-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(5): 117-132

doi:10.5923/j.ijfa.20170605.01

Effect of Deposit Money Banks Credit on Small and Medium Scale Enterprises Growth in Nigeria

Ubesie Madubuko Cyril, Onuaguluchi Ifeoma F., Mbah Anastasia M.

Department of Accountancy, Enugu State University of Science and Technology, Enugu, Nigeria

Correspondence to: Ubesie Madubuko Cyril, Department of Accountancy, Enugu State University of Science and Technology, Enugu, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study ascertained the effect of deposit money banks’ credit on small and medium scale enterprises growth in Nigeria. A lot of authors blamed lack of small and medium scale enterprises growth on non-availability and lack of access to finance while some others blame the same problem on managerial competency. Specifically, this study ascertains the effect of deposit money banks’ credit to small and medium enterprises, credit to private sector and interest rate on small and medium scale enterprises growth in Nigeria. An ex-post facto research design which employed secondary data sourced from Central Bank of Nigeria (CBN) Statistical Bulletin 2015 and National bureau of statistics (NBS) for the period 1986 – 2015 was adopted. The ordinary least square regression method was used in the analysis of the data after conducting a stationarity test on the variables. The study finds out that deposit money banks ’credit to small and medium scale enterprises has no significant effect on small and medium scale enterprises growth in Nigeria. Again, the result indicates that deposit money banks’ credit to private sector has significant effect on small and medium scale enterprises growth in Nigeria. The result also indicates that bank interest rate has serious significant effect on small and medium scale enterprises in Nigeria. To this effect, deposit money banks’ management should see economic development as a priority by extending more credit to the private sector which are driven by small and medium scale enterprises.

Keywords: Deposit Money Banks’ Credit, Small and Medium Scale Enterprises

Cite this paper: Ubesie Madubuko Cyril, Onuaguluchi Ifeoma F., Mbah Anastasia M., Effect of Deposit Money Banks Credit on Small and Medium Scale Enterprises Growth in Nigeria, International Journal of Finance and Accounting , Vol. 6 No. 5, 2017, pp. 117-132. doi: 10.5923/j.ijfa.20170605.01.

Article Outline

1. Introduction

- Finance has been identified as one of the major factors militating against the development of small and medium scale enterprises in Nigeria [27]. It was in recognition of this difficulty in credit availability for the purpose of investment that the Nigerian government singled out small and medium scale enterprises as key area of intervention. This was premised on the government desire of giving support to small and medium scale enterprises in the country as a measure of meeting up with its commitment to the development plan and the indigenization policy. The intention was that it would be a reaction against the dominance of the economy by the international capitalist entrepreneur and also on the account that revitalizing small and medium scale enterprises would enhance the capacity of the indigenous capitalist class, as a potential player in economic growth and national development [7]. While some governments had formulated policies aimed at facilitating and empowering the growth and development of the SMEs, others have focused on assisting the SMEs to grow through soft loans and other fiscal incentives [35]. Terms and conditions for accessing funds of this nature are spelt out against each credit type [35]. A large portion of bank loans to SMEs will ordinarily be short-term instead of long-term; this is due to mismatch between tenor of bank deposits and loans bing sought. However, Deposit Money banks are not risk averse but short-term exposure is as a rule less risky than medium or long-term because there is less time for things to go wrong.A healthy economic growth cannot be achieved without putting in place a well-focused policy to reduce poverty, through empowering the people, by increasing their access to factors of production, especially credit [2]. The inactive ability of the underprivileged to engage in entrepreneurship would be enhanced through the provision of bank services to enable them engage in economic activities, and be more self-reliant, thus increasing employment opportunities, enhancing household income and creating wealth (Nigerian Investment Promotion Council, 2004). Entrepreneurship which is noticeable in the form of Small and Medium Scale Enterprises (SMEs) can meaningfully contribute to the achievement of nation’s economic development objectives which include; employment generation, output expansion, location of industries among regions of a country, income redistribution, promotion of indigenous entrepreneurship and technology, as well as production of intermediate goods to strengthen, inter and intra industrial linkages. These among others, explain the increased interest, which many countries have shown in the promotion of entrepreneurship (Small and Medium Scale Enterprises) since the 1970s. Governments have therefore designed programmes of assistance to enhance the achievement of these objectives. These are usually in the areas of finance, extension and advisory services, training and the provision of infrastructural facilities. Financing programmes have attracted more attention than others, because every enterprise requires funds for its capitalization, working capital and rehabilitation needs, as well as the creation of new investments. The enormous interest in SMEs and entrepreneurship probably owes more to an intensified awareness among policy makers and international agencies about the problems of unemployment and poverty, than any change of heart among economists or specialists in industrial development. In many developing countries, the Small and Medium Scale Enterprises (SMEs) constitute the bulk of the industrial base and contribute significantly to their exports as well as to their GDP or GNP [24]. [15] posits that the potentials of the small and medium scale enterprises are manifested in their labour-intensive nature, income-generating possibilities, capital saving capacity, potential use of local resources and reliance on few imports, flexibility, innovativeness and strong linkages with the other sectors of the economy. These basically explain the reason SMEs are the darling of policy makers and governments all over the world [15, 26]. In Nigeria, the governments at various levels have formed different policy incentives aimed at boosting the performance of small businesses in order to reduce the level of poverty and enhance economic development [4].Motivation for the StudyCredit to small and medium scale enterprise (SMEs) as a service of deposit money banks is of paramount importance to economic growth and development. Small and Medium Scale Enterprises provide income, savings and employment generation. In Nigeria, government in the past, in the bid to accelerate economic growth and development in Nigeria had tried through several intervention schemes and policies to assist small and medium scale enterprises secure needed funds with very low interest rate and extended repayment period in the bid to enable them grow. These policies include establishment of Bank of Industry (BOI), Small Scale Industries Credit Scheme (SSICS), World Bank Small and Medium Enterprises I Loan, World Bank Small and Medium Enterprises II Loan, Refinancing and Rediscounting Facility (RRF) of the Central Bank of Nigeria, Small and Medium Enterprises Equity Investment Scheme (SMEEIS) and Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) among others. SMEDAN today is the agency in Nigeria that is vested with the coordinated control of SME sector. However, SMEDAN seem not to have been able to effectively carry out its functions so as to enable the SMEs create wealth/value thus SMEs heavy reliance on the banking sector for finance. The banking system which provides majorly short term finance, is critical for economic growth and development. The long term source through the stock market is completely out of reach of virtually all SMEs in Nigeria. Coupled with problem of co-ordination in granting finance to SMEs, deposit money banks show reluctance to lend to SMEs owing to perceived risk associated with such enterprises, especially farming. [41] observed that even banks with high volume of loans or retained liquidity levels in excess of what is required by law have shown reluctance in extending loans to SMEs, especially on long term basis as they are considered highly vulnerable with high credit risk. On the side of the banks, inconsistency in government policies, high monetary policy rate, loan diversion, exchange rate depreciation, infrastructural decay and tenor of loans also serves as constraints to lending to SMEs. The fraction of the loans extended to SMEs by the banking sector, the ascertaining of their effect on SMEs growth remains difficult and unsettled owing to SMEs meagre contribution to gross domestic product. Furthermore, with regard to the important role of banks finance in SMEs growth, there is no consensus that deposit money banks increases credit delivery to SMEs, particularly after the consolidation exercise. [33, 39] showed that deposit money banks credit to SMEs has no significant effect on their growth towards economic growth. This negates the results of [30, 28, 13] whom have empirically established the significant effect of deposit money banks credit on SMEs growth. Hence, it agitates the mind to carry out the study on the effect of bank lending and bank operational variables on small and medium scale enterprises growth in Nigeria. Specifically, this study ascertains the effect of deposit money banks’ credit to small and medium scale enterprises, credit to private sector and variations in interest rate on growth of SMEs.The remainder of this study is surrogated as follows: section two reviews the relevant conceptual, theoretical and empirical literatures. Section three shows the method and data applied. Data analysis and discussion of results of estimations were spelt out in section four. In section five concluded the study and offered some recommendations.

2. Review of Related Literature

2.1. Conceptual Clarifications

- In the context of the Central Bank of Nigeria, small scale enterprise is an industry with a labour size of between 11 and 100 workers or a total cost of not more than N50 million including working capital, but excluding cost of land. Medium enterprise scale on the other hand refers to an industry with a labour size of between 101 and 300 workers or a total cost of over N50 million but not more than N200 million, including working capital but excluding cost of land. According to the National Council of Industries (2009), SMES are business enterprises whose total costs excluding land is not more than two hundred million naira (N200m). [25] described small and medium scale enterprises as the engine room for the growth of a developing economy. [36] identify three main parameters to be common among all countries. The parameters are (1) capital investment (2) volume of production and (3) business turnover. In contrast to the opinion of [36] defined SMEs in relation to employment. He classified an organization with 1 to 10 employees as micro/cottage industry, 11 to 100 workers as small scale industry and medium scale industry from 101 to 300 workers and considered above 300 workers as large scale.Credit to Small and Medium Scale EnterprisesProvision of finance otherwise lending by the definition is a legal function of a bank. In essence it is one of the primary functions or purposes of existence of a bank. While relating bank historical existence with its lending function, [8] links it with the parable of the talents in the gospel of St. Luke – Why did you not deposit the money in the bank so that the owner could at least get some interest on it (Luke 19: 23). A little explanation here shows that banks were paying interest on deposits kept with them. And for bank to be paying interest on deposits, they must have been lending out the money to customers who pay them interest or must have been investing the money elsewhere for profit. Lending is perhaps one of the most important roles performed by deposit money banks in Nigeria. These banks usually play their intermediation role by sourcing for funds through deposits from customers and lending such funds out as loan which may be on short-term, medium-term or long-term basis to corporate bodies, government at various levels, institutions and individuals. The practice of lending by deposit money banks essentially constitutes the pivot of their operations and business. This is the more reason which informs their deployment of considerable expertise and deftness on the part of the bank management teams on lending administration and management. Interest RateOne role of the banks is advancing credit to borrowers. [18], notes that the Nigerian Banking Industry has been playing leading role in the development of the Nigerian Economy. According to him, banks mobilized and disbursed tremendous volumes of funds of both government and private sector investors for the growth of the economy. [29], postulates that the primary reason that banks want deposit is to enable them grant credit from which they can earn interest income. But more importantly, extension of credit to the economy is the core link that banks have with real sector, acting like a catalyst and contributing to the growth of the economy. According to [34], loan to small and medium scale enterprises entrepreneurs have a positive impact on the economic performance while high interest rate or lending rate has a negative impact on economic growth. They added that the greatest problem confronting SMES in Nigeria is managerial capacity whereas access to finance or capital is only necessary but not a sufficient condition for successful entrepreneurial development. [11] classify SMES financing concept into formal and informal. The formal Financing approach is made up of deposit money banks and development banks whereas the informal sources of financing have to do with borrowing from friends and relatives, cooperatives, Age grades, social clubs etc. In their studies of the problem of SME financing, [22] identified; cost of capital, risk, inappropriate terms on bank loans, and shortage of equity capital, as the key managerial problems of SME.Credit to Private SectorThis credit has its repayment period extended for a number of years. The loan which is meant for a period longer than five years, may be from 10-20 years and above are known as long term loans. This credit is normally being designated as ‘real estate bond’. The repayment of this form of credit is not made in a few years, but has to be spread over many years [6]. The commercial objective of deposit money banks’ long term lending is to maximize compounded profit, although other social and economic functions tend to deflect banks from profit maximization as their primary objective. Since banks are acknowledged agents of social, economic and political development, they have a social responsibility. The extent of this expanded responsibility varies from country to country and the social situation is a major determining factor, hence the role of deposit money banks as agents of development appears greater in developing countries of which Nigeria is one. Nevertheless, the principal lending objectives of a bank are to provide growth, profitability and liquidity.SME’s Output /Growth[37] points out that the major factor hindering the contribution of small and medium scale enterprises to economic growth is lack of access to cheap and effective source of finance. He went further to describe small and medium scale enterprises as a sine qua non in ensuring the attainment of the goals of the federal government’s National Economic Empowerment Development Strategy (NEEDS) in the areas of poverty reduction, employment generation, wealth creation and value orientation. Subsequently, [37] enumerates, infrastructure, enabling environment, cheap source of funds, availability of production equipment, efficient manpower, disciplined management and of course availability of markets as factors that enhance the operations of small and medium scale enterprises towards ensuring sustainable socio-economic development. On the other hand, [42] cites in [37] identifies ten factors responsible for failure or poor performance of SMES’S in Nigeria. The factors are; disasters, competition, infrastructure, taxes, accounting, management, marketing, economic, planning and finance. There has been a consensus opinion that financial support, or poor finance or poor economic condition is the main factor responsible for the small business failures in Nigeria [20, 1, 31]. Essentially, SMES’S in Nigeria face the problem of lack of access to desired capital or finance or fund due to the unwillingness of Financial Institutions in lending to them on long-term basis.

2.2. Theoretical Underpinning

- There are many theories which seek to explain the behaviour of money deposit banks in their lending activities in various economies around the world. To access the journey so far in the achievement of the stipulated objectives, the association between traditional bank lending and SMEs could be theoretically established from two theories under consideration namely, loan pricing theory, and supply leading hypothesis postulations. The loan pricing theory by Thompson Reuters in 1965 posits that banks cannot always set high interest rates by trying to earn maximum interest income. According to [16], if banks set interest rates too high, they may induce adverse selection problems because high-risk borrowers are willing to accept these high rates, but once these borrowers receive the loans, they may develop moral hazard behaviour or so-called borrower moral hazard since they are likely to take on highly risky projects or investments. According to [38], the supply leading theory postulates that the existence of financial institutions like deposit money banks and the supply of their financial assets, liabilities and related financial services in advance of demand for them would provide efficient allocation of resources from surplus units to deficit units, thereby leading the other economic sectors in their growth process. The highlight of this theory is a two dimensional function of transferring resources from traditional sectors to modern sectors, and promoting and stimulating small and medium scale enterprises into economic growth. Essentially, the proponents of this theory believe that the activities of the financial institutions serve as a useful tool for increasing the productive capacity of the Small and Medium Scale Enterprises (SMEs) in the economy. They opine that countries with better developed financial system tend to grow faster in this aspect. As far back as 1911, an early economist Schumpeter strongly supported the view of finance led causal relationship between financing of small and medium scale enterprises and a country’s economic growth. He describes the supply leading financial intermediation as “innovation finance”. Hence, Schumpeter in 1912, states that one of the most significant effects of supply-leading funds approach is that as entrepreneurs have new access to the supply leading funds, their expectations increase and new horizons as to possible alternatives are opened, thereby making the entrepreneur to think big. The supply leading theory presents an opportunity to induce real growth by finance means. Analysts believe that the use of supply leading theory is more result-oriented at the early level of a country’s development than later.

2.3. Empirical Studies

2.3.1. Related Studies on Deposit Money Banks’ Credit to SMEs and SMEs Growth

- [33] examined the effect of banking reforms on the performance of small and medium scale enterprises in Nigeria from 1986 to 2014. Applying the ordinary regression technique, the result reveals that credit to small and medium scale enterprises has negative effect on the growth of small and medium scale enterprises. [13] employed time series data obtained from the Central Bank of Nigeria for the period 1992-2011 to examine the impact of bank lending and macroeconomic policy on the growth of Small Scale Enterprises in Nigeria. Data were analysed using the Ordinary Least Square (OLS) regression technique. Empirical findings further revealed that Commercial bank credit finance and industrial capacity utilization exerted significant positive impact on the growth of Small Scale Enterprises. [17] investigated the effect of commercial banks’ credit on SMEs development in the country between 1992 and 2011. Secondary data was employed and the Ordinary Least Square (OLS) technique was adopted to estimate the multiple regression model. The estimated model revealed that commercial banks credit to SMEs and the saving and time deposit of commercial banks exert a positive influence on SMEs development.[39] evaluated the impact of deposit money banks (DMB's) financing of Small and medium scale enterprises on the economic development of Nigeria. The study adopted regression techniques. The finding of the study reveals that deposit money banks (DMB's) financing of Small and medium scale enterprises has no significant impact on economic development in Nigeria. [22] employed Co-integration and Error Correction Modelling (ECM) techniques to investigate empirically the impact of commercial bank credit on Nigeria's Small and Medium Scale enterprises (SMEs) between 1986 and 2012. The results revealed that SMEs and selected macroeconomic variables included in the model have a long run relationship with SMEs output. The study also reveals that savings time deposit and exchange rate has a significant impact on SMEs output in Nigeria. Furthermore, commercial bank credit to SMEs, total government expenditure and bank density has direct but insignificant impact on the country SMEs output. [15a] examined the impact of banking sector credit on the growth of small and medium enterprises in Nigeria. As part of the methodology, annual data between 1985 and 2010 was collected and used in the study while descriptive statistics, correlation matrix and error correction model was used to test the formulated hypotheses which reveals that banking sector credit has significant impact on the growth of small and medium enterprises in Nigeria. [30] ascertained the impact of commercial banks in financing small and medium scale enterprises (SMEs) in Nigeria between 2002 and 2012. A sample of ten (10) commercial banks is drawn for the study and individual bank data and macroeconomic time series annual data were collected. Using panel data regression analysis, the results reveal that commercial bank has significant impact on SMEs’ financing as deduced from the results of constant effect, fixed effect and random effect models which show that commercial banks credit to SMEs, the ratio of credit to SMEs to total credit in the economy and equity of commercial banks explain a substantial proportion of changes that arise in SMEs’ financing.

2.3.2. Deposit Money Banks’ Credit to Private Sector and SMEs Growth

- [13] examined the impact of bank lending and macroeconomic policy on the growth of small and medium scale enterprises in Nigeria, with the use of time series data from the Central bank of Nigeria 1992-2011 and ordinary least square regression technique for analysis, the study reveal that commercial bank credit finance has significant positive impact on the growth of small and medium scale enterprises. [21] analysed the contribution of commercial banks loan to small and medium scale enterprises on the growth of the Nigeria economy for the period 1993-2012. With the use of co-integration and error correction model approach they conclude that commercial banks loans to small and medium scale enterprises does not reveal any significant effect on Nigerian economic growth due largely to lack of access to credit occasion and by inability of the traditional financial institutions’ (commercial banks) to provide their credit needs. [3], conducted a study on growth effect of small and medium scale enterprises financing in Nigeria, 1980-2010. The study makes use of multiple regression model and then finds that lending rate has negative effects on economic growth whereas bank’s credit to small and medium scale enterprises is significant at 5% critical level. Hall and Fang (2004) studied the differentiation between long-term and short-term debt.

2.3.3. Deposit Money Banks’ Interest Rate and SMEs Growth

- [12] adopted the descriptive statistics in a symposium on interest rate, growth and development of small and medium scale enterprises finds that 73% of small firms in Libya depend on informal financial sources and only 11% of the firms are applying for term bank loans. The imposed interests on loans by banks limit the application for formal loans by SMEs and this adversely affects their growth. The study recommends that the high interest rate charged by banks should be reviewed drastically to enables small and medium scale enterprises (SMEs) access fund. [15], investigated the effect of financial Intermediation and small and medium scale enterprises performance in Nigeria with the use of an econometric model of the ordinary least square (OLS) analysis. They find that financial intermediation, bank loans and advances, to small and medium scale enterprises, bank lending rate to small and medium scale enterprises, exchange rate and monetary policy have positive and significant effect on small and medium scale enterprises performance in Nigeria. It is only bank interest rate to small and medium scale enterprises that does not have positive and significant effect. [14], investigated the effects of interest rates on micro, small and medium scale enterprises access to funds and their financing decision in way municipality of Ghana. In this study of 200 enterprises using multiple regression and descriptive survey for analysis, the study shows that micro, small and medium scale enterprises resort to equity financing in order to avoid the high interest rate of banks.[40] using descriptive statistics, found that high interest rate and costs of resolving information asymmetry can increase the difficulty of small firms to obtain loans and this impede their growth. [43], examined the impact of banking system credit to small and medium scale enterprises and economic growth in Nigeria with the use of annual data from 1981 to 2013. The study employs ordinary least square (OLS) and co-integration econometric method with the use of sequential modified LR test statistic. They noted that bank lending rate has negative and significant impact on economic growth in Nigeria. [22], investigated empirically the impact of commercial Bank credit or Nigerian small and medium scale enterprises (1986-2012), using co-integration and error correction modelling techniques. They found that interest rate has adverse effect on small and medium scale enterprises output. [9] adopted a descriptive statistics and observes that some savings and loans companies’ charge as much as 10 percent per month which when accumulated would be over 100 percent interest rate per annum. It is more difficult for firms paying such high interest rate to obtain excess profit after being able to settle this high cost of debt. The extremely high interest rate group pays interest between 7% and 10% per month. 8% of the respondents, which indicated that the rates charged by the financial institution are high, also pay interest of 5% to 7% per month, with just 5%, which may be termed “fortunate” service their debts at a maximum rate of 21% per annum. This puts the businesses under intense pressure and eventually making the business unprofitable.

3. Methodological Approach

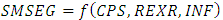

- An ex-post facto research design was adopted to estimating the effect of deposit money banks’ credit to small and medium scale enterprises, credit to private sector and variations in interest rate on growth of SMEs for a period of thirty years from 1986 to 2015. Secondary data were sourced from Central Bank of Nigeria (CBN) and National Bureau of Statistic (NBS) official reports. Small and Medium Scale Enterprises Growth (SMSEG) is the dependent variable. The independent variables are deposit money banks’ Credit to Small and Medium Scale Enterprises Growth (CSMSE), Credit to Private Sector (CPS) and Interest Rate (INTR). Real Exchange Rate (REXR) and Inflation (INF) were integrated in the models as control variables to cater for the probable effect of macroeconomic shocks on growth of small and medium scale enterprises growth. The amalgamation of control variables help to reduce bias and improve the robustness of model estimation.

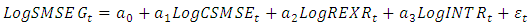

3.1. Empirical Model Specification

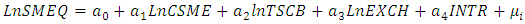

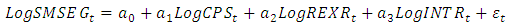

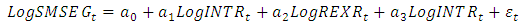

- The modified model of Dada (2014) for a similar study in Nigeria was adopted. [17] originally log linearized his model as follows:

| (3.1) |

| (3.2) |

| (3.3) |

| (3.4) |

| (3.5) |

| (3.6) |

| (3.7) |

3.2. Description of Variables

- SMSEG is small and medium scale enterprises growth: Whole and retail trade output as a component of real gross domestic product is the proxy for SMSE growth. The easier it is for them to access these loans from banks, the faster they grow and the better they perform.CSMSE is deposit money banks credit small and medium scale enterprises: This is the credit banks give to only small and medium scale enterprises. Deposit money banks’ in Nigeria are compel to set aside 10% of their profit after tax for allocation to small and medium scale enterprises. CPS is deposit money banks credit to the private sector: This is the credit banks extend to the private sector of the economy which are driven by small and medium scale enterprises. The credit mostly is short term and medium term in few occasions as banks consider long term as unattractive. INTR is interest rate: This is the rate at which banks extend credit to economy or the cost of capital that varies monthly and depending on the monetary policy rate the Central Bank of Nigeria. If the deposit money bank’s Interest rate is high, it becomes costlier for small and medium scale enterprises to access credit from Deposit Money banks. However, the reverse is the case when the Interest rate is low. REXR is real exchange rate: This is the exchange rate the Naira against the US dollar. Trade surplus rises the value of a local currency as a deficit trade balance of a foreign country. A stable and favourable increases export, which in turn enhances economic growth via production processes of small and medium scale enterprises. INF is inflation rate: Inflation rate is variation and sudden increases in the prices of goods and services which drastically reduces the purchasing power of money. A high level of inflation occasioned my high money supply results in high cost productive materials for small and medium scale enterprises, which ultimately affects their growth.

is a constant coefficient,

is a constant coefficient,  is a random error term and t is the time trend, which are amalgamated in standard time-series specifications model specification to account unexplained random effects within the model.

is a random error term and t is the time trend, which are amalgamated in standard time-series specifications model specification to account unexplained random effects within the model.4. Data Analysis and Discussion of Results

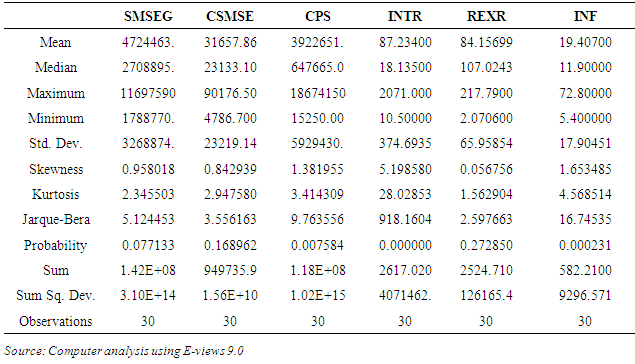

4.1. Descriptive Properties of Variables

- Exploring the descriptive properties of the variables as presented in Table 1, the means were found to be 4724463 for SMSEG, 31657.86 for CSMSE, 3922651 for CPS, 87.2 for INTR, 84.16 for REXR and 19.4 for INF. Similarly, SMSEG, CSMSE, CPS, INTR, REXR and INF show the median of 2708895, 23133.1, 647665.1, 18.13, 107.02 and 11.90 respectively. The maximum value reveal 11697590 for SMSEG, 90176.50 CSMSE, 18674150 for CPS, 2071 for INTR, 217.79 for INTR and 72.8 for INF while the minimum unveil 1788770 for SMSEG, 4786.7 CSMSE, 15250 for CPS, 10.50 for INTR, 2.07 for REXR and 5.4 for INF. The standard deviation of the series are 3268874, 23219.14, 5929430, 374.6935, 65.96 and 17.90 for SMSEG, CSMSE, CPS, INTR, REXR and INF respectively. The standard deviation of 23219.14 and 5929430 entails that there was much fluctuations in CPS compared to CSMSE within the period of the study. Again, the variations in interest rate was greater than the level of inflation in the economy as revealed by the standard deviation of 374.69 and 17.90 for INTR and INF respectively. The date were all positively skewed towards normality as shown by the positive values of the skewness statistic. The Kurtosis value shows CPS, INTR and INF are leptokurtic in nature as the Kurtosis statistic are higher than 3. The Jarque-Bera suggests that SMSEG, CSMSE and REXR are not normally distributed as the p-values are insignificant at 5% level of significance.

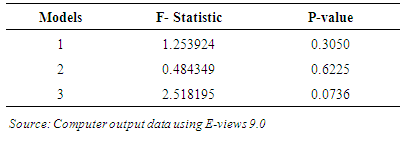

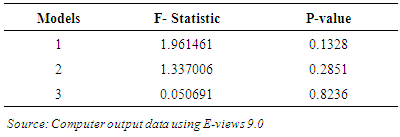

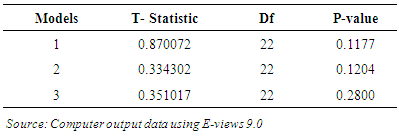

4.2. Diagnostic Tests Results

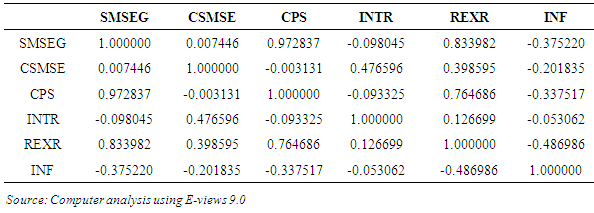

- The models were subjected to diagnostic test of serial correlation LM test, ARCH Heteroskedasticity Test, Ramsey RESET Test and multicollinearity. The insignificant p-values for the models in Tables 2 and 3 show no autocorrelation and heteroskedasticity issues. Table 4 unveils that the models were well specified (p-value insignificant at 5%) while Table 5 indicates no problem of multicollinesrity.

|

|

|

|

|

4.3. Stationarity Tests Results

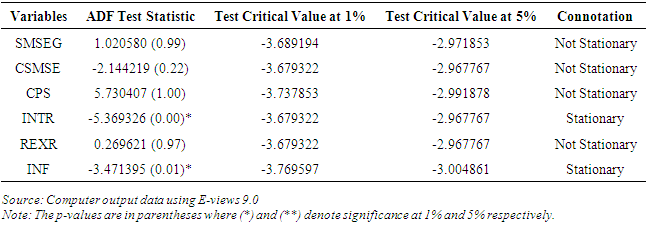

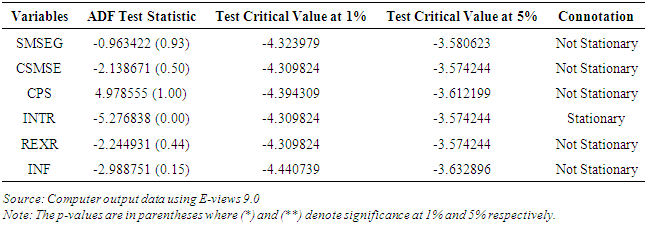

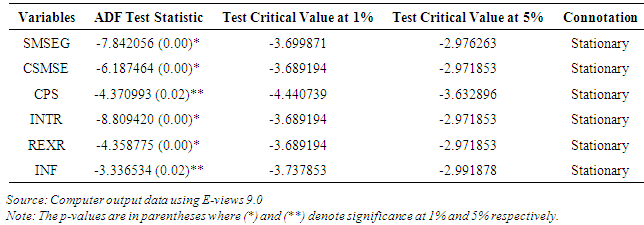

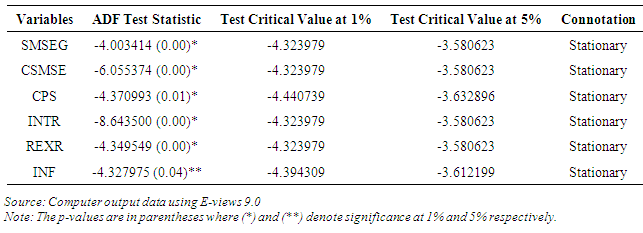

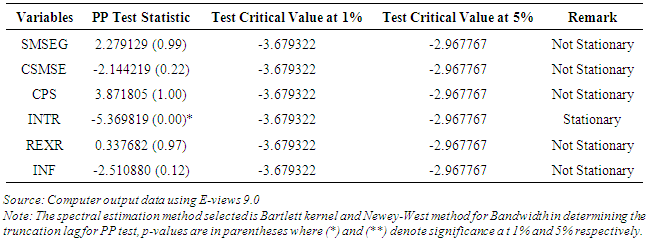

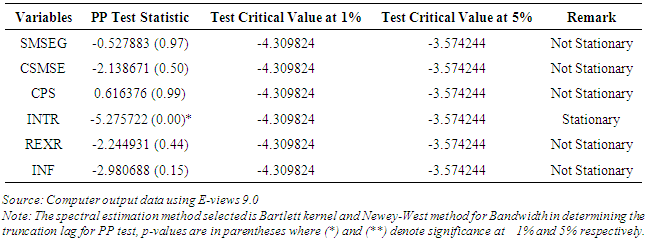

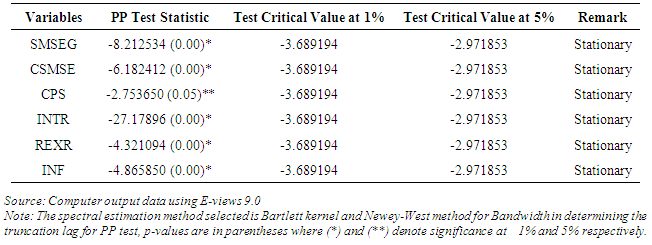

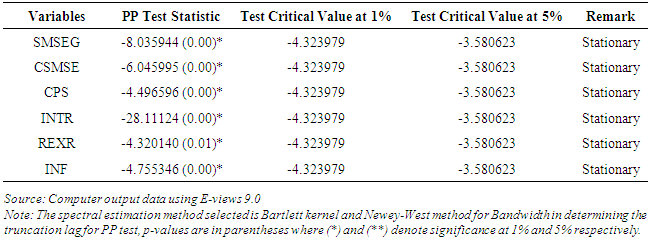

- Augmented Dickey-Fuller (ADF) and Phillip Perron (PP) TestTo check for stationarity of variables, the ADF and PP test was performed at level and first difference at constant without trend and with trend. The result of the ADF test in Tables 6 and 7 performed level form at constant without trend and with trend unveil that all the variables are not stationary at level form except INTR and INF. The unit root result in Tables 8 and 9 at constant without trend and with trend of first difference shows that the ADF test statistic for all the variables are stationary at first difference at the 5% level of significance and integrated of order one i.e. 1(1). Tables 10 and 11 depict the result of the level form test at constant without trend and with trend while Tables 12 and 13 that of first difference at constant without trend and with trend. The result in Tables 10 and 11 show that stationarity would not be achieved for all the variables thus, rechecking at first difference. The Phillip Perron (PP) test in Tables 12 and 13 reveal that all the variable are stationary at first difference. The result of the unit root test via ADF and PP depict that stationarity of all the variables were achieved at first difference, hence permitting for the testing of the long run relationship between the variables.

|

|

|

|

|

|

|

|

4.4. Long Run Relationship

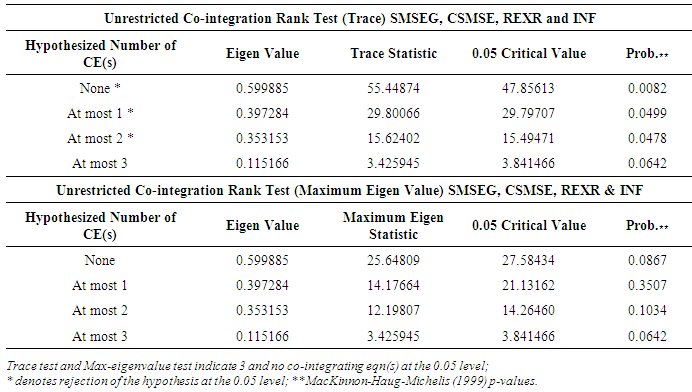

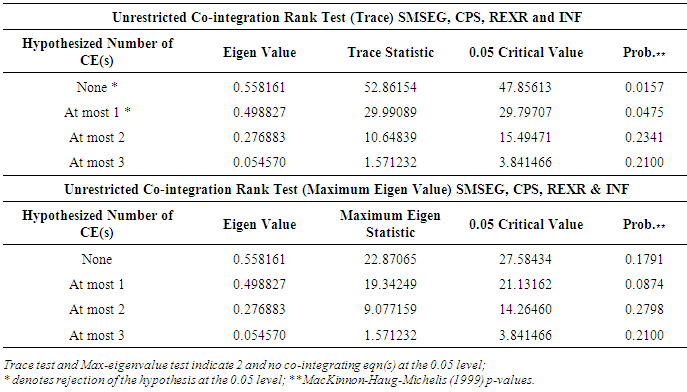

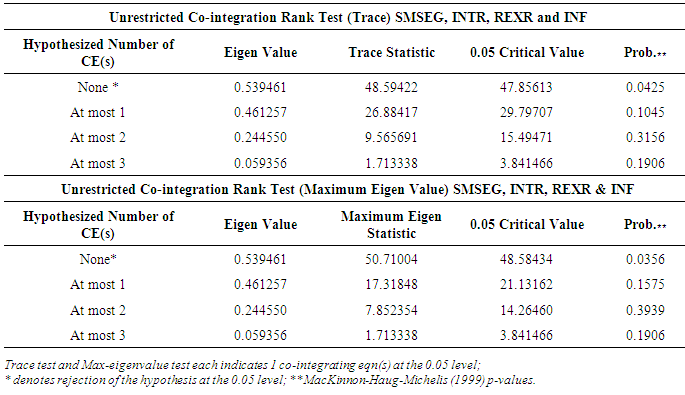

- The long run relationship between the dependent and the independent variables were tested using the Johansen co-integration methodology and the results summarized in Table 14, 15 and 16. The Johansen co-integration result in Table 14 reveals that small and medium scale enterprises growth and deposit money banks credit to small and medium scale enterprises are co-integrated in the long run. This affirmed by the trace test which indicates three (3) co-integrating equations at 5% level of significance. However, the max-eigenvalue indicates no co-integrating equation(s) between the dependent and the independent variables.As can be seen in Table 15, the trace test and Max-eigenvalue test show the presence of one (1) co-integrating equation at the 5% level of significance in line with MacKinnon-Haug-Michelis (1999) p-values. It can be deduce from this result that there is a long run relationship between small and medium scale enterprises growth and deposit money banks credit to private sector. This is insinuation that increasing credit to private sector by deposit money banks would spur the growth small and medium scale enterprises as would be evidenced in increased production. Looking at the trace and Max-eigenvalue test in Table 16 which shows one (1) co-integrating equation each at the 5% level of significance, there is a considerable evidence of the existence of a long run association between small and medium scale enterprises growth and interest rate in Nigeria. This implies that the prevailing level of interest rate would in the long run influence the growth of between small and medium scale enterprises.

|

|

|

4.5. OLS Regression Relationship

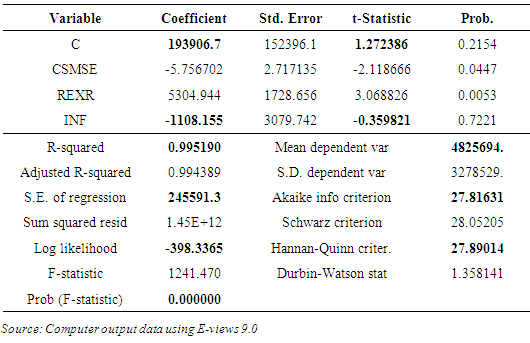

- The OLS relationship via multiple regression was determined using the ordinary least square estimation technique. Global utility (coefficient of Adjusted R-squared, F-statistic and Durbin Watson statistic) and relative statistics criteria (coefficient of the constant and independent variables) were employed in interpreting the output of the models. Nonetheless, the lagged values of the dependent variables, specifically for model 1 and 2 were applied check the reliability of the Durbin Watson in addition to the serial correlation test performed in Table 2. Small and Medium Scale Enterprises Growth and Deposit Money Banks CreditThe model relative statistics in Table 17 reveal that small and medium scale enterprises growth, inflation and deposit money banks credit to small and medium scale enterprises are negatively related while a positive and significant relationship was found between real exchange rate and small and medium scale enterprises growth. The coefficient of the constant 193906.7, suggests that holding deposit money banks credit to small and medium scale enterprises, real exchange rate and inflation constant, growth in small and medium scale enterprises would be

193, 906.7 million. The significant p-value of credit to small and medium scale enterprises is an indication that unit increase in deposit money banks credit to small and medium scale enterprises results in

193, 906.7 million. The significant p-value of credit to small and medium scale enterprises is an indication that unit increase in deposit money banks credit to small and medium scale enterprises results in  5.76 million reduction in small and medium scale enterprises growth. This negates the a priori expectation of a positive relationship. A percentage rise in real exchange rate entails a

5.76 million reduction in small and medium scale enterprises growth. This negates the a priori expectation of a positive relationship. A percentage rise in real exchange rate entails a  5, 304.94 million appreciation in small and medium scale enterprises growth. A rise in the level of inflation would likely reduce small and medium scale enterprises growth by

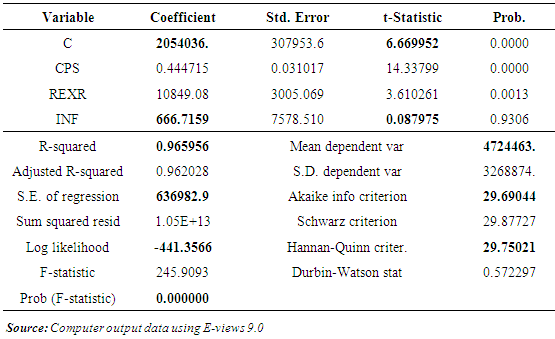

5, 304.94 million appreciation in small and medium scale enterprises growth. A rise in the level of inflation would likely reduce small and medium scale enterprises growth by  1, 108.12 million units. The Adjusted R-squared value of 0.994389 indicates that the independent variables explained 99.43 variations in small and medium scale enterprises growth in the period studied. The F-statistic of 1241.470 and p-value of 0.0000 show that banks credit to small and medium scale enterprises, real exchange rate and inflation jointly and significantly influenced variations in small and medium scale enterprises growth. The Durbin Watson statistic of 1.35 is not quite close to 2.0, however, any deficiency it may have created in the model was corrected with the serial correlation LM test in Table 2 which absolved the presence of autocorrelation in the model.Small and Medium Scale Enterprises Growth and Credit to Private SectorTable 18 shows that credit to private sector and real exchange rate have positive and significant relationship with small and medium scale enterprises growth. The relationship between inflation and small and medium scale enterprises growth is also positive but insignificant. The constant coefficient of the model provided that small and medium scale enterprises growth would be

1, 108.12 million units. The Adjusted R-squared value of 0.994389 indicates that the independent variables explained 99.43 variations in small and medium scale enterprises growth in the period studied. The F-statistic of 1241.470 and p-value of 0.0000 show that banks credit to small and medium scale enterprises, real exchange rate and inflation jointly and significantly influenced variations in small and medium scale enterprises growth. The Durbin Watson statistic of 1.35 is not quite close to 2.0, however, any deficiency it may have created in the model was corrected with the serial correlation LM test in Table 2 which absolved the presence of autocorrelation in the model.Small and Medium Scale Enterprises Growth and Credit to Private SectorTable 18 shows that credit to private sector and real exchange rate have positive and significant relationship with small and medium scale enterprises growth. The relationship between inflation and small and medium scale enterprises growth is also positive but insignificant. The constant coefficient of the model provided that small and medium scale enterprises growth would be  2, 054, 036 million if deposit money banks credit to private sector, real exchange rate and inflation are held constant. A percentage rise in credit to private sector would amount to

2, 054, 036 million if deposit money banks credit to private sector, real exchange rate and inflation are held constant. A percentage rise in credit to private sector would amount to  0.44 million growth in small and medium scale enterprises. Real exchange rate unit appreciation would increase small and medium scale enterprises growth by a factor of

0.44 million growth in small and medium scale enterprises. Real exchange rate unit appreciation would increase small and medium scale enterprises growth by a factor of  10, 849.08 million as inflation rate amidst credit to private sector and real exchange rate would rise small and medium scale enterprises growth by

10, 849.08 million as inflation rate amidst credit to private sector and real exchange rate would rise small and medium scale enterprises growth by  666.72 million consequent ton a unit rise in inflation rate. From the Adjusted R-squared in Table 18, 96.20% changes in small and medium scale enterprises growth was attributed to the joint effect of credit to private sector, real exchange rate and inflation. The F-statistic of 245.91 and p-value of 0.0000 show that the explanatory variables statistically and significantly explained the variation in small and medium scale enterprises growth in the period reviewed. The Durbin Watson value of 0.57 reflects autocorrelation. Nonetheless, the serial correlation test in Table 2 shows that the variables in the model are not serially correlated.Small and Medium Scale Enterprises Growth and Interest RateAs expected, regression result in Table 19 reveals that interest rate and inflation rate have negative but insignificant relationship with small and medium scale enterprises growth as real exchange rate positively and significantly relates with small and medium scale enterprises growth. From the coefficient constant, small and medium scale enterprises growth would amount to

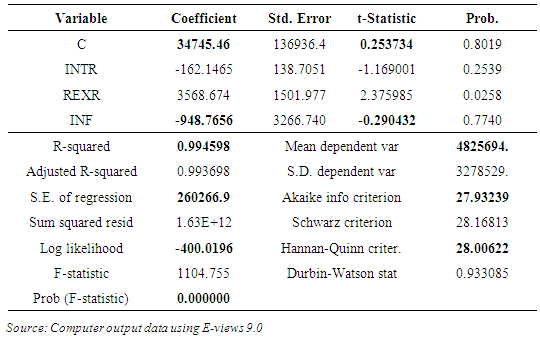

666.72 million consequent ton a unit rise in inflation rate. From the Adjusted R-squared in Table 18, 96.20% changes in small and medium scale enterprises growth was attributed to the joint effect of credit to private sector, real exchange rate and inflation. The F-statistic of 245.91 and p-value of 0.0000 show that the explanatory variables statistically and significantly explained the variation in small and medium scale enterprises growth in the period reviewed. The Durbin Watson value of 0.57 reflects autocorrelation. Nonetheless, the serial correlation test in Table 2 shows that the variables in the model are not serially correlated.Small and Medium Scale Enterprises Growth and Interest RateAs expected, regression result in Table 19 reveals that interest rate and inflation rate have negative but insignificant relationship with small and medium scale enterprises growth as real exchange rate positively and significantly relates with small and medium scale enterprises growth. From the coefficient constant, small and medium scale enterprises growth would amount to  34, 745.46 million when interest rate, real exchange rate and inflation are kept constant. A rise in interest rate and inflation would reduce small and medium scale enterprises growth by

34, 745.46 million when interest rate, real exchange rate and inflation are kept constant. A rise in interest rate and inflation would reduce small and medium scale enterprises growth by  162.15 million and

162.15 million and  948.76 million respectively. A percentage appreciation in real exchange rate enhances small and medium scale enterprises growth by

948.76 million respectively. A percentage appreciation in real exchange rate enhances small and medium scale enterprises growth by  3, 568.67 million. The Adjusted R-squared which shows the percentage variation in the dependent variable attributed to explanatory variable(s) infers in Table 19 that about 99.37% change in small and medium scale enterprises growth in the period studies was as a result of fluctuation in interest rate, real exchange rate and inflation. This explained variation in small and medium scale enterprises growth is statistically significant at 5% as affirmed by F-statistic of 1140.75 and p-value of 0.000. The Durbin Watson value of 0.93 is an insinuation that there is no problem of autocorrelation in the model. That notwithstanding, serial correlation test in Table 2 for model 3 envisages that the variables were not serially correlated.

3, 568.67 million. The Adjusted R-squared which shows the percentage variation in the dependent variable attributed to explanatory variable(s) infers in Table 19 that about 99.37% change in small and medium scale enterprises growth in the period studies was as a result of fluctuation in interest rate, real exchange rate and inflation. This explained variation in small and medium scale enterprises growth is statistically significant at 5% as affirmed by F-statistic of 1140.75 and p-value of 0.000. The Durbin Watson value of 0.93 is an insinuation that there is no problem of autocorrelation in the model. That notwithstanding, serial correlation test in Table 2 for model 3 envisages that the variables were not serially correlated.

|

|

|

4.6. Short Run Dynamics

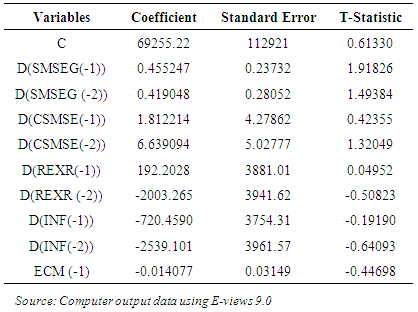

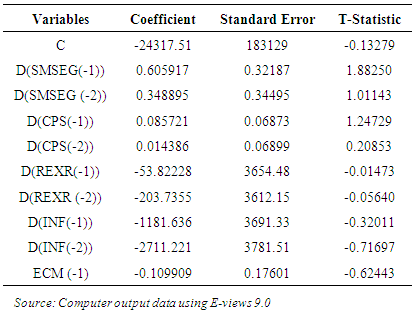

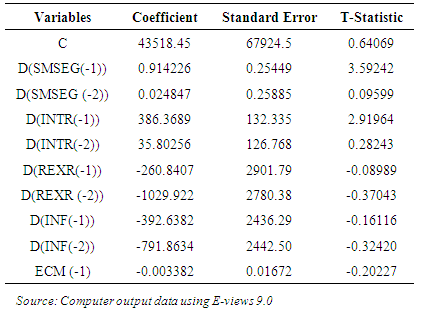

- Having established the presence of a long run relationship between the dependent and independent variables, the short run dynamics was ascertained using the Vector Error Correction Model (VECM) and the results presented in Table 20, 21 and 22. The VECM was conducted to ascertain if or not all the variations in dependent variable was owing to the co-integrating vectors trying to return to equilibrium and the error correction term that captures this variation. On the long run relationship between small and medium scale enterprises growth and deposit money banks credit to small and medium scale enterprises, the error correction model coefficient as shown in Table 20 showed the expected negative sign expressing that there is a tendency by the model to correct and move towards the equilibrium path following disequilibrium in each period thus, significant error correction is taking place. 1.41% of the error generated in the previous year is corrected in the current year. For long run linkage between small and medium scale enterprises growth and credit to private sector, Table 21 reveals that the error correction again possessed the expected negative sign envisaging that a significant error is taking place. 11% of the error generated in the preceding year is corrected in the present year. Table 22 presents the VECM result on the on the co-integration relationship between small and medium scale enterprises growth and interest rate. The error correction model again exhibited the expected negative sign, an indication that there are adjustments to stability in the short term.

|

|

|

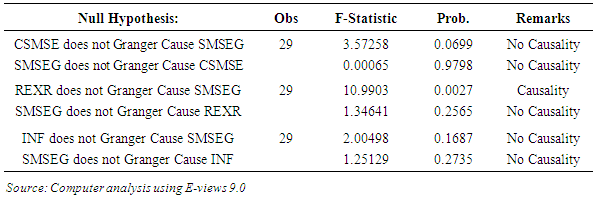

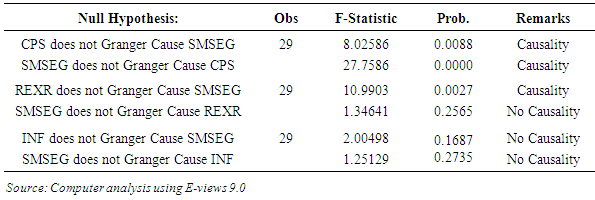

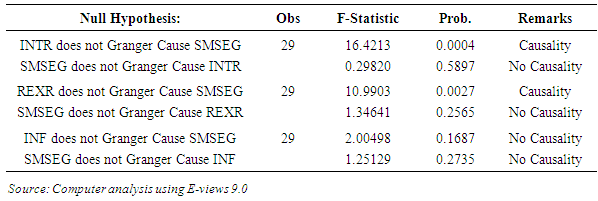

4.7. Pairwise Granger Causality Effect Assessment Test

- To assess the effect of deposit money banks credit surrogates on small and medium scale enterprises growth, the pairwise granger causality test was evoked and the results groomed in Table 23, 24 and 25. From the clad result in Table 4.10a, deposit money banks credit to small and medium scale enterprises does not granger growth of small and medium scale enterprises. Causality does not run from deposit money banks credit to small and medium scale enterprises to growth of small and medium scale enterprises. It can be inferred that deposit money banks credit to small and medium scale enterprises has no significant effect on the growth of small and medium scale enterprises in Nigeria. However, it was found that real exchange rate exerts significant influence on growth of small and medium scale enterprises as causality flows from real exchange rate to small and medium scale enterprises growth at 5% significance level.The result in Table 24 unveils that credit to private sector granger cause small and medium scale enterprises growth in one side and growth of small and medium scale enterprises granger cause credit to private sector, that is, there is a bidirectional or two way relationship between small and medium scale enterprises growth and credit to private sector at 5% level of significance. Causality runs from credit to private sector to small and medium scale enterprises growth and from growth of small and medium scale enterprises back to credit to private sector. This result shows that credit to private sector has significant effect on small and medium scale enterprises growth and small and medium scale enterprises growth on the other hand, has significant effect on credit to private sector. Inflation rate was found not significantly affect small and medium scale enterprises growth. Finally, from Table 25, there is unidirectional or one way relationship between interest rate and small and medium scale enterprises growth as interest rate granger cause small and medium scale enterprises growth at 5% level of significance. Causality was evidenced to flow from interest rate to small and medium scale enterprises growth. In essence, interest rate has significant effect on small and medium scale enterprises growth in Nigeria.

|

|

|

4.8. Discussion of Findings

- The result in Table 18 envisaged the expected positive relationship between credit to private sector and growth of small and medium scale enterprises. This is also confirmed the granger causality effect test in Table 25 which disclosed the significant effect of credit to private sector on small and medium scale enterprises growth. The findings in Table 18 and Table 23 clad that an increase in deposit money credit to private sector leads to rise in the liquidity positions of SMEs which gives them more room for business expansion by investing in high income ventures, hence their growth with respect to size and contribution to GDP. This supports the works of [13, 21] on the positive and significant effect of credit to private sector on SMEs growth in Nigeria. Following the significant negative relationship between SMSEs growth and interest rate in Table 19, granger causality test in Table 25 proved that interest rate negatively and significantly affect SMSEs growth in Nigeria. This is expected because the higher the interest rate, the higher the cost of capital which decreases the level of investment capable of spurring and sustaining growth. With high interest rate as the case in Nigeria today, investors or entrepreneurs are discouraged to produce which reduces the monetary value of goods and services of SMSEs. This is in tandem with the study of [12, 5, 14, 40, 43, 22] and legendary work of Morris (1976).Taking inferences from Table 17, it is surprising to observe that the relationship between SMSEs growth and deposit money banks credit to SMSEs is negative. This is against a priori expectation and theoretical consideration. This may be that the increasing credit to SMSEs by banks are under-utilized coupled with harsh macroeconomic and operating environment preluding efficacy of the credit extended to SMSEs. Nevertheless, the finding agrees with [33, 15] but would not confirm the previous studies off [17, 5, 30] on the positive influenced of banking sector credit to SMSEs. As shown in Tables 23, 24 and 25, real exchange rate exerted a significant effect on SMSEs growth within the period studied. This is an inference that the appreciation of the Naira against US dollar and other foreign currency would improve the value of the Naira, decrease imports as it will exorbitant and encourages exports. This is in unison with [17, 5]. Although inflation was not found to significantly affect SMSEs growth, OLS regression in Tables 17, 18 and 19 pointed that inflation and SMSEs growth are negatively related. This is on the premises that higher rate of inflation erodes the purchasing power of money thereby reducing value. The reduction in value of money ultimately leads to reduction in economic production units, threatening the progressive projection of sustained increase in gross domestic products.

5. Conclusions and Recommendations

- The economic rationale for credit to small and medium scale enterprises (SMEs) is indisputable as earlier views of small and medium scale enterprises was seen to have progressively become a major factor in economic development of many countries of the world. This study has empirically brought to light pivotal role of deposit money banks’ credit to growth of small and medium scale enterprises, which in turn accelerate economic growth and development. In addition, the finance led growth postulation for growth and development of an economy through mobilization and allocation of financial resources to deficit economic unit is valid in Nigeria. Although studies have assessed this subject matter, this study should be not an ultimate result on the nexus between banks’ credit and small and medium scale enterprises growth, rather a motivation for the development new ideas by scholars to emphatically and unambiguously assist banks to improving credit to the private sector as a way of achieving the vision of Nigeria to be among the top twenty economy in the world..In lieu of the findings of this study, the following recommendations are offered to be giving attention by decision makers to spur growth of small and medium scale enterprises in Nigeria:Ÿ While deposit money banks’ credit to small and medium scale enterprises so far has not improved growth of small of medium scale enterprises, the Central Bank of Nigeria should compel banks to increase the 10% fund allocation for small and medium scale enterprise to a range of 25% to 30% to serve as a pool of fund accessible only to small and medium scale enterprises. Nevertheless, 10% fund allocation for small and medium scale enterprise cannot be said to insufficient considering the business environment in the country.Ÿ Even though the banks operate as business entity, top management should see economic development as a priority by extending more credit to the private sector which are driven by small and medium scale enterprises. The oil and gas sector should not be seen as the only fertile sector for the bulk of banks’ credit.Ÿ The Central Bank of Nigeria should consider reducing the monetary policy rate from current 14% to a range of 5% to 7% as this would reduce the interest rate charge by banks on loans and advances and further lower the cost of capital for small and medium scale enterprises.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML