-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(5): 233-239

doi:10.5923/j.ijfa.20160505.03

Examination of the Relationship between Bank Age and Bank Retention Policy (A Study of Zenith Bank (Nig) Plc)

Inyiama Oliver Ikechukwu, Ugwuanyi Uche Boniface

Department of Accountancy Enugu State University of Science and Technology, Nigeria

Correspondence to: Inyiama Oliver Ikechukwu, Department of Accountancy Enugu State University of Science and Technology, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study aims at examining the effect of bank age on retained earnings of Zenith Bank Nigeria Plc, from 2002 to 2013. Regression analysis was used to establish the nature, direction and magnitude of the effect and relationship between bank age and retained earnings in Zenith Bank Plc. The analysis indicates that bank/firm age has a positive and significant effect on retained earnings. This is in line with the findings of this research. On the level of association between the variables, it was found that bank age share a positive relationship with retained earnings. This is not in tandem with the life cycle theory. The implication is that the banks retain earnings at every stage of their life cycle. This could be as a result of their specialized service which demands a very huge asset base; in terms of branch network, information and communication technology, specialized manpower skill, security and liquidity requirements. If the banks must source fund for all these requirements through external loans and equity, then the cost implication, in terms of interest content, will be unbearably high. The alternative is to source the bulk of their investible fund through reserves which is almost cost free. This is why the banks prefer to retain a large proportion of their earnings, issue bonus shares and make right issues instead of a high rate of dividend payout.

Keywords: Regression, Reserves, Bank Age, Correlation, Zenith

Cite this paper: Inyiama Oliver Ikechukwu, Ugwuanyi Uche Boniface, Examination of the Relationship between Bank Age and Bank Retention Policy (A Study of Zenith Bank (Nig) Plc), International Journal of Finance and Accounting , Vol. 5 No. 5, 2016, pp. 233-239. doi: 10.5923/j.ijfa.20160505.03.

Article Outline

1. Introduction

- The amount of free cash flows, which otherwise could be termed retained earnings, however, might depend on the capital requirements of the firm to finance its growth. Generally, firms in a growth stage, as postulated by firm life cycle, with abundant investment opportunities may tend to have low free cash flows and, in turn, pay lower dividends, while on the other hand, firms in a maturity stage with scarce profitable projects to invest may tend to have high free cash flows and be able to make high dividend payments (Thanatawee, 2011). Bulan and Subramanian (2012) affirms that firm life cycle theory of corporate payout and retention is based on the notion that as a firm becomes mature, its ability to generate cash overtakes its ability to find profitable investment opportunities and eventually, it becomes optimal for the firm to distribute its free cash flow to shareholders in the form of dividends. The researchers added that the extent to which a mature firm distributes earnings to shareholders instead of investing them internally will be a function of the extent to which the interests of its managers are aligned with those of its shareholders.There has been heated argument that at a particular stage in the life of a firm, it may no longer pursue growth and new investments as previously done at the earlier stage of the life cycle. Possibly at this stage, the firm may increase its’ dividend payout propensity the shareholders. At the stage of maturity, the firm would have grown in asset base, reasonably increased in age, accumulated revenue reserves and also had remarkable investment outlay. Miletić (2015) opines that at this point, the firm’s investment opportunity set is diminished, its growth and profitability have flattened, systemic risk has declined, and the firm generates more cash internally than it can profitably invest and eventually, the firm begins paying dividends to distribute its earnings to shareholders. This may, however, suggest that the dependence on internal funding (retained earnings) decreases as firm size increases (Al-Malkawi, 2008). Benartzi, Michaely and Thaler (1997) find that dividend increases are not followed by an increase in the earnings growth rate, while dividend reductions are associated with an improvement in the growth rate.Zenith Bank Plc was established in May 1990, and commenced operations in July of the same year as a commercial bank. The Bank became a public limited company on June 17, 2004 and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004 following a highly successful Initial Public Offering (IPO). Zenith Bank Plc currently has a shareholder base of about one million and is Nigeria’s biggest bank by tier-1 capital. In 2013, the Bank listed $850 million worth of its shares at $6.80 each on the London Stock Exchange (LSE) (http://www.zenithbank.com/CorporateInfo.aspx). It recorded a very high rate of dividend payouts to her shareholders during the period of study with a huge investment portfolio and strong asset base that supports growth and expansion. The retained earnings after consolidation also witnessed a rapid increase in consonance with the growth in earnings during the period.The aim of the study is to examine the relationship between the age of the bank and the retention policy. The study will specifically assess the causality and effect of age on the amount of retained earnings of Zenith Bank Nig. Plc. The remaining part of the paper is organized into four sections as follows: section 2.0 will review existing literature in the area of firm age and retention policy, section 3 will state the methodology to be adopted for data collection and analysis, section 4 will discuss the findings after data analysis, while section 5 concludes the study.

2. Review of Related Literature

2.1. Theoretical Framework: The Life Cycle Theory

- The life cycle theory of dividends by Mueller (1972) argued that a firm has a relatively well-defined life cycle, which is fundamental to the firm life cycle theory of dividends. However, as firms develop and age through its’ life cycle, they tend to alter the dividend policy depending on the financial demands of a particular stage. By implication, firms at their early stages of growth are likely to retain more earnings for expansion, thereby paying lesser dividend than older firms. More matured and older firms are likely to pay more dividends as growth opportunities would have dwindled.The underlying premise is that firms generally follow a life-cycle trajectory from origin to maturity that is associated with a shrinking investment opportunity set, declining growth rate, and decreasing cost of raising external capital. Some researchers such as Black (1998), Sugianis (1986) and Jenkins (2004) have studied the effect of accounting information on a company's life cycle and described the four stages of the life cycle as follows:i. Emergence ii. Growth iii. Maturity iv. Decline

2.1.1. The Emergence Stage

- The level of fixed and current assets (firm size) is at a very low level at this stage. The cash flow from operating activities and profitability are also low. Dividend ratio in these companies typically has a maximum of 10%, and internal rate of return is negligible when compared with the rate of financing.

2.1.2. The Growth stage

- Here, firms face increasing sales and profits, due to unpredictable level of sales as a result of uncertainty in demand products, face a higher business risk. Recent research shows that even though the demand for the products is on the rise, it is likely that consumer products are not yet generally accepted. Firms may be in the growth stage to achieve increased earnings and enhanced cash flow (Blake, 1998). Other things held constant, as a company gets older in terms of age, its investment opportunities decline, which leads to lower growth rates and consequently reducing the company’s funds requirements for capital expenditures (Al-Malkawi, 2007). In a related study, Ericson and Pakes (1995) argued that companies discover and learn ways to become more efficient as they grow older by standardizing, coordinating and speeding up their production processes and also start reducing their costs, therefore, they concluded that mature companies are expected to be more profitable. When firms are in the growth stage they avoid debt because they do not want to offer lenders the possibility of interfering in their institutional decisions. Therefore, companies with significant future perspectives choose to retain more profit in order to reduce the cost of capital (Pandey, 2001).

2.1.3. Maturity Stage

- Afza and Mirza (2011) observed that in early stages companies have to grow and a large amount of their funds are usually committed to undertake the investment and growth projects resulting in higher level of capital expenditures and less availability of free cash flows, but as companies pass through their establishment phase more free cash flows are available since they have less capital expenditure and hence are able to pay higher dividends. They stated that mature companies are less likely to invest in high growth projects, as they have already grown up at the level of an average industrial company of their particular business segment and that such companies are relatively older and do not have sufficient reserve building incentives due to which they face lower growth and fewer capital expenditures.Lifecycle theory contends that dividend policy is driven by the tradeoff between distribution and retention of corporate earnings and this tradeoff depends on firm maturity stage. The firm maturity stage enters the picture because it is believed that young firms rely more on new equity (or contributed equity) for early growth while mature firms rely more on self financing through corporate retentions and are more able to pay dividends because of ample accumulated earnings.

2.1.4. The Decline Stage

- In the decline stage, growth opportunities are generally very low. Indicators of profitability, liquidity and fulfillment of obligations enter a decline curve. There is stern competition at this stage as a result of high cost of financing from external sources and in most cases, the internal rate of return is less than the rate of financing.Mature companies are less likely to invest in high growth projects, as they have already grown up at the level of an average industrial company of their particular business segment and that such companies are relatively older and do not have sufficient reserve building incentives due to which they face lower growth and fewer capital expenditures (Afza and Mirza, 2011). They opines that this situation enables such companies to follow a liberal dividend policy (Al- Malkawi, 2005). On the other hand, they observe that new companies need to build reserves in order to meet the challenges brought to them by market competition, which implies that they have to maintain a reasonably good level of reserves to support rapid growth and financing requirements which restrict them to pay high dividends at an early stage of life cycle. Grullon, Michaely and Swaminathan. (2002) states that as company become mature, its growth opportunities shrink. They pointed out in their “Maturity Hypothesis” that a dividend increase is a sign of change in a company’s life cycle, especially as to a company’s transition from higher growth phase to a lower growth phase. The negative relationship of growth and dividends is also consistent with pecking order hypothesis presented by Myers and Majluf (1984) who supported the notion that companies with high growth opportunities pay low dividends.The optimum level of capital structure through which a firm can increase its financial performance in terms of retained earnings using annual data of ten firms spanning a five-year period was examined by Muritala (2013). The study hypothesized negative relationship between capital structure and operational firm performance. However, the results from Panel Least Square (PLS) confirm that asset turnover, size, firm’s age and firm’s asset tangibility are positively related to firm’s performance. Findings also provide evidence of a negative and significant relationship between asset tangibility and ROA as a measure of performance in the model. The implication of this is that the sampled firms were not able to utilize the fixed asset composition of their total assets judiciously to impact positively on their firms’ performance. Hence, his study recommends that asset tangibility should be a driven factor to capital structure because firms with more tangible assets are less likely to be financially constrained.Sales growth, capital expenditure, dividends and age ratios from 2006 to 2011 in relation to Life Cycle of the firms listed in Tehran Stock Exchange was examined by Anthony and Ramesh (1992). In this study, the pecking order theory was used for investigating the capital structure. The theory is based on asymmetric information between investors and firm managers. Based on the pecking order theory, the first priority for the use of internal funds (retained earnings), then the release of low-risk debt, and finally equity, the position of the last priority. The results of the hypothesis test showed that growth firms are following the pecking order theory in their capital structure model, while mature and declining firms’ capital structure model do not follow the pecking order theory.The free cash flow theory of capital structure for small restaurant firms by using different measures for firm size was assessed by Dalbor, Kim and Upneja (2004). They evaluated firm size in terms of total assets, total sales, number of owners, age, and number of employees. Only the proxy for firm age (the natural logarithm of one plus firm age) was not significant. The results largely confirm the size variables used in the financial literature for publicly traded companies both inside and outside the hospitality industry.If a firm is relatively old (with accumulated reputation) or big in terms of total assets in general and or in terms of tangibly disposable/collateralizable assets, the firm should be able to bargain low interest on loan (Chechet, Garba and Odudu, 2013). If the foregoing scenario is realistic, then managers may have some yardsticks in managing their finances. Age is a significant determinant of capital structure of a firm. The age of the firm connotes a standard measure of reputation in capital structure models (Shehu, 2011). As a firm grows longer in business, it establishes itself as an ongoing business and therefore increases its capacity to take on more debt; hence age is positively related to debt. A unique dataset of over 70,000 firms, most of which are small, in over 100 countries, was used to systematically study the use of different financing sources for new and young firms by Chavis, Klapper and Love (2012). They found that in all countries younger firms rely less on bank financing and more on informal financing. We find a clear substitution effect: as firms mature, more firms switch out of informal finance toward bank finance, while the total proportion of firms using external finance remains relatively unchanged. In addition, they found that these relationships hold for firms of different sizes, firms in different sectors, firms located in countries with different income level and on different continents. Thus, these patterns of young firm financing appear universal. Their results suggest that information asymmetry plays an important role in decreasing a young firm’s ability to obtain bank finance.Diamond (1984), however, suggests the use of firm reputation, which must have been developed over the years. By implication, reputation entails good name a firm has built up, which must factor in its age; this is recognized by the market, which has observed the firm's ability to meet its obligations efficiently. The researcher therefore hypothesized that age of the firm is positively related to leverage.Applying the standard cash-in-advance framework, Retained Earnings and the Real Effects of Monetary Shocks was examined by Doepke (2004) who summarized his findings by submitting that another key feature of an economy is that the business sector accumulates retained earnings and credits profits and dividends to the consumers and other stakeholders only with a delay. This is because the bottom line can only be determined at the end of the accounting year leading to proposing the year’s dividend in arrears, thus, the delay. The study concludes that Retained earnings matter for the transmission of monetary policy because they affect the overall balance between different uses of funds in the economy and that corporate profits react quickly to a monetary shock, whereas dividend payments adjust only after a considerable delay. Since the shareholders own the firms, in a frictionless model, they would consider retained earnings as equivalent to their own savings.Firms initiate dividends after reaching maturity in their life cycles (Bulan, Subramanian and Tanlu, 2007). Initiators are firms that have grown larger, are more profitable, have greater cash reserves, and have fewer growth opportunities compared to non-initiators at the same stage in their life cycles. They also find that no significant improvement in profitability or growth occurs around the initiation.

3. Methodology

- An ex post facto research (after the event research) provides a systematic and empirical solution to research problems, by using data which are already in existence and cannot be manipulated for the purpose a particular research (Inyiama, 2014). Accordingly, the time series data for analysis were sourced from annual report and accounts from the library division of Nigeria Stock Exchange as well as their Factbook for the relevant years and the internet. Ÿ DataThe research was conducted in the banking sector of Nigeria. The study will concentrate on Zenith Bank Nig. Plc. Zenith Bank Plc currently has a shareholder base of about one million and is Nigeria’s biggest bank by tier-1 capital. Availability of data is key to an ex post research of this nature and this was considered also in selecting Zenith Bank Nig. Plc for study. This is supported by the fact that Zenith Bank became a public limited company on June 17, 2004 and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004 following a highly successful Initial Public Offering (IPO).The dependent variable of the study is retained earnings while the independent variable is the age of the bank from year of listing on the Nigerian Stock Exchange (NSE). The study used simple regression analysis in the form of Ordinary Least Square (OLS) method to test the effect of company age on corporate retention in Zenith Bank Nig. Plc. The relationship between bank age and retained earnings is examined using correlation analysis.

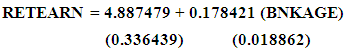

| (1) |

4. Discussion of Findings

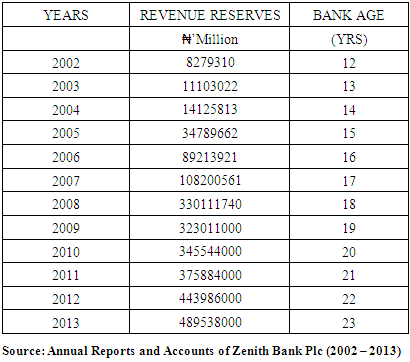

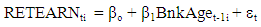

- Figure 1 reveals that revenue reserves of Zenith Bank Plc increases steadily over the study period. On the side of bank age, it is line with a priori expectation and the trend negates the postulations of the life cycle theory that firms tend to retain more reserve at the early stage of its’ life cycle for investment and development as this will properly position the bank to take up more opportunities in the future.

|

| Figure 1. Line Graph of Focal and Explanatory Variables – Zenith Bank Plc |

|

4.1. Test of Research Hypotheses in Zenith Nig. Plc

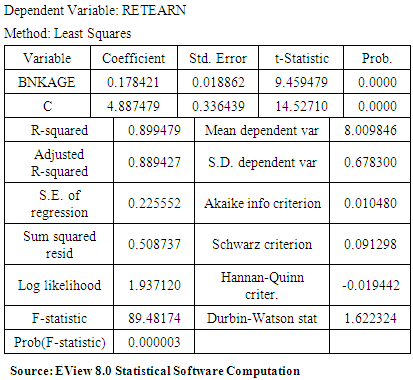

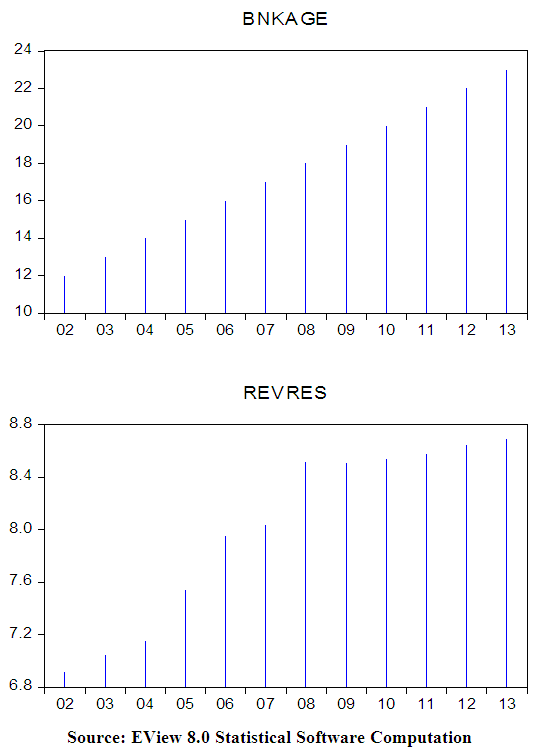

- H0: Bank Age does not significantly affect retained earnings in Zenith Bank (Nig.) Plc.Regression Equation:

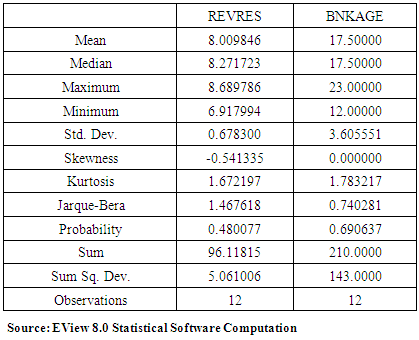

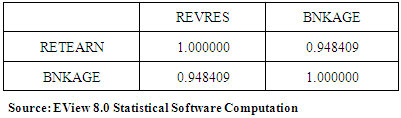

Interpretation of Regression Coefficient ResultTable 3, indicates that the relationship between retained earnings and bank age, is positive. However, in line with the life cycle theory, younger firms are under pressure to retain more earnings for growth and diversification. This is because the young firms search for investment opportunities and strive to take them up in order to continually maximize the wealth of the shareholders and this can only be supported by availability of fund.

Interpretation of Regression Coefficient ResultTable 3, indicates that the relationship between retained earnings and bank age, is positive. However, in line with the life cycle theory, younger firms are under pressure to retain more earnings for growth and diversification. This is because the young firms search for investment opportunities and strive to take them up in order to continually maximize the wealth of the shareholders and this can only be supported by availability of fund.

|

|

5. Conclusions

- The research aimed at examining the effect of bank age on retention/Zenith Bank Nig. Plc using simple regression technique. The coefficient of skewness for revenue reserves and bank age has values below one (1) signifying normal frequency distribution. The null hypothesis states that bank age does not significantly affect retained earnings in Zenith Bank Nigeria Plc. The null hypothesis is rejected in this case as revealed by the outcome of the analysis. The analysis indicates that bank/firm age has a positive and significant effect on retained earnings. Anthony and Ramesh (1992), Grullon et. al (2002), Afza and Mirza (2011) and Bulan, Subramanian and Tanlu (2007) assessed the interactions between company age and retention rate and found that the age of a company is a key determinant of retained earnings. This is in line with the findings of this research. On the level of association between the variables, it was found that bank age share a positive relationship with retained earnings. This is not in tandem with the life cycle theory.The implication is that the banks retain earnings at every stage of their life cycle. This could be as a result of their specialized service which demands a very huge asset base; in terms of branch network, information and communication technology, specialized manpower skill, security and liquidity requirements. If the banks must source fund for all these requirements through external loans and equity, then the cost implication, in terms of interest content, will be unbearably high. The alternative is to source the bulk of their investible fund through reserves which is almost cost free. Consequently, this is why the banks prefer to retain a large proportion of their earnings, issue bonus shares and make right issues instead of a high rate of dividend payout. Hence, to survive the cut-throat competition in the banking industry, banks should retain a greater proportion of their savings for growth and development. The bird-at-hand shareholders should be convinced to accept the proportion of cash dividend payout as they can also maximize their wealth through sale of shares, bonus shares and right issues.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML