-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(5): 245-252

doi:10.5923/j.ijfa.20150405.03

An Empirical Investigation of the Impact of Dividend Policy on the Performance of Firms in Developing Economies: Evidence from Listed Firms in Nigeria

Benjamin I. Ehikioya

Department of Finance, University of Lagos, Lagos, Nigeria

Correspondence to: Benjamin I. Ehikioya, Department of Finance, University of Lagos, Lagos, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This study investigates the possible impact of dividend policy on the value and performance of firms in developing economies. The data sample for this study is drawn from 81 firms listed on the Nigeria Stock Exchange during the period 2001 to 2010. The study employed the panel data regression model to analyze the data and to investigate the possible link among the variables identified. The result of the investigation provides empirical evidence to support the view that dividend policy is relevant in explaining the value and performance of firms in developing economies, especially listed firms on the Nigeria Stock Exchange. The findings revealed a significant positive impact of dividend payout on the performance of firms, measured as return on assets and return on equity. Also, the analysis revealed that firm’s dividend policy has a significant positive correlation with the firm’s profitability, proxied by return on assets. The finding confirms the proposition that dividend policy is an important determinant of firm performance. The study suggests policies that may help to improve the value and performance of the firm while contributing to shareholders’ wealth maximization.

Keywords: Agency Theory, Dividend Policy, Developing Economies, Nigeria, Firm Performance

Cite this paper: Benjamin I. Ehikioya, An Empirical Investigation of the Impact of Dividend Policy on the Performance of Firms in Developing Economies: Evidence from Listed Firms in Nigeria, International Journal of Finance and Accounting , Vol. 4 No. 5, 2015, pp. 245-252. doi: 10.5923/j.ijfa.20150405.03.

Article Outline

1. Introduction

- In a world of significant agency problems between the principal and the agent, those entrusted with the affairs of the organization are repeatedly faced with the decisions to enhance the value of the firm. Appreciably, such decisions bother on investment in the assets, financing structure and dividend policy of the organization. Of these three fundamental responsibilities, dividend decision has remained a major factor to appraise the activities of the agent. In principal-agent relationship, the agent is contracted to represent the interest of the shareholders while protecting and promoting the interest of other stakeholders.The dividend policy of the firm has remained one of the most contentious, but interesting issues in corporate finance. The relative merits of dividend policy on the performance of firms are important both from the firm and stakeholders’ perspectives. In examining this issue, the question is whether the dividend policy of a firm actually impacts on its economic value and performance, particularly in developing nations. The theoretical literature in this area, particularly in developing nations, is sparse in its predictions thereby lacking a unified view on the real consequence of dividend policy on the performance of firms. Opinion from scholars ranges from the position that dividend policy has no real impact on the value and performance of the firm to the position that the dividend policy of a firm does impact on the value and performance of that firm. Modigliani-Miller (1958) opined that in a world of efficient market condition, absence of taxes, transaction costs and asymmetric information, the value of the firm is not a function of the dividend policy and the debt structure of the firm. In order words, the value of a firm is unaffected by how that firm is financed. To them, the dividend policy of a firm is seen as not influencing the performance of the firm and the maximization of shareholders’ wealth. On the other hand, Gordon, 1961 and 1963; Pandy, 2005, posits that the value and the performance of a firm is a function of the dividend policy and other variables like the way the firm is being finance. In a related study, Petit (1972) conducted a research in the United States of America and reported that an upward or downward movement in dividend payout of a firm generally have positive or negative influence on the stock market price of that firm. Supporting the impact of dividend policy on the value of a firm further, Asquith and Mullins (1983) reported that, firm’s dividend policy have a significant positive impact on its shareholders’ wealth.In this study, we assume that the dividend policy of an organization would have an impact on its performance and, in turn, the wealth of shareholders. Dividend policy is especially critical in imposing discipline and providing fresh leadership when the corporation is performing sub-optimally and thus unable to guarantee the basic objective of maximizing shareholders’ wealth (Al-Malkawi, 2007).Since Adam Smith (1776) raised the issue of governance of publicly traded corporations, there has been a significant amount of research in finance about the relationship of stakeholders and contextual variables. One important contextual variable is the dividend policy. Several scholars have attempted to examine dividend policy from different perspectives, especially since Lintner (1956) examined the interrelations among incomes, dividends, retained earnings and taxes. Dividend policy has continued to engage the attention of researchers and corporate executives. Twenty years after, Black (1976) observed that, “the harder we look at the dividend picture, the more it seems like a puzzle, with pieces that don’t fit together”. Over the years, research interest in dividend policy has not waned; instead, it has remained a source of concern for researchers, investors, and business leaders, especially in the face of the recent global economic turbulence. In the modern corporation, dividends can play a useful role to mitigate the impact of conflict resulting from the principal-agent relationship. Furthermore, high dividend payout helps to guarantee reduced funds available for consumption by the agent. This is significant to compensate stakeholders in accordance of priority claims on firms’ assets. In order words, in the event that the organization is not having any immediate positive investment opportunity, the agent is compelled to pay out any available excess liquidity as dividend. And any additional investment opportunities would requires the agent to seek extra fund from the capital and debt markets. In this instance, firms’ dividend policy can affects the value of the firm by ensuring that the activities of the agent are monitored by the regulatory bodies such as the Security and Exchange Commission in order to ensure that only profitable investments activities are undertaken by the agent. As documented by Easterbrook (1984), this action of monitoring the activities of the agent by the capital market might assist to reduce any agency costs associated to investments in less rewarding ventures, Park (2009). In the finance literature, the dynamics of dividend policy has been analyzed for years. But, scholars in this field have presented different views to explain the dynamics of dividend policy over time and across cultural settings, Black, (1976); Samuel and Edward, (2011). The controversy around dividend policy has also been researched in Nigeria since the work of John Lintner (1956). As documented, Uzoaga and Alozienwa (1974) highlighted the pattern of dividend policy in Nigeria firm, especially during the indigenization decree programme of 1969 to 1972 and concluded that the dividend policy of a Nigerian firm is influenced by fear and resentment as against the conventional factors such as share pricing policy, to change in dividend policy. However, Inanga (1975) and Soyode (1975) had since challenged and criticized Uzoaga and Alozieuwa’s study for its failure to empirically test the contribution of conventional factors to dynamics in dividend of firms.In the same vein, Inanga (1975) and Soyode (1975) also failed in their bid to empirically investigate to what extent Lintner’s model on dividend policy could be used to explain the dividend policy of firms in Nigeria. Since the works of Inanga (1975) and Soyode (1975), a number of studies on dividend policy in Nigeria such as, Oyejide (1976), Izedonmi and Eriki (1996) and Adelegan (2003), have focused attention on the test of Lintner’s model as modified by Brittain (1964). Analyzing a sample size of 19 firms for the period 1968 to 1976, Oyejide (1976) found empirical evidence to support the Lintner’s model of dividend policy in Nigeria. Other recent studies in Nigeria such as Izedonmi and Eriki (1996), using data from 1984 to 1989 and Adelegan (2003) using data from 1984 to 1997 tested the modified Lintner’s morel and Their results are both consistent with the findings of Oyejide (1976). Theoretical agency models of dividends to ensure optimal contractual relationship between investors and corporate insiders are still sketchy. These models are expectedly to allow for a range of feasible financing instruments that would reduce agency problems while promoting return on investment. Instead, different models, such as Fluck (1998), Myers (1998), capture different aspects of the problem. Moreover, more studies are still being conducted to deal with the issues of choice between debt and equity in addressing agency problems, the choice between dividends and share repurchases, and the relationship between dividends and new share issues. This study examines how dividend policy could be used to mitigate agency problems that may have adverse effects on the firm. As stated above, dividend payment serves as a mechanism to compel the agent to approach both debt and capital market for finance to any profitable investment. This helps to reduce agency costs while curtailing the activities of the agent by the institutions.Against the backdrop of shareholders’ wealth maximization and agency theory, the objective of this study is to develop a further understanding of dividend policy in Nigeria, through empirical analysis of the relationship between corporate dividend policy and its effect on the performance of firms, especially at this instance of the present economic reforms in Nigeria. In addition, the study seeks to provide an extension of the currently available tests in corporate dividend policy through choosing large samples of listed firms in an emerging market. And to make insightful recommendations on how the significance of dividend policy in Nigeria can be optimized to increase stakeholders’ confidence and boost the maximization of wealth. Listed companies in Nigeria provide a unique opportunity for the study of this issue since they allow both quantitative and qualitative analysis of the variables in the study. Although listed companies represent only a small subset of Nigeria enterprises, they are however playing a pivotal role in steering the economic growth resulting to the present growth rate in the GDP in recent years. The balance of this paper is structured as follows. After the introductory section, the next section is the review of relevant literature. While section three introduce the data and research methodology, section four focused on the analysis of data and discussion of findings. Finally, the last section presents the conclusion of the study.

2. Literature Review

- Technically, the dividend policy of the firm relates to various decisions on payment of dividend, which remain a major aspect of the strategic decision of the firm. Essentially, it involves the determination of how earnings generated would be shared between payments to stockholders and reinvestments in projects that would yield positive net present value for the firm. In dividend policy decision, management needs to decide the amount, ratio and pattern of distributions to shareholders over time. As documented in the literature, the debate on dividend policy has basically focused on the irrelevance and relevance of dividend policy to the value of the firm (Modigliani and Miller, 1958, 1961; Gordon, 1961, 1963; Pandy, 2005). The basic theorem as put forward by Modigliani-Miller (1958) states that, in the absence of taxes, transaction costs, and asymmetric information, and under the condition of an efficient market, the value of a firm is unaffected by how that firm is financed. To Modigliani-Miller, it does not matter what the structure of a firm's dividend policy might be. Neither does it matter if the firm raised its capital by the issuance of stock or sale of debt. In the present economic rearrangement and reforms both at the public and private sectors as occasioned by the dynamics in the environment, the significant influence of dividend policies on performance has continued to gain attention with divergent views. A number of studies on dividend policy of the firms have produced both theoretical and empirical works, especially since Modigliani and Miller (1961) documented the dividend irrelevance theory in their seminar paper. Prior to Modigliani-Miller’s theory on dividend policy, Lintner (1956) developed and empirically tested the partial-adjustment model to investigate the factors that may influence firm’s dividend policy decisions. In that study, Lintner documented the influence of possible changes in earnings and dividend rates as significant to dividend policy decisions. He therefore concluded that managers tended to follow a smooth pattern of dividend policy on the short run since this would be appealing to investors who look forward to derive returns for their investment.Supporting the Litner’s view on dividend policy, Fama and Babiak (1968) examined other models of dividend policy and concluded that managers prefer stable and sustainable dividend policy decisions. Other empirical studies such as Darling (1957); Oyedeji (1976) and Adelegan (2003) tested the modified version of Litner’s model and affirmed support for managers’ preference for stable and sustainable dividend policy decisions, at least on the short run. The investigation on the determinants of dividend policy has equally been carried out using the behavioural approach, which tends to rely on the survey of corporate managers in order to determine factors that influence firm’s dividend policy. As reported in Baker et al. (1985), Baker and Farrelly (1988) and Mainoma (2001), factors such as the level of past and present earnings and the previous pattern of dividend policy may play significant roles in deciding firm’s dividend policy decisions. These factors may be given different levels of importance by different managers at different times in other to enhance the value of the firm, (Baker and Powell, 1999). Investigating the dividend policy further, Rozeff (1982) evolved an alternative model to analyse the determinants of dividend policy. In this model, Rozeff identified other variables that might also influence the dividend policy of the firm. Variables such as average revenue growth rate, percentage of shares held by insiders and the number of ordinary shareholders were related to the level of dividend payout ratio and found to influence the dividend policy decisions. However, Demsey and Laber (1992) tested Rozeff model on another seven-year period and confirmed the robustness of Rozeff model on dividend policy. Similarly, Casey and Dickens (2000) examined this model in their Tax Reform Act (TRA) model and confirmed consistency with the results of Demsey and Laber (1992).In the decision around dividend policy, management usually contends with several factors in order to optimize the potentials of such policy to maximize shareholders’ return on investment. For instance, investigating the elements that shape dividend policies of firms quoted in Argentina Stock Exchange for the period 1996 to 2002, Beabczuk (2004) reported that while larger and profitable firms without any viable investment opportunities pay something more to shareholders in return for their investment, firms with higher degree of risk and less chances to borrow tend to pay something less as dividend to investors. In a related study, Kale and Thomas (1990) posits that a firm’s pattern of dividend policy tend to follow a stable future cash flows. Apart from factors such as liquidity position, inflation, interest rate, investment, future growth consideration and legal requirements, dividend policy of a firm may be influenced too by the nature of ownership structure and the overall level of corporate governance enshrined in that firm. This is evident in a study by Kouki and Guizani (2009) who found managerial ownership to have a significant level of influence on dividend payout. Similarly, Rozeff, (1982) examined the link between dividend policies and variables such as beta rate, growth rate, and management ownership ratio. The study which evaluated 1000 firms in 64 different industries in the US revealed an upward and downward relationship between the payment of dividend and the number of shareholders. The results of Rozeff’s study showed dividend payment in a reverse function of future growth in sales, beta rate, and ownership ratio. In an apparent swift reaction to the effects of the remarkable reduction in dividend from 52.8% to 20% between 1973 and 1999 amongst US corporations, Fama and French (2001), examined the possible reasons for this decline in dividend in firms listed in the New York Stock Exchange. And they found that while larger firms pay higher dividends to their investors, smaller firms with investments opportunities pays lower dividends. Also, the results of their study indicates that factors such as the size of the firm, investment opportunities and profitability plays significant roles in dividend policy decisions. This result is consistent with the views of Oyedeji, (1976), who reported that not until firms attain their maturity growth stage, dividends payment is not a likely decision. In their seminal works, Modigliani and Miller (1958, 1961) postulated that in a perfect world with no asymmetric information, no taxes and no transaction costs, dividend policy is irrelevant in determining the cost of capital or firm value. Essentially, the postulation here is that since the firm’s investment opportunities, future net cash flows, cost of capital and overall company assets are not influenced by dividend policy decisions. Modigliani and Miller (1961) opined that the value of the firm is largely affected only by the investment and financing policies of the firm. However, analysing dividend policy further using Danish corporations, Raablle and Hedensted (2008) reported that dividend-paying firms tend to have high return on equity and larger firm size. Furthermore, Zhou and Ruland (2006) conducted a study on the relationship between payout and future earnings growth. They analysed a large sample of companies for over 50 years period, and revealed that high dividend payout firms tend not to experience weak, but strong future growth in earnings. The information signalling effect of dividend policy can be seen to mean a two edge sword. On the one hand and as noted by Brennan (1970), healthy dividend payout indicates that firms are generating real earnings from their performance. Samuel and Edward (2011) affirmed this fact in a study done in Ghana, which revealed dividend payout to have a positive relationship with the performance of banks in Ghana. The authors found that banks in Ghana pay dividend to their shareholders in order to increase profitability. In this instance, management could be seen as paying out dividends to shareholders as a way to signal good performance and be perceived in good faith. On the other hand, it is also important to note that non-payment of dividends may be seen by shareholders and other stakeholders as signalling adverse effect of economic activities of the firm on its performance, Rozeff, (1982); Jensen, (1986); Bhattacharya (1979); John and Williams (1985).

3. Methodology

- This study adopts the panel data regression model to gain the maximum possible observations to examine the impact of dividend policy on the performance of firms listed on the Nigeria Stock Exchange (NSE) for the period 2001 – 2010. These periods witnessed some levels of political stability and bank consolidation in Nigeria. The bank consolidation exercise impacted on other sectors considered in this study. During the consolidation exercise, the banks were encouraged to go into mergers and acquisition arrangements in order to take advantage of economic of scale to support businesses in Nigeria. In addition, the banks were encouraged to inject fresh funds to boost their capital base, not only aimed at increasing stakeholders confidence, but to be able to support huge capital projects that will translate into meaningful economic growth and development. Expectedly, this exercise was meant to lead to increased productivity and higher returns for the shareholders of firms in Nigeria, Aregbeyen and Olufemi (2011). As at December 2010, the NSE had grown to 217 listed firms with a total market capitalization of N9.92 trillion, from different sectors of the economy. These sectors according to NSE classifications are agriculture, computer and office equipment, healthcare, chemical and paint, banking, building materials, construction, food beverages and tobacco, emerging markets/second tier securities, industrial/domestic products, packaging, insurance, petroleum (marketing), publishing, textiles, automobile and tyre, breweries and conglomerates.The sample selection is based on a number of criteria previously employed in similar studies such as Adelegan (2003). For instance, in this study, we considered firms with records of dividend payment, debts, assets and liabilities during the period under review. In this study, we eliminated firms without records of financial and market activities sufficient to estimate data for the model specified to examine the link between dividend policy and performance. The final sample for this study consists of 81 firms listed on the NSE with information necessary and sufficient to investigate the impact of dividend policy on the performance of firms in developing economies, evidence from Nigeria. The large sample size employed to this study from a single country in sub-Saharan Africa provides us with the opportunity to investigate the subject matter and make necessary recommendations to stakeholders.Essentially, the study relied heavily on data sourced from the NSE fact books for the period 2001 to 2010 and the annual reports and accounts of firms in the sample. Publicly available information such as corporate performance, dividend policy and firm specific characteristics from the regulatory authorities, the media and periodicals from quoted firms were also considered. To analyse the data collected and make necessary recommendations to policy makers, the study employed the panel data analysis structured on the Ordinary Least Squares (OLS) regression method. This is to enable us gain maximum possible observations that would ordinarily be hindered due to inequality in the observations resulting from penalty suffered by firms due to delisting, mergers and acquisition and other possible factors numerous to mention. Apart from the processes in place where firms can willingly delist itself due to restructuring and any other factors, the NSE also exercises its regulatory authority by sanctioning firms that fails to comply with the post-listing requirements. The OLS regression model to determine the correlation between dividend policy and firm performance is thus given as: PERFit = α + β1DPRit + β2DPOLICYit+ β3FSIZEit + β4TLEVit + β5FCCGit + β6FAGEit + β7INDDUMit + εitIn the above equation, α represents the intercept, β the regression coefficients and εit is the error term. The dependent variable is performance measured as return on assets (ROAit) and return on equity (ROEit) respectively. While ROA is measured as the percentage of net income to total assets, ROE is measured as a percentage of net income to common equity. The study utilized firm dividend payout ratio (DPRit) and dividend policy (DPOLICYit) as independent variables. Dividend payout ratio is measured as dividend per share divided by earnings per share. The firm dividend policy is measured as dummy variable taking the value of 1 if the firm maintains dividend policy, otherwise zero (0). The control variables that might also influence firm performance are the firm size (FSIZEit) which represents the total assets owned by the firm and measured as the natural logarithm of total assets; total leverage (TLEVit), measured as the ratio of total debt to total asset; firms code of corporate governance (FCCGit), which is measured as dummy variable taking the value of 1 if the firm maintains code of corporate governance policy, otherwise zero (0), firm age (FAGEit), defined as the number of years since its incorporation and calculated as observation year less incorporation year. Finally, the industry dummies (INDDit), measured as dummy variable taking the value of 1 if the firm belongs to a particular industry, 0 otherwise.The interrelationship between dividend policy (payout) and firm performance is one area in finance literature that is so much debatable both in developed and developing countries. Although a lot of research work has been done in this area of corporate finance, there is still relatively no clear consensus to the pattern of firm’s dividend behaviour on the value and performance of the firm, Uzoaga and Aloizieuwa (1974). On the one hand, the pattern of a firm’s dividend policy in its strategic decision is believed to have some degree of influence on the performance of that firm. On the other hand, firm’s performance is important to determine the dividend payout ratio to shareholders, Adelegan (2003); Aregbeyen and Olufemi (2011). Consequently, this study hypothesized the existence of significant positive relationship between dividend payout and firm performance, measured as ROA and ROE. It is believed that dividend policy (payout ratio) is relevant to explaining the levels of performance of publicly quoted firms in Nigeria.

4. Discussion of Findings

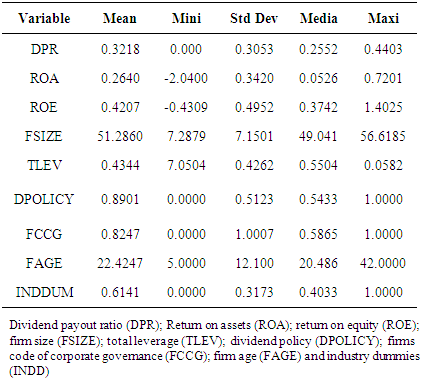

- The summarized descriptive statistics of the explained and explanatory variables as presented in Table 1 below for the period 2001 to 2010, revealed the following observations. First, the dividend payout ratio is reported to have a mean (median) value of 0.3218 (0.2552) and standard deviation of 0.3053. This shows that firms listed on the Nigeria Stock Exchange for the period under review pays only 32% of their total earnings as dividends to shareholders. It means therefore that 68% of their earnings are retained for future investment in profitable ventures. The mean (median) of dividend policy is 89% (54%), indicating that on the average, over 89% of sampled firms in the Nigeria Stock Exchange have a dividend policy to pay dividend to respective shareholders. In other words, more than 89% of listed firms have a dividend policy programme to make return to shareholders.

|

|

5. Conclusions and Recommendations

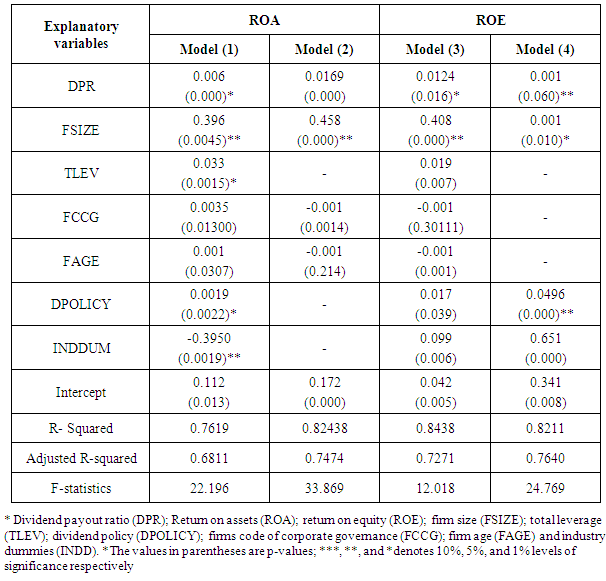

- This study investigated the impact of dividend policy on the performance of firms listed on the Nigeria Stock Exchange. Principally, the study used a sample of 81 listed firms for the period 2001 to 2010. Data collected from the NSE fact books, the annual reports and accounts of listed firms and those from the regulatory authorities were analysed using the Ordinary Least Squares regression model. The study of dividend policy of firms in Nigeria is of significance, especially now that the country is yarning for both rapid and sustainable economic growth and development.The study provides evidence that dividend policy is relevant to the performance of firms listed on the Nigeria Stock Exchange. The study confirmed the positive impact of dividend policy (payout) on the performance of firms, measured as return on assets. The study also found evidence that larger firms tend to payout dividend following the positive link between dividend policy and firm size. Furthermore, the results of the robust check using return on equity as a performance measure is consistent with the results of the analysis using return on assets. This, therefore, indicates the relevance of dividend policy to the value and performance of firms in Nigeria. Consequently, it is essential for those entrusted with the affairs of the firm to allocate adequate time and other resources in the design and implementation of a robust dividend policy. Undoubtedly, this measure would help not only to motivate investors, but would serve as a monitoring and control mechanism in the system, enhance firm performance and by extension improved on shareholders wealth maximization.This study and the analysis of the identified variables have really produced some interesting results important to further our understanding of the subject matter. The findings of this study may assist policy makers on dividend policy decision. Nevertheless, for the purpose of research, it is also important to expand the frontier of this study by choosing a larger sample size with additional variables. Finally, factors such as ownership structure, board composition, and effect of tax on dividend policy might be a fruitful avenue for further empirical investigation.

ACKNOWLEDGEMENTS

- I wish to acknowledge the Nigeria Stock Exchange for data necessary for analysis. Special thanks to the anonymous reviewer for his/her constructive comments.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML