthier Bessacier, 2016). One of the most important legal requirements is that auditors cannot have managerial positions at the auditing (Hassas Yeganeh, 2009).

2.3.3. Prohibition of Non-assurance Services

- Non-certification services of auditors is one of the most important issues affecting the auditor’s independence and is similar to the solutions that exist in dealing with the subject of financial and personal relationship between the auditor and the client (Hassas Yeganeh, 2009). Therefore, in order to improve apparent independence, existence of laws that prohibit providing management services by auditors simultaneously with providing auditing services is essential.

2.3.4. Necessity of Regulatory and Qualitative Rating

- As the membership of audit firms in professional assemblies is the key to their engagement in the audit profession, there is a need for them to comply with professional standards and regulations. Watts and Zimmerman (1986) stated that auditors usually require professional competence according to the law, and for this purpose, they must act based on standards developed by professional assemblies. Therefore, necessity of developing regulatory provisions to ensure the auditors’ independence and their periodic review of their activities by professional associations in order to comply with laws and standards and determine the qualitative rating of audit firms in this regard can convince and persuade them to maintain independence and adhere to professional standards in the formulation of review programs.

2.3.5. Necessity of Formulate Regulations on Audit Fees

- Simonic and Stein (1987) argue that the higher fee is considered for the auditors, the more they make effort. But in that case, the auditors will financially depend on their clients. Consequently, due to the fear of losing their jobs, they may not properly conduct the audit procedures, which, of course, can lead to bad financial consequences for them. In a research entitled " Audit Quality Perception: Beyond the Role Perception Gap", Gonthier Besacier et al. (2016), used the analytical framework provided by previous research with the definition of an epistemic community in the French professional environment, whose actors were auditors and financial statements, and shared the information values, including the quality of audit based on the analytical framework mentioned above, and determined three professional groups based on their deduction about the audit quality characteristics. As a result, he came to the conclusion that the deduction about the quality of audit is related to the individual characteristics of the professionals (that is correlated with the level of their skill and experience of understanding the information shared values between them) and does not necessarily relate to their role in the audit process. In a Nigerian-environment study entitled "Audit Expectations Gap Perception of Financial Reportin", Dibia (2015) explored the factors influencing the auditors’ and auditing users’ expectations gap and addressed issues such as inability of the community to understand the auditors’ duties, auditing standards support for the auditors’ performance and defects in existing professional standards including factors affecting the stability of the expectations gap between the auditors and auditing services users. Nikbakht and Rezaei (2012), in their study entitled " An Investigation of Factors Affecting Expectation Gap between Auditors and Users of Financial Reports in environment of Iran", showed that there was expectation gap between the auditors’ viewpoint and the viewpoint of financial statements users due to dichotomy between accounting standards and rules and regulations of the country as well as the provision of subsidiary services to the client by the audit firms.In a study entitled "A Framework for Understanding and Researching Audit Quality", Francis (2011) presented a more complete audit quality analytical framework based on the results of previous studies and European Auditing Standards (especially French), and found it to be more similar to the regulatory texts of the Sarbanes Oxley, a significant effort in understanding the factors affecting the audit quality. Igbinosun (2011), in a study entitled "An Evaluation of the Auditing Standards and their Application to the Auditing of Registered Companies in Nigeria", stated that the inability of the community to understand the role of auditing in detecting and reporting fraud was one of the most important causes of expectation distances from auditing. Arab Mazar et al. (2011), in their study entitled "Explaining the Relationship between the Transparency of the Financial Reporting with Tax Reporting in Iran", explained the relationship between transparency of financial reporting and tax reporting in Iran. The results of the research indicated that there was a positive relationship between tax reporting and transparency of financial reporting in a way that if tax reporting is prepared in addition to financial reporting, transparency of financial reporting would be largely provided. Hassink et al. (2009), in an empirical study entitled "Corporate Fraud and the Audit Expectations Gap: A Study among Business Managers," looked at expectations regarding the role of auditors in fraud cases. The findings of the research showed that auditors did not have much awareness of their professional responsibility for any fraud occurrence in all circumstances. Researchers have identified this factor as creating a gap between the expectations due to the effectiveness of the weakness and in order to overcome that, offered the training of auditors in this regard. Chowdhury et al. (2005) investigated the gap between public sector of audit expectations in Bangladesh and concluded that there was a significant distance between the auditor's expectations and the expectations of both auditing groups of the auditing reports. In a study entitled "The Audit Report: A Misunderstanding Gap between Users and Preparers", Boyd et al. (2001) argued another factor that might compromise auditors to deduce the quality of financial reporting of the entity was unreasonable expectations and misunderstandings by the auditing reports users.Mojtahed Zadeh and Aghaei (2004), in their research entitled "Factors Affecting Audit Quality from the Viewpoint of Independent Auditors and Users", while investigating the inference of auditors on 24 factors affecting the quality of auditing, concluded that there was not a significant difference between the inter subjective deduction of auditors and users of their reports as well as their inter subjective deduction. Hassas Yeganeh and Khaleghi Baqi (2004), in a study entitled "Expectation Gap between Auditors and Users of the Role of Independent Auditors Attest Functions", showed that there was a significant difference between the auditor's perception of the role of independent auditing and the user's perception. The results of Humphrey's (1997) study entitled "Banks: Responses to Deregulation: Profits, Technology and Efficiency" in the UK to assess the deduction of auditors and users about financial statements with regard to audit performance revealed that auditors' expectations were significantly different from financial managers and other users of financial statements. Auditors' service users believed that auditors did not understand the commercial problems of the auditing; meanwhile, they expected the auditors to report the management performance and efficiency to the shareholders. The results of Bozorg Asl’s (1997) research entitled "The Role of the Independent Auditor in the Community: Referred to the New Reduced Expectations (Imaginations)" indicated that there was a significant difference between what auditors reflect in their report and what the users perceive.

3. Research Hypotheses

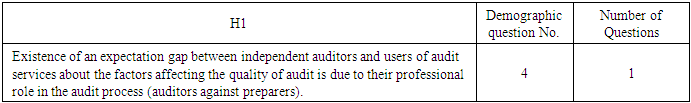

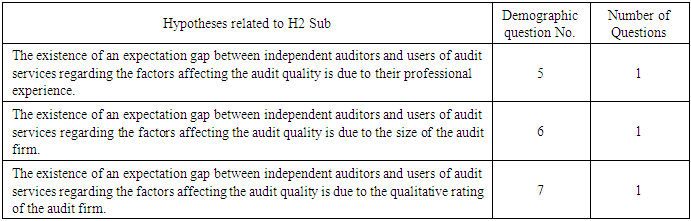

- According to the presentations based on the theoretical foundations of previous research, the hypotheses of this research are as follows:H1: Existence of an expectation gap between independent auditors and users of audit services regarding the factors affecting the audit quality is due to their professional role in the audit process (auditors versus financial statements preparers).H2: Existence of an expectation gap between independent auditors and users of audit services regarding the factors affecting audit quality is due to other characteristics of professionals, except their role in the audit process (auditors versus preparers).Considering the above-mentioned issues regarding the characteristics of professional people other than their role in the audit process, this hypothesis is divided into three sub-hypotheses as follows:H2-1: Existence of an expectation gap between independent auditors and users of audit services regarding the factors affecting the audit quality is due to their professional experience.H2-2: Existence of an expectation gap between independent auditors and users of the audit services regarding the factors affecting audit quality is due to the size of the audit firm.H2-3: Existence of an expectation gap between independent auditors and users of audit services regarding the factors affecting the audit quality is due to the qualitative rating of the audit firm.

4. Research Method

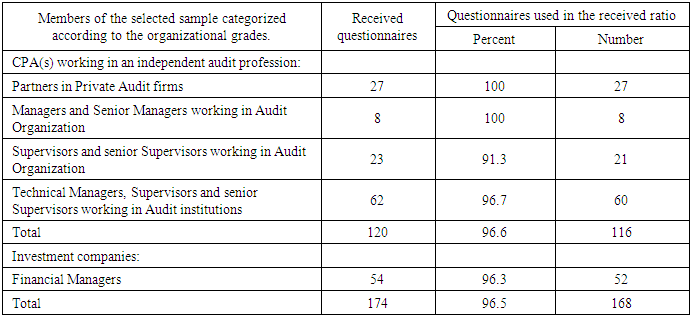

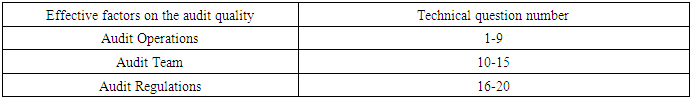

- The required information to test the research hypotheses has been obtained through a researcher-made questionnaire. The first statistical population consists of all official accountants working in the independent audit profession and different classes of managers and senior managers, supervisors and senior supervisors (in Audit organization of Iran) and partners, technical managers, supervisors and senior audit supervisors (in private audit firms), and the second population involves all investment companies working under the supervision of the Securities and Exchange Organization, whose financial managers respond to the questionnaire on their behalf. For sampling the first population of this research, stratified random sampling was used and sample individuals were selected from among all classes. For this purpose, Cochran's relationship was used to estimate the sample size in each class of the statistical population and the largest number was selected as the sample size from the resulting numbers as the final sample size of each class. The final sample size of this study was 155 people for the first population. In order to ensure that more questionnaires were completed, 170 questionnaires were provided to the respondents. Within three months, 120 questionnaires were received four of which were useless because they were not completely replied to. Also for the entire second population of the research, 72 questionnaires including general and special investment companies under the supervision of the stock exchange (18 of which have been accepted in the Tehran Stock Exchange), were sent to the companies through e-mail and were given to the respondents. Within three months, 54 questionnaires were received two of which were useless because they were not completely returned. Therefore, a total of 168 questionnaires were used in statistical analysis. Information about the number of the questionnaires sent, the questionnaires received and the questionnaires used in this research for each group of sample individuals is presented in Table 1.In this research, the validity of the questionnaire has been confirmed through face validity (formal validity). It means that the questions of the questionnaire were first developed by the researcher according to the existing theoretical foundations. In the next stage, the questions were presented to the experts of auditing field.After several stages of corrective work, necessary adjustments were made to the questions of the questionnaire based on their comments so that unambiguous and sufficient questions could be sent out to the respondents. Furthermore, the reliability of the questionnaire was measured by Cronbach's alpha test and the coefficient of 0.746 was calculated, which confirms the reliability of data collection tool. The present research questionnaires consisted of 20 specialized questions, and in each question, one of the characteristics of the three factors affecting the audit quality presented in this research were brought up. These questions were closed type in which the respondent had to mark the effectiveness rate of the factors presented in each question on the continuum.To evaluate each of these factors, one question was raised and the Likert grading scale from grades 1 to 7 (from no effect to very strong effect) was employed. Meanwhile, the difference in their deduction about the impact of the factors suggested was investigated based on demographic questions in the beginning of the questionnaire in order to test the existing expectations gap.Tables 2 to 4 provide information on the factors affecting the audit quality, with regard to the characteristics expressed and the number of questions related to them as well as the questions related to the first and second hypotheses.

|

|

|

|

4.1. Test of Research Hypotheses

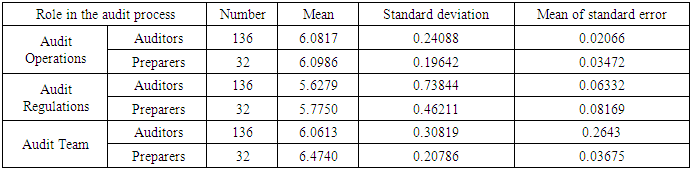

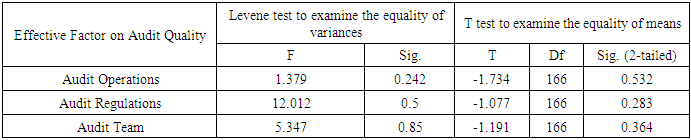

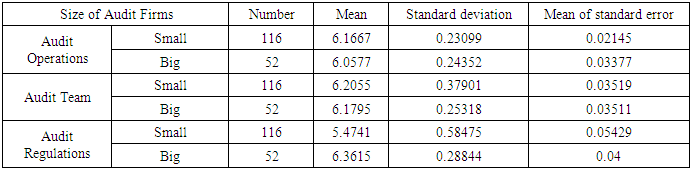

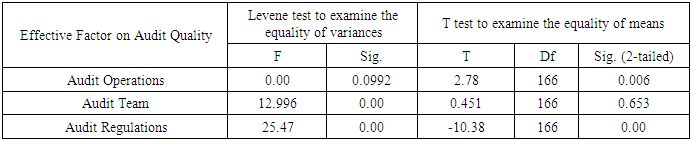

- Considering the fact that the questionnaire was designed to assess tendency of the respondents with 7 grades and they were respectively rated from 1 to 7, the questions were converted to an interval scale and the possibility of using the parametric statistical method and the student test is allowed. Also according to the data volume, there is a certainty that the data are subjected to normal distribution in order to use parametric tests based on the central limit theorem. Therefore, Student t test was used at 95% confidence level to analyze the hypotheses and generalize the results of the samples to the two statistical populations using the SPSS software.H1: Existence of an expectation gap between independent auditors and users of audit services regarding the factors affecting the audit quality is due to their professional role in the audit process (auditors versus preparers).The t-test results for the analysis of the first hypothesis in the study are presented in Tables 5 and 6. By examining the F statistics and its significance at the level of 5% error, the assumption of variances equalization has been confirmed and the t-test and its significance have been used to compare the meanings with the assumption of equality of variances. As can be seen in Table 6, significance level of the test for all the factors affecting the quality of audit services is greater than the permissible error of 5%. It is suggested that the role of individuals does not have any effects in the audit process within the expectations gap between the auditors and the users of the audit services regarding the impact of the three factors affecting the quality of the audit services, and rejection of the claim is at the confidence level of 95% (sig> 0.05).

|

|

|

|

|

|

|

|

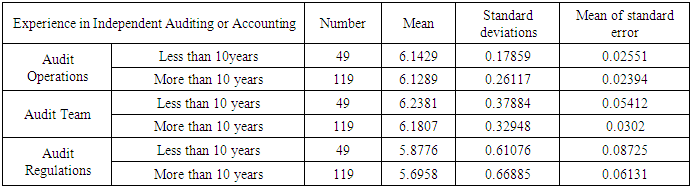

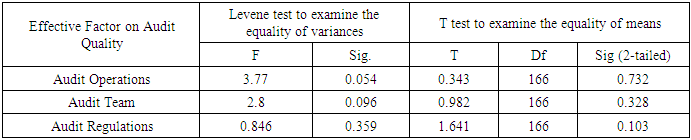

5. Summary and Conclusions

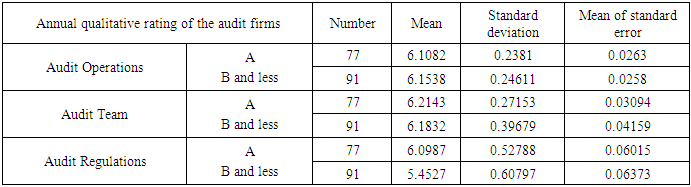

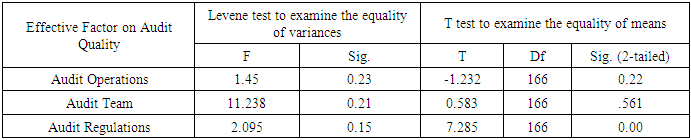

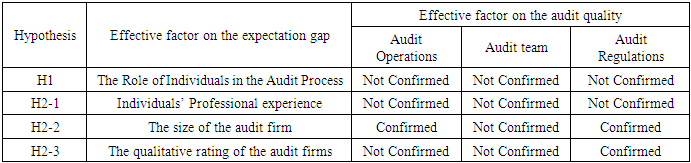

- In this research, two hypotheses were considered. In the first hypothesis, the professional role for providers and users of the audit services as an independent auditor and preparation of financial statements are suggested in order to establish the expectations gap between the aforementioned individuals and to influence the factors of the audit work, the audit group And the rules of auditing were introduced to the first hypothesis. Research results show that the role of providers and users of audit services in the audit process is not conducive to establishing the expectations gap between them regarding the effect of the above three factors on audit quality; therefore, the first hypothesis of the research is not confirmed.In contrast to the first hypothesis, the professional characteristics of these individuals, apart from their role in the audit process, include professional experience, the size and quality of the audit firms in the form of first to third sub-assumptions of the second hypothesis that the effect of features other than the role of individuals in the process An audit is presented. The results of the research show that the professional experience of the providers and users of the audit services does not affect the expectations gap between them in order to influence the triple factors on the audit quality, and therefore the first sub-hypothesis is not confirmed.The second sub-hypothesis is approved at the level of the audit and the third hypothesis at the level of the audit rules and regulations. This means that there is an expectation gap between independent auditors and users about the impact of audit regulations on the quality of audit services, which is due to the quality and size of the audit firms. In other words, the size and quality of the audit firms that audited and audited by independent auditors and users of their audit services were in their responsiveness and inference from the impact of audit regulations on audit quality and the creation of an effective gap between expectations. Also, the results of the research indicate that the size of the audit firms affected their inference on the impact of audit work on audit quality and the creation of an expectation gap between them. The results of the research indicate that the first hypothesis and the first sub-hypothesis related to the second main hypothesis of the research (H2-1) have been rejected and the second sub hypothesis (H2-2) at the level of the audit operations and audit rules and the third sub- hypothesis (H2-3) have been confirmed at the level of the audit regulations. This means that there is an expectation gap between independent auditors and users regarding the impact of audit regulations on the quality of audit services, which results from the size and quality of the audit firms. A summary of test results of the research hypotheses regarding the expectations gap between independent auditors and users of audit services about the effective factors on the quality of audit services can be seen in Table 13.

|

5.1. A Comparison between the Research Results and Previously Conducted Research

- In the hypotheses of this research, investigation of the effective factors on the expectations gap between audit service providers (as independent auditors) and users of audit services (as financial statements suppliers) regarding the factors affecting the quality of audit is proposed. The ineffectiveness of the role of professionals in the audit process in influencing the factors to influence the quality of audit in line with the expectations gap between audit service providers and users of these services, obtained from the present study, are similar to those of Gonthier Besacier et al. (2016). Other professional features of providers and users for audited services are divided into three sub-hypotheses. In the first sub-hypothesis, the professional experience of providers and users of audit services as a factor affecting the expectations gap on the factors affecting the quality of audit has been raised and the results of the research indicate that the hypothesis is not approved and the impact of the individuals’ professional experience on creating the expectation gap, which is different from the research results of Gonthier Besacier et al. (2016). The results of the research show that the size of the audit firms expressed in the second hypothesis is influenced by the expectations of individuals in the field of the audit operations and regulations impact on audit quality. In addition, the qualitative rating of the audit firms is only effective among the expectations of professionals regarding the impact of audit regulations on audit quality, which is consistent with the research done by Gonthier Besacier et al. (2016).

6. Limitations and Further Research Suggestions

- Lack of cooperation of some people in the community, which could be because of lack of sufficient time due to daily workload or lack of desire to scientific research, was one of the limitations of this study.Also, according to the theories described in the theoretical framework and the results of data processing, the research proposal is expressed as follows:- Since the investigation of effective factors on the audit quality in the previous research has often been studied individually or sporadically, it is suggested that the analytical framework, used in this study, should generalized and expanded regarding the classification of qualitative characteristics of factors influencing the audit quality in order to make the possibility to collect features that can develop these factors or increase the factors that explain effective qualitative characteristics in implementing an effective analytical framework on audit quality.- Confirmation of the existence of expectations gap between the providers and users of audit services regarding the effective factors on the quality of audit in the field of audit regulations and its impact on audit quality demonstrates that in order to reduce the gap between reasonable expectations, it is required to develop standards and professional guidelines relevant to the level of user awareness.- Considering the size of institutions and their qualitative rating in responding to the questionnaire of this research and creating an expectation gap between providers and users of audit services regarding the impact of audit regulations on the audit quality, existence of a performance gap between professional individuals under study is required. Conducting a training course at the level of audit firms or public courses for financial managers at a centralized level from the professional institutions can provide technical requirements of professional individuals in the audit process, including independent auditors or suppliers of financial statements.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML