-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(3): 163-171

doi:10.5923/j.ijfa.20150403.03

The Financial Risk Management Strategies during 2008/09 Global Financial Crisis: A Survey on Turkish Exporting Firms

Mustafa Yildiran

Finance department, Faculty of economy and admistrative sciencies, Akdeniz University, Antalya, Turkey

Correspondence to: Mustafa Yildiran, Finance department, Faculty of economy and admistrative sciencies, Akdeniz University, Antalya, Turkey.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The main purpose of the paper is to investigate the techniques and methods of the financial risk management such as exchange risk and interest risk management used by financial manager of exporting firms during the crisis. The paper focused specifically on the 2008/09 financial crisis. The data of the paper based on the surveys of the 104 exporting firms in Turkey. The survey findings indicated that 67% of firms use financial risk management tools for hedging and 80,4% of exporting firms perceived the exchange risk as important or the most important risk. Only 23 firms used the financial derivatives as a risk management instruments. The paper uses the binary logistic regression models for analyzing whether firms applied risk management strategies in exporting or not. In result of paper, arrived results large and listed at BIST firms succeeded using risk management strategies and derivatives other than small exporting firms.

Keywords: Financial risk management, Hedging, Financial derivatives, Exporting firms, Financial crisis

Cite this paper: Mustafa Yildiran, The Financial Risk Management Strategies during 2008/09 Global Financial Crisis: A Survey on Turkish Exporting Firms, International Journal of Finance and Accounting , Vol. 4 No. 3, 2015, pp. 163-171. doi: 10.5923/j.ijfa.20150403.03.

Article Outline

1. Introduction

- Every exporting firm suffer from financial crisis due to uncertainty and high volatility related to price. Especially, exchange and interest risk fluctuations impact on exporting firms during a crisis. Firm’s managers sought for new financial risk management (FRM) strategies and methods to avoid financial risk during 2008/09 global financial crisis (GFC) (Servaes, H., Tamayo A., 2009). For Turkish exporting firms, risk management is important in the crisis because of world trade stagnations 2008-09. In 2009 Turkey’s total export declined in 23% compare to previous year. The main concern for exporting firms during crisis period is to find solutions for their financial risk depending on risk types. Most international surveys indicates that firms actively manage financial risks such as foreign risk, interest risk, commodity risk and credit risk (Bodnar, G. M. Gebhardt, G., 1998; Servaes, H., Tamayo A., 2009; Bodnar, G.M., Graham, J.R., Harvey, C.R., Marston, R.C., 2011). Therefore, it is been vital for answering the question that “how exporting firms managed and control financial risk during the 2008/09 GFC?” in every specific country. The paper focus on financial risk management applications of exporting firms after GFC in the Turkey. The paper investigates the techniques and methods of financial risk management such as exchange risk and interest risk management used by financial manager of exporting firms during the crisis. In addition, the paper provides the information on management of credit risks and commodity risks.There are several points makes the paper different in the literature. Firstly, this survey applied just to the post crisis process. Thus, the paper presents many innovative techniques for financial risk management during and after crisis. So exporting firms may cope with financial crisis by using these new financial tools easily. Secondly, the paper provides opportunity for comparison of financial risk management in normal term. Thirdly, the paper provides management strategies of different financial risks such as exchange rate, interest rate, commodity price and credit. This study contributes to understanding of financial risk managements correctly in the developing markets such as Turkish derivatives market. This paper organizes as literature updates, data and methods, specialty of survey sample, findings of survey and conclusions.

2. Literature

- One of the most popular sub-fields of finance literature has been the financial risk management of non-financial and exporting firms since past 30 years. Especially, a studies on US non financial corporate by The Wharton School in 1995 and 1998 can be considered as pioneers of the literature. These researches provide both financial risk management strategies and use of the financial derivatives by US non-financial firms.The financial risk management brings up vital solutions for exporting firms during financial crisis. Because of the volatility of financial indicators rises up during financial crisis, the cash flow and value changes of firms often becomes reality.In that, exporting firms can be affected by financial indicators such as foreign exchange rate and interest rate. The currency and interest rate fluctuations have impact on solvency and liquidity of industrial firms as seen in the East Asian crisis in 1997-98. This impact left the Asian industrial firms in a difficult situation that the raised share of interest payment in earning. In a similar manner, the financial risk management activities affected from 2008 financial crisis according to survey which collected from top financial managers (CFO) of 334 non-financial companies (Servaes, H., Tamayo, A., Tufano, P., 2009). In particular, foreign exchange and interest risk had been accepted on firm value and financial operating by these CFO’s. In post 2008 financial crisis, Bodnar, G.M., (2011) at al. claimed that the risk management an important part of corporate activities and become global. A paper on strategies of risk management in exporting firms of Norwegian exporters focused on management of foreign exchange risk (Davies, D., Eckberg, C., Marshall, A., 2006) shows that firms struggled by hedge Foreign Exchange risk. An another study on 400 firms in UK (Judge, A., 2006) shows that nowadays firms used more derivatives in the risk management methods while making export and import. Also, Mian, S.L., (1996) provided many evidence about corporate hedging strategies according to survey data obtained a sample of 3022 firms. Among these firms, 772 firms were identified theirself as hedger firms. It is important that surveyed in non-financial firms have increased with derivatives in risk management. Brunzell, T., at al. (2011) demonstrates that using to the derivatives in risk management is about %62 of survey sample of Nordic firms. The study explores that using the derivatives is in common to the Nordic industrial firms than financial firms. Bodnar, G.M., (2011) et al. found that derivatives is used almost at a level of 64% of the firms in the sample according to the date based on global scale. Bodnar, G.M., et al. (2012) analyses of the risk management practices among 58 Italian non-financial firms. The paper presents that currency risk is the most common risk faced by non-financial firms. But derivatives of the exchange risk management are used by 83% of the firms facing this risk. The surveys on risk management in emerging countries has been rising recently. For example Charumathi, B., Kota, H.B., (2012) surveyed on large Indian non-financial firms. The survey consist of data on disclosed the derivative data of firms in their annual reports. This study uses cross sectional panel data for three years from 2007 to 2009. According to the survey, financial derivatives used to protect against financial risks during 2007/08 financial crisis. Other finding is that firm size is affected the derivatives usage by large Indian non-financial companies. In Turkey, Selvi, Y., Turel, A., (2010) surveyes on risk management strategies of both non-financial firms and banks. This study indicates that Turkish banks uses tools of financial risk management more than non-financial firms. In small emerging countries, such as the analysis on non-financial companies in Slovenian and Croatians, (Sprčič, 2007) the evident is the same. In these countries, the financial risk management instruments are seen as unimportant and unnecessary.

3. Data and Methodology

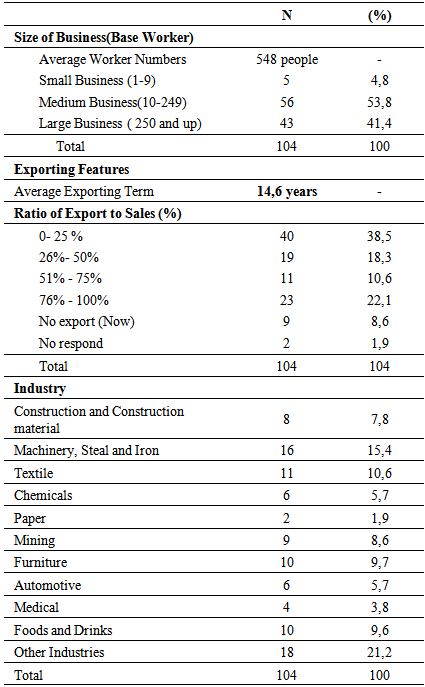

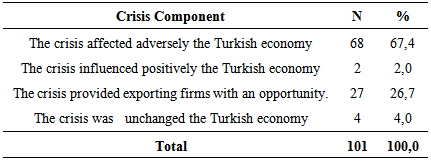

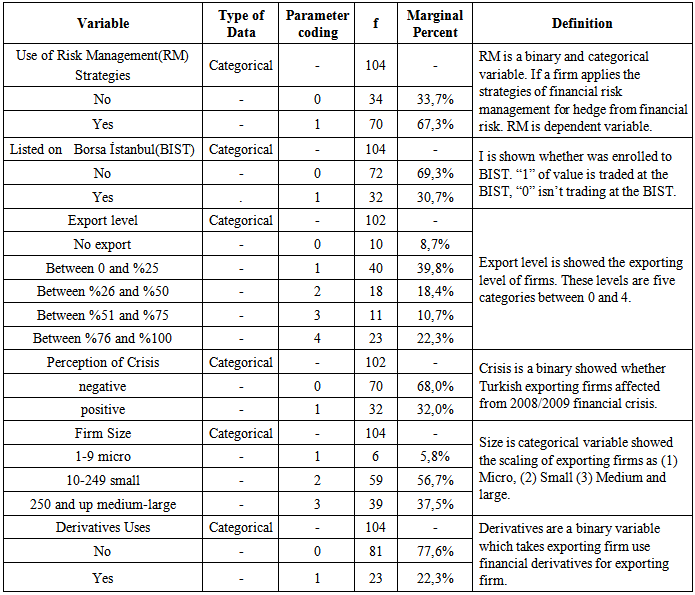

- The data for this study respond from a survey oriented by the top and financial managers on Turkish exporting firm. The survey conducted using face to face and over the phone interview techniques. The survey conducted in dates from November 2010 to January 2011. The survey comprise of top 500 Turkish exporting firms and only 104 of them response to the survey corresponding to 21% of the firms. The survey sample features is shown in Table 1.

|

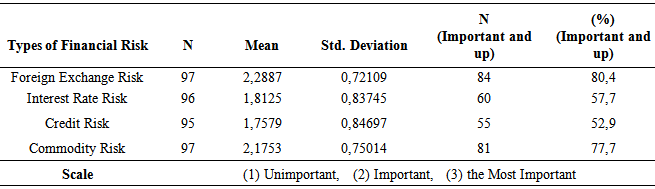

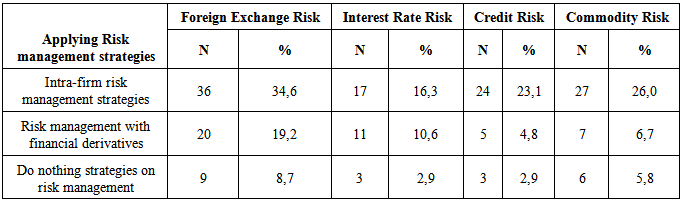

4. Survey Result on Financial Risk Management in Exporting Firms

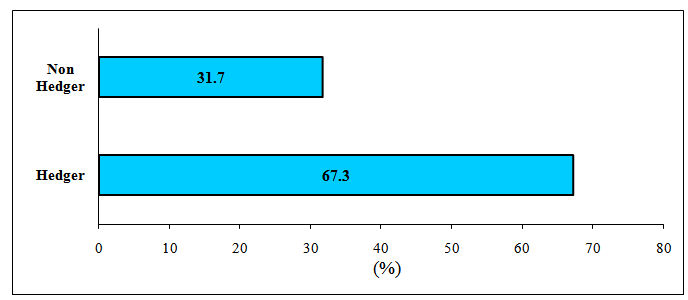

- Figure 1 shows the profile of risk management by exporting firms that used by survey respondents. It is questioned the pattern of “yes” or “no” whether applied the strategies of risk management hedge to financial risks. The survey findings shows almost 67% of firms give answer “yes” that firms defined as hedger, others firms(%31) defined as non-hedger. In short majority of the firms used strategies of financial risk management. This associated with development of the risk management abilities of exporting firms in emerging countries. Even Turkish exporting firms activities have reached a level of developed countries. As an example non-financial Italian firms applied 65% of firms to hedge from exchange risk and interest risk (Bodnar, G.M., at al. 2012).

| Figure 1. The exporting firms used the strategies of Financial Risk Management |

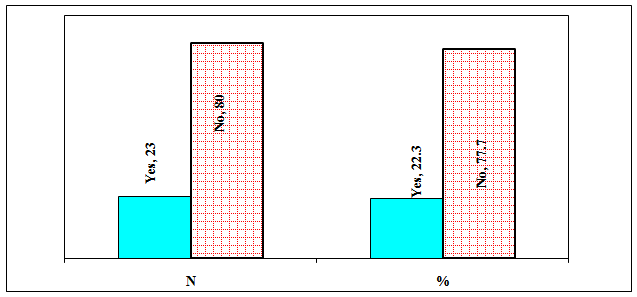

| Figure 2. Use of financial derivatives in risk management by exporting firms |

|

|

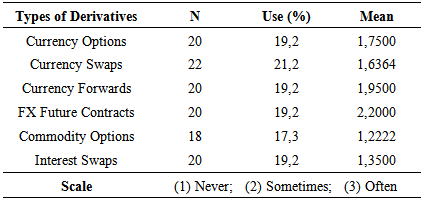

5. The Financial Derivatives Usage

- The survey asks to the firms whether they use financial derivatives or not by replying with “yes” or “no”. This question responded by 103 firms. Only 23 firms or %22,3 responded that they are using derivatives. This number is fairly low against to the non-financial firms in developed countries. Figure 2 shows that use of financial derivatives in risk management by exporting firms. According to result of survey, use of derivatives is fairly low. That is, only 22,3% of all firms used financial derivatives. Firm’s number using derivatives is alone 23% and 77,7% of all firms doesn’t use the financial derivatives. The ratio of firms using derivatives is lower than the result of other study by Selvi and Türel (2010) in that the derivatives 28% of 79 non financial firms listed BIST in Turkey. But both of results is low compared to the developed countries such as studying on four Nordic counties non financial firm derivatives usage ratio is %62 (Brunzell at al. 2011) and Derivatives usage in UK nonfinancial listed companies is 138 (60%) of 231 firms reported using at least one derivative instrument. The using of derivatives in Turkish exporting firms is still lower than that of the developed countries. Several examples can be found in comparative international analysis for example as a study on small and large economics by Prevost, Rose and Miller (2000). The firms in New Zeland uses less financial derivatives than the firms in UK and US. In this study arrived the result using the derivatives in small and non-liquid financial markets as New Zeeland. In Turkey, non-financial firms can use types of financial derivatives, option, and swap and future contracts. According to our surveys, it is remarkable that Turkish exporting firms mainly uses to the currency derivatives products. Especially they select the products of currency derivatives such as currency options, currency swaps, currency forwards and FX future contracts. For other financial risks, using the financial derivatives is commodity options and interest rate swaps. In all derivatives, it is occasionally used the currency derivatives such as FX contracts with mean of 2,20 (19,2%), currency options with mean of 1,75 (19,2%), swaps with mean of 1,64 (21,2%), forwards with mean of 1,95 (19,2%). Actually, currency derivatives using is being normal than other derivatives for exporting firm, so currency risk is important than other financial risk for exporting. The study by Yılmaz and Kurun (2007) is clarified this situation. In addition this firms used the interest swaps with mean of 1,35(19,2%) In short, the findings of survey shows that the Turkish firms do not use as perpetual and level of high the financial derivatives for hedging (Table 4).

|

|

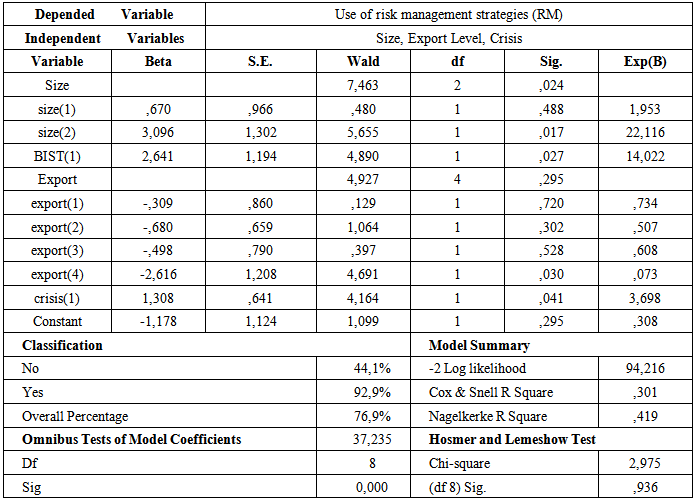

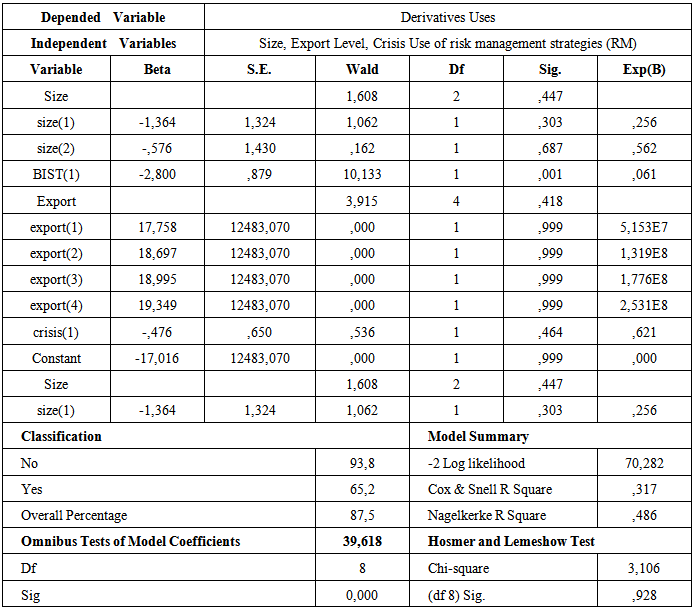

6. Determiners of Risk Management in Exporting Firms

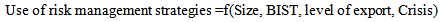

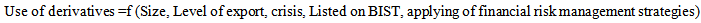

- The main aim of the survey is to clarify the factors to determinate the financial risk management strategies for exporting firm. In the paper, the binary logistic regression model(BLR) is used for analysis whether firms applied risk management strategies in exporting firms or not. BLR method facilitates to understand about risk management strategies predict the likelihood or odds ratio between risk management strategies and determiners factor as size, export and crisis. The analysis can be to have made to use for categorical data. In this study I have tested depend on the variables as risk management strategies, export level, trading at the BIST, perception of crisis, firm size and derivatives use. It can be seen that the variables used two models in Table 6.

|

| (1) |

|

| (2) |

|

7. Conclusions

- The purpose of the study is to determine how exporting firms on financial risk management activities do during 2008/09 financial crisis. It is based on survey realized the 104 exporting firms in the top 500 of Turkish exporting firm list. According to survey result exporting firms usually use of financial risk management tools for hedging. This study shows that Turkish exporting firms mostly set great store on financial risk management for hedging. Especially FXR is the most important risk in terms of exporting firms. In fact this result redoubles previous international studies on emerging countries or advanced non-financial firms (Saito at al., 2005; Davies, at al. 2006; Bodnar at al 2012). The firms usually solve their currency and other financial risks by using internal risk management strategies. Turkish exporting firms mostly negatively affected from 2008/09 financial crisis. So they perceived as important risk management strategies in struggle financial risk during financial crisis. However, Turkish exporting firms don’t use enough financial derivatives for hedging. The logistic regression models explain risk management strategies and the financial derivatives usage make out firm scaling, listed at BIST and the crisis. Still large and listed at BIST firms succeeded using risk management strategies and derivatives other than small exporting firms. My finding confirms large Turkish exporting firms gives priority to foreign exchange risk and commodity risk management compared to other financial risks. This situation can be arising from financial experience and having various financial instruments. If exporting firms invest to financial capabilities and markets, they can use more financial derivatives and complex financial instruments.

Note

- 1. The paper based on a project entitled “The financial risk management in the Turkish exporting firms during the global financial crisis”. The Project was financed by Cumhuriyet University finished between 2010 and 2012. The project has given as report to Cumhuriyet University Scientific Research Unit(CÜBAP).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML