-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(1): 22-26

doi:10.5923/j.ijfa.20160501.03

The Impact of Efficient Inventory Management on Profitability: Evidence from Selected Manufacturing Firms in Ghana

Kwadwo Boateng Prempeh

Department of Purchasing and Supply, Sunyani Polytechnic, Sunyani, Ghana

Correspondence to: Kwadwo Boateng Prempeh, Department of Purchasing and Supply, Sunyani Polytechnic, Sunyani, Ghana.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The manufacturing sector plays an important role in the Ghanaian economy, therefore, this study deems it necessary to investigate the impact of efficient inventory management on the profitability of manufacturing firms in Ghana. The study design was cross sectional. The study employed the use of secondary data. Cross sectional data from 2004 to 2014 was gathered for the analysis from the annual reports of four manufacturing companies listed on the Ghana Stock Exchange. Judgmental sampling was used to select the four companies and only manufacturing companies listed on the Ghana Stock Exchange (GSE) whose data was up to date were considered. Measures of profitability were examined and related to proxies for efficient inventory management by manufacturers. The Ordinary Least Squares (OLS) stated in the form of a multiple regression model was used in the data analysis. The study revealed that there is a significantly strong correlation between the main variable, raw materials inventory management and profitability of manufacturing firms in Ghana and it is positive. Therefore, efficient management of raw material inventory is a major factor to be considered by Ghanaian manufacturers in enhancing or boosting their profitability. This study is only based on manufacturing companies and listed on the Ghana Stock Exchange so it may reflect some partial.

Keywords: Manufacturing firms, Inventory management, Ghana Stock Exchange, Profitability

Cite this paper: Kwadwo Boateng Prempeh, The Impact of Efficient Inventory Management on Profitability: Evidence from Selected Manufacturing Firms in Ghana, International Journal of Finance and Accounting , Vol. 5 No. 1, 2016, pp. 22-26. doi: 10.5923/j.ijfa.20160501.03.

Article Outline

1. Introduction

- In recent years, Inventory Management has attracted a great deal of attention from people both in academia and industries. A lot of resources have been devoted into research in the inventory management practices of organizations. It represents one of the most important assets that most businesses posses, because the turnover of inventory represents one of the primary sources of revenue generation and subsequent earnings for the company. In the manufacturing companies, nearly 60% to 70% of the total funds employed are tied up in current assets, of which inventory is the most significant component (Carter, 2002). Thus, it should be managed in order to avail the inventories at right time in right quantity. Inventory can be also viewed as an idle resource which has an economic value. So, better management of the inventories would release capital productively. Inventory control implies the coordination of materials controlling, utilization and purchasing. It has also the purpose of getting the right inventory at the right place in the right time with right quantity because it is directly connected with the production. The objective of any organization is to get a good return out of every cedi invested in the company. According to Pandey (2005) management through their policies, coordination, decision and control mechanisms must maximize the return on investment (ROI).Peterson and Joyce (2007) while supporting Pandey (2005) states that it is clear that ROI can be maximized either by increasing profit margin or by reducing the capital employed or by both. In the market situation, sales price cannot be increased (rather there is a demand to reduce it) and as such profit can be increased only by reducing the material costs. On the other hand, the opportunity to reduce the overheads and capital employed is more by inventory reduction (Drury, 2002). It is thus evident that the ROI can be maximized by either reducing the material cost or reducing the current assets by way of inventory of materials or can be optimized by increasing profits. Peterson and Joyce (2007) maintain that it is evident that the inventory management can make a direct contribution in increasing profitability in the following ways:(a) By deciding inventory norms nationally and through control systems. Inventory turnover can be maximized which in turn will maximize current assets turnover and ROI.(b) By proper planning and control of spare parts, capacity utilization can be increased which will increase the turnover of fixed assets and consequently increase ROI.(c) By developing dependable sources and purchasing quantity materials at competitive prices. Materials cost per naira of sales can be brought down which will increase the profit margin.(d) By developing proper systems and control on issue of materials, the consumption can be minimized, reduction in wastes and rejects, resulting in reducing the materials cost, which will increase the profit margin.(e) Establishment of farms to grow the major raw materials and less dependent on importation.Unless operators in the manufacturing industry understand the true costs associated with inventory management and poor inventory productivity, and can review the benefits of alternative approaches, they will continue to be complacent, accepting average profit instead of better performance. This study is of the view that the operators in the industry adopting a holistic operating model that improves inventory productivity, enhances sales margin, and saves millions of Cedis in operating costs and especially on costs associated with inventory. Saving costs on inventory starts with a comprehensive organizational focus on inventory management. Therefore, the focus of this study is achieving profitability through effective management of inventory with emphasis on procurement, receipt of materials, holding and ordering costs, inventory control, and foreign currency for import.

2. Review of Relevant Literature

- Inventory refers to the value or quantity of raw materials, supplies, work in progress (WIP) and finished stock that are kept or stored for use as need arises (Lyons and Gillingham, 1981). Raw materials are commodities such as steel and lumber that go into the final product. Supplies include items such as Maintenance, Repair and Operating (MRO) inventory that do not go into the final product. Work in progress is materials that have been partly fabricated but are not yet completed. Finished goods are completed items ready for shipment (Kothari, 1992).Sharma (2003) defines inventory as the quantity of goods, raw materials, or other resources that are idle at any given point of time. From the definition above, inventories consist of raw materials, component parts, supplies or finished assemblies etc which are purchased from an outside source, and goods manufactured in the enterprise itself. In simple words, inventory refers to stocks held by a firm. Relating the definition to the brewery industry, this paper defines inventory as the stock of the product a company is manufacturing for sale and components that make up the product. Inventory is the stock of any item or resource used in an organization.An inventory system is the set of policies and controls that monitors levels of inventory and determines what levels should be maintained, when stock should be replenished, and how large orders should be, (Chase and Aquilano, 1995:546). The Concept of Inventory ManagementInventory management is the art and science of maintaining stock levels of a given group of items incurring the least cost consistent with other relevant targets and objectives set by management (Jessop, 1999). It is important that managers organizations that deals with inventory, to have in mind, the objective of satisfying customer needs and keeping inventory costs at a minimum level. Drury (2004) asserts that inventory costs include holding costs, ordering costs and shortage costs. Holding costs relate to costs of having physical items in stock. These include insurance, obsolescence and opportunity costs associated with having funds which could be elsewhere but are tied up in inventory.Ordering costs are costs of placing an order and receiving inventory. These include determining how much is needed, preparing invoices, transport costs and the cost of inspecting goods. Shortage costs result when demand exceeds the supply of inventory on hand. The costs include opportunity costs of making a sale, loss of customer goodwill, late charges and similar costs.Inventory Management and Financial PerformanceThere have been numerous attempts to explain financial performance of companies in the fields of strategic management, accounting, finance, marketing and management science. Naturally each of these areas concentrates on different explanatory variables and therefore this study limits the survey to papers that are perceived as immediately relevant. In the US, Sanghal (2005) studied the effect of excess inventory on long term stock price performance. The study estimated the long-run price effects of excess inventory using 900 excess inventory announcements made by publicly traded firms during 1990-2002.Roumiantsev and Netessine (2005) investigated the association between inventory management policies and the financial performance of affirm. The purpose of the study was to assess the impact of inventory management practices on financial performance across the period 1992-2002.They used conventional firm specific variables (inventory levels, margins, and lead times) as explanatory variables. They found no evidence that smaller relative levels are associated with financial performance as measured by return on assets. Eckert (2007) examined inventory management and role it plays in improving customer satisfaction. He found a positive relationship between customer satisfaction and supplier partnerships, education and training of employees, and technology. In Greece, Koumanakos (2008) studied the effect of inventory management on firm performance in manufacturing firms operating in three industrial sectors in Greece, food textiles and chemicals were used in the study covering 2000 – 2002 period. The hypothesis that lean inventory management leads to an improvement in a firm’s financial performance was tested. The findings suggest that the higher the level of inventories preserved (departing from lean operations) by a firm, the lower the rate of return. In conclusion, most of the studies reviewed concentrated on conventional firm level variables such as inventory levels, demand and lead time. Oko, Mgbonyebi and Umeadi (2008) carried out a research on the association of inventory control in enhancing business growth in Nigeria a survey of five selected manufacturing companies in port Harcourt metropolis. They made use of simple percentage and chi-square. The analysis revealed significant relationship between inventory control and business growth.Little attempt was made to capture the perceptions of managers about the impact of inventory management practices on firm financial performance. Agus and Noor (2006) did measure the perception of managers about the impact of inventory management practices on financial performance of manufacturing firms in Malaysia. Eneje, Nweze and Udeh (2012) did measure effect of efficient inventory management on profitability of breweries in Nigeria.However, circumstances in Nigeria could be different from those in Ghana. This study seeks to investigate the impact of inventory management practices on financial performance of manufacturing firms in Ghana.

3. Methodology

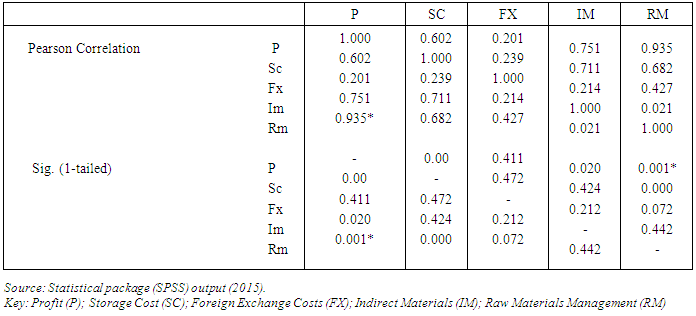

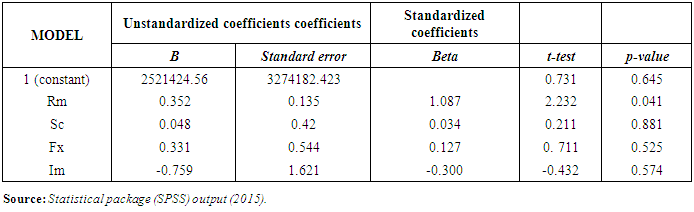

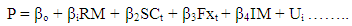

- This research covers listed manufacturing companies on the Ghana Stock Exchange. The population of manufacturing companies listed on the Ghanaian stock exchange out of which a sample of four manufacturing companies was selected using judgmental sampling techniques based on the researcher’s knowledge of the population. The four manufacturing companies chosen are those companies whose published financial reports and required data were available for the whole period under review. The data for the measure of the variables were collected from annual financial statement of the sampled companies and companies not listed on the GSE were excluded due to non-availability and non-disclosure of their financial reports respectively. The analyses were carried out in two stages. First, Pearson correlation was used to determine the strength and significance of the relationship between raw material management and profitability of manufacturing companies in Ghana. Secondly, data collected were analyzed using multiple regression analysis to ascertain the impact of raw material management on profitability of manufacturing firms in Ghana. The multiple regressions is stated thus:

| (1) |

4. Data Analysis and Discussions

- Pearson product correlation was to determine the relationship between the relation between the independent raw material inventory management and the dependent variable profit. The results are as presented in Table 1 below.

|

|

5. Conclusions and Recommendations

- This paper measured the effects of raw materials inventory management on the profitability of companies in the Ghanaian manufacturing sector. A cross sectional data of manufacturing companies in Ghana during the period of 2004 to 2014 provided the basis for the data analysis. Findings from this study reveal that the pivotal variable raw material inventory management designed to capture the effectiveness of a company's management of part of working capital on profitability is significantly positive and impacts on profitability of the manufacturing firms in Ghana. My findings confirms the findings of Eneje, Nweze and Udeh (2012) whose results of their research showed that there is a significant effect of efficient inventory management on profitability. From the results of the study, it can be deduced that raw materials inventory management is a major variable that has significant positive relationship on the profitability of the manufacturing firms in Ghana. Management of raw materials is therefore an important factor to be considered in enhancing or boosting the performance of manufacturers in Ghana. It is therefore necessary that adequate management of raw materials inventory should be pursued by manufacturing firms in Ghana. This can be achieved by encouraging large scale mechanized production of the major raw materials in Ghana and training and re-training of staff from time to time to update their knowledge and skills in modern manufacturing techniques.

6. Limitation of the Study

- There are some certain limitations of this study. It can be listed as: i. All the data used in this paper are secondary data which has been taken from different published journals, books and financial data are from the Ghana Stock Exchange. And this paper is related with the financial variables so there may be some variations. ii. This study is based on only manufacturing companies listed on Ghana Stock Exchange (GSE), so it may reflect some partial view.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML