-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(1): 1-7

doi:10.5923/j.ijfa.20170601.01

The Influence of the Original Revenue Balance Fund and Regional Income Areas at the Level of Provinces and Regency/City in Indonesia

Syapsan

Faculty of Economics, Universitas Riau, Indonesia

Correspondence to: Syapsan, Faculty of Economics, Universitas Riau, Indonesia.

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The effective implementation of regional autonomy implemented in January 2001 has made fundamental changes in the implementation and financing of regional development in each regency / city. The changes are especially visible in areas that have the natural resources, an area where their income increase is highly large compared to before the time of autonomy. The results showed that the largest source of receipts revenue (PAD), both at the provincial and district / city comes from local taxes. PAD provinces throughout Indonesia on average each year grew by 17.64% while the PAD districts / cities throughout Indonesia on average each year grew by 19.25%. The influence of Regional Income to the regional revenue at provincial level throughout Indonesia amounted to 1,979. While in regencies / cities throughout Indonesia the influence of regional revenue to the regional income / town of 7.744 and (2). The balance funds provincial governments throughout Indonesia on average each year grew by 13.50%, higher than the growth of the balance funds at the district / city that grows on average every year amounted to 9.85%. The balance funds influential provincial government amounting to 3.923 to the regional income, whereas the effect of balance funds at the district / city to the regional income amounted to 1.582.Later in the theoretical context that decentralization should be able to open a democratic space for participation, in the sense that may occur handover of authority to the lowest unit of government that is accessible to all parties, so that people can feel the political rights and freedoms. The authority and participation in the regional autonomy of course requires a good functioning of the rule (good governance), so that the functioning of autonomy correspond with the rules. In summary it can be said, good governance can be created if the two powers mutually supporting open government, responsive, willing to listen, willing to engage (inclusive) with responsible citizens, active and have awareness.

Keywords: Fiscal Decentralization, Local Revenue and Balance fund

Cite this paper: Syapsan, The Influence of the Original Revenue Balance Fund and Regional Income Areas at the Level of Provinces and Regency/City in Indonesia, International Journal of Finance and Accounting , Vol. 6 No. 1, 2017, pp. 1-7. doi: 10.5923/j.ijfa.20170601.01.

1. Introduction

- Law No.22 of 1999 on Regional Government and Law No. 25 of 1999 on Financial Balance between Central and Local Government is the basis of decentralization of political, administrative and fiscal in order to realize Autonomy. Law No. 22 cored division of authority and functions (power sharing) between the central and local governments. While Law No. 25 regulates the distribution of financial resources (financial sharing) between the center-region as a consequence of the division of authority (Simanjuntak, 2001; Suharyo, 2000). Both of these laws emphasize that the development of regional autonomy was held with regard to the principles of democracy, participation, equity, justice, and considering the potential and diversity of regional resources. Moreover this law has also given clear direction to be achieved and provide flexibility for regions beyond what is in the past. The effective implementation of regional autonomy implemented in January 2001 has made fundamental changes in the implementation and financing of regional development in each regency / city. The changes are especially visible in areas that have the natural resources, an area where their income increase is highly large compared to before the time of autonomy. This condition can be occur because regional autonomy has given highly broad authority to regulate every area of regional development and fiscal authority. So that each region has the flexibility to develop the potential local revenues on one side, and the flexibility to develop programs and development priorities on the other.On the implementation of fiscal decentralization should be regulated in a fair and consistent financial relations, public services, exploitation of natural resources and other resources between the central government and the regional governments, and among the regional governments. Government essentially three main functions, ie functions of distribution, stabilization, and allocation. The Central Government will be more effective and precise when carrying out the function of distribution and stabilization functions, while the regional government knows better the needs and situation of the local community will be more effective and precise in performing the allocation function. (Law No. 33 of 2004).Regional autonomy has brought fresh air to the area, because in addition to getting a greater authority also allocated a larger budget. Source shopping areas come from local revenue derived from fund transfers, local revenue and others are legitimate. However, based on Frediyanto’s research results (2010) showed that after the regional autonomy, increasing acceptance of PAD does not automatically increase the contribution of revenue in the budget even number of regions that have low fiscal capacity increased (from 88.57% to 91.43%).The decline in world oil prices also affect the declining acceptance of oil and gas producing regions in Indonesia. In the draft 2015 state budget set the ICP assumption of US $ 70 per barrel. This condition will affect the ability of the region in implementing fiscal authority. Meanwhile, other local revenue source, eg Local Revenue also influenced by local economic growth.According Syahelmi (2008) that the change in the GDP will respond to significant changes to the PAD. Slowing the growth of the national economy is also followed by a slowdown in economic growth in some areas, especially oil and gas producing regions. For example Riau province, its economic growth in the first quarter of 2015 contracted by 0.18%. For the autonomous regions mainly producing oil and gas, the role of local revenue into has a very important meaning as a source of revenue from oil and gas revenue-sharing has decreased. However, when the role of local revenue can not also be expected, such an area would face financial problems carrying out local authority.During this dependency autonomous regions against the central government is still quite high. The largest proportion of the reception area is still sourced from grants (fund transfer), for example in 2012 amounted to 65.69% of regional income at the provincial and district / city in Indonesia comes from balancing funds in the form of revenue-sharing tax / non-tax sharing, General Allocation Fund and Special Allocation Fund. Taryono’s research results (2013), in Kampar regency showed that the greatest contribution to regional revenue derived from the balance fund with the continued to decline trend. In an effort to improve the welfare of society, local governments faced with the needs of the growing shopping areas while local revenue sources are limited. If the government is not able to optimize revenues outside the balance fund, it can increase the fiscal gap is getting larger.Under these conditions the writer interested to study about the effect of revenue (PAD) and Balance fund to the regional revenue at provincial level and district / city in Indonesia. Therefore, the problem in this study, namely: How does revenue (PAD) and Balance fund at the provincial level and at the level of district / city in Indonesia to the regional revenue?

2. Research Methods

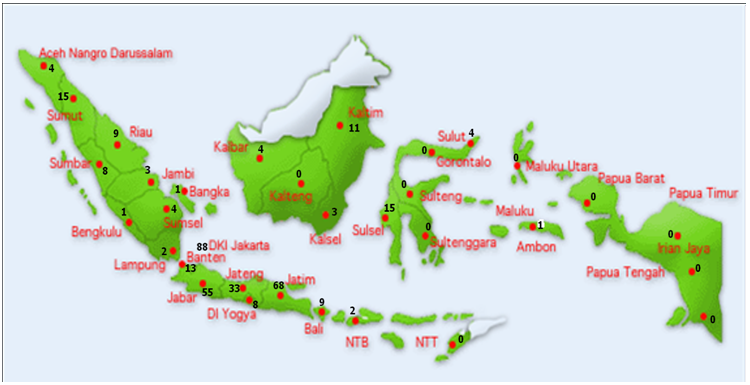

- The method used in this research is descriptive and quantitative analysis. Descriptive analysis is used to explain the behavior of each of the variables are displayed in tables and graphs. Quantitative analysis is used to determine the influence of local revenues and balance funds for regional revenue at the provincial and district / city in Indonesia. In this case use statistical inference techniques with a simple regression model.Formulations for influence regional revenue to the regional revenue at provincial and district / city in Indonesia are:PD = a + b1PADiWhere:PD = Local RevenuePAD = Local Revenue at the level of provinces and districts / cities in IndonesiaFormulations for influence Balance Fund to the regional revenue at provincial and district / city in Indonesia are:PD = a + b1DPiWhere:PD = Local RevenueDP = Balance Fund at the provincial and district / city in IndonesiaLocation of the study on the Influence of Regional Income and Fund Balance to Regional Revenue At the Provincial level and District / Municipality in Indonesia covering the whole territory of the Republic of Indonesia consists of 33 provinces. The location of this research can be seen from the following fig. 1.

3. Research Result

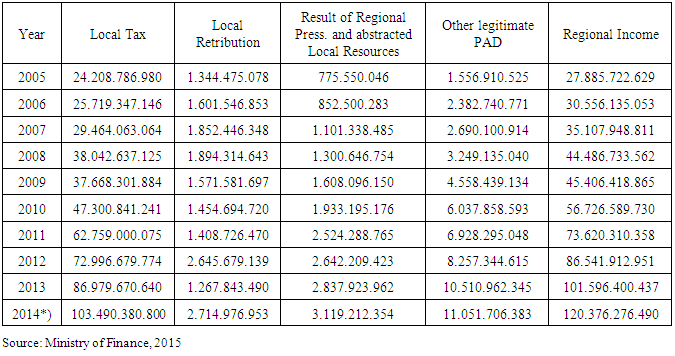

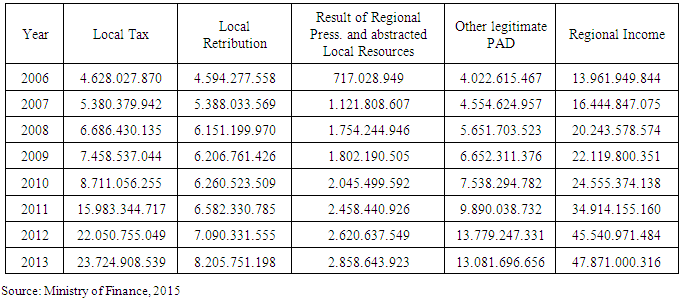

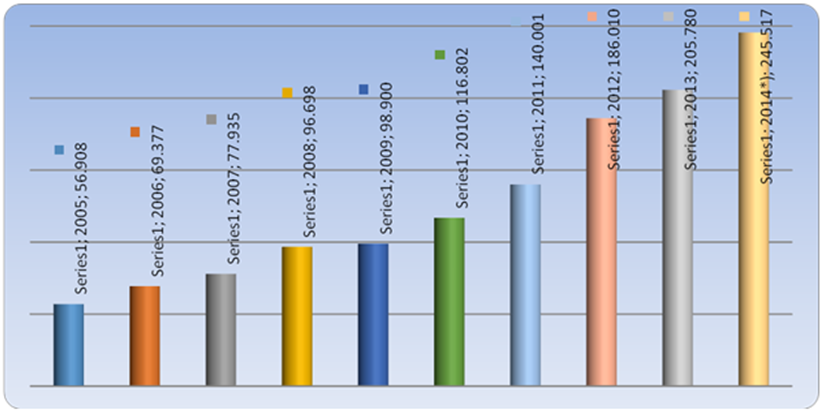

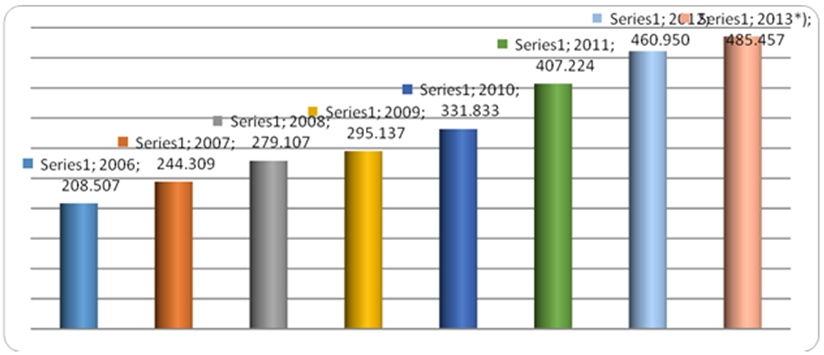

- Regional Autonomy in Indonesia that are effectively running in 2001 has brought changes in governance and economy in Indonesia. Granting wider powers to local authorities accompanied by their source of funding. Regional revenue from provincial governments throughout Indonesia continued to show an increasing trend. The actual revenue of the province during the period 2005-2014 the average annual growth of 17.64%. In 2005 the regional revenue from provincial governments throughout Indonesia Rp. 56 908 million and increased to Rp. 245 517 million in 2014.Increased regional revenue not only occur at the provincial government level, but also occurs at the level of district / city in Indonesia. However, growth in regional revenue at the level of districts / cities throughout Indonesia is lower than the realization of regional revenue at provincial level throughout Indonesia. Trend revenue districts / cities throughout Indonesia continues to increase, which in 2006 amounted to Rp. 208 507 million increased to Rp. 485 457 million in 2013. During the period 2006-2013 the average annual regional revenue from district / city governments throughout Indonesia grew by 12.83%.1. The effect of revenue (PAD) At the provincial level and district / city in Indonesia to the Regional RevenueLocal Revenue (PAD) aims to give authority to local governments to fund the implementation of regional autonomy accordingto the potential of the region as the embodiment of Decentralization. The largest source of receipts revenue (PAD) at the provincial level is derived from local taxes. In 2005 the provincial government local taxes throughout Indonesia Rp. 24 208 million and increased to Rp. 103 490 million in 2014 or during the period the average annual growth of 17.52%. The role of local retribution as a source of revenue for revenue (PAD) is still lower than other sources of income as the result of company-owned wealth management area and separated areas and other legitimate PAD.In an effort to increase revenue, a region may set the Perda on revenue which cause high economic costs, and establish a Perda on revenue which hinder the mobility of people and movement of goods and services between regions, and import / export activities. The realization of revenue (PAD) district / city governments throughout Indonesia in 2006 amounted to Rp. 13 961 million and increased to Rp. 47 871 million in 2013 or during the period 2006 to 2013 the average annual growth of 19.25%.

| Figure 1. Map Location Research |

| Figure 2. Regional Revenue Realization Provincial Government of Indonesia in 2005-2014 (Million) |

| Figure 3. Realization of Local Revenue District / City All Indonesia in 2006-2013 (Million) |

|

|

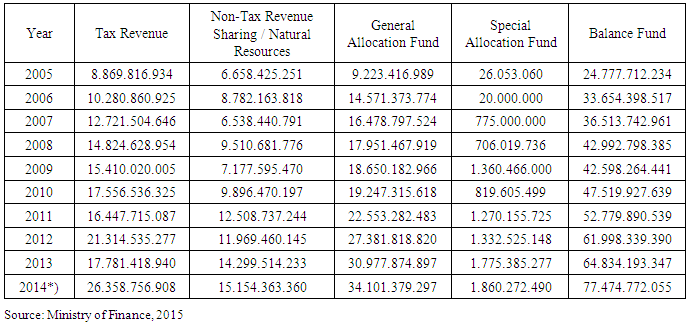

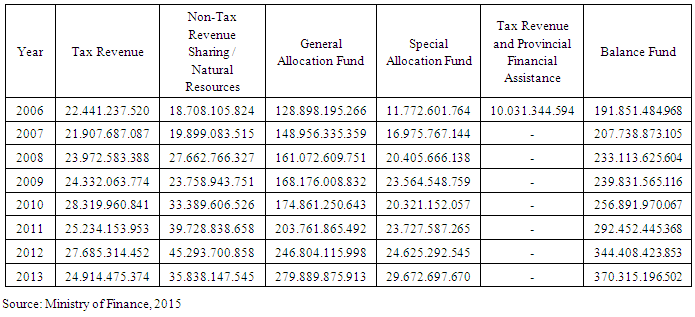

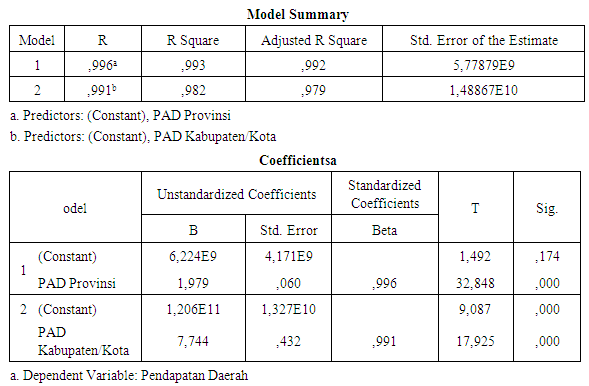

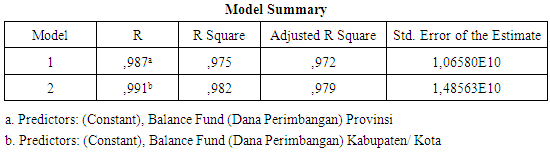

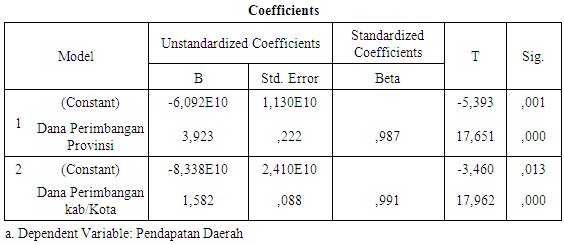

The relationship between revenue (PAD) with regional income has a positive relationship. The magnitude of the effect of local revenues to the regional income can be seen from the coefficient b. At the provincial level the coefficient of 1.979 means if PAD provinces throughout Indonesia increased by Rp. 1, then the revenues of provinces throughout Indonesia will increase by Rp. 1,979. At the district / city level coefficient of 7.744 means if PAD districts / cities throughout Indonesia increased by Rp. 1, the revenue districts / cities throughout Indonesia will increase by Rp. 7.744.2. The effect of Balance Fund at the provincial and district / city in Indonesia to the Regional RevenueFinancial balance between the Government and Local Government is a division of the financial system which is fair, proportionate, democratic, transparent, and efficient in order to funding the implementation of decentralization. Source balance funds derived from shared taxes, of non-tax / natural resources, general allocation fund and special allocation funds. At the provincial level, the largest source of balance funds come from the general fund and the lowest allocation comes from the special allocation fund. Realization of general allocation funds for provincial governments throughout Indonesia in 2014 amounted to Rp.34.101 million, while for the special allocation of Rp. 1,860 million.

The relationship between revenue (PAD) with regional income has a positive relationship. The magnitude of the effect of local revenues to the regional income can be seen from the coefficient b. At the provincial level the coefficient of 1.979 means if PAD provinces throughout Indonesia increased by Rp. 1, then the revenues of provinces throughout Indonesia will increase by Rp. 1,979. At the district / city level coefficient of 7.744 means if PAD districts / cities throughout Indonesia increased by Rp. 1, the revenue districts / cities throughout Indonesia will increase by Rp. 7.744.2. The effect of Balance Fund at the provincial and district / city in Indonesia to the Regional RevenueFinancial balance between the Government and Local Government is a division of the financial system which is fair, proportionate, democratic, transparent, and efficient in order to funding the implementation of decentralization. Source balance funds derived from shared taxes, of non-tax / natural resources, general allocation fund and special allocation funds. At the provincial level, the largest source of balance funds come from the general fund and the lowest allocation comes from the special allocation fund. Realization of general allocation funds for provincial governments throughout Indonesia in 2014 amounted to Rp.34.101 million, while for the special allocation of Rp. 1,860 million.

|

|

The magnitude of the effect of balancing fund at the provincial level throughout Indonesia for regional revenue amounted to 3.923. It means each an increase of Rp. 1 in the Indonesian provinces of balance funds to generate income provinces throughout Indonesia Rp. 3.923. Effect of balance funds for regional revenue in regencies / cities throughout Indonesia of 1.582 which means any increase in balance funds occurred in districts / cities throughout Indonesia Rp. 1, it will increase the income districts / cities throughout Indonesia Rp. 1.582.

The magnitude of the effect of balancing fund at the provincial level throughout Indonesia for regional revenue amounted to 3.923. It means each an increase of Rp. 1 in the Indonesian provinces of balance funds to generate income provinces throughout Indonesia Rp. 3.923. Effect of balance funds for regional revenue in regencies / cities throughout Indonesia of 1.582 which means any increase in balance funds occurred in districts / cities throughout Indonesia Rp. 1, it will increase the income districts / cities throughout Indonesia Rp. 1.582.

4. Conclusions

- This research resulted in a conclusion with regard to the achievement sought which are also linked with the courage to take risks and partnerships as well as self-concept in detail as follows: (1). The largest source of receipts revenue (PAD), both at the provincial and district / city comes from local taxes. PAD provinces throughout Indonesia on average each year grew by 17.64% while the PAD districts / cities throughout Indonesia on average each year grew by 19.25%. Influence of Regional Income to the regional revenue at provincial level throughout Indonesia amounting to 1,979. While in regencies / cities throughout Indonesia the influence of Regional Income to the regional income / town of 7.744 and (2). The balancing fund provincial governments throughout Indonesia on average each year grew by 13.50%, higher than the growth of the balance funds at the district / city that grows on average every year amounted to 9.85%. Fund balance influential provincial government amounting to 3.923 to the regional income, whereas the effect of balance funds at the district / city to the regional income amounted to 1.582.In addition this study provide advice, namely: fiscal dependence provincial government and district / city are still high relative to the central government that reflected the balance funds should be lowered. Fiscal independence of provincial and district / city sought to be improved by driving increased revenue through expansion and intensification, without causing high cost economy.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML