-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(2): 131-139

doi:10.5923/j.ijfa.20150402.03

ELSS Mutual Funds in India: Investor Perception and Satisfaction

Seema Sharma

Sydenham Institute of Management Studies, Research and Entrepreneurship Education (SIMSREE), Mumbai, University of Mumbai (UoM)

Correspondence to: Seema Sharma, Sydenham Institute of Management Studies, Research and Entrepreneurship Education (SIMSREE), Mumbai, University of Mumbai (UoM).

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Equity Linked Savings Scheme (ELSS) is a type of mutual fund, which invests the corpus in equity and the equity related products. These schemes offer tax rebates to the investors under specific provisions of the Indian Income Tax Act, 1961. Their growth opportunities and risks are like any other equity-oriented schemes. ELSS is open-ended; hence can be subscribed to and exited from at any point of time. The purpose of the study is to find out the perception of investors towards Equity Linked Savings Scheme mutual funds with special consideration towards the satisfaction level of the investors through grievance redressal, after-sales services and time taken to redeem the scheme. This study also tries to explore the part of behavioral finance, as the attributes used here explain the human (investor) psychology during the financial investment being executed in the financial market. In the present study, an attempt has been made to assess the overall investor perspective using a research design based on secondary data collected from various research paper portals like Ebsco, Proquest and Google. In all, 50 research papers have been downloaded and pursued for this purpose, primarily from year 2009 to year 2014. The review of the research papers reveals that, in the Indian scenario, most of the attempts have been made only to describe the mutual fund performance on the basis of risk and return. There are gaps in the knowledge domain regarding perception of the investor, customer satisfaction and demographic variables regarding ELSS Mutual Funds in financial market in general. Therefore a model is developed to explain the impact based on these variables on the ELSS Mutual Funds.

Keywords: ELSS, Mutual fund, Perception, Customer satisfaction, Grievance redressal, After-sales service, Investor

Cite this paper: Seema Sharma, ELSS Mutual Funds in India: Investor Perception and Satisfaction, International Journal of Finance and Accounting , Vol. 4 No. 2, 2015, pp. 131-139. doi: 10.5923/j.ijfa.20150402.03.

Article Outline

1. Introduction

- Every investor has his own set of objectives while investing, but primary objective remains creation of wealth (Jahanzeb, Muneer and Rehman, 2012) [1]. The finance theories have focused on the performance of funds in financial terms of gains over investment, but such theories have failed to explain the gap of perceived profits and received profits. Whether the investment decision is driven purely by wealth maximization goal or there are other factors which affect the perception of the investors about the actual gain vis-à-vis perceived gain; needs to be explained too. Jahanzeb, Muneer and Rehman [1] state that, in long-term investment decisions, investor psychology plays a very important role in describing the investor behavior. Dr. Paul Slovic [2], the eminent behavioral economist, has tried to assess the fundamental issues, such as, the influence of affect on judgement and decisions. Tversky and Kahneman [3], 1979 have studied the heuristic driven decisions and biases. Contributions of these studies have gradually led the way to behavioral finance. The behavioral theories have tried to bridge the gap between the traditional finance and economic theories. In the present study, an attempt has been made to explain the investor behavior by analyzing the Equity Linked Saving Scheme (ELSS) mutual funds of banks. Mutual fund is comparatively a newer topic in India. The first mutual fund was set up in India by the Unit Trust of India (UTI) in 1963. Since then, a service evolution of mutual fund industry has taken place in India with great efforts. The liberation of economy by the Government of India in 1990s allowed private and public sector banks to setup mutual funds in India (Dave, S. A. [4] 1992). We can categorise the Indian mutual fund industry into three phases. The first phase is from 1964 to 1987 and the only player in the market was Unit Trust of India, which had a total asset value of $1.08 bn at the end of 1988. The second phase is between 1987 and 1993, during which there were 6 funds established by banks and one each by the Life Insurance Corporation of India (LIC) and the General Insurance Corporation of India (GIC). The total assets under management had grown to $9.90 bn at the end of 1994 and the number of schemes was 167. The Third phase began with the entry of private and foreign sectors in the mutual fund industry in 1993. The share of private players has risen rapidly since then.

2. Current Status of Mutual Fund Industry in India

- As per the data given by Securities and Exchange Board of India (SEBI) [5] for the transactions on stock exchanges by mutual funds for the period of April 2008 – March 2009, the net investment in equity funds was $1.13 bn & net investment in debt funds in the same time period was $13.15bn (as per the data compiled by the SEBI on the basis of reports submitted to SEBI by the NSE & the BSE [5]). There was a net outflow of $3.12 bn in 2010-11 by private sector mutual funds as compared to $8.91 bn inflow in 2009-10. Public sector mutual funds and UTI mutual fund also witnessed net outflow of $2.20 bn and $2.67 bn in 2010-11 as compared to net inflow of $2.02 bn and $2.54 bn in 2009-10 respectively. Gross mobilisation of resources under open-ended schemes during 2010-11 was $1406.20 bn, of which, about 78.0 percent was raised by the private sector mutual funds followed by public sector funds (13.1 percent) and UTI mutual fund (8.9 percent). Similarly, gross resources mobilised under close-ended schemes stood at $20.91 bn in 2010-11, of which private sector mutual funds accounted for 87.1 percent followed by public sector mutual funds.

3. Equity Linked Savings Scheme (ELSS) Mutual Funds

- The objective of the tax paying investors is to invest their money in an opportunity that not only has tax exemption, but also gets maximum liquidity and better rate of return. There are various avenues available in the financial market such as fixed deposits, Public Provident Fund (PPF), National Savings Certificate (NSC), tax saving mutual funds etc., which provide tax exemption benefits. Equity Linked Savings Schemes (ELSS) mutual funds are similar to the normal equity diversified schemes that invest in the equity market. Features that differentiate ELS schemes from other open-ended equity diversified schemes are tax saving benefits (deductions under section 80 C of the Indian Income Tax Act) and a lock-in period of 3 years. There is no tax on capital gains of these funds either. People can invest in these ELSS mutual funds in small amounts through Systematic Investment Plan (SIP) and can begin with a small fund size. Some expenses are borne by the investor in the form of entry or exit load or both. This expense is similar to any other expense of equity schemes of mutual funds.

4. Statement of Problem and the Need for Study

- ELSS mutual funds continue to be a popular investment choice (Garg M [6], 2014). This is evident from the fact that the first ELS scheme in India was launched in 1993 and today, the investors have more than 35 ELS schemes to choose from (Chakrabarti R & Malik S [7], 2014). The total corpus of ELS schemes in India, as on October 31, 2007 is $2.43 bn as stated on the SEBI website [5}(sebi.gov.in). The economic theory states that the investor behaves in a rational manner (Jorgenson Dale [8], 1967). The present study proposes to investigate the factors which influence the investors while making an investment choice. In the last two decades it has been noticed that for the success of any product, customer satisfaction is very important (Manjappa, D H Osmane and Niranjan, R [9], 2010). The present study has been undertaken with the objective of finding out the perception of investors towards ELSS mutual funds.

5. Objective of the Study

- The present study aims to –1. identify the behavioral dimension of investment made in ELSS mutual funds in India.2. evaluate the components that influence the investor preferences while making investment decisions.3. analyse whether increased perception and customer satisfaction can influence and play a vital role while making investment decisions.4. prepare a model defining the customer satisfaction as the base for investment behavior.

6. Literature Review

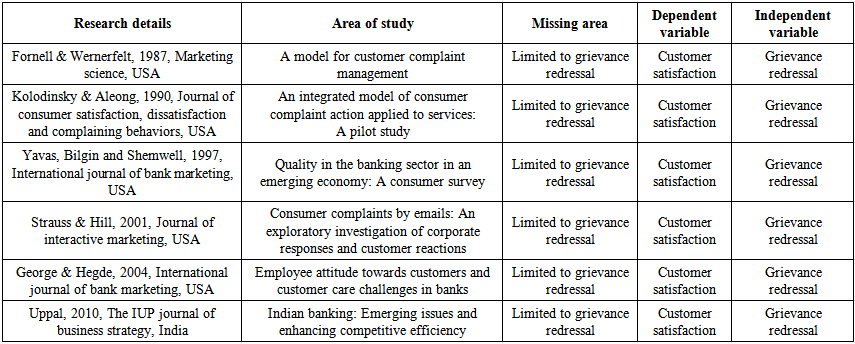

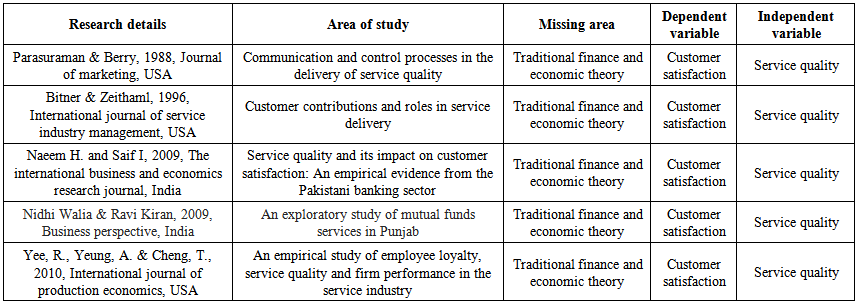

- Grievance redressalFornell and Wernerfelt [10], 1987 gave a model for complaint management which can be used as a defensive marketing strategy in terms of reducing customer turnover. Kolodinsky and Aleong [11], 1990 brought an integrated model of consumer complaint action which can improve customer service. The introduction of ombudsman scheme for grievance redressal in customer service has been supported by various researchers. Yavas, Bilgin and Shemwell [12], 1997 concluded that, the ultimate success of any service quality program of bank could only be gauzed by its satisfied customers. Strauss and Hill [13], 2001 studied that effective consumer complaint handling resulted in increase in customer satisfaction and building long-term relationships. George and Hegde [14], 2004 studied that employees attitude is pre-requisite for customer satisfaction in the context of customer complaint. Aarti [15], 2009 pointed out that online mode of receiving complaint is more common in foreign banks as compared to domestic public sector and private banks. Uppal [16], 2010 ascertained that complaints in public sector banks are continuously increasing and adversely affecting the customer satisfaction.

| Table 1. Review of literature on grievance redressal |

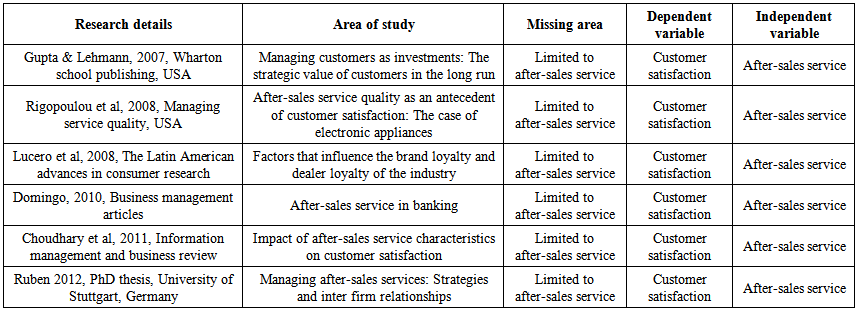

| Table 2. Review of literature on after-sales service |

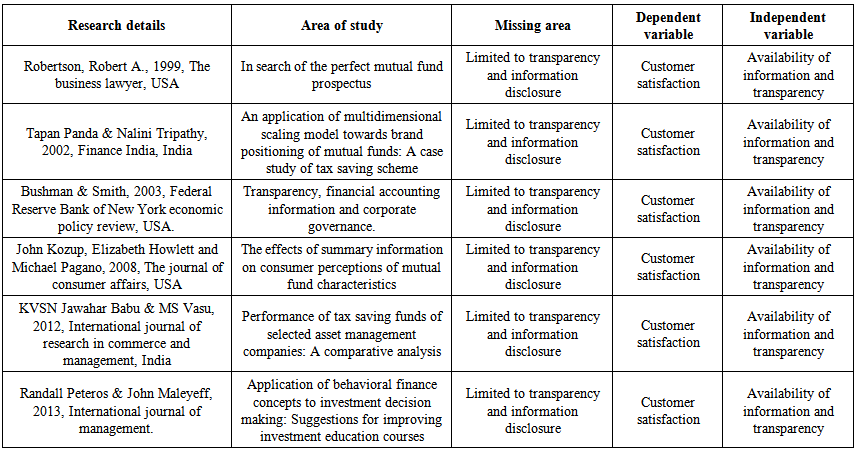

| Table 3. Review of literature on transparency |

| Table 4. Review of literature on customer satisfaction and increased perception |

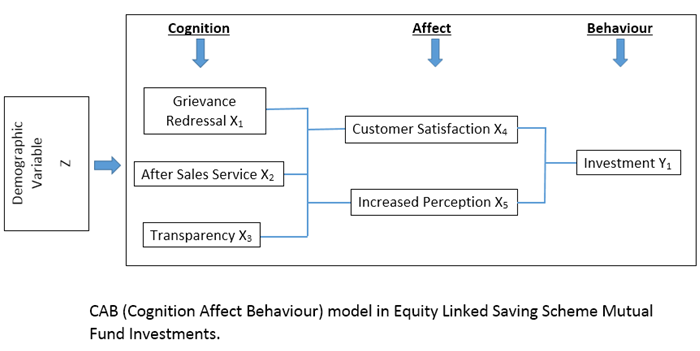

7. Identification of Variables for the Study and Developing Theoretical Construct

- Based on the review of the above literature, it is clearly evident that the most important variables affecting the investor behavior towards the investment decisions and overall impression about the Equity Linked Savings Schemes (ELSS) mutual funds are grievance redressal, after sales service and transparency. The competitive power and survival of the bank lies in the degree of customer satisfaction (Titko & Lace [40], 2010) and therefore banks should pay attention to customer satisfaction (Kattack & Rehman [41], 2010). Creating satisfied customers is critical in fostering customer retention (Marandi & Harris [42], 2010). Customer satisfaction is influenced by expectations, perceived service and perceived quality (Hu & Juwaheer [43], 2009).Grievance RedressalThere are several occasions where the investors have some issues or grievances related to mutual fund in which they have invested. ELSS mutual fund with a good grievance redressal system must incorporate certain elements in its standard operating procedure (SOP) like whom and how to contact in case of a grievance, timeline for redressal, tracking the complaint by customer, investor’s feedback and the way ahead for the investor in case of negative feedback. Grievances of investors are mainly due to misleading advertisements, non-receipt of allotment advice or refund orders (Morris et al [44], 2008). Delay in payment or non-payment on the sale of securities is the major complaint against the brokers (Venugopal & Sudarshan [45], 2012).

After-sales servicesNot only the ELSS mutual fund should facilitate the transactions, but it should also provide a comprehensive after-sales service. The major components of a good after-sales service from the perspective of investor include regular reporting on fund’s performance, hand holding during exit/ withdrawal/ redemption, support to the investor for switching between schemes, appropriate suggestions for additional investment, online access to investment portfolio and similar service standards for all investors. As all of these services are already charged in the form of entry load/ exit load/ both, the investor should not be asked to pay extra for any of these services. Generally, those ELSS mutual funds, which provide for better after-sales service, are able to attract more investors and more investments. The cost of delivering poor quality service includes the costs associated with rendering the service, compensations for poor service, loss of customers and negative word of mouth (Zeithaml et al [32], 1996).TransparencyInvestors who invest their hard earned money in the mutual funds seek to know where their money goes and how it is invested. To help investors make informed investment decisions, the ELSS mutual funds are expected to extensively disclose the material details of their entire operations. An ELSS mutual fund with good operational transparency always reassures the investors that they are in total control of their money. There should be transparency about cost of services, any inherent commissions etc. The fund should divulge more and more information to the investors through advertisements, annual reports, the current Net Asset Value (NAV) of the scheme etc. All those ELSS mutual funds adhering to these transparency norms are likely to widen their investor base over a period of time.Service quality is about what consumer makes an opinion of an overall firm’s brilliance or superiority. Gronsoss [46], 2000 argued that whatever be the customer experience in the interaction phase, it will definitely have a strong effect on the customer’s estimation about the service quality. Based on the above theoretical construct, the present study goes on to suggest that customer satisfaction and increased perception are the affect of the cognition stored in investor’s memory, which results in a behavior manifestation of investment by the investor. The proposed theoretical model of this study tries to build an association between grievance redressal (X1), after-sales service (X2) and transparency (X3) on one hand, and customer satisfaction (X4) and increased perception (X5) on the other, which in turn manifests in the form of investment decision (Y1) by the investor. Thus, as per the above discussion, the following equations between the variables can be arrived at –Y1 = a1 X1 + a2 X2 + a3 X3 + a4 X4 + a5 X5 + a6 Z + ϵ1X4 = b1 X1 + b2 X2 + b3 X3 + ϵ2X5 = c1 X1 + c2 X2 + c3 X3 + ϵ3The above equations are based on multiple regression analysis because in the present study, there are multiple independent variables, X1, X2 etc., and one dependent variable, Y. In the above equation based on present study, Y is the value of the dependent variable, which is being predicted (investment in present study). In the present study, it has been suggested that the investment as the dependent variable is affected by grievance redressal, after-sales service, transparency, customer satisfaction and increased perception as the independent variables. Out of these 5 variables, the first 3 also affect the subsequent 2 variables. Here, a1, a2, a3 and so on (b1, b2, b3 and c1, c2, c3) represent the slopes (beta coefficient) for the respective dependent variables X1, X2, X3 and so on.Let us assume the case of bank “S”. Assumption: The quantum of investment (and the number of investors) of ELSS mutual fund schemes of “S” bank is affected by grievance redressal, after-sales service, transparency, customer satisfaction and increased perception.Equation: Y1 = 0.37 X1 + 0.48 X2 + 0.12 X3 + 0.49 X4 + 0.17 X5 + 18.9If X1 = 10, X2 = 23, X3 = 7, X4 = 40, X5 = 15Then Y1 = 0.37 (10) + 0.48 (23) + 0.12 (7) + 0.49 (40) + 0.17 (15) + 18.9 = 37.73If any one of the five variables changes value, the other 4 remaining the same, the value of Y1 will proportionally change in tune with the change in value of that one variable. In this mathematical model of the proposed theoretical construct, the coefficient of variation is assumed to be nil or negligible.Similar inference can be deduced in case of other banks.Thus, the theoretical construct proposed in the present study is proved to be true.

After-sales servicesNot only the ELSS mutual fund should facilitate the transactions, but it should also provide a comprehensive after-sales service. The major components of a good after-sales service from the perspective of investor include regular reporting on fund’s performance, hand holding during exit/ withdrawal/ redemption, support to the investor for switching between schemes, appropriate suggestions for additional investment, online access to investment portfolio and similar service standards for all investors. As all of these services are already charged in the form of entry load/ exit load/ both, the investor should not be asked to pay extra for any of these services. Generally, those ELSS mutual funds, which provide for better after-sales service, are able to attract more investors and more investments. The cost of delivering poor quality service includes the costs associated with rendering the service, compensations for poor service, loss of customers and negative word of mouth (Zeithaml et al [32], 1996).TransparencyInvestors who invest their hard earned money in the mutual funds seek to know where their money goes and how it is invested. To help investors make informed investment decisions, the ELSS mutual funds are expected to extensively disclose the material details of their entire operations. An ELSS mutual fund with good operational transparency always reassures the investors that they are in total control of their money. There should be transparency about cost of services, any inherent commissions etc. The fund should divulge more and more information to the investors through advertisements, annual reports, the current Net Asset Value (NAV) of the scheme etc. All those ELSS mutual funds adhering to these transparency norms are likely to widen their investor base over a period of time.Service quality is about what consumer makes an opinion of an overall firm’s brilliance or superiority. Gronsoss [46], 2000 argued that whatever be the customer experience in the interaction phase, it will definitely have a strong effect on the customer’s estimation about the service quality. Based on the above theoretical construct, the present study goes on to suggest that customer satisfaction and increased perception are the affect of the cognition stored in investor’s memory, which results in a behavior manifestation of investment by the investor. The proposed theoretical model of this study tries to build an association between grievance redressal (X1), after-sales service (X2) and transparency (X3) on one hand, and customer satisfaction (X4) and increased perception (X5) on the other, which in turn manifests in the form of investment decision (Y1) by the investor. Thus, as per the above discussion, the following equations between the variables can be arrived at –Y1 = a1 X1 + a2 X2 + a3 X3 + a4 X4 + a5 X5 + a6 Z + ϵ1X4 = b1 X1 + b2 X2 + b3 X3 + ϵ2X5 = c1 X1 + c2 X2 + c3 X3 + ϵ3The above equations are based on multiple regression analysis because in the present study, there are multiple independent variables, X1, X2 etc., and one dependent variable, Y. In the above equation based on present study, Y is the value of the dependent variable, which is being predicted (investment in present study). In the present study, it has been suggested that the investment as the dependent variable is affected by grievance redressal, after-sales service, transparency, customer satisfaction and increased perception as the independent variables. Out of these 5 variables, the first 3 also affect the subsequent 2 variables. Here, a1, a2, a3 and so on (b1, b2, b3 and c1, c2, c3) represent the slopes (beta coefficient) for the respective dependent variables X1, X2, X3 and so on.Let us assume the case of bank “S”. Assumption: The quantum of investment (and the number of investors) of ELSS mutual fund schemes of “S” bank is affected by grievance redressal, after-sales service, transparency, customer satisfaction and increased perception.Equation: Y1 = 0.37 X1 + 0.48 X2 + 0.12 X3 + 0.49 X4 + 0.17 X5 + 18.9If X1 = 10, X2 = 23, X3 = 7, X4 = 40, X5 = 15Then Y1 = 0.37 (10) + 0.48 (23) + 0.12 (7) + 0.49 (40) + 0.17 (15) + 18.9 = 37.73If any one of the five variables changes value, the other 4 remaining the same, the value of Y1 will proportionally change in tune with the change in value of that one variable. In this mathematical model of the proposed theoretical construct, the coefficient of variation is assumed to be nil or negligible.Similar inference can be deduced in case of other banks.Thus, the theoretical construct proposed in the present study is proved to be true.8. Discussion

- Based on the above data analysis, it is clearly evident that the most important variables affecting the consumer behavior towards the investment decisions and overall impression about the ELSS mutual funds are grievance redressal, after-sales service and transparency. Guetzman et al [47], 1997 states that there is evidence that investor psychology affects fund/ scheme selection and switching. ELSS mutual funds, with a good grievance redressal system incorporated in its standard operating procedure (SOP), are the ones which are most likely to have the investor confidence and trust. Providing for a comprehensive after-sales service is a pre-requisite to annul the doubts in the investor’s mind regarding the attitude of the fund towards him and his hard earned money. A fund which has a good after-sales service is perceived as a co-operative fund. Thus, those ELSS mutual funds, which provide for better after-sales service, are able to attract more investors and more investments. Xuan et al [48], 2013 found that strong internal system generates the positive reinforcement for the investor to invest in that scheme. Investors who invest their hard earned money in the mutual funds seek to know where their money goes and how it is invested and this helps the investors make informed investment decisions. An ELSS mutual fund with good operational transparency always reassures the investors that they are in total control of their money and there is transparency about cost of services or any inherent commissions etc. Shanmugan [49], 2000 conducted a survey and found that psychological and sociological factors dominated the economic factors in share investment decisions. The funds which divulge more and more information to the investors through advertisements, annual reports etc. are generally more successful and widen their investor base over a period of time vis-a-vis their counterparts. The willingness of the ELSS mutual funds to be empathetic to the customer’s needs and to deliver accordingly so as to improve the service experience at every step, starting from the entry to exit, wins the trust of the investors. Walia & Kiran [38], 2009 found that investors want to add quality to existing services. Being transparent, well regulated and tax-efficient makes them a preferred investment choice for investors.But, few other studies differ in their opinion about the role of variables like grievance redressal, after-sales service and transparency on overall customer satisfaction and perception and ultimately on the investment decision of the investors. Fama [50], 1970 has advocated that the investor is rational about investment decision making. Holland [51], 2010 argues that established knowledge is always used in investment decision-making but academic knowledge is not used in the capital market. Simon [52], 1986 has propounded that rationality is there in psychology and economics.

9. Conclusions

- It is clearly concluded during the course of this research that the factors of the theoretical model do have a bearing over the customer satisfaction in the mutual fund market. Service quality and customer satisfaction have been conceptualized as a distinct, but closely related constructs. There is a positive relationship between the two constructs. The fluctuations in the economy and uncertainty in the financial market worldwide has intensified the competition and created a lot of pressure on the mutual fund industry to perform. Several practices have been adopted to boost sales and enhance the performance of ELSS mutual funds. Therefore, to assist in alleviating the problem, the present paper tries to explain the various factors involved in building the relationship between investor perception and customer satisfaction. Wang [53], 2010 argues that there is a positive relationship between service quality, perceived value and customer loyalty. During the course of the present study, it is observed that grievance redressal, after sales service and transparency affect customer satisfaction and increase perception towards ELSS mutual funds. Grievance redressal increases the perception either on positive or the negative side. Customer satisfaction leads to investment and reinvestment in the same ELS scheme in the same fund. The ELSS mutual fund providers should become pro investor with special consideration towards the small tax payer investors, as these investors play an important role in the task of nation building by paying taxes from their hard earned money. The relationship between customer satisfaction and service quality is debatable. Some researchers argued that service quality is the antecedent of customer satisfaction, while others argued the opposite relationship. Consequently, the findings of the present study indicate that theoretical construct of the present study is applicable to the investor services provided by the mutual funds. Thus, the present research succeeds in proving the hypothesis in the realms of the theoretical model of the study. It has the potential to contribute to the ELSS mutual fund industry in improving the customer satisfaction and increase investor perception on the positive side to achieve a larger market share, higher investments and greater profitability.

10. Managerial Implications

- The findings of the study on secondary data bring out number of managerial implications for the mutual fund industry at large and the asset management companies in particular. Considering that grievance redressal has effect on investor satisfaction and the perception of the investor of ELSS mutual fund providers, it becomes imperative that the funds should treat the investors fairly all the time. The complaints raised by the investors should be dealt with courtesy and in time. Any grievances should be treated efficiently and if not resolved, the investor should be made aware of his further consumer rights. After-sales service is equally important as it manifests in an increase in positive perception about the ELSS mutual fund. The fund should be welcoming to the investor all the time and respect investor’s choice with all energy and enthusiasm. After-sales service is the key to keep the investment closed and the investors satisfied, resulting in further investment. The ELSS mutual funds have to build up the procedures and train their employees so as to build and sustain a healthy and long-term relationship with the investors and with tax payers in particular. The tax payers are usually burdened with tax related procedures and paper work, so, a little help from the ELSS mutual fund providers will go a long way in putting the tax payers at ease and gain their confidence for investment in ELSS mutual funds.

11. Scope of Further Study

- The present paper suggests that availability of updated information about the financial market and financial system is necessary and crucial for making an informed decision, both by the investors and the ELSS mutual funds. Hence, further studies need to be undertaken to study the variables in even greater depth, in correlation with the prevailing market forces. The study can be made broad spectrum by taking more number of variables into account. This paper recommends that further research should be done to examine the three factors studied presently in more depth and on a larger scale to assist the ELSS mutual funds in India as well as to bring procedural advances and hassle free investing environment for the tax payer investors. The further studies on the subject may be used to develop a charter of customer rights at the level of funds and financial institutions, as well as the asset management companies. As the present study is based purely upon secondary data, there is further scope to undertake the study with primary data based on structured questionnaire designed for both the funds and the investors. Further, specific funds and asset management companies can be brought under the study to have more representative inferences. To conclude, the research reported in this article represents the study of only secondary data to investigate the factors influencing customer satisfaction and investor perception.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML