-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(1): 60-70

doi:10.5923/j.ijfa.20150401.06

International Financial Reporting Standards and Moral Hazard of Creative Accounting on Hedging

Firas Aziz M. Jawad1, 2, Xinping Xia1

1School of Management, Huazhong University of Science and Technology, Wuhan, China

2College of Administration of Economics, University of Mosul, Mosul, Iraq

Correspondence to: Firas Aziz M. Jawad, School of Management, Huazhong University of Science and Technology, Wuhan, China.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This research takes a closer look at moral hazard of creative accounting was the root of the global financial crisis that has shaken trust in the market economies and its institutions to the core. In addition in order to brief the role of practices and objectives of creative accounting and their contexts. Although the adoption and implementation of international financial reporting standards (IFRS) are receiving the serious attention in many countries. The role of accounting standards according to the moral hazard of the creative accounting is the objective of the IFRS Foundation. That “to develop, in the public interest, a single set of high quality, understandable, enforceable, and internationally accepted financial reporting standards based upon clearly articulated principles.

Keywords: Creative Accounting, Moral Hazard, IFRS, Hedging, Financial Reporting

Cite this paper: Firas Aziz M. Jawad, Xinping Xia, International Financial Reporting Standards and Moral Hazard of Creative Accounting on Hedging, International Journal of Finance and Accounting , Vol. 4 No. 1, 2015, pp. 60-70. doi: 10.5923/j.ijfa.20150401.06.

Article Outline

1. Introduction and Theoretical Background

- Innovation refers to renewing, improving or creating more efficient processes, products or ways of doing things. Everyone can innovate. Innovation is the thing that lies behind the stillness. The conventional understanding of innovation, as defined in the Oslo-Manual of the [1] (see also [2]) distinguishes mainly between process, product and organizational innovation [3]:• Organizational innovations include new forms of management, e.g. total quality management and just-in-time. • Product innovations require improvements to existing goods/services or the development of new goods. Product innovations in machinery in one firm are often process innovations in another firm.• Process innovations occur when a given amount of output (goods, services) can be producing with less input.Successful innovation should be an inbuilt part of the function strategy and the strategic vision, where create an environment and lead to innovative thinking and creative problem-solving. Also, we should remember, innovation is the key to competitive advantage for the function.The concept of "innovation" means not only that produces new product (the product innovation) and that implements new technology for producing the product (the process innovation). However, also means the wide meaning including the reclamation of the new market, raw material, and acquisition of new supply source of semi-finished goods and a new organization. Especially, product innovation and process innovation. The role of the university, enterprise and government is big in order to promote the innovation as a whole country [4].What’s Innovation? Innovation may be defining as exploiting new ideas leading to the discovery of a new product, process or service. It is not just the development of new the concept that is important, but it is “bringing it to market.” Putting into practice and utilizing it in a manner that leads to new products, services or systems that add value or enhance the quality. Innovation also means exploiting new technology and employing out-of-the-box thinking to generate new value and to bring about significant changes in society [5].As for creativity is an aspect of mental processes, rather than a product [6, 7]. The creativity refers to the use of skill and imagination to produce something new or a work of art. The creative manner is one of the biggest mysteries of the human minds. Scientists and psychologists have been using different means to reach the essence of the problem. Creativity is nascent brainstorming, and brainstorming opportunity for those who wish to obtain, to turn it into a creative process, because it is there no creativity without the strain.

2. Research Importance

- The research importance comes from the Influences of moral hazard and its dimensions by practitioners of the accounting profession in techniques practices of the creative accounting, and including has several classifications, to achieve the hedging goals, and to serve the other purposes of the firms’ administrations under the guise of the hedging cover.International accounting standards and financial reporting issued for the purpose of reducing the creative accounting practices exercised by the practitioners of the accounting profession in the firms. In order to maximize profits and managers wealth, and minimize the cost of capital and executive costs.Therefore, those who pay researchers to study the motives of firms in the practice of creative accounting methods and innovate a new approaches and techniques for several classifications.

3. Research Methodology

- The importance of theoretical research is underlined by [8] who affirmed that: “empirical research is (or should be) informed by theory as an interpretation of empirical analysis is impossible without theoretical guidance.” Accounting research literature on international accounting & financial reporting standards and creative accounting by considering studies that develop a theoretical approach. The paper uses literature review methodology in order to develop a critical and evaluative account of what has been publishing.

4. Creative Accounting

4.1. The Creativity Term in Accounting

- Given the fact that the term of creativity of accounting ancient and modern concurrently, it is the term ancient due to the existence of the Anglo-Saxon accounting. The new term is given to developments in the field of accounting that led to the emergence of international accounting standards. That are creative accounting is continuing to grow and evolve over time, and then the emergence of international financial reporting standards. The international accounting and financial reporting standards is a guide to improving the presentation and measurement and disclosure of financial and accounting information of the institution and called creative accounting.The significance of the study comes from showing the creativity of accounting as an attribute that will prepare creative accountant can achieve. The creativity of accounting within the following areas; use of the methods, techniques procedures, concepts, standards and theories unfamiliar to interpret, analyze and solve various accounting problems. Thus, prompting the International Accounting Standards Committee (hereafter IASC), to introduce amendments and changes to accounting standards and interpretations. Then change to international financial reporting standards, in order to reduce the accountants and firms are using loopholes in the paragraphs of international accounting standards and interpretations. This “in itself” is a purely accounting innovation by the International Federation of Accountants (hereafter IFAC) and its committees, reflected in the issuance of international accounting standards and its interpretations. In addition, over time through the application of these standards would be the amendment, cancelation and change some paragraphs and standards.

4.2. The Concept of Creative Accounting

- The concept of creative accounting has British roots, as well it represents the object of long lectures within Anglo-Saxon system [9] Literature in 1970s by [10-12] That resembles the basis of the theory of positive accounting. This term complemented by several concepts, the most common being “imaginative accounting” and “accounting of intent”, regarding the existence of this concept. Creative accounting refers to earnings management, earning smoothing, financial engineering, income smoothing and cosmetic accounting.The concept of creative accounting is usually used to describe the process through which the accounting specialists use their knowledge in order to manipulate the figures included in the annual accounts. Accounting has been described as art: “The art of faking a balance“ [13], “The art of calculating its profits“ [14], “The art of presenting a balance sheet” [15], “The art of saving money aside” [16], while [17] says “doesn’t hesitate to describe accounting flexible art.” In additional, accounting has become "strategic" because, to ennoble this technique, some articles introduce a policy link or strategy. Thus, the world has seen a flowering of training seminars in the strategy, policy or optimization accounting [18] Finally, accounting has described “strategic accounting” and in the recent years, describes “forensic accounting”. Forensic accounting, as a result, is an option of a professional career for future accountants [19] According to Smart Money magazine, forensic accounting is one of “the top 10 next hot jobs” [20, 21]. In one word, we say: the creative accounting is a combination of the other mechanisms. Considering the numerous publications, it appears essential to reflect aimed to define the concept of "creative accounting" based on many techniques. In addition, many researchers have tried, to establish a definition of the term of creative accounting. In addition, because of the different orientations of these researchers, have appeared many definitions of the term, those definitions were built each depending on the point of view who put it.We can present an academic’s view, offers a definition of creative accounting that is the transformation of financial accounting numbers from what they actually are to what preparers desire. By taking advantage of the present rules and/or neglecting some or all of them [22]. Two features are common to many writers [23]: a. They perceive the incidence of creative accounting to be common, b. They see

4.3. Creative Accounting Practices

- All steps used to play the financial numbers game, including the aggressive choice and application of accounting principles, both within and beyond the boundaries of generally accept accounting principles, and fraudulent financial reporting. Also included are steps taken toward earnings management and income smoothing [24] This is the motivation to resort to the use of creative accounting by firms. [25] observes that “creative accounting” can be equated with “disclosure management,” “in the sense of an aimed intervention in the financial reporting process.”The remainder of this paper is organized as follows: some research methodology features are discussed, the main part of the paper deals with analyzing theoretical studies in the area of creative accounting, and development the international accounting and financial reporting standards. In order to synthesize pros and cons being documented through accounting research literature, and eventually this study conclude upon the developed analysis by, also formulating some future developments that might complement this study.As implicit methodology adopted, it was the inductive methodology that sustained the main idea of the fact that general conclusions regarding the development of a subject are drawn based on a sample of the literature. The main scope was to build an internal history of the literature; we were further interested to include in our research an adequate methodology. So the purpose of such an analysis in the area of the literature review studies are summarized, synthesized, and analyzed the arguments of studies being analyzed. Besides generating a summary of sources in the nearest area, the employed research methodology imposes a certain organizational pattern that combines both summarize and synthesize. More precisely, our analysis of each considered study covered the following aspects: question formation, identification of the relevance, evaluation of quality, evidence summarization and interpretation of conclusions.

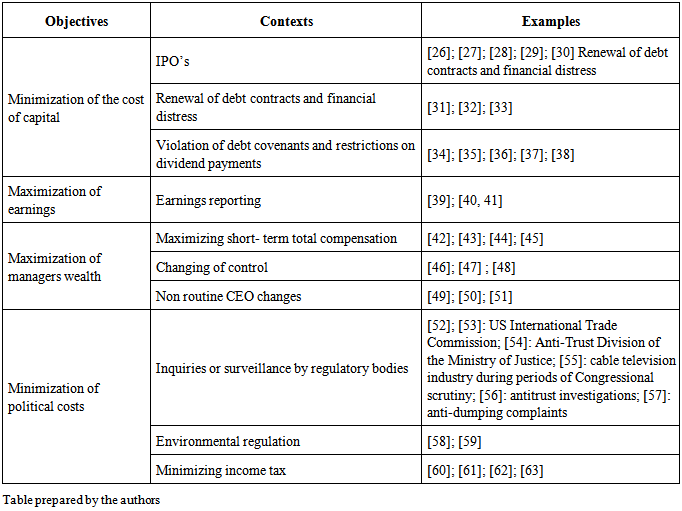

4.4. Objectives of Creative Accounting and Their Contexts

- The firms’ motivations to practice the creative accounting are to manage the financial risks through the approach of hedging at present and future, to achieve the vital purposes axial objectives that are; minimization of the cost capital, maximization of earning, maximization of managers wealth and minimization of executive costs.

4.5. Techniques and Classification of Creative Accounting

- Creative accounting is characterizing by several properties, which in turn shows the properties that characterize the creative accountant: the ability to analyze and assembly, imagination, and intuition. In addition, the enjoyment with the courage and self-confidence and self-criticism. The accountant is the creator who can develop the same in terms of criticism and civility, evaluate ideas and information, and analysis techniques, which it uses. Creative accounting has many areas: accounting information system, accounting measurement, methods of distribution and allocation of various expenses, various techniques. To display and presentation financial and accounting statements and reports (creative disclosure) and financial analysis techniques, as well as, the development of technical accounting softwares.

|

4.6. Classifications of Techniques of Creative Accounting

- The creative accounting is that developments in the field of accounting in terms of communication, measurement, presentation and accounting disclosure in the consolidated financial reports, which were prescribed by the International Accounting Standards Board standards of their own. Hence, there are many creative accounting techniques, which are classified according to several considerations and in several varieties. According to the angle that is seeing, and these categories are [65-67]:a) Classification François Bonnet 1995:- Income statement and accounting principles: according to internal and external use, the use of finance leases, production assessment, inventory provisions.- Income statement and accounting policies: it has to do with accounting changes result from the profit and loss.- Income statement and management decisions: by improving income.- Activities on a balance sheet: capitals, permanent debt and working capital needs in addition to off-balance sheet activities.b) Classification d’Hervé Stolowy:- Techniques have an impact on the determinants of income.- Techniques have an impact on the presentation of income accounts.- Techniques have an impact on the presentation of the balance sheet.c) The Other Classifications:And others are classified creative accounting techniques to the opportunity of creative accounting may be present in six principal areas: (a) regulatory flexibility, (b) lack of regulation, (c) managerial judgment of assumptions about the future, (d) the timing of some transactions, (e) the use of artificial transactions, (f) and also the reclassification and presentation of financial numbers [68]In this paper, we will consider that creative accounting includes a transformation of fiscal accounts using accounting options, estimates, and other methods allowed by accounting rules.

5. International Accounting and Financial Reporting Standards

- This study deals with the impacts of innovation and creativity of the international accounting standards, which have developed in the seventies of the last century. The inevitable result of the events and developments in the area accounting at the time of the establishment of unions, associations, councils, accounting for the issuance of accounting standards, whether international, regional or local.International Accounting Standards (hereafter IAS) issued by the International Accounting Standards Board (hereafter IASB), IAS aims primarily to provide accounting standards are high quality and easy to understand. As well as, enforcement for all countries wishing to apply. So as to make all disclosures, recognition, and measurement uniform in all countries within the framework is applicable and comparable. These standards began to emerge during the years of the seventies during which he founded the IASC in 1972. From nine countries to the subject of this committee to restructure to become the IASB were applied in most countries in 2001.

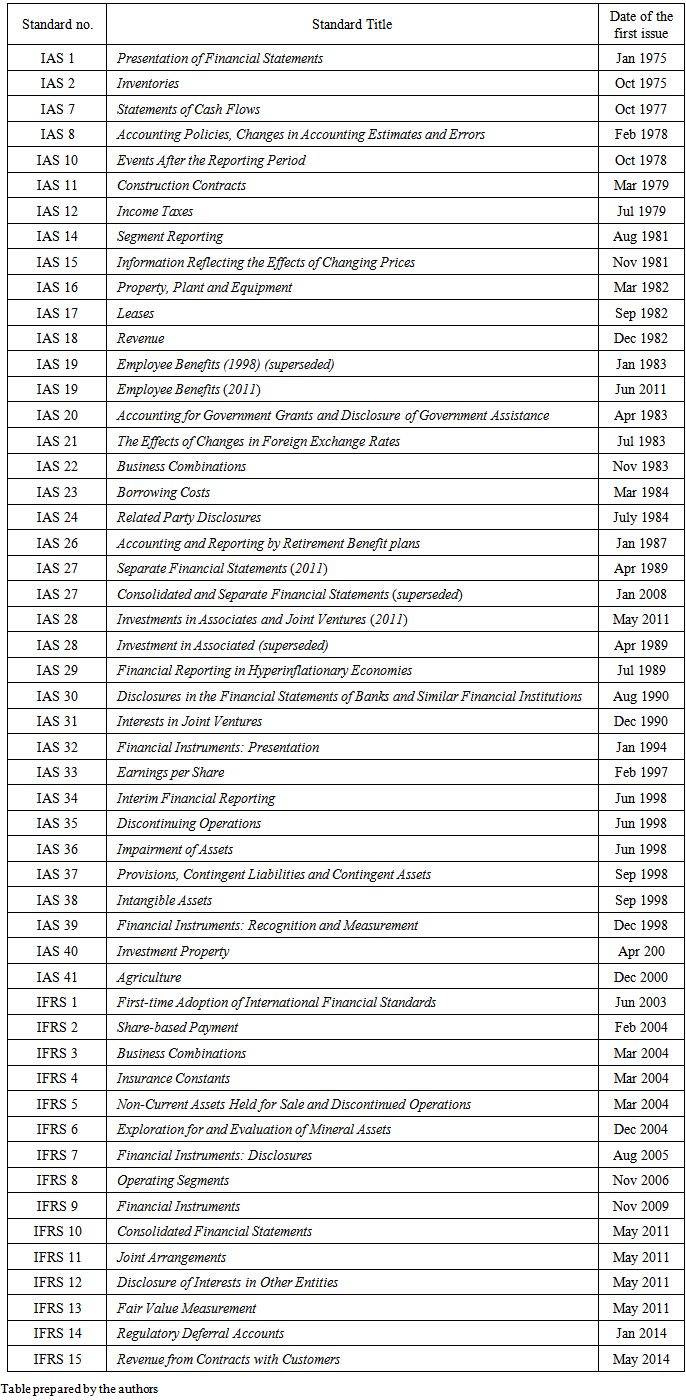

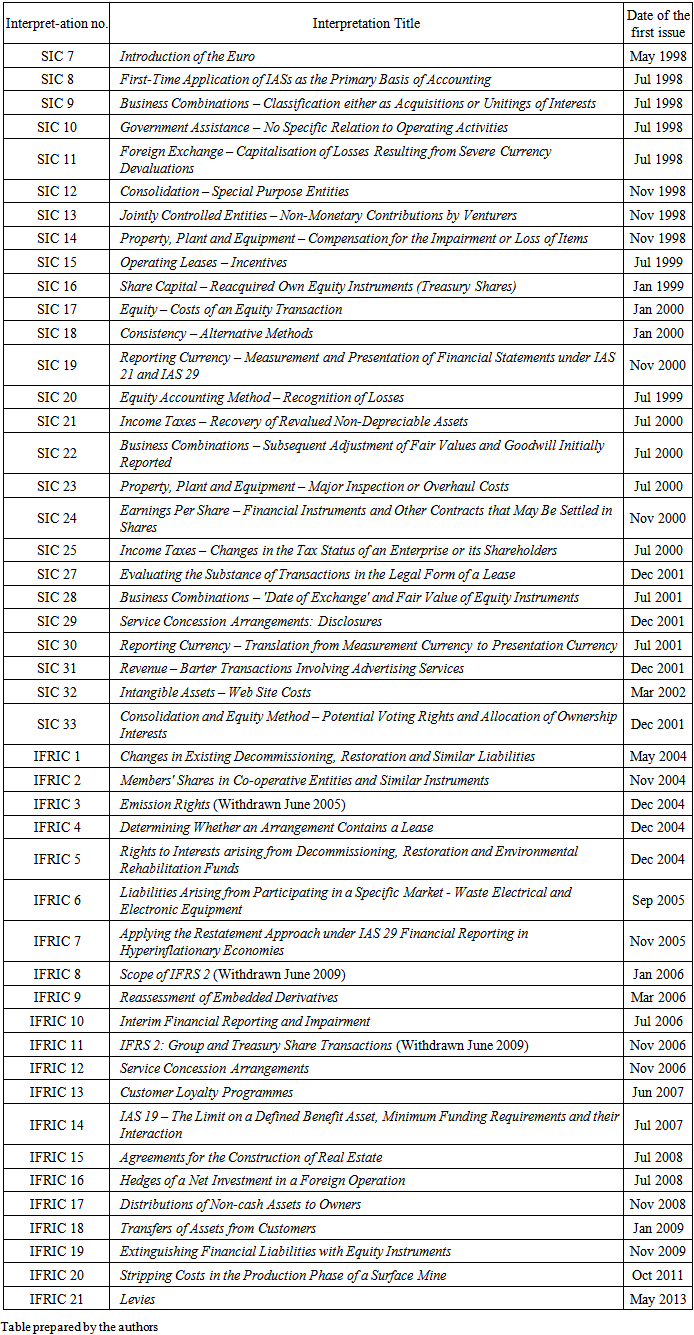

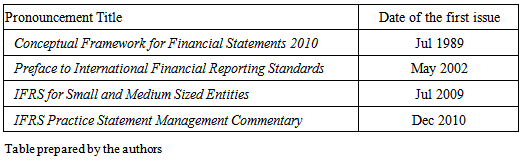

5.1. Chronology of IAS

- The development phases of IASs passed in five periods, as follows:1) The establishment period: period lasted from 1973 until 1989 during which has issued basic accounting standards is necessary, including such topics as the inventories and the accounting policies, financial disclosure, and others.At this period, the standards involved in several alternatives in the application, nor was there a committee to interpretation and for this reason did not have a mechanism to monitor compliance.2) Development period: It continued this phase from 1989 to 1995, and the project was implementing development and comparability, which represents the modification ten accounting standards. In order acceptance of the global body overseeing the financial markets, in an amendment has resulted to reduce the alternatives in the application.3) Basic standards comprehensive period: Having concluded this period in 1999, at which point it was agreeing with the world body supervising the financial markets on a number of comprehensive standards to be issuing. The view to their adoption and acceptance of the purposes of the requirements of financial markets on a global level. Also, falls under these criteria universal basic standards about financial instruments, income tax, real estate investments, impairment of assets and other agricultural accounting.It was at this phase to establish the council for the interpretation of international standards.4) Restructuring period: Having concluded this phase in 2001, was a review of the infrastructure of the IASC. In order to strengthen and promote the level of achievement in, and became a representation on boards and committees depends on the competence and experience. As well as, not on the basis of geographical representation as was practiced previously, and became members of the councils and committees are working full-time, and not a partial job.An included restructuring process during this period includes:- Restructuring the infrastructure, including the board of directors and the board of trustees.- The formation of an advisory council to the standards.- Registration committee as a non-profit in Delaware in America. Registration and Standards Board in London.- A new constitution.Additionally, characterized this period, with the consent of the world body supervising the financial markets in 2000 to accept financial statements prepared in accordance with international accounting standards. As within of the conditions relating to displaying them as additional information shows the following:- Settlement shows the extent of their impact.- Additional disclosure.- Explain the differences.During this time, the name of the IASC was changed to the IASB.5) Financial reporting standards time: This phase started in 2002 and is nearing completion in 2005.In this time, the names of “international accounting standards” were changed to “international standards for financial reporting”, but international accounting standards will remain in effect until amendment or withdrawal from use.These standards began to emerge during the years of the seventies, founded during the IASC in 1972 from nine countries. Later, this committee was subject to restructuring to become the IASB in 2001. The Standards became applied in most countries. Also, the table below displays the standards issued them in chronological order of the date of the first issue [69].In appendix, table (1) displays the appearance and development of international accounting standards in chronological order until the end of the year 2012.In addition to these standards, the Commission interpretations of the International Accounting Standards Committee interpretation ambiguity and confusion over the application of the criteria as mentioned above and pro table shows us interpretations' chronological evolution.In appendix, table (2) displays the appearance and development of international accounting standards interpretations in chronological order until the end of the year 2012.In addition to these standards and interpretations, there are other pronouncements issued by IASC & IASB and pro table shows us pronouncements' chronological evolution.In appendix, table (3) displays the appearance the other pronouncements in chronological order until the end of the year 2012.

5.2. Components of the International Financial Reporting Standards

- Study of international accounting and financial reporting standards, we note that the accounting standard often contains:- Introduction.- Objective.- Scope.- Context- General points to note.- APPENDICESA. Defined termsB. Application guidanceC. Effective date and transitionD. Amendments to other IFRSs

5.3. Financial Reporting

- According to [70], the relevance of the financial statement must be measured by reporting to the:- Association between the market and the estimated profits.- Contribution of the administration function.- Reduction of the agency’s costs.- Streamline of the management.- Supply of the information to the stakeholders.

6. Discussion

- The role of accounting standards according to the moral hazard of the creative accounting is the objective of the IFRS Foundation that “to develop, according of the public interest, a single set of high quality, understandable, enforceable and internationally accepted financial reporting standards based upon clearly articulated principles. These standards should require transparent, high quality, also comparable information in fiscal reports and other financial reporting to help investors, other participants in financial transactions in the world. Additionally, other users of financial information make financial decisions.”Recently, there is a similar battle with leasing. The vast majority of lease contracts are not recorded on the balance sheet, even though they usually contain a heavy element of financing. For many firms, such as airlines and retail chains, the off-balance sheet financing numbers can be quite substantial. Throughout the financial crisis, it became apparent that the incurred loss pattern could be using for another type of earnings management. The pattern provides legitimacy for postponing the recognition of losses when they had all, but, become inevitable. Our new expected loss pattern should put an end to this practice while it still contains sufficient safeguards against earnings management.As a result, these are what was producing by the International Federation of Accountants issuing international accounting standards that are considered the product/service. Up to a labor market accountants (offices) and put into application and implementation. As well as, exploited through the use of international standards as that leads to new products represented by the accounting principles, concepts, methods, and policies. Also, a general framework for financial reporting of high quality, and services, accounting systems and financial reporting that add value and improve the quality of reporting.Innovation means using accounting techniques of international accounting standards and employs from outside the accounting thinking box with the accountants. For generate new accounting value and create significant changes in financial reporting, which leads to raising the value of the firm, and meet the obligations, and needs of the relevant beneficiary parties.So members of the international accounting standards board are innovators, they play a significant role in the change processes of accounting. Even though they often are far from leadership positions and business management in firms, but they, nevertheless, have the right skills that pay others to be aware of the new idea. The innovation policy pursued by the International Financial Accounting and Reporting Standards Committee/Board and the Reporting helps to cut the costs of technological, institutional, social and individual innovation, especially in the phases of innovation. In the sense the phases of issuing international standards, and diffusion phase, which may help to improve the characteristics of these accounting standards.In the light of the increasingly global trend of IFRS, some developing economies have been quick to adopt IFRS as theirs national version of GAAP.The adoption benefits of IFRS are; IFRS improves the level of comparability between the accounts of firms across different countries. The stringent disclosure provisions improve the visibility of liabilities such as future pension costs and employee stock schemes. IFRS can afford greater reassurance for investors, credit rating agencies and lenders, probably giving firms path to lower cost capital in line with the lower risk.The adoption obstacles of IFRS are; the adoption of IFRS can bring significant additional short-term costs to businesses, such as fees to pay experts external accountants, and as modifications to comply with IFRS can make year-on-year performance comparisons tough for investment analysts. Potentially creating uncertainty and stock price volatility. The firms must also devote resources to the preparation of accounts using the legacy conventions.Finally, the mission of the IASB is to make trust in financial markets. With disseminate of IFRS around the world, IFRS come a long way in fulfilling this mission. Some vital significant jurisdictions still have not adopted or completely adopted IFRS.

Appendix

|

|

|

Note

- 1. Financial numbers game: The use of creative accounting practices to alert a financial statement reader’s impression of firm’s business performance.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML