-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(2): 67-76

doi:10.5923/j.ijfa.20160502.01

Monetary Policy and Inflation in Nigeria

Tamunonimim Aniprirworima Ngerebo-A

Department of Banking and Finance, Faculty of Management Sciences, Rivers State University of Science and Technology, Nkpolu, Nigeria

Correspondence to: Tamunonimim Aniprirworima Ngerebo-A, Department of Banking and Finance, Faculty of Management Sciences, Rivers State University of Science and Technology, Nkpolu, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The main purpose of this study is to empirically examine the effectiveness of monetary policy in controlling inflation in Nigeria. Annual time series data, sourced from Central Bank of Nigeria (CBN) Statistical Bulletins (1985–2012) were used to analyze and estimate the three multiple regression models drawn up, with the aid of Software Package for Social Sciences (SPSS). The study modeled inflation rate in Nigerian (dependent variable) as a function of monetary policy (independent variables) made up of monetary policy rate (MPR), treasury bill rate (TBR), savings rate (SR), prime lending rate (PLR), maximum lending rate (MLR), growth of narrow money supply (M1g), growth of broad money supply (M2g), net domestic credit (NDC), net credit to government (NCG) and credit to private sector (CPS). The result shows collinearity that corresponds with the Eigenvalue condition index, and variance constants were less than 0.5. The Durbin Watson statistic shows the absence of multiple autocorrelation and negative autocorrelation, while the variance inflation factors (VIFs) indicate the absence of autocorrelation. The results show that MPR, TBR, PLR, MLR, and NDC are not statistically significant, while SR, M1g, M2g, NCG and CPS are statistically significant in explaining the changes in Inflation rate in Nigeria. The implication of this finding is that some monetary policy instruments are effective in managing inflation while others are not. We therefore recommend that contractionary monetary policy aimed at curtailing excess money in circulation should be used to moderate inflation in Nigeria.

Keywords: Monetary policy rates, Growth rates in Broad and Narrow Money, Credits, Inflation

Cite this paper: Tamunonimim Aniprirworima Ngerebo-A, Monetary Policy and Inflation in Nigeria, International Journal of Finance and Accounting , Vol. 5 No. 2, 2016, pp. 67-76. doi: 10.5923/j.ijfa.20160502.01.

Article Outline

1. Background of the Study

- Monetary policy is the summation of the economic actions taken by regulatory authorities in-charge of regulating or managing the dynamic economic variables that affect changes in the prices of goods and services and hence the value of money. Usually, these dynamic economic variables are grouped as short-term macroeconomic factors and include instruments like demand and supply of money, interest/discount rates, volume of credits, and size of deposit money institutions’ reserves. These instruments are so volatile that their regulation/management have direct implications on the price stability goals of macroeconomic authorities. Of course, it is worth noting that price generally covers the values that goods and services as well as foreign exchanges are traded. Although little emphasis is paid to deflation, most concerns of regulatory authorities have been on inflation, over time. It is against this background that this study is conducted to ascertain the veracity of the link or relationship between monetary policy and the commonly dreaded economic phenomenon called inflation. In this study therefore only three of the dimensions of monetary policy, namely interest rate, money supply and domestic credits, are considered in analyzing the relationship between monetary policy and inflation (as a parameter for price stability).Again as the controversy on the role of money supply in the control of inflation rages on between classical, Keynesian, monetary and neoclassical economists; managers and policy-makers of emerging economies are tilting towards a combination of the various postulations in managing inflation, with the main focus on inflation targeting as the guiding framework of monetary policy actions (Demchuk et al, 2012; Mukherjee and Bhatta, 2011). Inflation is an economic condition in which more money is demanded in periods of falling value of money as a result of consistent, persistent and sustained increases in the prices of goods and services. It is the economic phenomenon that describes the reduction in the purchasing power per unit of money, meaning a loss of real value in the medium of exchange and unit of account within the economy.Inflation targeting, which is an outshoot of quantity theory of money, considers the after-effect of periods of inflation, given the various stages of monetary transmission process undergone (Lyziaka et al, 2012). Under inflation targeting, movements in the monetary policy rate and short-term interest rate (ultimately in retail interest rates) form the key transmission media between monetary policy instruments and inflation, and any mismatch between the monetary and fiscal policy objectives makes price stability macroeconomic objective useless (Ezirim, 2005). For a developing economy like Nigeria, it is vital to analyze monetary policy transmission effect on inflation for several reasons, such as the determination of the appropriate channel and the effectiveness of monetary policy in managing inflation, among other reasons (Bussimis and Magginas, 2006).The dent for effectiveness of monetary policy is deepened in an underdeveloped financial market like Nigeria (Andreas, 2010). Despite the application of the monetary policy tools, inflation has continued to pose challenges to the monetary authorities. Some of the reasons include the inability of the monetary authorities to enforce compliance through the monetary channel in the banking and non-banking institutions, and fiscal imbalance characterized with expansionary fiscal policy with deficit budget (Gogor, 2011; Umeredu, 2007). Therefore this study intends to examine the effect of monetary policy in controlling inflation in Nigeria.This study is significant in that it intends to contribute to the existing body of knowledge, given the fact that is commonly said the monetary policies are part of the governance rituals and that they only below-average income earners, is the reason for poor industrialization of Nigeria as a result of the stringent credit policies of banks and other financial institutions, and the unpredictability of the Nigerian economy.

1.1. Research Hypotheses

- HO1: There is no significant relationship between interest rate and inflation rate in Nigeria. HO2: There is no significant relationship between money supply and inflation rate in Nigeria. HO3: There is no significant relationship between domestic credit and inflation rate in Nigeria.

2. Review of Related Literature

2.1. Theories of Inflation

- Monetary economic theories postulate that an increase in the quantity of, or the velocity of, money supply higher than the rate of growth of outputs results in inflation. They therefore claimed that in order to control inflation, monetary policies must be used (Adalid and Detken, 2007, Barro & Grilli, 1994; Makin, 2010). This is contrary to the claims of the Keynesians, who assert that inflation is the result of pressures in the economy expressing themselves in prices, and that these pressures have no direct relationship with money supply. The Keynesians therefore claim that the causes of inflation can mainly be attributed to fiscal changes, which they list into three main groups namely cost-push factors, demand-pull factors and built-in or adaptive expectation factors. These three groups of factors are commonly referred to as triangular model or three types of inflation (Gordon, 1988; O’Sullivan, 2002; Sheffrin, 2003). According to the Keynesians, increased private and government spending, natural disasters, or increased prices of inputs, and price/wage spiral are the causes of inflation. However, Ezirim (2005) has shown with the aid of econometrics that monetary factors cause inflation in emerging markets like Nigeria. This is in agreement with the monetary theory school of thought, whether the inflation is money inflation or price inflation. The underpinning assertion is that monetary policies influence price inflation (hereafter referred to as inflation) by influencing the financial conditions existing in the economy. These financial conditions (savings, deposits, investments, lending / borrowing, conservation/spending of incomes, and proportion of funds meant for effecting demand for goods and services) adjust to the various rates charged or permitted by regulatory authorities for the movement/usage of funds. The monetary authorities, especially the Central Bank of any country, use their regulatory tools to influence the availability of money in the economy through the various banks and financial institutions. The size of money available for people to use for the demand for goods and services is what the monetarists refer to as the Quantity of Money, hence the Quantity Theory of Money. Since most banking activities are short-term in nature, the deposit and lending activities will eventually affect the long-term economic activities.The link between the short-run (monetary) and the long-run (fiscal) factors influencing inflation can be explained using the Fisher’s Effect. By this theory/effect, as propounded by Irving Fisher, inflation has a link between real and nominal interest rates. Real interest rate refers to the long-run, while nominal interest rate refers the short-run. Production and aggregate supply and demand for goods and services are long-run economic activities which respond to all adjustments of the short-run economic activities. Accordingly, the Fisher’s Effect states that real interest rate equals nominal interest rate minus expected inflation rate. By this therefore, real interest rate increases as inflation rate declines (holding nominal interest rate constant), unless the rate of increase in inflation and nominal interest rate are equal (Investopedia, 2014). The underlining factor in the Fisher’s Effect or Hypothesis in linking the Keynesian and Monetary theories of inflation is interest rate. This is why various elements or parameters were adopted in this study as measures of independent variables (monetary policy) so as to enrich an investigation on the influence of each of these parameters on inflation. But this study was short of stating the disintegrated form of monetary policy such as to show which of the monetary policy tools cause inflation most and therefore should be the focal point in the control of inflation in such markets. This therefore forms the basis for this study.

2.2. Monetarism, Money and Inflation

- One of the major features of monetarism is its focus on the long-run supply-side properties of the economy, described as the quantity theory of money and the Neutrality (independence of level of money supply) or Superneutrality (independence of growth rate of money supply) in the long-run, based on the concept of neutrality of money. The Quantity Theory of Money linked inflation and economic growth by simply equating the total amount of spending in the economy to the total amount of money in existence (Aksoy et al, 2009) and also suggests that control in the money supply will help in the fight against inflation. This theory also empirically links money and inflation (Svensson, 2003; Grauwe and Polan, 2005; Beck and Wieland, 2010). Friedman proposed that inflation is the product of an increase in the supply or velocity of money at a rate greater than the rate of growth in the economy. Friedman also challenged the concept of the Phillips Curve. His argument was premised on an economy where the cost of everything doubles and where individuals have to pay twice as much for goods and services, because their wages are also twice as large. By this inflation would be harmless.In summary, Monetarism suggests that in the long-run, prices are mainly affected by the growth rate in money, while having no real effect on economic growth. If the growth in the money supply is higher than the economic growth rate, inflation will result (Assenmacher and Gerlach, 2006).

2.3. Monetary Policy and Inflation – A Review of Empirical Research

- Empirical studies on the relationship between money, monetary policies and inflationary processes have been conducted using both the new Keynesian economics and the monetarist theories, by applying monetary or credit aggregates, consumer price index (CPI), and the quantity theory of money. For instance, Bernanke (2006) tested the quantity theory of money on data from the United States (1961-1988), shows that there is a significant relationship between price changes and changes in the quantity of money at a constant. This confirms the assertion that in countries with high inflation, an increase in the quantity of money has more than a proportional effect on inflation and a negligible impact on GDP growth, thus showing a positive correlation between changes in the quantity of money and changes in the velocity of money.Many studies based on the expanded standard new-Keynesian model with the money demand equation and a monetary adjustment in the central bank's reaction function, weight of the monetary adjustment on the basis of actual data, distribution of revisions of the output gap estimates or the monetary cross-check to the central bank reaction function, (Beyer, 2009; Berg et al, 2010; Beck and Wieland, 2010, Sirchenko, 2008). The closest to the Nigerian study was that of three African countries (Ghana, Uganda, and Tanzania) with a relatively low inflation, which have been implementing inflation targeting since 2004, in addition to estimating the. It was found that in Uganda and Tanzania, the optimum weight of the monetary adjustment is similar to the weight estimated on the basis of actual data. In Ghana, where the optimum weight of the monetary component was much higher than estimated, the results of inflation targeting could have been better if the Central Bank had paid more attention to monetary aggregates.

3. Research Design

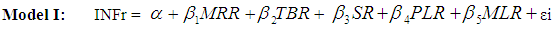

- This study used the quasi-experimental research design, by combining theoretical consideration (a prior criterion), and empirical observations in analyzing the effects of predictor variables on the criterion variables (Juselius, 2006). It used secondary data from Central Bank of Nigeria Statistical Bulletin and Economic Review for various years and E-view multiple regression method of data analysis and test of hypotheses.

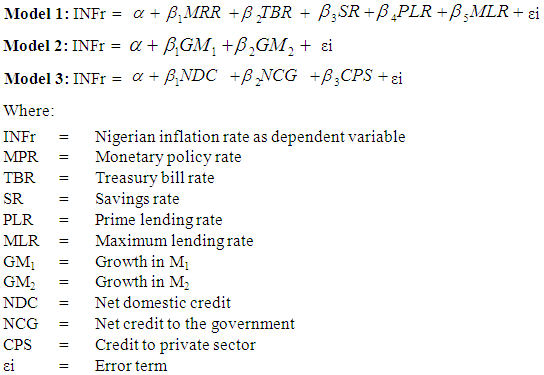

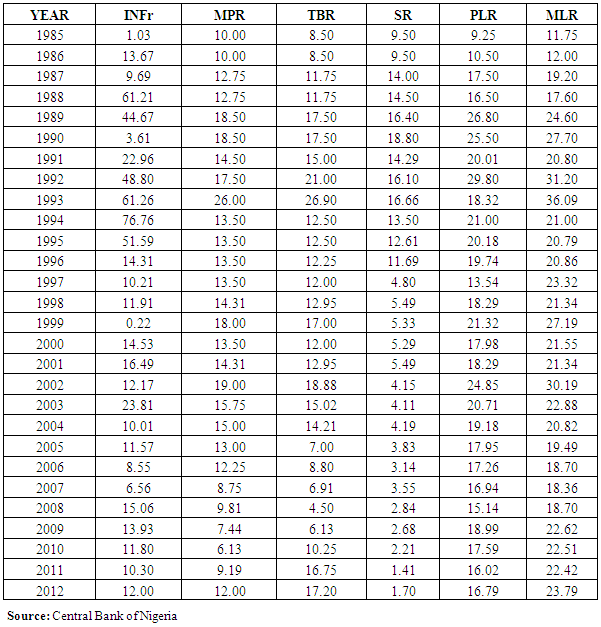

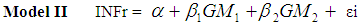

3.1. Model Specification

4. Results and Discussion

4.1. Colinearity and Autocorrelation Test

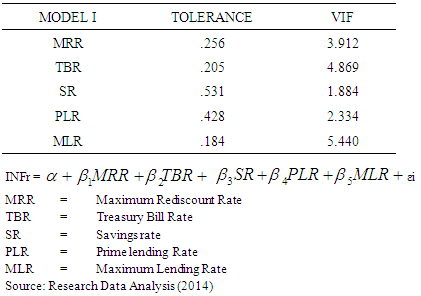

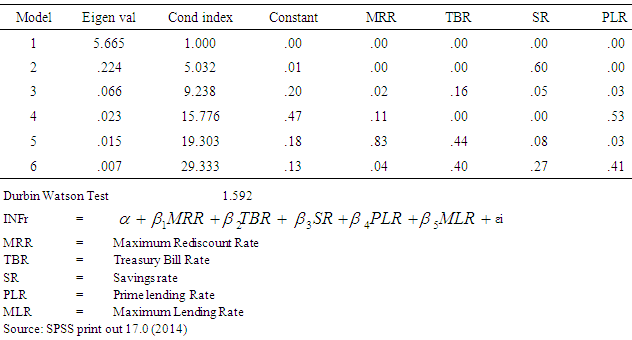

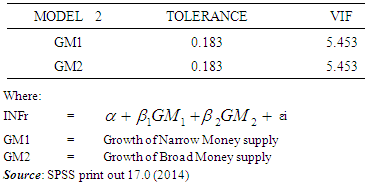

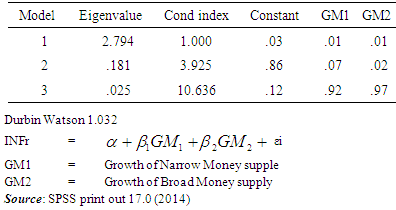

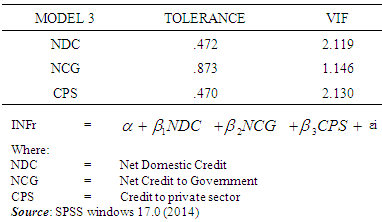

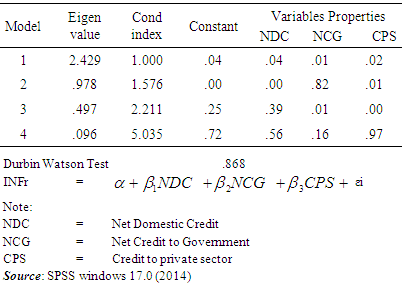

- Table 4.1 shows the tolerance Value results and variance inflation factors of the variables in the model. The tolerance values are less than 1.00 but above 0.1 for all the variables examined in the model with respect to inflation. This is contrary to the traditional level and the rule of thumb which is contrary to testing the multicolinearity on the tolerance. The variance inflation factor result shows that only maximum lending rate satisfy the rule of being above 5.0 but less than 10.0 while other variables in the model are less than 5.0 and 10.0 as the conventional rule of thumb.

|

|

|

|

|

|

|

|

|

|

|

|

4.2. Summary of Findings

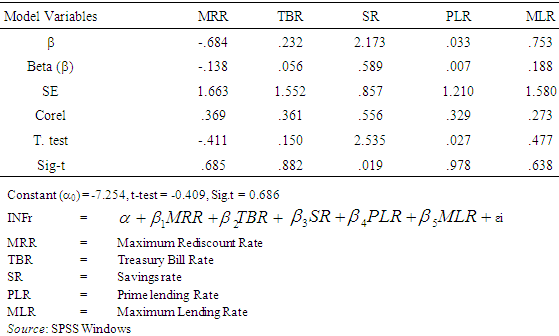

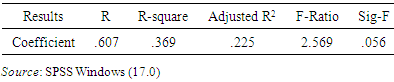

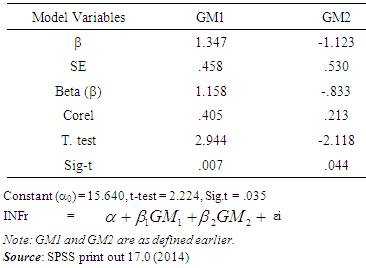

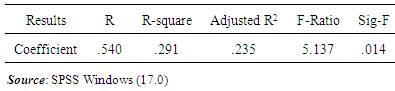

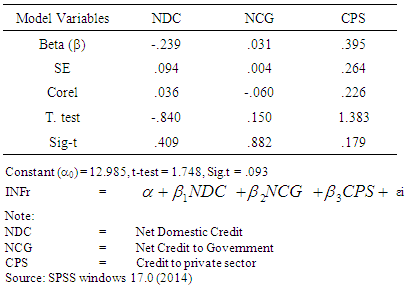

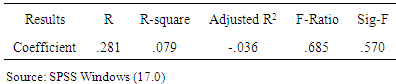

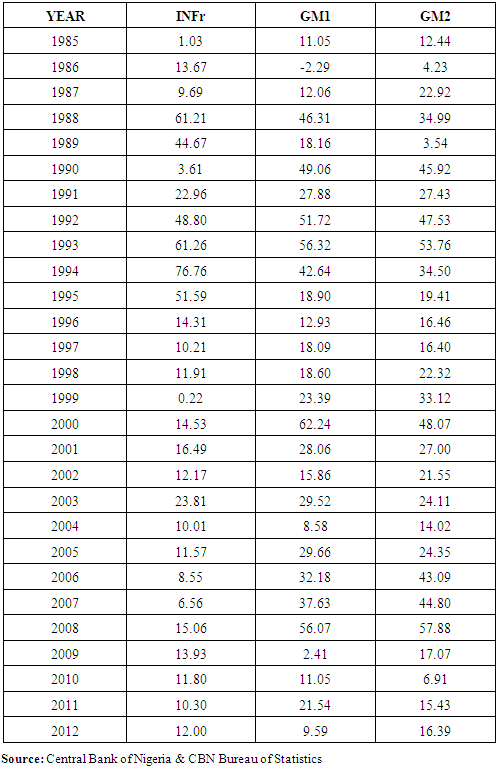

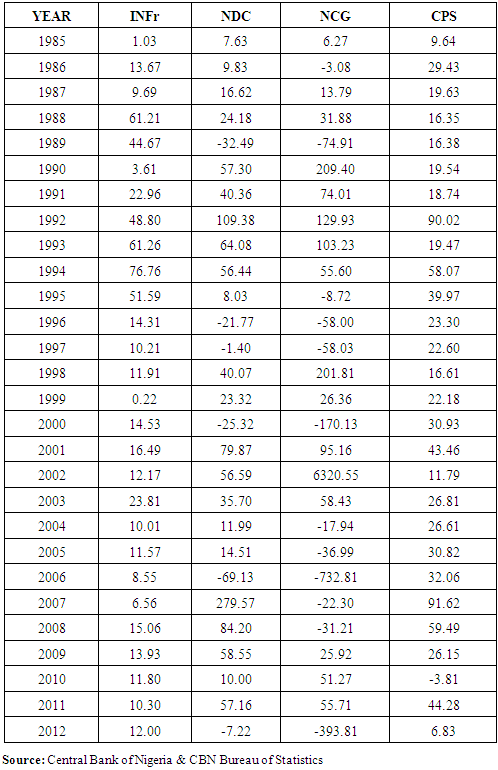

- The study found that:1. Minimum rediscount rate has negative effect on Nigerian inflation rate, while treasury bill rate, savings rate, prime lending rate and maximum lending rate are positively related to Nigerian inflation rate in agreement with the findings of Gogor (2011); and that all the variables are statistically not significant except savings, hence we accept HO1. 2. Growth of narrow money supply (M1) is positively related to Nigerian inflation rate while broad money supply (M2) is negatively related to Nigerian inflation rate; and that the variables are statistically significant in explaining Nigerian inflation rate, in agreement with the apriori expectation (Bedford et al, 2009; Bernanke, 2006; Dai, 2010), though only 29.1% variation in inflation rate can be traced to the variables in the model 2. Thus we reject HO2.3. Net domestic credit has negative effect on Nigerian inflation rate while net credit to government and credit to private sector have positive effects on Nigerian inflation rate, while the variables are statistically not significant. The R2 and the adjusted R2 indicate that 7.9% and -3.6% variations in inflation rate can be traced to the variables in the model, hence we accept HO3.

5. Conclusions

- We conclude that:1. Minimum rediscount rate has negative and insignificant effect on Nigerian inflation rate.2. Treasury bill rate has positive and insignificant effect on Nigerian inflation rate.3. Savings rate impact positively and significantly on Nigerian inflation rate.4. Prime lending rate impact positively on Nigerian inflation rate.5. Maximum lending rate has positive effect on Nigerian inflation rate.6. Narrow money supply impact positively and significantly on Nigerian inflation rate.7. Broad money supply impact negatively to Nigerian inflation rate.8. Net domestic credit impact negatively to Nigerian inflation rate.9. Net credit to government has positive effect on Nigerian inflation rate.10. Credit to private sector has positive effect on Nigerian inflation rate.

5.1. Recommendations

- 1. There should be effective monetary policy management to achieve the objective of price stability.2. Treasury bills and treasury certificate should properly be used to achieve low inflation in Nigeria.3. The monetary policy instruments should be applied properly and timely to achieve low inflation.4. The domestic money market instruments should well be applied and integrated with the monetary policy objective of price stability.5. The monetary authority should device improved measures of managing the monetary policy to achieve price stability.6. There should be contractionary monetary policy that will constrain excess money in circulation to achieve low inflation.7. Domestic credit should be directed towards the productive sectors of the economy to avoid too much money in circulation that will lead to inflation.8. Credit to government should properly be managed to avoid excess money in circulation.9. Credit to private sector should properly be guided and directed to avoid excess money in circulation that will lead to inflation.10. More policies should be applied to control inflation in Nigeria.11. The domestic financial market should be well structured and the policies reformed for effective implementation of monetary policy to achieve price stability.

Appendix 1

Appendix 2

Appendix 3

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML