-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(3): 187-194

doi:10.5923/j.ijfa.20150403.06

An Assessment of Financial Records Keeping Behaviour of Small Scale Businesses in Ghana: A Case Study of Bolgatanga Municipality

1Bolgatanga Polytechnic, School of Business and Management Studies, Upper East Region

2Bongo District Assembly, Upper East Region

Correspondence to: Abudu Dawuda, Bolgatanga Polytechnic, School of Business and Management Studies, Upper East Region.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This paper focuses on financial records keeping behavior of registered Small Scale Businesses (SSBs) in the Bolgatanga Municipality. A multistage sampling method was used to select one hundred and twenty (120) respondents. As per the study, majority of SSBs do not keep proper records of their businesses, hence, inability to measure financial performance and position of their businesses. The factors that accounted for the failure of SSBs to keep proper records among others include: lack of knowledge in accounting; expensive to hire qualified accounting staff; exposing financial information for tax; time consuming and inability to quantify the value of proper records keeping and lack of internal control procedures. It was also observed that the volume and value of transactions can influence records keeping behavior of SSBs owners. The study, therefore, recommends that the National Board for Small Scale Industries (NBSSI) should assist small scale business operators to keep proper records by organizing training on proper record keeping for them. The government agencies should sensitize the small scale business operators about the need to keep proper records. A law on financial records of small scale businesses should be passed and strictly enforced. The regulatory bodies should also provide simple accounting manual for the businesses.

Keywords: Book keeping, Small Scale Businesses (SSBs), Financial Performance

Cite this paper: Abudu Dawuda, Ibrahim Azeko, An Assessment of Financial Records Keeping Behaviour of Small Scale Businesses in Ghana: A Case Study of Bolgatanga Municipality, International Journal of Finance and Accounting , Vol. 4 No. 3, 2015, pp. 187-194. doi: 10.5923/j.ijfa.20150403.06.

Article Outline

1. Introduction

- A proper system of financial records keeping has become integral part of managing enterprises in today’s competitive and challenging business environment. A good financial record keeping enables business organizations to plan properly and also check for misappropriations of resources of the organization. Reference [1] explains that keeping proper books of accounts is essential to the growth and survival of a business. In order to ensure efficiency, effectiveness and the continuing survival of any business organization, management must seek for reliable, relevant, accurate and timely financial information for planning and decision making. Poor records keeping or non-availability of financial records will lead to resources mismanagement and poor cash management and this can cause the business to fail. Poor records keeping makes it difficult to differentiate between business transactions and personal transactions. It is the responsibility of business owners and managers to avoid using assets of the business for personal use at the expense of the business [2, 3]. According to them a well-qualified accountant should be employed to carry on this task. He or she should have proper knowledge to control cash as liquidity is the key to the success of any business. Qualified Accountants play major roles in decision making process of a business. Accountants with higher skills and experience have greater influence on the decision making process of a business [4]. With their skills and experiences, they are in a good position to measure the financial performance and position of a business. This allows users especially management to plan and make economic decisions. In a developing and unstable economy like Ghana majority of the people are engaged in SSBs operations such as wholesaling, retailing and small scale manufacturing. Others include weaving, hairdressing, catering services, carpentry and dressmaking. These small scale businesses play a very vital role in the social, socio-cultural and economic development of our country more especially in the rural areas. They contribute positively to the living standards of people. Due to massive contribution of SSBs to the development of the country, the government of Ghana has established the NBSSI in 1981 by an Act of parliament (ACT 343) to support the small scale enterprises in terms of finance, exports and advisory service.However, on record many small scale businesses still collapse due to lack of proper financial record keeping among other problems [5]. Book- keeping is the process of collecting and recording business transactions [6]. It consists of maintaining a record of the money values of the transactions of a business either mechanically or electronically by using a computer. Reference [7] concluded that businesses which even keep financial records did not keep all relevant books of accounts. It was also observed that majority of SSBs do not keep complete accounting records because of lack of accounting knowledge and as a result there is inefficient use of accounting information in financial performance measurement [8]. It appears from these evidences that SSBs still fail to keep proper books of accounts despite the importance of records keeping in decision making and planning. In view of the importance of SSBs to the development of a country, the researchers have, therefore, designed this study to assess the financial records keeping behavior of Small Scale Businesses in the Bolgatanga municipality.Specifically, this study seeks to achieve the following objectives:i. To find out the kinds of financial records kept by small-scale business operators.ii. To examine the benefits of proper records keepingiii. To determine the factors that account for the failure of SSBs in keeping proper books of accounts

2. Literature Review

2.1. Definition and Roles of Small Scale Businesses in Economic Development

- There have been several studies on SSBs in recent times due to the roles they play in socio-economic development of every country. Most of the studies focused on financial records keeping of small scale business and how it affects their financial performances [7, 9, 10]. There is no single definition for small scale businesses. The classification of firms under small, medium or large scale is based on capital assets, skill labour, turnover level, firm size, legal status, and method of production [11, 12]. However, the most used criteria in Ghana to classify firms is number of employees [13]. The Ghana Statistical Service for example classifies firms with less than 10 employees as small-scale enterprise and firms with more than 10 employees as medium and large-sized enterprises. The International Accounting Standard Board provides a general and acceptable definition of Small and medium-sized entities as the entities that:i. do not have public accountability, andii. publish general purpose financial statements for external users. Examples of external users include owners who are not involved in managing the business, existing and potential creditors, and credit rating agencies [14]In recent times, small scale businesses play critical roles in economic growth and sustainable development most especially for rural economy [8, 15]. Reference [16] observed that, SSBs contribute about 70 percent of Ghana’s Gross Domestic Product (GDP). Small scale industries are widely recognized as powerful instrument for socio- economic growth and balanced sectional development [17, 18, 5]. These businesses create employment opportunities and contribute to the GDP growth of the country. Apart from providing employment and their contributions to balance of payment, SSBs also pay tax to government for economic development. For any country to grow, SSBs sector should be given serious attention. It is therefore, appropriate for the owners of small scale businesses to deploy appropriate technology and sound financial management practices which include proper system of records keeping if they want to succeed and survive.

2.2. Accounting and its Environment

- Accounting is a product of its environment and therefore, plays important roles in shaping its environment. The environment consists of social, economic, political and other regulatory bodies. The demand of these variables change from time to time and this put pressure on accountants to efficiently and effectively response to these influences and demands [19]. A core function of accounting systems is to avail accurate information to owners and managers of SSBs operating in any industry for use in the measurement of financial performance. The resources of societies are limited in supply but they have competing demand. Accounting therefore, plays an important role in efficient and effective management of these resources. It helps to identify efficient and inefficient users of resources by measuring, communicating and comparing the income and assets employed of such companies. SSBs would be able to secure credit facilities from financial institutions with reliable and accurate financial records. The financial institutions usually assess the ability of a business to meet its financial obligations before granting a loan facility. This means that those businesses with poor records keeping would face difficulties in accessing loan facilities. One objective of accounting system is to enable information users to make decisions which improve the allocation of available resources within their control [20].

2.3. Importance of Records Keeping

- Reference [21] emphasized the need for businesses to keep proper financial records and argued that proper system of financial records provide how well the business is performing and what decisions are necessary to be made in order to keep the business in the market. Most businesses are interested in measuring their profitability and to determine the profit, they should adopt appropriate accounting bases, concepts, principles and standards to ensure the reliability of its measurement [22]. Accounting records can improve the performance of a business and as reference [23] noted, there is a strong positive relationship between accounting records keeping and performance of small scale enterprises. Accounting records keeping is essential for decision making which invariably affects the performance of SSBs. If the SSBs do not keep proper books of accounts, they would not be able to know whether their businesses are growing or not [5]. The financial records enable owners to determine whether or not the business is operating at a profit and whether the business was able to meet its commitment as they fell due.

2.4. International Accounting Standard for Small and Medium Sized Enterprises (SMEs)

- The objective of financial statements of a small or medium-sized entity is to provide information about the financial position, performance and cash flows of the entity that is useful for economic decision-making by a broad range of users who are not in a position to demand reports tailored to meet their particular information needs. Financial statements also show the results of the stewardship of management, that is the accountability of management for the resources entrusted to it [14]. The International Accounting Standard Board requires SMEs to prepare the following financial statements:i. Statement of financial position ii. Statement of comprehensive income and income statement iii. Statement of changes in equity and statement of income and retained earnings iv. Statement of cash flows v. Notes to the financial statementsFor the users of SMEs financial statements to make well-informed economic decisions, these complete set of financial statements must be made available to them. Anything short of this, would limit their decision making process. SMEs often produce financial statements only for the use of owner-managers or only for the use of tax authorities or other governmental authorities. Financial statements produced solely for those purposes are not necessarily general purpose financial statements [14].The IASB envisage the users of SMEs financial statements to include:i. banks that make loansii. suppliers that sell to SMEs to make credit and pricing decisionsiii. credit rating agencies and others to rate themiv. customers on deciding whether to do businessv. shareholders that are not also managers.

2.5. Factors that Account for Failure of SSBs to Keep Proper Records

- The factors that account for improper records keeping has been identified as illiteracy, lack of qualified personnel and hire cost to hire a consultant [8]. Reference [24] strengthened the position of Makeso and Manayani. They disclosed that the most predominant challenge is costs constraints, followed by inadequate accounting skills of manager and owners of SMEs. These studies believed that most business owners and employees have no vocational and technical training and were therefore inexperienced as far as record keeping was concerned and that considering the size of the SSBs, the owners deemed it waste of resources to employ qualified accountants. SSBs are reluctant to maintain proper books of accounts as they think there is no need to keep accounting records and believe that, it would even expose their financial position for tax purposes [25]. Reference [26] were also of the view that owners of these businesses feel reluctant to record their daily activities (revenues and expenditures) because of the low worth, returns and performance of their businesses. They argued that the owners, therefore, tend to rely on their memory and do not necessarily see the need to maintain books of accounts. Poor or lack of records keeping by small scale businesses in the country would not only limit their ability to accurately and reliably measure their financial performance and position, but also deny the government the right tax revenue from them. Other users such as customers, suppliers, financial institutions, existing and potential investors would find it difficult to make financial decisions due to improper or non-availability of financial records.

3. Methodology

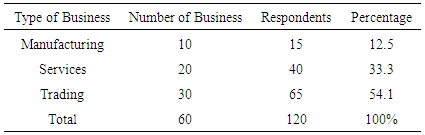

- The study was a survey research of both qualitative and quantitative approach. This design was appropriate because, the study allowed the collection of data and analysis of finding by the use of descriptive statistics. Descriptive research studies are designed to obtain information, which concerns the current status of phenomenon [27]. The estimated population of the study was 200 registered small scale businesses in the Bolgatanga municipality. Due to the complexity of the study area, multi-stage sampling technique was deployed. A list of registered SSBs was obtained from the Municipal Assembly and then stratified into service, manufacturing and trading. In each stratum, the businesses were given a unique number and proportionate simple random sampling was deployed to select them using table of random numbers technique [27]. After this, purposive sampling was deployed to select the participants. In all, a sample size of sixty (60) SSBs was used for the study. With a population size of 200 cases, a sample size of 59 is deemed appropriate at a level of .03 margin of error [28]. On this basis, the same size of 60 businesses out of 200 registered businesses is appropriate for the study because, they have the same accounting environment and accounting systems. The table 1 provides the details.Structured questionnaire and interview schedule were used to collect the data. The researchers trained research assistants to help in data collection. The respondents who could not read was assisted to complete the questionnaires and those who could read was given a period of three weeks to complete the questionnaires. The raw data was processed into meaningful information. The process involved editing, tabulation and analysis with a view of checking the completeness and accuracy of the information and this was done using statistical product for service solution (SPSS).

|

4. Result and Discussions

4.1. Educational Background of Respondents

- The study sought to find out the educational background of the respondents and the evidence is depicted in Figure 1.

| Figure 1. Highest Educational Background of Respondents |

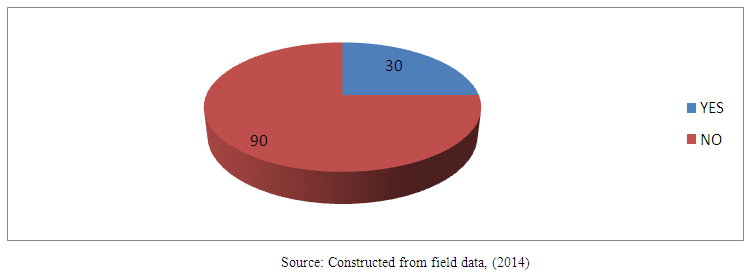

4.2. Financial Record Keeping

- The study sought to find out from the respondents how many of them are keeping proper records and the information is shown in Figure 2.

| Figure 2. Financial records keeping in SSBs |

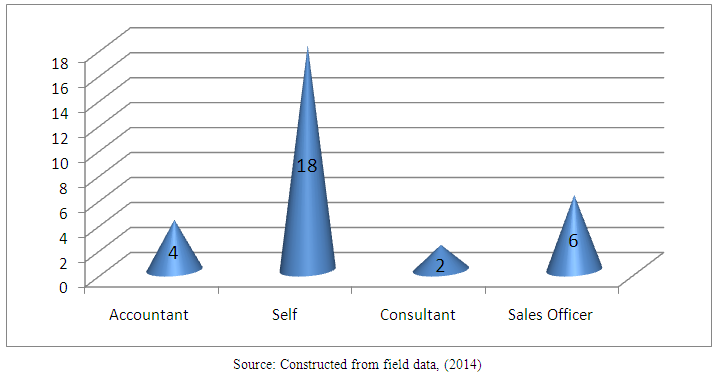

| Figure 3. Persons responsible for keeping records of SSBs |

4.3. Books of Accounts Kept by SSBs

- A question was also asked to find out the kinds of records kept by these SSBs operators. This was to enable the researchers to determine whether the records kept by SSBs are in line with the International Accounting Standards Board requirements for SMEs. It was observed that SSBs operators are keeping improper records like note books, writing on walls and papers. It was also noted that only a few of them are keeping proper records such as:i. Cash booksii. Sales day booksiii. Petty cash iv. Purchase day booksv. Income statementsvi. Statement of financial positionIt is posited that, even those who are keeping financial records of their businesses are not fully meeting the requirement of IASB for SMEs. They ignore statement of cash flows, statement of changes in equity, statement of income and retained earnings and notes to the financial statements. For those who do not keep records of their businesses also gave out some methods they used in controlling their businesses. This information is displayed in Figure 4.

| Figure 4. Measures of controlling business activities |

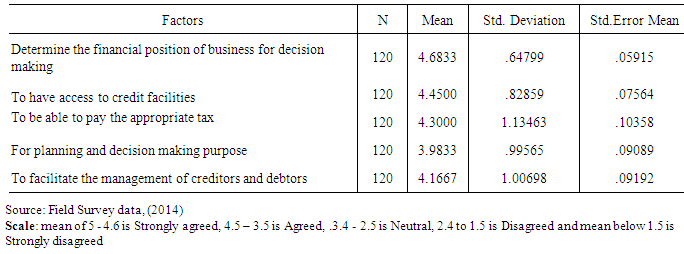

4.4. The Benefits of Financial Record Keeping

- The study also sought to examine the benefits of keeping proper financial records of a business. To achieve this objective, the benefits were presented on likert-type of scale from strongly disagree (1) to strongly agree (5). The result is presented in the table 2.

|

4.5. Factors that Account for Failure of SSBs in Keeping Proper Books of Accounts

- This section examines the factors that account for the failure of SSBs to keep proper books of accounts. The factors were presented on likert-type of scale from strongly disagree (1) to strongly agree (5). Table 3 depicts the results.

|

5. Conclusions and Recommendations

5.1. Conclusions

- On the basis of our findings, we concluded that lack of education and high cost of hiring qualified staff made it very difficult for the owners to keep proper books of accounts. Some also failed to keep proper books of accounts in order to avoid or evade tax. This evidence confirms the position of previous authors acknowledged in this paper. In addition, it is posited in this paper that, SSBs owners are ignorant of the value of keeping proper financial records and have perception that it is waste of time and resources to create finance and accounting department with qualified staff considering the scale of their operations. This may be true for businesses which are not generating much revenue. It could be argued from this evidence that, the volume and value of transactions can influence records keeping behavior of SSBs owners. This paper also uncovered that, most SSBs do not have a well-designed and effective set of internal control procedures and their failure to keep proper financial records could also be attributed to it. Any well-designed and effective set of internal control procedures guarantees good financial control and records. Cash control method is the best method for businesses who do not keep proper books of accounts. The overall effect of poor financial records keeping is that, the owners cannot perform financial analysis to establish trends to know whether their businesses are doing well or not. They cannot understand and predict business environment and this can lead to business failure. Effective working capital management would also be a problem for them without keeping good financial records. Inadequate or poor financial records affect users such as government agencies, financial institutions, investors and other users in decision making and economic planning. Avoiding or evading tax payment would have negative impact on the revenue generation capacity of the government since this sector forms larger part of the economy.

5.2. Recommendations

- In view of the conclusions drawn from the study, the following recommendations are provided to help enhance an accelerated and sustainable growth in small scale businesses sector and the economy as a whole.i. The National Board for Small Scale Industries (NBSSI) with support from Government and NGOs should assist the SSBs operators to keep proper records by organizing financial accounting training for them.ii. Accounting software packages should also be made available by government to all institutions and also for sale at affordable prices for them to be able to purchase and use.iii. A law on financial records of small scale businesses should be passed and strictly enforced.iv. The regulatory bodies such as the Registrar General Department, the Institute of Chartered Accountants (Ghana) and the other bodies should come out with an accounting manual and accounting standards for SSBs. Regular training on the application of accounting standards and manual should be organized for the operators of these businesses. They should ensure that SSBs comply with their directives and punish those who fail to comply.v. The local authority should have a reliable database for SSBs so that their activities can be monitored including proper records keeping. vi. The cost of hiring qualified accounting staff should be moderate to enable the operators to seek for their services. Government can also play a role here by controlling the cost of hiring qualified accounting staff.

Further Research

- i. This paper focuses on financial records keeping behavior of Small Scale Businesses. No provision was made in the paper to find out whether those SSBs owners or managers, who keep financial records, prepare their accounts in compliance with the International Accounting Standards (IAS). We, therefore, recommend further research in this area. ii. We did not also do in-depth study on the internal control practice of Small Scale Businesses. We only sought for information to know if the SSBs have internal control procedures and whether they are well documented. Our position is that any well-designed and effective set of internal control procedures would provide good financial control and records. Further study is required in this area too.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML