-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(2): 126-133

doi:10.5923/j.ijfa.20160502.06

Capital Structure and Operating Performance of Listed Conglomerate Firms in Nigeria

Terzungwe Nyor, Abdulateef Yunusa

Department of Accounting, Faculty of Arts and Social Sciences, Nigerian Defence Academy, Kaduna, Nigeria

Correspondence to: Terzungwe Nyor, Department of Accounting, Faculty of Arts and Social Sciences, Nigerian Defence Academy, Kaduna, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study seeks to investigate how capital structure variables impact on operating performance of listed conglomerate firms in Nigeria. The research was motivated by scarcity of studies on capital structure and operating performance in Nigeria. Data were collected from published financial reports for the period of 2004 to 2013 from a sample of five listed conglomerate firms. The study adopted correlation research design using fixed-effect regression model. The results reveals that total debts to total assets has positive and significant impact on noncurrent asset turnover, while shareholders’ funds to total assets has negative and insignificant impact on noncurrent assets turnover. Hence, it is established that listed conglomerate firms in Nigeria depends more on short terms debts. It is therefore recommended that listed conglomerate firms should increase the level of equity finance and exploit the advantages of leverage.

Keywords: Capital Structure, Operating Performance, Noncurrent Assets Turnover, Debt and Equity

Cite this paper: Terzungwe Nyor, Abdulateef Yunusa, Capital Structure and Operating Performance of Listed Conglomerate Firms in Nigeria, International Journal of Finance and Accounting , Vol. 5 No. 2, 2016, pp. 126-133. doi: 10.5923/j.ijfa.20160502.06.

Article Outline

1. Introduction

- Capital structure of a company is an important component of management decisions that is concerned with debt and equity mix toward meeting the firm’s objectives. It is capable of influencing both financial and operating performance of a company as a result of its interest and dividend elements. The performances of firms are aimed at meeting the interest of various stakeholders through effective and efficient operating activities such as increase turnover and efficient noncurrent asset utilization. The capital-mix of a firm can take many forms, but the most realistic is that which combines both a certain percentage of debt and equity in the capital structure and thus, the advantages of leverage (if any) is exploited (Olokoyo, 2012). There is no doubt that benefits abound in the use of debt in the capital structure of firms which influences long term solvency of that firm. The main benefit of debt financing is the tax-deductibility of interest charges which results in lower cost of capital (Krishnan & Moyer, 1997). Does it then mean that for growths potentials firm should go on increasing the debt proportion in its capital mix? If every increase in debt financing were going to increase the wealth of the shareholders, then every firm would have been 100% debt financed. However, there are certain costs associated with debt financing. So between the two extremes of whole equity financing and whole debt financing, a particular debt-equity mix is to be decided. Any attempt by a firm to design its capital mix therefore, should be undertaken in the light of two propositions: firstly, that the capital mix be designed in such a way as to lead to the objective of maximizing stakeholders interest and secondly, that though the exact optimal capital structure may be impossible, efforts must be made to achieve the best approximation to the optimal capital structure to attain its long term solvency and stability of the firm. When a company relies on debts because of interest payment which is treated as business expense for tax purpose, such debts may create financial risk. Financial risk is the increased risk of equity holders due to financial gearing as opposed to business risk which is associated with operating gearing. Business risk is the variability that a business firm experiences over time on its revenue (Owualah, 2000). Financial risk does not arise from a company’s investment, but solely from the capital structure and more specifically from the level of gearing. Quoted conglomerate companies in Nigeria are classified as conglomerates diversify because they engage in series of unrelated business activities prone to financial and business risk (NSE, 2013). As they employ fixed interest debt into their capital structure, it increases their financial risk. This is partly because the interest must be paid whatever happens to earnings. When the companies are in default, they run the risk of compulsory winding up. This is particularly so where the providers of debt finance have security for their investment in the form of mortgage over the firms’ asset. Capital structure of conglomerate firms become paramount for meeting firm’s obligations as at when due supported by her operational efficiency (Olokoyo, 2012). In order to mitigate financial and business risk, quoted conglomerate companies in Nigeria should be effective in their financing decisions so as to boost her operating performance. In line with the above, this study tends to investigate the impact of capital structure on the operating performance of listed conglomerate companies in Nigeria.It could be argued that when management is unable to adequately utilise the firms’ current and noncurrent asset, revenue of the firm may not be adequate to cover operating expenses and hence, it may affect profitability of the firms. Then, how could a company have good financial performance when faced with this situation? This explains the importance and pride of operating performance over financial performance. Previous studies such as Olokoyo (2012) and Muritala (2012) focused on firm’s capital structure and financial performance in Nigeria and neglected its impact on their operating performance. Even Appah, Okoroafo and Bariweni (2013) that titled their study as capital structure and operating performance did not actually use operating performance variables in their analysis, instead, they used financial performance variables. Studies that attempts to consider operating performance concentrated on solvency and operating performance of firms in India such as Gurbachan and Sumesh (2014) and Sandeep (2012).This study therefore focuses on the impact of capital structure on operating performance of conglomerate companies listed in Nigeria. To the best of our knowledge, there is paucity of studies on capital structure and operating performance with specific focus on the conglomerates. Furthermore, most studies examine theories of capital structure in terms of their impact on financial performance. This study however goes further to look at capital structure theories as they affect operating performance in order to provide evidence of the individual and combined impact of debts and changes in equity on operating performance over time. The study on operating activities of firms is important because financial performance is a direct outcome of revenue generation and effective utilization of noncurrent assets of a company. The outcome of the study will equip Nigerian conglomerate firms with useful information that will assist in making financing decisions. Hence, the objective of the study is to determine the impact of capital structure (shareholders’ funds to total assets, total debts to total assets and long term debts to total assets) on operating performance of quoted conglomerate companies in Nigeria.

2. Review of Empirical Studies

- Lewis (1972) defined operating performance as firm's performance measured against standard or prescribed indicators of assets effectiveness, employees efficiency and environmental responsibility such as cycle time, productivity, waste reduction and regulatory compliance. While financial performance, is the level of performance of a firm over a specified period of times, expressed in terms of overall profit or losses during that time. It is measuring the results of a firm’s policies and operation in monetary terms. These results are reflected in the firm’s return on investment, return on assets and valued added.Appah et al. (2013) investigated the impact of capital structure on operating performance of thirty two firms quoted on the Nigerian Stock Exchange from 2005 to 2011 in a total of 224 observations by analysing relationship between operating performance measures and capital structure variables. Total assets efficiency was used as control variable. Their result revealed that short term debt, long term debt and total debt have significant negative relationship with operating performance. Total asset efficiency has positive relationship with performance. On the basis of their result, they concluded that capital structure affects the operating performance of firms. They recommended that performance of quoted firms can be improved using the optimal capital structure model. The above study of Appah et al. (2013) was limited to a seven year period from 2005 to 2011 and ignored size and age of the firms as control variables. These are factors distinct in company affairs that may influence capital decision and performances. In addition, Appah et al. (2013) entitled their study as capital structure and operating performance of quoted firms in the Nigeria stock exchange but used financial performance variables instead of operating performance variables. In effect, their study was on financial performance of quoted Nigerian firms. Based on these limitations, the study at hand uses efficiency ratio (noncurrent assets turnover) as a measure of operating performance and employed size and age as firm’s factor capable of influencing capital structure and operating performance of listed conglomerate firms in Nigeria for a ten year period from 2004 to 2013.Muritala (2012) examined the impact of capital structure on firm’s financial performance using 10 listed non- financial firms in Nigeria between 2006 and 2010. The study revealed that asset turnover is an important determinant of financial performance. The study provides evidence of a negative and significant relationship between asset turnover and capital structure. The implication is that the sampled firms were not able to utilize the noncurrent asset composition of their total assets judiciously to impact positively on their firms’ performance. The study opined that no organization can be sustained without some investment in noncurrent asset. Investment in noncurrent assets like land, building, plant and machinery, fixtures, fittings and motor vehicle enhances the productive capacity of firms. Hence, the study recommended that asset tangibility should be a driven factor to capital structure because firms with more tangible assets are less likely to be financially constrained. From the above, Profits can be generated by investing in such assets (land, building, plant and machinery, fixtures, fittings and motor vehicle) to ensure long term profitability. This category of assets does not change frequently and they are purchased to produce and sell more. Assets have significant role in determining the efficiency and the profit ratio of a firm. Since a firm acquires plant and machinery and other productive noncurrent assets for the purpose of generating sales, efficiency in the use of noncurrent assets should be judged in relation to sales. Murtala (2012) study was limited to a period of five years ending 2010. This period could be argued to be short to provide significant impact of changes in financial decisions on performance of listed firms in Nigeria. On this basis, the study at hand covers a period of ten from 2004 to 2013. Olokoyo (2012) examined the relationship between capital structure and performance of Nigerian quoted firms from 2003 to 2007. The empirical results based on panel data for 101 quoted firms in Nigeria. The study found out among others that the leverage measures long term debts to total assets, short term debts to total assets and total debts to total assets have a positive and highly significant relationship with the performance of quoted firms in Nigeria. The maturity structure of debts affects the performance of firms significantly and the size of the firm has a significant positive effect on the performance of firms in Nigeria. The study further revealed a salient fact that Nigerian firms are either majorly financed by equity capital or a mix of equity capital and short term financing. Finally, the study suggested that Nigerian firms should try to match their high market performance with real activities that can help make the market performance reflect on their internal growth and accounting performance. The study of Olokoyo (2012) neglects operating performance of Nigerian Quoted Firms and concentrated on financial performance. The period of 2003-2007 covered by the study is too short to adequately reveal the impact of changes in capital structure decisions on performance of quoted firms in Nigeria. This is based on the fact that quoted Nigeria firms experienced global economic meltdown from the period of 2007 to 2009. This study at hand covers the period of 2004 to 2013. Similarly, capital structure measures the long term financial worth or credit worthiness of a firm. This worthiness is what many creditors look up to over a period of time before deciding to invest in the firm. This study focussed on capital structure and operating performance to add to existing study.Rathiranee and Sangeetha (2011) examined how tangibility and asset turnover influence the capital structure of listed manufacturing companies in Sri Lanka. The study covered a period of 2005 to 2009 and employed total debts to total assets and long term debt to total assets as dependent variables to proxy capital structure and uses ratio of fixed assets to total assets and sales revenue to average total assets ratio as independent variables to measure performance. Findings of this study revealed that there is low relationship between the factors of leverage and performance; Asset turnover has negative relationship with leverage; the impact of tangibility and asset turnover on leverage was insignificant and profitability has the most impact on Leverage than other factors of tangibility and asset turnover. From the above study, capital structure variables are used as dependent variable while operating efficiency as independent variable of listed manufacturing firms in Sri Lanka for a period of five years. It can be argued that leverage should be influencing assets turnover over a period of time. This is because the way in which a firm is financed would affect its operation positive or negatively as interest of the fund providers would be pivot before any other interest.Ebaid (2009) found that capital structure has no influence on the performance of listed firms from 1997 to 2005 in Egypt as one of emerging or transition economies. The empirical tests came with the result that capital structure particularly Short term debts and Total debts have a negative impact on an organization’s performance. Apart from that, capital structure including short-term debt, long-term debt and total debt has no significant impact on an organization’s performance. The study of Ebaid (2009) was limited to Egyptian firms and restricted to period of 2005 and concentrated on financial performance. The current study seeks to bridge domain gap alongside period of study and focused on operating performance on Nigeria firms. Nima, Mohammad, Saeed, & Zeinab (2012) examined the relationship between capital structure and firms’ performance of Tehran Stock Exchange Companies from period of 2006 to 2011. The study used three capital structure variables including long term debt, short term debt and total debt ratios as independent variable. The study reported a significant negative relationship between performance and capital structure variables, except long term debts that has positive and insignificant relationship with performance. To harmonise the study of Nima et al. (2012), the period from 2004 to 2013 is considered and focused on operating performance of Nigerian quoted firms. Iorpev & Kwanum (2012) examined the impact of capital structure on the performance of manufacturing companies in Nigeria from 2005 to 2009. The annual financial statements of 15 manufacturing companies listed on the Nigerian Stock Exchange were used. Multiple regression analysis was applied on performance indicators on Short-term debt to Total assets, Long term debt to Total assets and Total debt to Equity as capital structure variables. The results show that there is a negative and insignificant relationship between Short term debt to total assets and Long term debt to total assets on performance; while Total debt to equity is positively related with performance and negatively related with profit margin. Short term debt to total assets is significant on performance while Total Long term debt to total assets is significant using profit margin. The work concludes that statistically, capital structure is not a major determinant of firm performance. The study of Iorpev and Kwanum (2012) posed a time gap of 2009 to 2013 and ignored operating performance of firms in Nigeria which this study aimed to cover.Harwood I. K. (2014) examined the effects of debt on firm performance using a longitudinal research design, employing secondary data for from 2010 to 2014. The data was obtained from Nairobi Securities Exchange Handbooks and Published books of accounts of the companies listed in the Nairobi Securities Exchange. Simple linear regression model was used to predict firm performance in the study. The study concluded that the use of debt in a firms’ capital structure negatively affects a firms’ performance though not statistically significant. The ratio of total liabilities to total assets negatively affects the firms’ performance. This implies that an increase in the proportion of debt used by commercial banks results into a decrease in a firms’ financial performance. The study recommended among others that the management of Commercial banks should identify alternative low risk sources of financing to swap with debt financing. The result of the study would be harmonised with quoted conglomerate firms in Nigeria for a period of ten years and focused on operating performance to add to literature.

3. Methodology and Model Specification

- This study adopted correlation research designs. This is because the study aims at assessing the association between the capital structure and operating performance using their historical data. The population of this study is the six (6) conglomerate companies quoted on the Nigerian Stock Exchange as at 31st December, 2013 namely: A.G Leventis Nig. PLC listed 1978, Challerams PLC listed 1977, SCOA Nig. PLC listed 1977, John Holt PLC listed 1974, UAC Nig. PLC listed 1974 and TRANSCORP Nig. PLC listed 2006. TRANSCORP Nigeria PLC quoted in 2006 does not have complete data for the period under study and was eliminated. The remaining five companies thus constituted the sample of the study. The data were collected from secondary sources as contained in the published annual reports of the conglomerates in Nigeria Stock Exchange.

3.1. Variables Definition and Measurement

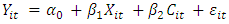

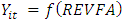

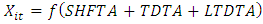

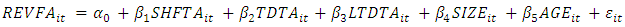

- Operating performance is proxy by REVFAwhich is a ratio of noncurrent assets turnover measured as sales revenue divided by net noncurrent assets as used by Rowland & Fernado (2011) and Ahmed et al (2012) while capital structure is proxy by SHFTA, TDTA and LTDTA.SHFTA is a ratio of shareholders’ funds to total assets measured as shareholders’ funds divided total assets (Saeedi and Mahmoodi, 2011). TDTA is a ratio of total debts to total assets measured as total debts divided by total assets as used by Appah et al (2013). LTDTA is a ratio of long term debts to total assets measured as long term debts divided total assets (Iorper & Kwanum, 2012).Control variables of the study are size and age. SIZE is size of firm measured as log of total assets (Olokowo, 2013). AGE is age of firm measured as Number of years from the date a firm was listed on the NSE as used by Rashmi and Uday (2003).Multiple regressions were used for the analysis of dependent and independent variables. The model used for the analysis is as seen below:

| (1) |

| (2) |

| (3) |

| (4) |

The dependant variable is a function of a constant, explanatory variable, control variable and error term of the sampled firms.Where:REVFAit = Noncurrent Assets Turnover of firm i for period t,α0 = Constant of firm i for period t,SHFTA= Shareholders’ Funds to Total Assets of firm i for period t,TDTA= Total Debts to Total Assets of firm i for period t,LTDTA= Long Term Debts to Total Assets of firm i for period t, β1 to β5 are the coefficients of the regression for explanatory variables of firm i for period t, while eit is the error term of firm i for time period t capturing other explanatory variables not explicitly included in the model.

The dependant variable is a function of a constant, explanatory variable, control variable and error term of the sampled firms.Where:REVFAit = Noncurrent Assets Turnover of firm i for period t,α0 = Constant of firm i for period t,SHFTA= Shareholders’ Funds to Total Assets of firm i for period t,TDTA= Total Debts to Total Assets of firm i for period t,LTDTA= Long Term Debts to Total Assets of firm i for period t, β1 to β5 are the coefficients of the regression for explanatory variables of firm i for period t, while eit is the error term of firm i for time period t capturing other explanatory variables not explicitly included in the model.4. Results and Discussions

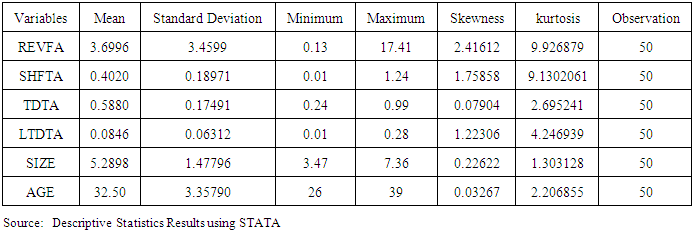

- This section presents results and discussion obtained from the data of sampled quoted firms.Table 1 shows the detail accounts of the descriptive statistics for the dependent and independent variables. The most prominent among the results in the descriptive statistics are the higher standard deviations of firm size 1.48 and number of years 3.36 relative to the standard deviations of other independent variables used in the model which ranging from 0.06 to 0.2. The high standard deviation of firms’ size and number of years indicated that our sample firms are of varying size and maturity. This is further substantiated by their average values of 5.29 and 32.50 respectively. Hence, this justifies the inclusion of size, number of years in the model.

|

|

|

|

5. Conclusions and Recommendations

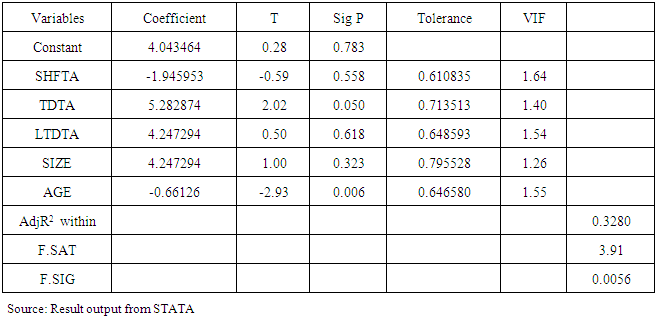

- From the above analysis, the capital structure of Conglomerate firms in Nigeria consists of more short term finance than long term debt. This reveals that Nigerian firms rely heavily on short term financing rather than long term finance. With the adjusted r2 of 0.328 significant at 0.0056, the study concludes that capital structure has significant impact on operating performance of listed conglomerate firms in Nigeria. Hence, the study recommends that the management of conglomerate firms should strive towards having optimum capital structure by increasing their equity level and reducing dependence on debts so as to avoid being cash strapped and debt ridden. This is because, beside equity holders providing funding, they could be helpful by bringing in their business experiences, skills, and contacts to grow the conglomerates. Investors are often prepared to provide follow-up funding as the business grows and they take a long-term view as most do not expect return on their investment immediately.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML