-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(6): 324-332

doi:10.5923/j.ijfa.20150406.02

Determinants of Tunisian Banks’ Profitability

Raoudha Dhouibi

Management Science Department, Faculty of Law, Economics and Management of Jendouba, Tunisia

Correspondence to: Raoudha Dhouibi, Management Science Department, Faculty of Law, Economics and Management of Jendouba, Tunisia.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Tunisia is one of the countries where the banking sector forms the core of the financial system. However, Tunisian banks have a high credit risk associated with low levels of profitability, liquidity and capitalization. The presence of these signs of fragility in the Tunisian banking system motivated us to study the determinants of this low profitability of banks. The contribution of this study consists to examine the impact of organizational variables, in addition to macroeconomic and financial variables, focusing primarily on the role played by the Board of Directors. The interest to this internal governance mechanism stems from the particularities of banks corporate governance. The empirical results of this study, contrary to expectations, show that the board of directors, despite its great importance, it granted only a limited place in Tunisian banks and it has several shortcomings in relation to its mission.

Keywords: Profitability, Banks, Determinants, Board of directors

Cite this paper: Raoudha Dhouibi, Determinants of Tunisian Banks’ Profitability, International Journal of Finance and Accounting , Vol. 4 No. 6, 2015, pp. 324-332. doi: 10.5923/j.ijfa.20150406.02.

Article Outline

1. Introduction

- The rapid changes caused by globalization, deregulation and technological advances are increasing more and more the vulnerability of banks against the risks associated to their activities. This increased risk could produce bank failures affecting both their own partners than other banks because of various relationships between them and, therefore, it has a systemic impact on the economy in general. Indeed, there have been many examples of countries throughout the world where bank failures led the entire economies to systemic crises. Moreover, past experience shows that bank failures are not always the result of a weak macroeconomic environment. Indeed, the situation of banks and their indicators can be important sources of crisis even in a healthy environment.Tunisia is one of the countries where the banking sector forms the core of the financial system. Despite the weight of bank intermediation for the financing of the Tunisian economy, assets of banks relative to GDP are relatively low. In addition, Tunisian banks have a high credit risk associated with low levels of profitability, liquidity and capitalization.This signals of the fragility of Tunisian banking system, show the interest to study the determinants of bank profitability by focusing primarily on the role played by Board of directors. We focused on the internal mechanism of governance because the particularities of the corporate governance of banks acquire it an ultimate role.This research paper aims to examine the impact of the characteristics of the board of directors on the profitability of Tunisian banks. The second section of this paper presents the profitability measures.The third section will be devoted to the presentation of the theoretical approach, in which we will explain the various factors affecting the profitability. Thereafter, in the fourth section, we present the methodology and empirical results. Finally, the fifth section presents the conclusion.

2. Profitability Measures

- The financial sector is essential for a strong and healthy economy to meet the needs and aspirations of the main economic actors. It performs a wide range of important functions for the economy. The demands of players led to many changes in services. These changes have significantly altered the financial landscape and have increased the risks affecting the profitability and solvency of banks. The profitability of an institution is its ability to achieve from his operation sufficient earnings, after deducting the necessary costs, in order to sustain its activities. It is the result of the transformation process (such interest rates, currencies or maturities) implemented by credit institutions in their intermediation function.The supervisors use several instruments for assessing profitability. Instruments fall into three broad categories (Nouy D. 1992). One approach is to highlight the intermediate operating balances. This helps to identify the elements which contribute to the achievement of the final result. These balances are overall net banking income, the gross operating income, operating income and net income. The second approach to measure profitability is to analyze the costs, yields and margins. This is mainly motivated by the need to take into account the entire business banking, including service activities and off-balance operations in order to calculate a simple indicator easily used for international comparisons.The third approach includes all the operating ratios calculated in order to highlight operational structures. These include the “overall coefficient of exploitation” which shows a synthetic share of gains absorbed by fixed costs, “The coefficient of return” (return on equity, ROE) witch expresses the return from viewpoint of shareholder, “The coefficient of yield” (return on assets, ROA) which expresses the overall return on assets. The disadvantage of its reference to total assets is that it makes no difference between assets despite non-converging risks.

3. Determinants of Bank Profitability

- According to a review of the literature on the determinants of bank profitability (Bourke 1989, Molyneux 1992, ...), banking institution is affected by external variables and other quantitative internal variables. The literature suggests that several factors may influence the profitability of banks. The main factors are the regulatory (Jordan, 1972), the size of the bank and economies of scale (Benston et al. 1982; Short 1979), competition (Tschoegl, 1982), concentration (Bourke, 1989), the market share (Short, 1979), interest rates (Short, 1979), the state ownership (Short, 1979), Inflation and demand for money (Bourke 1989).However, in another area of research, authors such Hermalin and Weisbach, (2003) and Spong et al. (2001) etc…, Explain the profitability of banks by other variables, the variables related to the internal organization of bank and the manner for which they are governed. Indeed, corporate governance is the process by which each of the different aspects of a company plays the role which is planned and assigned to create value for shareholders and hence for society as a whole. Also, corporate governance creates responsible and transparent companies who are better prepared to manage their financial risks.Furthermore, it facilitates the development institutions that build healthy and stable business environments.

3.1. Internal Determinants

3.1.1. Characteristics of the Board of Directors

- As an organ of approval, the board does not make significant decisions but helps leaders to take important decision, thereafter it ratify them. In banking industry, the significant lack of creditors discipline due to deposit insurance encourages leaders to take higher risks than it should be. Datar (2004) emphasizes in this context the need to empower the Board of directors to strict responsibilities.The board must have a power to appointment, control and possible revocation of the managerial team. In addition, it must have to define the long and medium term strategies and the most important policies and it must have to ensure their applications. According to Nam (2004), the Board of Directors is responsible for the effectiveness of governance and specifically internal systems of control. In addition, it assesses the performance of the bank, supervises the leaders, sets their pay and establishes communication systems and disclosure of information regarding all operations of the bank. Similarly, it must ensure the control of procedures developed to handle various situations of risk which the bank is exposed. Becher and Frye (2004) argue that deregulation has increased the need to exercise more control by the internal mechanisms of governance particularly the Board of Directors. This requires to the board of directors an extra attention compared to the attention exerted by their colleagues in other types of firms. The authors emphasize that the role of board of directors should not be ignored under the pretext that the authorities monitor this vital sector particularly. According to Craig (2004), the board of directors of banks is recruited to assume high public responsibilities. Indeed, they are not only responsible towards the shareholders elected but they have also to be responsible for the safety of fund trustees and for the permanent influence of banks into the market they serve. They must develop and maintain a system of supervision. The fact set them apart from other boards of directors working in other firms. The ability of the board of directors to fill its roles in an optimal way depends primarily on its composition and its size.Empirical studies on the impact of Board of directors on the performance of banks and firms generally give rise to conflicting results. The size of the boards, the presence of each type of directors (external, institutional, foreign and representative of government and public institutions) and the accumulation of offices of Chairman and CEO may be positively or negatively correlated with banking performance.- The size of the board (BDSiz): According to agency theory some authors have concluded that the size of the board is negatively related to the performance of firms, (Hermalin and Weisbach, 2003). When the size of the board of directors is high, it promotes its domination by the CEO and creates possible conflicts of interest among administrators and managers. This creates a fragmented and inefficient board and it will be hard to reach a consensus on major decisions, (Jensen, 1993). However, the contribution of a large number of directors may be more important than increasing problems of communication, coordination and decision-making (Dalton et al, 1999). We had expected a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 1: When the size of the board increases, the performance of the bank increases.- The presence of independent administrators on the board: The studies that analyze the impact of the board of director’s characteristics on the banks performance, take into account other features of the composition of the board, as the presence of independent directors. Nam (2004) stipulates that independent directors are the most influential and they are the only ones who can ensure that banks apply the regulations of their activities and that the leaders do not have discretionary behaviors that are harmful to the wealth of shareholders. However, Adams and Mehran (2003) reveal that the percentage of outside members of board of directors has no effect on the accounting and on the stock market performance of banks. Prowse (1997) stipulates that these members of board of directors are less effective, compared to regulatory mechanisms established by the government, in disciplining managers of banks. In our analysis of the determinants of bank profitability Tunisian, we do not take into account this feature, namely the number of independent directors, because of lack of disclosure of information about this topic. In fact, among the ten commercial banks only ATTIJARI BANK who mentioned in his independent director serving on its board.- The presence of institutional administrators on the board (InstAD): the impact of institutional directors in the board of directors on the value of the bank and the company in general has been debated in the literature between positive (such for Zeckhauser and Pound, 1990; Oswald and Jahera, 1991 and Li and Simerly, 1998 and Whidbee, 1997) and negative (such as for Morck, Shleifer and Vishny, 1988; Barclay Holderness, 1989; Mikkelson and Regassa 1991, Shleifer and Vishny, 1997 and Weinstein & Yafeh, 1998). Indeed, these directors have skills enabling them to finely analyze the accounts of the bank, its development prospects and the quality of its management. Their presence on the board of directors allow to a greater efficiency of control and hence better profitability. However, Paquerot (1997) notes that the amounts invested by institutional investors increase their dependence on managers. Their main objective would not be maximizing the value of their holdings but a minimum payment to offset their risks. We had expected a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 2: The higher the proportion of institutional directors serving on the board of directors the higher is the performance of banks.- The presence of foreign administrators in the board (FrAD): The banks with high foreign ownership have better access to capital markets, a higher capacity to diversify risk and greater opportunities to offer some of their services to foreign customers that are not easily accessible to domestic banks. In developing countries, the foreign-owned banks from developed countries also have access to new technologies. Oxelheim and Randoy (2003) found that the impact of foreign directors on the performance of firms is positive. Their study covers over 200 firms and performance is measured by Tobin’s Q. They argue that the recruitment of a new foreign member of the board of a company is perceived by investors as a signal of transparency and commitment to improving governance. We had expected a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 3: When the proportion of foreign directors serving on the board increases, the performance of the bank increases.- The presence of representatives of government and public institutions in the board (PubAD):According to the agency theory, banks held by the state suffer from a lesser disciplinary effect. This reduces the profitability of these banks. Similarly, La Porta, Lopez-de-Silanes and Shleifer (2002) reveal that in all countries, especially developing countries, the shareholding of the state in commercial banks is a common and a clear cause of their inefficiencies. We expected a negative and significant relationship between this variable and profitability of Tunisian banks.Hypothesis 4: When the proportion of directors who represent the state and public institutions, serving on the board increases, the performance of the bank increases.- The duality (DUAL): Pi and Timme (1993) show that in the case of duality the efficiency and profitability of banks are lower. The explanation lies in to the fact that the manager who is also chairman of the board still wants to protect its powerful position and makes decisions that involve less risk, as predicted by agency theory. As against, and Griffith Fogelberg (2000) not notice any impact of duality on the bank performance. Finally, Boyd (1995) shows that the relationship’s nature between the duality and performance depends to the environment. Therefore we assume a significant and negative relationship between this variable and bank’s performance.Hypothesis 5: The duality has a negative impact on the performance of the bank.

3.1.2. The Capital Structure (CAR)

- Berger (1995) precise that well-capitalized banks are considered less risky and can therefore access funds on better terms. In addition, if the capital increases, the financial autonomy of the bank increases resulting in a decreased need for long-term funds. Previous studies show a positive relationship between the ratio of capital and the ratio of return on assets (Demirguç. K, and Huizinga 1999; Bourke 1989). We expect a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 6: When the ratio of capital increases, the performance of the bank increases.

3.1.3. The Assets’ Quality (AQ)

- The loans granted by a bank represent an important source of income. The relationship of this ratio with the bank's profitability depends on the risk inherent in loans. Juvin (2001) in its analysis distinguishes eight classes of risk: The commercial risk, the risk of information technology, operational risk, legal and fiscal risk, political risk, the risk of competition, the environment risk, and the risk of resources.To deal with these types of risks banks ranking them, put up a charter for each risk, thereafter control and clarify responsibilities. But the essential is a necessary evolution and delicate culture of risk. The Basel II accord is expected to correct errors related to misuse of these risks.As the risk of loans increases, returns demanded by banks are also increasing. Therefore, the higher the ratio of loans compared to total assets increases, the bank is profitable. However, when the failure rate of these loans is high, the probability of bad loans is important and the relationship between this rate and profitability could be negative (Caudamine and Montier, 1998). So we expect a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 7: When assets quality deteriorates, the performance of the bank decreases.

3.1.4. Bank Efficiency (EFFISC)

- Bank profitability depends to the production efficiency of banks. Therefore, it seems that efficiency is a determinant of productivity and hence of the bank performance. Frei, Harker and Hunter (1997) showed that the success of banks depends on the way in which managers choose the production process and come to transform inputs into outputs. This concept is measured by different indicators and techniques. In Tunisia, intermediation function is still the main function of credit institutions. Thus, we chose as a measure of efficiency, the rate of financial products to financial charges. We expect a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 8: The more the bank is efficient, the more its profitability increases.

3.1.5. Public Ownership Versus Private Ownership (PrivOWN)

- Several studies have shown that the ownership of a bank may be an important variable in explaining the bank profitability. According Bourke (1989) and Short (1979), there is a negative relationship between public ownership and the bank performance. This is explained by the fact that the objective of public banks is not always maximizing profits, but rather, financing strategic sectors with a relatively high risk as the agricultural and tourism sectors. However, Molyneux and Thornton (1992) found that there is a positive relationship between public ownership of the bank and the return on equity. Banks owned by the state generates a return on equity higher than private banks, because public banks generally maintain a lower ratio of capital, as the government provides implied coverage of transactions undertaken by them. Relying on agency theory, Saunders, stock and Travlos (1990) suppose that banks controlled by shareholders are less risk averse than those controlled by executives and managers, which directly affects bank profitability. We had expected a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 9: Private ownership of the bank increased its performance.

3.1.6. Bank Size (BankSiz)

- This variable is used in various studies such as Mak and Ong (1999), Godard (2001) and Fernandez and Arrondo (2002). It is also used by Kwan (2003). The latter finds that the size of banks has a significant and positive effect on profitability suggesting the existence of economies of scale. It confirms this by distinguishing between banks listed and unlisted companies. Other authors (Boyd and Runkle, 1993; Pinteris, 2002; Adams and Mehran, 2003) also found that performance is positively associated with the size of the bank. Relying on these results, it is assumed in this study that the size of the bank influence positively its performance. We had expected a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 10: The more the size of the bank increases, performance increases.

3.1.7. The Macroeconomic Determinants

- The development of the financial system is undoubtedly a driving force behind economic growth. At the same time it can be as a result of the overall development of the economy. The relationship assumed by Patrick (1966) and more recently validated by Greenwood and Jovanovic (1990), shows that economic growth enhance the development of new financial institutions.The variables related to the economic environment seem therefore important determinants to explain the profitability of banks. In this context, we address the impact of the economic growth and of inflation on profitability of banks.- Inflation (INF): Inflation affects the banking sector through its influence on the market of bank credit. Indeed, an increase in the rate of inflation leads to a decrease in the real rate of return, which will consequently affect the credit market and thus the bank profitability, because with high inflation, banks will give less credit. However, according Demirguc-Kunt and Huizinga (1999), an increase of inflation should have a positive impact on net interest margin and thus performance.We had expected a positive relationship between this variable and profitability of Tunisian banks.Hypothesis 11: When inflation rises, the performance of the bank increases.- Economic growth (GDP): The classical theories and neoclassical financial insist on the passive role of the financial system as it adapted to needs of financing the real sector of the economy by ensuring its autonomous development. As against, Patrick (1966) showed a bilateral relationship between the two sectors by distinguishing between supply caused by the financial development and demand induced by it. To confirm this hypothesis, Jung (1986) used the causality test of Granger and has shown that during the early stages of economic development, financial development accelerates growth and subsequently the direction of causality is reversed. So, he concludes that there is a reciprocal relationship between the two sectors. As the bank is the financial engine of development, especially in developing countries, it is necessary to examine the effect of economic growth on the profitability of banks. On the basis of empirical studies, the results show that the impact of economic growth on banking activity is mixed and sometimes not significant. Barth, Nolle and Rice (1997) found that the annual Gross Domestic Product (GDP) has a positive impact on return on equity, Deminguç-Kunt and Huizinga (1999) observed a significant impact, while Mickel et al (2003) found that the margin intermediation of banks depends on the type of shock on real activity and that the meaning of the relationship between credit demand and economic activity depends on the gap between investment and lending that could also increase or decrease with economic activity. We had expected a significant and positive relationship between this variable and profitability of Tunisian banks.Hypothesis 12: When the economic growth rate increases, the performance of the bank increases.

4. Methodology and Empirical Results

4.1. Presentation of the Sample

- The data used in the empirical analysis are derived from financial statements of the ten banks listed on the Stock Exchange of Securities of Tunis (BVMT) in the period 2005-2014. We retained in the sample all listed banks which are 10 in number. We have paid particular attention to the continuity of temporal data of the banks. The information about the characteristics of the boards is collected from the annual reports of activities of banks. We also used aggregated data from the statistics of National Institute of Statistics (INS). These data concern mainly, gross domestic product and the information on the index of consumer prices.We are particularly interested in Tunisian banks because, like all developing countries, financing of the Tunisian economy is based primarily on banking firms. However, when these establishments show signs of fragility, these can negatively affect the entire economy and on the welfare of households.

4.2. Indicators’ Measures

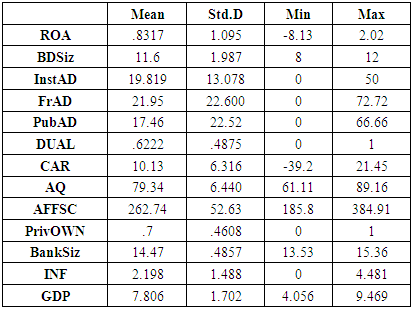

- The dependent variable chosen to explain the profitability of Tunisian banks is the economic profitability, ROA. This is a quantitative variable expressed by the ratio of net income / Total assets. We chose this ratio as a measure of Tunisian bank profitability, and it was preferred to returns on equity, because in the developing countries, banks operate with low capital. This weakness in equity is strongly encouraged by the implicit insurance of deposits (IMF Report, 2004).Regarding the first assumption (H1), to measure the impact of the size of the board of directors on the profitability of Tunisian banks, we used the number of directors serving on the board.As the following assumptions (H2), (H3) and (H4), we used the proportion of institutional directors serving on the board, the proportion of foreign directors and the proportion of representative State and public institutions, respectively. For the fifth hypothesis (H5) the extent of duality is to allocate 1 if the duality exists and 0 otherwise. It is a binary variable.And to measure the structure of equity (H6), we can use several ratios; we chose the ratio of equity compared to total assets.Regarding the seventh hypothesis (H7), the quality of assets (AQ) is measured by the ratio of non-performing loans to total loans.To measure the efficiency of the bank (EFFISC) for the eighth hypothesis (H8) we used the rate of financial products on financial charges.Regarding the ninth hypothesis (H9) we use the following variable: PrivOWN = 1 if the bank has a private ownership; 0 if not.The variable (BankSiz) representing the size of the bank of the tenth hypothesis (H10) is measured by the natural logarithm of total assets. The transformation to the logarithm avoids the problem of scale that may result from the huge gap with the measures of other variables considered in the model.Finally, assumptions (H11) and (H12), we used, respectively, the growth rate of the index for consumption as a measure of inflation and the growth rate of GDP as a measure of economic growth.Table 1 presents the descriptive statistics. It demonstrates a disparity in average values and the standard deviations of certain variables. These two sizes suggest that the structure of the sample is not homogeneous and that additional tests are needed to choose the appropriate estimator.

|

4.3. The Methodology

- As already mentioned, we used in this study individual (10 banks) and temporal (10 years) data. Baltagi (2001) and Hsiao (1986) indicate that the methodology of Panel data controls the individual heterogeneity, reduces the problems associated with the multicollinearity and bias estimation. The estimate by ordinary least squares (OLS) on panel data presupposes uniformity of individuals who make up the sample, otherwise the estimators are biased.The heterogeneity of the average values of explanatory variables and their standard deviations between different banks in our sample shows the need for other tests in order to choose the appropriate estimator.In conducting the test of Fisher (F-test) and Breushe-Pagan Lagrange Multiplier (LM), we accept the rejection of a homogeneous Panel and therefore our model is either fixed individual effects or random individual effects. The Hausman test (1968) tells us that the model that fits the data structure of the sample is fixed effects.The estimate of a model to individual fixed effect helps eliminate the individual heterogeneity and implement the estimator OLS on transformed data. Indeed, the application of this model is to calculate for each variable its difference from the average of the period for each bank (WITHIN processing).However, the calculation of the estimate eliminates any variable that does not vary in time for the same individual, as the variables that takes the value 0 or 1 (as the variables representing the private property and the duality in our case).The method of Prais Winsten Regression (PCSE) can overcome this problem. This method allows estimation in the presence of AR(1) autocorrelation within panels and cross-sectional correlation and heteroskedasticity across panels.The model will take the following form:ROAi,t = α + β Xi,t + ui + ei,tWhere,i = 1, 2… 10 (10 Banks)t = 2005, 2006… 2014 (10 years)Xi,t : Are explanatory variables of Tunisian bank profitability (ROA) for the bank (i) for the year (t).These variables are: BDSiz, InstAD, FrAD, PubAD, DUAL, CAR, AQ, EFFISC, PrivOWN, BankSiz, INF and GDP.ui represents the specific effect of each bank, which remain fixed in time, while ei,t is a random disturbance.

4.4. Empirical Results

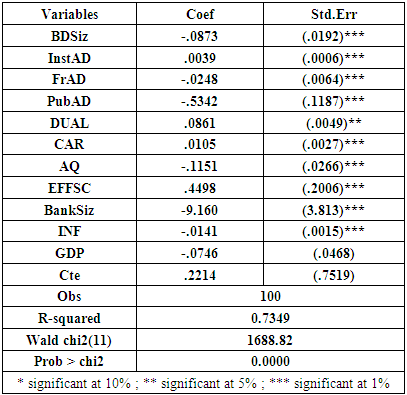

- The review of data shows that there is a strong collinearity of the variable representing the private ownership of the bank and the proportion of public administrators serving on the bank’s board of directors. To avoid multicollinearity problems we have excluded the variable indicating private ownership of the bank (PrivOWN).In addition, examination of data shows that there are problems of heteroscedasticity and contemporaneous correlation (cross-sectional correlation) in errors terms. As against the autoregressive correlation AR(1) does not exist.Therefore, after taking into account heteroscedasticity and contemporaneous correlation between the panels, the estimate of the proposed model has allowed us to achieve results presented in table 2.

|

5. Conclusions

- The empirical results of our analysis allow us to clarify the relationship between Tunisian bank profitability and different external and internal determinants. The key findings emerged from this empirical study support a negative relationship between inflation and bank profitability. While economic growth has no impact on the profitability of Tunisian banks. Tunisian banks respond to the increasing of capital with higher performance, this is in line with the expectations of regulators in setting the capital ratio (Ratio Cooke) since 1992 and strengthened it in 1999. However, the size of the board of directors adversely affects the profitability of banks. The presence of institutional administrators in the composition of the board has a positive and low impact on Tunisian bank profitability. Finally, the presence of foreign directors adversely affects the profitability of Tunisian banks. This can be attributed to the absence of perfect knowledge of the specific economic environment of Tunisia. In this study, contrary to expectations, the results have shown that the board of directors in whole, does not have a dominant role in the Tunisian commercial banks. Despite the great importance attached to this internal mechanism of governance, it appears that it plays a limited role and it has several shortcomings in relation to its mission.Therefore, banks control management bodies must ensure the diversity of the members of the board, limiting its size and to ensure the professional competence of its members. Economic conditions have no significant effect on the performance of banks, which could indicate that the quality of management is the most important factor that determines the performance of Tunisian banks. This conclusion is proved by the result which shows the positive and significant sign of the coefficient of the variable apprehending the quality of management. Consequently, banks control management bodies should also improve the quality of management by providing training and monitoring of bank executives. Moreover, they must ensuring compliance with prudential regulations on the strengthening of the capital ratio to reduce risk-taking by these banks and improve their performance.Note, also, that our results have limitations as the sample size is relatively small compared to previous studies that have examined the relationship between bank profitability and its determinants.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML