-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(1): 27-36

doi:10.5923/j.ijfa.20160501.04

Determinants of Bank Lending: Case of Tunisia

Mohamed Aymen Ben Moussa, Hedfi Chedia

Faculty of Economics Sciences and Management of Tunis, Tunisia

Correspondence to: Mohamed Aymen Ben Moussa, Faculty of Economics Sciences and Management of Tunis, Tunisia.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Bank loans represent a source of income for banks. Indeed, the main purpose of financial intermediation of banks is to grant a profitable loans. In the context of this article, we studied the internal factors and external factors of bank credits in Tunisia using a panel data through a sample of 18 banks in the period (2000….2013). We found that among the internal factors, only the return on assets, net interest margin, liquidity has a significant impact on bank loans. Among the external factors, only the inflation rate has a significant impact on bank loans.

Keywords: Bank, Loans, Return on assets, Net interet margin, Liquidity, Inflation rate, Panel

Cite this paper: Mohamed Aymen Ben Moussa, Hedfi Chedia, Determinants of Bank Lending: Case of Tunisia, International Journal of Finance and Accounting , Vol. 5 No. 1, 2016, pp. 27-36. doi: 10.5923/j.ijfa.20160501.04.

Article Outline

1. Introduction

- Lending is the heart of banking business. Banking mostly transform liquid assets like deposits into illiquid assets like loans (Diamond and Rajan (1998)). This is transformational process of bank’s activity is at best influenced by a host of factors namely macroeconomic levels (Peek and Rosengren (1995)) and industry level characteristics (Boot and Thakor (2000)). Lending is the most important services that commercial bank’s do render their customers, in other words banks grant advances and loan to individuals, government and business organization (Cheboi (2012)).Lending is the main function of commercial banks evidenced by the volume of loans that constitute bank’s assets and the annual considerable raise of loan which is granted to borrowers both to private and public sector of economy (Malede (2014)).Bank loan is typically the largest asset and the predominant source of income for banks. Bank accept customer deposits and the use that funds to grant loans to borrowers or invest in other assets that will yield a return higher than the amount of bank pays the depositor (Mac Carthy and al (2010)). In the other hand, Boot and Thakor (2000) indicate that the level of banking industry competition greatly influences bank lending strategy positively.Again, Kashyap and Stein (2000) find a strong case that in situations where a bank is handicapped in terms of credit it will only take the bank capital to measure its ability of lending.It is understable that the main source of lending is deposit or money accepted from the depositors but the amount that would have to be lent is a percentage of the total deposited amount and the remaining is kept as a reserve for the purpose of maintaining its liquidity.Lending is the principal business for most commercial banks. Consequently, loan portfolio is the largest asset and source of revenue for banks (Comptroller 1998). In developing countries, bank’s lending behavior significantly will have a potential impact on executing the monetary policy than in developed countries (Alkilani et al (2015)). Generally, speaking bank’s loans are one of the most important sources of long term financing in most countries (Freixas and Rochet (2008)).There are several articles that show the determinants of bank loans (Ladime and al (2013), Malede (2014), Rababah (2015)…). Therefore, it seems interesting to study the determinants of bank credits in the Tunisian context. We will adopt an approach consisting of 3 sections. The first section is devoted to literature, in the second section, we will make an empirical study, after we will draw a conclusion.

2. Literature Review

- There are a several studies that examines the determinants of bank lending. Olusanya and al (2012) examines the determinants of commercial bank lending behavior in Nigeria case and they found that, foreign exchange rate, investment portfolio, deposits and liquidity ratio have positive impact on commercial bank lending volumes, while the coefficients of lending interest rate and minimum cash reserve ratio were negative.Iriana. B (2003) asses bank liquidity and exchange rate in European perspective, and claim that higher lending rates do not encourage banks to lend more. Abdkarim et al (2011) investigated the impact of interest rate on bank lending in Malaysian context, and contented that interest rate affect bank lending negatively, while controlling for other macroeconomic variables such as GDP and inflation rate.Besides, Tomak (2013) studied the bank level (size and access to funds) and market based (interest rate, inflation rate, GDP) variables impact on bank lending behavior in Turkey using quarterly bank level data of 15 private commercial banks and 3 state owned banks for the (2003….2012) period. The empirical results indicate that bank’s business loans performance depends on its size, total liabilities, non performing loans to total loans (NPL) and inflation rate.On the other hand, Djiogap and Ngomsi (2012) investigated the determinants of bank long term loan using a sample of 35 commercial banks of 6 African countries over the period (2001….2010). They found that a bank’s ability to extend long term business loans depends on its size, capitalization, GDP growth, and the availability of long term liabilities.These results underlined the importance of supply side constraints in extending vital long term credit to firms. Moreover, Chernykh and Theodossiou (2011) reveal that the size of the bank which is measured by assets and the bank capitalization are the only determinants of business and long term loans.Chodechai (2004) has investigated the factors that affect interest rates, degree of lending volume and collateral setting in loan decisions of banks, stated that banks have to be careful with their loan pricing decisions.Because if banks charge too loan rates the revenue from the interest income will not be enough to cover the cost of deposits, general expenses and the loss of revenue from some borrowers. Hence, charging too high loan rates may also create an adverse selection situation and moral hazard problem for the borrowers.Moreover, Abdkarim, Mohd, Adziz (2007) reveal that monetary policy tightening instruments like interest rate in Malysia reduces bank lending to all the sectors. But it sever in some sectors such as manufacturing and suggest that, interest rates are positively associated with Islamic financing and negatively associated with conventional loans.Christian and Pascal (2012), Cargill and Mayer (2006), Montono and Moreno (2011) contended that an increase in reserve requirement case to decrease bank credit.Further, Wilcox (2012) sustains that changes in reserve requirements had only small and statistically insignificantly impacts on bank loans and investments. On the other hand, Sapeinza (2004) demonstrated that state and privately owned banks behave differently. The analysis period covers 85 banks (40 banks are privately and 43 banks are state owned, 2 banks were privatized during the period of observation) in Italy between (1991….1995).Their findings showed that state owned banks charge systematically lower interest rates to similar or industrial firms than do privately owned banks. Besides, state owned banks mostly favor large firms and firms located in depressed areas. The lending behavior of state owned banks is affected by the electoral results of the party affiliated with the bank.The stronger the political party in the area where the firm is borrowing, the lower the interest rates charged. Besides, Ladime and al (2013) investigates the determinants of bank lending behavior in Ghana.Using the GMM estimator developed by Arellano and Bover (1995), Blundell and Bond (1998), they find that bank size and bank capital structure have a statistically significant and positive relationship with bank lending behavior.They also find evidence of negative and significant impact of some macroeconomic indicators (central bank lending rate and exchange rate) on bank lending behavior.Malede (2014) investigates the main determinants of commercial bank lending in Ethiopia by using panel data of 8 commercial banks in the period from (2005….2011). It tested the relationship between commercial bank lending and its some determinants (bank size, credit risk, gross domestic product, investment, deposit, interest rate, liquidity ratio, and cash required reserve).Ordinary least square (OLS) was applied to determine the impact of those predictor variables on commercial bank lending.The results suggests that there is significant relationship between commercial bank lending and its size, credit risk, gross domestic product and liquidity ratio. But deposit, investment, cash required reserve and interest rates does not affect Ethiopian commercial bank lending for the study period.The study suggests that commercial bank have to give more emphasis to credit risk and liquidity ratio because it weakens bank loans disbursement and leads a bank to be insolvent.Rababah (2015) examine the determinants of commercial bank lending in Jordan. He studies 10 Jordanian commercial banks during the period (2005….2013). He used the ratio of credit facilities to total assets as a dependent variable and 11 independent variables including the ratio of deposits, ratio of non performing loans, capital ratio, liquidity ratio, deposit rate, window rate, legal reserve ratio, inflation and economic growth.The results showed that the ratio of non performing loans, liquidity ratio and window rate have a negative and significant impact on the ratio of credits facilities, while he found that the bank size and the economic growth have a positive and significant impact on the ratio of credits facilities granted by commercial banks in Jordan.Amidu (2013) analyses the broad determinants of bank lending in Sub Sahran Africa (SSA) using both micro bank and macro country level data of 264 banks across 24 SSA countries. The core findings that the structure of banking market influences credit delivery in SSA in an environment where the financial sector is reformed and banks are allowed to corporate freely.Also, there is an evidence to suggest a link between bank credit and the financial strength of banks. The overall results suggest that regulatory initiative, which restricts banking activities, imposes sever entry requirements and requires high regulatory capital, influences bank’s decisions to supply loans.Laidroo (2013) investigates lending growth determinants and cyclicality in banks of 15 CEE countries during the period (2004….2010). The results support expected cyclicality in lending growth.However, contrary to expectation, the association between GDP growth and lending growth is lower when economy is below trend compared to when it is above trend.As expected, lending growth is negatively associated with monetary policy indicator and bank’s credit risk and positively associated with bank’s level of equity, liquidity, profitability and deposit ratio.Some support is found by lending growth’s, positive association with inflation, previous year’s share price index, changes and foreign ownership.However, contrary to expectation, bank’s size is negatively and banking sector concentration positively associated with lending growth. The results also show that bank’s equity level, credit risk, and size have stronger association with lending growth when economy is below trend foreign ownership matters only when economy is above trend.On the other hand, Aisen and Franken (2010) indicated that the rate of growth in the bank credit before the financial crisis was higher than in the financial crisis through the application of a sample of 80 countries.The study also found that the cyclical fluctuations in the monetary policy and the liquidity position of the banks have played a major role in the reduction of the bank credit provided after the financial crisis, which calls for the need that countries should follow economic and monetary structure accompanying the financial policies to face fluctuations.The results also indicate that countries have responded differently to the financial crisis because of the diversity in their structural characteristics, such as the financial depth and integration.Moreover, Hanh (2014) investigates the determinants of bank credit by using a large data set covering 146 countries at different level of economic development over the period (1990…2013). He find evidence of the country specific effect of economic growth on bank credit.Our empirical results also suggest that the health of domestic banking system plays a relevant role in boosting bank lending.By contrast, the dependence on foreign capital inflows of a country can make its banking sector more vulnerable to external shocks and then to face credit boom bust cycle.On the other hand, using the dynamic panel data methods estimated over (2003….2012) on around 16 Tunisian banks, Abid and al (2014) attempts to examine the determinants of households non performing loans (NPLS).The main objective is to investigate the potential effect of both macroeconomic and bank specific variables on the quality of loans. Our results indicate the extent to which houselhod’s NPL in the Tunisian banking system can be explained particularly not only by macroeconomic variables (GDP, inflation, interest rate) but also by bad management quality.Besides, using panel data and applying multi-regression analysis on 13 Jordanian conventional banks and 2 islamic banks for the period (2000…2013) that are covered in this research.Takats (2010) studied the bank lending behavior and found that during the financial crisis, the bank lending has fallen sharply across the border. By relying on the data of 21 emerging economies, the study found that during the financial crisis, the supply and demand factors contribute to supply and demand factors contribute to the reduction of bank lending and that the supply shocks was the main determinants of slowdown of cross border lending of the emerging markets during the crisis.Alkilani and Kadummi (2015) found that lending behavior is statistically significant affected by internal factors (DV, IR, net profit after tax) and it is also affected significated by external factors (RR, GDP, IFR, OWDR, R), also the analysis indicated that OWDR and Red R as a proxy of monetary policy did a have a negative impact on lending behavior but not significantly proven.The study also reached to a conclusion that the amount of loans and advances extended by Jordanian banks is not affected by the rate of interest.Then, there are a multiple determinants of bank lending.We test the following hypothesis H1: Internal factors have a significant impact on bank lending H2: External factors have a significant impact on bank lending

3. Empirical Study

- The determinants of bank credit has been the object of several studies (Rafik (2013), Vodova (2011)) prompting us to study this problem in the Tunisian context. Under this section, we will identify the sample at the beginning, then, we specify the variables and models.On the other hand, we carry out the necessary econometrics tests. Finally, we show the estimation results of the model and their interpretations.

3.1. Sample

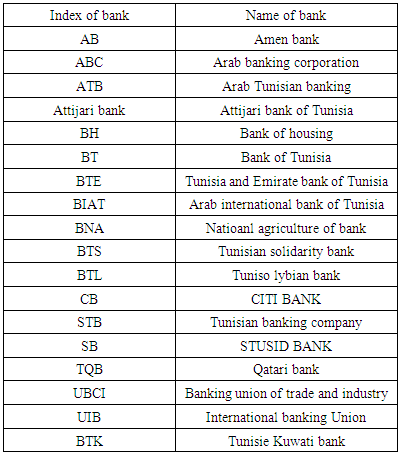

- We will use 18 banks (table 1) that belong to professional association of banks in Tunisia over the period (2000….2013). Financial data are collected through the web sites of the professional association of banks in Tunisia over the period (2000….2013). Macroeconomic data are collected from site of central bank of Tunisia and national statistic institution.

|

3.2. Estimation Method

- We will utilize panel static because it can control:- The time and individual variation in the observable behavior or cross sectional time series aggregated - The observed or unobserved individual heterogeneity - The hierarchical structure

3.3. Specification of Variables

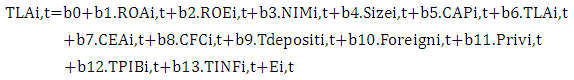

- We will estimate the following model:

ROA = net income / total assets ROA = return on assets ROA show how to generate income form the assets of the bank (Chin (2011)).This ratio is used in several studies to compare the financial performance of banks,it reflects the ability of the banks to use the financial data and real estate resources to generate profits (Naceur (2003), Khrawish (2011), Ongore et Kusa (2013)).ROE = return on equity = net profit / equity ROE reflect the ability of the bank to use its own funds to generate profits (Yilmaz (2013)).NIM = interests receivables – interest incurred / total assets Interest receivables (by borrowers)Interest incurred (paid by the bank to the creditors and depositors)NIM indicates the efficiency of financial intermediation (Hamdi, Awdedh (2012)).Size = size of the bank = natural logarithm of total assets Size can show the economies of scale. The large banks benefit from economies of scale which reduces the cost of production and information gathering (Boyd, Runkhle (1993)). Bank size is considered as an important determinant of bank lending decision (Berger and Udell (2006), Uchida et al (2007)). Berger and Udell (2006) provide that large and complex banks tend to lend few loans to small scall firms.Besides, Rajan and Dahl (2003) indicates that bank size has significance effect on occurrence of non performing loans. Bank size had positive and statistically significant influences on commercial bank lending in Ethiopia (Malede (2014)).Stein (2000) explains that small banks have comparative advantages in producting soft information whereas large banks also have comparative advantage in lending based on hard information. On the other hand, when large and complex banks are able, through financial expertise, to process soft information about small scale firms, then there would be positive relationship between bank size and lending.ALA = total liquid assets / total assets ALA depicts the bank’s ability to absorb liquidity shocks. In theory, the higher liquidity rato indicates that the bank is in a better position to meet its stochastic withdrawals (Chagwiza (2014)).The size of the liquid assets held by the bank is one of the factors affecting the size of bank lending because the high liquidity ratio reduces the proportion of loans granted (Rababah (2015)).More liquid banks are able to provide more lending by drawing on their stock of liquid assets (Beji, Belhadj (2014)). CAP = equity / total assets CAP show the strength of bank capital against the vagaries of economic and financial environment. The effect of bank capital on lending behavior have been widely debated since 1988 Basel capital accord (Gambacorta et Mistrulli (2004)).However, the empirical literature on European countries is rather inconclusive. Ehraman et al (2003) find that monetary tightening has a serve negative impact on rather undercapitalized bank’s lending. Thus, we can conceive that the precise relationship between bank capital and lending is mixed.Empirical evidence form emerging economies would therefore enrich our understanding of the bank’s capital lending nexus. Berrospide and Edge (2010) indicated that the impact of the bank’s capital on the bank lending is a key factor that determine the relationship between the financial conditions and the real activities of the bank.Their study used the method of shared regression analysis to test the bank lending by large banks and found a slight impact of the capital in the size of bank loans. The coefficient ratio of the capital to the total assets (CAP) was negative and not statistically significant, which means that the proportion of the capital does not affect the ratio of credits facilities granted by the commercial banks in Jordan (Rababah (2015)).CEA = operating expenses / total assets Operating expenses including personal expenses and other expenses. CEA shows the weight of operating expenses compared to total assets. CFC = financial expenses / total credits Financial expenses include interest expense due to loan made in the money market and the capital market by banks. CFC shows the share of financial expenses in relation to total loans.T deposit = total deposits / total assets Deposits include demand deposit and terme deposits. T deposits show the share of deposits compared to toal assets.According to Mac Carthy et al (2010), customer deposit is the primary source of bank loan. And thereby, deposits directly have a positive effect on lending. Moreover, Sebastian (2009) strongly reveal that demand deposit liabilities had a most significant and positive influence on bank’s credit allocation in Nigerian case.Deposits have positive statistically insignificant relationship with commercial bank lending (Malede (2014)).TPIB = growth rate of gross domestic product TPIB show the growth of economic activity in the country (Ayadi and Boujelbène (2012)). Hing (1986) by investigating the monetary transmission through bank loans and establishes that change in GDP cause to change the volume of loans.Besides, Talavera, Tsapin and Zhold (2006) found that banks make out more loans during periods of boom and diminishes lending when the economy is in recession.Pruteanu – Podpiera (2007) investigated the impact of gross domestic product growth on growth rate of total loans in Cezch banks from (1996….2001). The results suggests a strong positive effect of GDP growth on the growth rate of loans.The macroeconomic environment within which a bank operates matters for its lending decisions for instance, in the period of economic boom business demand for loans to take advantage of expansion and bank investment opportunities equally soar.On the other hand, in periods of economic recessions, demand for credit plummets. This provides a procyclical relationship between economic growth and bank lending (Ladime et al (2013)).Dell Arricia and Marquez (2006) find that bank credit expansion tent to be procyclical that is, high return of growth in GDP tends to induce a high rate of growth in bank credit.TINF = rate of inflation TINF shows the rate of increase in the price index. Inflation is generally the persistence increase of price level of goods and services in an economy over a period of time.Inflation is a key determinant of commercial bank’s lending rate globally.Taner (2000) study on the effect of inflation uncertainty on credit market reveals that unpredictable inflation raises interest rate, decrease loan supply affect loan demand.This therefore suggests that an increase in inflation may raise the bank lending rates and lead to low bank lending volume.Emon (2012) confirm this assertion and states that lenders are very aware that inflation erodes the valuer of their money over the time period of loan, so they increase the interest rate to compensate for the loss.Foreign = binary variable that takes 1 if the bank is foreign, o otherwise The bank is foreing if the foreign investors owned more than 50% of bank (Kobeissi (2010)).Priv = binary variable that takes 1 if the bank is private, o otherwise The bank is private if more than 50% of their shares are owned by private investors (Fazdalan (2010)).Ei,t = error term

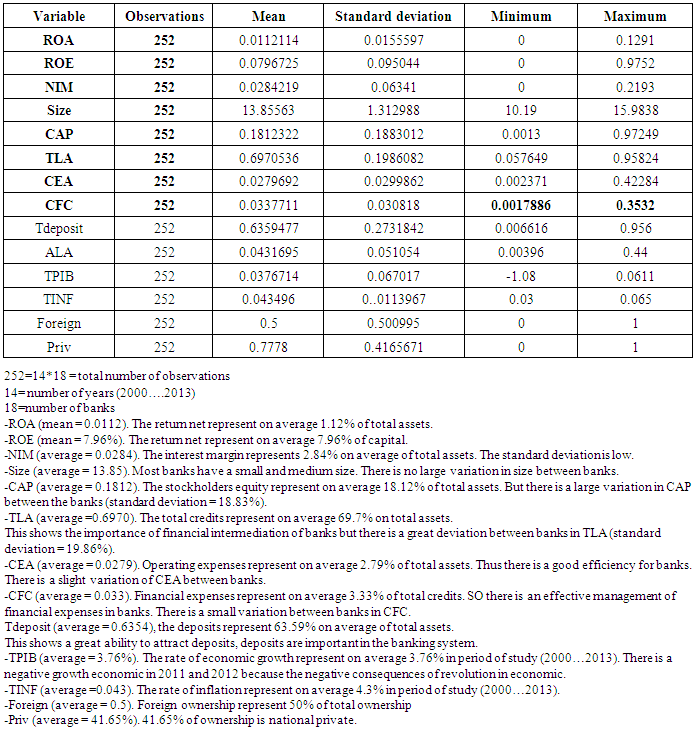

ROA = net income / total assets ROA = return on assets ROA show how to generate income form the assets of the bank (Chin (2011)).This ratio is used in several studies to compare the financial performance of banks,it reflects the ability of the banks to use the financial data and real estate resources to generate profits (Naceur (2003), Khrawish (2011), Ongore et Kusa (2013)).ROE = return on equity = net profit / equity ROE reflect the ability of the bank to use its own funds to generate profits (Yilmaz (2013)).NIM = interests receivables – interest incurred / total assets Interest receivables (by borrowers)Interest incurred (paid by the bank to the creditors and depositors)NIM indicates the efficiency of financial intermediation (Hamdi, Awdedh (2012)).Size = size of the bank = natural logarithm of total assets Size can show the economies of scale. The large banks benefit from economies of scale which reduces the cost of production and information gathering (Boyd, Runkhle (1993)). Bank size is considered as an important determinant of bank lending decision (Berger and Udell (2006), Uchida et al (2007)). Berger and Udell (2006) provide that large and complex banks tend to lend few loans to small scall firms.Besides, Rajan and Dahl (2003) indicates that bank size has significance effect on occurrence of non performing loans. Bank size had positive and statistically significant influences on commercial bank lending in Ethiopia (Malede (2014)).Stein (2000) explains that small banks have comparative advantages in producting soft information whereas large banks also have comparative advantage in lending based on hard information. On the other hand, when large and complex banks are able, through financial expertise, to process soft information about small scale firms, then there would be positive relationship between bank size and lending.ALA = total liquid assets / total assets ALA depicts the bank’s ability to absorb liquidity shocks. In theory, the higher liquidity rato indicates that the bank is in a better position to meet its stochastic withdrawals (Chagwiza (2014)).The size of the liquid assets held by the bank is one of the factors affecting the size of bank lending because the high liquidity ratio reduces the proportion of loans granted (Rababah (2015)).More liquid banks are able to provide more lending by drawing on their stock of liquid assets (Beji, Belhadj (2014)). CAP = equity / total assets CAP show the strength of bank capital against the vagaries of economic and financial environment. The effect of bank capital on lending behavior have been widely debated since 1988 Basel capital accord (Gambacorta et Mistrulli (2004)).However, the empirical literature on European countries is rather inconclusive. Ehraman et al (2003) find that monetary tightening has a serve negative impact on rather undercapitalized bank’s lending. Thus, we can conceive that the precise relationship between bank capital and lending is mixed.Empirical evidence form emerging economies would therefore enrich our understanding of the bank’s capital lending nexus. Berrospide and Edge (2010) indicated that the impact of the bank’s capital on the bank lending is a key factor that determine the relationship between the financial conditions and the real activities of the bank.Their study used the method of shared regression analysis to test the bank lending by large banks and found a slight impact of the capital in the size of bank loans. The coefficient ratio of the capital to the total assets (CAP) was negative and not statistically significant, which means that the proportion of the capital does not affect the ratio of credits facilities granted by the commercial banks in Jordan (Rababah (2015)).CEA = operating expenses / total assets Operating expenses including personal expenses and other expenses. CEA shows the weight of operating expenses compared to total assets. CFC = financial expenses / total credits Financial expenses include interest expense due to loan made in the money market and the capital market by banks. CFC shows the share of financial expenses in relation to total loans.T deposit = total deposits / total assets Deposits include demand deposit and terme deposits. T deposits show the share of deposits compared to toal assets.According to Mac Carthy et al (2010), customer deposit is the primary source of bank loan. And thereby, deposits directly have a positive effect on lending. Moreover, Sebastian (2009) strongly reveal that demand deposit liabilities had a most significant and positive influence on bank’s credit allocation in Nigerian case.Deposits have positive statistically insignificant relationship with commercial bank lending (Malede (2014)).TPIB = growth rate of gross domestic product TPIB show the growth of economic activity in the country (Ayadi and Boujelbène (2012)). Hing (1986) by investigating the monetary transmission through bank loans and establishes that change in GDP cause to change the volume of loans.Besides, Talavera, Tsapin and Zhold (2006) found that banks make out more loans during periods of boom and diminishes lending when the economy is in recession.Pruteanu – Podpiera (2007) investigated the impact of gross domestic product growth on growth rate of total loans in Cezch banks from (1996….2001). The results suggests a strong positive effect of GDP growth on the growth rate of loans.The macroeconomic environment within which a bank operates matters for its lending decisions for instance, in the period of economic boom business demand for loans to take advantage of expansion and bank investment opportunities equally soar.On the other hand, in periods of economic recessions, demand for credit plummets. This provides a procyclical relationship between economic growth and bank lending (Ladime et al (2013)).Dell Arricia and Marquez (2006) find that bank credit expansion tent to be procyclical that is, high return of growth in GDP tends to induce a high rate of growth in bank credit.TINF = rate of inflation TINF shows the rate of increase in the price index. Inflation is generally the persistence increase of price level of goods and services in an economy over a period of time.Inflation is a key determinant of commercial bank’s lending rate globally.Taner (2000) study on the effect of inflation uncertainty on credit market reveals that unpredictable inflation raises interest rate, decrease loan supply affect loan demand.This therefore suggests that an increase in inflation may raise the bank lending rates and lead to low bank lending volume.Emon (2012) confirm this assertion and states that lenders are very aware that inflation erodes the valuer of their money over the time period of loan, so they increase the interest rate to compensate for the loss.Foreign = binary variable that takes 1 if the bank is foreign, o otherwise The bank is foreing if the foreign investors owned more than 50% of bank (Kobeissi (2010)).Priv = binary variable that takes 1 if the bank is private, o otherwise The bank is private if more than 50% of their shares are owned by private investors (Fazdalan (2010)).Ei,t = error term 3.4. Analysis of Descriptive Statistics

3.5. Econometrical Tests

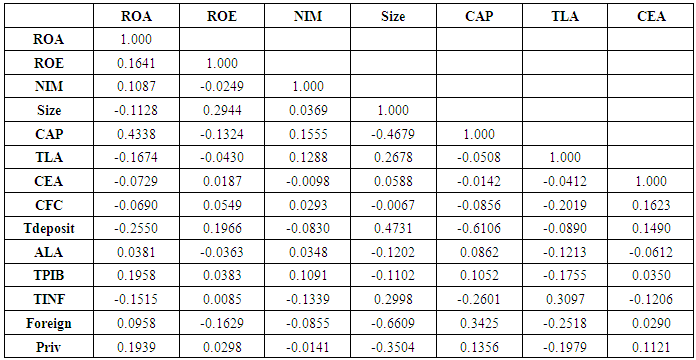

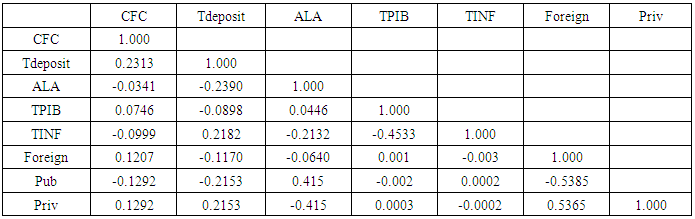

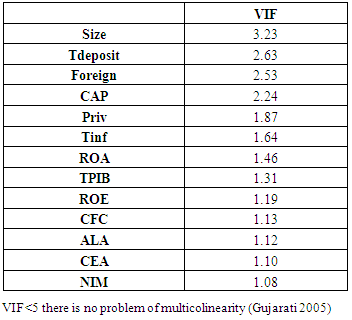

3.5.1. Test of Multi-Collinearity

|

|

3.5.2. Hausman Test

- It determines if the individual effects are fixed or random. It determines if the coefficients (beta) and 2 fixed or random estimates are not statistically different.Under the null hypothesis of independence between errors and explanatory variables, both estimators are unbiaised, so the estimated coefficient becomes somewhat different.The fixed effect model assumes that the influence of explanatory variables on the dependent variable is the same for the all individuous, and that whtehver the period (Sevestre (2002)).The random effect model assumes that the relationship between the dependent variable and the explanatory variable is not fixed but random, the individual effect is not fixed parameter but a random variable (Bourbonnais (2009).The null hypothesis of the test is following: H0: the presence of random effect The Hausman test blends in Pv = Chi2, If Pv<5%; we accepte H0 (presence of random effect), If not we accept H1: Presence of fixed effect.In our model Pv=0.03 <5%, we accept random effect.

3.5.3. Breush Pagan test

- The Breush Pagan test developed in 1979 by Trevor Breush and Adrian Pagan. It is used to test for heteroskedasticity in a linear regression model. It is a Chi squared test. The test statistic is nX2 with the degree of freedom. It tests the null hypothesis of homoskedasticity. If the chi squared value is significant with p value below an appropriate threshold (p<0.05) then the null hypothesis of homoskedasticity is rejected and heteroskedasticity assumed.In our model P<0.05 there is a heteroskedasticity.

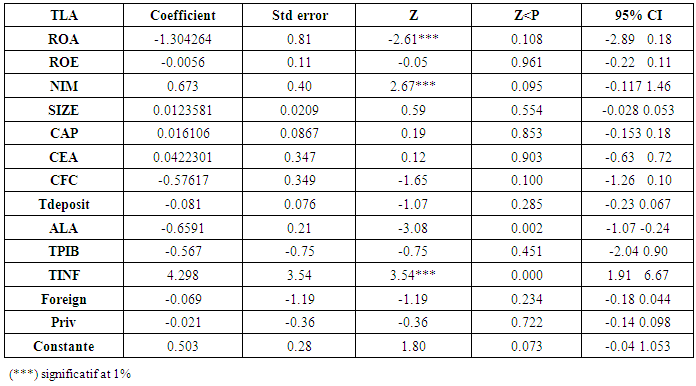

3.5.4. Resultats of Estimations and Interpretations

- -There is a negative relationship between ROA and TLA (if ROA increases by 1%, TLA decreases by 1.30%). The increase of return on assets has a negative effect on bank credit.This relationship is statistically significant at 1%.-There is a negative relationship between ROE and TLA (if ROE increases by 1%, TLA decreases by 0.0056%). The increase of return on equity has a negative effect on bank credit. This relationship isn’t statistically significant.-There is a positive relationship between NIM and TLA (if NIM increases by 1%, TLA increases by 0.673%). The increase of net interest margin has a positive effect on bank credits.-There is a positive relationship between size and TLA (if size increases by 1%, TLA increases by 0.012%). The increase of size has a positive effect on bank credit. This similar a result found by (Malede (2014), Ladime and al (2013), Tomak (2013), Chernykh and Thedossiou (2011)) but contrary a result found by Berger and Udell (2006).Large and complex banks are able, through financial expertise, to process soft information about small scale firms, then there would be positive relationship between bank size and lending (Stein (2000)).Chernykh and Thedossiou (2011) indicated that the large banks are usually more diversified and they have large funds and more accessibility to borrowers from large companies with a high credit card balances, in addition they possess adequate resources for the development of advanced systems to manage and assess the credit risk.-There is a positive relationship between CAP and bank credit (if CAP increased by 1%, TLA increases by 0.016%). The increase of capital has a positive effect on bank credit. This result is similar a result found by Diamond and Rajan (1999), Ladime and al (2013), Beatty and Liao (2011)).Bernanke and Lown (1991)using equations linking bank loan growth to bank capital ratios and employment found that bank loan growth at individual banks was positively linked to initial capital ratios. In a study, focusing on latin America, Berajas and al (2005) identified positive statistically significant impact of capital ratios (equity to total assets) on loan growth, meaning that the banks with higher capital ratios were able to extend more loans.Carlson and al (2013) find that US commercial banks loan growth was more responsive to capital ratios during and shortly after the recent financial crisis but not at other times.Labonne and Lame (2014) concentrate on French banks and also find evidence of the significant positive effect of bank capital on loan growth.-There is a positive relationship between TLA and CEA (if CEA increases by 1%, TLA increases by 0.042%). The increase of overhead costs has a positive effect on bank credits. This relationship is not statistically significant. There is a negative relationship between TLA and CFC (if CFC increases by 1%, TLA decreases by 0.57%). The increase of financial expenses has a negative effect on bank credit.-There is a negative relationship between bank deposits and TLA (if deposits increases by 1%, Deposits decreases by 0.081%). The increase of deposits has a negative effect on bank credits. This result is contrary to result found by Mac carthy et al (2010), Sebastian (2009), Malede (2014).-There is a negative relationship between ALA and TLA (if ALA increases by 1%, TLA decreases by 0.6591%).The increase of liquid assets has a negative effect on bank credits.-There is a negative relationship between TPIB and TLA (if TLA increases by 1%, TPIB decreases by 0.567%). The increase of economic growth has a negative effect on bank credits. This result is contrary to result found by (Mansor (2006); Pruteanu Podpiera (2007), Dell Arricia and Marquez (2007), Guo and Stepanyan (2012), Rababah (2015)).-There is a positive relationship between inflation and bank credit (if inflation increases by 1%, bank credit increases by 4%). The increase of inflation has a positive effect on bank credit. This result is similar found by Omondi (2014), but contrary to result found by Taner (2000).-There is a negative relationship between foreign ownership and bank credit (if foreign ownership increases by 1%, TLA decreases by 0.069%). The increase of foreign ownership has a negative effect on bank credit.-There is a negative relationship between private ownership and bank credit (if private ownership increases by 1%, TLA decreases by 0.021%).

|

4. Conclusions

- Bankers look at the total business package when making financial decisions and the ability to repay a loan is determined by factors such as business plan, cashflow projections, asset base, sales and market place analysis and business viability. (www.cba.ca)Indeed, it is important to determine the factors influencing bank lending. In the context of this article, we examined a sample of 18 banks in Tunisia over the period (2000…2013). It was found that only the return on assets, net interest margin, inflation has a significant effect on bank loans.While other factors (deposits, liquid assets, the rate of economic growth, financial expenses, bank size), does not have a significant effect on bank loans

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML