-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(1): 46-53

doi:10.5923/j.ijfa.20160501.06

Theoretical Aspects Underpinning Public Sector Audit and Financial Accountability in Tanzanian Local Government Authorities (LGAs)

Flavianus Benedicto Ng’eni1, 2

1Department of Commerce and Business Administration, Acharya Nagarjuna University (ANU), India

2Institute of Finance Management (IFM), Dar Es Salaam, Tanzania

Correspondence to: Flavianus Benedicto Ng’eni, Department of Commerce and Business Administration, Acharya Nagarjuna University (ANU), India.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Local government authorities play significant roles in the provision of public social services at the local level. It is very important to recognize the contribution of local government reforms in Tanzania which aimed to strengthening operations of local governments particularly in the area of financial management. Financial management is very crucial for the prosperity of any organization but it is particularly important in the public sector organizations due to the nature of their operations and inherent perception of public resources’ ownership. The main objective of the study is to assess the role of auditing in enhancing public financial accountability at local government authorities. The study has conducted thorough analysis on how auditing contributes to the success of financial accountability which assures proper use of public funds. Conclusively, the study has alarmed on how independence of Controller and Auditor General (CAG) need to be maintained in order to enable his office to work independently without any due influence from either parts. Following this contention, the study advice policy and decision makers to rethink on the proper way of enabling National Audit Office of Tanzania (NAOT) to work strongly, diligently and prudently for the betterment of the National.

Keywords: Public Sector Audit, Auditing, Financial Accountability, Local Government Authority

Cite this paper: Flavianus Benedicto Ng’eni, Theoretical Aspects Underpinning Public Sector Audit and Financial Accountability in Tanzanian Local Government Authorities (LGAs), International Journal of Finance and Accounting , Vol. 5 No. 1, 2016, pp. 46-53. doi: 10.5923/j.ijfa.20160501.06.

Article Outline

1. Introduction

- Local Government reform programmes continue to be a dominant agenda of public sector governance and public financial management in particular. The main objective of these reforms includes the transfer of administrative, political and financial responsibilities to Local Government Authorities (LGAs) as famously known as decentralization. It is noteworthy that, of all local governance reforms aspects fiscal decentralization (transfer of financial responsibilities from central government to sub-central government) is of specific importance. Of recent, developing countries have been evolving in this move to enhance local fiscal autonomy and transparency in which public sectors are challenged to install strong financial management that will help to link autonomy and transparency with available resources for the provision of public social services. Subsequent to this governance revolution; policy makers, decision makers and researcher are increasingly focusing on assessing the impact of local governance reforms on the financial management with special attention on accountability. “The Local Government Authorities have a wide range of responsibilities for the provision of essential services and good governance for the citizens of their area of jurisdiction. In order to fulfill these responsibilities, they have to collect revenues through taxes, licenses, fees and other sources. In this respect, sound financial management system is crucial to ensure that revenues are properly collected and used for intended purposes and yields the maximum benefits to the public”(CAG Report1 2012/2013 p 20). The proper mechanism that can help to safeguard public resources is financial accountability, which held those entrusted with public resources responsible in mobilizing, spending and even financial decisions they make. According to Lane (2008) financial accountability can be assessed through four variables namely; comprehensiveness and transparency budget framework and practices, accounting records and reporting and external scrutiny and audit. Auditing is very important and plays vital roles in strengthening financial accountability in public sector organizations (Gendron et al, 2001). Public sector audit provides key mechanisms in which financial accountability is enforced within public sector organizations (Gideon and Tawanda, 2012). It helps to build the culture of accountability, integrity, legitimacy and value for money for all public development projects. In their studies; Ijeoma and Nwufo (2015); Gideon and Tawanda (2012) point out that public sector audit is very important although audit recommendations are not dealt seriously by the responsible management. Furthermore, their results revealed that there is a need to update legal and regulatory frameworks in order to strengthen the independence and operations of the Controller and Auditor General. Additionally, Zinyama (2013) revealed poor appointment procedures for Controller and Auditor General (CAG) in Zimbabwe. These poor procedures of appointment in one way or other can harm CAG independence and thus affects his constitutional obligations of controlling and auditing public revenues and expenditure. As such, poor appointment procedures might contribute to the failure of financial accountability in the public sector financial management. Notwithstanding, Odia (2014) points out that Supreme Audit Institutions (SAIs) is very important in achieving public accountability in Nigeria, however he stresses on strengthening of the legislature oversight and institutional capacity building. Likewise, in assessing public sector audit as an effective tool of enforcing accountability, Okara and Okafor (2011) found that insufficient independence of SAIs, limited accounting environment and lack of capacity inhibit institutions in fulfilling audit responsibilities. Also, community based organizations and NGOs are in front line to ensure proper use of public funds, fighting against corruption and extravagant. Sikika (2011) unveils that public sector audit is not only imperative for the organization but also for the general public simply because it assures effective and efficiency use of public funds. The importance of public sector audit should not be overemphasized, for example in 2012 Tanzanian CAG report enforced President to sack six ministers due to rampant misuse of public funds. “Announcing the cabinet reshuffle, President Kikwete said that accountability would be taken seriously and ministers’ subordinates and even executives working for state-owned companies would also be held responsible over any embezzlement”2. Following notable roles of public sector audit, Horgan et al (2012) argue that audit activities need to be organized suitably and have broad mandate to enhance proper use of public resources. Public sector audit need to be empowered to act with integrity and produce reliable services and enhancing financial accountability among public officials. It is indisputable fact that financial accountability plays a pivotal role in public sector financial management. This study therefore aims to explore the existing studies which link auditing practices with the financial accountability and makes an assessment of the roles played by auditing in enhancing public financial accountability in public sector. The study is of paramount usefulness to policy makers, decision makers and other stakeholders of public sector financial management. The rest of this paper is organized as follows; data and methodology; Auditing and Financial accountability explaining the key aspects; Auditing and Accountability, Financial Accountability (Significance of Accountability); The role of Auditing and Financial Accountability (Tanzania); Legal Framework of Auditing in Tanzania, The role of Auditing and Accountability in General and in Tanzania, The Challenges of Public Sector Audit in Tanzania and the last part is Concluding Remarks.

2. Data and Methodology

- This is a desktop studying which considers published and unpublished materials. Also the study has made use of library services in undertaking this theoretical study. In undertaking this study authors conducted a rigorous literature review including the use of library and e-Journals. The paper is thus purely based on desktop and library research methodology. In this regard various journals and research papers and paper articles germane to public sector auditing and financial accountability have been surveyed extremely in undertaking this study. Also, the study has surveyed in greater detail all legal frameworks which govern the whole work of public sector audit and accountability in Tanzanian context.

3. Auditing and Financial Accountability; Explaining Key Aspects

3.1. Auditing and Accountability

- Auditing can be explained as an assessment of accounting transactions and records with an idea of ascertaining accuracy and compliance with relevant statutory provisions, accounting standards, professional pronouncements and the organization policies (Badara, 2012). Also, Domingues, Sampaio and Arezes (2011) expound auditing as a systematic and independent process which works under documented process for obtaining audit evidence to enable auditors to form opinion on whether presented financial statements show true and fair view. Generally, auditing is an examination of financial statements to ensure that they conform to reporting framework and policies and works objectively to determine the extent to which the identified audit standards are fulfilled and observed. Auditing plays a pivotal role in the overall mechanism of public financial management. Correspondingly, Wang and Rakner (2005) opined that the International Organization of Supreme Audit authenticates that auditing is performed in order to ensure proper and effective use of public funds, and proper execution of administrative activities. In effect, it facilitates a soft flow of information to government authorities and general public through the publication of objective report. Salawu and Agbeja (2007) explain that public audit is applicable to all public sector organizations and as such it is relatively widespread from verifying accounts to assessment of value for money to include; Economy, efficiency and effectiveness (3Es). For economy element, value for money is achieved by minimizing cost (aiming to provide quality public services at minimum cost) whereas efficiency is realized by ensuring that objectives are achieved with minimum reasonable effort and effectiveness, value for money is achieved by ensuring that all objectives planned are achieved at the right time. Proper audit therefore plays significant roles in promoting accountability and ensuring the best use of public money by providing credibility to the information obtained from management through impartially obtained and assessed supporting evidence (Salawu and Agbeja (2007); Ijeoma and Nwufo (2015)). In recent years, the concept of auditing has experienced some operational changes from traditional to performance audit, the later focus on the outcomes as compared to the traditional which places strong emphasis on inputs. The concept of auditing has evolved within the context of rapidly changing political and economic conditions which raise a number of questions on the proper roles of government and public management (Khemakhe, 2001). In many countries, particularly for developed countries, auditing organizations have moved beyond simple financial accounting audit which bases on the historical papers facts to engage in (performance audit) efficiency and effectiveness auditing (World Bank, 2007). Auditing of government accounts is very fundamental for ensuring effective and efficient stewardship reporting for public accounting officials (Onatuyeh and Aniefor, 2013) and enhancing credibility and integrity of public finance and related administration (Santiaso, 2006). It is undeniable fact that auditing mechanisms enforce public officials entrusted with the public resources to account for what they have done with public resources, giving explanation on how they have conformed to budget guidelines and accounting rules and regulations. Public Sector audit is thus critical for effective financial accountability mechanisms regarding implementation of public budget and in ensuring value for money. No one can disregard notable roles played by public sector audit under the office of Controller and Auditor General, however, the conduct of the audit activities need to change from traditional audit (reports based) to performance audit which concentrates on the value for money rather than auditing documents and books of accounts only.

3.2. Financial Accountability and Financial Management; Significance of Accountability

- Most developing countries have experienced governance reforms in public sector management. One of the major reforms is decentralization which entails transfer of fiscal responsibilities to sub-national governments. Transfer of fiscal affairs to lower level of government requires strong and sound financial management due to fiscal autonomy in both revenues and public expenditure (Renyan et al, 2012). No doubt that sub-national government is obliged to create internal control mechanism that can help and ensure proper use of public money as documented in the budgets. In this aspect, sub-national governments need to institute a sound financial accountability leading to efficient and effective use of public fund (Yilmaz, Beris and Berthet; 2008). The important principles of local governance in the area of local government financial management are transparency and accountability (Djatmiat et al (2014); Rahman (2014). Bowrey (2007) argues that the proper means of discharging financial accountability is transparency. In any sub-national government, financial management is prompted and strappingly promoted by financial accountability and effective local governance. “Financial accountability concerns tracking and reporting on, allocation, disbursement and utilization of financial resources, using tools of auditing, budgeting and accounting” (Brinkerhoff, 2004 p.3). Also, financial accountability is explained as a concept originated from financial accounting which involves ability to give explanations and stewardship to the public for those entrusted in handling public finance (Sanni and Osemene (2012); World Bank(2001); Rabrenovic (2009)). Financial accountability gives assurance for the efficient and effective manner of utilizing public funds and report on the stewardship. Financial accountability places emphasis on responsiveness and productive use of public fund (Rabrenovic (2009); Akpanuko and Asongwa (2013)). Adeyemi et al (2012) also pointed out that financial accountability ensures strong control on receipts and expenditure of public funds. There is a behavior of misusing public funds intentionally with the idea that nobody cares or nobody own them, are just for public. As a matter of this bad tendency, something needs to be done for those who deal with public fund to enforce them to be accountable and adhering to rules and regulations and also held them responsible for financial decisions they make (Fatemi and Behmanesh, 2012). The fundamental objective of improved accountability is to identify, punish and rectify anything done inappropriate on public resources (Hedger and Blick, 2008). The basic idea here is how to build financial accountability internally. Nevertheless, it should be noted that accountability helps to secure improvements in the service delivery for ensuring efficiency effectiveness in committing public funds. Financial accountability in public sector can be discussed on the internal operational mechanism of sub-national governments as well as external environment. Internal Financial accountability mechanism can be created by enforcing rules, regulations and accounting rules that govern local budget and financial issues within the local government. Also internal financial accountability mechanism can be created and enforced by internal auditing and external auditing. Again, we can think about external financial accountability which can be enforced by citizens by demanding transparency and participation in all public financial issues including planning and budgeting. Also, we can think about the roles plays by Non Governmental Organization (NGO) in demanding transparency and proper use of public funds in servicing citizens (Lawrence and Nezhad, 2009). The behavior of demanding transparency in public sector operations helps to enhance financial accountability. As a result, financial accountability enforces those entrusted with public fund to use them diligently in providing public social services. Conclusively, the ultimate goal of financial accountability is legitimacy and efficiency in using public resources for the provision of public services (Wang, 2002).

4. The Role of Auditing and Financial Accountability (Tanzania)

4.1. Legal Framework of Public Sector Audit in Tanzanian LGAs

- The public sector audit in Tanzania Local Government Authorities is coordinated and controlled by the National Audit Office of Tanzania (NAOT). NAOT has offices in all twenty six regional of Tanzania mainland. The NAOT is headed by the Controller and Auditor General (CAG) who is a presidential appointee and operating in zones managed by Deputy Controller and Auditor General (DCAGs) to enhance auditing in all geographical areas of Tanzania. The responsibilities of Controller and Auditor General are mandated by the Constitution of the United Republic of Tanzania (URT) of 1977. Sections 143 (2) of the Constitution of the URT states clearly the audit mandate and responsibilities of Controller and Auditor General; (a) CAG shall ensure that the use of any moneys proposed to be paid out of the Consolidated Fund has been authorized and that the funds shall be paid out in accordance with the provisions of Article 136 of the Constitution and where he is satisfied that those provisions shall be duly complied with, then he shall authorize payment of such moneys that the use of any fund proposed to be paid (b) Also CAG shall ensure that all the moneys the payment of which has been authorized to be charged on the Consolidated Fund of the Government of the Untied Republic, or the moneys the use of which has been authorized by a law enacted by Parliament and which have been spent, have been applied to the purposes connected with the use of such moneys and that such expenditure has been incurred in accordance with the authorization for such expenditure; and (c) CAG is required by law to give audit report in respect of the Government at least once every year. In additional to the constitutional role of CAG, Local Government Finance Act of 1982 section 45(1) states clearly that the external auditor of all local government authorities shall be Controller and Auditor General. The existence of legal framework which governs audit responsibilities of public sector organizations through National Audit office of Tanzania helps to improve public financial management. Further to the above legal provisions of public sector auditing in Tanzania, Public Audit act of 2008, Public Finance Act of 2004, Public Audit Regulations, Standing Orders for Public service of 2009 and Government circulars give the NAOT mandate regarding public finance audit. All these legal provisions intend to strengthen the operational efficiency of public sector audit given its importance and critical role in ensuring public revenues and expenditure are accounted in full. Public sector audit is the main catalyst for economic growth and takes part directly on improving citizens’ welfare by ensuring proper use of public funds (Sikika, 2011). In effect, through public sector audit, Government can be assured that development projects are undertaken by taking into account the operational efficiency and effectiveness. Generally speaking public sector audit can be seen as a cornerstone for effective public financial management particularly when the recommendations are taken seriously by the management in charge. In Contrast if audit recommendations are ignored through induced political motives then public sector audit becomes meaningless and merely a show event of compliance. This follows the call by CAG report (2013/14) which urges the Government that more effort is needed in order to ensure all audit recommendations are attended to enhance performance and financial accountability of Tanzanian LGAs.

4.2. The Role of Auditing and Accountability in General and in Tanzania

- Public sector audit plays important roles in the overall process of achieving local governments’ objectives of providing quality health services, education, infrastructure, water services and sanitation services. This corroborate the main objective of auditing which is to ensure that public funds are provided and spent in accordance with approved budgets and in accordance with financial regulations. The Controller and Auditor General (CAG) through National Audit Offices of Tanzania are mandated and fully responsible for the public sector auditing including local government authorities. In analyzing auditing as an instrument for improving organization’s operating efficiency in Tanzania Local Governments (Tulli 2014) found that auditing has a considerable role to play in ensuring Local Government’s objectives are achieved effectively and efficiently. It was further revealed that the working relationship between Local Authority Audit Committee (LAAC) and external auditors functions help to enhance local government officials’ accountability. The performance audit which focuses on the economic, efficiency and effectiveness (value for money audit) to public sector can indeed help to improve and promote public financial accountability (Odia (2014); Agbo and Aruomoaghe (2014)). Financial accountability places major emphasis on the proper use of public resources and ensuring optimization of public services. Tanzanian Local Government Authorities (LGAs) have full autonomy on political issues, fiscal issues and administrative issues. Fiscal responsibilities which is about mobilizing revenues and spending responsibilities (Kokor, 2003) create an operational environment which requires strong financial management. Budget transparency and financial accountability play important roles in safeguarding financial integrity and improve financial discipline in public financial management in general and public spending in particular (Santiaso, 2006). Auditing enforces public sector to be more accountable to the needs of the citizens and direct all efforts to achieve true development and reduce corruptions. Further; Power (1997) as cited by Gendro, Cooper and Townley (2001) points out that auditing is a crucial component of modernist conception of accountability simply because it is the informational legitimacy on which formal financial accountability is focused. Public sector audit as a cornerstone of good governance helps organizations to enhance accountability through promoting integrity, improving operations and building confidence among citizens and stakeholders (Horgan et al, 2012). However, enhanced accountability can be achieved provided that public sector audit focuses on those possessing authority and responsibility (McCulloch, 1998).Effective and sound financial management systems are powerful instruments for preventing, discovering and facilitating punishments of fraud and corruptions (Langloi, Beschel and Stapenhurst; 1998). It is irrefutably fact that audit mechanisms can help to assess all components of financial accountability such as internal control, reporting of financial resources, budgeting practices guidelines, risk management and procurement practices (Muhammed 2014). It worthy note that in order to curb corruption and to focus on the efficiency and effectiveness in public sector operations, it is strongly encouraged to attach performance management in the auditing and accounting organization of public sector for ensuring greater financial accountability (World Bank, 2007). It is very important to note that the role of SAIs as a watchdog in most developing countries is limited due to financial and skills, lack of independence and poor communication flow among key stakeholders (Ramkumar and Krafchik, 2005), however its importance is indisputably. In effect, public sector audit helps to strengthen the general mechanism of financial accountability and ensuring its enforcement on the public organizations including local government authorities (Gideon and Tawanda; 2012). Public sector audit (financial audit) is strongly dedicated to ensure that systems of accounting and financial control operate in an efficient manner and also to guarantee that all transactions are properly authorized and recorded in the books of accounts (Zinyama; 2013). Also, Adagye and Nuhu (2015) opined that relevant agencies should ensure public funds are spent diligently and are properly authorized in order to enhance financial accountability. Financial accountability encompasses financial reporting framework, strong mechanism of internal control, budgeting practices and auditing. It is clear and irrefutable fact that public sector audit plays important roles in the prosperity of the general community at large.Twaweza (2011) in their study regarding auditing in Tanzania revealed that Local Government Authorities (LGAs) needs to establish strong mechanisms in order to ensure implementation of audit recommendations with a view of improving financial accountability. It was then suggested that LGA management teams and all other actors who take part directly in supervising LGAs such as LAAC need to work strappingly in order to accomplish the objectives of the financial audit in LGAs. The study revealed the importance of auditing by questing LGAs and other stakeholders that if audit findings are ignored why auditing. This statement unveils some weaknesses in responding to audit queries and implementing audit recommendations (findings). Furthermore; Mzenzi and Gaspar (2015) assessed the relevance of external auditing on accountability in the Tanzanian local government authorities (LGAs). The authors concentrated on the external audit reports for the past ten years with a view of examining its contributions to the local government financial accountability. The study revealed that external auditing is very important and contributes much on improving accountability in LGAs. They assert that accountability remains a strong attribute of financial management in public sector. Sincerely, there is limited literature on public sector auditing and accountability in Tanzania; however, these few studies present notable roles played by public sector auditing in enhancing financial accountability in Tanzania local government authorities.

4.3. Challenges of Public Sector Audit in Tanzania

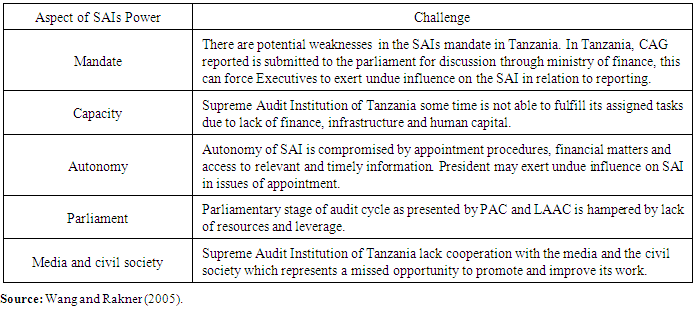

- Public sector Auditing is headed by Controller and Auditor General through National Audit Office of Tanzania (NAOT). NAOT has full mandate in auditing Local Governments, Public Authorities, Central Governments, National Accounts and also responsible for Performance and specialized Audit. The main challenges facing public sector auditing in Tanzania can be explored by considering three main factors such as mandate, autonomy and technical capacity of Controller and Auditor General Office (Wang and Rakner 2005). These challenges in one way or another might intimidate the Supreme Audit Institutions in fulfilling their obligations of controlling and auditing public revenues and expenditure. Supreme Audit Institutions of Tanzania has key roles of assuring general public about the proper use of public funds and aligning plans with the approved budget. According to Wang and Rakner (2005), executive dominance in reporting procedures of audit report is a particular threat for Supreme Audit Institutions in Tanzania. CAG report is submitted to the parliament through ministry of finance but before submitting audit report to the parliament it should be submitted to the President of the United Republic of Tanzania. In this reporting case, Executives might exert undue influence and hence threaten the independence of Supreme Audit Institution of Tanzania. Another challenge observed which can hamper NAOT to fulfill its obligations is due to lack of finance, infrastructure and human capacity. Tanzania’s National Audit Office independence may be compromised by lack of autonomy in relation to the appointment of the Controller and Auditor General (CAG). In Tanzania, CAG is appointed by the President of the United Republic and there is no need to be approved by the parliament which can potentially threaten CAG independence. Lawson and Rakner (2005) point out that there is a delay when audit is carried out and reported to the parliament and tabling recommendations raised by the audit report. These delays prevent Public Audit Committee (PAC) and Local Authority Audit Committee (LAAC) to work conscientiously on the recommendations of the CAG report.

|

5. Concluding Remarks

- The study explores and presents theoretical aspects of auditing practices in Tanzanian local governments and its roles in sound financial management using desktop methodology. The study reveals that public sector auditing under NAOT is critical to effective, sound financial management in general and financial accountability in particular. Public sector auditing focuses on the conformity for the established budget guidelines, financial regulations and other financial rules. It assesses the efficient use of public finances and ensures adhering to laid down rules and regulations. There are some legal provisions and frameworks which control the acts of public official in utilizing public resources, such documents are Local Government Finance Act of 1982 and its subsequent amendments, Local Government Accounting Manual and Local Authority Financial Memorandum of 1997. Accountability and transparency in the management of public resources are the powerful means for preventing, discovering of fraud and corruption in service delivery. To put this system in place, accountability is inevitable in organizations and staffing of local resources administration together with effective auditing systems and good budgetary procedures. It is hoped that, public audit can further extend its roles to enhancing public financial accountability apart from assessing conformity to guidelines. It is the time now for public sector audit to put much emphasis on value for money audit (performance audit). This type of audit can enable public sector to focus on both inputs and outcomes which advocates economy, efficiency and effectiveness in utilizing public resources for the provision of public social services and also for the betterment of social welfare.Also the study unveils the main challenges of the public sector auditing in Tanzania which in one way or other might interfere during fulfilling audit responsibilities such as independence, resources and its mandate. Public sector audit is very crucial in the whole mechanism of safeguarding public recourses to ensure proper provision of social services to the citizens, however, these challenges can hinder NAOT from fulfilling responsibilities of serving the general public. The main challenges observed concerning with CAG office is about its autonomy and mandate. According to the United Republic of Tanzania Constitution of 1977 Section 143 (4), after completing his annual audit report, CAG is required to submit audit report to the President of the United Republic of Tanzania and the President will cause the report to be presented to the national assembly for discussion and other directives. Author’s suggestion in this point is that, the annual audit report needs to be presented directly to the national assembly for discussion and further actions; however this case needs constitutional amendments and review of other regulations which govern the operational activities of CAG. The results from review imply that the importance of auditing cannot be overemphasized and that its role is critical for effective provision and improving public service delivery.

Notes

- 1. Controller and Auditor General Audit Report for Tanzanian Local Government Authorities for the financial year 2012/20132. http://www.bbc.com/news/world-africa-17957767; accessed on 10-12-2015

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML