-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(1): 8-20

doi:10.5923/j.ijfa.20150401.02

Effects of the Convergence to International Financial Reporting Standards in Earnings Management

Ilse Maria Beuren 1, Roberto Carlos Klann 2

1Post-Graduate Accounting Program, Universidade Federal do Paraná, Curitiba, Brazil

2Post-Graduate Accounting Program, Universidade Regional de Blumenau, Blumenau, Brazil

Correspondence to: Ilse Maria Beuren , Post-Graduate Accounting Program, Universidade Federal do Paraná, Curitiba, Brazil.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The mandatory adoption of International Financial Reporting Standards (IFRS) in the consolidated financial statements of companies located in the European Union, since 2005, had the objective of improving the quality of the accounting information. This goal of this study is to identify European countries of the sample in which the adoption of IFRS represented greater change in the earnings management levels disclosed by companies. The documentary research was based on Thomson Financial data base, from which were collected the data covering the period from 2000 to 2003 (before the IFRS adoption) and from 2006 to 2009 (after the IFRS adoption), to calculate the frequency distribution of small profits over small losses, as an indicator of earnings management. The research results indicate the existence of three groups of countries: those positively affected by the adoption of IFRS, with a reduction in the level of earnings management; those negatively affected, with increased management; and those which that did not present significant effects or they could not be detected. It was concluded that, despite the higher quality expected with the adoption of the IASB accounting standards, in some countries the effect of IFRS application is not consistent with this expectation in the period analyzed.

Keywords: IFRS, Earnings management, Small profits, Small losses

Cite this paper: Ilse Maria Beuren , Roberto Carlos Klann , Effects of the Convergence to International Financial Reporting Standards in Earnings Management, International Journal of Finance and Accounting , Vol. 4 No. 1, 2015, pp. 8-20. doi: 10.5923/j.ijfa.20150401.02.

Article Outline

1. Introduction

- The development of global capital markets and trade has contributed to the increased need for greater comparability and transparency of accounting information. In this scenario, the global accounting convergence process to the International Accounting Standards Board (IASB) has been significantly developed in recent years.The European Union enforcement to the public companies located in their scope area to publish consolidated financial statements based on IFRS from 2005 can be considered as an important step in this process. Over 100 countries have adopted or are in total or partial adoption process of the accounting standards established by IASB. It is worth to mention that Brazil, where the requirement for public companies and financial institutions is to adopt the International Financial Reporting Standards (IFRS) from 2010 on, is also in adoption process.However, the results of these studies do not point to a single direction. Some studies indicate that the adoption of IFRS may increase the earnings management levels in certain countries, depending on characteristics such as the rigidity degree of local regulations, the country's legal system and the accounting education level, among others. In general, greater IASB standards flexibility, based on principles, would give greater discretionary power to the accounting information preparer in certain countries. On the other hand, some studies have highlighted the reduction in the earnings management levels with the adoption of IFRS, once the IASB standards have a higher quality compared to the set of local rules of several countries, dealing with various situations not covered by the local regulations. Moreover, the principles of IFRS recognition and disclosure would be closer to the economic transactions reality, regarding the accounting standards of certain countries.The determination of earnings management existence, according to Mohanram (2003), can occur through qualitative and quantitative models. According to Martinez (2001), quantitative models are more frequently used and are based on three basic methodologies: frequency distribution; analysis of specific accruals; and analysis of aggregate or total accruals.In the methodology of frequency distribution analyzes the behavior of the accounting result with some reference point is analyzed. One of the positive aspects for its application is that the accruals do not need to be estimated. In turn, the focus of the specific accruals analysis is to evaluate the behavior of certain segments of businesses or specific ledger accounts. In the methodology of aggregate or total accruals, the target of the analysis is to estimate the discretionary component of the accruals.Given the above, the following research question was made up: What is the impact of the IFRS adoption in the earnings management levels of European companies, taking in consideration the positive results of frequency distribution compared to the negative results for the period analyzed? Thus, the goal of the study is to identify in which European countries of the sample the adoption of IFRS represented greater changes in the earnings management levels disclosed by companies.The main contribution of the study is to demonstrate through empirical evidence that the regularity in the frequency distribution of financial results, for example, a small number of companies disclosing small losses and a large number of small firms disclosing small profits, characterized as earnings management, as proposed by Burgstahler and Dichev (1997). This involves checking whether the observations of results below the parameter (previous year results or nil results) are very different from the observations above that parameter (Trapp, 2009).The research is justified by the importance of investigating changes in the quality of the financial information of the companies, specifically European companies, since the IFRS adoption in 2005, in the earnings management perspective. It is important to analyze whether a greater IASB standards flexibility, based on principles, allowing greater discretion power to the preparer of the financial information, leads to earnings management changes. To analyze the impact, the periods from 2000 to 2003 (before the adoption IFRS) and 2006 to 2009 (after the adoption of IFRS) were considered.The contribution of this study consists in showing that the convergence process to IASB accounting standards does not necessarily represent improvement in the quality of the accounting information, particularly regarding the reduction in levels of earnings management. This finding may lead to the identification of similar contextual characteristics among the surveyed European countries, which may relate to this effect. Thus, new studies, with a qualitative approach, can be carried out on those specific countries in order to confirm the influence of environmental characteristics on the levels of earnings management from the adoption of IASB standards.

2. Theoretical References

2.1. Definition of Earnings Management

- The term earnings management has as main definitions the ones presented by Schipper (1989) and Healy and Wahlen (1999). According to Schipper (1989, p. 92), earnings management is a "purposeful intervention in the external disclosure process, having the intention of obtaining some private gain”. With this definition the author limits the discussion on external reporting management, not addressing the question of managerial earnings management.Baptista (2008) warns that in Schipper’s definition of management can occur, in any part of the external disclosure and may be practiced through the use of accruals (or accumulations derived from the accrual system), changes in the accounting method, among others. Paul (2007) points out that studies on accounting manipulations have analyzed management through the use of aggregate accruals, specific accruals and frequency distribution analysis (histogram analysis).Healy and Wahlen (1999, p. 368) understand that the earnings management occurs when managers use "judgment on the financial information and on operational activities to change the financial information, or deceive investors about the economic performance of the company, or to influence contractual outcomes that depend on the accounting numbers disclosed”.By analyzing the definitions of Schipper (1989) and Healy and Wahlen (1999), Martinez (2001) infers that the earnings management can be characterized as an intentional change of accounting results of a company in order to achieve some particular goals.Cardoso (2005) considers Healy and Wahlen’s (1999) definition of earnings management as the best up to date. Commenting on its key points, he states that accounting information management occurs to the extent that managers use discretionary criteria to amend the financial statements and mislead some users of such information about the actual economic performance of an organization or to influence contractual outcomes that depend on the numbers disclosed. The author also emphasizes that the discretionary judgment is not limited to the choice of accounting practices, but may also include operational activity manipulation.The earnings management, according to Gould (2007), can be understood as an interference of the financial statements preparer’s specific interests in the content or form of the information disclosed. It is noteworthy that earnings management is not the same as fraud. Dechow and Skinner (2000) differentiated fraudulent choices and aggressive but acceptable choices. Earnings management, according to the authors, is practiced in accordance with accounting principles.

2.2. Arrangements for Earnings Management

- Martinez (2001) states that there are several modalities of earnings management, depending on the motivations involved in the process. However, the author highlights three main modalities: a) target result (target earnings) - manage to increase (improve) or decrease (worsen) the accounting results; b) result smoothing (income smoothing) - manage to reduce the variability of accounting results; c) conservative accounting (big bath accounting) - manage to reduce the current profit in order to increase future profit.Mohanram (2003) also classifies the management methods in three specific types: bump up, big bath and Cookie Jar. All modalities are related to a target result. The first classification (bump up) occurs when a company is very close to reaching its target result, having incentive to increase profits through management. The second classification (big bath) is the same as used by Martinez (2001), smoothing results. The third classification (Cookie Jar) occurs when a company is above the target result, having incentive to reduce the result through management, not to raise excessively market expectations for the next periods.Trapp (2009) also mentions result smoothing (income smoothing) as a modality of management, already stated by Martinez (2001), for reducing the profits variability, showing to investors lower volatility and risk in the company income rates. These modalities of earnings management imply methodological procedures in their calculation, which is addressed below.

2.3. Methodological Procedures for Determining Earnings Management

- Several methodological approaches for the calculation of earnings management are found in the literature but, in general, are divided into qualitative and quantitative. Mohanram (2003) presents the following steps for the qualitative approach: a) identify the most important accounting policies for the companies’ segment; b) evaluate the company's accounting flexibility; c) evaluate the accounting strategy adopted by the company; d) evaluate the disclosure quality; e) evaluate if the company provides adequate information for understanding the economic strategies; f) analyze and identify the red flags; and g) undo accounting distortions.However, it is found in the literature that the quantitative approach is the most used in empirical research. Martinez (2001) distinguishes three basic procedures used in studies of the area: analysis of specific accruals; analysis of aggregate or total accruals; and frequency distribution.The goal of the analysis of specific accruals is to analyze the behavior of certain segment of businesses or specific financial accounts. This requires large number of observations (Trapp, 2009), and by working with a larger length of data, this method allows the development of multivariate analysis. However, it has as main disadvantages the fact of being based on certain assumptions that are not necessarily true, and not being conclusive on the practices of management, since it does not focus on specific incentives (Cardoso, 2005).Regarding the aggregate or total accruals, Healy (1985) was the first author to use this methodology. The goal is to estimate the accruals’ discretionary component. The accruals are divided into: discretionary and non-discretionary. The discretionary part of the accruals is that which is manageable, or depends on the manager's judgment, and the non-discretionary is not manageable.Studies based on the frequency distribution have the objective of verifying the behavior of the accounting results, relating them to some reference point or benchmark, which may be the result of the previous year or nil. From this point of reference, it can be verified whether the observations of accounting results below this point are very different from the observations above this point (Trapp, 2009).The regularity in the frequency distribution of results was associated with the earnings management by Burgstahler and Dichev (1997). According to these authors, it consists of empirical evidence of a small number of companies with small losses and a large number of companies with small profits. According to Baptista (2008, p. 47), "the concentration of small profits observations related to the small losses observations could indicate that the companies are making efforts to avoid negative results, [...] surpassing zero".The main advantage of this methodology is not to have to estimate the accruals. However, it does not allow analyzing how the result management was done (Trapp, 2009). This last methodological approach to calculate earnings management is adopted in the development of this study.

3. Research Method and Procedures

- A documentary research was done so as to collect the data. They were collected from the electronic website of Thomson ONE Banker in the Thomson Financial database. Were collected the figures of Sales, Operating Profit (Lop) and companies Active Total (AT), in the period from 2000 to 2003 and from 2006 to 2009. Data of the years 2004 and 2005 were not used, because it was the transition period of the IFRS adoption by sample companies.

3.1. Data Analysis

- The first data analysis consists of a descriptive statistics, contemplating mean, median and standard deviation of the figures of sales, Operating Profit (OP), Total Asset (TA) and Operating Profit divided by Total Assets (OP / TA) of companies under analysis, divided into two periods: period 1 (2000-2003), before the adoption of IFRS, and period 2 (2006-2009), after the adoption of IFRS by the companies.After this preliminary analysis, based on the study of Burgstahler and Dichev (1997) and Jeanjean and Stolowy (2008), was calculated the frequency distribution of Operating Profit over Total Assets (OP / TA) of companies, based on a range from -1 to +1. It was then analyzed the number of observations on two central points near zero (nil result) in frequency distribution, the range -0.1 and the range +0.1. The greater the difference in the number of observations in the range +0.1 related to range -0.1, the greater the indication of earnings management existence.According to Glaum, Lichtblau and Lindemann (2004), irregularities in the frequency distribution indicate that companies often avoid the disclosure of negative net results, when close to zero, managing them up. In the absence of earnings management, a relatively smooth distribution near the limit zero (nil result) is expected.In order to determine which countries were most affected in terms of earnings management with the IFRS adoption, a rate was calculated based on the studies of Brown and Higgins (2001), Leuz, Nanda and Wysocki (2003), Glaum, Lichtblau and Lindemann (2004). This rate consists of the division of the number of observations of small profits (located in the range 0: 0.1 in frequency distribution) by the number of observations of small losses (located in the range -0.1, 0) of the distribution.The intention of this survey is, firstly, to determine the impact of the IFRS adoption in the earnings management levels presented by European companies. From this, it seeks to identify countries in which this impact was more significant. However, it is necessary to highlight that the study does not cover all European Union countries, nor all companies of the countries examined.

3.2. Population and Sample

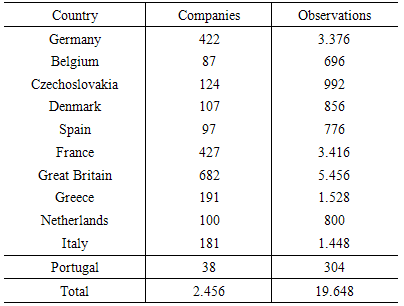

- The population of the research comprises companies located in the Union European, which adopted IFRS for disclosing consolidated accounting statements from 2005, and have their accounting information indexed in the Thomson Financial database. The samples of the research were selected from this population. The sampling is non-probabilistic, and this fact must be considered in the analysis of results, especially regarding its generalization.First, companies from countries most economically representative of the European Union were selected, such as Germany, France, Britain, Italy and the Netherlands. However, being a descriptive research and trying to give more diversity to the sample, data were also collected from companies in the Iberian Peninsula, Portugal and Spain; from a representative of Eastern Europe, Czechoslovakia; of a Scandinavian country, Denmark; and also Greece and Belgium. Table 1 shows the sample.

|

3.3. Research Hypothesis

- Although several international studies on the subject are not unanimous about the effects of the convergence to IASB accounting standards in the levels of earnings management practices employed by companies, some research indicates that certain contextual features of the countries can influence this process.Countries with weak investor protection mechanisms (Nenova, 2003; Dyck & Zingales, 2004; Renders & Gaeremynck, 2007) and stock market in development (Jeanjean & Stolowy, 2008) are more susceptible to the practice of earnings management after the adoption of IFRS, especially if their local accounting standards are based on rules rather than principles (Van Tendeloo & Vanstraelen, 2005; Goncharov & Zimmermann, 2006).Thus, two research hypotheses were developed from these assumptions:H1 - companies in countries with weak stock market or in development present higher levels of earnings management accounting;H2 - companies in countries with local accounting standards based on principles rather than on rules present higher levels of earnings management.

4. Data Description and Analysis

- This section presents the description and analysis of the research data. First a general analysis was performed based on the research data, with emphasis on the descriptive statistics of the figures of Sales, Total Assets and Operating Profit of the companies surveyed. Then, it is presented the frequency distributions of the Operating Profit over the Total Assets of the companies, in histogram form, individualized per country. Following, the rate of small profits over small losses in the analyzed countries is calculated.

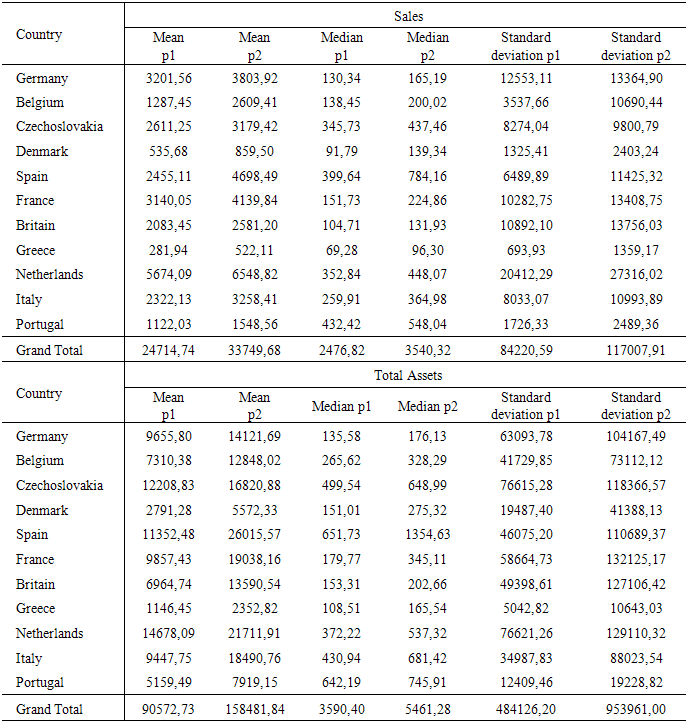

4.1. Descriptive Statistics

- This topic presents the mean, median and standard deviation of the figures of Sales, Total Assets, Operating Profit and Operating Profit over Total Assets of the companies researched, individualized by country (Table 2).

|

|

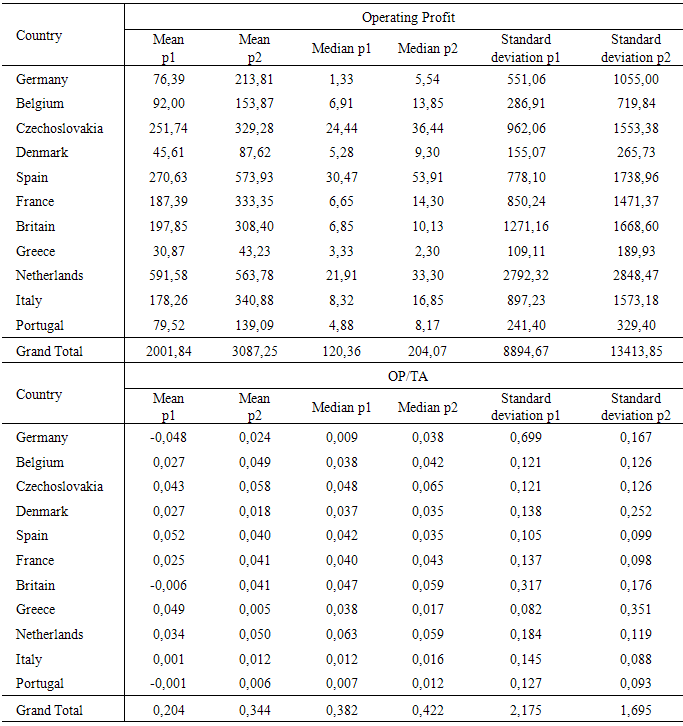

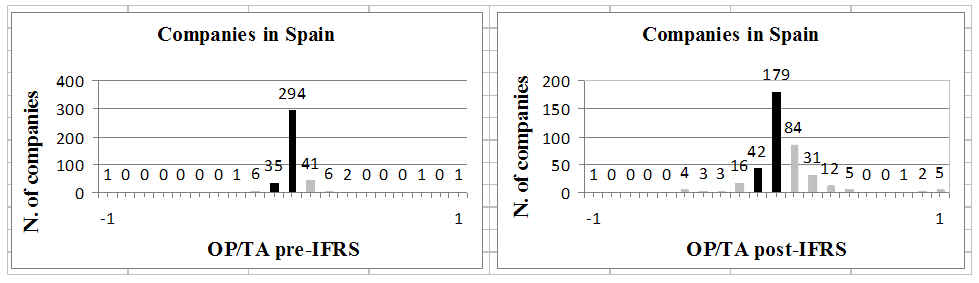

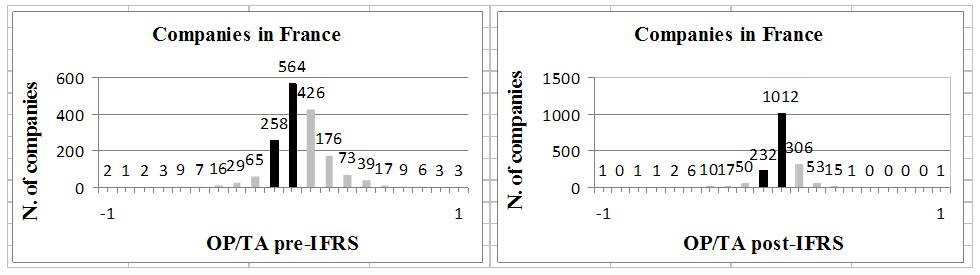

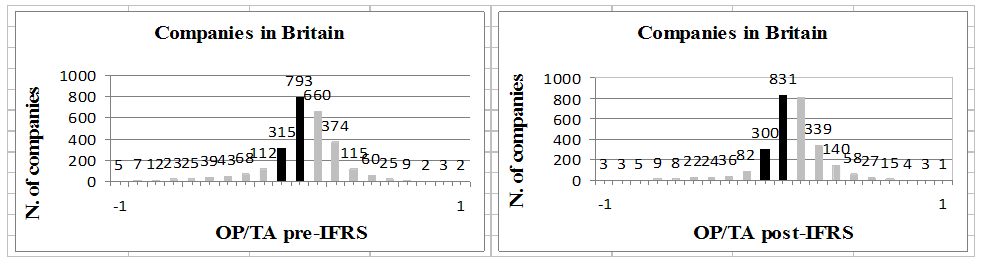

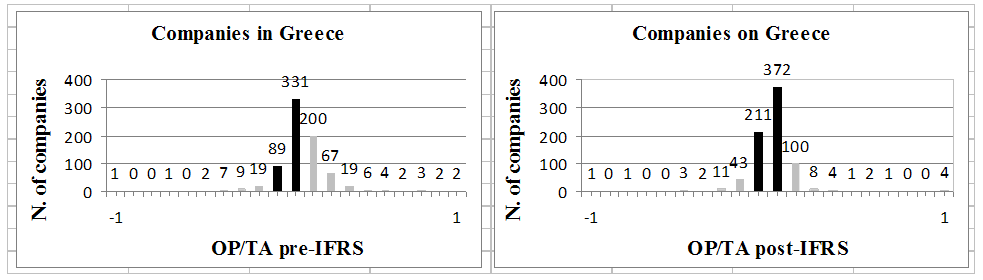

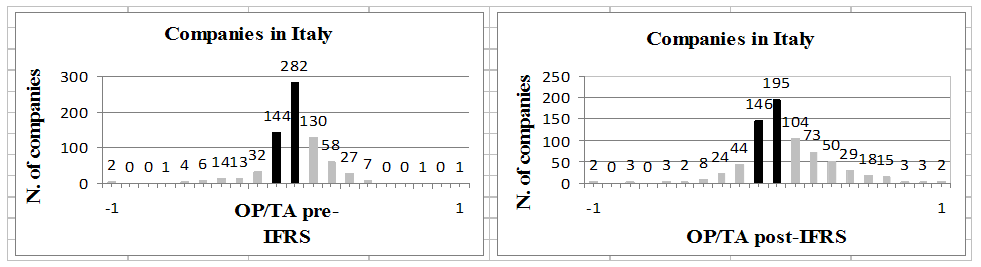

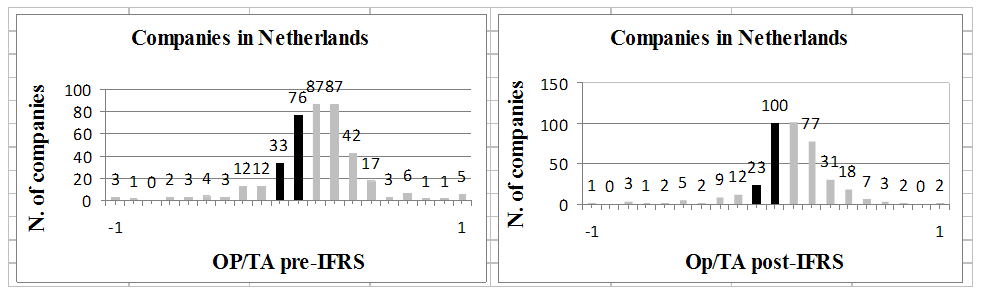

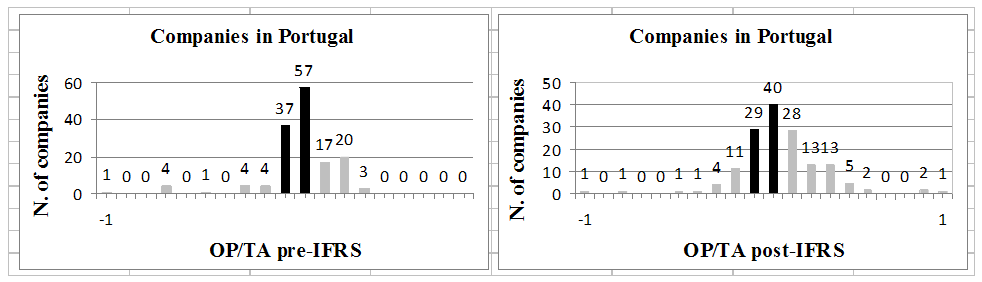

4.2. Distribution of the Disclosed Results

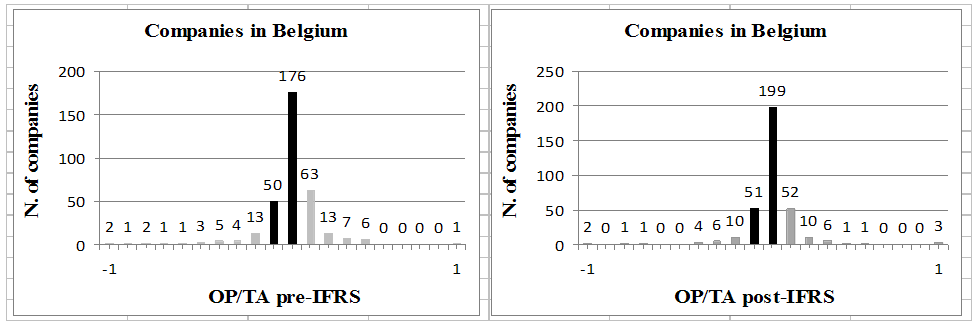

- To detect the presence or absence of changes in the earnings management levels with the IFRS adoption, an analysis of the frequency distribution of OP / TA in the two studied periods, for each country of the sample was performed. The pre-IFRS period of analysis (period 1) covers the years from 2000 to 2003. The post-IFRS (period 2) covers the years from 2006 to 2009.The operating profits divided by total assets (OP / TA) of the companies were grouped into 20 classes, from -1 to +1. The ranges in bold are the ones close to the limit zero (-0.9 and +0.1), where this analysis focuses on earnings management (Burgstahler & Dichev, 1997; Glaum, Lichtblau & Lindemann, 2004; Jeanjean & Stolowy, 2008).It can be seen in Figure 1 that Belgian companies have higher concentration of small profits compared to small losses in relation to post-IFRS, which may denote a higher earnings management level with the adoption of IASB standards.

| Figure 1. Concentration of small profits versus small losses of companies in Belgium |

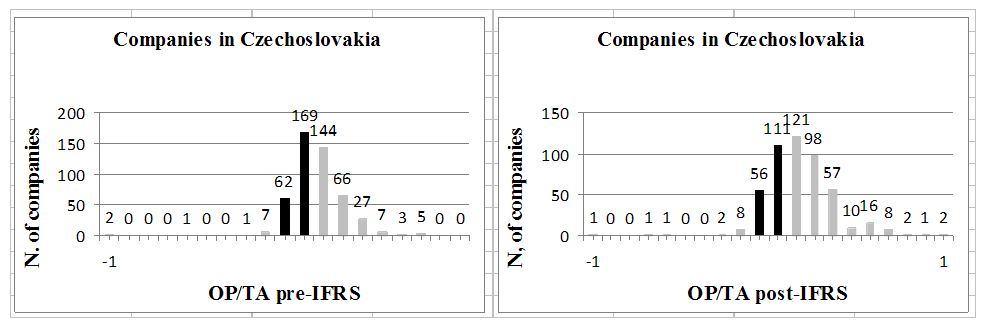

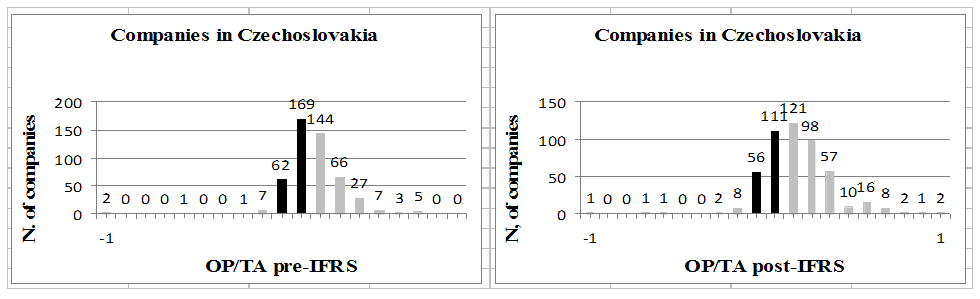

| Figure 2. Concentration of small profits versus small losses of companies in Czechoslovakia |

| Figure 3. Concentration of small profits versus small losses of companies in Germany |

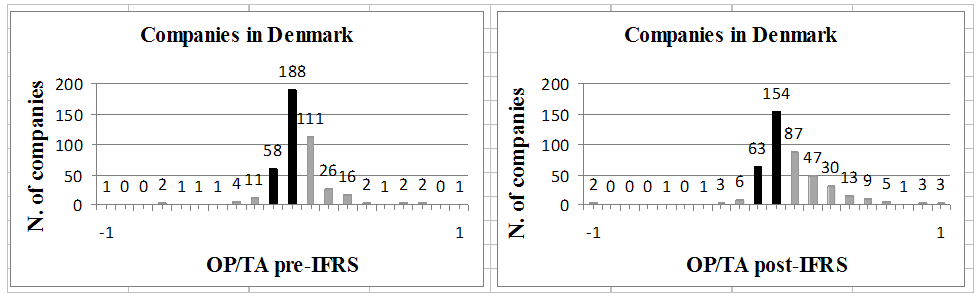

| Figure 4. Concentration of small profits versus small losses of companies in Denmark |

| Figure 5. Concentration of small profits versus small losses of companies in Spain |

| Figure 6. Concentration of small profits versus small losses of companies in France |

| Figure 7. Concentration of small profits versus small losses of businesses in Britain |

| Figure 8. Concentration of small profits versus small losses of companies in Greece |

| Figure 9. Concentration of small profits versus small losses of companies in Italy |

| Figure 10. Concentration of small profits versus small losses of companies in the Netherlands |

| Figure 11. Concentration of small profits versus small losses of companies in Portugal |

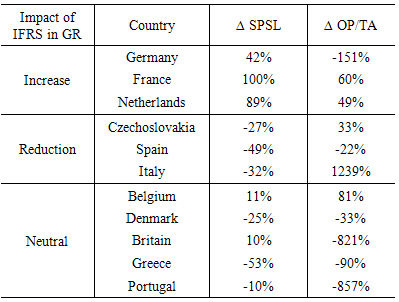

4.3. Summary of Results

- A summary of results is presented in Table 4, considering the changes in the indicator of Small Profits on Small Losses (SPSL) for the period 1 to period 2, with changes in Operating Profit on Total Assets (OP / TA) of companies in the same period.

|

5. Conclusions

- The goal of the study was to identify in which countries of the sample analyzed the IFRS adoption has represented a greater change in the earnings management levels disclosed by companies. A descriptive study was performed with a quantitative approach, based on documentary analysis in Thomson Financial’s database, where data covering the period 2000 to 2003 and from 2006 to 2009 were collected to calculate the frequency distribution of small profits on small losses.Regarding the profitability analysis of companies, through the mean OP / TA indicator, it was observed that companies in Greece, Spain and Denmark showed negative change in this indicator. Coincidentally or not, Greece and Spain were the two countries highlighted in the worldwide news media in 2010 due to financial difficulties faced by their governments.On the other hand, countries such as Germany, Britain, Italy and Portugal showed higher profitability growth (OP / TA) in their companies, when comparing the two analyzed periods of the study. Germany and Britain traditionally are countries with strong and stable economy, two of the biggest EU economies. What is surprising here is the performance of Portuguese companies, faced with problems similar to those that Greece and Spain faced by the Portuguese government.However, this study did not intend to do an economic analysis of these countries, but rather use the OP / TA indicator assist the analysis of earnings management presented by companies after the IFRS adoption. It was found that there are countries where there was a reduction of management with the use of IFRS, countries where companies started to exhibit higher levels of management and countries where there was no significant impact with the IASB accounting standards adoption.It was found that in companies from Czechoslovakia, Spain and Italy there was a reduction in earnings management levels after the IFRS adoption, showing that the IASB standards, more flexible and with high quality, contributed to the improvement of the accounting information provided by these companies.On the other hand, companies in Germany, France and Netherlands have had opposite results with the IFRS adoption. There was an increased of earnings management levels. The result of German companies, which has an accounting model strongly legalistic, and French companies, with tax-based accounting model (Nobes, 1983), in a sense, is not surprising. The use of a more flexible accounting standard, based on principles rather than standards such as IFRS, could give greater discretionary power to managers who, accustomed to stricter standards, would feel greater freedom to practice earnings management.The result of German companies is consistent, somehow, with the study of Goncharov and Zimmermann (2006) that analyzed German companies and found higher levels of earnings management based on IFRS compared to the U.S. GAAP. Regarding French companies, Jeanjean and Stolowy (2008) also found an increase in the level of management after the IFRS adoption.Finally, there is a group of countries of which cannot be said that the IFRS adoption brought changes in the levels of management, given the small variation observed in the SPSL rate or by the influence of changes in the corporate profitability, measured by the variable mean OP/TA. In this group countries such as Belgium, Denmark, Britain, Greece and Portugal can be classified.It is concluded, therefore, that, despite the higher quality expected with the adoption of IASB accounting standards, in some countries the effect of the IFRS practice is not consistent with this expectation in the period analyzed. In addition, features how the strength of the country's capital market and the similarity of their accounting standards with IASB standards did not impact the results of this study. However, other characteristics such as legal system and accounting education system from each country, which were not under investigation in this study, can influence these effects.Understanding how these various environmental characteristics influence, either alone or together, the process of adopting the accounting standards of IASB, is a concern that requires further research. A deeper analysis of these characteristics in the countries that have showed in this study increase in management (Germany, France and the Netherlands) and countries in which there was a decrease in management (Czechoslovakia, Spain and Italy) can help to get those answers.It is important to highlight that the results here presented may change depending on the period of analysis and the model used to measure the management. Another limitation of this research is regarding the use of a single model to assess the management, based on the frequency distribution of small profits on small losses. Several other models, based on total or discretionary accruals, may be found in the literature. Using several control variables it can also contribute to increase the reliability of results.As this is a descriptive study, the concern was to draw a general profile of the countries regarding earnings management with the IFRS adoption. It is recommended for future research to deepen the study, using other models for detecting earnings management, or to have a more specific focus on a given country in order to obtain explanations for earnings management.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML