-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2016; 5(1): 13-21

doi:10.5923/j.ijfa.20160501.02

Auditor’s Independence and Audit Quality: A Study of Selected Deposit Money Banks in Nigeria

Babatolu Ayorinde Tobi 1, Aigienohuwa Osarenren Osasrere 2, Uniamikogbo Emmanuel 3

1Department of Accounting, Federal University of Agriculture, Abeokuta, Nigeria

2Department of Accountancy, Nnamdi Azikwe University, Awka, Nigeria

3Department of Accounting, Rhema University, Aba, Nigeria

Correspondence to: Babatolu Ayorinde Tobi , Department of Accounting, Federal University of Agriculture, Abeokuta, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The need to ensure reliable and high quality of audit work has largely focused on auditors independence to ensure an auditor is not too familiar with his client, because if an auditor is too familiar with his client it will jeopardize their integrity and in return impair their independent opinion. The objective of this study is to examine the effect of auditor’s independence on audit quality of selected deposit money banks in Nigeria. The population of this study comprised of twenty (20) listed Deposit money banks in Nigeria. Purposive sampling technique was used to select sample size of seven (7) banks. Secondary Data was used and data were sourced from the audited annual report of the sample banks. The Data analysis techniques that were adopted for this study consisted of descriptive statistics, correlation and ordinary least square (OLS) regression. The study revealed that there is a positive relationship between audit fee, audit firm rotation and audit quality. There exist negative relationship between audit firm tenure and audit quality. The correlation between audit quality and leverage is strong, negative and statistically significant. The correlation between audit quality and company size is strong, positive and statistically significant. The study recommends that Auditor’s independence should be strengthened by taking different measures to address the issues which could create threats for auditors. The measures will include, but not limited to regular rotation of auditors, reduction in the tenure of auditors and appropriate audit fees.

Keywords: Audit quality, Auditors independence, Audit fee, Audit firm rotation, Audit firm tenure

Cite this paper: Babatolu Ayorinde Tobi , Aigienohuwa Osarenren Osasrere , Uniamikogbo Emmanuel , Auditor’s Independence and Audit Quality: A Study of Selected Deposit Money Banks in Nigeria, International Journal of Finance and Accounting , Vol. 5 No. 1, 2016, pp. 13-21. doi: 10.5923/j.ijfa.20160501.02.

Article Outline

1. Introduction

- In recent times, research about the quality of audit report has increased tremendously, several factors has contributed to this fact, stemming from the growing importance of good corporate governance mechanism arising from highly publicized accounting scandals in Nigeria and across the globe. Many high profile corporate collapses, such as the case of world Com and Enron in the United state, have been traced to poor audit quality associated with a perceived lack of auditor independence. Recent reports of questionable accounting practices adopted by some companies in Nigeria have brought the issue of auditor’s independence to the forefront, and putting the auditing profession credibility in doubt (Otusanya and Lauwo, 2010). As a result of all these questionable accounting practices engaged in by companies, auditors have been put under pressure to ensure that their reports is made up of assurance to investors whose funds are invested in those companies are properly accounted for.In Nigeria at present, there are two recognized accounting bodies, the institute of Chartered Accountants of Nigeria (ICAN) and the Association of National Accountant of Nigeria (ANAN), which are saddled with the responsibility of regulating accounting practices in Nigeria. As stipulated by CAMA (2004) it is pertinent that every incorporated companies appoints an external auditor, who is required by law to give an independent opinion on the state of affairs of these corporations, whether or not they show a true and fair view of the financial health of the corporation. The company and allied matters act (CAMA, 2004) states that every auditor shall have the right of access, at all times, to the books, accounts and vouchers of the company and to such information and explanation as may be necessary in the course of carrying out the audit work.As posited by Knechel (2009), auditing and the audit process provide an evaluation of the probability of material misstatement and reduce the possibility of undetected misstatement to a reasonable or appropriate assurance level. Auditor’s independence has been of serious concern not only to the end users of financial information but to the whole society in general. The need to ensure dependable and high quality audit work has largely focused on auditor’s independence in order to ensure that an auditor is not too familiar with his client, because familiarity will jeopardize the integrity of the auditor and in turn impair their independent opinion as to the financial health of their client. Arrunda (2000), in his view shows that demand for auditing services arose from the need to facilitate dealings between the parties involved in business relationships- shareholders, creditors, public authorities, employees and customers.

2. Objectives of the Study

- The main objective of the study is to examine the relationship between auditor’s independence and audit quality of selected deposit Money Banks in Nigeria. The study outlines the following specific objectivesi) To investigate the relationship that exists between audit fee and audit qualityii) To examine the relationship that exist between audit firm rotation and audit qualityiii) To find out the relationship that exists between audit firm tenure and audit quality

3. Literature Review and Hypotheses Development

- The international audit and assurance Standard Board (IAASB), a sub-committee of the international federation of Accountant (IFAC) defined audit as an independent examination of, and expression of opinion on the financial statements of a business enterprise by an appointed auditor in accordance with his terms of appointment and in compliance with the relevant statutory and performance requirement. The audit report is the end product of every audit assignment that the auditor issues to its client company expressing his opinion on the true and fair view regarding an enterprise financial statement.The statutory audit of companies is coded in the companies and allied matters Act, 2004, section 357 which deal with the appointment of an auditor by members at the annual general meeting (AGM). Section 359 of CAMA, 2004 outlined the statutory duties of an auditor to include: (i) the primary duty of the auditors of a company is to make a report to its members on the accounts examined by them, and on every statement of financial position and statement of comprehensive income, and on all group financial statements, copies of which are to be laid before the company in a general meeting during the auditors tenure of office; (ii) Schedule 6 of CAMA 2004 sets out those matters that must be expressly stated in the auditor’s report.Auditor’s independence may be defined as an auditor’s unbiased metal attitude in making decisions throughout the audit and financial reporting process. An auditor’s lack of independence increases the possibility of being perceived as not being objective. This means that the auditor will not likely report a discovered breach (Deangelo, 1981). The major threats to auditor independence are the fees perceived by the auditor for audit and non audit services and the length of the auditor – client relationship. The impaired independence of an auditor result in poor audit quality and allows for greater earnings management and lower earnings quality (Okolie, 2014). Auditor’s independence may be impaired by auditor tenure. As the auditor client relationship lengthens, the auditor may develop close relationship with the client and become more likely to act in favour of management, resulting in reduced objectivity and audit quality. Audit quality is an important issue that is considered by various interest groups in the company, audit scope and capital market. Because audit quality is barely visible in practice, research in this area has always been faced with many problems of definition. One of the most common definitions of quality audit, which is defined by Di Angelo (1981), is the market assessment of the likelihood that the auditor (i) detect significant distortions of the financial statements or employers accounting system and (ii) report significant distortions.

4. Review of Empirical Literatures

- The collapse of banks and corporation in Nigeria has drawn the attention of the public and regulatory agency to question audit quality. Banks in Nigeria are regulated by different agencies in Nigeria like: Central Bank of Nigeria (CBN), Banks and other Financial Institution Act (BOFIA), Securities and Exchange Commission (SEC) and so on.Ilaboya and Ohiokha (2014), this study empirically examines the impact of audit firms’ characteristics on audit quality. They proxy the dependent variable (audit quality) using the usual dichotomous variable of 1 if big 4 audit firm and 0 if otherwise. Data for the study were sourced from the financial statements of 18 food and beverage companies listed on the Nigerian Stock Exchange market within the period studied (2007-2012). They adopted multivariate regression technique with emphasis on Logit and Probit method in analyzing their data for the study. Their study revealed there is a positive relationship between firm size, board independence and audit quality whereas there is a negative relationship between auditor’s independence, audit firm size, audit tenure and audit quality. Chijoke, Emmanuel and Nosakhare (2012), examine the relationship between audit partner tenure and audit quality. They used Binary Logit Model estimation technique in analyzing the relationship between the tenure of an auditor and audit quality. Their findings reveal that there is a negative relationship between auditor tenure and audit quality though the variable was not significant. The other explanatory variables (ROA, Board Independence, and Director Ownership and Board size) considered alongside auditor tenure were found to be inversely related to audit quality aside from Returns on Assets which exhibited a positive effect.Adeyemi and Okpala (2011), opined that an audit firm’s tenure can result in a loss of auditor’s independence. A long audit-client relationship could lead to an alignment of the auditor’s interest and that of its client which makes truly independent behaviour of the auditor a probability. The study concluded that audit firm rotation does not necessarily enhance audit independence in Nigeria. This could be due to the unity of professional attitude among auditors and similarity in cultural bias and orientation. or tenure may have significant effect on the audit quality.Dopuch, King and Schwartz (2001) also examine the impact of auditor tenure on audit quality. The result is consistent with the hypothesis that the auditor compromises his independence most often in a long term auditor contract and suggests that after all auditor tenure may have significant effect on the audit quality.Kabiru and Abdullahi (2012), they carried out an empirical investigation into the quality of audited financial statements of deposit money banks in Nigeria, using both primary and secondary data and from the population of 21 banks they select a sample of 5 banks comprises of First Bank, Zenith Bank, Union Bank, United Bank for Africa and Access Bank, all publicly quoted companies in Nigeria. They found that Independence of an auditor does significantly improve the quality of audited financial statements of money deposit banks in Nigeria. Compliance to auditing guidelines has positive and significant effect on the quality of audited financial statement of money deposit banks in Nigeria. Material misstatement does significantly affect the quality of audited financial statements of money deposit banks in Nigeria. They also found that audited financial statements of Nigerian money deposit banks, if re-audited by other independent auditors, will give the same result and conclusion.Vanstraelen (2000) examines the effect of long-term audit client relationship on audit quality. The external user’s perception of the audit report was used as the indicator for quality. Utilizing the logistic regression model, the study findings shows that long-term auditor client relationships is positively related with the increased likelihood of the auditor issuing an unqualified opinion. A significant difference was also found between the auditor’s reporting behaviour in the first two years versus the last year of the audit mandate. This implies that auditors are more willing to issue an unqualified audit report in the first two years of their official mandate than in the last year of their mandate. The policy implications of Vanstraelen (2000) support mandatory auditor rotation to maintain the value of an audit for the external users. Adeniyi and Mieseigha (2013), examined the effect of audit tenure on Audit Quality in Nigeria. A dummy value of 1 was used if a firm employ the services of any of the big 4 auditors and 0 if otherwise, tenure measured in terms of number of years spent as auditor for Sample company. If greater than 3, we assign 1, else 0, size measure as natural logarithm of total assets, return on Assets Calculated by dividing a company's annual earnings by its total assets, board Independence measured as the proportion of external directors on the board, board Size measured as the number of directors on the board, directors’ ownership measured as the percentage of ownership by directors. Their study revealed that the relationship between tenure and audit quality was observed to be inverse and this could stimulate the discourse on the sensibleness of changing auditors after a period of time as it may be effective at increasing the level of audit quality. For the other variables examined alongside tenure such as board size, board independence and director ownership which are all proxy of the corporate governance were found to be inversely related with audit quality. Their study further reveal that return on assets have also be seen to be in line t with prior studies while that of company size is at variance with prior study.We hypothesize, based on the review of literature that:H01: There is no significant relationship between audit fee and audit quality.H02: There is no significant relationship between audit firm rotation and audit quality.H03: There is no significant relationship between audit firm tenure and audit quality.

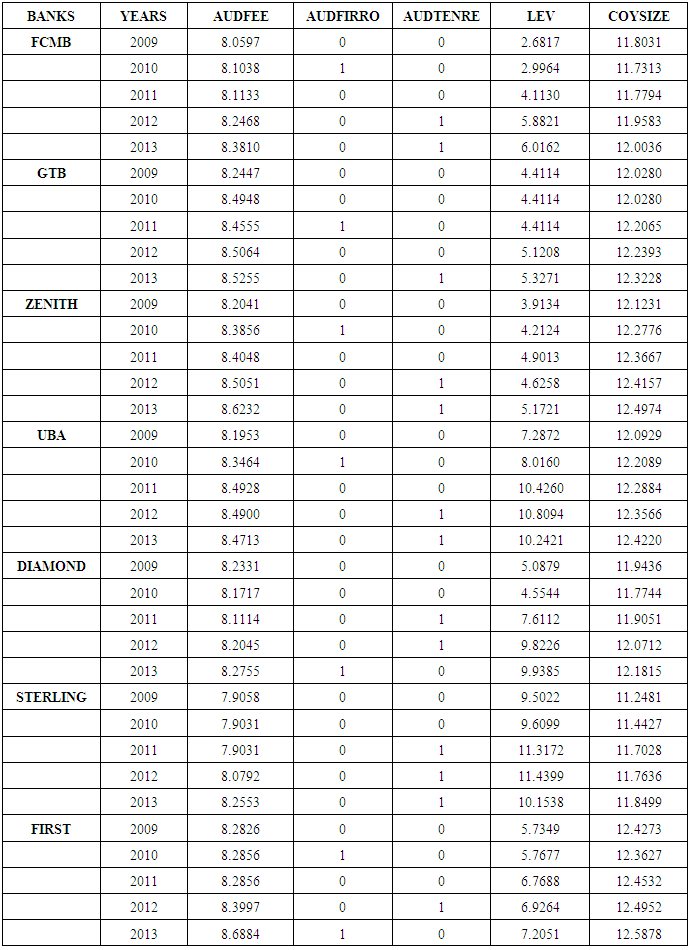

5. Methodology

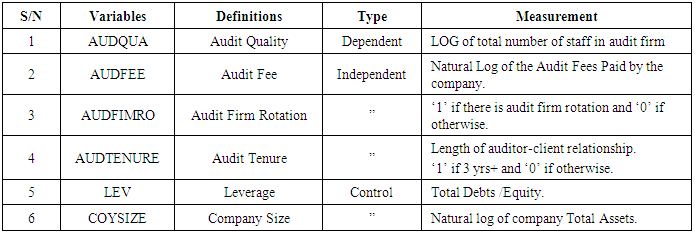

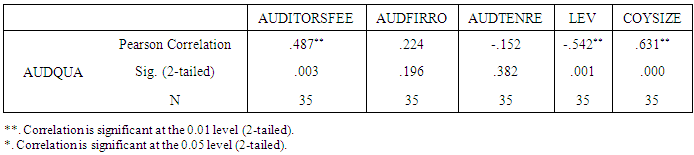

- This paper adopted historical and descriptive research design. A panel data analysis was carried out considering the fact that the paper simultaneously combines cross sectional and times series data. The population of this study comprised the twenty (20) listed Deposit Money Banks in Nigeria. Purposive sampling technique was used to select sample size of seven (7) banks out of a population of twenty (20) quoted Deposit Money Banks in Nigeria over a period spanning between 2009 to 2013 accounting – year. Secondary Data was used for this study and the data were sourced from the audited annual report of the sample Deposit Money Banks in Nigeria. The Data analysis techniques that were adopted for this study consist of multiple regression using ordinary least square method of estimation (OLS) and correlation.Model specification and measurement of variablesAUDQUAit=α0+α1AUDFEEit+α2AUDFIMROit+α3AUDTENUREit+α4LEVit+α5COYSIZEit+eitWhere;AUDQUA = Audit QualityAUDIN = Auditor IndependenceAUDFEE = Audit FeeAUDFIRRO = Audit Firm RotationAUDTENRE = Audit TenureControl variablesLEV = LeverageCOYSIZE = Company sizeet = Error Termα0 = Intercept

|

6. Presentation and Analysis

- Descriptive AnalysisTable 2 contains the descriptive statistics of the study variables. The audit fee does not disperse too much away from the average audit fee of 8.2924200, as indicated by the standard deviation of .19821386.There is also regular audit firm rotation, as the mean is .20, and the standard deviation is low at .406.The average audit tenure stand at .3714286, with a standard deviation of .49024089. The average leverage ratio of selected firm is 6.7547914; the average company size is 12.0959629.Overall, all variables are well represented, with the computation of the minimum, maximum, mean and standard deviation.

|

|

|

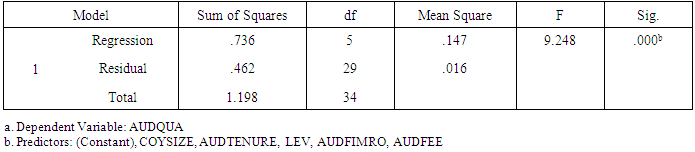

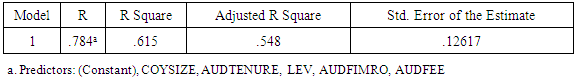

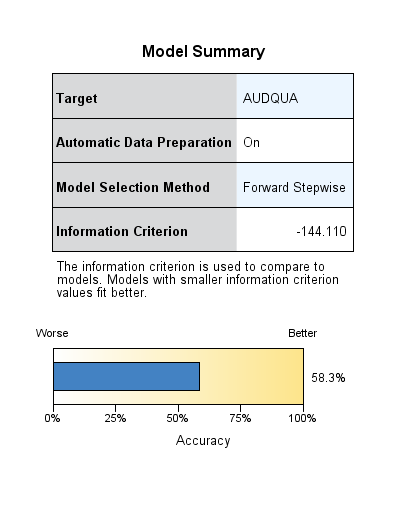

| Figure 1. Model Summary for Audit Quality |

|

|

|

7. Discussion of Findings

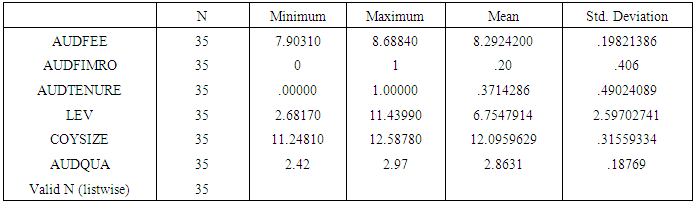

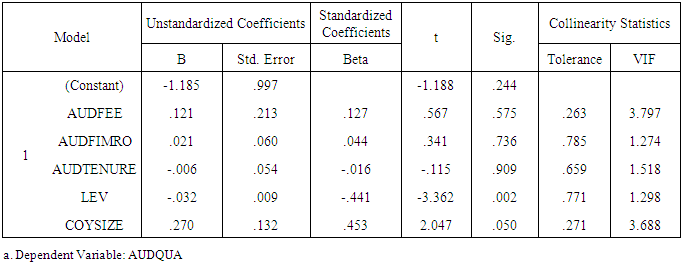

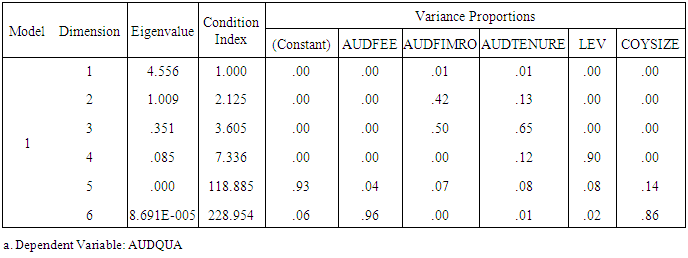

- Stemming from the result of the analysis of this study, the findings showed that there is positive relationship between audit fee and audit quality and this indicate that audit quality is dependent on audit fee; the higher the audit fee, the more qualitative the audit work will be. The result is consistent with the studies of Craswel (2002), Frankel et al (2002) and Li et al (2005), they also agree that higher audit fees will increase the auditor’s effort and result in a higher audit quality.The relationship between audit firm rotation and audit quality is also positive and this signify that the rotation of audit firms on a regular basis engenders audit quality because regular rotation of auditors will help checkmate some of the threats to the independence of auditors which could adversely affect or jeopardize the quality of audit. Findings by Healy et al (2003), Carcello et al (2004), have also argued that rotation of audit firms is a way of improving audit quality. This is because familiarity with the client has the effect of reducing the fresh point of view auditors have in the early years of engagement. There exist negative relationship between audit firm tenure and audit quality and this imply that the shorter the tenure of the auditor, the more qualitative the audit is likely to be. It is also in tandem with the findings of previous studies such as that of Chijoke et al (2012), Davis et al (2003) and Carcello et al (2004). The correlation between audit quality and company leverage is strong, negative and statistically significant at 5% level of significance and this indicate that the higher the leverage level of the firm, the lower is the audit quality likely to be. The correlation between audit quality and company size is strong, positive and statistically significant at 5% level of significance. The positive relationship means that the bigger the firm, the higher the quality of audit is likely to be. It is in line with the study of Ilaboya et al (2014).

8. Conclusions

- The correlation between audit quality and audit fee is positive, strong and statistically significant (r = .603, p ≤ .000). The positive relationship means that the quality of audit is dependent on the audit fee; the higher the audit fee, the more qualitative the audit work will be. The correlation between audit quality and audit firm rotation is positive but somewhat weak strong and not statistically significant at 5% level of significance (r = .224, p ≤ .196). The positive relationship means that the rotation of audit firms on a regular basis engenders audit quality, because regular rotation of auditors will help checkmate some of the threats to the independence of auditors which could adversely affect or jeopardize the quality of audit.The relationship between audit quality and audit tenure is weak, negative but not statistically significant at 5% level of significance(r = -.152, p ≤ .382). The negative relationship means that the shorter the tenure of the auditor, the more qualitative the audit is likely to be. The correlation between audit quality and company leverage is strong, negative and statistically significant at 5% level of significance (r = - .542, p ≤ .001). The positive relationship means that the higher the leverage level of the firm, the lower is the audit quality likely to be. The correlation between audit quality and company size is strong, positive and statistically significant at 5% level of significance (r = .631, p ≤ .000). The positive relationship means that the bigger the firm, the higher the quality of audit is likely to be. This may be unconnected to the fact that larger sized firms (expectedly with wider spectra of stakeholders), can afford to pay auditors better which in turn implies that such auditors are likely to do more qualitative job, partly because of the large audit fee and partly because of the need to protect the interest of the wider stakeholder group in such large firms.

9. Recommendations

- In order to make Nigerian Auditing firms more effective in their activities, so that they can continue to play their appropriate roles in the growth and development of deposit money banks and the economy at large, the following measures are recommended for adoption and practice: ● Auditors of deposit money banks in Nigeria should live up to the expectations of their clients, their professional bodies, the laws of the land and the general public. These can be achieved by upholding the ethics of their profession as they observe ethical codes such as integrity, objectivity and confidentiality. ● It is also recommended that the auditor should be remunerated on the basis of work experience, qualification, duration of the audit assignment, and background profile. The payment of the adequate fee will encourage the auditor to do the assurance engagement assignment according to the high degree of standardization expected.● The professional bodies should always watch governmental actions and raise alarm on policies which could hinder smooth discharge of Auditors’ responsibility, especially in the audit of deposit money banks in Nigeria.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML