-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(4): 95-103

doi:10.5923/j.ijfa.20170604.01

Value Relevance of Accounting Data in the Pre and Post IFRS Era: Evidence from Nigeria

Olayinka Erin1, Paul Olojede1, Olaoye Ogundele2

1Department of Accounting, Covenant University, Ota, Nigeria

2Department of Business Management, Babcock University, Ilishan, Nigeria

Correspondence to: Olayinka Erin, Department of Accounting, Covenant University, Ota, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

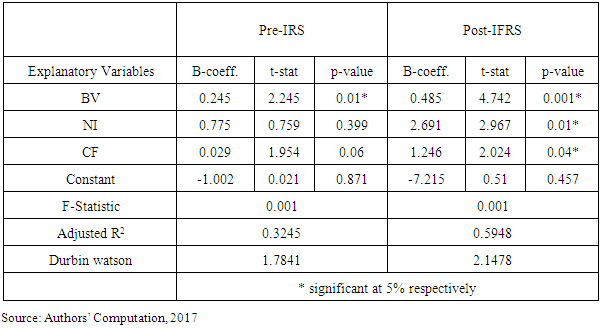

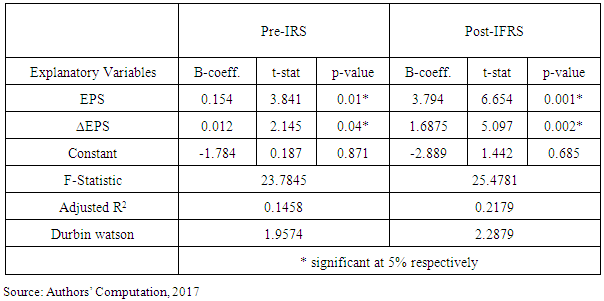

This research examines value relevance of accounting data in the pre and post IFRS period in Nigeria. The study focuses on four year period (2008-2011) before IFRS and four year period (2012-2015) after IFRS adoption. We sampled 52 public entities from consumer goods and financial services sector in Nigeria. We measured value relevance using price regression model and returns regression model of accounting data. Our findings of price regression show an increase in adjusted R2 between the two periods from 32% to 59% which accounts for 84% growth in adjusted R2 while the return regression model shows an increase in adjusted R2 between the two periods from 14% to 22% which accounts for 57% growth in adjusted R2. This finding suggests the value relevance of accounting data is more pronounced in the post-IFRS period for the sampled firms used in this study. Our findings also reveal that IFRS implementation in Nigeria has enhanced the value relevance of accounting data such as earnings, cash flow, book value and net income. We recommend that more measures should be taken by regulatory authorities (Financial Reporting Council of Nigeria, Central Bank of Nigeria) to ensure that all public entities comply strictly with IFRS. This will enable relevant and reliable financial information to be passed to the capital market for investors to take an informed and relevant decision.

Keywords: Accounting Data, IFRS, Nigerian Stock Exchange, Value Relevance

Cite this paper: Olayinka Erin, Paul Olojede, Olaoye Ogundele, Value Relevance of Accounting Data in the Pre and Post IFRS Era: Evidence from Nigeria, International Journal of Finance and Accounting , Vol. 6 No. 4, 2017, pp. 95-103. doi: 10.5923/j.ijfa.20170604.01.

Article Outline

1. Introduction

- International Financial Reporting Standards (IFRS) implementation is considered as one of the most important events in the history of accounting worldwide. In recent times, many countries have adopted IFRS in compliance with global best practice and to ensure single accounting framework (Barth, Landsman & Lang, 2008). The rapid development in cross border transactions, transnational investments, and international market activities brought to fore the need for the preparation of a financial statement by different countries. These complexities in financial transactions have brought about the adoption of IFRS globally (Armstrong Barth, Jagolinzer & Riedl, 2010). The increase in competition and globalization of business makes it imperative for countries to consider IFRS in order to comply with global accounting standards. Also, stock market activities and cross-border trading have become a global issue because companies now source and trade in multiple stock markets around the world. Thus, the acceptance of IFRS provides an answer to all these aforementioned issues. IFRS is intended to harmonize all the differences in tax matters, legal issues, and business structure, so as to resolve the diversities and complexities in financial reporting (Essien-Akpan, 2011).IFRS is regulated by the International Accounting Standards Board (IASB) that has the sole responsibility and authority to issue international accounting standards. Thus, IASB provides high quality accounting standards that are aimed at helping to eliminate the barriers for corporations who want to find access to international equity markets, and for investors who want to seek global investment opportunity (Pradhana, 2014). One major reason for IFRS implementation is to avail countries the opportunity to enhance their international stock market trading activities (Lambert, Hubner & Michel, 2006). Ball (2006) posits that IFRS benefits to investors are enormous as it brings improved quality of financial reporting, timeliness in financial reporting process compared to having and applying various local standards.The major reason for the collapse of some big corporations such as Enron, WorldCom, and AIG was creative accounting and manipulation of financial statements. In 2002, Enron, a major energy company, collapsed as a result of manipulation of accounting figures in relation to share price manipulation. In 2005, AIG was investigated for accounting fraud and non-adherence to corporate governance issues. As a result of this scandal, the company lost over $45 billion worth of market capitalization. Similarly, in Nigeria precisely October 2006, the board of directors of Cadbury Nigeria Plc. discovered “overstatement” in its accounts, which spanned for many years. The company lost

billion as a result of the financial manipulation (Eromosele, 2015). In 2009, several CEOs of banks in Nigeria were sacked as a result of manipulation of financial figures, share price manipulation, non-adherence to corporate governance codes and distortion of the financial statement.Sequel to the aforementioned challenges, we are motivated to examine whether accounting data has produced high quality and value-relevant financial information after the adoption of IFRS, which is able to reduce manipulative and creative accounting. This study is expected to contribute to the growing literature in the area of capital market research in Nigeria. However, there are previous studies (Umoren & Enang, 2015; Onipe, Onyabe & Usman, 2015; Emeni, Uwuigbe, Uwuigbe & Erin, 2016) on IFRS and value relevance which was only restricted to listed banks in Nigeria. This study, therefore, seeks to expand the scope of literature by examining the consumer goods and financial services sector listed on the Nigerian Stock Exchange (NSE) for four year pre-IFRS period (2008-2011) and four year post-IFRS period (2012-2015). In view of the above stated problems, the following research questions are stated: (i) To what extent has the implementation of IFRS enhanced the value relevance of accounting data of sampled firms in Nigeria using price regression model? (ii) Does the IFRS implementation enhance the value relevance of accounting data of sampled firms in Nigeria using returns regression model?We organize the paper as follows: Section 2 discusses the review of literature; Section 3 presents the methods adopted as well as specification of the model. Section 4 reports the results and discussion while Section 5 concludes the paper and presents recommendation.

billion as a result of the financial manipulation (Eromosele, 2015). In 2009, several CEOs of banks in Nigeria were sacked as a result of manipulation of financial figures, share price manipulation, non-adherence to corporate governance codes and distortion of the financial statement.Sequel to the aforementioned challenges, we are motivated to examine whether accounting data has produced high quality and value-relevant financial information after the adoption of IFRS, which is able to reduce manipulative and creative accounting. This study is expected to contribute to the growing literature in the area of capital market research in Nigeria. However, there are previous studies (Umoren & Enang, 2015; Onipe, Onyabe & Usman, 2015; Emeni, Uwuigbe, Uwuigbe & Erin, 2016) on IFRS and value relevance which was only restricted to listed banks in Nigeria. This study, therefore, seeks to expand the scope of literature by examining the consumer goods and financial services sector listed on the Nigerian Stock Exchange (NSE) for four year pre-IFRS period (2008-2011) and four year post-IFRS period (2012-2015). In view of the above stated problems, the following research questions are stated: (i) To what extent has the implementation of IFRS enhanced the value relevance of accounting data of sampled firms in Nigeria using price regression model? (ii) Does the IFRS implementation enhance the value relevance of accounting data of sampled firms in Nigeria using returns regression model?We organize the paper as follows: Section 2 discusses the review of literature; Section 3 presents the methods adopted as well as specification of the model. Section 4 reports the results and discussion while Section 5 concludes the paper and presents recommendation.2. Literature Review

2.1. Conceptual Framework

2.1.1. IFRS Adoption in Nigeria

- The call for uniform accounting standards internationally started in 1966, when the request to establish an international study group (ISG) was put forward by American Institute of Certified Public Accountant (AICPA), Canadian Institute of Chartered Accountant (CICA) and Institute of Chartered Accountant of England and Wales (ICAEW). The following year, precisely, February 1967, this resulted in the formation of Accountants International Study Group (AISG), which began to publish papers on important accounting topics regularly (Wilson, Ioraver, Adaeze & Iheanyi, 2013). The call to unify accounting standards occurred because of the international differences that curtailed investment opportunities among the countries of the world (IFAC, 2008).Due to the need for Nigeria to comply with international accounting standards in line with other countries of the world, the Financial Reporting Council of Nigeria (FRCN) formerly known as Nigerian Accounting Standards Board (NASB) in 2010 published a roadmap which spelled out the blueprint that would lead to the implementation of IFRS in Nigeria. Detailed in three distinct milestones and timelines, the roadmaps were stated as follows with (i) all public listed companies and significant public interest entities in Nigeria by 2012 (ii) other public interest entities in 2013 and (iii) small and medium-sized entities in 2014.A number of African countries including Nigeria, Ghana, Sierra Leone, South Africa, Kenya, Zimbabwe and Tunisia among others have adopted or declared intentions to adopt the standards. In particular, Nigeria’s adoption of IFRS was launched in September 2010 by the Honourable Minister, Federal Ministry of Commerce and Industry – Senator Jubriel Martins-Kuye (OFR) (Madawaki, 2012). The adoption was planned to commence with Public Listed Companies in 2012 and end 2014. As at today, the banking sector has fully implemented IFRS. This is considered a welcome progress for developing countries, especially for those that had no resources to establish own standards.There has been an argument whether the benefits of adopting IFRS outweigh the costs because many countries have been faced with the challenges of adopting IFRS. This argument remains an empirical issue that should be answered. IFRS proponents argue that substantial benefits can be derived from greater cross-country comparability of firm’s financial reports while opponents argue that one single set of accounting standards cannot proffer solution to differences in business practices arising from differences in culture and institutions (Iyoha & Faboyede, 2011). There are both political and economic factors affecting adoption of IFRS in any country. The political factors includes assessment as to whether adopting countries consider the benefits arising from the potentially political nature of international accounting standard setting while the economic factors consider the direct financial benefits as they are usually conceived in the economic models of networks (Barth, Landsman & Lang, 2008).

2.1.2. Financial Reporting and Capital Market in Nigeria

- There are set of rules that guide the practice of accountancy worldwide. These rules and guidelines are compiled into accounting standards that dictate the tune of financial reporting in any country of the world. These standards are statements of principle that discuss the accounting treatment and disclosure of a particular item or group of items in the preparation of financial statement (Herbert, 2010). Different countries of the world have their respective local accounting standards, developed, issued and regulated by their respective local accounting bodies before the global convergence to IFRS (Umoren & Enang, 2015).The Nigerian Accounting Standards Board (NASB) has been responsible for developing, issuing and regulating accounting standards in Nigeria since 1982 until July 2012, when the Financial Reporting Council Bill was signed into law. Companies listed on the Nigerian Stock Exchange are required by law to provide the stock market with full information about their operation (Goddy, 2010). The required financial information includes quarterly, half-yearly and annual financial reports. The FRC is a unified independent regulatory body of accounting, auditing, actuarial valuation and corporate governance. It is expected that more meaningful and high quality report can now be arrived at from the financial statements issued in Nigeria because these financial statements are now regulated by Financial Reporting Council of Nigeria.There are sixteen (16) IFRSs/IASs with no equivalent SASs: IFRS 1 (First time Adoption of International Financial Reporting Standards), IFRS 2 (Share-based Payment), IFRS 5 (Non-current Assets Held for Sale and Discontinued Operations), IFRS 7 (Financial Instruments: Disclosures), IFRS 9 (Financial Instruments), IFRS 13 (Fair Value Measurement), IFRS 14 Regulatory Deferral Accounts, IFRS 15 Revenue from contracts with customers, IAS 18 (Revenue), IAS 20 (Accounting for Government Grants and Disclosure of Government Assistance), IAS 23 (Borrowing Costs), IAS 24 (Related Party Disclosures), IAS 29 (Financial Reporting in Hyperinflationary Economies), IAS 32 (Financial Instruments: Presentation), IAS 36 (Impairment of Assets) and IAS 41 (Agriculture). Also, SICs (1-33) and IFRICs (1-21) have no equivalent Nigerian interpretations (IFAC, 2008).Eromosele (2015) reveals that IFRS implementation in Nigeria would ensure the integrity of the capital market. The capital market integrity will be enhanced in the area of implied cost of equity capital, the frequency of zero-return days, the price impact of trades and cost of capital efficiency. He further added that IFRS will reduce manipulation of earnings, positively enhance stock market activities, impact on entity’s stock returns and financial performance measures. Casmir (2015) posits that effective financial reporting is a stimulant for the capital market mechanism. Companies have vested interest in providing a high quality of financial reports as it will convey confidence to the capital market operators. However, accounting standards play a key role in the following ways:Consistency: Accounting standards are generally developed in accordance with an agreed conceptual framework. This consistency helps investors to place reliance on the quality of financial reports of firms that operate in the capital market. Neutrality: While companies have an incentive of gaining access to capital, for providing relevant financial information, they do not necessarily have to be unbiased. Users are aware of the potential bias, but if effective accounting standards are in place, investors will have confidence in the financial statements of firms operating in the capital market.Comprehensiveness: Financial reports are prepared in accordance with accounting standards and they are required to contain certain information that will convey detailed information to users of the financial statement. Comparability: If accounting standards are in force, the financial statement of companies can be compared effectively, which makes the decision-making process more efficient. This is particularly important in the context of a global economy, where cross-national comparisons are important. Verification: Auditors verify that financial statements have been prepared in accordance with applicable accounting standards, though an audit report is not a guarantee of a good investment, it, however, lends credibility to the financial statements in a report.

2.1.3. IFRS and Value Relevance

- Value relevance of accounting data is one of the stock market indices that inform the quality of financial information that is passed to the stock market for investors’ to take a relevant decision. Value relevance is the power of accounting data that affect investors’ perception about the future earnings of an entity (Barth et al., 2001). Accounting information can be deemed value-relevant when a significant part of firm’s equity value or other important information can significantly affect investor’s decision. Therefore, the power of financial information to effectively affect investors’ decision on key investment matters depends largely on the relevance of such financial information.Dimitropoulos, Anestis, and Christos (2010) believe that IFRS implementation is the most important event in the history of European accounting because IFRS enables the financial statement provide more value relevant information to all categories of shareholders. In their opinion, IFRS substitute historical cost principle with Fair Value Principle (FVP). The implementation of FVP leads to firm’s values that are closer to intrinsic value in terms of assets valuation. Thus, the target is to provide investors more value-relevant accounting information; this means that accounting information under IFRS is more value relevant than accounting information under the local accounting standards.

2.2. Review of Prior Literature

- Value relevance studies on accounting information began in the early 1960s with the work of Ball and Brown (1968) which observed that efficient capital market will be affected by newly released useful accounting information. The aim of conducting empirical research on value relevance is to extend knowledge on reliability and relevance of accounting information as reflected in equity values. Most researches compared value relevance of accounting information among countries assuming that an increase in value relevance is an indication of better accounting information and quality (Karampinis & Hevas, 2009). In the work of Alford, Jones, Leftwich & Zmijewski (1993), value relevance of earning of seventeen countries of USA was used as empirical research. They reported that the value relevance of earning is higher in countries where the collaboration between tax accounting and financial accounting is lower. This thus suggests that value relevance of earnings is more in the Anglo-Saxon system in financial accounting, that is, common-law countries than in code-law countries.Barth (1994) in his study examines the measurement of value relevance of banks’ investment securities using historical cost and fair value for both earnings and assets. The study provides evidence on the two methods- incremental and relative explanatory power of measurement error. He discovered that fair value measurement of investment securities have significant explanatory power over historical cost. In the work of Ahmed and Takeda (1995), the result of same study is different from that of Barth (1994) as Ahmed and Takeda (1995) included the controlling effects of other net assets. Ohlson (1995) ties the market value of a firm to accounting information (book value, dividends and earning). The model has been used by many researchers and countries. In the study of Latridis (2010), he reveals that implementation of IFRS generally reinforces accounting quality and leads to more value relevant accounting measures. Al-Horani (2010) study shows that both multivariate and univariate analyses reveal no evidence of value relevance of earnings components for commercial banks data for periods 2000-2008 in Amman stock markets.Escaffre and Sefsaf (2011) conducted a comparative study on the impact of IFRS on the value relevance of accounting information in European and US financial institutions. The study showed that book value and earnings reveal high value relevance in the European markets than in American markets with US GAAP. Agostino, Drago, and Silipo (2011) found that the implementation of IFRS increased the information content of book value and earnings of more transparent banks while the less transparent banks did not show any major increase in the value relevance of listed banks in 15 EU countries conducted over the period of 2000-2006.The study of Trabelsi and Trabelsi (2014) reveals that IFRS increased the value relevance of accounting data in the United Arab Emirates (UAE) listed banks. The overall findings show that earnings are positively correlated to stock prices. Khanagha (2011) shows the value relevance of earning and equity for sampled listed companies on Abu Dhabi Stock Exchange for periods 2001-2008. The study reveals that accounting information is value-relevant in the UAE stock market. Mousa and Desoky (2014) examine the value relevance of IFRS on accounting information of Gulf Co-operation Council (GCC) counties, Bahrain. Their finding shows that there is no obvious difference in the value relevance of accounting information after the adoption of IFRS by listed companies in Bahrain.Furthermore, Larsson & Bogstrand (2012) investigated whether IFRS adoption has improved the extent at which the earnings and book value of Scandinavian listed firms provide information to the market. The authors sampled 431 listed firms at NASDAQ OMX Nordic and Oslo Stock Exchange between 2001 and 2010 resulting from 4310 firm-year observation. The study found that both Scandinavian earnings and accounting information are positively associated to capitalized market values of equity as well as annual changes in capitalized market value of equity.Onipe, Onyabe, and Usman (2015) examined the adoption of IFRS and value relevance of accounting information of listed deposit money banks in Nigeria. Their study shows that explanatory power of accounting number increased after the IFRS adoption in Nigeria. The study discovered that adoption of IFRS has improved the relevance of accounting number in the deposit money banking sector with the use of return model and price model. Prather-Kinsey (2006) investigates the capital markets of two different countries using earnings announcement of Mexican Stock Market and Johannesburg Stock Exchange (JSG) for developing and developed country accounting standards. The findings reveal that book values are value-relevant in both markets, with a significant positive relationship between market value and earnings in the reported financial statements in the two markets.Umoren and Enang (2015) conducted a study on the effects of IFRS adoption on the value relevance of financial information using the Nigerian banking sector as the sample for the study. The study sampled 12 banks to determine whether the impact of IFRS adoption has improved value relevance of accounting numbers. The findings show that earnings reported under the IFRS are more informative to equity investors than under the Nigerian GAAP. Consistent with this study, Emeni, Uwuigbe, Uwuigbe & Erin (2016) carried out a study on the impact of IFRS on the value relevance of accounting numbers using Nigerian listed banks as a case study. Their finding reveals that IFRS has impacted value relevance of accounting information using price regression model and returns regression model to capture value relevance in the Nigerian banking sector.

2.3. Hypotheses Development

- Value relevance implies the power of financial information to explain stock market variables as contained in financial statement (Vishnani & Shah, 2008). Stock market measures such as share price, the book value of equity, firm size, cash flow, and earnings guide investors in the pricing of company’s share. Therefore, the need for transparent and full disclosure of relevant accounting numbers in a financial statement that is relevant to investors. IFRS are designed to present stakeholders with value-relevant information that would help in making economic decisions regarding a company.Therefore, this study thus predicts the following null hypotheses:H01: Value relevance of accounting data is not significantly pronounced in the post-IFRS era than in the pre-IFRS era using price regression model.H02: Value relevance of accounting data is not significantly pronounced in the post-IFRS era than in the pre-IFRS era using return regression model.

2.4. Theoretical Framework

- The emphasis on capital market research in accounting started in the 1960s because of its usefulness to accounting information. This research was pioneered by Ball and Brown (1968) to make relevance to capital market theory. In recent times this theory did gain prominence among stock market researchers. Researchers adopt market-based theories to test the importance of financial information in relation to the stock market reaction. Market based theories fall into the following categories: efficient market theory, capital need theory, and signaling theory.This study adopts signaling theory which postulates that efficient companies provide the capital market with relevant and better information than less efficient companies in order to raise capital (Francesco, Laura & Francesco, 2014). Most studies believe that the problem of information asymmetries can be overcome by the signaling theory because this theory ensures that relevant information is passed to the stock market (Morris, 1987). Grossman and Stiglitz (1980) revealed that some participants in the stock market have more and better information than others participants as a result of their high disclosure requirement. Therefore, the best-informed participants are able to make both financial and economic decisions which give them the upper hand, from their contractual relationship with the market, and derived more benefit than other participants.IFRS adoption has improved the signaling power of companies by giving them competitive edge in terms of better communication, quality reporting and value-relevant financial information to the market (Watts, 2006). Theoretical research has confirmed that signaling theory can be more beneficial and informative for companies (Kreps & Sobel, 1994; Cho & Sobel, 1990). The conflicting role of principal and agent has caused managers to put more attention on the information (signal) they send to the stock market. Therefore, this study seeks to examine the presence of signaling theory in the mandatory adoption of IFRS and the power it attaches to accounting data.

3. Methodology

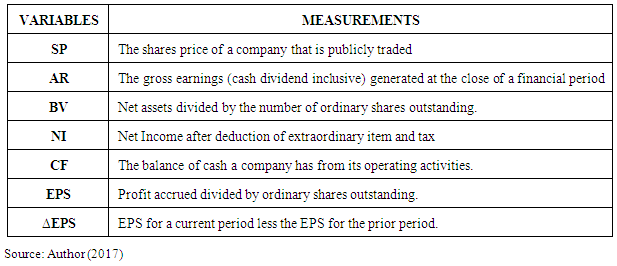

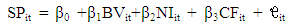

- This study is based on non-survey research design and the data cover the period of 2008 to 2015. We extracted our data from the firms’ annual report and NSE report (2015). A total of 80 firms were used in this study; 50 firms from the financial services sector and 30 firms from the consumer goods sector. We chose these sectors because they account for 75 percent of the entire market capitalization (NSE Report, 2015). The study’s final sample size used in this study is 52 firms. The basis is because only these firms have readily available data that are IFRS financial statement compliant after the adoption in 2012. The choice period for this study is four accounting period before IFRS adoption and four accounting period after IFRS adoption. This resulted in a sample observation of 208 firm years in the pre-IFRS period (2008-2011) and 208 firm years in the post-IFRS period (2012-2015). Measurement of variablesDependent VariablesShare Price (SP): This is the value of a company’s share price that is publicly traded.Annual Returns (AR): This is the total revenue generated by an entity in a fiscal year.Independent VariablesThe Book value of Equity (BV): Book value of equity otherwise known as net assets of a firm; it is used to evaluate the total equity of a firm. Net Income (NI): It is a company’s total earnings after adjusting for the cost of doing business and other expenses.Cash flow (CF): This is the amount of cash available for company’s operation either generated or lost.Earnings per Share (EPS): It is the amount of share attributable to ordinary shareholder at the end of a financial year.Changes in Earnings per Share (∆EPS): It is the net difference in current year EPS from the prior year EPS.

|

| (1) |

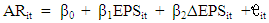

error term (surrogate for all other variables not included)Return Regression ModelThis model developed and postulated by Easton & Harris (1991); the model is formulated as follows:

error term (surrogate for all other variables not included)Return Regression ModelThis model developed and postulated by Easton & Harris (1991); the model is formulated as follows: | (2) |

error term (surrogate for all other variables not included)Β0 = constant term

error term (surrogate for all other variables not included)Β0 = constant term4. Empirical Results and Discussion

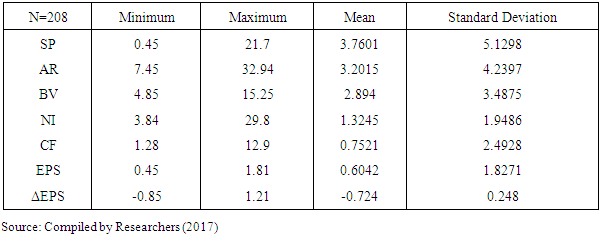

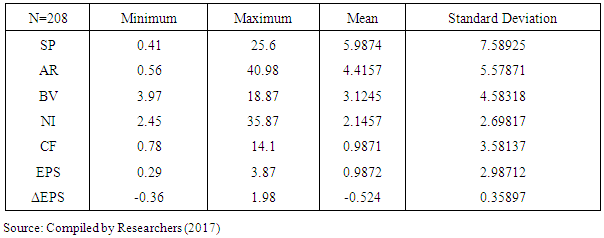

- In this section, we present the results of our empirical findings both the descriptive and inferential.

|

|

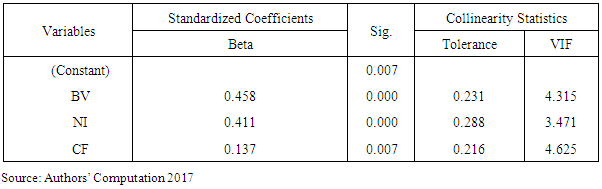

4.1. Regression Models

4.1.1. Regression Analysis (Test of Model I) (Price Model)

|

|

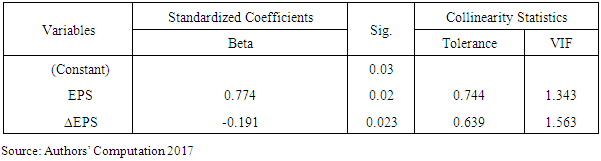

4.1.2. Regression Results (Test of Model II) (Return Model)

|

|

5. Conclusions and Recommendations

- We provide empirical research into the study of value relevance of accounting data in the pre- and post- IFRS in Nigeria. This study provides in-depth analysis into the consumer and financial services sector in Nigeria. Our findings reveal that accounting data is more pronounced in the post-IFRS period for all the explanatory variables used in this study. It is evident that the implementation of IFRS in Nigeria has contributed to the value relevance of accounting data.Our findings have important policy implication for policy makers particularly Financial Reporting Council of Nigeria (FRCN) and Securities and Exchange Commission (SEC) which regulates the accounting profession and Nigerian capital market respectively because the findings show that IFRS is a proof of quality for accounting standards. We recommend that more measures should be taken by regulatory authorities to ensure that all public entities comply strictly with IFRS. This will enable relevant and reliable financial information to be passed to the capital market for investors to take an informed and relevant decision.We provide important contribution empirically that IFRS adoption in Nigeria has proved to be relevant considering the incremental value of all the explanatory variables of accounting numbers in this study. Our study advances the growing literature in the area of IFRS as it affects the quality of financial disclosure in Nigeria. Our results are important for various market participants; regulators because it reveals that adoption of IFRS had been a good factor that impacts the quality of financial disclosure in Nigeria.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML