-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(2): 59-65

doi:10.5923/j.ijfa.20170602.03

Career Decision of Accounting Students and Its Influencing Factors: A Study of University Accounting Students in DKI Jakarta, Indonesia

Harnovinsah

Departement of Accountancy Mercu Buana University, Jakarta, Indonesia

Correspondence to: Harnovinsah, Departement of Accountancy Mercu Buana University, Jakarta, Indonesia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The purpose of this study was to examine the factors that influence university accounting students’ career choices. The testing was done by dividing respondents into 2 (two) categories. First, students who want to work as public accountants, assuming that the public accountant profession provides better job opportunities and this field is in accordance with the field that they engage in. Second, students who are not willing to become public accountants, assuming that the profession other than public accountants will provide wider career opportunities and will have low levels of stress. From both analyses, this research tried to find the factors that have strong influences in the selection of accounting university students' career, either as the public accountant or else. The research results prove that the profession that will be taken after graduating is very dependent on their respective perceptions of the expectations and opportunities that will be accepted by them when choosing a profession.

Keywords: Accounting Career Options, Accounting Education, Employment Opportunity, Public Accountant

Cite this paper: Harnovinsah, Career Decision of Accounting Students and Its Influencing Factors: A Study of University Accounting Students in DKI Jakarta, Indonesia, International Journal of Finance and Accounting , Vol. 6 No. 2, 2017, pp. 59-65. doi: 10.5923/j.ijfa.20170602.03.

Article Outline

1. Research Background

- Based from the Institute Indonesia Chartered Accountants (Ikatan Akuntan Indonesia/IAI) data, the interest of accounting graduates (which reach 35,000 per year) in public accountant career is still low, while the data from the Ministry of Finance shows an annual growth rate of 4% of public accountants in Indonesia. This growth rate thus causes a dilemma to the public accounting profession with implications for career choice for accounting students (Yusoff, Omar, Awang and Yusoff, 2011).The career choice is an individual process or activity to prepare to enter work life through a series of directed and systematic activities, to be able to choose a career in accordance with the interest. In making career choices, a person will first seek for information on various kinds of professional alternatives. The career choices of accounting students as public accountants begin by seeking information and considering various career alternatives during their college days (Jaffar,Ismail and Zahid, 2015). Meanwhile, lectures help students to recognize the nature of accounting careers by providing the knowledge and skills necessary for success in the accounting profession. Essentially, the career choices reflect one's interests, personality, ability, and background. Uyar and Kuzey (2011), Ahinful, Paintsil and Danquah (2012) and Britt (2012) state that a person will feel comfortable with his or her career choice if the choice meets what he or she wants and fits his or her interests and abilities. The sets of information obtained by accounting students about public accountants and others professions are the most important things in the decision-making process to become a public accountant. Student interest and career plans are very useful in lecture preparation so that the material can be delivered effectively to students who need it. Career planning is crucial to achieving success (Tan and Laswad, 2006; Rasmini, 2007; Philip, 2010). Therefore, stimulation is needed to make students start thinking seriously about their desired career since they are still in college. They need to use their time and facilities optimally. The role of educator accountants as a stimulator for this matter is considered necessary (Rasmini, 2007). Factors affecting the selection of students' career and career type are interesting to be studied as the career choice that interested students, it can be seen why someone chooses the career (Rahayu, 2003). The Student interest and career plans will be very useful in lecture preparation so that the material can be delivered effectively to students who need it (Rasmini, 2007). If the career path of accounting students can be identified, the accounting education may plan a curriculum in accordance with the demands of work. Thus, if a student has graduated, he/she is expected to more easily adjust his/her ability with job demands.In future, public accounting profession will face the heavier challenge Noravesh, Dilami and Bazaz. (2007). Therefore, the competence and professionalism are necessary to support the profession (Geiger and Ogilby, 2000; and Rahayu 2003). The developing information about the working environments of public and non-public accountants can shape the perception of accounting students that may eventually affect their career choices upon graduation. Career planning is crucial in achieving success in careers, but some people cannot do that because they are always engulfed with worries about the uncertainty of the future. This is mostly experienced by final year students approaching graduation. They desperately need career planning to complement their study period.Rhode (1977) state that the most common reasons for leaving the public accounting profession are: (1) conflict between work and family life, (2) lack of free time, and (3) individual disability to fully use his/her talents and abilities. Meanwhile, Carcello et al. (1991) indicate the public accounting attributes that may reduce the accounting students’ interest to choose a career path as a public accountant or may cause those who have chosen the career as a public accountant to be dissatisfied. The four commonly mentioned characteristics are: over time, unrealistic deadlines/budgets, job stress/pressure, and corporate politics. Overtime and work pressure are the most common reasons for leaving the public accounting profession. United States Accounting Education Change Commission (1993) states that new accounting graduates working as public accountants often face problems about unanticipated working hours, deadlines, budgets, work stress and less-than-expected benefits (Williams, 1993: 76). This causes their interest for a career in public accountancy field to wane. In their research, Dennis et al. (1996) indicated the impact of litigation on the public accountancy profession as a career choice as a stepping stone for the career in non-public accountancy. One of the causes of the shift in career path is the stress and time issues that characterize the public accountancy profession. These factors lead to the stereotype of the public accounting profession in a society that it is a boring profession with uncompetitive salaries amidst heavy workloads. As a result, the quantity and quality of accounting graduates who work as professionals in public accounting have decreased in recent years (See, Mauldin et al., 2000 2003; Tan and Laswad, 2006; Smith; 2005; Chen, Jones and McIntyre, 2002; Sawarjuwono and Kalanjati, 2013).Based on the type of career that can be taken by accounting graduates, Greenberg and Baron (2000) state that the career includes the sequence of one's work experience during a certain period. Student career choices are influenced by the stereotypes they form about various careers (Sugahara and Boland, 2006). Thus, career perceptions and stereotypes are important in determining career choices because student perceptions are generally influenced by personal knowledge of the work environment, information from past graduates, family, lecturers, and textbooks they read (Felton, Buhr and Northey, 1994; Allen, 2004). Therefore, this research is needed with the aim to find the accounting students' perception of the factors that determine career choice, either as a public accountant or non-public accountant. The results of this research are expected to give feedback to policy-makers, universities and professional institutions associated with the accounting profession, to create strategies and policies that can meet the needs of the profession and industry. Ultimately, it will be able to improve the quality of professional accountants needed by the business world.

2. Literature Review

- Expectancy TheoryThe concept of selection of a profession is related to the theory of motivation, namely the expectancy theory. Motivation is a concept that describes one's forces to start and direct one’s behavior towards a particular job (Gibson, Ivanchevich and Donelly, 2007). Meanwhile, according to Robbins (2006), motivation is a process that determines the intensity, direction, and perseverance of individuals to achieve the target. The expectancy theory assumes that the power of the tendency to act in a certain way depends on the power of expectation that it will be followed by a certain output and the appeal of such output to the person (Redmond, 2010). Briefly, the key to expectancy theory developed by Viktor H Vroom in 1964 is the understanding of each goal and the interrelation between effort and performance, between performance and reward. Therefore, an accounting student’s career choice is determined by the expectation of a career that he or she will choose in terms of meeting their needs and the attraction it has for them. For example, a student may be lured into a career by the expectation of a decent organizational reward, such as bonuses, salary increases, or promotions. In other words, students expect their careers to provide what they want in terms of salary, professional training, professional recognition, social value, work environment, labor market considerations and personality in line with the concept of the social economic theory developed by Venable (2011).Empirical StudyFactors Affecting Career DecisionAccording to Gati, Krausz and Osipow (1996), career decisions will be realistic and proper if one can seek the right information and use it as well as possible. Meanwhile, Sukardi (2002) proposes three types of information in making a career decision, namely: (1) social personal information, (2) educational information, and (3) job information. The social personal information is related to self-understanding concept and relationship with others who will influence the choice of position. Educational information is related to what educational knowledge should one own to get a job. Meanwhile, the job information is related to the knowledge of which job can fulfill one's decision and satisfaction. This is in line with Wattles’s (2009) research which concludes that the needs of business people will always change and grow in line with the progress of business complexity, technology, competition demands, globalization, and various expectations that are in line with one's economic condition. Thus, one information about the profession that can be useful in making career decision is information about the working environment of the profession, that is, what conditions will be faced by someone at work later. This also applies to the accounting profession. A useful information for accounting students in making career decision as an accountant is one that concerns the work environment. In DeZoort, Lord and Cargile (1997) research, the work environment of public accountants is described in three dimensions that are considered to cover various issues relevant to the world of public accountants, namely: (1) job duties and responsibilities, (2) advancement, training, and supervision, and (3) personal concerns. Considering that the instrument has been tested, the researcher reuses the instrument in this research with necessary modifications. Student accountants get information about their prospective working environment from various media. The main source of information is the working environment of public accountants. For students, it includes lectures, written publications, recruiter, accountants, family, friends, and work experience (DeZoort, Lord and Cargile, 1997). According to Yayla and Cengiz (2005) there are 5 factors that influence the career choice of accounting students after graduation, namely: “one's own choice”, “family and environmental influences that are close to the public accountant profession”, “self-interest in accounting”, “better salary”, and '' better job and career opportunities.” According to Agarwala (2008), there are 7 factors which influence decisions in career choices; they are high salary expectations, broad career development opportunities, work experience, skills and knowledge, family environment, social status, and educational environment.Meanwhile, Janvrin,Lowe and Bierstaker (2009) research examine whether accountants and the public know the accounting websites that have provided information to students. His research tests whether the website has been effective in providing information to users. The result shows that website may be effective if their users have a positive perception of their quality. Rakhmat (1998) states that the notion of perception is as follows: “Perception is the experience of objects, events or relationships obtained by inferring and interpreting information.”Perception has an important role in the career decision. Friedlan (1995) posits that teaching methods have an influence in shaping accounting students' perception about the accounting profession that will influence their career decision. Samsuri,Arifin and Hussin (2016) research indicates that the majority of students in Malaysia chose accounting profession because of the information they obtain from the environment. In addition, the research also states that undergraduate students are familiar with the chosen profession as it is introduced very well during the lecture. The information then forms a perception that gives direction to the career decision (Hutaibat, 2012; and Samsuri, Samsuri, Arifin and Hussin, 2016).

3. Research Methodology

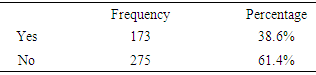

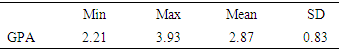

- Method UsedThis survey study adopts the descriptive method. The population of the study consists of 7th semester accounting students at colleges or universities in Jakarta. This population is chosen based on the consideration that the accounting undergraduate program students who are in the 7th semester are not only closer to understanding the requirements and expectations of the public accountant but are ready for immediate entry into the profession than students at the lower semester level because in the 7th semester the students have taken courses with accounting and business backgrounds as well as auditing courses. A number of studies have examined the relationship between career options and post-graduation (Cohen and Hanno, 1993; Allen, 2004; Tan and Laswad, 2006; Agarwala, 2008). To determine the career options by accounting students after graduation, 800 questionnaires were distributed to 17 universities in Jakarta who have accounting course. Of the 800 questionnaires distributed, 448 (or 56%) questionnaires were returned with complete answers and processed. From the 448 respondents, 173 (38.6%) plan to work as public accountants and 275 (61.4%) indicate interest in non-public accountancy field (Table 1). The mean Grade Point Average (GPA) of respondents is 2.87.

|

|

4. Results and Discussion

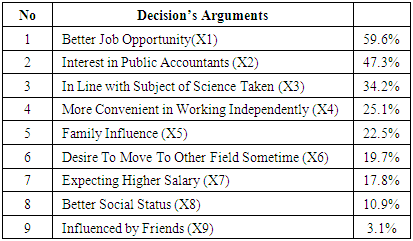

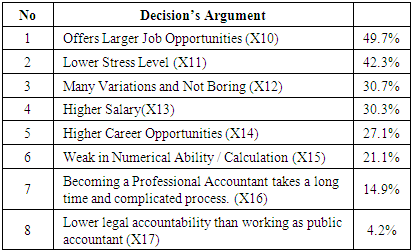

- Career Decision in Public Accounting Profession or Non-Public Accountant ProfessionIn this research, each respondent was asked the same question: “Are you planning to work as a public accountant?” If the answer is “Yes”, then a follow-up question is: “Why are you planning to work as a public accountant? There are 9 possible answers available to respondents from which they were required to select and rate at least 3 best options based on the suggestions of Cohen and Hanno, 1993; Hermanson and Hermanson, 1995; Adams et al. 1994; Allen, 2004; Mauldin et al., 2000; Wooten, 1998; Tan and Laswad, 2006). The results of respondents' answers are as follows: Better job opportunities (59.6%), interest in public accountants (47.3%), in line with subject of science (34.2%), more convenient in working independently (25.1%), family influence (22.5%), the desire to move to other fields sometimes (19.7%), expecting higher salary (17.8%), better social status (10.9%), and the lowest is influenced by friend (3.1%).

|

|

|

|

5. Conclusions and Implication

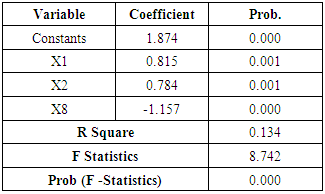

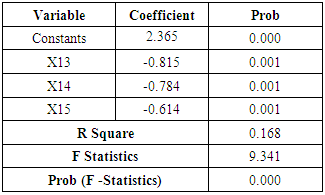

- Based on the research, the first model shows that ‘interest in accounting’ and ‘job opportunities in accounting’ have significant positive associations with the success in accounting courses. On the other hand, the accounting “social status” factor in career offerings has a significant negative association with students' performance. This may be due to the fact that choosing a public accounting profession because of social status does not automatically mean that a student will succeed in that field.Furthermore, this research shows that there is a significant influence on the performance of accounting students and the important factors that play a role in determining whether to choose a public accountant as a career path. Meanwhile, the second model proves that career development in professions other than public accountant has high prospects or "it's difficult to develop the career as a public accountant". "The lack of numerical ability as a public accountant", and "wide employment opportunities in other fields than public accountant" have significant negative relationship with the students’ performance in the accounting course. Furthermore, the first model shows that "interest in accounting" and "job opportunities in accounting" have significant positive associations with success in accounting courses. On the other hand, the accounting "social status" factor in career offerings has a significant negative association with students' performance. This may be due to the fact that choosing a public accountant profession because of social status does not automatically mean that a student will succeed in that field. These results are in line with the expectancy theory that the strength of the tendency to act in some way depends on the power of expectation that the action will be followed by a certain output and depends on the appeal of such output to the individual (Robbins, 2006). This study suggests that the profession that will be taken after graduating from college or university is largely dependent on the perceptions of the expectations and opportunities that coexist with the choice of a profession. There are several implications from this research. First, lecturers must be able to perform activities that support the students to have a positive perception about public accountancy profession. Second, the accounting study program may invite professional public accountants to interact with students and thereby give them a broad insight into the public accounting profession as well as to encourage and motivate them by providing real-life examples and success stories of public accountancy career. In addition, universities can build a strong network between accounting education and work life by creating a synergistic relationship with the profession and the business world. Third, the financial award on the public accounting profession should be improved to increase accounting students' career interest in public accountancy profession.Job opportunity in public accounting field is still wide open. Many students still think that public accountant doesn't give a relatively fast salary increase and this should be managed in order to improve the accounting students' interest for public accountant profession. Students still consider public accountancy career prone to the risk of layoff. This should also be managed so as to enhance accounting students' interest in public accountancy profession. Students assume that environmental conditions make them public accountancy career unattractive. This trend should also be managed.

ACKNOWLEDGEMENTS

- We wishes to acknowledge research grant from Universitas Mercu Buana.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML