-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(1): 71-78

doi:10.5923/j.ijfa.20150401.07

Location Choices of Regional Financial Institutions in the Tohoku Region of Japan

Michiko Miyamoto

Akita Prefectural University, Yurihonjo, Akita, Japan

Correspondence to: Michiko Miyamoto, Akita Prefectural University, Yurihonjo, Akita, Japan.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Under the Financial Services Agency’s action program for the enhancement of relationship banking program, regional financial institutions are being asked to assist small and medium-sized companies in the rehabilitation of their financial positions. Location choices of regional financial institutions are important to support such activities. This paper examines location choices of different types of regional financial institutions in the Tohoku region in 2012. The main conclusion of the empirical analysis is that some financial institutions are mainly revenue driven in certain prefectures, while some focus on both profitability and public nature of the banks.

Keywords: Regional Financial Institutions, Location Choices

Cite this paper: Michiko Miyamoto, Location Choices of Regional Financial Institutions in the Tohoku Region of Japan, International Journal of Finance and Accounting , Vol. 4 No. 1, 2015, pp. 71-78. doi: 10.5923/j.ijfa.20150401.07.

Article Outline

1. Introduction

- The Pacific Ocean side of the Tohoku region in Japan was badly damaged in the earthquake of March 11, 2011. The role of local financial institutions for supporting the reconstructions of the area has been greater than before. The financial institutions have abundant knowhow on corporate management. Each ordinary regional bank is extending loans to tens of thousands of companies and so understand very well the status of corporate management in various industries, sectors and regions. Small- and medium- sized enterprises (SMEs) are the backbone of Japan's economy. According to the Ministry of Economy, Trade & Industry, there are 4.69 million SMEs nationwide and they account for 99.7% of all enterprises and 70% of total employment. As such, the Japanese government went to extraordinary lengths to protect its small businesses from bankruptcy in the face of a deepening economic crisis. One of these measures has been the enactment of the SME Finance Facilitation Act, also known as the Debt Moratorium Law, introduced in December 2009. The legislation obliges financial institutions to alter loans terms at the behest of those borrowing from them, which essentially means that SMEs can defer repayment of their debts. The Act had been in effect for over two years since December 2009 after the Lehman crisis, and expired in March 2012. Teikoku Data Bank (2012) conducted a survey on corporate attitudes towards the expiration of the SME Financial Facilitation Act and relationships with financial institutions. According to the survey, in Tohoku regions, 55 out of 606 companies (9.1%) took an advantage of the Act to modify borrowing terms, whose percentage is higher than national average of 7.5%. That has been said that because of the earthquake and tsunami, as well as Fukushima nuclear disaster hit the areas.According to the Public Opinion Survey on Household Financial Assets and Liabilities on household with more than two people from June 15 to July 24, 2012, the most common way of interacting with a financial institution remains in-person at a branch or an ATM, with 79.9 percent of banked consumers reporting that they had choose the particular bank because its branch or ATM is located in the neighborhood (CCFSI, 2012). This poll has been conducted since 2003, and nearly 80 percent of respondents answered the same way every year. While use of online banking or mobile banking have been increasing, the survey explores that the most common way of interacting with a financial institution remains in-person at a branch. Thus, it is worthwhile to study on location choice of regional banks. By using the data of 2012 after the earthquake, this paper analyzes the branch location choice of financial institutions at the municipal level in the Tohoku region. The rest of the paper is organized as follows. Previous studies that analyzed the behavior of location choice for branches of financial institutions in various prefectures in Japan are described in Section 2. Section 3 will describe the framework of analysis. In sections four and five the data and detail results are described. The results of the analysis of location choice of regional banks in each prefecture of Tohoku are summarized in Section 6.

2. Literature Review

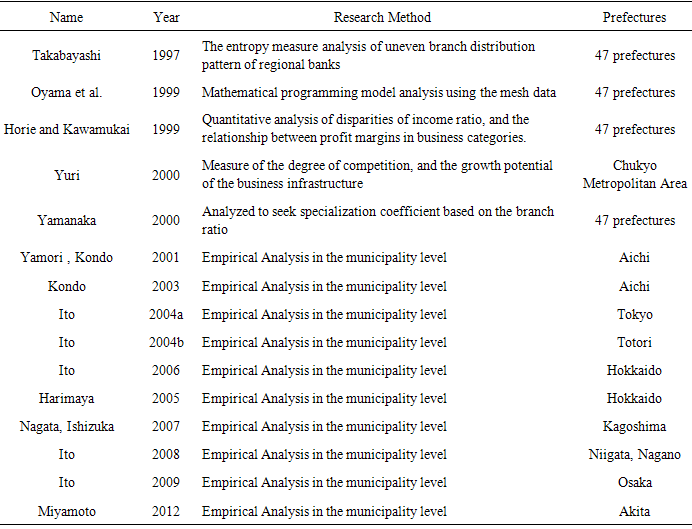

- Avery et al. (1999) examined the trends in branching which based on changes in population, income and business activities. Changes in those factors effects on the demand for services provided by bank offices, eventually determine banks’ branching patterns. Based on Avery et al. (1999), several studies have conducted to measure location choices of financial institutions, such as regional banks, shinkin banks, credit unions, JA (Japan Agricultural) banks, in different areas of Japan (see table 1).

|

3. Analytical Framework

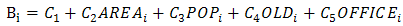

- Avery, et al. (1999), Yamori and Kondo (2001), Ito (2004a, 2004b, 2006, 2008, 2009), and Miyamoto (2012) have been studied the relationship of the regional population, branch placement of financial institutions, as well as location behavior. For comparison with previous studies of other prefectures in Japan, the following equation (1) will be estimated in accordance with the analytical method that has been used in the prior researches. As an economic factor, a number of offices are added to the analysis. As demographic factors, targets area population and the elderly population ratio are used. Geographic areas are added as a regional variable.

| (1) |

is the number of branches of financial institutions in municipal i;

is the number of branches of financial institutions in municipal i;  is measure of geographic area in square kilometer;

is measure of geographic area in square kilometer;  is variable that indicate population;

is variable that indicate population;  is ratio of people older than 65 years old to an entire population; and

is ratio of people older than 65 years old to an entire population; and  is measure of the office numbers in regions.The followings are hypotheses of the analyses. Financial institutions which take a positive and significant in population are considered as having public nature of providing services in a wide range. Elderly ratio has two interpretations; one is an indication of the commercial purpose of financial product sales for the elderly with many financial assets. The other one is as an indicator to support the weak social; i.e., the elderly ratio would indicates possible interpretation to represent their public nature. The larger positive value of the coefficients of elderly ratio would show consideration for the elderly, or their business strategies aiming at asset management held by the elderly are strong. The number of offices is considered as an indicator of the pursuit of profit. Thus, if a coefficient of offices takes a positive and significant, their business strategy could be considered as profit oriented.

is measure of the office numbers in regions.The followings are hypotheses of the analyses. Financial institutions which take a positive and significant in population are considered as having public nature of providing services in a wide range. Elderly ratio has two interpretations; one is an indication of the commercial purpose of financial product sales for the elderly with many financial assets. The other one is as an indicator to support the weak social; i.e., the elderly ratio would indicates possible interpretation to represent their public nature. The larger positive value of the coefficients of elderly ratio would show consideration for the elderly, or their business strategies aiming at asset management held by the elderly are strong. The number of offices is considered as an indicator of the pursuit of profit. Thus, if a coefficient of offices takes a positive and significant, their business strategy could be considered as profit oriented.4. Data

4.1. Branches of Financial Institutions

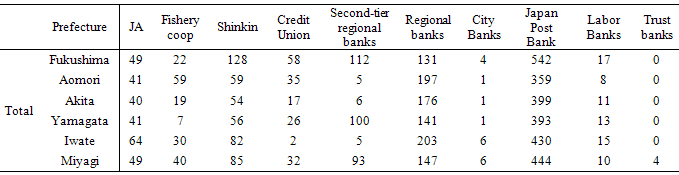

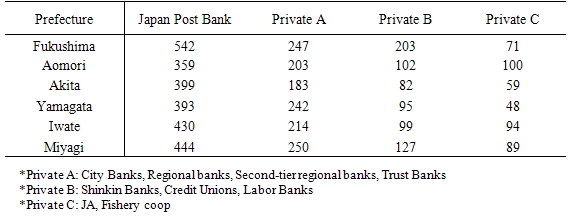

- As for the business category of financial institutions, the 11 business categories are selected, such as Japan post banks, city banks, regional banks, second-tier regional banks, long-term credit banks, trust banks, shinkin banks, credit unions, labor banks, agricultural cooperatives (JA), the fishing cooperatives. Then, private business categories were divided into three groups; city banks, regional banks, second regional banks, long-term credit banks, and trust banks are “private A”; sinkin banks, credit unions, labor banks are “private B”; and agricultural and fishing cooperatives are regarded as “private C”.Number of branches in each business category, with the exception of the part, is based on those of the end of March 2012. Data for city banks, regional banks, second regional banks, long-term credit union, trust banks, shinkin banks, and credit unions are quoted from "2013 edition Japan Finance Directory" (Nihonkin'yutsushinsha). "The Annual Book of prefectural agricultural cooperatives Directory 2013" (Nihon'nogyoshinbun) are used for JA data. With respect to fishery cooperatives, home pages of each Prefectural Fishery Cooperation are referred to. And the latest numbers of branches for the Japan post banks are referred to the search engine in the Japan Post HP for the fiscal year, 2012. The number of groups by financial institutions and the number of business type of each province are listed in Table 2.

|

4.2. Dependent Variables

- Data for geographical areas of fiscal 2012 were referred to "Prefectures, cities, towns, and villages1." Specifically, geographical area in square kilometer are listed by municipalities of each province in Tohoku prefectures (Aomori, 10-city, 22-town, 8-village; Iwate, 13-city, 15-town, 5-village; Miyagi, 13-City, 21-town, one village; Yamagata, 13-city, 19-town, 3-village; Fukushima, 13-city, 31-town, 15-Village; Akita,13-City, 9-town, 3-village).Population and numbers needed to calculate the elderly ratio (the population of 65 years or older to the total population) were referred to population estimates issued by each prefecture. Number of offices was referred to Ministry of Internal Affairs and Communications Statistics Bureau edition of the "Fiscal 2012 Economic Census."

4.3. Descriptive Analyses

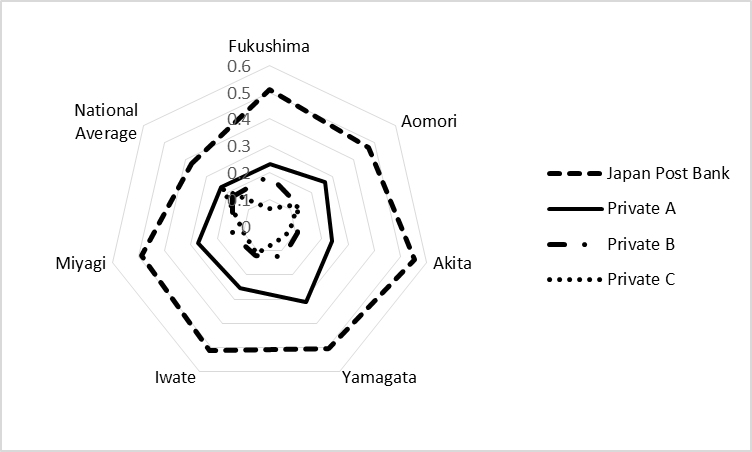

- Ratios of different financial institutions for the nation average, as well as each prefecture in Tohoku, are shown in Figure 1.

| Figure 1. Ratios of Financial Institutions |

5. Results of Location Choice of Financial Institutions Analysis

5.1. Japan Post Banks

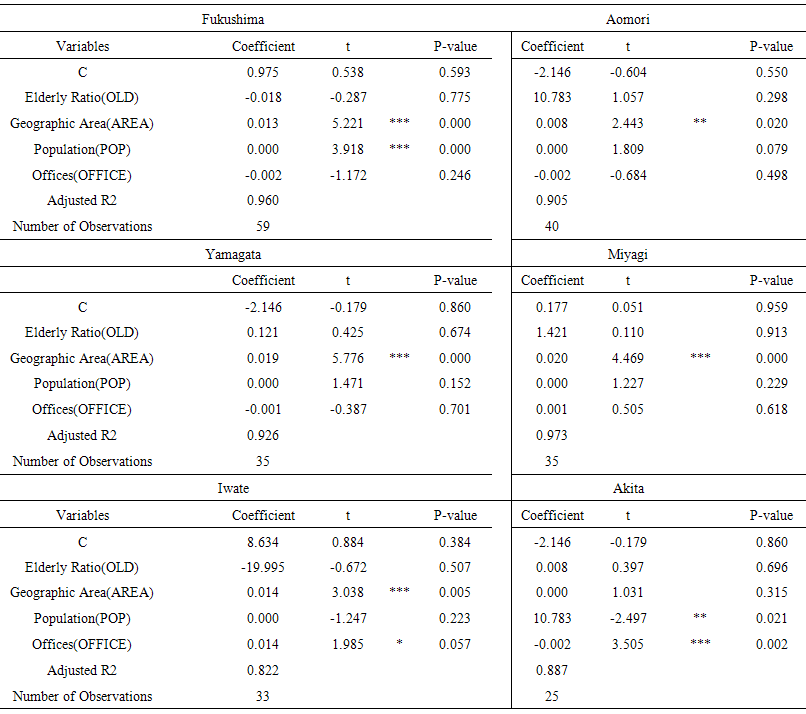

- The areas have taken positive and statistically significant at 1% level except for the Akita Prefecture. With regard to population, Akita is positive and significant at 5%, and Fukushima becomes positive and significant at 1% level.Since every prefecture took positive and significant results, it is suggested that the Japan post banks are located in the Tohoku region by taking into consideration of the principle of ‘providing their service widely and equally’ (see Table 4).

|

| Table 4. Location Choices of Japan Post Banks in Tohoku |

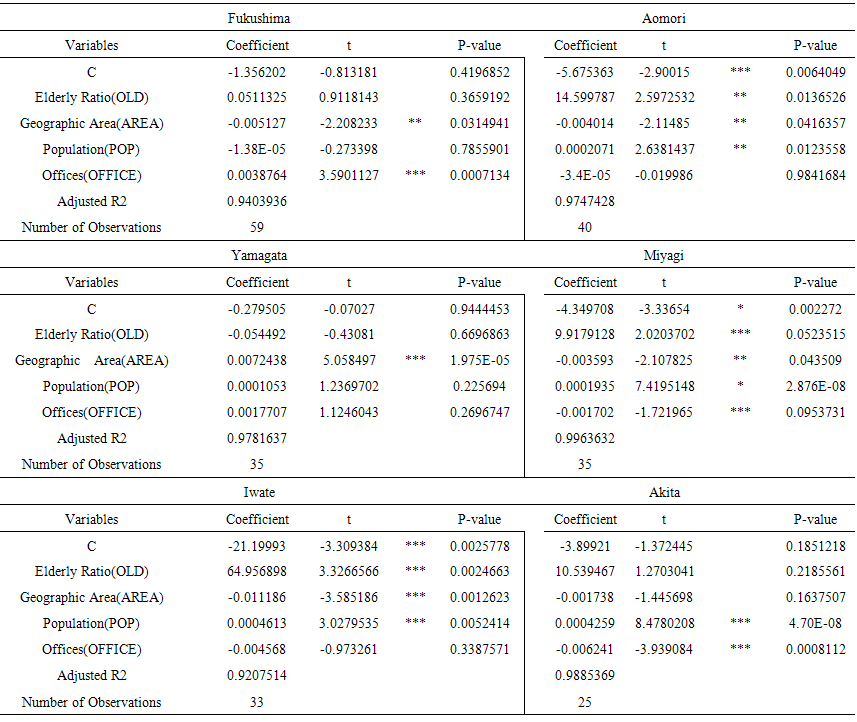

5.2. Private A (city banks, regional banks, second regional banks, long-term credit banks, and trust banks)

- In the case of Fukushima, the area is negative and significant and the offices are positive and significant; they are assumed to have deployed location of branches to serve businesses rather than publicness. In Aomori, the population and the elderly ratio are positive and significant, while the area is negative; they are assumed to be more profit oriented and aimed at assets held by the elderly. In the case of Miyagi, the population and the elderly ratio takes positive and significant coefficient, while the number of offices and the area have taken negative coefficients; the results imply that location choices of financial institutions in Miyagi have been focusing more on the elderly that holds the assets than corporate partners. In Iwate, that population and the elderly ratio are positive and significant, while the area is negative and significant; this is consistent with the Aomori analysis result. In Akita, the number of offices are negative and significant, while the population is positive and significant.The branch development in Akita seems to focus on public nature rather than the pursuit of profit. For Yamagata, the area is positive and significantly; it implies that financial institutions in Yamagata are providing services in a wide range. Overall, the populations and the areas of financial institutions in private A are significant and positive; it seems that those in Tohoku area’s location choices are based on pursuit of profit, but they also have the viewpoint of public nature (see table 5).

| Table 5. Location Choices of Private A in Tohoku |

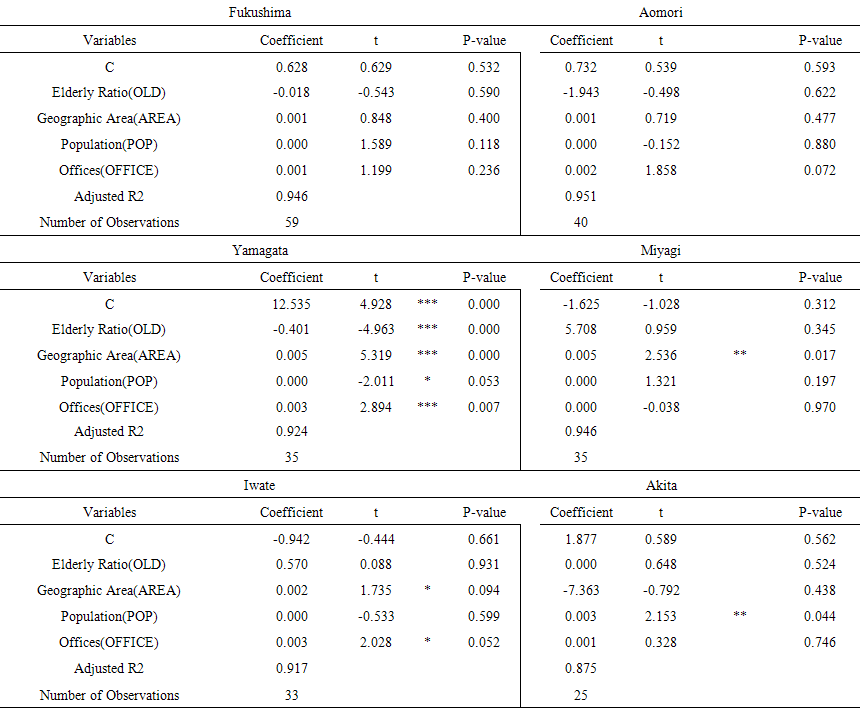

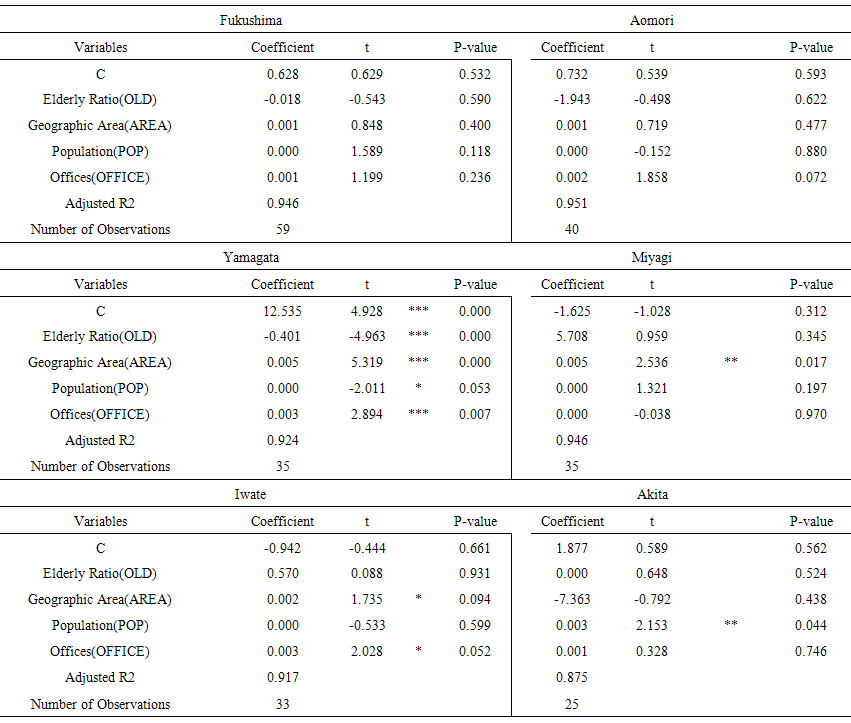

5.3. Private B (Shinkin Banks, Credit Unions, Labor Banks)

- There are no statistically significant results in Aomori and Fukushima. As far as offices concerned, with exception of Miyagi, financial institutions in Tohoku has positive coefficients. It can be considered those in private B are friendly to small and medium-sized enterprises whose are members of unions. The area of Miyagi is positive and significant at the 5% significance, which implies that that of branch development is based on the viewpoint of public nature (see Table 6).

| Table 6. Location Choices of Private B in Tohoku |

5.4. Private C (JA, Fishery coop)

- In Fukushima, the population is positive and significant at the 1% level, while the number of offices is negative and significant at the 1% level. In Yamagata and Aomori, the areas are positive and significant at the 1% and at the 10%, respectively. The results imply that financial institutions in Private C have the public nature in Yamagata, Aomori and Fukushima.

| Table 7. Location Choices of Private C in Tohoku |

6. Conclusions

- The results of location choices of regional financial institutions analysis in Tohoku region show the "providing their service widely and equally" nature of the Japan post banks have become clear. On the other side, those of private B and private A are more profit oriented, however, that some institutions combines the public nature and the pursuit of profit in different prefectures are confirmed. In the case of private C, they seem to have deployed the service from the public nature as the same as Japan post banks. The analysis obtained in this paper are consistent with those of Yamori (2003), Kondo (2003) and, Ito (2004a, 2004b)

Note

- 1. http://uub.jp/ accessed on October 3, 2014.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML