-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(4): 209-219

doi:10.5923/j.ijfa.20160504.06

Can Earnings Management be Influenced by Audit Quality?

Mohammad Ebrahim Nawaiseh

Department of Accounting, Al - Zaytoonah University of Jordan, Jordan

Correspondence to: Mohammad Ebrahim Nawaiseh, Department of Accounting, Al - Zaytoonah University of Jordan, Jordan.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The objective of this study is to examine the prediction that external audit quality is positively associated with earnings management. The primary aim is to help stakeholders predict earning management based on some proxies that are not publicly available in annual reports. This study investigates the informative of audit quality for estimate in earning management (EM) during the period of (2006-2010) of Jordanian Banking Firms listed in Amman Stock Exchange (ASE). Some leading proxies were taken based on audit quality; Audit tenure (AT), Audit fees (AF), and the affiliation with international big auditing firms (INT). Furthermore, other controlling variables used such as; Financial Leverage (FL), (Return on Assets) ROA, (Return on Equity) ROE, (Cash flow/Total assets) CFO, and EM already taken in the analysis. The population of the study comprised of thirteen (13) Jordanian working commercial Banks over a five year period. The study tested the effects of audit quality on earning management using the panel data methodology. The paper finds that; (AT), (AF), and the (INT) have significant relations with earning management. It means, future earning management forecast is predictable based on audit quality leading indicators (AT, AFEE, and INT). In addition to company size, that is, when external auditing is conducted, earning management mitigates. Moreover, no relationship is found between Leverage, ROA, CFO, and Earning management. I conclude, the study examines earning management forecast based on audit quality leading indicators (AT, AFEE, and INT), and company size. These groups; whether commercial banks, or audit quality indicators, have not been well researched in the past literature, especially in the Jordanian Banking Sector.

Keywords: External Audit quality, Banking Sector, Earning Management, Jordan

Cite this paper: Mohammad Ebrahim Nawaiseh, Can Earnings Management be Influenced by Audit Quality?, International Journal of Finance and Accounting , Vol. 5 No. 4, 2016, pp. 209-219. doi: 10.5923/j.ijfa.20160504.06.

Article Outline

1. Introduction

- The three regulatory laws that organized the accounting profession in the Hashemite Kingdom of Jordan (HKJ) are: “Law for Practicing of the Auditing Profession. Law No. 10 (1961)” [1], Auditing Law No. 10 (1961) was amended by the “Law of Auditing Profession. Law No. 32 (1985) [2], and “Law of Organizing the Practice of the Public Accounting Profession. Law No. 73 (2003)” [3]. The professional act no 10 [1] did not fully specify any prohibited activities for an auditor’s duties and his rights, the second is act no. 32 which was enacted in 1985 [2], this act revised the provisions concerning auditors’ qualifications. The candidate by this law must sit for an examination administered by the Audit Profession Council headed by Audit Bureau President. The latest law for regulating the profession no. 73 [3] was enacted in 2003; this law provides further instructions in organizing the audit profession, increased the level of qualification needed for practicing auditing including a requirement of training. Al-Rai and Dahmash [4] pointed out that establishment of Amman Stock Exchange (ASE) was a major motive for adopting the international financial reporting standards (IFRS) in Jordan. In addition to bring Jordanian Audit Bureau as the authority body to regulate an entrance exam to the profession in cooperation with the Jordanian Association of Certified Public Accountants (JACPA). The profession council under this law is headed by minister of industry and trade. Accordingly, Hells [5] categorizes accounting practice in Jordan as being in accord with the British-American Model. But Hells’ characterization may well be too simplistic a view of Jordanian accounting development. The Companies Law No. 22 /1997 was enacted in 2006 [6]; this law; did not mention any specific qualifications; whether academic or professional for auditors. Rather, the matter of qualifications is referred to the Provisional Law on Organizing the Audit Profession No. 73 of 2003 [3]. Both the latest two laws (73/2003 and 22/1997) mandated the use of International Accounting Standards (IASs) and International Financial Reporting Standards (IFRSs) by all Jordanian public shareholding companies. Moreover, questions about the quality of auditing in Jordan, the quality of financial statements reported by public shareholding companies for decision-making need more investigation. The current research aims at evaluating factors that attracted the attention of former writings in the business environment as indicators of the quality of external audit Okolie A, et al [7]; Okolie [8]. To highlight its role in detecting earnings management operations in Jordan, this research is an invitation to develop and improve the profession of Auditing and strengthen its role in enhancing the credibility of financial statements through analysis of audit quality indicators, which works to assess the phenomenon of earnings management practices, to reduce the financial collapses in the Jordanian banking sector business environment.The definition of earning management was given by Schipper [9] who defined it as; “purposeful intervention in the external financial reporting process with intent to obtain some private gain. According to Healy and Wahlen [10] "Earnings Management" occurs when managers use judgment in financial reporting and in structuring transactions to alter financial reports to either mislead some stakeholders about the underlying economic performance of a company, or influence the contractual outcomes that heavily depend on reported accounting numbers. Earnings management is the choice by a manager of accounting policies, or real actions that affect earnings, to achieve some specific reported earnings objective. Others reported, Arthur Levitt, believes that in the years leading up to Enron's collapse the auditors were busy organizing themselves into a lobbying force on Capitol Hill-one that has been singularly effective. Levitt, who issued a series of warnings about the accounting profession in those years, suggests that the aim of the so-called Big Five accounting firms-PricewaterhouseCoopers, Deloitte & Touche, Ernst & Young, K.P.M.G., and Arthur Andersen, Enron's auditor-was to weaken federal oversight, block proposed reform, and overpower the federal regulators who stood in their way. "They waged a war against us, a total war," JANE [11]. Khurana [12] Defined audit quality (AQ) as ‘‘an auditor will (1) detect and (2) correct/reveal any material omission or misstatements in the financial statements’’. A study by Davidson and Neu [13] provide further that an AQ definition is based on the auditor’s ability to detect and eliminate material misstatements and manipulations in reported net income, they examined the relation between the size of auditing firm and the audit quality. Based on above, the current major problem of this study attempts to ascertain and establish whether there is a significant relationship between Audit quality (AQ) and Earnings Management (EM) of banking companies listed in ASE. The purpose of this study is to test the prediction that external (statutory) audit quality is positively associated with earnings management, whilst the main significance it can help stakeholders to predict earning management based on some proxies that are not publicly available in annual reports. The study is structured into five sections; Section one is introduction, section two reviews related literature on meaning and other related components of earning management and audit quality, section three explore methodology, section four shows results and discussion of data, and section five dwell on conclusion and recommendations.

2. Prior Literature Review

- Many researchers have attempted to identify and measure audit quality. Numerous researches have been done in the world about the relationship between the audit quality and size of audit firm, fees and earning management. Mehdi, et al [14] Concluded that there is no significant difference between discretionary accruals of audited companies by auditing organization and other members of society of chartered Accountants in Iran. Okolie A, et al [7] Used their study for determining whether Audit Quality has any significant impact on and relationship with Market Value per Share (MPS) of companies in Nigeria. Audit Quality was estimated using Audit Firm Size, Audit Fees, Auditor Tenure and Audit Client Importance, for the years 2006-2011, the results of the tests show that Audit Quality exerts significant influence on the (MPS) of quoted companies in Nigeria Similarly, growing interest in the business sector is relying on the moral entrance in the areas of business management, accounting, and auditing, for this reason, various studies in the Arab world gave the Audit Quality some attention. Al-Nawaiseh [15] analyzed some factors affect audit quality from the perspective of Jordanian auditors. To achieve the study aims; two forms of questionnaires were designed and circulated by hand to a sample of auditors representing the Jordanian auditors; First questionnaire consisted of 75 variables, the second consisted of 62 variables, one of its findings indicate an agreement regarding the important role of audit quality with a percentage of (80.20%), and the most effective variables were the factors associated with audit work team (74.4%). The lowest effect was (64.6%) for variables concerning audit company organization. Hamdan and Abu Ijela [16] Investigate the existence of earnings management practices and earnings quality in the industrial public companies listed in Amman Stock Exchange (ASE), and tests the impact of auditing quality characteristics (the audit office size, the connection with global offices, client retention period, auditing fees, and specialty in client’s industry) on reducing earnings management practices, and enhancement earnings quality. Data of 45 companies of the industrial sector for the period 2001-2006 were arranged. The most important conclusion of that study was; the industrial public companies listed in (ASE) have practiced earnings management each year during the study period, the study itself cannot prove the earnings quality in the companies of the industrial sector. Researchers and professional bodies interested in recent years studying the phenomenon of earnings management. It was noted by Magrath, et al [17] that professional bodies to issue the necessary directives to ensure audit quality and to reduce the earnings management. Another study examined the relation between concentration at the local level and auditor tolerance for earnings management during 2003-2009. Specifically, analysis is focused on clients that met (or beat) the analysts’ earnings forecast but would have missed the target in the absence of positive (i.e., income-increasing) discretionary accruals. Findings are consistent with the misgivings expressed by policy makers, i.e., that oligopolistic dominance of the audit market by the Big 4 fosters complacency among auditors resulting in a more lenient and less skeptical approach to audits and lowers service quality according to Boone et al [18]. Balsam et al [19] examined the association between measures of earnings quality and auditor industry specialization. Prior work has examined the association between auditor brand name and earnings quality, using auditor brand name to proxy for audit quality; they find clients of industry specialist auditors have lower Discretionary Accruals (DAC) and higher Earnings Response Coefficients (ERC) than clients of non-specialist auditors. In the context of the challenges that confront the audit function. Earnings management have been considered as one of the methods used by the business leaders to mislead their stakeholders to report unrealistic numbers, despite the various check and balances (e.g. corporate governance code) on the process. Nigeria experienced two corporate governance codes issued by SEC, code 2003 and code 2011. Nuraddeen and Kamardin [20] tend to measure the effectiveness of these two codes and make comparisons using audit committee and audit quality against earnings management in the pre- and post-code 2011. Palmrose [21] Finds that there is a significant association between audit fees and auditor size measured by Big 8 vs. non – Big 8 dichotomy. While using audit fees as AQ measure has greater power than Big 8 vs. non – Big 8 dichotomy in explaining variation levels of local government disclosures Copley [22]. While others explain why investors in a company have vital interest in the earnings reports, earnings management as a strategy used by company managers to deliberately manipulate company earnings to match a predetermined target and involves the planning and execution of certain activities that manipulate or smooth income, achieve high earnings level and sway the company’s stock price Schipper [9]; Healy and Wahlen [10]. Al-Ajmi [23] Noticed perceptions of credit and financial analysts with regard to the relationship between the effectiveness of audit committee, size of the auditing firm and audit quality in the context of Bahrain. By survey of 300 credit and financial analysts, he shows five major findings: 1- both credit and financial analysts see the credibility of financial statements to be a function of the size of the auditing firm. 2- Both groups assume that characteristics of Big-Four firms allow them to produce better-quality reports than non-Big firms. 3-Non-audit services affect auditor's independence hence impairs audit quality. 4-Both the groups of analysts believe that effective audit committee enhances the quality of audit reports. 5-Financial analysts perceive financial statements to be more credible than do credit analysts. There were no changes for non-big client firms Ding [24]. Boone et al [18] find weak evidence that the Big 4 have a higher propensity to issue going concern audit opinions for distressed companies. Moreover, they find that the level of performance-adjusted abnormal accruals for Big 4 and Second-tier audit firm clients appears to be similar. With respect to investor perceptions, the client-specific ex ante equity risk premium to be lower for Big 4 clients than for Second-tier audit firm clients. Overall, their findings suggest little difference in actual audit quality but a more pronounced difference in perceived audit quality. One can conclude, what are motivations for companies that use earnings to misrepresent economic performance. Extant archival evidence is often conflicted on what motivates firms to manage earnings. For instance, Klein [25] argues that better governance mitigates earnings management but Larcker, et al [26] disagree.

3. Data and Methodology

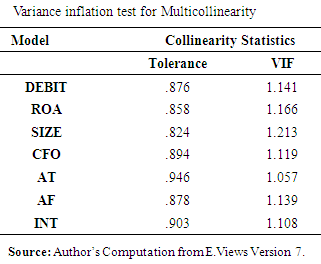

- Reporting number of measures of these firms, measures of the magnitude of accruals, and standardized by the magnitude of cash flows. The model for testing the effects and presumed relationships between dependent and independent variables considers the three used External audit proxies. Dechow and Dichev [27] find that larger firms have larger accruals; hence, we adapted the proxy (SIZE) for firm size by including the log of total assets (Assets). Others include leverage previous research has shown that highly leveraged firms are associated with both income-increasing accruals Press and Weintrop [28]. Because of that, the current study uses the absolute value of abnormal accruals as a dependent measure, expecting Leverage to control for such effect, therefore to have a negative sign as demonstrated in the research for linear least squares regression analyses were used to test the effect on the dependent variable (EM) in form of Discretionary accrual (DA) with the identified independent audit variables. The model is specified as follows: DACi,t = a0 + β1AFi,t +β2INTi,t + β3ATi,t +β4CFOi,t + β5sizei,t + β6DEBTi,t + β7ROAi,t + ei,t.Where: Dependent variable is;DAit = Discretionary accruals in year t for firm i = Total Accrual minus Non-Discretionary Accrual.Measures of External Audit Quality Independent variables; The composite measure of audit quality is based on three individual proxies specified by the following: A Fees = A measure of Auditor Independence = Fees Paid by the auditee. AT = Audit Tenure = Length of auditor-client relationship, INT=International Auditing Firm (Big 4) relationship: ‘1’if there is relation, ‘0’ if otherwise. Big 4 in Jordan are: Deloitte, PWC, Ernst & Yong and KPMG.Control variables;Four controlling variables established as a part from prior work to be related to audit quality and earning management; Okolie and Izedonmi [7], Okolie [8], Al-Ajmi [23]. Debt ratio (Leverage) = Total Debts /Total assets, Com Size = Natural log of company Total Assets, ROA = Return on Assets, CFO=Cash flow/Total assets .Discretionary accrual is measured using the Jones [29] as modified by Dechow and Sweeney [30] stated as: TAi,t/Ait-1 =αi[1/Ait-1] + β1i[ΔREVit – ΔRECit/Ait] + β2i[PPEit/Ait-1] + εi,t. This model estimates the: discretionary portion of total accruals. Where TAi,t = Total accruals in year t for firm I; Ait-1 = Total assets in year t – 1 for firm i; ΔREVit = Change in Revenues in year t less revenues in year t – for firm I; ΔRECit = Change in accounts receivables in year t less receivables in year t – for firm I; PPE it = Gross property, plant and equipment in year t for firm i; εi, t = Error term in year t for firm i. As a proxy for earnings management, discretionary accruals is used, assume that accruals are comprised of non - discretionary and discretionary elements. By assuming, ceteris paribus, that the non- discretionary portion of accruals would remain constant year on year and therefore the observed changes must be due to the discretionary element over which management has control. All Companies had filed audited accounts and had had the external auditor for a five-year period was selected. There is no any company had changed accounting date in the 5 year time, the accounting period starts from Jan.1 and ends in Dec.31 as per Jordanian Companies Law no.22 for 1997 with its amendments. The size of the pilot study sample was 13 companies. In the case of Jordan, there is no any existing study relating to the effects and association between auditor tenure, auditor fees, and Audit firm relationship with international auditing firm with earnings management as at the time of this study.The methodology is identical to the Nigerian study applied on the industrial sector as an African country Okolie and Izedonmi [7], Okolie [8], but the current study will be applied on the (Banks) in Jordan as a service sector. Secondary historical data obtained from a sample of 13 listed banking companies are studied out of the companies listed on ASE over a period of five years from 2006 to 2010. It is post facto research; researcher has no control on collected data in these sorts of study. Archival data were extracted from annual reports of these companies. In this study, amount of Discretionary Accruals (DAC) is measured as the residual of Jones [29]. Model modified by Dechow and Sweeney [30], and used by Becker, et al [31]. Earning management means, using discretion within GAAP to report earnings which misrepresent the economic performance of the business. The research design adopted in this study was the descriptive survey method. The design was adopted because the study involves the use of a representative sample from the population and the drawing of conclusion based on the analysis of available data. However, since the variables under investigation cannot be manipulated by the researcher. As already mentioned, the research population for this study consists of both listed companies and external auditors for the commercial banks companies listed on Amman Stock Exchange (ASE), Great care was exercised to get a fair representation for the population as sample. The sample was determined from the listed Banking annual reports, because the bank nominates the external auditor at the annual reports on a yearly basis. For the purpose of this study, the hypothesis that will be tested in order to achieve the stated objective is: Audit Quality (AQ) has a direct positive effect on Earning Management (EM).

4. Presentation and Analysis

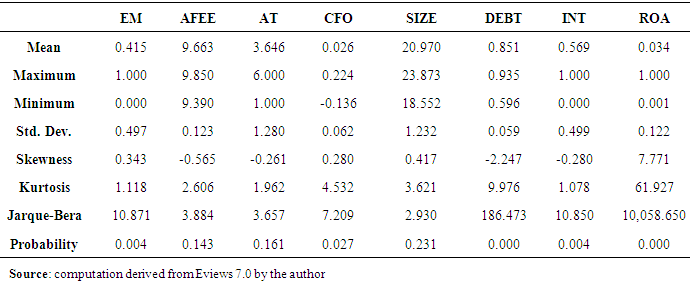

- This section contains the presentation, analyses and interpretation of the data collected for the study. The estimation models are examined empirically and used to test the causal-relationships between Earning Management and audit quality. Descriptive statistics and panel OLS Regression analyses were conducted for testing hypotheses. The analyses and results are presented below.Table 1 below presents the result for the descriptive statistics conducted on the variables. The result showed that EM has a mean value of 0.4154, which suggests minimal value after CFO 0.0259 for the sample. The maximum and minimum mean values stood at 85.12892 and 0.0259 for DEBT and CFO respectively. The maximum and minimum standard deviation values stood at 12.2272 and 0.0619 for ROA and CFO respectively, while the Jacque-Bera statistic for EM is 10.8710 alongside its p-value (p= 0.0044 <0.05) indicates that the data satisfies normality and the unlikelihood of outliers in the series.

|

|

|

|

|

|

|

|

5. Hypotheses Testing and Empirical Results

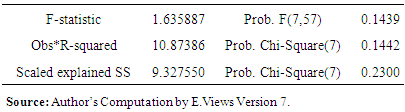

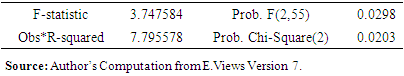

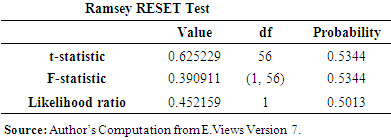

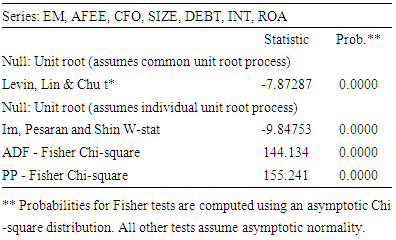

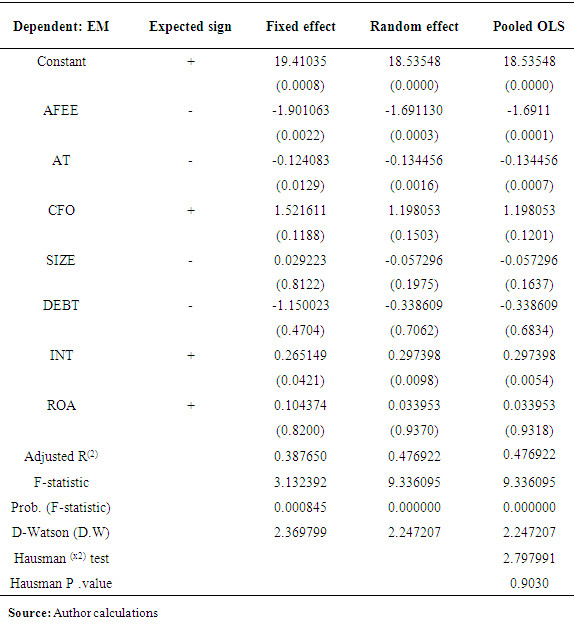

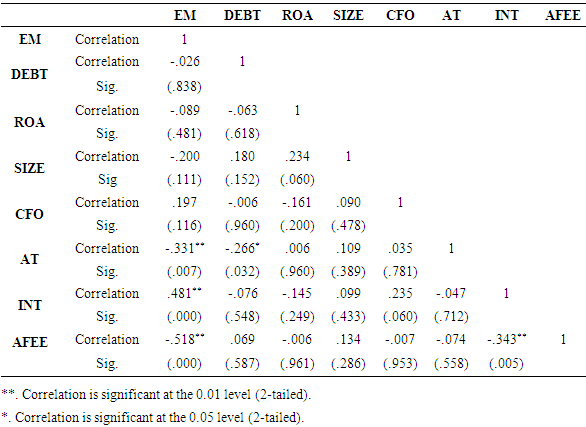

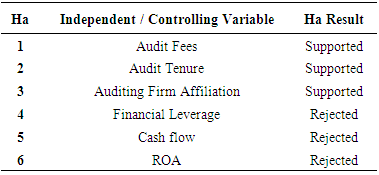

- Panel data method is used. For the analysis purpose; Hausman test is used to compare the estimation method of fixed and random effects. So, firstly pooled method based on the regression model was fitted. Results of Hausman test for study hypothesis model is given in Table 6. The findings demonstrate the rejection of H0. On this basis, it is suggested to use random effects for fitness of regression model of hypothesis test. Thus, regression model of hypothesis test, based on the panel data and in the random effects the method is fitted. Statistic hypothesis related to Hausman test are as follows:H0: Regression is based on the fixed effects; there is no relationship between individual effects and description variables.H1: Regression is based on the random effects; there is a relationship between individual effects and description variables. Palmrose [21] Used audit fees as a quality measure, its study theorized that there is a significant association between audit fees and auditor size measured by Big 8 vs. non – Big 8 dichotomy. Copley [22] finds that using audit fees as Audit quality measure has greater power than Big 8 vs. non – Big 8 dichotomy in explaining variation levels of local government disclosures. On other side, the discretionary component of accounting earnings is assumed to be contained or located in accruals. Total Accruals designates all the expenses and revenues accounted for in the Net Income, but not intervening in the Cash Flow of given accounting period Piot and Janin [37]. Dechow et al [30] assert that the analysis of earnings management often focuses on management’s use of discretionary accruals. The length of auditor tenure with external auditors in recent years has been a source of concern for Jordan Association of Certifies Public Accountant (JACPA) and ASE. The JCPA Act no. 23 / 2007 attempts to eliminate auditors’ conflicts of interest (actual or potential) by requiring, among other things, that auditors rotate their partners off the audit every four years for each client. One does not feel that the existing empirical evidence is sufficient for us to conclude that either of the scenarios presented above is more likely than the other is. Therefore, I am offering this research hypothesis in the alternative form of positive effect and show an ambiguous prediction (+/-) for the relevant parameter estimate in the model. Recall that the main hypothesis is: Audit Quality (AQ) has a positive effect on Earning Management (EM).Sub-hypothesis H1a: Audit fees have a positive effect on Earning Management in banking firms listed in ASE .The results of this hypothesis test are presented in Table 6 under random effect type. The correlation coefficient between two variables is negative (-0.518) as per table 5. It already noticed that the relationship between audit firm fees and earning management is weak, but statistically significant considering t-Statistic (0.0003). Weakness and significance of regression coefficient indicates that other variables other than audit firm fees affect earning management. It means larger audit fees have the likelihood of delivering lesser earning management. This is probably the result of divided attention because of the larger earning management cases being attracted to the less auditing fees. Overall, the first sub-hypothesis is accepted considering the significance of effect of audit firm fees on earning management. The first sub-hypothesis is accepted considering the significance of effect of audit firm fees on earning management. In view of the onerous challenges that face the audit function, some studies Ebrahim [38], Gerayli et al [39] have attempted to ascertain any noticeable relationship between auditor tenure, auditor independence, and earnings management, and have tried to demonstrate the impact of this relationship on the quality of the earnings reported by quoted companies in many countries. The above studies show that the quality of audit is expected to minimize the extent of a firm’s manipulations of reported income, but this result presents a paradox of contradiction, it means that long association between the auditor and the client may constitute a threat to independence. Therefore, audit quality as personal ties may be developed between the parties. Sub-hypothesis H2a: Auditor tenure has a positive effect on Earning Management in banking firms listed in ASE. Anecdotal as well as empirical evidences on the effects of auditor tenure on earnings management of non-financial institutions may exist in the developed countries DeAngelo (a) [40], DeAngelo (b) [41], McMullen [42], Abbott et al [43], and Bauwhede [44]. Such evidence on the relationship between auditor tenure, and earnings management in emerging countries is scanty. A rather too long association between the auditor’s tenure and his client may constitute a threat to independence as personal ties and familiarity may develop between the parties, which may lead to less vigilance on the part of the auditor, and even to an obliging attitude of the latter towards the top managers of the company. Because of this case, the audit engagement may become routine over time, and if so, the auditor will devote less effort to identifying the weaknesses of internal control. This suggests, to the contrary, that the quality of auditor reporting improves over time. Frankel and nelson [45] Observe a negative relationship between auditor tenure and abnormal accruals in absolute value, as well as a moderating effect of the former variable on income-decreasing earnings management. The Jordanian Association of Certified Public Accountants (JACPA) recommended a rotation of engagement partners every four years. However, the theory that auditor tenure is inversely related to audit quality is far from being corroborated by empirical research. Lys and watts [46] report that the likelihood of an auditor being subjected to legal action is not related to his tenure. Article 192 (Jordan Companies Act, 1997) [6] mentioned the General Assembly of a Public Shareholding Company shall elect one or more licensed auditors from amongst licensed auditors for one renewable year. According to a General Accounting Office (GAO) report GAO [47], the average auditor-client tenure of Fortune -1000 companies in 2003 exceeded 22 years. The GAO report was requested by Congress as a part of the Sarbanes-Oxley Act (the Act, hereafter) of 2002 because of conflicting testimony offered about the effect of auditor tenure on auditor independence Kealey et al [48]. On the one hand, former Securities and Exchange Commission (SEC) Chairman Levitt testified ‘‘that serious consideration be given to requiring companies to change their audit firm—not just the partners—every 5–7 years to ensure that fresh and skeptical eyes are always looking at the numbers’’ Levitt [49]. Audit tenure was found to be significant with a coefficient of (-0.13446) though negative but significant with a probability value of (0.0016). This means longer audit tenure may likely reduce the earning management. The result is consistent with the correlation, which also reported negative relationship between audit tenure as a proxy for audit quality and earning management. The second sub-hypothesis is accepted considering the significance of effect of audit firm tenure on earning management. Sub-hypothesis H3a: The auditor’s relation with international auditing firms has a direct positive effect on Earning Management in banking firms listed. This relation with international auditing firms was to be significant with unstandardized coefficient of 0.2974 and the probability value of (0.0098), The result is consistent with the correlation, which also reported a positive weak relationship 0.481, this alternative hypothesis is supported, most of auditing firms in Jordan have a relation with big audit firm affiliation are significantly related to earnings management. Other prior studies agree on audit quality as a function of audit firm size and demonstrate that larger (Big 5 or Big 4) audit firms possess greater capacity to constrain and reducing earnings management through accruals manipulations Kim [50], Krishnan and Schauer [51] pointed out at their study results show a considerable cluster of audit firm choice around the Big-4 or big 5 audit brand names .The conclusion of this hypothesis means that the company’s management has to give more attention to the auditor’s implications . On other side, the auditor’s work doesn’t imply any evaluation in relation to the earning management because he is not in a position to do so. Accordingly, the auditor’s responsibility is to express an opinion on the financial statements based on his audits. The auditor conducts his audits in accordance with international standards on auditing. According to above; one can infer the auditor’s main tasks are not to address any opinion about quality of earnings from the management’s perspective. Sub-hypotheses H4a, H5a, and H6a; Sub-hypothesis H5a: Debt has a positive effect on Earning Management (EM), Sub-hypothesis H6a: CFO has a positive effect on (EM), and Sub-hypothesis H6a: ROA Company size has a positive effect on Earning Management (EM). These hypotheses were tested as follows; the regression model results using company size. In relation to the determinants of earnings management, the results in Table 6 show that the model has predictive power of approximately 0.4769 considering the R2 value. Adjusted R-square for the model indicating that 47.69% of variance in earning management can be explained by audit quality. Statistic value, F=9.336095 is significant at α<0.05, hence the model is useful to predict perceived earning management. Audit quality is a significant factor to increase perceived earning management. Specifically, effects from Audit tenure, the company’s auditing firm relationship with International auditing firms , and auditing fees with unstandardized coefficient have significance value <0.05. Therefore, this hypothesis is supported. With respect to the control variables, the cash flow variable is positively weak correlated with earnings management, indicating that companies with higher cash flow feel more needs to manage earnings, while those with low cash flow tend to manage earnings less aggressively, but this relation in not significant. From the results of testing H4a, H5a, and H6a the regression model for estimating effect of company size, CFO, and ROA are not significant. P. Values were; (0.8122), (0.1188), and (0.8200) respectively as presented in table 6. The results make these three predictors not useful measures of earning management in Jordanian Banking Firms case. The variable ROA, indicating profitability, is negatively correlated with EM, but the p-value is not significant. Therefore, it cannot be said that earning management prediction is affected by more profitable banking firms. In other words, Banking firms that suffer losses, rather than using discretionary accruals to minimize the losses. Therefore, the discussion of the results is more concentrated and centered only on the measures that are related to (AF), (AT), and (INT). Hence, I rejected the null hypotheses Numbered; (H1a), (H2a), and (H3a). I observe that not all variables had statistically significant individual (partial) effects on the earning management value of the companies. The adjusted coefficients of determination were zero for hypotheses 4, 5, and 6 on the prediction of earning management; these three alternative hypotheses are not supported. Empirical results of the hypotheses tests as per individual effects at p<0.05 is summarized in Table 7;

|

6. Conclusions and Recommendations

- This study contributes to the accounting and auditing literature by shedding light on the informative earning management. Moreover, auditing quality is a leading indicator of earning management, especially for the banking firms in Jordan. Several studies have examined the effect of auditor tenure on audit quality, both perceived and in-fact. Contrary to opinions and concerns expressed in the popular press, several of these studies find a positive relationship between auditor tenure and proxies for audit quality. The results are somewhat mixed, however, as other studies provide evidence of a negative relationship. The evidence appeared that company size is associated with a moderation in the level of earnings management as measured by audit quality proxies. However, future earning management data forecast are predictable based on audit quality that is available to professional in real time. future earning management forecast is predictable based on audit quality leading indicators (AT, AFEE, INT) in addition to company size, that is, when external auditing is conducted, earning management mitigates. Moreover, no relationship has been observed between Leverage, ROA, CFO, and Earning management. A related direction for future research would be to probe the link between aggregate auditing data, subsequent discounted cash flows, discretionary accrual growth, and window dressing measures. Companies may use timing of transactions, discretional accruals, and bad debt expenses to manage earnings to increase Earning per Share (EPS), and receive gain from stock options. Earning management for that should be discouraged through the regularity bodies if possible because stakeholders could not see real accounting figures to provide transparency of performance. Another suggestion, the auditors should prepare a quality of earnings report on the statement of income to be concurrently disseminated with the normal annual external auditors report, because auditors are not in a good position to assess this earning at this moment. In order to enhance high Audit Quality and minimize Earnings Management, Banking Firms in Jordan should adapt to or engage in an outright adoption of currently available best practices like the provisions of Public Companies Accounting Oversight Board standards for public companies in developed countries. Further studies may include the company size that moderates the Leverage, ROA, or CFO on earning management with structural equation modeling (SEM). Future studies could focus on types of earnings management, such as to reduce the variability of earnings or to make the results look worse than they really are in order to increase the chances of presenting better performance in subsequent periods.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML