-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(5): 231-235

doi:10.5923/j.ijfa.20150405.01

Firm Size, Ownership Concentration and Business Sector: The Influence to Credit access SMEs in Indonesia

Ratna Anggraini ZR, Yohan, Etty Gurendrawati

Department Accountancy, Economic Faculty, Jakarta State University, Jakarta, Indonesia

Correspondence to: Ratna Anggraini ZR, Department Accountancy, Economic Faculty, Jakarta State University, Jakarta, Indonesia.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The one of important role of SMEs in economic development in Indonesia, Hill (2001) stated is a significant contribution of SMEs with regard to employment. Central Statistics Agency (BPS) 2009 showed the proportion of SMEs have 99.99% of the total businesses in Indonesia or as many as 52.76 million units, SMEs proved to account for 56.92% of the total Gross Domestic Product (GDP) of Indonesia, equivalent to Rp1.213,25 Trillion. Using three independent variabel: firm size, Concentration of ownership and business sector, this paper aimed to exploring the factor that has contribution on credit acces to solved the financial problem SMEs in Indonesia. Data of this research is primary data by distributing questionnaires to the respondents. Sample of this research is obtained from 78 SMEs companies in Bekasi West Java Indonesia. Using analysis which a technique development of multiple linear regression. The results of this research, the size of company and the business sector affect the credit access, the concentration of ownership does not affect the credit access individually. Using F test The size of the Company, the concentration of ownership and the business sectors together affect the credit access is measured based on the perception of entrepreneurs for the company access to external capital.

Keywords: Small and Medium Enterprises, Financial problem, Credit access

Cite this paper: Ratna Anggraini ZR, Yohan, Etty Gurendrawati, Firm Size, Ownership Concentration and Business Sector: The Influence to Credit access SMEs in Indonesia, International Journal of Finance and Accounting , Vol. 4 No. 5, 2015, pp. 231-235. doi: 10.5923/j.ijfa.20150405.01.

Article Outline

1. Introduction

- European Central Bank Consultation (2011) which stated that credit access was ranked as the second most problems put pressure on SMEs in Europe. Even Survey World Business Enterprise Survey (WBES) carried out in 135 countries and covers up to 130,000 companies in 6 sub-region puts credit access as a matter of the greatest economic barriers with figures of 16.9%, outpreforming other issues such as corruption, discrepancy political in stability and transportation. It is almost similar also be inferred from the Public Consultation on the effectiveness of innovation support in Europe (2011), that the lack of credit access is a major factor inhibiting the activity of innovation and the introduction of innovations into the market.RAM Consultancy (2005) stated that the restrictions on capital were divided into two, from the supply side, and the demand side. This triggers the magnitude of asymmetric information between SMEs and institutions that intend to provide loans. It is to be considered for creditors to lend SMEs head. SMEs resources for their own benefit.Other characteristics that may affect credit accesses a business sector in which SMEs operate, because the business sector represents a risk that must be faced by SMEs. This has been stated by Punyasavatsut (2011), which states that the manufacturing company is considered to have a lower risk, have a debt to equity ratio that is higher than any other business sector. The business sector also determines the amount of tangible assets owned by the company that can be used as collateral, as an example, a manufacturing company has a number of tangible assets greater than a company engaged in the field of information technology, so that ccompany manufactures have easier access to funding from external parties. In addition, the business sector also affects the amount of funds needed by SMEs, and ultimately affects the creditor's decision to provide the necessary funds or not.

2. Literatur Riview

- Access to CapitalCapital is an important factor for the operation of a company in addition to other factors such as labor and skill. Difficult credit access is often a barrier for SMEs to start or expand their business. In general, credit access refers to the availability of supply to financial services at a reasonable cost (Claessens et al., 2006). Credit access can also be defined as the absence of barriers to price and non-price (Demirguc-Kunt and Levine, 2008). While the OECD defines credit access as a percentage of the company can use financial services if they wish. Reducing barriers tocredit access external funding that prevents expansion of the company.Firm sizeThe size of the company is a value that indicates the size of the company. There are a variety of proxy which is usually used to represent the size of the company, i.e. the number of employees, total assets, sales, and market capitalization. Assets are a measure of the magnitude or scale of an enterprise. Based on the Law of the Republic of Indonesia Number 20 (2008), Ministry of Finance No.316/ KMK.016/ 1994 dated June 27 (1994). So it can be concluded that the range of the size of SMEs in Indonesia which are classified as SMEs business is a business that has a net worth of more than 50 (fifty) million dollars to a maximum of 10 (ten) billion excluding land and buildings, has annual sales ranging from 300 (three hundred) million to 50 (fifty) billion dollars, and has a number of employees less than a hundred people. Wide enough range also allows SMEs established in the form of various entities, either incorporated or not. Hu and Schiantarelli (1994) find that firm size has positive influence on capital barriers; it is because the bank will be a greater risk when lending large amounts to little creditors than if you divide the number of loans to many lenders at once.Concentration of ownershipOwnership of the company can be divided into two, namely the concentrated ownership and possession of the spread. La Porta et al. (1999), Claessense et al. (2000a), and Facio and Lang (2002) showed that the ownership of public companies in almost all countries is concentrated, except in the United States, Britain and Japan. Thus Indonesia is included in the group of countries that share ownership of public companies is concentrated. La Portaetal. (1999 and 2000) showed that concentrated ownership structure occur in countries with a low level of corporate governance. La Portaetal. (1998 and 2000) found that a group of French origin countries (including Indonesia) has the highest concentration of ownership as compared to the three other groups origin countries. In the group of samples even Indonesian company shows that ownership concentration is greater than the average group is the third largest share holder ownership mastere dan average of 58%. They argue that the lack of legal protection and institutional environment (law and enforcement) are closely linked with concentrated ownership.Business sectorThe business sector is an area where a number of companies have the same product or service. The business sector can also be interpreted as an industry that has the same characteristics and each business sector as its own characteristics and different risks.BPS divide the business sector into three main sectors namely the primary, secondary and tertiary. The primary sector is a combination of agriculture and mmining, the secondary sector is an aggregate processing business sector, construction sector, as well as electricity, gas and water. The tertiary sector is a combination of trade, hotels and restaurants; transport and communications sector; financial and business services sector; and the social services sector. In addition to the three sectors, along with advances in technology, some experts argue that there is a quaternary sector providing IT-based products or services.The business sector could be expected to affect the access of SMEs capital. This is because in certain sectors such as the creative business sectors and services, which despite having a number of intangible assets are relatively large, but still find it difficult to raise capital because of the amount of intangible assets that can be offered as collateral is not as much as in manufacturing companies.HhypothesisBased on a literature review and a framework that has been described can be formulated in the following research hypothesis: H1: Firm size positive effect on credit access.H2: The concentration of ownership negatively affects credit access.H3: The business sector influence on credit access.H4: Firm size, The concentration of ownership, The business sector influence on credit access

3. Data and Methodology

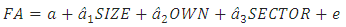

- Definition and Measurement of Operational VariabelsIn this research independend variables are ownership concentartion, Firm size and business sector and dependent variables is credit access. Ownership Concentrate on is a condition in which the majority of shares are owned by a small proportion of individuals/groups, so that the individual or the group has a number of relatively dominant share in comparison with other shareholder. The concentration of ownership proxies by the number of the largest holdings the concentration of ownership seen from the percentage ownership of the total ownership of the company (Nuryaman: 2008).Firm size is a value that indicates the size of the company. In this study, the company uses a proxy measure the value of natural log annual income, this is so great value not too different and not to long digits. The business sector is an area where a number of companies have the same product or service. In this study, the business sector in the proxy by using a nominal scale, where there are three business sectors, namely sectors Manufacturing, and Retail Services. Dependent Variable credit acess is ability the SMEs to get the credit from external.This study used secondary data obtained from the World Business Enterprise Survey (WBES). The SMEs population located in Bekasi. The sample selection is done by purposive sampling. Purposive sampling is the selection of a group of subjects based on the characteristics or certain properties that are believed to have a close relation with the characteristics or properties of the previously grouped populations.Data Analysis MethodAnalysis Descriptive StatisticsDescriptive statistical analysis was descriptive technique that provides information on the data held and does not intend to test the hypothesis. This analysis is used to present and analyze the data with the calculations in order to clarify the circumstances or characteristics of the data in question. The next testing phase in data analysis is hypothesis testing using multiple linear regression analysis. The equation used in this study, namely:

Finding and DiscussionAnalysis Unit Description/ObservationThe data in this research is secondary data obtained from the World Business Enterprise Survey (WBES). The data used is credit access as the dependent variable, the size of the company, the concentration of ownership, and the business sector as an independent variable. The data taken in 2009 with classified as SMEs according to the Law of the Republic of Indonesia Number 20 of 2008. Other criteria, the company has complete data regarding the size of the company, the concentration of ownership and the business sector, as well as the data needed to detect the credit access. In this study, there are companies that meet the criteria of 189 companies. At time of processing the data contained outliers that should eliminate the symptoms of a sample of 111 companies, it is one of the steps is to eliminate the sample. The data can be processed into 78 companies with predefined criteria.Hypothesis TestingMultiple Regression AnalysisThis study using multiple linear regression analysis, before this analysis classical assumtion was done. The equation from multiple linear regression analysis as follow:

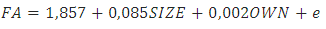

Finding and DiscussionAnalysis Unit Description/ObservationThe data in this research is secondary data obtained from the World Business Enterprise Survey (WBES). The data used is credit access as the dependent variable, the size of the company, the concentration of ownership, and the business sector as an independent variable. The data taken in 2009 with classified as SMEs according to the Law of the Republic of Indonesia Number 20 of 2008. Other criteria, the company has complete data regarding the size of the company, the concentration of ownership and the business sector, as well as the data needed to detect the credit access. In this study, there are companies that meet the criteria of 189 companies. At time of processing the data contained outliers that should eliminate the symptoms of a sample of 111 companies, it is one of the steps is to eliminate the sample. The data can be processed into 78 companies with predefined criteria.Hypothesis TestingMultiple Regression AnalysisThis study using multiple linear regression analysis, before this analysis classical assumtion was done. The equation from multiple linear regression analysis as follow:  Test FUsed F test, the results can be seen in the output of ANOVA of the results of multiple linear regression analysis. With 95% confidence level and 78 samples of company’s. Results of ANOVA generate significant value of 4.857, that indicates that simultaneous or jointly independent variables significantly influence the dependent variable.The coefficient of determination indicates show large a percentage of the independent variables. The test results showed R2 (adjusted R2) of 0.354 or 35.4%. So it can be said that 35.4% of the company’s credit access is influenced by firm size, ownership concentration and corporate business sector. While the remainder caused by other variables-variables that are not included in the regression model.t TestUsing t test the result as follow:

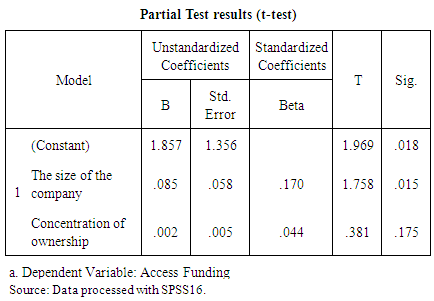

Test FUsed F test, the results can be seen in the output of ANOVA of the results of multiple linear regression analysis. With 95% confidence level and 78 samples of company’s. Results of ANOVA generate significant value of 4.857, that indicates that simultaneous or jointly independent variables significantly influence the dependent variable.The coefficient of determination indicates show large a percentage of the independent variables. The test results showed R2 (adjusted R2) of 0.354 or 35.4%. So it can be said that 35.4% of the company’s credit access is influenced by firm size, ownership concentration and corporate business sector. While the remainder caused by other variables-variables that are not included in the regression model.t TestUsing t test the result as follow: From table we can see significant t value and partial. On the Coefficients table it can be seen that the t value of variable size and ownership concentration of 1.758 and 0.381 to 0.015 and 0.175 significant. Thus H1 this study received. While that value of the variable concentration of ownership is smaller than the existing value of the t table. Significant value of the concentration of ownership has a value greater than 0.05 or 5%. Thus, it can be concluded that the variable size of the company does not have a significant influence on the variable credit access. Thus H2 this study was rejected the third hypothesis states that affect the business sector credit access. Since both variables are used to test this hypothesis is categorical variables, the test used is the chi-square test (chi-squared). Results of Cross Tab shows the distribution of the data, as shown in the table, the business sector who have the easiest access weighted capital is the retail sector with 8 of the 10 samples (80%), a company engaged in the retail sector states do not have problems in obtaining capital external. Chi-Square test results produce a sympsig. Amounted to 0, 047, below 0.05, then the hypothesizes accepted. Similar results were demonstrated through a symmetrical test where Cramer's v produces apprising. 0.047.

From table we can see significant t value and partial. On the Coefficients table it can be seen that the t value of variable size and ownership concentration of 1.758 and 0.381 to 0.015 and 0.175 significant. Thus H1 this study received. While that value of the variable concentration of ownership is smaller than the existing value of the t table. Significant value of the concentration of ownership has a value greater than 0.05 or 5%. Thus, it can be concluded that the variable size of the company does not have a significant influence on the variable credit access. Thus H2 this study was rejected the third hypothesis states that affect the business sector credit access. Since both variables are used to test this hypothesis is categorical variables, the test used is the chi-square test (chi-squared). Results of Cross Tab shows the distribution of the data, as shown in the table, the business sector who have the easiest access weighted capital is the retail sector with 8 of the 10 samples (80%), a company engaged in the retail sector states do not have problems in obtaining capital external. Chi-Square test results produce a sympsig. Amounted to 0, 047, below 0.05, then the hypothesizes accepted. Similar results were demonstrated through a symmetrical test where Cramer's v produces apprising. 0.047.

4. Discussion

- The size of the Company to access capital SMEsFirm size appears to be affecting creditors in lending decisions, as companies with a larger size can provide greater assurance as well; in addition, larger companies also tend to have greater operational results. In addition, creditors will have more confidence to the larger companies, because big companies are considered to have survivability and experience in running the business. These results are consistent with previous studies such as Punyasavatsut (2011) who found that firm size has a positive impact on credit access.Concentration of ownership of credit access of SMEsConcentration of ownership has no effect on SMEs credit access. This is presumably due to the characteristics of SMEs in Indonesia have a family company, that Indonesia is a country with a large number of family companies. This leads to the creditor cannot choose to lend to SMEs based on the concentration of ownership, because it seems the majority of SMEs in Indonesia have these characteristics. The same thing expressed by Isachenkova and Mickiewitz (2003), that the effect of concentrated ownership and credit access can be ambiguous, because the fund providers can gain a positive impression on the supervision of a better company, but on the other hand, also saw a negative impression of the existence of agency problems. In addition, many SMEs in Indonesia allegedly operated by owner-manager so that regardless of the ratio of the concentration of ownership in SMEs, the owner of which doubles as a manager in a SMEs still have full control over the company.The business sector of the SMEs credit accessThe business sectoral so affect thee company access to external capital. This is because each business sector has different characteristics to be considered for creditors to lend. One of the most characteristic into consideration for creditors is tangibility of the company, which in general manufacturing companies have a higher level than the tangibility of services and retail companies. The results of this study are consistent with As Artola and genre (2011) found that the company engaged in the business of construction and real estate experience barriers more capital than any other company in Spain and Italy. However, this result is contrary to Pandula (2011) who found that the company's business sector showed no association with access to credit.

5. Conclusions and Suggestions

- ConclusionsBased on the results of the data analysis and discussion that has been done in the previous chapter, it can be concluded as follows:First, the size of the company as measured by annual sales affect the credit access is measured based on the perception of entrepreneurs for the company access to external capital. Second, the concentration of ownership does not affect the credit access is measured based on the perception of entrepreneurs for the company access to external capital.Third, the business sector affect the credit access is measured based on the perception of entrepreneurs for the company access to external capital. Fourth, The size of the Company, the concentration of ownership and the business sectors together affect thecredit access is measured based on the perception of entrepreneurs for the company access to external capital. Limitations of ResearchThe limitations found in this study, First, the definition and measurement of the dependent variables limited to the perception of entrepreneurs to access capital company regardless of whether the sample companies have over external financing needs or not. Second, the relationship between independent variables and the dependent in building hypothesis is based on a strong the oretical justification. SuggestionBased on the results, the suggestion is follows; first, Credit access is one of the main obstacles for SMEs which is a vital sector in the economic growth of a country. The state's role in ensuring the availability of credit access for SMEs can help the growth of SMEs, which in turn can positively affect the economic conditions of the country. Second, The financiers in this case banks and other credit institutions can be expected to make it easy for businesses outside the manufacturing sector, so as to encourage the growth of new creative efforts. Third, the following researchers who are interested in discussing credit access for SMEs to use measurements in addition to the perception of entrepreneurs, or try to look at the issue of access capital from the supply side. In addition, the following researchers who are interested in discuss credit access SMEs can also use some of the variables that could be expected to affect SME success to capital but is not discussed in this study, such as the use of standards-compliant financial statements.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML