-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(2): 46-58

doi:10.5923/j.ijfa.20170602.02

The Impact of External and Internal Factors on the Management Accounting Practices

Tijani Amara, Samira Benelifa

High Institute of Business Administration, Gafsa University, Tunisia

Correspondence to: Tijani Amara, High Institute of Business Administration, Gafsa University, Tunisia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The accounting system plays a crucial role on the company organizational structure. The literature shows that the important contingency factors that affect the organizational structure are the environmental uncertainty, the production technology, the strategy, the size and the structure. The aim of this research is to demonstrate that the integration of Management Accounting Practices is a matter of harmonization between the external and internal factors of firms and the Management Accounting Practices. Thus, we adopt the contingency model to determine the main external contingency factors that explains the adoption of business accounting practices management of distinct levels of development. The exploratory study examines a sample of Tunisian firms belonging to different sectors. Our research is divided into two parts. The first one presents a review of the literature on the conceptual framework and theoretical foundation of management accounting and the concepts of contingency theory as a management accounting reading approach. The second part deals with the research methodology and the analysis and interpretation of the results.

Keywords: Management accounting practices, Internal factors, External factors, Contingency theory, Environmental uncertainty

Cite this paper: Tijani Amara, Samira Benelifa, The Impact of External and Internal Factors on the Management Accounting Practices, International Journal of Finance and Accounting , Vol. 6 No. 2, 2017, pp. 46-58. doi: 10.5923/j.ijfa.20170602.02.

Article Outline

1. Introduction

- With globalization and technological development, trade between nations has taken a new cognitive aspect. The exchange of accounting techniques and practices occupies a prominent place in this exchange culture. The adoption of a management accounting technique is explained by a set of contingency factors. These factors have affected the model and functioning of organizations (Reid et al (2000)). Faced with a multiple choice of techniques with distinct ideologies, companies must design a management accounting system that meets the new requirements. In this context, several studies have been carried out to study the factors that have influenced the choice of management accounting practices, as well as their divergent reality in different countries. (Helsing et al. 2006), (Helsinki et al. 2006)The company's accounting system is a significant part of the organizational structure. The particular features of an appropriate system will depend on the circumstances faced by the company. Otley (1980). The literature shows that the important contingency factors affecting organizational structure are the environmental uncertainty (Gull et al (1994), the production technology (Woodward 1965), the strategy (Naranjo 2004), and the size (Haldma et al. (Mitchell, 2002) and the consumer power (Abdelkader et al (2008) Thus, based on the contingency theory, we will try to demonstrate the factors that explain why companies adopt different sophistication levels of management accounting practices. In other words, are the levels of sophistication of management accounting practices significantly influencing by the characteristics of companies. To answer this question, we have conducted an exploratory study of a sample of Tunisian companies. Our research is divided into two parts: The first one presents a review of the literature of the theoretical foundation of management accounting and the concepts of contingency theory as a management accounting approach. The second part presents the research methodology and the interpretation of the results.

2. The Theory of Contingence as an Approach to Reading Management Accounting: A Review of the Literature

2.1. Management Accounting: The Justified Evolution for Decision-Making

- The Management Accounting is one of the "descending generations" of Accounting. It is not the result of an abrupt event, but rather a consequence of several effects. In connection with its external environment, such as accounting is a subject to profound changes and modifications. These changes in the field of Management Accounting have been the subject of several debates. For Johnson et al (1987) these changes have come to respond to the current needs of the business environment. These changes in Management Accounting are the result of a combination of incentives. Several techniques have been developed to respond to changes in the competitive environment and to innovations in manufacturing technologies and practices. In this context, Scapens (1990) emphasizes that these changes are synonymous with evolution. They act as an extension of traditional Management structures for planning and control. With the flow of information from Management accounting to managers, decision-making techniques become more flexible. For Simon (1979), decisional computing is synonymous with a concentration of company data in a data warehouse to facilitate data analysis and decision-making.With this evolution, accounting data are using for decision-making that has as its foundation the knowledge and strategic steering of the costs of acting when there is still time to intervene. Decision-making is an act that has proactive consequences. The primary objective of this decision-making is performance management. The Management Accountant must use his or her talents to help create the environment that will maximize the likelihood that the results will be satisfied even before decisions are madding and implementing. For Bouquin (2006), this strategic knowledge "does not consist in periodically monitoring it to ensure that it conforms to expectations or to check that they are lower than those of the competitors.The role of Management Accounting as a decision-making tool lies behind the following three functions: the processing of data concerning the acquisition and consumption of resources, the alert consists of reporting opportunities and the simulation allows an analysis, which identifies the best solutions and subsequently informs the decisions of the managers. As a result, Management Accounting provides information that enables "rational" managers to make logical decisions. (Mihlàilàa (2014); Butlern et al. (2015)). These authors argue that accounting as practiced allows members of an organization to have an institutional basis for decision-making within the organization. Accounting cannot therefore be regarded as having a legitimizing role for decisions rendered, but it is also deterministic in nature and subject to the users' interpretation of information to improve their decisions.

2.2. The Contingency Theory as a Reading Approach

- The theory of contingency suggests that no theory or method can be applied in all cases. In other words, there is no better way to design, lead or manage an organization, Donaldson (2001). From a contingency perspective, the concept of the best practice is studied in a specific context, since the impact of the best practices depends on the environment in which it operates (Ketokivi et al (2004)). Indeed, this theory is based on two fundamental assumptions. This implies that there is no one efficient structure for all organizations; a structure can be optimal only by varying according to certain contingency factors. Although, the contingency approach was developed at the level of the literature of organizational theory in the first half of the 1960s. There was no reference to the theory of contingency in the accounting literature during this period. Applying to accounting information systems, the contingency theory leads to the study of accounting information systems. This is possible by assuming that managers act with the objective of adapting their organizations to changes in organizational factors and to improve the performance of their business. In this sense, researchers try to identify a correspondence between the factors of the environment and those of the organization that lead to high performance. According to Vroom et al (1973), the effectiveness of a decision-making procedure depends on a number of aspects:- The importance of the quality and the consent of the decision.- The amount of appropriate information owned by the leader and collaborators.- The probability that the collaborators will cooperate to make a good decision.This implies that the contingency theory plays a crucial role in accounting system understanding. By adopting this contingent approach, the accounting information system, as an element of the organizational structure is conditioned by the factors features of the context in which the company operates. It must adapt to a set of contingent variables, namely size, ownership structure (Lavigne (1999)), sector of activity (Dupuy (1990)) and age of firm (Ngongang 2013)). A list of contingent variables presents the corporate strategy (Hoque (2011)) and the market competition (Ghasemi et al (2015)) and the national culture (Anderson et al. (2004). The latter found that SME performance measurement systems do not adapt to the balanced structure of the "Balanced Scorecard".

3. The Research Methodology

- An exploratory study by means of a questionnaire was carried out among a sample of Tunisian companies belonging to the different of activity sectors. The main objective of this research is to study the impact of business factors on the management accounting practices. To do this, we will present the data collection method, the sample, the measurements of the variables, the questionnaire as the only means of data collection and the statistical tools used to test the different hypotheses.

3.1. Presentation of the Sample

- Industrial firms have been a crucial foundation for several researches in terms of management accounting subject. (Alleyne et al., 2011), Chris et al. (2008). In our case, the sample incorporates the different activity sectors. This choice is justified by the integration the activity sector as an explanatory factor of choice of the practices of the management accounting.

3.2. Method of Data Collection

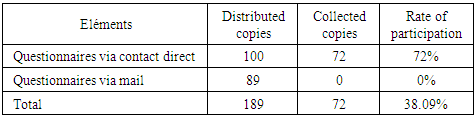

- In order to collect the necessary data, we will adopt a questionnaire that focuses on a sample of Tunisian companies that are characterized by diversification in terms of internal and external factors. The aim of this questionnaire is to determine that management accounting practices is directly related to these factors. The questionnaire was distributed by direct contact and by email. 189 questionnaires were distributed and only 72 copies were finally completed and retained with a rate of 38%.

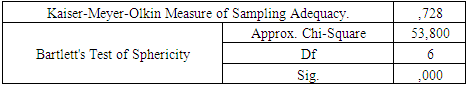

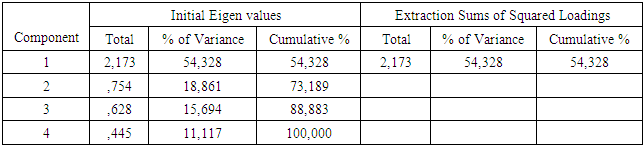

3.3. The Statistical Tools Used

- Tools and statistical methods are necessary for the purposes of the analysis to be conducted. We opted for the SPSS 19.0 software for processing the questionnaire data. We used principal components analysis to test the hypotheses of the research. From the perspective of interpreting factors, analysis suggests major components we performed a linear regression analysis to explain a quantitative variable by another quantitative variable. This may be checked through the discriminate analysis that demonstrates the relationship between a dependent variable and a nominal set of explanatory variables (quantitative) of proportion or interval.At the global level, the adjusted coefficient of determination (R2) will explain the share of variable Y explained by the variation of X. Then the Fisher test allows us to assess the significance of the results.

3.4. The Research Conceptual Framework

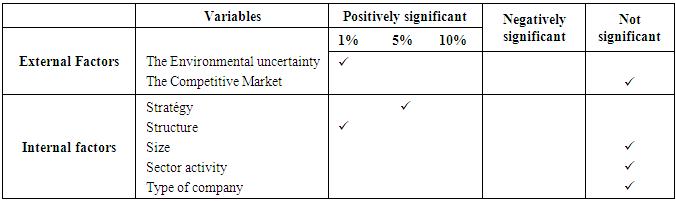

- There is no typical model of structure adapted to several environments but several structures adapted to environments. It is within this framework that there is a divergence between organizations in the integration of management accounting practices. Each structure is a reaction translation of the various factors in relation to the company. Here, we speak of the contingency factors that are classified according to the literature into external and internal factors which are presented in the following diagram:

| Figure (1). Contingency factors |

3.5. Description of the Study Assumptions

3.5.1. External Factors

- An organization cannot simply develop to reflect the objectives and the motivations or the needs of its members or leadership. It must comply with the constraints imposed by its relationship with the environment. Thus, the unpredictability of the environment has assumed implications for the management accounting system (Jones (1985)).

3.5.1.1. Environmental Uncertainty

- The Environmental uncertainty is one of the first contingent factors examined for their effect on the design of management accounting practices. Gull et al (1994) showed that when perceived environmental uncertainty is low, management is able to make relatively accurate predictions in the market. In 2008, Abdelkader et al (2008) found that firms that perceive a higher degree of environmental uncertainty adopt more sophisticated management accounting practices than firms that perceive low environmental uncertainty. Based on this framework, we formulate the following hypothesis:H1: Companies operating in a high environmental uncertainty integrate the management accounting practices.

3.5.1.2. Market Competition

- Mia and al (1999) tested the relationship between the intensity of market competition and the use of information by managers. The researchers also tests the use of Management accounting and performance of the business unit. Their results show that the increase in the intensity of competition in the market is associated with the increased managerial use of management accounting information. Previous contingency studies by way of example Hoque (2004) and Krishnan et al (2002) suggest that today's firms need management accounting control systems that can provide timely, accurate, and relevant information on a wide range of issues, including product costs, productivity, quality, customer service, customer satisfaction and profitability. Bromwich (1990) argues that the management accounting control system should be modified or developed to focus on a company's value-added activities relative to its competitors. Thus, the second hypothesis can be formulated as follow:H2: Companies facing the most intense market competition integrate the management accounting practices.

3.5.2. Internal Factors

- The internal factors of the company are related to its organizational structure, its size and its pursued strategy.

3.5.2.1. The Organizational Structure

- Among the important structural parameters that have received a lot of attention in organizational research are those related to the definition of the extent to which decision-making within the organization is centralized or decentralized. Abdelkader et al (2008) and Chia (1995) found a positive relationship between decentralization and the management accounting practices. In this context, we assume our hypothesis.H3: Firms with decentralized structures adopt the management accounting practices compared to firms with centralized structures.

3.5.2.2. The Size

- "The size of the organization is a major predictor of its structure" Desreumaux (1992). In this context, the smaller company has usually the simpler accounting information system and the lower of the sophistication. Vallerand et al (2008). For Lavigne (2002), the size represents the essential factor of structural contingency, which explains and justifies the use of management control tools. Thus, our hypothesis is the following:H4: The big companies integrate more sophisticating management accounting practices than small companies.

3.5.2.3. The Strategy

- The reading of the relationship strategy and the management accounting system was discussed from three angles. In this sense, three typologies of strategies have been widely used to describe the various business strategies. Miles et al (1978) classified companies in into four groups: defenders, prospectors, analyzers and reactors. Langfield (1997) found that the sophisticated management accounting system has a more positive effect on the performance of the companies that adopt a prospecting strategy than in companies that adopt a defender strategy. Cadez et al (2012) predict that an appropriate management accounting system should support strategic priorities in order to improve performance. Competitive strategy was also examining by Anderson et al (1999) as a mediating variable in the contingent relationship between external competition and management accounting practices. They found differences in competitive strategies and international outlooks, as explanatory factors for differences in management accounting practices. In this sense, our hypothesis is: H5: Companies that adopt the differentiation strategy adopt the most sophisticated management accounting practices compared to companies that adopt a low-cost strategy.

3.5.2.4. The Business Line

- The sector of activity has been taken by several researchers as an explanatory factor, particularly in small and medium enterprises (SMEs). However, Holmes et al (1988), in a study of 928 Australian SMEs, show that the industry has an effect on the level of production of non-compulsory accounting data for SMEs. In this framework, we formulate our hypothesis.H6: The level of sophistication of management accounting practices depends on the activity sector.

3.5.2.5. The Type of Business Affiliation

- The concept of the parent company and its subsidiary has not been integrated as a contextual factor in explaining the integration of a range of management accounting practices. In this context, Jones (1985) emphasizes the ability of the parent company to influence the form of its subsidiary's management accounting system. In addition, the study by Lokman et al. (1994) showed that firms adopted the Activity Basing Costing method because they were influenced by the foreign parent company. In this sense, we have integrated this factor to study its impact on the integration of a set of management accounting practices and their level of sophistication. Our hypothesis is as follows:H7: Companies controlled by a parent adopt more sophisticated management accounting practices.

4. Analysis and Interpretation of Results

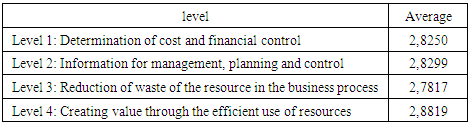

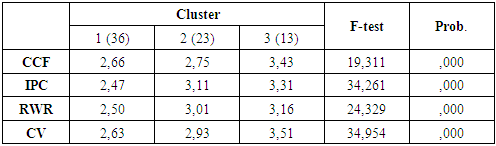

4.1. Classification of Companies

- The validation of our hypotheses passes through two phases. In order to identify the impact of business factors on the management accounting practices, it is first necessary to classify firms into four groups according to the IFAC model of practice of management accounting.Companies are classified into different groups. We followed the same approach adopted by Abdelkader et al (2008) based on a classification of management accounting practices according to the IFAC model (1998) into four levels of sophistication which are: - Level 1: Cost Determination and Financial Control (DCCF)- Level 2: Information for management, planning and control (IPC)- Level 3: Reduction of resource waste in the business process (RGR).- Level 4: Creation of value through the efficient use of resources (CV).Based on this classification and a review of the literature closely linked to the history of the evolution of management accounting, Abdelkader et al (2008) have lifted the hedge at each stage of this accounting. Thus, they have assigned each of the 38 practices of management accounting in the stage of the evolution to which they belong. In order to classify our companies, we asked respondents to indicate the frequency of use for each of the 38 practices of management accounting. In this sense, the scores uses of practices that are attached to each step of the IFAC (Table 1) were used to classify individual firms into groups.

|

|

|

|

|

4.2. Empirical Validation of Assumptions

- Our assumptions are the results of a trinomial business contingency factors theory and management accounting practices. Consequently, the characteristics of firms are classifying into three categories (internal factors, external factors and transformation processes). After classifying companies according to the level of sophistication of their management accounting practices into three classes, we proceed to test the validation of our assumptions.

4.2.1. External Factors

- The external characteristics take their appointment in relation to their external relations with the company. They correspond to a set of external factors that produce facts that can influence how the organization is managing. As a result, these external characteristics are qualified as contingent factors. In our study, we took environmental uncertainty and market competition.

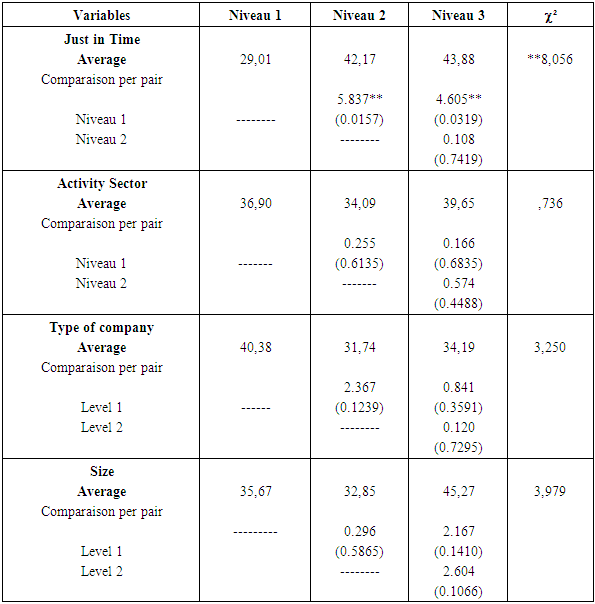

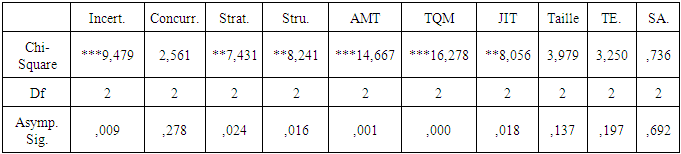

4.2.1.1. Environmental Uncertainty

- Environmental uncertainty has been the subject of several previous studies in the area of management accounting (Gordon et al. (1984) and Mnif (2008)). Our hypothesis is whether the degree of environmental uncertainty influences the level of sophistication of management accounting practices. We test this hypothesis using the Kruskal-Wallis test on equality of population.Thus, we perform a peer comparison (level 1 and level 2, level 1 and level 3, level 2 and level 3). While, the opposite is true for level 1 and level 3 with equal probability (0.0031) and level 2 and level 3 for equal probability 0.0241. H1 is accepted and confirms the studies conducted by Chong, V., Chong, K., (1997).

4.2.1.2. Market Compétition

- The integration of this variable as a contingent factor in the management accounting system has the same weight as environmental uncertainty. It was taking from several angles about the accounting system (Patiar et al (2009) and Ghasemi et al (2015)). In our study, this variable was integrating as a contingent factor that explains the level of sophistication of the management accounting. H2 predicts that companies facing intense market competition incorporate the most sophisticated management accounting practices. The Kruskall-Wallis test indicates that there is no significant difference between the three groups of firms in terms of the intensity of market competition. The pairwise comparison between the three groups based on the Kruskall-Wallis equality of population rank test indicates that there is no significant difference between each group peer. This implies that the level of sophistication of management accounting practices is not explaining by the intensity of market competition. Therefore, H2 is rejected.

4.2.2. The Internal Factors

- The internal characteristics correspond to all the internal qualifications that characterize each company or group of companies. In our study, these internal factors are qualified as contingent factors, which are the competitive strategy, the structure, the size, the sector of activity and type of enterprises.

4.2.2.1. The Competitive Strategy

- As part of our study, we focused our analysis on two types of competitive strategy: differentiation strategy and low cost strategy. Indeed, our hypothesis is to verify if the choice of one of two strategies is relating to the level of sophistication of management accounting practices. According to the Kruskall-Wallis test, we find that there is a significant difference between the three levels, with a probability equal to 024 of less than 5%. To validate our hypothesis we go on to apply Kruskall-Wallis equality of population rank test, which allows comparing groups of companies two to two. As a result, no difference was detected between level 1 and level 2 following a probability (0.8826) greater than 10%. In contrast, a significant difference was detected between levels 1 and level 3 as well as between levels 2 and 3 with two successive probabilities 0.0116 and 0.0148. As a result, the strategic choice has an impact on the level of sophistication of management accounting practices. Thus, H3 is confirmed.

4.2.2.2. The Organizational Structure

- The structure has been considered by several authors intends that contingent factor that explains the integration of management accounting practices. It is reflecting in the literature review by two types of opposing structures related to participation in the decision. They correspond to the centralized structure and the decentralized structure. As results, Abdelkader et al (2008) found a positive relationship between decentralization and the level of sophistication of management accounting practices. Erserim (2012) found that there is no positive relationship between centralization and management accounting practices. In this sense, our hypothesis 4 states that the level of sophistication of management accounting practices is positively associated with the degree of decentralization of business. According to the Kruskal-Wallis test, a significant difference was founding between the three groups with a probability, 016. This test does not guarantee the comparison between each group peer. For this, we will adopt first the Krusll-wallis poulation rank test. Our results predict that there is no significant difference between level 1 and level 2, so the integration of first level and second-level practices is not explained by the organizational structure of the 'business. On the other hand, for Level 1 and Level 3, as well as Level 2 and Level 3, a significant difference was founding for each group peer with the respective probabilities 0.0083 and 0.0102. As a result, our H4 is confirmed.

4.2.2.3. The size

- Several previous studies have shown the crucial role of size as an explanatory contingent factor in the management accounting system. The result shows that sophisticated accounting information system is simpler (Lavigne (2002)). These results are explained by the fact that large companies have the financial means to integrate the most sophisticated practices. In this sense, it is assuming (hypothesis 5) that the level of sophistication depends on the size of the firm. Through the Kruskall-Wallis test application, no differences were founding between the three levels of sophistication. The paired comparison produces a result that predicts that there is no significant difference between level 1 and level 2, as well as level 1 and level 3, and finally between level 2 and level 3, Thus in the Tunisian context the size fails to explain the level of sophistication of the management accounting. This may be justified by the fact that the Tunisian context is particularly composed of SMEs.

4.2.2.4. The Sector of Activity

- The business sectors have a contingent role in several accounting research particularly in small and medium-sized enterprises (SMEs) (Holmes et al. (1988)). Previous research has tested the relation between the industry and the reality of integrating a singular number of management accounting practice such as the accounting method by activity. Alcouffe (2004) Thus, we have integrating the business sector of a company as a contingent factor in a broader context. Our hypothesis (H6) predicts that the level of sophistication of the practices of the management accounting sector depends on the sector of activity. As a result, we found that there is no difference between each peer of the group of companies.

4.2.2.5. Type of Companies

- For Dik et al (2008), the Arab world represent an important emerging market for foreign investment. Local companies face foreign one, which can affect their choice of management accounting practices. In this context, our hypothesis (H7) states that companies controlled by others foreign companies adopt the most sophisticated management accounting practices. The Kruskall-Wallis test shows that there is no significant difference between the three groups. Thus, hypothesis H7 is not confirmed.It is clear that the level of sophistication of the practices of management accounting is based on a number of business factors. These factors vary between two categories; internal and external. According to our results, in the Tunisian context, these factors are the perceived environmental uncertainty, the competitive strategy and the organizational structure.

|

|

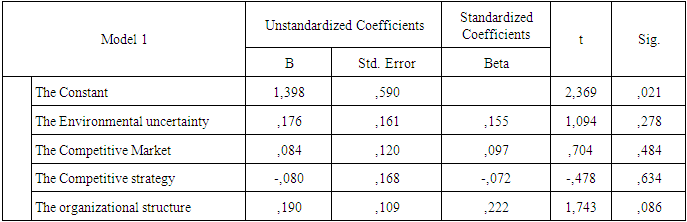

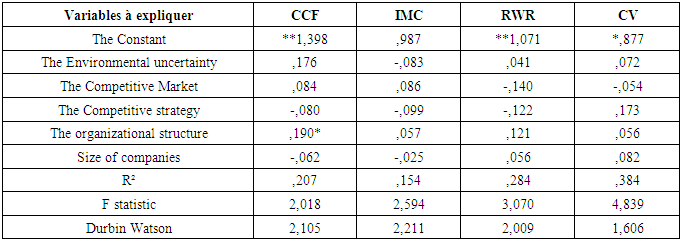

4.3. The Regression Analysis

- At this stage, we will try to understand the relationship between the variables of our analysis in a multi-variate study. Variables that describe management accounting practices will be linearly relating to those identifying the factors of the business. The aim is to measure the magnitude of the comparative effect of the various factors proposed as explanatory of changes in levels of sophistication of accounting practices.

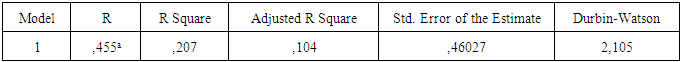

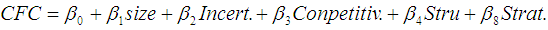

4.3.1. Practice of Cost and Financial Control (CFC)

- The estimated model is as follows:

The aim is to determine the integration of the management accounting practices of level 1 of sophistication related to the costing and financial control (CCF) according to the internal and external factors of the companies. The results of the linear regression show that only the organizational structure is a significant variable. Indeed, with a probability equal to 0.086 (significance at the 10% threshold), this variable explains the integration of management accounting practices of level 1 of sophistication. For a centralized structure, the integration of these practices is adequate as opposed to a decentralized structure.

The aim is to determine the integration of the management accounting practices of level 1 of sophistication related to the costing and financial control (CCF) according to the internal and external factors of the companies. The results of the linear regression show that only the organizational structure is a significant variable. Indeed, with a probability equal to 0.086 (significance at the 10% threshold), this variable explains the integration of management accounting practices of level 1 of sophistication. For a centralized structure, the integration of these practices is adequate as opposed to a decentralized structure.

|

|

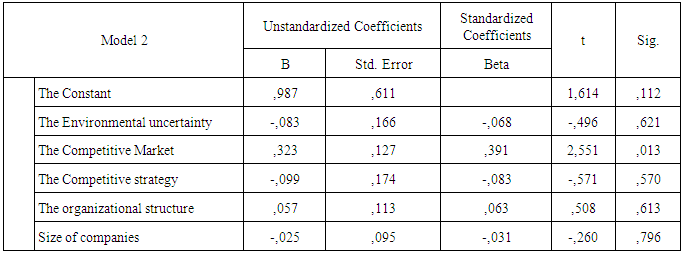

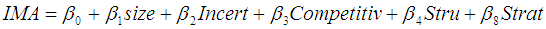

4.3.2. Practice of Integration Management Accounting (IMA)

- The determination of the integration of management accounting practices belong to the level 2 sophistication depending on the characteristics of the company’s results in the following model:

|

|

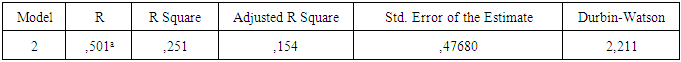

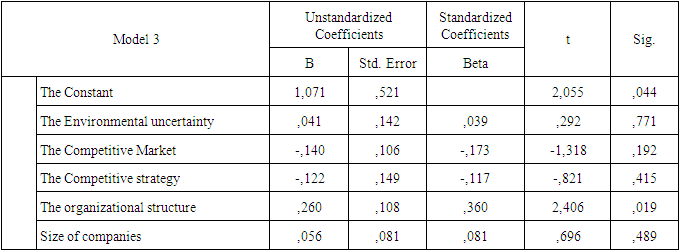

4.3.3. Practice of Reduced Waste of Resources (RWR)

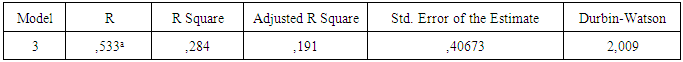

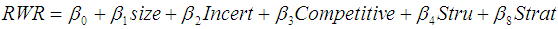

- The integration of management accounting practices that are part of Level 3 sophistication is studied based on business characteristics by adopting the following model.

|

|

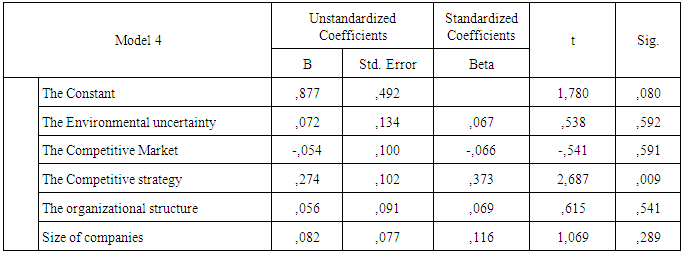

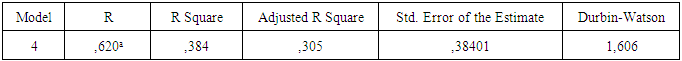

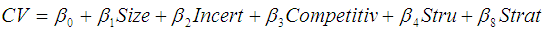

4.3.4. Practice of Value Creation

- To investigate the relationship between level 4 of sophistication regarding the creation of value through resource efficient use and business factors, we estimate the following model.

|

|

|

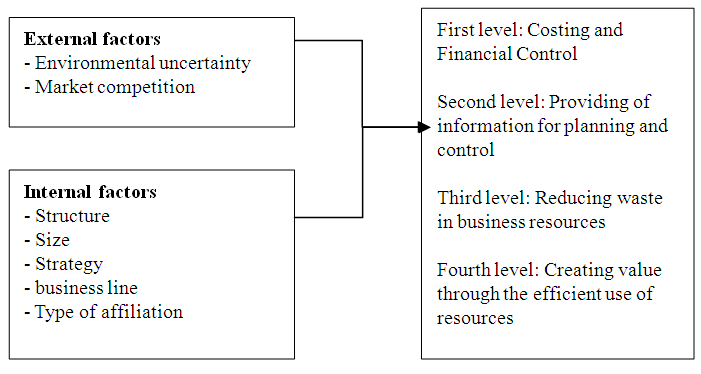

4.4. Interpretation of the Results

- The results of our research show that 50% of Tunisian companies use Management Accounting Practices that belong to level 1 of sophistication. For level 2, we recorded 30.26%. As a result, the majority of companies surveyed place a high degree of confidence in the practices described by the review of the accounting literature as traditional. This finding confirms the results of the previous studies carried out by Mclellan et al (2010) on the countries of the Arabic Gulf Cooperation Council Countries and on Egypt by Ismail (2007). A comparison of our results on the use of accounting practices with the results obtained by the Anglo-Saxon and continental context, leads us to note that there is a lag and delay between the Arab countries and the continent 'Anglo-Saxon. Indeed, fidelity to the use of traditional practices has been observing in several studies in the Arab context. An observation of the discipline of management accounting in the three contexts: Anglo-Saxon, continental and Arab, shows that the Arab world does not have an accounting identity, but rather it is dominated by continental countries. Indeed, the discipline of management accounting in the Arab world is characterizing by an absence of nationality, and a persistent imitation. This observation, dated since 1990 through the research of Khadra (1990), is confirming by our research on the Tunisian context. The following table summarizes all the results obtained.

|

5. Conclusions

- The results obtained concerning the empirical validation of our hypotheses are in harmony with the review of the literature of management accounting. A reading of the results obtained shows that the Tunisian context is in the same basket as the developing country because the majority of companies are satisfied with the less sophisticated accounting practices that correspond to level1 and level 2 (CCF and IMC). These findings confirm the empirical results of previous research (Almahamid et al. (2012), Mohamad et al. (2014)) which show that levels of sophistication in management accounting practices are depending on internal and external factors. We have integrated the business sector and the type of affiliation of the company as factors explaining the level of sophistication of management accounting practices. Our results show that the role of these two factors as contingent variables in the integration of management accounting practices is neutral. Similarly, size as a control variable and contrary to the review of the literature of management accounting, is not an explanatory factor.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML