-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(4): 219-229

doi:10.5923/j.ijfa.20150404.04

The Discussion of Influence Factors to Stock Market after Vietnam Joined WTO

Mei Ling Chen 1, Ngo Doan Quoc Huan 1, Tien Lin Hsieh 2

1Department of International Business Management, Dayeh University, No.168, University Rd., Dacun, Changhua, Taiwan (R.O.C.)

2PH.D Program of Management, Dayeh University, No.168, University Rd., Dacun, Changhua, Taiwan (R.O.C.)

Correspondence to: Tien Lin Hsieh , PH.D Program of Management, Dayeh University, No.168, University Rd., Dacun, Changhua, Taiwan (R.O.C.).

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The stock market is an important part of the economy of each country, the increase or decrease in the share prices indicates the boom or recession of economy cycle. This study examined these factors such as Inflation (I), Interest Rate (IR), Foreign Direct Investment (FDI), Exchange Rate (ER) and Oil Prices (OP) impact to Stock Market after Vietnam joined the World Trade Organization (WTO). Simultaneously, this paper seeks to contribute further understanding about the impact of each factor affect to Vietnam stock market. The results, from analysis monthly data from 2007/2 to 2013/12, show that some factors have the positive effect to the securities market and some others have the negative effect. Using the ADF Unit Root test reveals that these variables used in this study are stationary. Analyzing of Co-integration test presents evidence about the long-run relationship between Vietnam stock index (VNI) and other variables. This study uses VECM to forecast the near future of VNI and VAR test to find the relationship between VNI and the factors.

Keywords: Influence Factors, Vietnam Stock Market, the World Trade Organization (WTO)

Cite this paper: Mei Ling Chen , Ngo Doan Quoc Huan , Tien Lin Hsieh , The Discussion of Influence Factors to Stock Market after Vietnam Joined WTO, International Journal of Finance and Accounting , Vol. 4 No. 4, 2015, pp. 219-229. doi: 10.5923/j.ijfa.20150404.04.

Article Outline

1. Introduction

- In the past decade, participating into the regional and international economic integration is a top priority of Vietnam government. Vietnam has set up trade relations with 165 countries, signed bilateral trade agreements with 72 countries, and the most important is with the United States in 2001. Vietnam became no.150 member of WTO (World Trade Organization in short) in January 2007. WTO membership brought opportunities for Vietnam to continued rapid economic development and sustained poverty reduction. New opportunities and challenges created by international economic integration have had significant effect to the economy. The stock market is often considered as the primary indicator of a country's economic strength and development (Mahipal Singh, 2011). Nowadays, with development of technology, stock transaction becomes more easy and popular so that nearly anybody can own stocks (Investopedia Staff et al. 2009). Vietnam is an emerging country and its stock market has grown rapidly. Vietnamese stock market consists of two stock exchanges, namely the Ho Chi Minh City Securities Trading Centre (HSTC) and the Hanoi Securities Trading Centre (HaSTC). The state securities commission is responsible for monitoring the stock exchanges. This study uses the Ho Chi Minh Stock Exchange and known as Vn-index (VNI). The aim of this study is to contribute towards the study of the influence factors to Stock Market after Vietnam Joined WTO. All over the world, many analysts have researched for impact of some factors affect to the stock market. And in this paper, we will research five factors affect to Vietnam stock market which is Inflation (I), Interest Rate (IR), FDI, Exchange Rate (ER) and Oil Price (OP).This study uses data from 2/2007 to 12/2013. The objectives of this research include: (1) To investigate which variables influence stock market in Vietnam, especially after joining the WTO. (2) To explain more about the extent of each factor affect to Vietnam stock market. (3) To find out the lead-lag relationship between VNI and the factors, beside that we use impulse response function to observe how the VNI react if there was a shock on the factors.

2. Literature Review

2.1. The Relationship between Inflation and Stock Market

- In study by Rene and Taufiq (2014) showed that a positive relationship between the inflation rate and stock prices. In contrary, Fama (1981) suggest that a negative relationship between stock prices and inflation. Moreover, Modigliani and Cohn (1979) show that inflation erodes the long-run real value of stocks. Boyd, Levine, & Smith (1996 and 2001) empirically documents that the relationship between long run inflation rate and economy financial system performance.

2.2. The Relationship between Interest Rate and Stock Market

- Tejvan Pettinger (2008) showed that higher interest rates tend to slow down the economic growth and are often seen as bad news for the stock market. Higher interest rates tend to slow down economic growth. The finding of Campell and Ammer (1991) suggests that what economic forces create the persistent changes in expected excess stock returns.

2.3. The Relationship between FDI and Stock Market

- In study by Acheampong and Wiafe (2013) show that a positive relationship between efficient stock market and FDI. Chun-Pin, Chin-Wen and Alfred (2013) find that FDI does not worsen the domestic stock market during a period of financial crisis. However, Haussmann and Fernandez-Arias (2000) emphasized that FDI tends to be larger in countries that are riskier, financially underdeveloped and institutionally weak. In contrary, Syed Ali Raza and Syed Tehseen Jawaid (2012) find that FDI has a significant negative impact on the stock market capitalization in the short run.

2.4. The Relationship between Exchange Rate and Stock Market

- Base on the result of Ma and Kao (1990) found the relationship between exchange rate and stock market area also different which is positive for the import-dominant country and negative for the export-dominant country. In stydy by Jorion (1990) show that the volatility of exchange rate market on the stock market sometimes is very little or even showing no power. The study of Vincent and Paul (1999) has shown that an increase in exchange rate volatility is accompanied by a decline in the stock markets. Ying Wu (2001) argues that the relations between the exchange rate and stock prices are negative.

2.5. The Relationship between Oil Price and Stock Market

- Bjornland (2009) analyzes the effects of oil price shocks on Norwegian stock market. Her results show that higher oil prices would be expected to lead to higher levels of economic activity. According to Bjornland (2009) and Jimenez-Rodriguez and Sanchez (2005), an oil price increase is expected to have a positive effect in an oil-exporting country, as the country's income will increase. Another study shows that the oil price is not impacted the price creation process of equities in Indian stock markets by Seyed (2012). Kilian and Park (2008), they documented that the responses of U.S. real stock returns to oil price shocks differ substantially, depending on the underlying causes of the oil price increase, can cause the decrease in the stock price.

3. Methodology

3.1. Data Description

- Based on the research objectives in the introduction above, we collected monthly data on the following variables: Inflation (I), Foreign Direct Investment (FDI), Interest Rate (IR), Exchange Rate (ER), Oil Price (OP) and Vn-Index (VNI). The data are collected from 2007/2 to 2014/12. All the data are converted into USD using US/VNI exchange rate cited from website of the State Bank of Vietnam.

3.2 Methodology

3.2.1. Unit Root Test

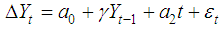

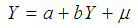

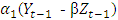

- This study uses the Unit Root Test to examine the time series properties of the concerned variables. In this study, the DF and ADF unit root test of Dickey and Fuller (1981) have been adopted to examine the data is stationary or non-stationary.

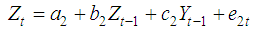

| (1) |

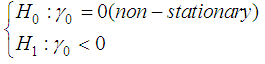

is the first difference operator, a0 is a drift term or an intercept, a2t is the time trend, and εt is a white-noise error. In this study, we will test for unit root with variables: VNI, Inflation (I), Interest Rate (IR), FDI, Exchange Rate (ER) and Oil Price (OP).Test hypothesis for above equations is

is the first difference operator, a0 is a drift term or an intercept, a2t is the time trend, and εt is a white-noise error. In this study, we will test for unit root with variables: VNI, Inflation (I), Interest Rate (IR), FDI, Exchange Rate (ER) and Oil Price (OP).Test hypothesis for above equations is

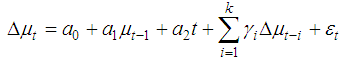

3.2.2. Co-integration Test

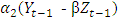

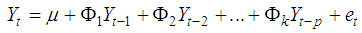

- Co-integration is a property possessed by some non-stationary time series data. In this concept, two variables are co-integrated when a linear combination of the two is stationary, even though each variable is non-stationary:

| (2) |

| (3) |

is the intercept, and µ is the disturbance term.The first of the two tests of co-integration is based on the Co-integration Regression Durbin-Watson (CRDW) statistic. The second test of co-integration is based on testing the stationary of the error terms from equation (3).

is the intercept, and µ is the disturbance term.The first of the two tests of co-integration is based on the Co-integration Regression Durbin-Watson (CRDW) statistic. The second test of co-integration is based on testing the stationary of the error terms from equation (3).  | (4) |

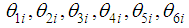

and γ are the estimated parameters and

and γ are the estimated parameters and  is the error term. The number of lags (k) chosen in equation (4) should be sufficient to ensure that the error term

is the error term. The number of lags (k) chosen in equation (4) should be sufficient to ensure that the error term  is white noise. The choice of k is based on the modified Lagrange Multiplier (LM) statistic. The test for co-integration involves the significance of the estimated

is white noise. The choice of k is based on the modified Lagrange Multiplier (LM) statistic. The test for co-integration involves the significance of the estimated  coefficient.

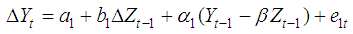

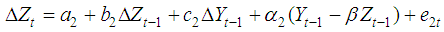

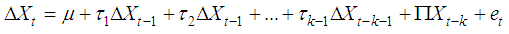

coefficient. 3.2.3. Vector Error Correction Model (VECM)

- A Vector Error Correction Model (VECM) can lead to a better understanding of the nature of any non-stationary among the difference component series and an also improve longer term forecasting over an unconstrained model. Consider the following two-variable VECM with non-stationary time series:

| (5) |

| (6) |

and

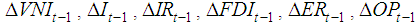

and  from the co-integrating relation. In general, the

from the co-integrating relation. In general, the  order VECM can be represented by the following system:

order VECM can be represented by the following system: | (7) |

is a vector of p I(1) variables,

is a vector of p I(1) variables,  is a p x 1 vector of intercepts,

is a p x 1 vector of intercepts,  , are p x p matrices of parameters,

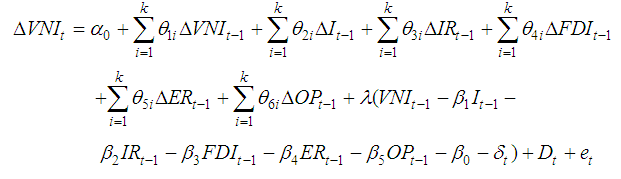

, are p x p matrices of parameters,  is a vector of uncorrelated structural shocks, is a difference operator, I(1) is integrated of order 1.We design VECM for VNI and influenced factors as the following equations:

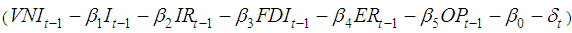

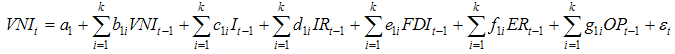

is a vector of uncorrelated structural shocks, is a difference operator, I(1) is integrated of order 1.We design VECM for VNI and influenced factors as the following equations: | (8) |

is the error correction term, λ is the coefficients of the error correction term which capture the adjustments towards long run equilibrium;

is the error correction term, λ is the coefficients of the error correction term which capture the adjustments towards long run equilibrium;  : white nose error;

: white nose error;  : intercepts,

: intercepts,  : coefficient of

: coefficient of  , respectively, which describe the short run relationship;

, respectively, which describe the short run relationship;  is the trend in co-integration equation, D is a dummy variable financial crisis.

is the trend in co-integration equation, D is a dummy variable financial crisis.3.2.4. VAR Model

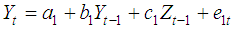

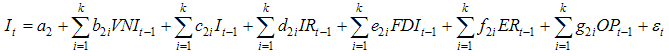

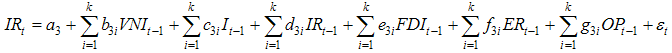

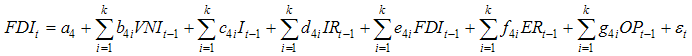

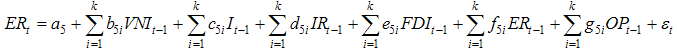

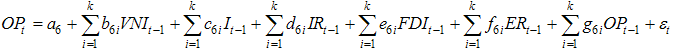

- In a simple form, a Vector Auto Regression (VAR) model is composed of a system of regression where asset of dependent variables are expressed as linear functions of their own and each other’s lagged values, and possibly other independent variables. Consider the following two-variable, one-period lag VAR model:

| (9) |

| (10) |

| (11) |

| (12) |

| (13) |

| (14) |

| (15) |

| (16) |

| (17) |

3.2.5. Impulse Response Function

- Impulse response analysis is used widely in the empirical literature to uncover the dynamic relationship between the variables within vector auto regressive (VAR) model. Impulse response measures the time profile of the effect of a shock or impulse, on the expected future values of a variable.

4. Results and Discussion

4.1. Analysis of Unit Root Test

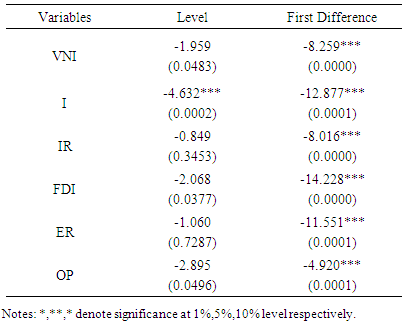

- In this study, we use the ADF Unit Root Test of Dickey and Fuller (1981) to examine whether the data are stationary series. The results of the ADF Unit Root test for these variables in the level data are reported in Table 1.

|

4.2. Analysis of Co-integration Test

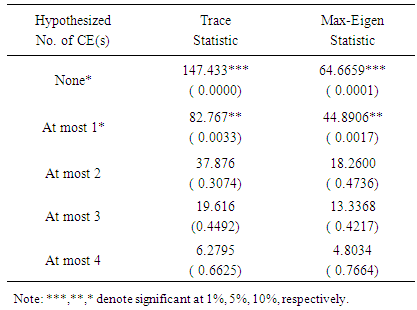

- The Co-integration test is used to determine whether long-term relationships exist among the variables. The results of Johansen Co-integration are displayed in Table 2.

|

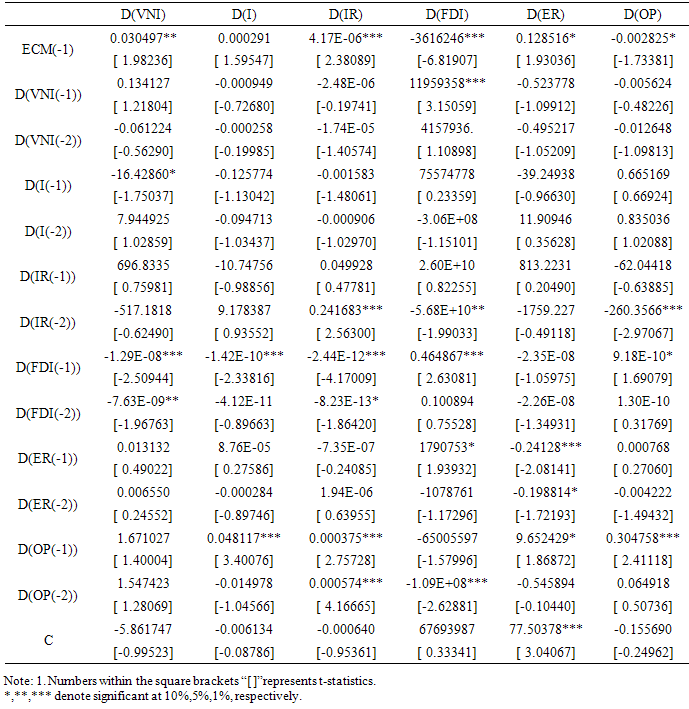

4.3. Analysis of VECM Test

- The results of Co-integration test suggest there are long run relationships between stock prices and the factors in Vietnam. There force, in this section, we will employ the VECM model to analyze the short-run relationships.

4.3.1. Selection of Optimal Lag Terms with VAR Model

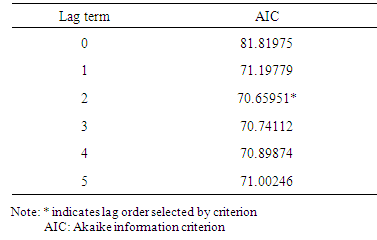

- Before employing the VECM test for analysis, it is necessary to select optimal lag terms. In this research, we take AIC served as the rule for selection of optimal lag terms. Outcomes are shown in the Table 3.

|

4.3.2. Long Run Relationship

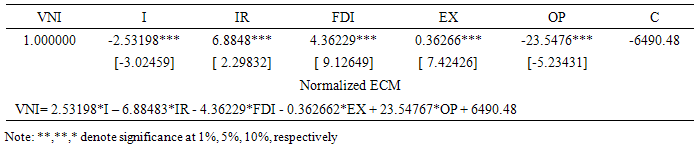

- In VECM, the error correction term reveals the long run relationship, which is taken out from the results of Co-integration test. The Table 4 presents the Co-integration coefficients from the Johansen Co-integration test.

|

|

4.3.3. Short Run Relationship

- It can be observed that the coefficient of the error correction term carries the expected positive sign, and it is highly significant at 1% level. The significant of the error correction term support Co-integration, suggesting the existence of the long run steady-state equilibrium between VNI and the factors. In fact, the ECM indicates a feedback of approximately 3% (ECM(-1) = 0.030497) of the previous period’s disequilibrium from long run. The empirical results show that, in the short run, VNI is negatively significant affected by FDI one month lag at 1% level and two month lag at 5% level, indicating that either 1% rises in FDI would decrease VNI by 1.29% in the one month lag and 7.63 in the two month lag. The other factors do not have the short run relationship with the VNI. VNI is also negatively significant affected by Inflation (I) one month lag at 1% level.

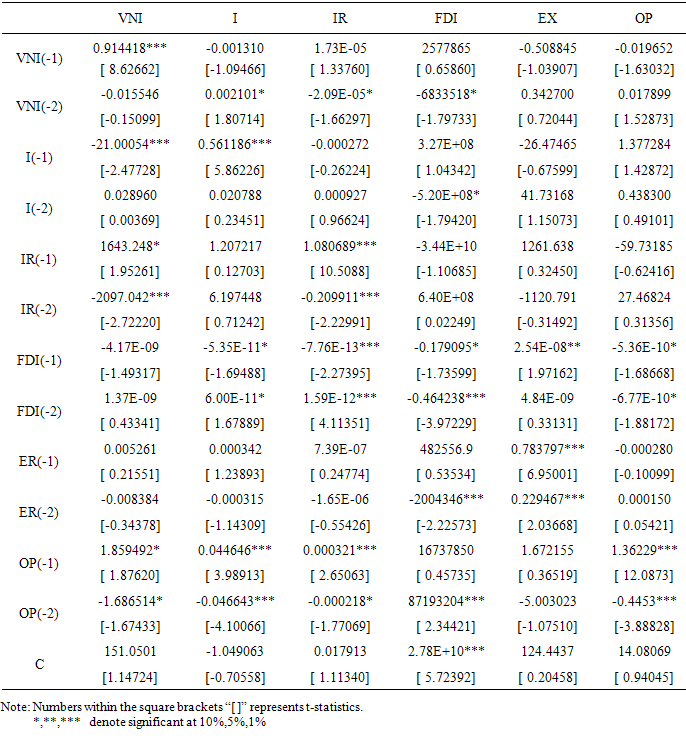

4.4. Analysis of VAR Test

- In this section, we employ the VAR model to analyze the short-term relations of random disturbances on the system variables. The main objective of estimating VAR in this study is to identify any causality relationship among these variables and explain more clearly about their relations. Empirical results obtained through testing appear in Table 6. In this study, we exclusively research about the effect of five factors to the Vietnam stock market. The empirical evidence suggests that Inflation (I), Interest rate (IR), Oil price (OP) in one month lag data affect VNI and Interest Rate (IR), Oil price (OP) in two month lag affect VNI. The result also concludes that VNI can be influenced by itself at 1% significant.

|

|

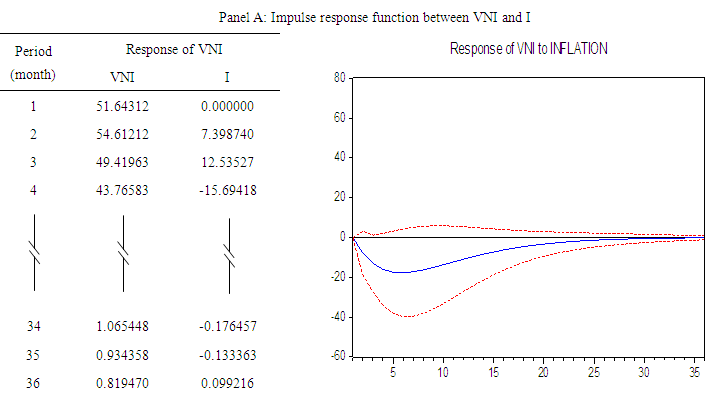

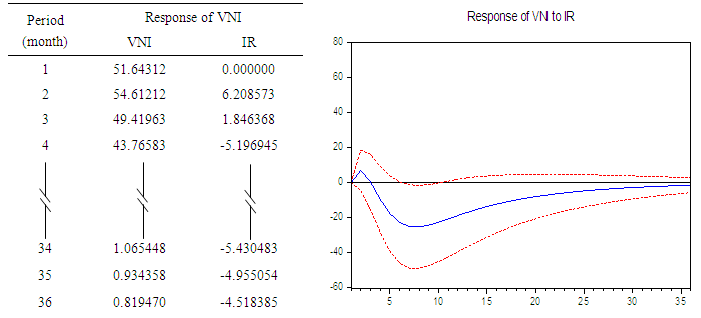

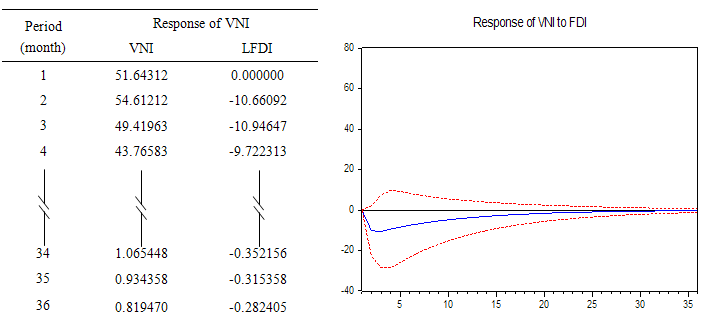

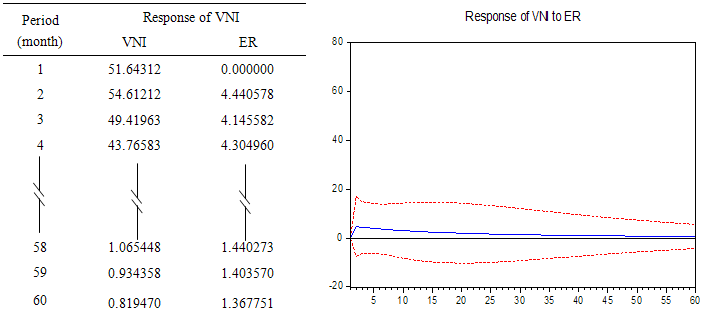

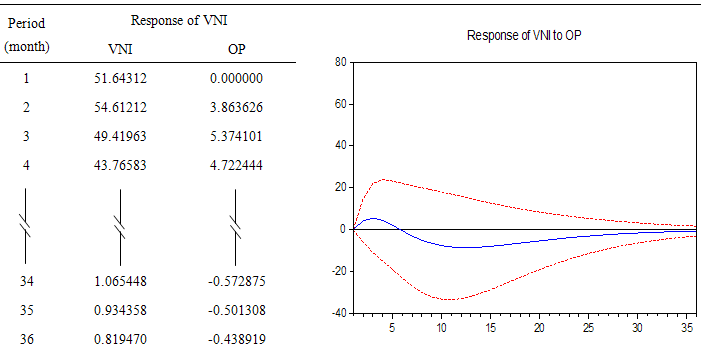

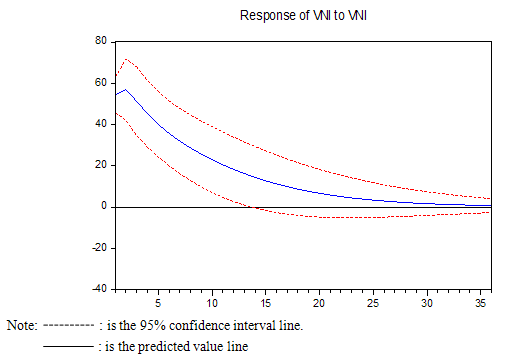

4.5. Impulse Response Function

- The impulse response function refers to the level of variables when subjected to the spontaneous interference of one variable in the model. In other words, an impulse response analysis allows us to understand better the dynamic shock and response pattern among variables that results from changes occurring in one variable. The impulse response function also reveals whether these responses are continuous, short or long term, positive or negative. Table 8 show the impulse response function of VNI from other variables.

|

|

|

|

|

|

5. Conclusions

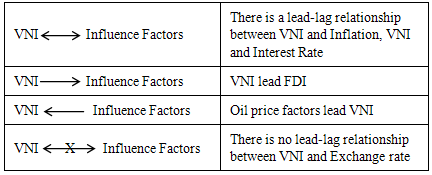

- Recently Vietnamese economy in general and stock market in particular have been noticeably improving in all aspects. The purpose of this study is to contribute towards the study of influence factors to stock market after Vietnam joined WTO. In the Chapter one, this study has mentioned and list out the possible factors which could affect to stock market. In the VAR test, the results show that the Vietnam stock market is not efficiency, contrary with the conclusion of Khoa and Jian Zhou (2014) covering the efficiency of the Vietnam stock market. The results suggest that Vietnam stock prices could be affected by Inflation (I), Interest Rate (IR) and Oil price (OP), VNI is also affected simultaneously by the previous period’s VNI. One lag of Inflation rate value negatively affects Vietnam stock market at 1% significant. Meanwhile, one lag of real interest rate positively influence Vietnam stock market at 10% significant but two lag of real interest rate oppositely negative affect Vietnam stock market at 1% significant. Besides that, one lag of Oil price value positively affects Vietnam stock market at 10% significant but in two lag of Oil price, its value negatively affects Vietnam stock market also at 10% significant. And with the other factor, FDI and Exchange Rate (ER) do not have an impact on the Vietnam stock market.Besides that, according to the results of VAR model, we can figure out the lead-lag relationship between VNI and the factors. The result shows that there is a lead-lag relationship between VNI and Inflation, VNI and interest rate. Meanwhile, VNI lead FDI, Oil price (OP) lead VNI and there is no lead-lag relationship between VNI and Exchange rate (ER).With the results of impulse response function between VNI and the factors, this study can suggest that Inflation (I), Interest rate (IR), FDI, Exchange Rate (ER) and Oil Price (OP) have different effect on the VNI. It is clearly that the impulse response of VNI to Inflation (I), FDI has a negative impact but after 36 months, VNI will get back to the normal level. For the impulse response of VNI to Exchange Rate (ER), the response of VNI to it is positive and it takes a very long time for VNI converge back to the normal level even after 5 years. But for the Interest Rate (IR) it has positive affect for the first 3 months, but after the third months, it is turn to a negative effect on VNI and then, it will converge back to the normal level after 36 months. In the same way, Oil Price (OP) also shows a positive effect to the fifth month, but after that, the impact on VNI of OP becomes negative.Based on the results of VECM suggest that Vietnam stock market has short-run relationship with FDI. The other factors do not show any evidence of the existing of short-run relationship between them. Besides that, we can base on the results of VECM to forecast the future VNI through other factors. Therefore stock investors have gradually become more professional in their investment and they can base on the information about historical value of VNI and other factors to make a prediction about VNI.

6. Suggestion

- Future research in the following directions will be encouraged because we take the Vietnam stock index monthly after joining WTO, 2007, then the monthly data period is short. Therefore, it will be interesting to apply data such as daily or weekly data in order to make analysis that is more complete. In this research depend on the VAR model and VECM model to characterize the behavior of important variables. Therefore, a possible extension of this work would be to employ this economic theory to investigate the relationship between Vietnam stock market and the influenced factors in developing country as Vietnam.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML