-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(2): 120-125

doi:10.5923/j.ijfa.20160502.05

Exploring Sustainable Strategies for Executives of Microfinance Banks in Nigeria

Josephine A. Diete-Spiff , Yvonne Doll

College of Management and Technology, Walden University, Minneapolis, United States

Correspondence to: Josephine A. Diete-Spiff , College of Management and Technology, Walden University, Minneapolis, United States.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The purpose of this phenomenological study was to explore strategies microfinance bank executives use to maintain business sustainability. The concepts of microfinance banking, sustainability value, and strategic management theory formed the conceptual framework for this study. Twenty executives from microfinance banks in Anambra state of Nigeria participated in semi-structured interviews. The data analysis process involved the use of Moustakas’ modified van Kaam process, which resulted in the emergence of three themes: strategic management, fear of microlending, and maintaining sustainability. The findings indicated the practice of strategic management, but indulgence in commercial activities instead of microlending to maintain business sustainability. The outcome reinforced the necessity for a strategic management focus on the expansion of microlending services, implementation of best practices, and technological input.

Keywords: Microfinance banking, Nigeria, Sustainability value, Strategic management, Best practices

Cite this paper: Josephine A. Diete-Spiff , Yvonne Doll , Exploring Sustainable Strategies for Executives of Microfinance Banks in Nigeria, International Journal of Finance and Accounting , Vol. 5 No. 2, 2016, pp. 120-125. doi: 10.5923/j.ijfa.20160502.05.

Article Outline

1. Introduction

- The need for financial inclusion of low-income earners in the Nigerian society led to the establishment of microfinance banks (MFBs) in 2005 [1, 2]. Yunus established MFBs in 1976 [3]. Microfinancing includes the working poor in financial services, funds distribution, and provides access to money without collateral, thereby improving family welfare. The improvement of family welfare creates positive social and economic development, which gave rise to the decision to incorporate microfinance into Nigeria’s economic system [4]. The establishment of MFBs in Nigeria led businesspeople, who were uninformed about microfinancing and who misinterpreted potential government funding, to subscribe and open MFB offices [5]. The current situation in the microfinance industry highlights the need for Nigerian MFB executives to have practical sustainability strategies [6].

1.1. Problem Statement

- Nigerian microfinance banks began to close offices in 2010, causing massive loss of shareholders’ funds [7]. By 2014, 38% of microfinance banks in Nigeria liquidated because Nigerian bank regulators determined that the microfinance banks were bankrupt [8]. The general business problem is that some microfinance banks in Nigeria are unable to remain solvent. The specific business problem is that some microfinance executives in Nigeria lack strategies to maintain business sustainability.

1.2. Purpose Statement

- The purpose of this qualitative, phenomenological study was to explore strategies that microfinance bank executives use to maintain business sustainability. To explore these strategies, twenty (20) MFB executives in Anambra State of Nigeria participated in the research through interviews sharing their strategies for business sustainability. The selected participants each had 10 years’ experience as members of the board of directors and the bank strategic policy developers.

1.3. Research Question

- The desire for access to sustainable strategic management best practices precipitated the interview of executives of profitable MFBs in Nigeria. To achieve the objectives of this qualitative research, the use of oral questions to evaluate the experience of MFB executives was employed. The central research question for this study was: What strategies do microfinance bank executives use to maintain sustainability?

2. Research Design and Method

- The need for a sustainable strategic management model for MFBs was the central focus of the study. The qualitative research method was appropriate to address these challenges because the problem was an underexplored area of research. The phenomenological design allowed for analysis of the study participants experiences [9]. The emphasis of a phenomenological research is on the depiction of the communal meaning of a factual lived experience from the first person viewpoint [10]. The goal of the study aligned with the phenomenological design. As the intention was to understand, describe, interpret the challenges, and find solutions for managing MFB from the perspective of the participants who experienced the phenomena [11]. The phenomenological research enabled the understanding and observation of the participant’s explanations through interviews. The phenomenological design provided an avenue for a comprehensive understanding of the best practices, managerial strategies, and concerns of the executives of the microfinance bank to maintain sustainability in the sector. This design of qualitative inquiry required interviewing participants to elicit information on sustainability achievement that can ensure management best practices among the executivesin the MFBs in Nigeria. Hence, the phenomenological design being a factual design of experiences fit the purpose of the study as the study related to the first-persons’ work experience in MFB.

2.1. Data Collection

- To confirm data saturation and research thoroughness in this study, data from 20 participant bank executives were collected as selected from 45 profitable MFB. Coenen, Stamm, Stucki, and Cieza, (2012) stipulated that saturation happens when an interviewer has obtained ample data from the field of research [12]. Data was collected using semi-structured and open-ended interviews, with progressive probing questions until no new data, theme, or coding emerged. The data collection techniques included face-to-face or a Skye chats, with a semi-structured questions that explored the participants’ experiences in relationship to maintaining sustainable strategies in microfinance banks. The interviews dwelt on the essence of the study, reaffirmation of qualification, and nine open-ended questions on the lived experiences of each microfinance bank executive. The interview instruments used were the interview script, a digital tape recorder, and observational note, resulting from the themes that emerged from the interviews.

2.2. Data Analysis

- To address the central research question,the three semistructured interview questions and six follow up questions were asked during each interview. The answers to the interview questions provided insight into the participants’ experiences of strategic management best practices, strategies for business sustainability, challenges, and ideas on how to maintain sustainability. The interview questions were initiated from a comprehensive review of the researched literature, as recommended by Moustakas.

2.3. Transcribing, Organizing, and Horizontalizing Data

- Participant data from the 20 participants was transcribed using a digital tape recorder and imported into a qualitative software program called NVivo 10. NVivo 10 was the analysis tool used in the analysis of the data, assisting in the assemblage, categorization, and organization of the data.The application of the NVivo 10 software enhanced the interpretation of the data and the use of the Moustakas modified van Kaam design process, which required the application of seven process steps [10]. The seven steps included bracketing, horizontalization, categorization, reduction, and elimination, description of textual and structural experiences, clustering and thematizing and then exploring the meanings that best described the lived experiences.The process aligned with the phenomenological study design to analyze the response of the lived experiences of the research participants. Through these component data analysis, emerged the final three study themes.

3. Findings

3.1. Research Question

- The central research question of the study was: What strategies do microfinance bank executives use to maintain sustainability?

3.2. Data from the Interviews: Question 1

- The first interview question asked was: What were your experiences with strategic management best practices as a microfinance bank executive? In response to the question, 100% of the participants described that strategic management best practices were influenced by the input of topmanagement. The strategic management best practices highlighted constant supervision, decision making opportunities, implementation of decisions reached, and oversight functions. For example, Participant A1 described strategic management experience in the following manner:My experience with strategic management best practices stems from my membership of the formation of strategies by top management decision-makingcommittee of my bank. Our staff and customers carry out the policies made in these meetings and adhere to them.The interviewed executives of the successful microfinance banks used at least one form of strategy for maintaining sustainability in their businesses, which indicated strategic management best practices as noted by Chen et al. [13]. The sustainable strategies used by the MFB executives resulted from their decision making mechanisms derived from training and exposure [14, 15]. These forms of management led to the emergence of the theme, Strategic Management.

3.2.1. Interview Question 2

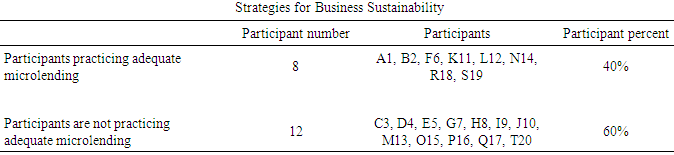

- The second interview question asked was: What strategies do you use for business sustainability? Table 1 depicts the participants practicing adequate microfinancing and those who are not practicing adequate microfinancing in their businesses. The table shows the number of participating interviewees, the participants with their coded names, and the percentage of participants with similar or dissimilar experiences in relationship to interview question 2. The table content shows the number of MFB executives with differences in their strategies to maintain sustainability in the sector.

|

3.2.1.1. Question 2 Follow-up Questions

- In contrast is an example response from one of the 60% of participants who were not adequately practicing microlending; Participant C3 described strategic business sustainability as follows: We do savings investment in commercial banks overtime to make interest to take care of our overheads. Lendingto the working poor, even the rich, is a no-go area, as they do not repay loans. We rather lease event chairs and do goods trading. From the data findings, most of the MFB executives have not mastered the use of microlending methodologies to support client demands. Microfinance customers have been collecting money and not making payments when the payments are due. Invariably the poor in Nigeria do not repay loans. Customers received the loan payments and used the loan money for household or personal use. The analysis of the data led to the emergence of the second theme, Fear of Microlending.

3.2.2. Interview Question 3

- The third interview question asked was: What are the challenges you have experienced in implementing strategic management best practices for sustainability in your microfinance bank? All 20 participants described their challenges experienced in microfinance banking as reflected in the literature review [4, 16, 7]. The microfinance challenges, as identifed by the researchers, included loan default, lack of electricity, loss of shareholders funds, and inadequacies of management. The participants also noted the high cost of operations, infrastructure deficiencies, training of staff, and low internet services. For example, Participant S19 described their microfinance banking challenges as follows: Managing people can be difficult especially in an economy like ours, when the conditions of living are so high that the poor barely survives. Still, the act of lending without collateral is also problematic because the disadvantaged does not repay their loans, but see it as government free money. However, our lending methodology helps us through these times. Other challenges we have are workers, [not] having the qualified and dedicated staff to work with us [is a problem]. Infrastructures and constant electricity have been a major problem in implementing the ATM Card and mobile money innovations. Participant O15 presented a similar description stating,“Our challenges in microfinancing were heighten by the high cost of operations, unrecovered loans, fraud, inflation, and lack of basic amenities.”100% of the interviewed executives of the successful microfinance banks had experienced challenges in their microfinance operations. The challenges have caused the failure of most MFBs in Nigeria, but the participants have managed to remain solvent and maintained sustainability in the face of the challenges. Their strategies include the formulation of new approaches that are different from the microfinancing ideology. The new strategic systems of micro commercial banking involved trading, individualized lending to big customers, cash mobilization, leasing, corporate governance, training, and exposure. The descriptions narrated by the participants’ experiences led to the emergence of the theme, Maintaining Sustainability.

4. Emergent Themes

4.1. Theme 1: Strategic Management

- Strategic management was consistent in practice among the participants. 100% of the participants participated in decision making before the execution of set goals. The described lived experiences are similar to Herepath’s (2014) description of strategic management as a process that enables decision-making, commitments from the workforce, and implementations of needed actions [17]. Strategic management actions are required for the company to attain strategic competitiveness and earn above average revenue. Likewise, Thomas and Ambrosini [18] reported that management controls are vital to strategy creation because top management shape the emergence of strategies and supports the implementation process.

4.2. Theme 2: Fear of Microlending

- Fear of microlendingwas reported by 60% of the participants stating that they complete commercial activities without microlending. The remaining 40% of the participants engage in small scale microlending with additional commercial activities to sustain their businesses.Microlending is the act of giving microcredit, which are small loans to low income earners for commercial purpose to improve their livelihood [19]. As the center of microfinance business, microcredit involves the practice of delivering social and financial services to the poor [20]. Based on the responses of the participants, the concept of fear of microlending remains severe. The findings indicate that the MFBs executives have not mastered the use of microlending methodologies to support their client demands. For example, there exist MFB customers who collected loans but failed to make repayments when due. Contrary to Yunus’s (2003) experience in Bangladesh, the poor in Nigeria do not repay loans [21]. As echoed by participant I9, the poor business owners received the loans for business, but used the monies for household or personal use and did not repay the loans.

4.3. Theme 3: Maintaining Sustainability

- All of the participants, even with obvious challenges, experienced maintaining business sustainability. Maintaining sustainability includes sustaining a business over time. Sustainability means maintaining a balanced environment and a continuous level of development or product quality, service, or progress [22]. Findings from the research revealed stability in the participant businesses, despite the deviation from the core microfinance business. All of the participants’ company strategies revolved around top manager oversight, creativity, decision-making, and implementation. 100% of the participant responses to questions 3 and 3a showed challenges that caused the failure of most MFBs, and how the solvent MFB executives managed to maintain sustainability. All of the participant responses indicated the same challenges of unrecovered loans, high turnover of staff, oversight function lapses, and fall of oil prices leading to unrealistic government policies. Also included as challenges, were the high cost of operations, fraud, inflation, lack of basic amenities such as electricity, water, and the high cost of rent. Participant H8 mentioned a weak legal structure, lack of dedicated staff, and the high cost of training. The MFB executives could maintain sustainability in the face of these challenges due to creativity in strategic change and employing constant innovations to stay in business.

5. Recommendations for Further Study

- The purpose of the study was to discover prospects of maintaining sustainability in microfinance banks in Nigeria. Management sustainable strategies with best practices were the platform of discovery, and the findings demonstrated that 100% of the study participants practice strategic management. The discovery might support sustainable maintenance for the MFB sector, but not entirely in relationship to the growth of microeconomics. To re-focus executives of Nigerian MFBs in their exclusive sector, I recommend further studies on maintaining sustainability with microfinance methodology and ideology.The focus of the MFBs in Nigeria in the banking sector will enable the achievement of the MFB goals of the social mission and financial inclusion of the active poor. In the future, researchers might use the mixed method research approach to determine the lived experiences and the influence of MFBs intervention on stakeholders business. Further recommendation is on the use of technology in MFBs and the technological benefits to Nigerian MFBs. The exploitation of technology in MFBs will support maintenance of the industry because technology usage enables lower operational costs, speedy transactions, and the prevention of fraud [23].To determine the most successful MFB model in Nigeria, future scholars might use a case study design to explore the comparison between the operations of microfinance institutions (MFIs), the Nigerian MFB practices, and the model of MFB that was imported. The assessment could improve the governmental guidelines and address poverty alleviation in Nigeria.

6. Conclusions

- The findings from the analyzed research supported strategic management best practices as an application of creative and productive structures that can develop business interest. Despite the MFB phobia against microlending, which is the core of microfinancing business, the executives of MFBscan remain solvent and maintain sustainability by formulating and implementing strategies. The fear of microlending brings to the forefront the issue of financial exclusion of the active poor. Financial exclusion signified the obstacles that prevent low income earners from accessing the financial system. The research study findings demonstrate that the exclusion of the active poor in the financial administration has increased, but not entirely due to the lack of sustainable strategies to maintain the sector. The participants’ disclosure of fear of microlending indicated the participants are unaware of recovery loan tactics. On average, the participants’ loan portfolio is over 90% unrecovered. The unrecovered loans reduced MFBs earning power and generated leader trepidation for microlending. The net result is that MFB executives changed their business strategies with 60% of the participants indulging in commercial activities instead of microlending. MFB participantstrategies involved a change from microlending when the scheme failed to micro-commercial banking. Micro-commercial banking involved dealing with commercial activities as in commercial banking or deposit banks. The described micro-commercial banking included trading, cash mobilization, leasing, lending to big companies and big customers. Thus, the MFB participants neglected the low income earners, who are the MFBs primary clients. However, some of these practices are permissible by the regulators of MFB [24]. Conversely, money realized from these practicesremains shared between the shareholders and the bank, thereby keeping the bank solvent. In conclusion, the microfinance ideology is at the evolving stage in Nigeria and has a future in the country. Nigeria’s MFB operations should have an alignment with global standards, collaborations with commercial banks, improvement of clients’ literacy, and the establishment of social change [25, 26].

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML