-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(2): 109-118

doi:10.5923/j.ijfa.20150402.01

Certified Accountants' Perceptions of Forensic Accounting Education: The Case of Bahrain

Sayel Ramadhan

Department of Accounting, College of Business Administration, University of Bahrain, Kingdom of Bahrain

Correspondence to: Sayel Ramadhan , Department of Accounting, College of Business Administration, University of Bahrain, Kingdom of Bahrain.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The main purpose of this study is to report the perceptions of certified accountants regarding the awareness, demand, benefits, relevance and contents of forensic accounting education in a developing country, Bahrain. A certified accountant is one who holds any professional qualification in accounting and is employed by an auditing firm in Bahrain. A questionnaire survey was used to collect the data and a total of 80 certified accountants completed and returned the questionnaire. Using descriptive statistics and factor analysis, the results show that all respondents are familiar with forensic accounting and they expect demand on forensic accounting to increase in the future. The most important benefits of forensic accounting are: strengthen the credibility of financial reporting, promote responsible corporate governance and prepare students to engage in fraud examination. Twenty six topics derived from relevant literature were proposed to be included in a forensic accounting course. The respondents perceive all topics as important and the topics that received the highest rating are: bribery and corruption investigation, corporate governance and analytical review procedures. The study recommends that colleges and universities in Bahrain should incorporate forensic accounting in their accounting programs. The preparers of accounting programs should recognise the value of practitioners' inputs when developing the contents of forensic accounting because their views can improve the relevance of programs and foster graduates' marketability.

Keywords: Forensic accounting education, Accounting curriculum, Accountants', Perceptions, Bahrain

Cite this paper: Sayel Ramadhan , Certified Accountants' Perceptions of Forensic Accounting Education: The Case of Bahrain, International Journal of Finance and Accounting , Vol. 4 No. 2, 2015, pp. 109-118. doi: 10.5923/j.ijfa.20150402.01.

Article Outline

1. Introduction

- Corporate crises and failures early in the twenty first century (e.g. Enron and WorldCom in the USA and HIH Insurance, Ansett and Pan Pharmaceuticals in Australia) have undermined investors' confidence in financial reporting and raised serious concerns over the effectiveness of financial reporting, accounting standards and accountability. These concerns made forensic accounting an attractive career opportunity in recent years and increased the demand for forensic accounting practices as a means to combat fraud and misappropriation of financial statements and, as a result, restore confidence in financial reports. This suggests a need to incorporate forensic accounting education in the accounting curriculum at university level. Research has shown that a number of universities are already offering forensic accounting courses while some are even introducing full academic programs in the area (see Efiong, 2012; Smith and Crumbley, 2009; Kleyman, 2006 and Vogt 2003). Although values of courses and tracks in forensic accounting are fairly well established in the US and UK, but in Bahrain and the Gulf region this area is not getting sufficient attention. In the Kingdom of Bahrain, there is a very limited number of accounting programs that offer forensic accounting courses. The University of Bahrain covers forensic accounting as one of the topics of "Current Issues in Accounting" course at the undergraduate level.The main purpose of this study is to examine the perceptions of certified accountants working in auditing firms in Bahrain regarding the demand, benefits and contents of forensic accounting education. An emerging stream of education research considers the need for revised content and structure, e.g, teaching interviewing skills in forensic accounting (Seda and Kramer, 2009 and Porter and Crumbley, 2012). Some may argue that the contents of an accounting program should be based on academicians' perceptions of what is the best interest of students, and not by practitioners' demands. However, it is important that accounting programs generally recognize the value of practitioners' input when designing program contents, because their views and suggestions can improve the relevance of programs and foster graduates' marketability. It also reduces employers' criticism about accounting programs being out of touch with reality (see, Rezaee et al., 2006). Moreover, accounting practice innovations generally precede innovations in accounting scholarship (Hopwood, 2007). As such, perceptions of academicians and users of forensic accounting services are not covered in this research.The motivation for the study stems from the fact that forensic accounting education in developing countries has not received adequate coverage in accounting curriculum as demanded by investors, practicing accountants and the business community who are deeply concerned with reported financial and accounting scandals. This study extends survey research on the importance of forensic accounting to Bahrain. The results should be relevant and of interest to higher education institutions and academicians in Bahrain in that they will help them to decide whether to offer courses/programs in forensic accounting. There is also evidence as to what topics would be appropriate in such courses and programs. The remainder of the paper is divided into four sections. The next section reviews previous research on forensic accounting education. The third section explains the survey procedure and methodology. The fourth section analyses the results, and the final section discusses the conclusions, implications of the study, identifies its limitations and suggests ideas for future research.

2. Background and Literature Review

- Maurice Peloubet is credited with developing the term forensic accounting in his 1946 essay "Forensic Accounting: Its place in Today's Economy". Formalized procedures of forensic accounting were not put in place until the 1980s when major academic studies in the field were published (Rezaee et al. 1996). Forensic accounting is defined as an "accounting specialization in which investigative and analytical skills are applied for the purpose of resolving financial issues in a manner that meets standards required by courts of law" (Hopwood, et al. 2012 and Bolgna and Lindquist (1995). The word fraud is absent from the definition. Hopwood et al. (2012) define fraud examination as an investigation undertaken to determine the facts of a suspected fraud. Thus, the two terms are not synonymous and not interchangeable. This is also emphasized by the AICPA and Covaleski, (2003) which delineate the following practice areas that fall under the relatively new certified in financial forensic (CFF) credential and what is generally considered “fraud examination” (i.e., item 6 below) is only one of seven practice areas within the forensic accounting umbrella:1. Bankruptcy, insolvency and re-organization 2. Computer forensic analysis3. Economic damages calculation4. Family law5. Financial statement misrepresentations6. Fraud prevention, detection and response7. Business valuationCrumbley et al. (2011) state that forensic accounting concerns an issue that co-joins accounting and law. It is conducted within the context of the rules of evidence, and includes all activities designed to prepare a lawyer to try a case, including interviewing involved parties, document review, draws conclusions and provides an accounting analysis that is suitable to the court which will form the basis for discussion, debate and ultimately resolution of disputes that involve claims (Kranacher et al. 2008 and 2011; Lexbe, 2010; American Institute of Certified Public Accountants-AICPA, 2004 and Bolgna and Lindquist, 1995). Thus, forensic accounting is not only about investigating fraud or fraud examination. Forensic accountants serve as expert witnesses. They do not testify as to whether fraud has occurred. This is the court's decision and the expert witness presents evidence (Gray, 2008). A forensic accountant is viewed as a combination of an auditor and private investigator. He should possess the knowledge and expertise to interpret financial statements or to work under circumstances where financial information has been destroyed or tampered with, necessitating the creation of information to determine if appropriate actions have taken place. The potential significance of forensic accounting is described by Neal Batson, the former United States Department of Justice Examiner who was assigned to investigate the Enron Corporation scandal. He stated that, "There has been no other time in the legal and accounting professions when it has been more important for the two to work together". This indicates that forensic accounting and fraud examination are important areas and will likely continue to be important.Previous research on forensic accounting practices, certifications, education and research indicate that it is a rapidly growing accounting discipline. Research provides evidence that forensic accounting education has evolved from being limited, to continuing professional education sessions for practicing accountants, to a current state of being offered as a credit course by many universities (Razaee 2002; Crumbley 2001; Peterson and Reider 1999, 2001; Rezaee et al. 1996; Rezaee and Burton 1997). Buckhoff and Schrader (2000) found that forensic accounting is very popular and students rating it 9.14 on a ten-point satisfaction scale in the US. Peterson and Reider (2001) and Ramazani and Rafiei (2010) reviewed course syllabi of universities offering forensic accounting courses and analyzed the level of the course contents, learning objectives and course requirements and course coverage. They found that accounting educators agree that there is a need for universities to provide forensic accounting education. Rezaee et al. (1996) examined course syllabi to determine the curriculum coverage of forensic accounting and fraud investigation. They suggested that the accounting curriculum provides a knowledge acquisition base in forensic accounting as part of curriculum changes in response to the mandated (AICPA) 150-hour accounting program. Rezaee and Burton (1997) concluded that the demand for forensic accounting education and practice will continue to increase and that forensic accounting education should be integrated into accounting curricula as a separate course or as a module in auditing or other accounting courses. In addition, they found that academics preferred to integrate forensic accounting topics in the existing accounting courses, whereas the certified fraud examiners preferred offering it as a separate course. Kleyman (2006) reviewed examples of some universities and the forensic accounting education they offer. He noticed that California State University has been teaching forensic accounting course as part of its regular accounting program and the result has been quite impressive. Rezaee et al. (2006) examined the opinions of academics and practitioners regarding the importance, relevance, and delivery of forensic accounting education. Their results indicated that the demand for and interest in forensic accounting will continue to increase. They also found that the number of universities planning to include forensic accounting education in their program is increasing. Both academics and practitioners viewed forensic accounting as relevant and beneficial to accounting students, accounting programs, the accounting profession and the business community. They also considered the (49) proposed topics of a forensic accounting course as important for integration into the accounting curriculum. DiGabriele (2008) found that universities and colleges are currently considering adding forensic accounting to their curriculum. His results provide needed guidance to educators for the development of forensic accounting curriculum by identifying relevant skills to accompany a program of study. Evan Zadeh and Ramazani (2012) found that accountants are not familiar with the services offered by forensic accounting. They relate this to poor training provided by firms’ financial managers who have limited knowledge of forensic accounting. Efiong, (2012) examined the degree of awareness of forensic accounting among accounting undergraduates in Nigeria and found a very low level of awareness of forensic accounting among respondents.Buckhoff and Schrader (2000, 135) state that “adding a forensic accounting course to the accounting curriculum can greatly benefit the three major stakeholders in accounting education: academic institutions that are considering integrating forensic accounting into the accounting curriculum, accounting students and employers of accounting graduates. Professional accounting institutions, auditing firms, clients, regulatory agencies and the business community are also concerned with forensic accounting. Kleyman (2006) argues that enrollment in a forensic accounting course can show students a different side of such a renowned discipline as accounting. In addition, forensic accounting provides the practitioner with profound knowledge of both accounting and law which will enable him/her not only to investigate accounting issues, but also collect evidence, provide litigation support, as well as testify in court (Efiong, 2012). Rezaee (2002) found that students believe that forensic accounting is a sound career option but should be promoted in universities because it is not getting the proper attention. Finally, Rezaee et al. (2006) found that both practitioners and academicians perceive the following benefits of forensic accounting: strengthen the credibility of financial reporting; promote responsible corporate governance; make students more desirable in the market place; satisfy society's demand for forensic accounting; prepare students to engage in fraud investigation, litigation support and expert witnessing.In summary, the academic literature identifies forensic accounting courses and contents in the accounting curriculum. The literature have also empirically identified that accounting academics will educate future students who will become competent forensic accountants. This study adds the necessary contribution to the literature that identifies practitioners' views regarding forensic accounting education. It also sheds light on the increasing importance of forensic accounting in business and academic community.

3. Methodology

3.1. Population and Sample

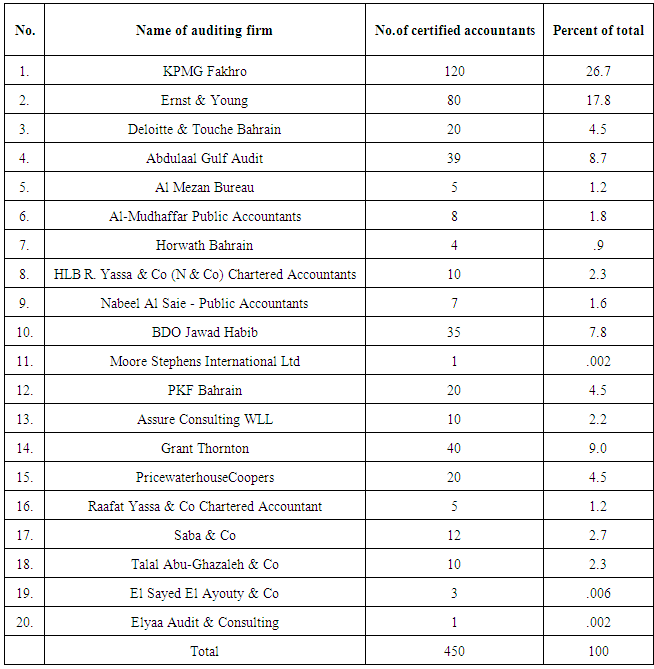

- The study specifically examines certified accountants perceptions regarding forensic accounting education. For the purposes of the study, a certified accountant is an accountant who holds a professional qualification in accounting and works with one of the auditing firms in Bahrain. It is assumed that certified accountants are more likely to be familiar with forensic accounting than an accounting graduate without a professional qualification. There are 20 auditing firms in Bahrain and each firm was contacted by the researcher to get the correct information about the total number of certified accountants. There is also Accounting & Auditing Organization for Islamic Financial Institutions. This institution is excluded because it is not involved in providing audit services to clients. They issue international auditing standards for Islamic financial institutions.Table 1 shows that the total number of certified accountants working in the (19) auditing firms in Bahrain (490). This number represents the population of the study. A random sample of (100) accountants was selected.

|

3.2. The Survey Instrument

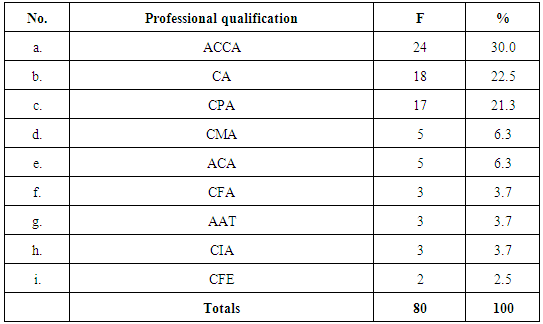

- A questionnaire survey was used to gather data. The questionnaire consists of two sections: section 1 provides information about the future demand on forensic accounting and its perceived benefits. Section 2 covers the relative importance of topics related to a forensic accounting course. A list of (26) topics relating to the two main areas of forensic accounting, litigation support and expert witnessing, were included in the questionnaire. The selection of topics was based on previous research, content analysis of course syllabi at some US universities and obtained from accounting programs (e.g. California State University-Northbridge, West Virginia University, The University of Texas at Austin, The University of Nebraska at Lincoln, The University of Denver, Brigham Young University and others), interviews with practitioners in the field, knowledgeable accounting faculty in Bahrain, and the researcher's experience in teaching "Current Issues in Accounting" course at the University of Bahrain (UOB). This course includes a topic entitled "Forensic accounting". Some topics related to fraud were excluded because fraud is covered in two auditing courses offered at the undergraduate accounting program. So, the list of topics was not all-inclusive. The proposed topics are measured on a five-point Likert scale rated from 1=not important to 5=extremely important. Respondents were asked to add any other topics they feel relevant.The questionnaires were distributed by hand to the entire population. Eighty accountants completed and delivered the questionnaire by hand to the researcher; a response rate of 40%. This high response rate was because copies of the questionnaires were administered using face to face approach through the researcher himself. Table 2 shows the professional qualification each respondent holds. These qualifications are: Association of Chartered Certified Accountants (ACCA), Institute of Certified Accountants (ICA), American Institute of Certified Public Accountants (AICPA), Certified Financial Accountant (CFA), Chartered Institute of Management Accountants (CIMA), Institute of Certified Forensic Examiners (ICFE). The table shows that the respondents are with a sufficient background that enables them to comment on forensic accounting education. A notable point is that only two accountants are Certified Fraud Examiners (CFE). Although having more CFE's to the sample is feasible, but the number is very small because there is lack of knowledge on this issue and forensic accounting is relatively a new area in Bahrain.

|

3.3. Internal Consistency Reliability

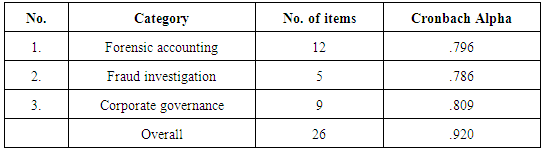

- The question of reliability rises as the function of scales is extended to cover the kingdom of expectations. One of the most popular reliability statistics is Cronbach alpha. It is a tool for assessing the internal consistency (average correlation) of items in a survey instrument. The higher the alpha, the more reliable the test is. There is not a commonly agreed cut-off, but usually 0.7 and above is acceptable (Sekaran, 2003). Thus, Cronbach alpha was used to indicate and improve upon the reliability of variables derived from summated scales. The interrelated (26) proposed topics were distributed among three categories of forensic accounting education namely, forensic accounting, fundamentals of fraud, and legislation, regulation and corporate governance. Table 3 shows that for each of the three groups and overall, it is more than the minimum required (0.7), indicating a high degree of internal consistency about the items.

|

4. Results and Discussion

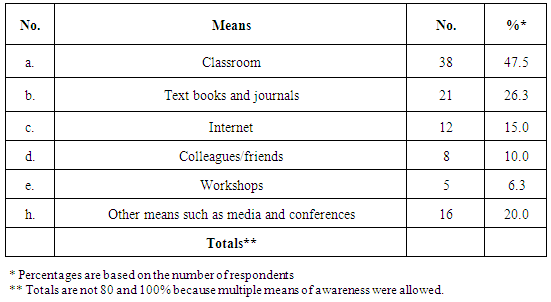

- Respondents were asked to indicate whether they are aware of forensic accounting or not (Table 4). All respondents indicated that they are familiar with forensic accounting because they all have professional qualification and have work experience of three years or more. The main source of awareness is classroom education (38%), particularly studying for professional qualifications in accounting. followed by textbooks and journals (21%) and internet (12%). The least cited sources were colleagues and friends, workshops, conferences and media. One respondent added that he became familiar with forensic accounting through work experience and practice. He stated that "my job is fraud investigator and dispute service provider".

|

4.1. Future Demand on Forensic Accounting

- The failure of internal and external audits to discover accounting scandals has led to an increased demand for forensic accounting to investigate fraud. Stone and Miller (2012) state that employment in forensic accounting appears to be growing and as an evidence of this assertion, the Department of Labour in the US recently added a new and emerging occupation called "Fraud Examiner, Investigator and Analyst". This is in addition to the growth of forensic accounting certification which evidences the expanding opportunities for and increasing professionalism of forensic accounting practice (Huber, 2011 and 2012). An example is the Association of Certified Fraud Examiners 2010 which created the Certified Fraud Examiner (CFE) certification. Growing forensic accounting educational opportunities are also evident in the increasing availability, and success of textbooks and curriculums in forensic accounting methods (Buckhoff and Schrader, 2000). Based on this, respondents were asked to indicate their expectations about the future demand of forensic accounting in general. The majority (81%) expect that it will increase; (6%) stated that it would remain the same and (13%) were not sure. None of the respondents expected a decrease in the demand.

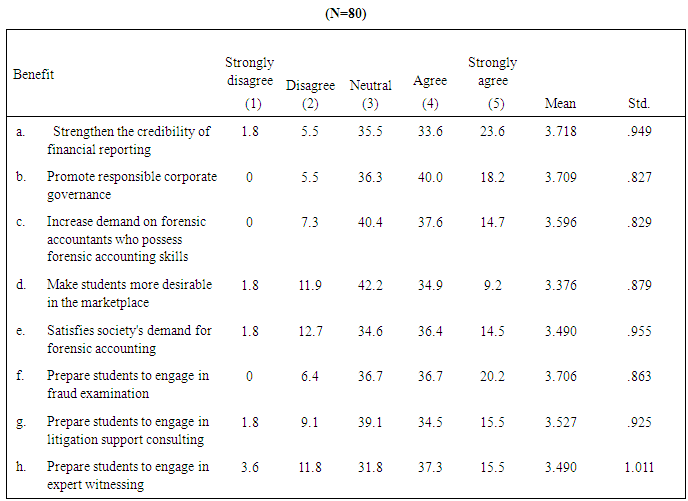

4.2. Benefits of Forensic Accounting Education

- Respondents were asked to indicate their perceptions regarding the benefits of forensic accounting education. Table 5 shows that all benefits are important and received above average (3) rating. The benefits rated the most important were: "strengthen the credibility of financial reporting", "promote responsible corporate governance" and "prepare students to engage in fraud examination" (means are 3.718, 3.709 and 3.706 respectively). This indicates that practitioners associate forensic accounting with fairness of financial reporting and corporate governance more than legal aspects such as preparing students to engage in litigation support and expert witnessing. The benefit rated as least important was "make students more desirable in the market place" (mean=3.376 and Std=.879). The standard deviation for all benefits is low indicating that there is no dispersion in responses and respondents agree on the perceived benefits.Other benefits added by respondents are:"It prevents shortage of skills and lack of expertise"."It widens the accounting field of experts and gives more option for students". "Forensic accounting gives more options to accounting students to expand their knowledge and skills". "The world is in a constant change and a forensic accounting course to exist and taught would be impressive". "Forensic accounting is useful to combat and detect fraud". This added benefit is consistent with Bierstaker et al. (2006) who consider forensic accounting as one of the factors in fraud prevention.

|

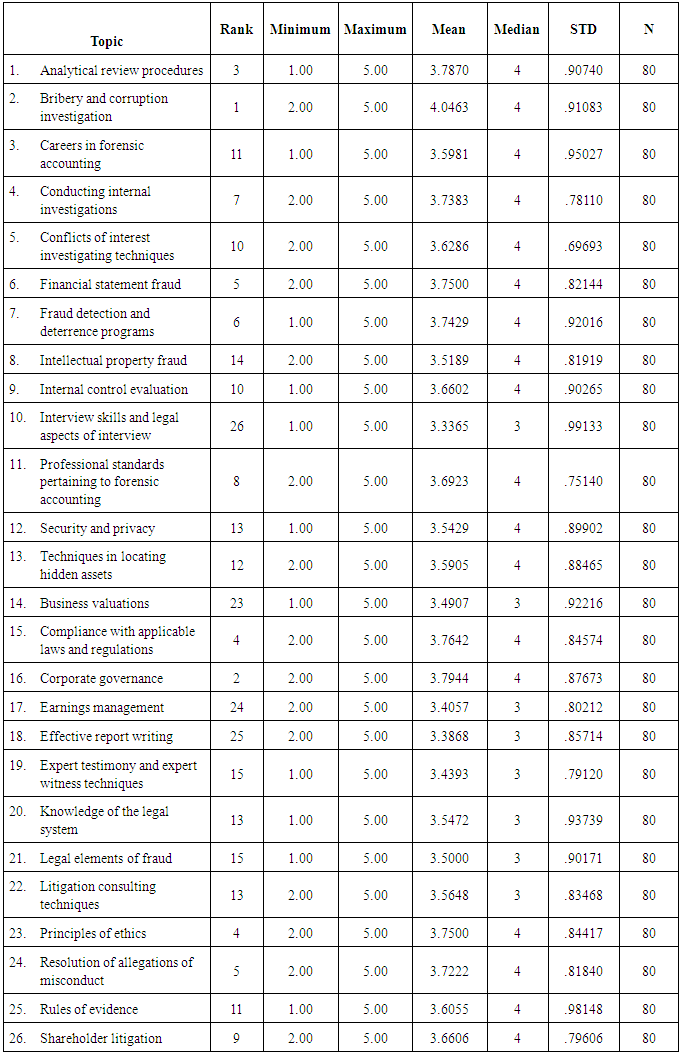

4.3. Proposed Topics in a Forensic Accounting Course

- As was mentioned earlier, a list of 26 topics was selected for the study. Respondents were asked to indicate the degree of importance they attach to each of the proposed topics and were also asked to add any other topics they feel important. Table 6 shows that respondents perceive all topics as important and the topics which received the highest rating were number 1 and 2 respectively: "bribery and corruption investigation" "(mean=4.05 and Std=.91) and "corporate governance" (mean=3.8 and Std=.876). It is interesting to know that bribery and corruption was the second highest frequent economic crime in the Middle east and was ranked first as expected fraud to occur in the next 12 months (PWC, 2011). The perceived importance of corporate governance indicates that governance, compliance with regulations and ethics are effective strategies to restrict fraudulent activities. The topic "analytical review procedures" was ranked as third by respondents (mean=3.78 and Std=.9). Although teaching interviewing skills in forensic accounting curricula is important (Porter and Crumbley, 2012), it is surprising that the topics "interview skills and legal aspects of interview" and "effective report writing" received the lowest ranks. Table 6 also shows that the overall mean for all listed topics is (3.2). This is greater than the average of (3) suggesting a high degree of importance and relevance of covering these topics in a forensic accounting course. Moreover, the standard deviations are low indicating that there is some consensus among the respondents regarding the importance of each topic in forensic accounting education.Other topics added by respondents are: crises management, communication and negotiation skills, IT innovative tools and data management techniques using IT based methods.

|

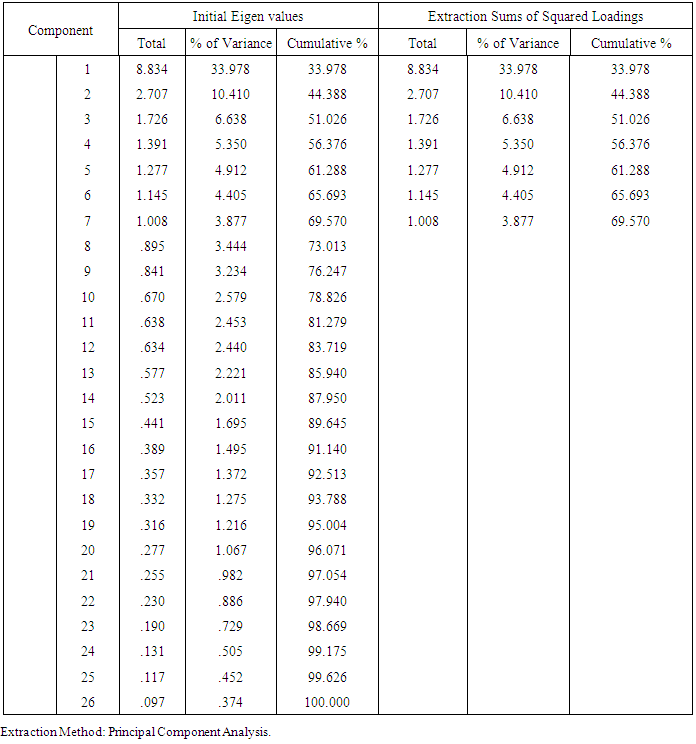

4.4. Factor Analysis

- The primary purpose of factor analysis is data reduction and summarization. Using factor analysis for the proposed twenty six components of a forensic accounting course, the principal component analysis shows that topics can be combined efficiently into seven explaining 70% of the total variance among the inter-correlations of the 26 topics in our analysis of 80 questionnaires. These topics are:

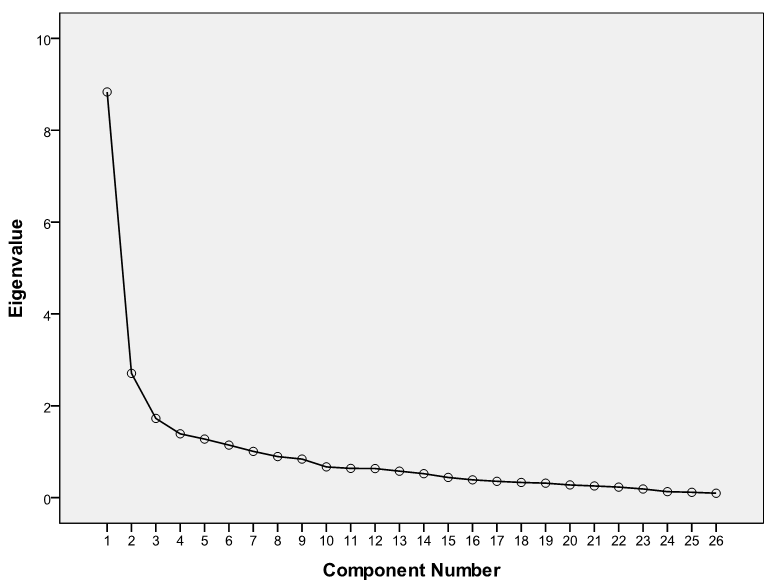

By default SPSSx only extracts Eigen values over (1) which tends to avoid analyzing error variance. This analysis confirms that many dimensions can accommodate respondents' differences in their proposed contents. It should be pointed out that rotating the factors produces a different assessment of the importance of the seven factors from the principal component analysis. This draws attention in particular to the eighth factor from the rotated analysis. How many factors should be retained for analysis? One rule of thumb is to consider only those with Eigen value over 1. Table 7 shows that part of the total variance which is explained by each of the factors is indicated by Eigen values. If we divide this Eigen value for each factor by the number of variables, then we will obtain insight into the part of the total variance that is explained by every factor. For example, the first factor explains 33.978% of the total variance in the 26 variables; the second factor explains the largest possible part of the remaining variance.

By default SPSSx only extracts Eigen values over (1) which tends to avoid analyzing error variance. This analysis confirms that many dimensions can accommodate respondents' differences in their proposed contents. It should be pointed out that rotating the factors produces a different assessment of the importance of the seven factors from the principal component analysis. This draws attention in particular to the eighth factor from the rotated analysis. How many factors should be retained for analysis? One rule of thumb is to consider only those with Eigen value over 1. Table 7 shows that part of the total variance which is explained by each of the factors is indicated by Eigen values. If we divide this Eigen value for each factor by the number of variables, then we will obtain insight into the part of the total variance that is explained by every factor. For example, the first factor explains 33.978% of the total variance in the 26 variables; the second factor explains the largest possible part of the remaining variance.

|

| Figure 1. Scree Plot |

5. Conclusions

- This study reports certified accountants perceptions regarding forensic accounting education. More specifically, it attempts to examine the expected future demand, benefits, and the identification of topics to be included in a forensic accounting course. The results of the study indicate that respondents perceive an increasing demand on forensic accounting in the business environment as a means to restore investors' confidence in financial reporting. They also perceive forensic accounting as beneficial to accounting profession, accounting students and the business community. In addition, respondents perceive that all proposed topics are relevant and important and factor analysis shows the seven most important topics. The results of the study contribute to the literature on forensic accounting by identifying the most relevant topics to be included in a forensic accounting course. They also help in setting the future direction and role of forensic accounting education. As forensic accounting is expected to be one of the best careers in the future, a model curriculum in accounting would be to include forensic accounting as a separate course in the accounting program. The course is taught at the undergraduate level and should include all topics perceived important by the respondents. It should be delivered jointly by both specialized academicians and practitioners. The institute of Certified Fraud Examiners (ACFE) is now a 41000 member-based global association dedicated to providing forensic accounting and antifraud education and training.

5.1. Implications

- This research has a number of implications for academicians, students, the business community, the accounting profession and users of forensic accounting services. The study provides useful information for faculty members and their universities working to implement forensic accounting education in their curriculum. In addition, specialisation in forensic accounting at the graduate level should be encouraged (see Efiong, 2012). This has a high potential to enhance students' skills and competencies which could contribute to fraud examination and detection. The accounting profession and the business community are concerned with financial reporting and accounting scandals. After the accounting scandals early in the twenty first century, many people question why internal accountants and internal and external auditors did not report wrongdoing sooner so that large collapses could have been avoided (Shawver, 2011).

5.2. Limitations

- A limitation of this study is that the proposed contents of the forensic accounting course are limited to (26) topics. Although these topics were based on previous research and content analysis of course syllabi, it is possible that this list of topics does not include all relevant topics that should be covered (see Rezaee et al. 2006). The list excluded some fraud related topics because they are covered in auditing courses and attempted to avoid overlap with other courses. Nevertheless, respondents were asked to add any other topics they feel relevant and important.

5.3. Directions for Future Research

- Research could examine academicians perceptions regarding forensic accounting education. Curriculum design issues would be, who best suited to teach the course? Should it be elective or compulsory? Should it be taught at undergraduate or graduate level (see Rezaee et al. 2006)?. Research is also needed to investigate the extent of growth of forensic accounting services and the growth in demand for such services. It would also be interesting to investigate the provision of forensic accounting services provided by professional organizations such as auditing firms, attorneys, investigators, and security firms. Further research could also examine the relevant skills that a forensic accountant should possess. These could be looked at from the point of view of academicians, practitioners and users of forensic accounting services (see DiGabriele, 2008). Finally, research is needed regarding the costs, benefits, and profits associated with offering forensic accounting services (Watters et al., 2007).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML