-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(2): 140-143

doi:10.5923/j.ijfa.20150402.04

The Role of Business Valuation in Strategic Planning of Activity of the Company

Yuliia Sivitska

Consulting company "Forex", appraiser, Poltava, Ukraine

Correspondence to: Yuliia Sivitska, Consulting company "Forex", appraiser, Poltava, Ukraine.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This article examines the role of business valuation in long-term planning of activity of the company, contains analysis of the recent publications on strategic planning, the reasons and benefits that companies get from ordering of a business valuation and some specific business situations which may call for a formal valuation study. Business valuation helps chart the course of success, starting with the strengths and weaknesses of your organization, and determines the actions, which will help drive the enterprise value to where it should be tomorrow. The role of business valuation is determined as one of the main roles of strategic planning of activity of the company, because, all companies have limited resources, so strategic planning and task needs to be prioritized to ensure a methodical, realistic approach for company that wants to succeed.

Keywords: Business valuation, Strategic planning, Reasons for independent business valuation

Cite this paper: Yuliia Sivitska, The Role of Business Valuation in Strategic Planning of Activity of the Company, International Journal of Finance and Accounting , Vol. 4 No. 2, 2015, pp. 140-143. doi: 10.5923/j.ijfa.20150402.04.

Article Outline

1. Introduction

- The contemporary development of methods of business valuation proceeds in the direction of satisfying the requirements of modern management. Today value management is one of the most popular concepts of the management philosophies.The evaluation results of business obtained by analyzing the external and internal information are necessary not only for negotiating about buying and selling, they play a significant role in the selection of enterprise development strategies: in strategic planning, it is important to estimate future revenues of an enterprise, level of sustainability and value of the image; to substantiate investment projects for the acquisition and business development it is necessary to have information on the cost of an enterprise or part of its assets.

2. Analysis of Recent Researches and Publications

- The authors of fundamental scientific works on strategic planning are A. Chandler, K. Andrews and I. Ansoff. In recent years, there has been a tendency abroad towards generalization and comprehension of the results of researches in the area of strategic planning and management. In connection with the above, we note, for example, scientific works of H. Mintzberg, and D. Alstrend Lempel.It should be noted that scientific literature quite completely and describes the theoretical approaches to strategic planning. But the role of evaluation in long-term planning of the company is covered fragmentarily or even omitted from consideration. Implementation mechanisms of strategic planning, development and application is the matter of consulting companies which have little interest in public discussion of the results.

3. Problem Statement

- At the contemporary stage, competition level in all areas of producing goods and service delivery is constantly increasing. Any company needs planning as a dynamic process, to anticipate and take into account environmental changes and adapt the internal production factors for its development and growth. Valuation of the company plays an important role in long-term planning of the company.

4. Purpose and Objectives of the Article

- Purpose of this article is to identify and describe the role of business valuation in the long-term planning of activity of the company.

5. Basic Results of the Article

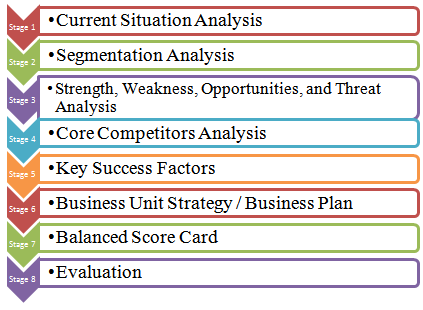

- Strategic planning is a process that brings to life the mission and vision of an enterprise. A strategic plan, well crafted and of value, is driven from the top down; considers the internal and external environment around the business; is the work of managers of the business; and is communicated to all the business stakeholders, both inside and outside of the company. [3]Many business owners believe that since their hand is on the pulse of the business, no surprises will come. Unfortunately, they are usually wrong. [13]As a company grows and as the business environment becomes more complex the need for strategic planning becomes greater. There is a need for all people in the corporation to understand the direction and mission of the business. Companies consistently applying a disciplined approach to strategic planning are better prepared to evolve as the market changes and as different market segments require different needs for the products or services of the company. There is no unique formula or process for strategic planning. There are however, principles and required steps that optimize the value of strategic planning. [5]The steps in the process described in this article on strategic planning are presented below (Figure 1):

| Figure 1. The process of strategic planning |

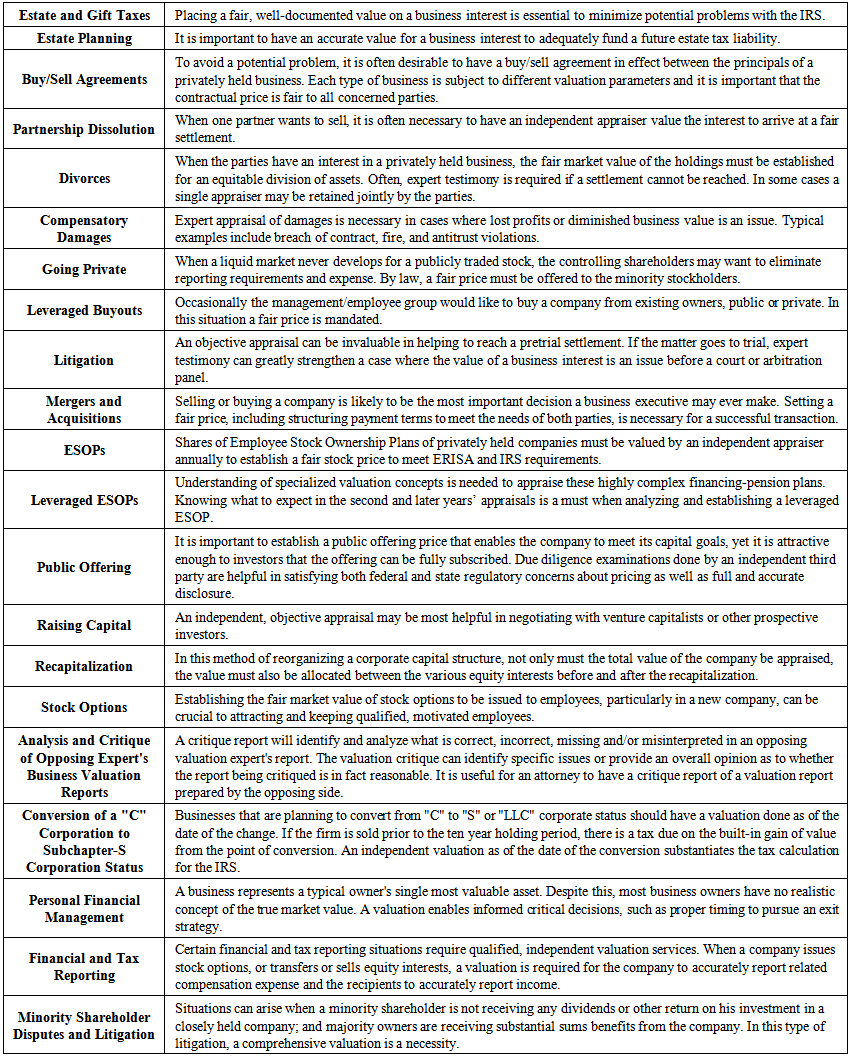

| Table 1. Reasons for independent business valuation |

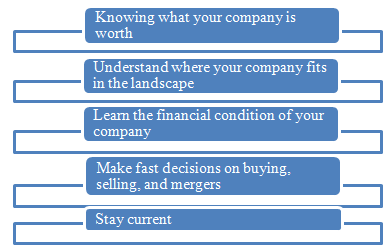

| Figure 2. Benefits which a company will receive from independent business valuation |

6. Conclusions

- Strategic planning or long-range planning, is a management-directed process that is intended to determine a desired future state for a business entity and to define overall strategies for accomplishing the desired state. Through planning, management decides what objectives to pursue during a future period, and what actions to undertake to achieve those objectives.Successful business planning requires concentrated time and effort in a systematic approach that involves: assessing the present situation; anticipating future profitability and market conditions; determining objectives and goals; outlining a course of action; and analyzing the financial implications of these actions.Business valuation is one of the main stages of the strategic planning of the company. Based on the assessment of business value company management determines the content and sequence of the implementation of the most important events, make decisions on complex problems of the company.If a business is overvalued, it will not sell. If a business is undervalued, the seller will not realize a full return on investment. In most cases, a properly priced business will sell and all parties will walk away satisfied. A fair price of the business is the result of an independent professional valuator’s opinion.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML