-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(4): 184-192

doi:10.5923/j.ijfa.20160504.03

Operationalising the Qualitative Characteristics of Financial Reporting

Mbobo Erasmus Mbobo1, Ntiedo Bassey Ekpo2

1Department of Accounting, Faculty of Business Administration, University of Uyo, Nigeria

2Department of Banking & Finance, Faculty of Business Administration, University of Uyo, Nigeria

Correspondence to: Mbobo Erasmus Mbobo, Department of Accounting, Faculty of Business Administration, University of Uyo, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study examined the perception of Nigerian accountants on the quality of financial reporting and the use of qualitative characteristics in the measurement of financial reporting quality. The objective was to demonstrate how the qualitative characteristics, as defined by the IASB can be operationalised. The study adopted a survey approach. 120 copies of structured questionnaire, designed in accordance with the underneath attributes of the qualitative characteristics, were distributed to professional accountants in three major cities in Nigeria. The data generated from the survey was analysed using tables, percentages, mean and descriptive analysis. Findings indicate that the qualitative characteristics of financial reporting can be operationalised if we pay attention to the underneath attributes of these main characteristics, namely; relevance, faithful representation, comparability, verifiability, understandability and timeliness. The results further indicate that the respondents perceived faithful representation and relevance as having greater potential of enhancing the quality of financial reporting, with an average mean score of 3.2 and 3.1 respectively. The type of auditor’s report (3.6); the use of fair value as a basis for measurement (3.4); the presence of information which explains the assumptions and estimates made in the financial statements (3.4); as well as information which explains the choice of accounting principles used in the preparation of financial statements (3.4), are also the underneath attributes which enhance the quality of financial reporting to a great extent. Findings also revealed that, although the adoption of IFRS has greatly impacted the quality of financial reporting, training on IFRS and qualitative characteristic-based study are still scanty. The study recommends training of accounting personnel on IFRS and more research studies in this area.

Keywords: Financial reporting quality, Operationalization, Qualitative characteristics, and professional accountants

Cite this paper: Mbobo Erasmus Mbobo, Ntiedo Bassey Ekpo, Operationalising the Qualitative Characteristics of Financial Reporting, International Journal of Finance and Accounting , Vol. 5 No. 4, 2016, pp. 184-192. doi: 10.5923/j.ijfa.20160504.03.

Article Outline

1. Introduction

- The quality of financial reporting has remained an issue of major concern among professional accountants, regulators and other users of financial information. This is due to the fact that financial reporting has been a principal means of communicating the results of transactions and events which transpired within the organisation to the outsiders; who may use such information in assessing the economic performance and condition of a business as well as a guide in making economic decisions. Hence, the expectation of every user of financial information is that such information will help them in gauging the health status of the reporting entity and in making informed financial decisions. However, events in recent times, especially the series of corporate scandals (such as Enron, Worldcom and several Nigerian banks) have placed serious doubt on the quality of financial reports circulating in our corporate environment and their ability to meet the expectations and needs of the users.In response to the need for improvement in the existing financial reporting system, the International Accounting Standards Board (IASB) released a conceptual framework for financial reporting following the exposure drafts issued in 2008 and 2010. The key issues raised in the framework are the objectives of financial reporting and the characteristics of quality financial reporting. It noted that a key prerequisite for achieving quality financial reporting is the adherence to the objectives and the qualitative characteristics of financial reporting information. According to the framework, qualitative characteristics are the attributes that meet the decision usefulness of financial information. The framework listed these attributes as; relevance, faithful representation, comparability, understandability, verifiability and timeliness. It has been argued that the model which uses the qualitative characteristics approach in measuring quality financial reporting provides a direct and better measure of financial reporting quality (Van Beest, Braam, & Boelens, 2009).In spite of the obvious merits of this model, especially the fact that it aligns strongly with the International Financial Reporting Standards (IFRS), many researchers in recent studies still prefer to use the indirect method, especially discretionally accrual (earnings management) as a proxy for financial reporting quality. This, perhaps, is due to the difficulty in operationalising the qualitative characteristics (Van Beest et al., 2009). Indeed, studies which attempt to operationalise the qualitative characteristics in financial reporting are very scanty in Nigeria. This paper therefore contributes towards filling this gap.Prior studies (e.g. VanBeest, et al., 2009; Tasios and Bekiaris, 2012) provide a model for operationalising the qualitative characteristics, based on the IASB conceptual framework. Van Beest, et al. (2009) make use of annual reports of companies listed on the US, the UK and Dutch stock market, for the period 2005 to 2007. Also, Tasios and Bekiaris (2012) evaluate the perception of Greece Auditors on the quality of financial reports, based on the qualitative characteristics of financial reporting information, as defined by IASB in its conceptual framework. The present study differs from these prior studies in several ways. In contrast to Van Beest et al. (2009), we adopt a survey research design. Our questionnaire was, however, patterned after their model. In addition, the current study examines the perception of professionals in the Nigerian context. The study contributes to the existing body of knowledge and literature in measuring the quality of financial reporting and ways of improving the quality of financial reporting in Nigeria. The result of this study will be beneficial to researchers in the area of corporate governance and quality financial reporting. The remainder of the paper is organized as follows: following this introductory section, section two presents a review of relevant literature of the concept of financial reporting and the various methods of measuring the quality of financial reporting. In section three the methodology of the study is presented; while data presentation and discussion of findings are in section four. Finally, we draw conclusion and discuss recommendation in section five.

2. Review of Related Literature

2.1. The Concept of Quality Financial Reporting

- The main objective of financial reporting is to provide information concerning economic entity, primarily financial in nature, useful for economic decision making (IASB, 2008; Van Beest et al., 2009). Financial reporting provides information about the management’s stewardship; the entity’s assets, liabilities, equity, income and expenses (including gains and losses), contributions by and distributions to owners as well as cash flows (Van Beest, et al., 2009). This information is usually in the form of annual financial statements such as the statement of financial position; the income statement or statement of comprehensive income; statement of cash flows and statement of changes in equity as well as notes to the accounts (IASB, 2008, 2010). To enhance reliability and confidence in the minds of the users, these reports are subjected to scrutiny by external auditors. However, the spate of financial scandals in recent times has casted serious doubt on the quality of audited financial reports circulating in our corporate environment. Thus, the concept of quality financial reporting has commanded considerable research interest around the world. However, researchers, practitioners or regulators are in disagreement as to a clear definition of what constitutes ‘quality financial reporting’ (Pomeroy and Thomton, 2008; cited in Miettinen, 2008). SOX (2002), for instance, require audit committees and auditors to discuss the quality of the financial reporting methods of the company, and not just their acceptability. But the Act did not define what constitutes ‘quality’ in financial reporting. The IASB (2008) has however provided a working definition of quality financial reporting. The Board in its conceptual framework defines quality financial reporting as that which meets the objectives and the qualitative characteristics of financial reporting (IASB, 2008; Van Beest et al., 2009).

2.2. Methods of Measuring the Quality of Financial Reporting

- To assess the quality of financial reporting, various measurement models have been used in prior researches. Some of these include: (i) accrual models (Jones, 1991; Dechow, Sloan & Sweeney, 1995); (ii) value relevance model (Choi, Collins & Johnson W.B. 1997; Barth, Beaver & Landsman, 2001; Nicholas & Wahlen, 2004); (iii) specific elements in annual reports (Beretta & Bozzolan, 2004; Hirst et al., 2004); (iv) qualitative characteristics model (Jones and Blanchet, 2000; Schipper & Vincent, 2003; Barth, Landsman & Lang, 2008; Van der Meulen, Gaeremynck, & Willekens, 2007; Van Beest, et al, 2009).Accrual Model: This model uses the level of earnings management as a proxy for the quality of financial reporting. It measures the extent of earnings management under existing rules and legislation. The model assumes that managers use discretionary accruals, i.e. accruals over which the manager can exert some control, to manage earnings (Healy & Wahlen, 1999; Dechow et al., 1995). This model is based on the assumption that a company’s earning is believed to be the most important item in the financial statements. Hence, most analysts tend to use this when analyzing a company’s performance and prospective potential. Earnings management is assumed to negatively influence the quality of financial reporting by reducing its decision usefulness (Van Tendeloo & Vanstraelen, 2005). There are many approaches in detecting earnings management but the accrual-based models, especially the discretionary accrual, is the most popular approach (Chen, 2012). Proponents of this model argued that the main advantages of using discretionary accruals to measure earnings management is that there is relative ease in data collection and measurement. In addition, when using regression models it is possible to examine the effect of company characteristics on the extent of earnings management (Healy & Wahlen 1999; Dechow et al. 1995). The main limitation of this model, however, is how to distinguish between discretionary and non-discretionary accruals (Healy & Wahlen, 1999). Also, the model only provides an indirect measure for financial reporting quality.Value Relevance Model: This model examines the relationship between stock returns and earnings figures in order to measure the relevance and reliability of financial reporting information. The model measures the quality of financial reporting information by focusing on the association between accounting figures and stock-market reactions (Choi, Collins & Johnson, 1997; Barth, Beaver & Landsman, 2001; Nichols & Wahlen, 2004). Under this model, the stock price is assumed to represent the market value of the firm, while accounting figures represent firm value based on accounting procedures. When both concepts are strongly correlated, (i.e. changes in accounting information correspond to changes in market value of the firm), it is assumed that earnings information provides relevant and reliable information (Jonas, & Blanchet, 2000; Schipper & Vincent, 2003; Nichols & Wahlen, 2004). According to Schipper & Vincent (2003), this method is used to examine earnings persistence, predictive ability, and variability, as elements of earnings quality. Although the model provides insight into the economic value of earnings figure, it does not distinguish between relevance and reliability. In other word, it does not explicitly show whether or not tradeoffs have been made when constructing accounting figures. Above all, it provides only an indirect measure of financial reporting quality.Specific Elements in the Financial Reports: The third category of assessment tools is those which measure the quality of specific elements in annual financial reports as a benchmark for the overall financial reporting quality. This model evaluates specific elements in the financial reports in depth, usually through experiment. It thus examines the influence of presenting specific information in the annual report on the decisions made by the users of such information. Although this model provides a direct measure of financial reporting quality, it has a partial focus, and does not provide a comprehensive overview of total financial reporting quality (Van Beest et al., 2009). The Qualitative Characteristics Model: This represents the most recent model for assessing the quality of financial reporting. The model examines the level of decision usefulness of financial reporting information by operationalising the qualitative characteristics of financial reports. Jonas and Blanchet (2000) pioneered the use of this model in assessing the quality of financial reporting. They develop questions that were germane to the separate qualitative characteristics of financial reporting as stipulated by the FASB (1980) and IASB (1989). The model was adopted by McDaniel, Martin & Maines (2002); Lee, Strong, Kahn, & Wang (2002) and Van Beest et al. (2009) in their related studies. However, while McDaniel et al. (2002) and Lee et al. (2002) operationalised the qualitative characteristics based on FASB (1980) and IASB (1989), Van Beest et al. (2009) operationalisation was based on the IASB Exposure Draft (ED) of 2008. The major advantage of this model is that it provides a direct measure of financial reporting quality and covers all aspects of financial reports, including both financial and non-financial information.

2.3. Operationalization of the Qualitative Characteristics

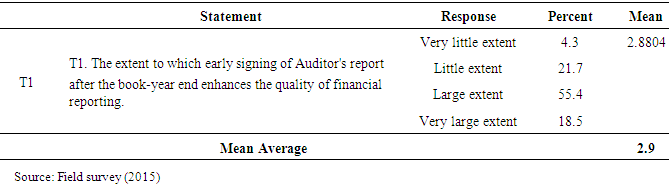

- The IASB (2008) defines quality financial reporting in terms of the fundamental and enhancing qualitative characteristics. Therefore, prior studies have operationalised the qualitative characteristics in line with this categorization. Relevance and faithful representation are categorized as the fundamental qualitative characteristics of financial reporting information. The enhancing qualitative characteristics on the other hand include understandability, comparability, verifiability and timeliness). The enhancing qualitative characteristics improve decision usefulness of financial reports when the fundamental qualitative characteristics have been established. They cannot determine financial reporting quality on their own (IASB, 2008).RelevanceIASB (2008) defines relevance as the capability of making a difference in the decisions made by users in their capacity as capital providers. Relevance is usually operationalized in terms of predictive and confirmatory value (McDaniel et al., 2002; Van Beest et al. 2009). Predictive value generally refers to information on the firm’s ability to generate future cash flows. According to IASB (2008) information about an economic phenomenon has predictive value if it has value as an input to predictive processes used by capital providers to form their own expectations about the future. Predictive value is considered as an important indicator of relevance in terms of decision usefulness. The basic measures of predictive value, according to Van Beest et al., (2009) are: 1) the extent to which annual reports provide forward-looking statements; 2) whether the annual reports disclose information in terms of business opportunities and risks; and 3) whether the company uses fair value.The forward-looking statement usually describes management’s expectations for future years of the company. For capital providers and other users of the annual reports this information is relevant since management has access to private information to produce a forecast that is not available to other stakeholders (Bartov & Mohanram, 2004). A relevant financial report should include both financial and non-financial information. Such information should be able to provide insight into business opportunities, risk as well as possible future scenario for the company (Jonas and Blanchet, 2000). Prior studies record that in comparison to historical cost, fair value presents a better predictive value of financial reporting information than historical cost (Barth et al., 2001; McDaniel et al. 2002; Schipper & Vincent, 2003; Schipper, 2003; Hirst, Hopkins & Wahlen, 2004). Maines and Wahlen (2006) argue that fair value accounting provides more relevant information than historical cost because it represents the current value of assets, instead of the purchase price. In addition, fair value is the accounting measure espoused by both the IASB and the FASB; and both frameworks consider fair value as one of the most important methods to increase relevance (Barth et al., 2001).In addition to predictive value, confirmatory value contributes to the relevance of financial information. According to IASB (2008) information has confirmatory value if it confirms or changes past (or present) expectations based on previous evaluations. Jonas and Blanchet (2000) argue that if the information in the annual report provides feedback to the users of the annual report about previous transactions or events, this will help them to confirm or change their expectations. Information relating to the confirmatory value are usually contained in the ‘management, discussion and analysis’ section of the annual reports (Jonas & Blanchet, 2000).Faithful RepresentationFaithful representation is the second fundamental qualitative characteristic espoused in the IASB (2008) framework. According to IASB (2008), to faithfully represent economic phenomena which the information purports to represent, annual reports must be complete, neutral, and free from material error. IASB (2008), states that economic phenomena represented in the annual report are “economic resources and obligations and the transactions and other events and circumstances that change them. Faithful representation is usually measured in terms of neutrality, completeness, freedom from material error, and verifiability Jonas & Blanchet, 2000; Sloan, 2001; Rezaee, 2003; Gaeremynck & Willekens, 2003; Cohen et al., 2008). Botosan (2004) argues that it is difficult to measure faithful representation directly by only assessing the annual report, since information about the actual economic phenomenon is necessary to assure faithful representation. However, Maines and Wahlen (2006), maintain that estimates and assumptions that closely correspond to the underlying economic constructs and the standards pursued can enhance faithful representation. The proxies commonly used to measure faithful representation include: 1) freedom from bias; 2) neutrality; 3) unqualified audit report; and 4) corporate governance statement (Van Beest et al. (2009). To be free from bias, financial reports should clearly explain assumptions and estimates made in the preparation of the financial statements, as well as the choice of accounting principles. A financial report is assumed to be neutral if it highlights both the positive and negative events in a balanced way (IASB, 2008; Van Beest et al., 2009).UnderstandabilityThe first enhancing qualitative characteristic, as stated by IASB (2008) is understandability. According to IASB (2008), understandability will increase when information is classified, characterized, and presented clearly and concisely to enable users comprehend their meaning. Understandability is usually measured using five items which include: 1) how well-organised the information in the annual reports is presented; 2) disclosure of information in notes to the account; 3) presentation of certain information in tables and graphs; and 4) whether the financial statements are devoid of technical jargons and 5) the inclusion of a glossary of unfamiliar terminologies.ComparabilityA second enhancing qualitative characteristic is comparability. IASB (2008) defines comparability as the quality of information that enables users to identify similarities in and differences between two sets of economic phenomena. This suggests that similar situations should be presented likewise, while different situations should be presented differently. Comparability is often measured using six items, which together measure consistency in the use of the same accounting policies and procedures and comparability across companies within the industry. Specifically, these items are: 1) notes to changes in accounting policies explaining the implications of the change; 2) notes to revisions in accounting estimates and judgments explaining the implications of the revision; 3) the extent to which the company adjusts previous accounting period’s figures, for the effect of the implementation of a change in accounting policy or revisions in accounting estimates; 4) the extent to which the company provides a comparison of the results of current accounting period with previous accounting periods; 5) the extent to which the information in the annual report is comparable to information provided by other organizations within the industry; and 6) the extent to which the company presents financial index numbers and ratios in the annual report (Van Beest et al., 2009).TimelinessThe last enhancing qualitative characteristic discussed in the IASB (2010) conceptual framework is timeliness. The framework defines timeliness as having information available to decision makers before it loses its capacity to influence decisions (IASB, 2010). In specific terms, timeliness relates to the decision usefulness of financial reports. It refers to the time it takes to reveal the information in annual reports. It is usually measured in terms of the number of days it takes for the auditor to sign the accounts after book-year end.

3. Methodology

- The study adopts a survey research approach. We made use of data from an earlier study on the ‘perception of professional accountants on measuring the quality of financial reporting’, in which a total of three hundred copies of questionnaire were distributed to professional accountants across the three geo-political zones of the country. The questionnaire was structured into two main sections and eight sub-sections. Section A provides the respondent’s background information and includes gender, age, educational and professional qualifications, nature of employment, designation and work experience. Section B, the main section of the questionnaire, was aimed at gathering respondents’ opinion regarding their perceptions on the measurement of the quality of financial reporting. The last sub-section of this section contains questions/statements on operationalising the quality of financial reporting. The responses from this section form the basis of this study. The questions/statements were designed in a four-point Likert scale format. The survey instrument was subjected to validity and reliability tests, which indicates a Cronbach alpha of 0.874, indicating the reliability of the instrument.

4. Data Analysis and Discussion of Findings

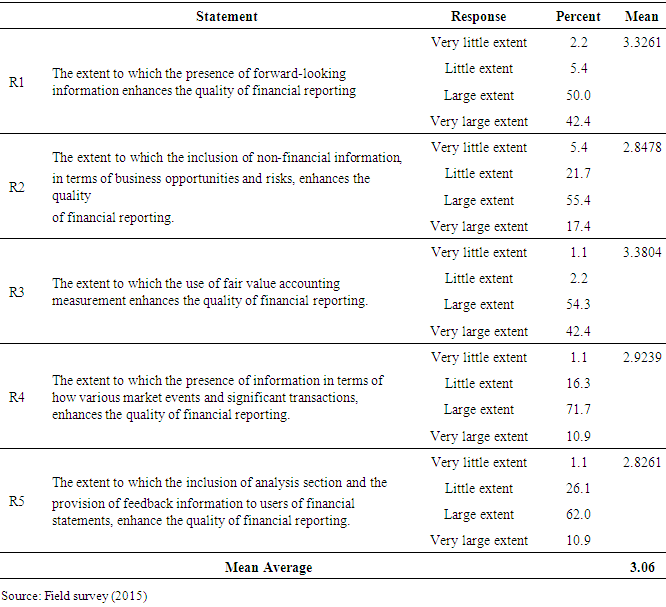

- Relevance:Table 1 shows that relevance, as a fundamental characteristic, was operationalised using five underneath characteristics, denoted as R1 to R5. The result shows that all the underneath attributes show a mean value that is higher than 2.5. However, the use of fair value accounting as a measurement basis (R3), has the highest mean of 3.4; followed by the presence of forward-looking information (R1). The mean average value of 3.06 in agreement with the findings of Tasios and Bekiaris (2012), whose study of the perception of Greek Auditors gave a mean average of 3.3 for relevance.

|

|

|

|

|

5. Conclusions

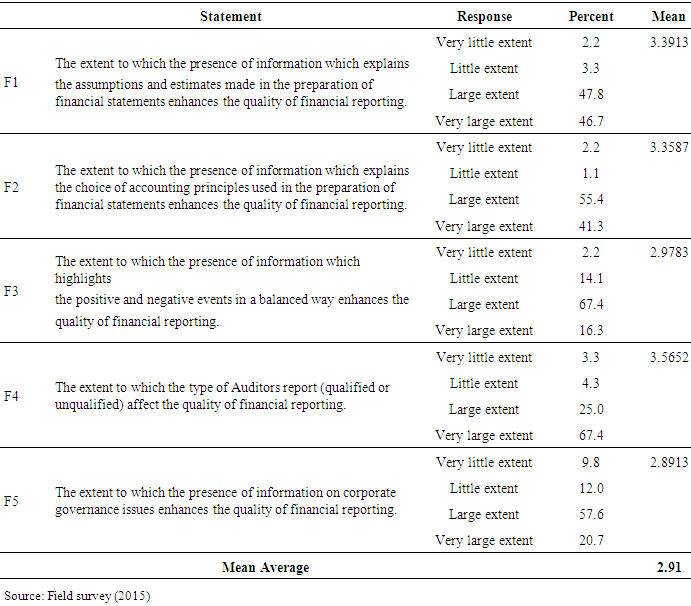

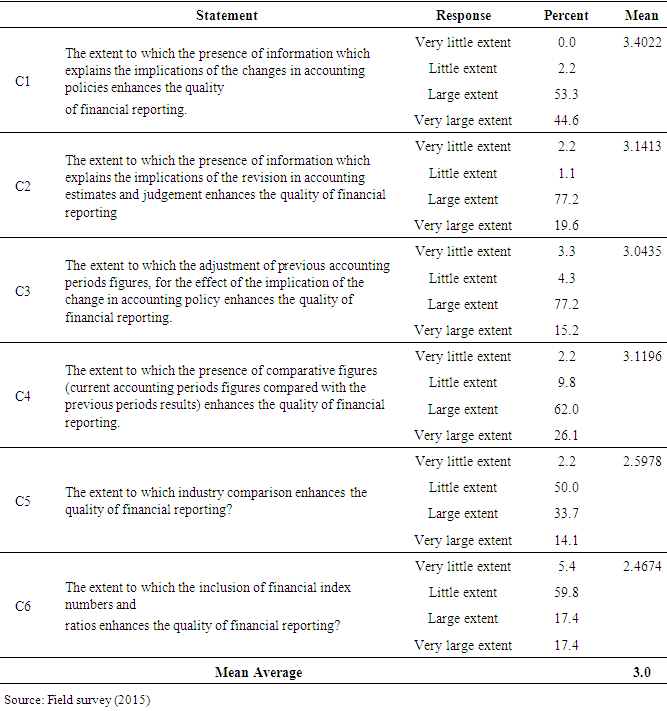

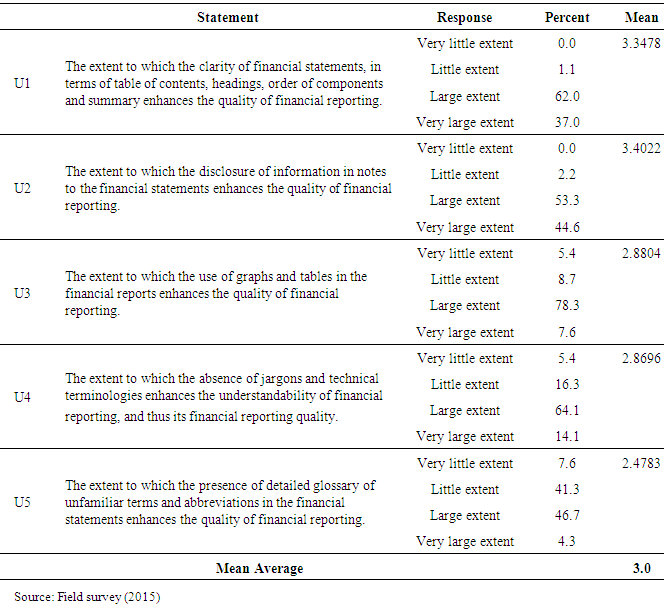

- The main objective of this study was to demonstrate how the qualitative characteristics could be operationalised in the measurement of the quality of financial reporting. To achieve this objective a survey study was undertaken to evaluate the perception of professional accountants in Nigeria on the extent to which the underneath attributes of the various qualitative characteristics enhance the quality of financial reporting. These underneath attributes form the basis of operationalising the qualitative characteristics in financial reporting, as defined by the IASB in its conceptual framework. Findings indicate that the qualitative characteristics of financial reporting can be operationalised if we pay attention to the underneath attributes of these main characteristics, namely; relevance, faithful representation, comparability, verifiability, understandability and timeliness. The results of the analysis indicate that the respondents perceive faithful representation as having the potentials of enhancing the quality of financial reporting, with an average mean score of 3.2; followed by relevance with average mean score of 3.1. With regards to the underneath attributes, the type of auditor’s report (whether qualified or unqualified), records the highest mean of 3.6, followed by the use of fair value as a measurement basis in the financial report, with a mean score of 3.4. The presence of information which explains the assumptions and estimates made in the preparation of financial statements as well as information which explains the choice of accounting principles used in the preparation of financial statements also enhance the quality of financial reporting to a great extent. These two record a mean score of 3.4 each. The presence of information which explains the implications of the changes in accounting policies also records a high mean score of 3.4, implying that this attribute greatly enhances the comparability of financial report and by extension the quality of financial reporting. The non-quantitative attributes such as: notes to the accounts, clarity of the contents of financial statements, the use of graphs and tables and timeliness of financial reporting, all show significant influence in enhancing the quality of financial reporting.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML