-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(4): 193-201

doi:10.5923/j.ijfa.20160504.04

The Effect of Financial Sector Liberalization on Economic Growth in Nigeria

Madubuko Ubesie

Department of Accountancy, Enugu State University of Science and Technology, Nigeria

Correspondence to: Madubuko Ubesie, Department of Accountancy, Enugu State University of Science and Technology, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study aims at examining the effect of financial sector liberalization on the economic growth of Nigeria from 1980 to 2013. It also tends to know whether the achievement of liberalization will continue to increase the economic growth of the Nigeria since financial suppression leads to economic distortion and poor economic performance. In the model specified, real gross domestic product (real GDP) was used to proxy economic growth while Real Interest Rate, Real Exchange Rate, Inflation Rate, Total Deposit and Foreign Direct Investment were used to capture financial sector liberalization. The Vector Error Correction Model was employed, which was conducted after checking the stationarity using Augmented Dickey-Fuller (ADF) test and ensuring the existence of cointegration of the variables by Johasen co-integration test. All the variables except real GDP had their data series differenced at first difference as a result of their unit root issues. GDP was however differenced at second difference. The results of the co-integration test show existence of a long run relationship between the dependent and independent variables at a 5% significance level. The error correction model (ECM) shows a very high coefficient of multiple determinations of 92%. Therefore from the above assertion it can be concluded that financial sector liberalisation has positively reinforced economic growth in Nigeria. The advantage of reform programmes in Nigeria should be consolidated by the government by avoiding drastic policy reversal but concentrate effort in perfecting the existing policy. This will induce prudence on the part of major operators in the financial market and encourage saving behavior of all economic agents.

Keywords: Economic Growth, Liberalisation, Financial Sector, Stationarity, Cointegration and VECM

Cite this paper: Madubuko Ubesie, The Effect of Financial Sector Liberalization on Economic Growth in Nigeria, International Journal of Finance and Accounting , Vol. 5 No. 4, 2016, pp. 193-201. doi: 10.5923/j.ijfa.20160504.04.

Article Outline

1. Introduction

- Financial Liberalization refers to the deregulation of domestic financial markets and the liberalization of the capital account. The linkage between financial Sector liberalization and economic growth has long been a subject of intense scrutiny. In developing countries, the structural imbalance and economic disorder were severe owing to distortions of regulation coupled with oil price shocks and escalating real interest rate for external debt servicing of the 1970 and 1980s. Hence, many countries have made attempts to liberalize their financial sectors by deregulating interest rates, eliminating credit controls, allowing free entry into the financial sector especially banking, giving autonomy to commercial banks, and liberalizing international capital accounts. However, following financial liberalization, many developing countries have found their financial markets more unstable and their financial institutions more fragile because of unfamiliar practices, excessive risk-taking and weaknesses in the regulatory and supervisory frameworks.Anyanwu (1995) asserted that financial repression such as loaning restriction with respect to high interest rates, high reserve requirements on bank deposits, and mandatory credit allocations interact with ongoing inflation to reduce the attractiveness of holding claims on the domestic financial system. He advocated for financial liberalization as a remedy to the distortive financial repressive policies of developing countries. Financial liberalization as posit by McKinnon (1973) and Shaw (1973) is a better and efficient mobilization of resources such as savings with positive real interest rates which will stimulate investment and economic growth. Thus, the issue of financial liberalization has remained controversial especially for the developing countries.From the foregoing analysis, this paper seeks to empirically examine the effect of financial sector liberalization on economic growth in Nigeria. The remaining part of the paper is organized into four sections. Section 2 focuses on review of related literature. Section 3 centers on the methodology for data analysis, section 4 presents the empirical results and discussion, while section 5 concludes.

2. Conceptual Issues and Review of Related Literature

- Financial sector liberalization refers to the removal or loosening of restrictions imposed by the government on the domestic financial sector. However, this definition seems to be too narrow in explaining the concept of financial sector liberalization.Kaminsky and Schmukler (2003) have provided a more broad definition. Financial liberalization consists of deregulation of the foreign sector capital account, domestic financial sector, and the stock market. From this definition, they put forward that full financial liberalization occurs when at least two of the three sectors are fully liberalized and the third one partially liberalized.Johnston and Sundarajan (1999) view financial liberalization as a set of operational reforms and policy measures designed to deregulate and transform the financial system and its structure with the view to achieving a liberalized market-oriented system within an appropriate regulatory framework. Financial liberalization refers to measures directed at reducing regulatory control over the institutional structures, instruments and activities of agents in different segments of the financial sector. These measures can relate to internal or external regulations (Chandrasekhar, 2004). From the above definitions, it is obvious that financial liberalization focuses on eliminating controls that restrict financial activities and allowing the market forces (interplay of the forces of demand and supply) to serve as the price mechanism for financial services.Various empirical studies have been conducted to validate whether financial liberalization has a positive impact or otherwise on economic growth. Evidences from various researchers are thoroughly reviewed in order to get adequate and better knowledge of the effects of financial liberalization in some emerging economies on economic growth. According to Detragiache and Tressel (2007), financial sector reforms represent eight main factors. The first relates to deregulation of credit controls to ensure efficient allocation of credit among competing sectors of the economy. The second relates to reliance on indirect monetary controls through the use of reserve requirements, while the third relates to deregulation of interest rate controls so that they are conducive to savings mobilization and investment. The fourth relates to removing bank entry barriers so as to increase competition and efficiency in the banking sector. The fifth area concerns bank privatization with a view that the private sector is best placed to intermediate financial resources compared to government. The sixth area of financial sector reforms involves supporting the growth and development of financial infrastructure such as securities markets so as to foster the development of government and corporate bond markets as well as other financial equity markets in order to encourage savings mobilization in support of long-term investment and growth on one hand, and also support the conduct of monetary policy on the other. The seventh aspect relates to strengthening bank supervision and regulation, so that there is orderly entry and exit in the financial sector based on Basel capital regulation, including specific efforts aimed at strengthening bank supervisory system, consolidating and granting high degree of independence of the bank’s supervisory authority/agency to ensure effectiveness of, on-site and off-site examinations of banks by supervisory agency. Finally, liberalization of the foreign exchange market, including opening up of the current and capital account aim at encouraging high economic growth based on out-ward oriented policies. McKinnon (1973) and Shaw (1973) in their Financial Repression Hypothesis, assert that, interest rates, if regulated among other components of the financial system, undermine not only the efficiency of financial intermediation but also interferes with the efficient allocation of resources which result into poor long run economic growth.Akpan (2004) in a study conducted to theoretically and empirically explore the effect of financial liberalization in the form of an increase in real interest rates and financial deepening (M2/GDP ratio) on the rate of economic growth in Nigeria using the endogenous growth model. The study used time series annual data covering the period from 1970 – 2002. The Error Correction Model (ECM) was used to capture both the short and long run impact of the variables in the model. The finding shows a low coefficient of the real deposit rate which implies that interest rate liberalization alone is unlikely to expedite economic growth. Overall, the results show a positive impact on the economy of Nigeria.Okpara (2010) also investigated the effect of financial liberalization on some macroeconomic variables in Nigeria. Real GDP, financial deepening, gross national savings, foreign direct investment and inflation rate, were selected and given pre/post liberalization comparative analysis using the discriminant analysis technique. The pre-liberalization period covers 1965 – 1986 while the post-liberalization period continued from 1987 to 2008. The findings show that the variables had positive impacts on the economy owing to financial liberalization; the real GDP recorded positively the highest contribution. This implies that financial liberalization positively increases the growth of the economy.Tokat (2005) evaluated the impact of financial liberalization on some macroeconomic variables in two emerging countries (Turkey and India) from the period spanning 1980 to 2003. The changing dynamics of domestic industrial production index, domestic interest rate, and trade-weighted average foreign industrial production index were analyzed by conducting Multivariate Granger-causality test. The findings suggest that there is an increased interdependency among the variables following the financial liberalization process. The study provides evidence on the increasing impact of foreign economies on both countries macroeconomic variables which implies that financial liberalization has been beneficial to both countries.Kasekende and Atingi-Ego (2003), in the case of Uganda, examined the impact of financial liberalization on the conduct of banking business and its effect on the real sector. Quarterly data from 1987Q1 to 1995Q3 for the following variables: Gross Domestic Product, Commercial Bank Credit to the Industrial Sector, Premium on Official Exchange Rate, Lending Rate, and Inflation Rate were analyzed using the Vector Autoregressive (VAR) methodology. Their findings show that financial liberalization has promoted efficiency gains in the banking industry and consequently, the increased growth of credit to the private sector following financial liberalization, leads to economic growth. The study provides evidence of a positive impact and supports the McKinnon-Shaw Hypothesis.Banam (2010) analyzed the impact of financial liberalization on economic growth in Iran through Johansen Co-integration test using time series data from 1965 to 2005 while also investigating the determinants of economic growth. The financial liberalization index was represented by the financial restraints index which includes interest rate controls, reserve requirements and directed credit multiplied by -1. The results suggest that financial liberalization has positive and statistically significant impact on economic growth measured by the gross domestic product in Iran. The findings provide support to Mckinnon (1973) and Shaw (1973), who argued that financial liberalization can promote economic growth by increasing investment and productivity.The above review of related literature is an indication that there are varying results from different countries. In Nigeria which is an emerging economy, there is dearth of empirical study on the effect of financial sector liberalization on economic growth which is the aim of this study.

3. Methodology

- The model adopted in this study was built based on the modification of the models in Kasekende and Atingi-Ego (2003), Faria et al. (2009), and Akpan (2004). For the purpose of this study, financial liberalization index was used, because it is seen as an important and better financial liberalization proxy variable. The model specified the endogenous variable Gross Domestic Product as a function of Real Interest Rate, Real Exchange Rate, Inflation Rate, Total Deposit, and Foreign Direct Investment representing the exogenous variables.The model is specified as thus:

| (1) |

| (2) |

| (3) |

4. Results and Discussions

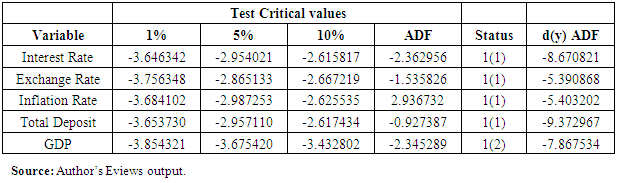

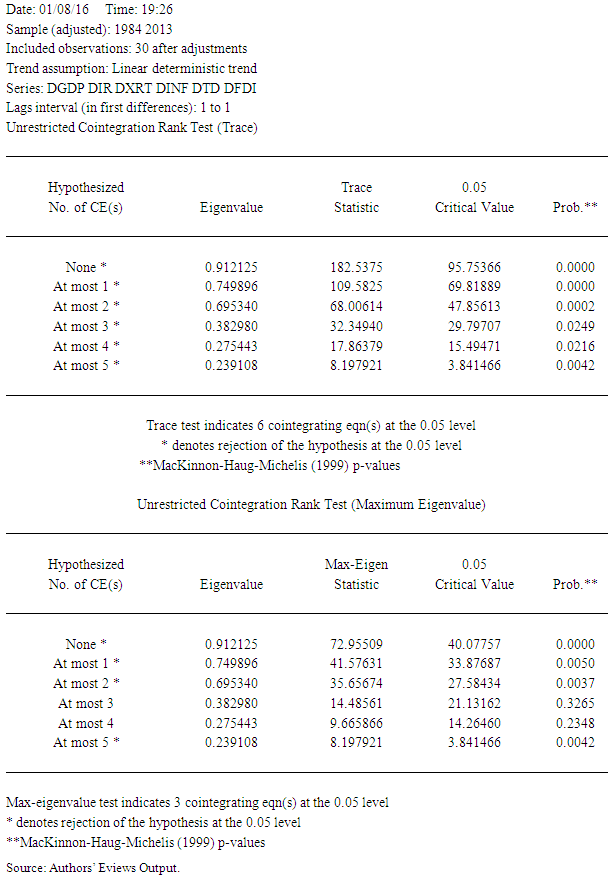

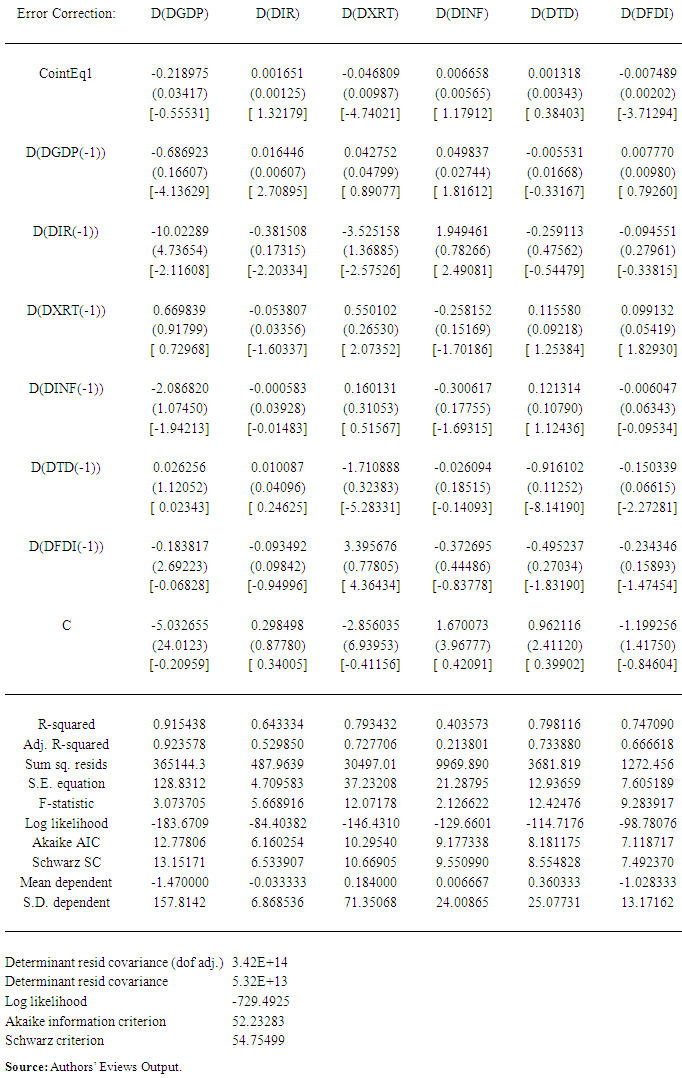

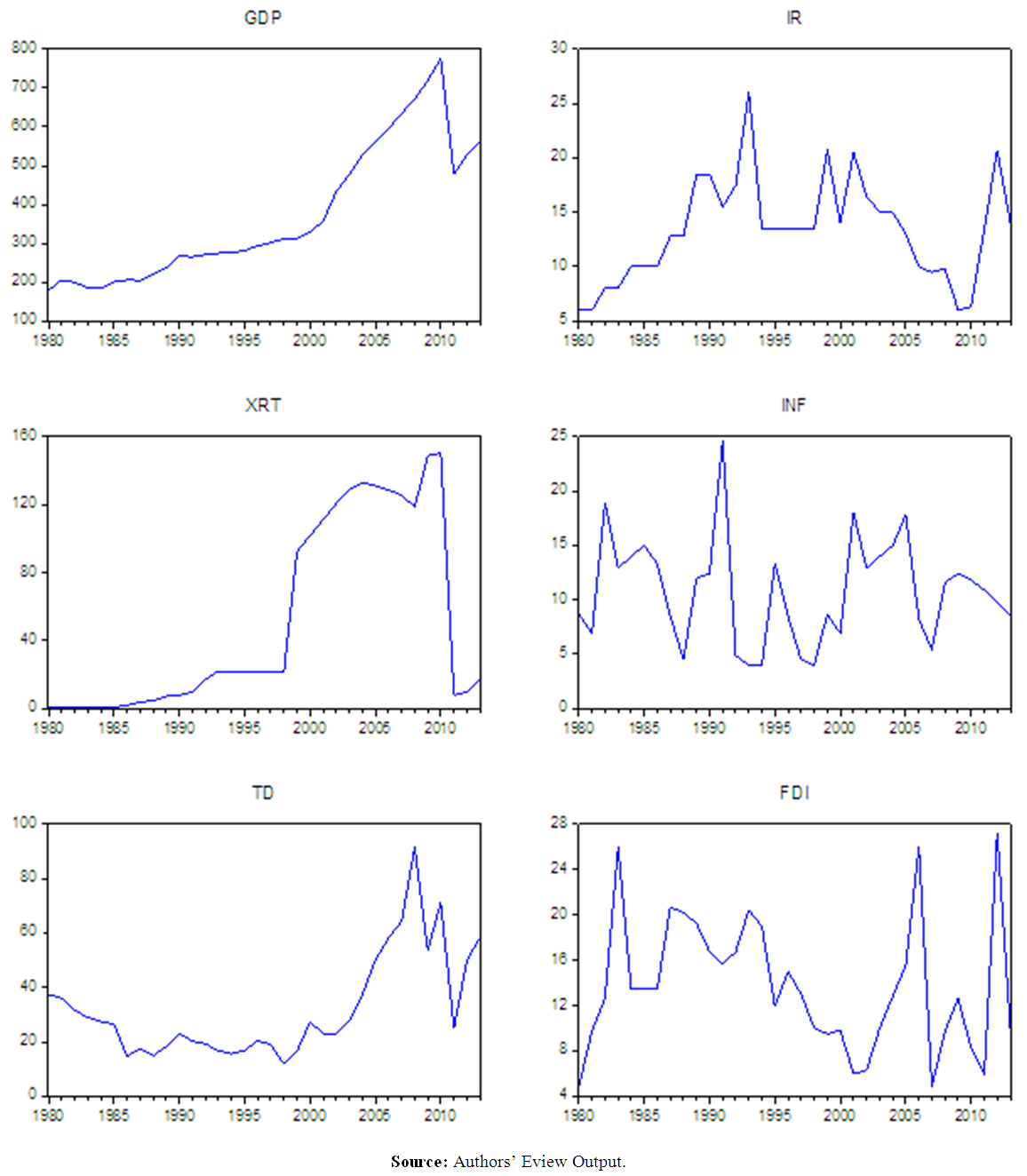

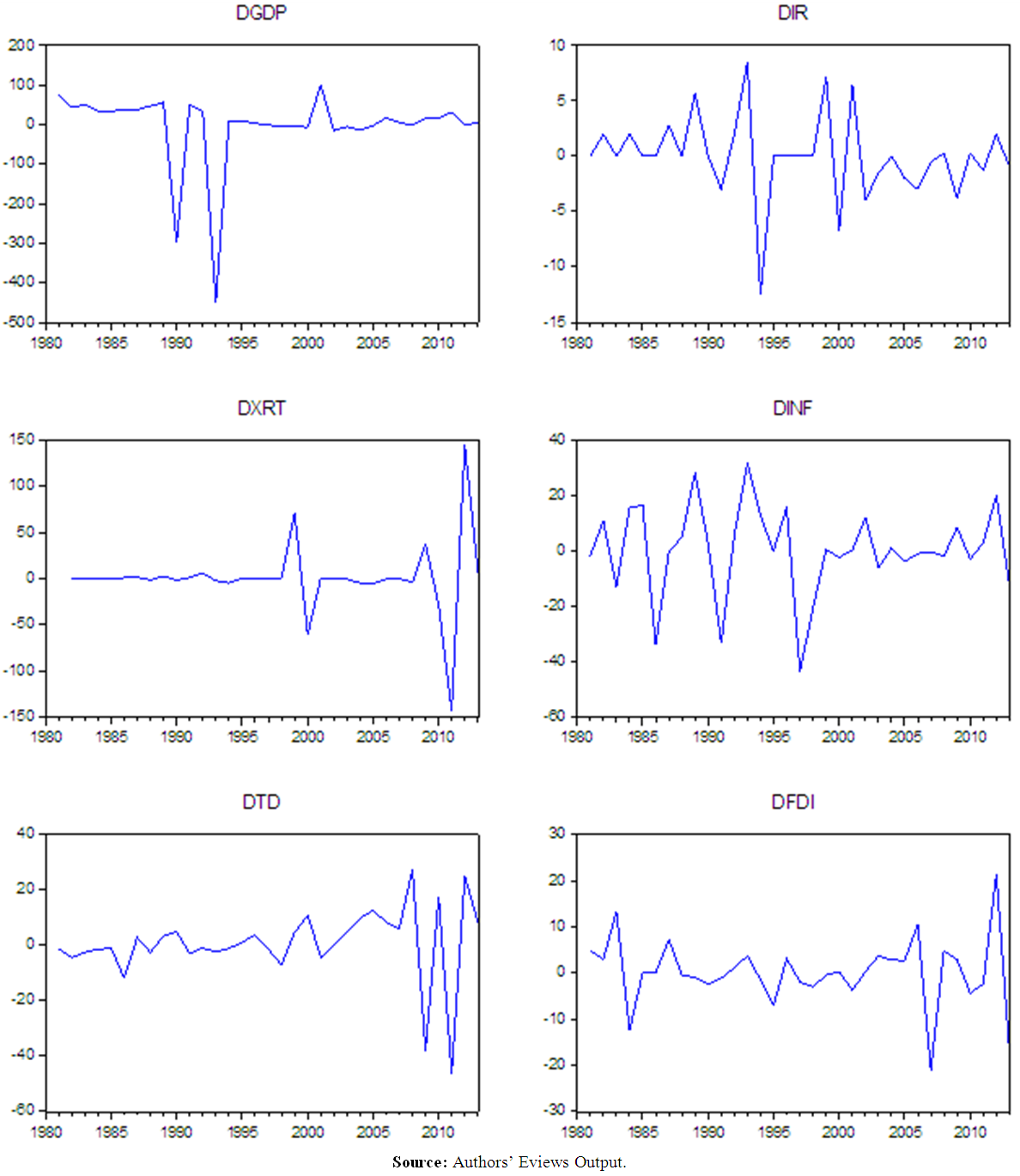

- One of the requirements for running VEC model is that the data involved should be stationary. Hence, the stationarity of the data are first tested using the Augmented Dicker- Fuller (ADF) test (Dickey and Fuller 1981, unit root tests). The endogenous and exogenous variables (real GDP, interest rate, exchange rate, inflation, total deposit and foreign direct investment) were checked for stationary. The stationarity or otherwise of a time series data can also be plotted graphically as represented below:The series shows evidence of unit root as the line graph of the diverse variables plotted above failed to cross several times the zero-line with large departure from it. However, the ADF test on the series was performed to ascertain the number of times we differentiated our non-stationary time series to become stationary which the results are as presented in table 4.1.

|

| Figure 4.1 |

| Figure 4.2 |

|

|

5. Conclusions

- The paper investigates the effect of financial sector liberalization on economic growth in Nigeria. The study shows how the removal of heavy government interventions on the financial sector influences economic growth in Nigeria.The results show that financial sector liberalization positively influences economic growth through its effects on interest rate, savings and investments. The study found out that, financial sector liberalization positively re-enforced interest rates which encouraged savings, investments and economic growth. However, the study found a positive but insignificant effect of financial liberalization on financial development and economic growth in the short run although results were reversed in the long run. Hence, government embarking on financial liberalization should set in place a sound capital base, prudential guidelines and a strong supervisory agency that will follow up action to ensure compliance.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML