-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(6): 241-246

doi:10.5923/j.ijfa.20160506.01

Investigating the Connection between Company’s Multidimensional Performance and the Remuneration Level of Company’s Boards in the Italian Context

Alessia D’Andrea, Martina Vallesi, Marco Montemari

Department of Management, Università Politecnica delle Marche, Ancona, Italy

Correspondence to: Marco Montemari, Department of Management, Università Politecnica delle Marche, Ancona, Italy.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Several studies examine the increasing influence of sustainability dimensions on the company's strategies. In this context, some researches in-depth analyze the impact of multidimensional performance (social, environmental and economic) on the business objectives and activities, in particular with focalization on the connection between the board's remuneration (or key managers' incentives) and the CSR issues. In Italy, Mio et al. (2015) emphasize the lack of information about this aspect in the CSR reporting and compulsory documents. The purpose of this paper is to investigate the changes after the introduction in the social accountability practices of the version G4 of the standard Global Reporting Initiative (GRI) and the updating of the IAS and Consob resolution in the regulation framework. To achieve the scope, the analysis of report on remuneration (compulsory) and social accountability tools (voluntary) is developed, with reference to Italian listed companies. The content analysis method is used to identify the information about the link between company's performance and remuneration of the highest bodies. The findings confirm the results of previous studies and, specifically, those presented by Mio et al. (2015).

Keywords: CSR objectives, Report on remuneration, Content analysis, Global Reporting Initiatives

Cite this paper: Alessia D’Andrea, Martina Vallesi, Marco Montemari, Investigating the Connection between Company’s Multidimensional Performance and the Remuneration Level of Company’s Boards in the Italian Context, International Journal of Finance and Accounting , Vol. 5 No. 6, 2016, pp. 241-246. doi: 10.5923/j.ijfa.20160506.01.

Article Outline

1. Introduction

- Several studies recognize the need to integrate social responsibility culture in the company strategies: the adoption of a management approach characterized by medium-to-long term objectives of both economic nature and social and environmental nature allows to satisfy this aim (Manetti, 2011). Moreover, the involvement of managers in the achievement of sustainability objectives (three-dimensional) develops a strategic management not only based to monetary values (Strand, 2013). At the same time, the creation of a control system linked to an incentive system based on social and environmental objectives ensures the efforts of managers in pursuing sustainability in the company policies. In the other hand, managers (above all member of Boards) have increasingly responsibility to achieve sustainability goals and promoting Corporate Social Responsibility (CSR) matters (Ingley, 2008; CR-INDEX, 2014). About this point, several studies recognize the power of corporate governance to push CSR objectives (Dunn and Sainty, 2009; Huang, 2010). The Board, in this sense, plays a crucial role in the corporate governance policies (Jamali et al., 2008). The analysis of financial information about remunerations (included on the annual report) and its link with performances could be a possible way to address transparency about managers’ behaviours (Rodriguez and Seabra, 2011). On the one hand, the transparency on the relationship between financial and corporate social performance is even more important in re-building the confidence on business activities, during the current economic and financial crisis (Ducassy, 2013; Alniacik et al., 2011). On the other hand, the attention on the specific aspect of the levels of remuneration is increasing, after the changes introduced by Version 4 of the GRI (Global Reporting Initiative) guidelines published in May 2013. The last version of GRI (G4) requires greater transparency on fixed and variable remuneration of managers and directors.The aspect of analysis is previously addressed by Mio et al. (2015), with focalization on companies listed on the Italian Stock Exchange (as of 31.12.2011) with the aim to ascertain whether these companies provide information about how sustainability is linked to remuneration, and sustainability indicators included in the staff bonus schemes. Mio et al. (2015) started from the consideration that the companies that provided a sustainability report “may be considered more sensitive than other listed companies to social and environmental issues” (p. 327). This study - the first focused in Italy to examine the question - shows that only 44 Italian listed companies published the sustainability report on their own company web sites; among these, only 22 companies used sustainability parameters in their incentive schemes for managers and directors; among these 22 companies, 13 companies declared, in their sustainability report, the use of specific quantitative and qualitative indicators as a basis for their remunerative/incentive systems policies, but these criteria were not explained in their remuneration reports, where the "sustainability information regarding payments made and/or KPIs used in 2011 is practically non-existent (average compliance 3 percent)" (p. 355). The research by Mio et al. (2015) did not include the analysis of the effect on Sustainability report after the publication of the version 4 of GRI. Moreover, several specifications are included in the last update of the recommendation about the Remuneration Report (established by art. 123-ter of TUF - Consolidated Law on Finance, Italian Legislative Decree 259/2010): compulsory report required for Italian listed companies. In view of these changes, the accountability practices developed by Italian listed companies on the issue at stake could be evolved towards improved levels of disclosure.For these reasons, the purposes of this paper is twofold. Firstly, it analyses the changes, after the introduction of version 4 of GRI, in the accountability practices on the sensibility of the Italian listed companies to report on the link between the multidimensional performance (social, environmental and economic) and the level of remuneration of Board and the other managers with strategic responsibility. Secondly, it proposes a tool to enhance the disclosure quality on the link between the company’s multidimensional performance and the level of remuneration of Board and the other managers with strategic responsibility. The structure of the remainder of the paper is as follows: section 2 presents the literature review on compulsory and voluntary information on remuneration of key managers, section 3 describes the method chosen to achieve the objective of the paper and discusses the findings. Finally, section 4 concludes the paper by presenting its main contributions and by providing recommendations.

2. Literature Review

2.1. The Compulsory Information on Remuneration of Key Managers

- The strategic managers’ remuneration considers different national and international standards with the final purpose to perform operations for benefit of all shareholders in a company and not only of specific individuals who are able to influence and to carry out such operations.Since 2012, the Italian companies listed on regulated markets are required to publish annually (at the registered office or on the website) a remuneration report (established by art. 123-ter of TUF - Consolidated Law on Finance, Italian Legislative Decree 259/2010, published 7 February 2011), due to the implementation of European Community recommendations 2004/913/EC, 2005/162/EC, 2009/384/EC and 2009/385/EC. The remuneration report - aimed at making transparent and motivated the assumptions which are at the remuneration’s base considering the long-term strategies - is structured into two main parts: (1) explanation of company policy regarding the remuneration of the members of the directors’ boards, the general managers and the managers with strategic responsibilities referring to the following year; explanation of the procedures used for the adoption and implementation of this policy; (2) description of each component of the remuneration (including the treatment provided in case of office termination, highlighting the coherence to the company's remuneration policy), of each director and the general managers and, in aggregate form, for the key management personnel. The specific information to be disclosed for the first and second section have been determined by Consob (The Italian National Commission for Companies and the Stock Exchange), according to the powers contained in the TUF (art. 84-quater and attachment 3A-7 bis scheme). At this point, any specification is about the nature of the criteria (economic, social and/or environmental) used to define remuneration.Moreover, considering the IAS 24, if a company had transactions with a related party, in the case considered with a key manager, the company has to disclose also information on: the amount of the transactions; the amount of outstanding balances, including terms, conditions and guaranties; provisions for doubtful debts related to the amount of outstanding balances; expenses in the year relating to bad or doubtful debts due from related parties (paragraph 18). The information requested in the paragraph 18 has to be given separately for the key management personnel of the entity or its subsidiaries (IAS 24, 19, f). In relation to the procedures to disclose the information in the financial statement, the document of CNDCEC of 2015 (p. 32 and 33) provides details of the examples according to the information required in paragraphs 18 and 19 of IAS 24. As for managers, their remuneration includes (IAS 19): a) short-term employee benefits; b) post-employment benefits; c) other long-term employee benefits; d) termination benefits.

2.2. The Voluntary Information on Remuneration and Sustainability Objectives

- The incorporation of CSR objectives into mechanisms of company governance and management system becomes a key factor in the creation of long and medium term value (Crane et al., 2014; Porter and Kramer, 2006). The consideration of the interrelation between the governance mechanisms, CSR practices and company performance is a recent field of studies (De Villiers et al., 2011; Harjoto and Jo, 2011) also with reference to the influence of the social issue and the governance policy on the performance (Sahin et al., 2011; Arora and Dharwadkar, 2011; Jo and Harjoto, 2011). For the purpose of the present paper, the attention is focalized on the Board’s compensation connected to multidimensional performance in the mechanism of external accountability. In this field, Yuan et al. (2011) recognize that CSR issue could be integrated in the business activities and objectives considering the connection between the sustainability indicators and the incentive policies. Other recent studied focus on the interrelation between incentive systems and sustainability measures (Merriman and Sen, 2012; Walls et al., 2012). Other researches examine the association between sustainability performance and executive compensation (Cordeiro and Sarkis, 2008; Berrone and Gomez-Mejia, 2009; Cai et al., 2011) and show that no explicit can be found. At the same time, a brief overview of the different situation in the several countries has underlined that, for example, in Germany that the executive remuneration structure has to be aligned with a sustainable development of the company (Section 87-1 of the German Public Companies Act). In addition, the Global Reporting Initiative (GRI) standards, which develop a broadly-based triple-bottom line approach stress, in the last version, G4 the importance to connect the two variables. In particular, the relationship between the level on remuneration and the social, environmental and economic objectives is an aspect to account for (GRI – G4.51). In Italy, Mio et al. (2015) highlight the lack of this connection in the CSR documents of the Italian Listed companies and on their compulsory document.

3. Empirical Analysis

3.1. Sample and Data Research Methods

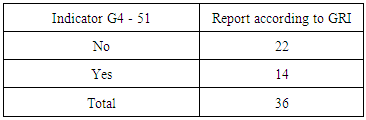

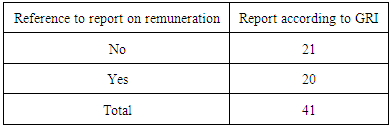

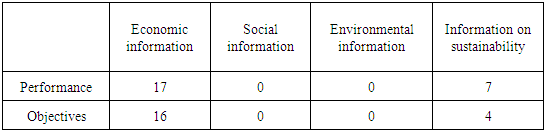

- The sample used in this study comprises all Italian companies listed at 27th July 2016 (as the update of “Orbis Europe" database, accessed in 3rd August 2016), without including the following industries: “Financial service activities, excepted insurance and pension funding”, “Insurance, reinsurance and pension funding, excepted compulsory social security”, “Activities auxiliary to financial services and insurance activities”. The aim was to verify the changes on the adoption of social report by Italian listed companies and the transparency of reporting practices on performance indicators linked to remuneration policy of governance body and senior executives, the reference is to GRI standard, version G4. The focus was on the indicator G4 - 51 (point b.) "b. Report how performance criteria in the remuneration policy relate to the highest governance body’s and senior executives’ economic, environmental and social objectives". The final sample was composed by 263 listed companies. The field material for this study was derived from companies’ websites observation, taken from the Google Directory, which contains links to the total of Italian listed companies’ websites. The choice to use internet tools is linked to its potential, as recognized by literature, of direct communication tool. The internet tools break down barriers between organisation and individual, providing a multi-dimensional information and guaranteeing transparency (Pinterits et al, 2006). Through internet, the companies, in fact, can disclose different type of information: in particular, many studies show the presence of social responsibility disclosures on companies’ web pages (Frost et al., 2005; Patten, 2002; Patten and Crampton, 2004; Williams and Pei, 1999). Moreover, this tool is able to supply a vast amount of information available in an array of formats including text, audio, and video, with low costs (Coombs, 1998).The entire web pages were examined. An initial brief overview of the company home page and of the main categories available on toolbars (or page forefront) was completed. After this first step, two different researchers identified the presence of a CSR section (called "sustainability", "social and environmental", "sustainable development" and so on) and - at the same time - the presence of sustainability report (called in different way, for example social report, environmental report) on each company web site. The remainder of the analysis included the examination of subcategories (brought back in cascade menu connected to main categories or new windows) in order to take out information not found in the home page. Many sites had links to outside locations including possibly subsidiaries; for the purposes of this study, also those links that had the different base URL as the corporate web site were included in the content analysis, choosing those which contained meaningful key words, functional to data disclosure. If a corporation had a link to a subsidiary and the first portion of the URL for that entity was different from the parent firm, the subsidiary's page was included in the analysis in order to consider complete information. This brief exploration allowed the researchers to limit the error possibility on the identification of the units of analysis. After having identified the presence of sustainability report (as stated above, different labels were considered, such as social report, environmental and social report, and so on) - relating to the year 2015 - each report was downloaded and analysed in order to understand how companies disclosed the link between managers' remuneration and company performance, not only economic but also social and environmental. Content analysis method was used in order to reach this aim. About this point, the content analysis - as “a research technique for making replicable and valid inferences from data to their context” (Krippendorff, 1980) - was conducted by two coders in order to ensure reliability of the coding process by independently analysing content (Krippendorff, 1980). Only the CRS report edited according the GRI standard were included in the analysis. For each report, the unit to be investigated was represented by the indicator G4 - 51 (point b), as recalled before. The first step was the check of the table of content according to GRI standard (generally, at the end of the document). If the indicator G4 - 51 was cited, the related page (of the report) was analysed in order to examine the link between manager's remuneration and company performance. The second step was the analysis of the different nature of performance (environmental, social, economic). Using the toolbar "find", the reference to report on remuneration and to remuneration committee was always considered as unit of analysis. If the reference to report on remuneration was found on the CSR reports, a content analysis of this compulsory document was also performed, in order to verify the presence of sustainability indicators on this further declaration. In particular, the 20 companies which referred to the report on remuneration in the social report were considered in order to carry out the analysis of reports on remuneration. The analyzed remuneration reports were downloaded from the site www.borsaitaliana.it (in the committee-corporate-governance section, the remuneration report 2016). Published in 2016, these documents collect the information principally on the remuneration of the year 2015 and of the previous year, considering also future remuneration policy. For each document the content analysis of the words "performance" and "objectives” was made. Using the tool “find”, those words were searched in 20 reports on remuneration. Then, in each paragraph where one of the mentioned two words were found, it was investigated even further searching for the presence of the words: economic, social, environmental, sustainable, sustainability. This procedure was followed in order to approximate respectively economic, social or environmental related to performance and business objectives. Moreover, the presence of visualization techniques (charts or maps), that could link the performance or objectives with one of the economic, social or environmental dimensions, was investigated in the 20 documents.

3.2. Findings

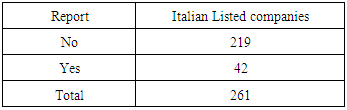

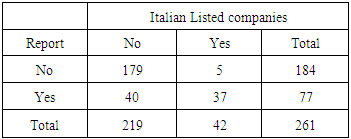

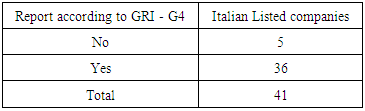

- The sample was composed by 263 listed companies: for two of them, the website was not accessible during the research period (end of August 2016). The sample was then reduced to 261 companies (table 1). The empirical analysis (table 2) – conducted on web pages – showed that only 42 companies published their social report on the website (16,1% of the sample), about the same number found by Mio et al. (2015). At the same time, 77 Italian listed companies inserted a CSR section on its website: 37 companies included the CRS report in a specific link accessible by the section.

|

|

|

|

|

|

4. Recommendations and Conclusions

- The analysis of the current listed companies’ documents (remuneration reports and social reports) highlights that it is not easy to understand the link between managers’ remunerations and company’s performance, overall its social and environmental dimensions. In some cases, the information is missing (reference to internal accountability mechanisms, i.e. MBO systems), in some others, relevant information is disclosed, but the exploitation of the actual performance indicators linked to remuneration is not included. Moreover, the information is spread over several documents and this makes the understanding of the link difficult to stakeholders. Since the state of the art in this research area is still unable to provide exhaustive answers, there is a need of further steps aimed at understanding which types of tools are suitable in order to increase the transparency of the link between managers’ remunerations and company’s multidimensional performance. In particular, the paper claims that there is the necessity to integrate and link to each other the different compulsory and voluntary information disclosed in different documents in order to increase the transparency and to understand how remuneration is linked to performance, overall to its social and environmental dimensions. The study presents limitations related to the sample. Indeed, the research considers only companies which operate in the Italian context, and this limits the applicability of the results to other national contexts. Thus, further research could investigate the link between the multidimensional performance (social, environmental and economic) and the level of remuneration of Board and the other managers with strategic responsibility in other national contexts.The financial and economic crises have decreased confidence in markets and business, involving shareholders in higher risks. So, “the research on disclosure has regained importance.” (Neifar and Halioui, 2013, p. 174). The accountability mechanisms keep the systems’ actors on “virtuous path” avoiding to pursue “selfish interest” (Akpanuko and Asogwa, 2013, p 171). Moreover, the corporate social and environmental responsibility becomes the key of this path, with a “company’s commitment to operating in an economically, socially and environmentally sustainable manner, balancing the interests of diverse stakeholders” (Dibia and Onwuchekwa, 2015, p.150).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML