-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(3): 67-74

doi:10.5923/j.ijfa.20170603.01

Electronic Payment Methods and Profitability of Banking Firms in Nigeria: A Panel Data Analysis

Obiekwe Chinelo Jenevive1, Mike Anyanwaokoro2

1Department of Banking and Finance, Michael Okpara University of Agriculture Umudike, Nigeria

2Department of Banking and Finance, Enugu State University of Science and Technology, Nigeria

Correspondence to: Obiekwe Chinelo Jenevive, Department of Banking and Finance, Michael Okpara University of Agriculture Umudike, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study investigated the effect of Electronic payment Methods (EPM) on the profitability of commercial banks in Nigeria. In order to achieve the broad objective, the study specifically investigated the effect of Automated Teller Machine (ATM), Point of Sale (POS) and Mobile Payment (MPAY) on the profitability of commercial banks in Nigeria. A total sample of five (5) banks was considered for the period 2009 to 2015 and the study adopted the Panel Least Squares (PLS) estimation technique as the analytical tool. Data were collected from the Central Bank of Nigeria (CBN) Statistical Bulletin and Annual Reports and Statements of Accounts of the five banks used in the study. Findings revealed that Automated Teller Machine (ATM) and Mobile Phone payment have significant effect on the profitability of commercial banks in Nigeria. However, Point of Sale (POS) has an insignificant effect on commercial banks’ profitability in Nigeria. The study recommended, among others, that commercial banks in Nigeria should sponsor media campaigns in order to boost the awareness on Automated Teller Machine (ATM) payment and Mobile Phone payment methods so as to further increase their profitability.

Keywords: Electronic Payment Methods, Automated Teller Machine, Mobile Payment, Commercial banks’ profitability

Cite this paper: Obiekwe Chinelo Jenevive, Mike Anyanwaokoro, Electronic Payment Methods and Profitability of Banking Firms in Nigeria: A Panel Data Analysis, International Journal of Finance and Accounting , Vol. 6 No. 3, 2017, pp. 67-74. doi: 10.5923/j.ijfa.20170603.01.

Article Outline

1. Introduction

- Electronic Payment Methods (EPM) has become a marvel to the world especially the developing nations (Nigeria inclusive). Electronic payment methods (EPM) are simply methods of carrying out transactions (in the internet) without involving physical cash or paper cheque (Daniel, 1999). Gone are the days in which one must carry large sums of cash and perhaps stay endlessly in the banking halls in order to pay or get paid (Adewoye, 2013). Electronic Payment Methods have abridged this gap by offering speed, efficiency, comfort and security to banking procedures. Thus, the role of electronic payment methods in the banking business and our daily transactions cannot be undermined.With the Automated Teller Machine (ATM) and Point of Sale (POS) among others, one does not need to physically carry cheques to withdraw and pay money from ones accounts (Olasope, 2013). All that is needed is to slot the card, provide the needed information and the transaction is done. This scenario is replicated in other electronic payment methods such as mobile phone, web, NIBSS instant payment and NEFT.It is no gainsaying that electronic payment methods have hugely been accepted in Nigeria going by the share volume and value of transactions done through the ATM, POS, and Mobile phones etc. Little wonder, the volume of transactions done with the ATM was put at 109,151,646 (amounting to N548.60 million) in 2009 and this increased to 400,102,507 (amounting to N3,679.88 billion) in 2014 (CBN, 2014). Thus, no one is left in doubt about the penetration of electronic payment methods in Nigeria. But the question that clearly ought to be answered is “To what extent has electronic payment methods influenced the profitability of banking firms in Nigeria?”

2. Statement of the Problem

- Despite the obvious benefits attributed to electronic payment method in Nigeria, it has not come without some challenges. One of the major challenges negating against electronic payment methods in Nigeria is the tendency of fraudsters to clone ATM cards and hack into bank depositors’ accounts (Shehu et al., 2013). These acts have become a source of fear and worry to electronic payment users and have even discouraged some from enrolling into the EPM (Electronic Payment Methods) platforms. Ultimately, the banking industry may have been adversely affected since the volume (value) of transactions that would have boosted its profitability has been reduced.

3. Research Objectives

- The broad objective of the study is to investigate the effect of electronic payment methods on the profitability of banks in Nigeria. Specifically, the study sought to do the following:i. To investigate the effect of ATM payment method on return on equity of banking firms in Nigeria.ii. To investigate the effect of POS payment method on return on equity banking firms in Nigeria.iii. To determine the effect of Mobile Phone payment on return on equity of banking firms in Nigeria.

4. Research Questions

- The study sought to provide answers to the following questions:i. What is the effect of ATM payment method on return on equity of banking firms in Nigeria?ii. What is the effect of POS payment method on return on equity of banking firms in Nigeria?iii. What is the effect of Mobile Phone payment method on return on equity of banking firms in Nigeria?

5. Research Hypotheses

- In line with the specific research questions and objectives, the study tested the following hypotheses:i. ATM payment method does not have significant effect on return on equity of banking firms in Nigeria.ii. POS payment method does not have significant effect on return on equity of banking firms in Nigeria.iii. Mobile payment does not have significant effect on the profitability of banking firms in Nigeria.

6. Empirical Review

- Several literatures exist on the nexus between electronic banking and performance of banking sector. However, only a few of such literature pertains to Nigeria and they are mostly descriptive analysis. For instance, Furst, Lang and Nolle (2002) examined the influence of internet banking on profitability amongst United States national banks. The study considered large banks in urban areas and their counterparts in the localities. Findings revealed that bank profitability has a strong correlation with internet banking in all US national banks. However, the study emphasized that in large banks in the urban areas, bank profitability has no relationship with internet banking because those banks merely use internet banking for competition purposes and not for profit making. Hasan, Maccario and Zazzara (2005) investigated the impact of internet banking on the performance of commercial banks in Italy. Hasan et al (2005) adopted return on assets (ROA) and return on equity (ROE) as performance indicators. Findings showed that internet banking has significant effect on both ROA and ROE of commercial banks in Italy. Hence, the study concluded that internet banking significantly affects commercial banks performance in Europe. Onay, Ozsoz and Helvacioglu (2008) investigated the effect of internet banking on the performance of commercial banks in Turkey from 1996 to 2000. The study adopted a sample of 14 commercial and savings banks and the profitability measures include return on assets (ROA), return on equity (ROE) and Margin of Interest which served as the dependent variables. Findings revealed that (i) In the first year of adopting internet banking, there is no positive performance between internet banking and profitability of commercial banks. (ii) In the second and third years, some improvements in performance were seen such that return on equity (ROE) had a positive and significant relationship with internet banking. However, return on assets (ROA) had a positive but insignificant relationship with internet banking. Francesca and Peter (2008) conducted a comparative analysis of the effect of electronic banking on performance in four European countries namely UK, Spain, Finland and Italy. The study adopted panel data method from 1995 to 2004 using 46 banks. The dependent variables were return on assets (ROA) and return on equity (ROE). Findings revealed that banks involved in only online banking services and those involved in mixed internet banking services do not have any clear differences. However, the study showed that internet banking has a significant effect on both return on assets (ROA) and return on equity (ROE). Pooja and Balwinder (2009) carried out an investigation on the link between electronic banking and banks’ profitability using 85 commercial banks comprising private and public commercial banks from 1998 to 2006. The study adopted univariate and multivariate analytical tools using 10 performance indicators. In the univariate analysis, the study investigated how the 10 performance indicators reacted in response to e-banking services. Findings revealed that (i) in terms of size (SIZE), e-banking shows bigger effect on assets and employees. (ii) In terms of profitability, operating efficiency and financing, banks that use internet banking platforms perform better with lower costs. (iii) In terms of assets quality and diversification, banking using internet banking platforms have lower net non-performing assets (NPA). (iv) In terms of cost of operation, internet banking assures lower cost of operation. Hence, in the context of univariate analysis, the study concluded that private banks enjoy lower costs when engaged in internet banking while public banks do not. Nevertheless, in the context of the multivariate analysis, the Ordinary Least Squares (OLS) method was used and the dependent variables were return on assets (ROA), return on equity (ROE) and net non-performing assets (NPA). Findings showed that there is no significant relationship between internet banking and return on assets and return on equity in the public banks. On the other hand, there is a negative significant relationship between internet banking and return on assets (ROA) in the private banks. Husni and Noor (2011) investigated the impact of e-banking services on the performance of Jordanian domestic banks. The study categorized the banks into three namely non-internet services banks, recent adopters or e-banking services and early adopters of e-banking services. The study adopted return on assets (ROA), return on equity (ROE) and margin of interest as the performance measures and dependent variables. The study period covered 2000 to 2009 and various findings were made. (i) Non-internet banks indicate that e-banking services have no significant effect on return on assets (ROA). (ii) For recent adopters of e-banking services, e-banking services had significant effect only on margin of interest from a period less than 2 years. (iii) Early adopters of e-banking revealed that e-banking services had no significant effect on banks’ performance for all the periods considered in the study. Josiah and Nancy (2012) investigated the effect of e-banking on performance of 27 commercial banks in Kenya using the Pearson product moment correlation coefficient test as the analytical tool. The study adopted return on assets (ROA) as the dependent variable while investment in electronic banking, number of cards issued by the banks and ATM installed by the banks served as the independent variables. Findings revealed that e-banking has a strong positive effect on return on assets (ROA) of banks in Kenya. Akhisar, Tunay and Tunay (2015) investigated the effects of electronic-based banking services on the profitability of 23 commercial banks in both developed and developing countries from 2005 to 2013. The study adopted the panel data analytical methodology. Number of branches to number of ATM ratio, point of sale (POS) and web (internet) banking served as the explanatory variable while return on equity (ROE) and return on assets (ROA) were the dependent variables. Findings revealed that ratio of number of branches to number of ATM have positive and significant effect on banks’ profitability in both developed and developing countries. However, POS and web (internet) banking have negative relationship with banks’ profitability.On the home front, Yunus and Waidi (2011) investigated the nexus between electronic banking, employee’s and customers’ responses, and bank performance in Nigeria using a sample of fifteen (15) commercial banks. The questionnaire descriptive research design was adopted using a sample of 1223 respondents. Findings indicate that technological innovation has a strong influence on bank employees and customer satisfaction thereby having a strong effect on banks’ profitability in Nigeria. Similarly, Abaenewe et al (2013) examined the relationship between electronic banking and bank performance in Nigeria using a descriptive analytical methodology. Four banks were randomly selected using the pre-adoption and post-adoption era of electronic banking in Nigeria as the scope of the study. Return on assets (ROA) and return on equity (ROE) both served as the dependent variables. Findings revealed that electronic banking has a positive and significant effect on return on equity (ROE) of Nigerian banks but has no significant effect on return on assets (ROA). Olasope (2013) investigated the effect of electronic banking on commercial banks’ operations in Nigeria using primary data derived from questionnaire and oral interviews. The study employed simple percentages and chi-square as the analytical methods. Findings revealed that poor staff orientation, poor infrastructure and high cost of adoption of electronic banking platforms are factors that have affected the profitability of the commercial banks in Nigeria.Nnolim (2013) examined the impact of information and communication technology (ICT) on the banking sector using Access Bank PLC as a case study. The study also made use of the questionnaire research design and adopted the chi-square test as the analytical tool. Findings revealed that ICT has influenced operational costs of banks in terms of personnel management, personnel administration and efficiency thereby increasing the profitability of the banking sector in Nigeria. Shehu et al (2013) investigated the effect of electronic banking products on the performance of Nigerian listed Deposit Money Banks (DMB) using 6 Deposit Money Banks (DMB). The dependent variable was return on equity while the independent variables include E-Direct, SMS alert, E-mobile and ATM. Findings revealed that E-Direct has a negative and insignificant relationship with the profitability of Deposit Money Banks (DMB) in Nigeria. However, SMS alert has a positive but insignificant relationship with profitability of DMBs in Nigeria. Finally, E-mobile has a positive and significant relationship with the profitability of DMBs while ATM has a negative and significant relationship with the profitability of DMBs in Nigeria. Adewoye (2013) investigated the impact of mobile banking on service delivery in the Nigerian commercial banks using a sample of 125 respondents. The study adopted frequency tables, percentages, mean score and chi-square test as analytical tools. Findings revealed that mobile banking improves bank service delivery in the form of transactional convenience, savings of time, quick transaction alert and saving of service costs among others. The study concluded that mobile banking has improved customers satisfaction thereby increasing the profitability of the commercial banks in Nigeria.

7. Review of Summary

- Most of, if not all, the studies carried out in Nigeria on electronic payment and commercial banks’ profitability adopted the descriptive research design (Yunus & Waidi, 2011; Abaenewe et al, 2013; Nnolim, 2013; Olasope, 2013; Shehu et al, 2013; Adewoye, 2013). However, this study adopted the ex-post facto research design employing the Panel Data analytical tool so as to capture the cross-sectional effect of electronic payment methods on the banks. This becomes necessary given the fact that electronic payment methods have diverse effects on different banks at the same period. While it may be profitable to one, it may not be profiting the other. Investigating the cross-sectional effect enables us to capture the aggregate effect of the electronic payments on the banking industry as a whole while at the same time keeping note of the individual abilities of the different banks.

8. Theoretical Framework

- Certain theories of branchless banking were reviewed since the concept of electronic payment anchors on branchless banking. These theories include:

8.1. Bank-Focused Theory

- This theory was popularized by Kapoor (2010) and anchors on the premise that banks use non-traditional but conventional low-cost delivery channels to offer services to its customers. Such channels include the automated teller machines (ATMs), mobile phone banking, Point of Sale (POS) among others. In using these channels, the bank offers a wide range of services to its customers regardless of location and branch attachments. All that is required is to enter the needed information into the system and the transaction is done. This theory favours this study since the emphasis here is on electronic platforms as means of delivering services.

8.2. Bank-Led Theory

- The bank-led theory of branchless banking was postulated by Lyman, Ivatury and Stachen (2006) and emphasizes the role of an agent who acts as a link between the banks and the customers. In this case, the retail agents have direct interaction with the banks’ customers and perform the role expected of the bank by either paying cash or collecting deposits (Owens, 2006). Finally, this agent is expected to transmit all his dealings with the bank’s customers to the bank he is representing through electronic means (such as phones, internet, etc).

8.3. Nonbank-Led Theory

- This theory was popularized by Hogan (1991). Here customers do not deal with any bank and they do not maintain any bank account. All that the customers have to deal with is a non-bank firm such as mobile network operator or prepaid card issuer who they exchange their cash with for e-money account. The e-money account is then stored in the server of this non-bank agent. This tends to represent the most risky platform in the electronic payment methods because of lack of existing regulatory framework upon which these e-agents operate.

9. Model Specification

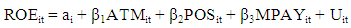

- The study anchors on the bank-focused theory which brought to the fore the roles of commercial banks in providing electronic platforms as veritable tools for satisfying the banking needs of its customers. This theory emphasized the intermediation roles of commercial banks in any economy. Shehu et al (2013) specified a model for the relationship between electronic banking products and performance of DMBs as:

(i)WhereROE = Return on equityβ1 – β4 = Slope coefficientβ0 = InterceptATM = Automated Teller MachineED = Electronic DirectSMSA = SMS AlertEM = Electronic Mobilee = error termIn line with Shehu et al (2013) with modifications, the model for the study can be specified as:

(i)WhereROE = Return on equityβ1 – β4 = Slope coefficientβ0 = InterceptATM = Automated Teller MachineED = Electronic DirectSMSA = SMS AlertEM = Electronic Mobilee = error termIn line with Shehu et al (2013) with modifications, the model for the study can be specified as:

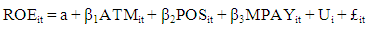

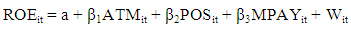

(ii)WhereROE = Return on equity (proxy for commercial banks’ profitability)ATM = Automated Teller Machine payment methodPOS = Point of Sale payment method∫ = functional relationship notationTransforming equation (1) into its panel data form, the model takes two major specifications:

(ii)WhereROE = Return on equity (proxy for commercial banks’ profitability)ATM = Automated Teller Machine payment methodPOS = Point of Sale payment method∫ = functional relationship notationTransforming equation (1) into its panel data form, the model takes two major specifications:

(iii)

(iii)

(iv)

(iv)

(iv)*Where

(iv)*Where i = 5 (number of banks) and t = 6 (number of years)Ui = firm-specific error term

i = 5 (number of banks) and t = 6 (number of years)Ui = firm-specific error term idiosyncratic error termWit = error term for the random effect model Equation (iii) represents the fixed-effect model and equation iv (iv)* represent the random-effect model.

idiosyncratic error termWit = error term for the random effect model Equation (iii) represents the fixed-effect model and equation iv (iv)* represent the random-effect model.10. Description of Variables

- (i) Dependent variableReturn on equityReturn of Equity also known as, Return on Net Worth, measures how effectively a company has used the owner’s resources (Anyanwuokoro, 2008).It is used as a measure of performance or profitability of the commercial banks in the study. Return on equity is described in the study as:ROE = Profit after tax ÷ Shareholders’ fund or Profit after tax ÷ Total equity(ii) Independent Variables Automated Teller Machine (ATM)ATM is described in the study as the total value of ATM transactions in Nigeria.ATM = Total value of ATM transactionsPoint of Sale (POS)POS is described as the total value of POS transactions in Nigeria. POS = Total value of POS transactionsMobile Payment (MPAY)MPAY is described as the total value of mobile payment transactions in Nigeria. MPAY = Total value of mobile payment transactions.

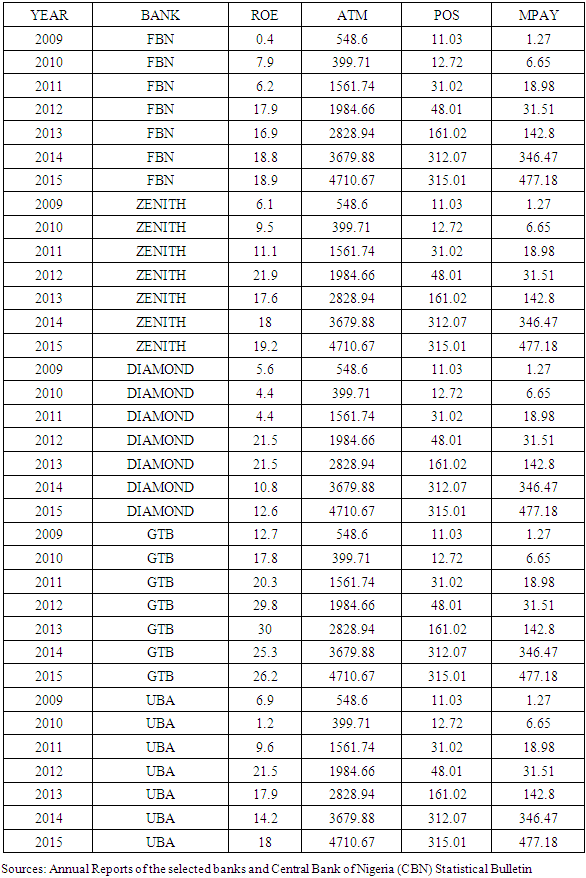

11. Data Presentation

- Table 1 below shows that there are different levels of profitability attached to different banks at different times (periods). For instance, the profitability of First Bank Plc stood at 0.4 percent in 2009 and this increased to 7.9 percent in 2010. However, it fell to 6.2 percent in 2011 but increased afterwards to 17.9 percent. From 2014, there was a steady increase in the profitability of First Bank Plc from 18.8 percent to 18.9 percent in 2015.

|

11.1. Electronic Payment Methods (EPM)

- Three major electronic payment methods were considered in the study and they include Automated Teller Machine (ATM), Point of Sale (POS) and Mobile Phone (MPAY). It is evident that over the years, the value of transactions associated with the electronic payment methods have been largely on the increase. For example, the value of transaction associated with ATM usage increased from

399.71 billion in 2010 to

399.71 billion in 2010 to  4710.67 billion in 2015. Similarly, value of POS transactions in Nigeria increased from

4710.67 billion in 2015. Similarly, value of POS transactions in Nigeria increased from  12.72 billion in 2010 to

12.72 billion in 2010 to  315.01 billion in 2015. In the same vein, value of mobile phone transactions increased from

315.01 billion in 2015. In the same vein, value of mobile phone transactions increased from  6.65 billion in 2010 to

6.65 billion in 2010 to  477.18 billion in 2015.

477.18 billion in 2015. 12. Data Analysis

|

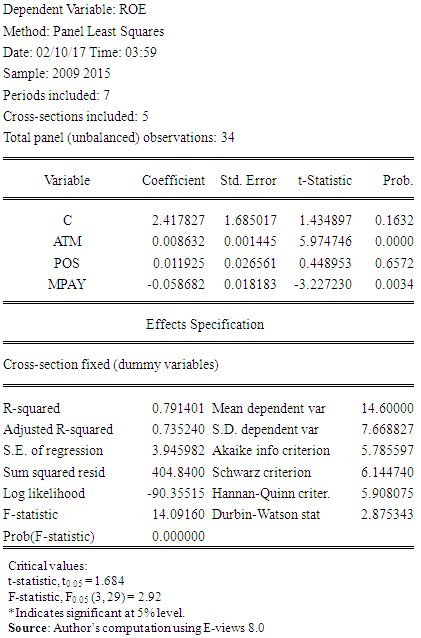

13. Discussion of Findings

- First, the study reveals that there exists a positive and significant relationship between ATM payment method and profitability of banks in Nigeria. This finding conforms to economic theoretical expectation because the more bank customers use the ATM platform, the higher the profitability of the banks. Perhaps, this result is attributed to the service charges associated with the use of ATM in Nigeria. Usually, at the end of every month the banks send an SMS alerts to ATM users detailing the amount deducted from the users account either as maintenance fees or SMS alert fees. The more people use the ATM payment platform, the higher the fees (ATM maintenance charges) and the higher the returns (profitability) of the commercial banks in Nigeria. This finding corroborates Abaenewe et al. (2013) that electronic banking has a significant effect on performance of commercial banks in Nigeria.Second, the result reveals that there is a positive but insignificant relationship between Point of Sale (POS) payment method and profitability (proxied by return on equity) of banks in Nigeria. This relationship is in line with economic expectation because the more the patronage associated with POS payment method, the higher the volume of transactions and ultimately the higher the profits recorded by the banks. This finding concurs with the findings of Njogu (2014) which argued that POS has a positive relationship with performance of commercial banks in Kenya. However, the finding in the study differs from Njogu (2014) in terms of effect of POS on performance as it shows an insignificant impact while Njogu (2014) found a significant impact of POS on performance of commercial banks.Finally, the result reveals that there exists a negative and significant relationship between mobile payment method and profitability of banks in Nigeria. This finding is surprising as one expects that an increasing usage of mobile phones in financial transactions would have boosted economic activities thereby increasing the profits made by the banks. This finding corroborates Pooja and Balwinder (2009) that established a negative relationship between components of internet banking such as mobile banking and banks’ profitability in the private banks. Perhaps, this finding may be attributed to the fear and apathy caused by fraudsters to mobile phone payment users. In Nigeria, many have lost their monies through the mobile phone banking platform simply because fraudsters were able to hack into their bank accounts. Because of the activities of fraudsters, the banks were made to pay back these monies to the affected customers and this has negative effects on their profitability.

14. Conclusions

- The study examined electronic payment methods and profitability of commercial banks nexus in Nigeria. In order to achieve this objective, the study specifically investigated the effect of ATM, POS and Mobile payment on the return of equity of commercial banks in Nigeria. From empirical findings, it is revealed that ATM and Mobile phone payment have significant impact on commercial banks’ profitability in Nigeria. However, POS payment method has no significant impact on the profitability of commercial banks in Nigeria.

15. Recommendations

- i. Commercial banks in Nigeria should increase the awareness about ATM usage through media campaign, seminars and symposia. This is against the backdrop that increased usage of ATM payment method increases the profitability of commercial banks in Nigeria.ii. Commercial banks should collaborate with phone service providers to checkmate and prosecute hackers in order to reverse the negative effect of mobile payment on commercial banks’ profitability in Nigeria.iii. Point of Sale (POS) payment method should be encouraged in Nigeria for the purpose of transactions. Hence, the commercial banks should organize seminars and workshops on the benefits of using POS for both customers and traders. This would boost its impact on the profitability of commercial banks in Nigeria.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML