-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2015; 4(1): 1-7

doi:10.5923/j.ijfa.20150401.01

IFRS Adoption and Value Relevance of Financial Statements of Nigerian Listed Banks

Adebimpe O. Umoren, Ekwere Raymond Enang

Department of Accounting, University of Uyo, Uyo, Nigeria

Correspondence to: Adebimpe O. Umoren, Department of Accounting, University of Uyo, Uyo, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Adopting the International Financial Reporting Standard (IFRS) have been empirically found to improve the quality of accounting in some countries, thereby increasing its usefulness to stakeholders. This study empirically examines whether the mandatory adoption of IFRS has improved the value relevance of financial information in the financial statements of commercial banks in Nigeria. The sample comprises of twelve listed banks in Nigeria. Specifically, financial statement figures of 2010 and 2011 (pre-adoption period) and 2012 and 2013 (post-adoption) were utilized. Descriptive statistics and least square regression were conducted to analyse the effect of IFRS adoption on the accounting quality. The result indicates that the equity value and earnings of banks are relatively value relevant to share prices under IFRS than under the previous Nigerian SAS. Results also indicate that earnings per share is incrementally value relevant during post-IFRS period while book value of equity per share is incrementally less value relevant during the post-IFRS period. This may imply that earnings reported by Nigerian Commercial banks have become more informative to equity investors in determining the value of banks following IFRS adoption. We therefore recommend that Financial Reporting Council of Nigeria and other accounting standards setters should incorporate more measures to enhance the quality of the financial reporting in order to increase the value relevance of financial statements.

Keywords: Value relevance, IFRS adoption, Accounting quality, Nigerian listed banks

Cite this paper: Adebimpe O. Umoren, Ekwere Raymond Enang, IFRS Adoption and Value Relevance of Financial Statements of Nigerian Listed Banks, International Journal of Finance and Accounting , Vol. 4 No. 1, 2015, pp. 1-7. doi: 10.5923/j.ijfa.20150401.01.

Article Outline

1. Introduction

- In Nigeria, the banking sector forms one of the pillars of economic development. It intermediates funds between the surplus and the deficit economic units, thus stimulating and promoting investments and economic growth and development. It follows that increase in investment in the banking sector will lead to improved performance of the economy. However, for any meaningful investment to occur in the banking sector, quality accounting information regarding share price and other performance indicators are essential. Investors, who are usually different from the management of the investments, only rely on the information supplied by management in the financial statements, in assessing the risk and value of a firm before deciding either to invest or to disinvest. The ability of the financial statement to effectively and satisfactorily guide investors on their investment decisions depends on the value relevance of the information in the financial statements. According to [1] “Value relevance” implies ability of the financial information contained in the financial statements to explain the stock market measures. A value relevant variable is that data or amount in the financial statement that guide investors in their pricing of shares. Investment decision, therefore, centres on the association between stock returns or share price and accounting related information such as earnings, cash flows, book value of equity, firm’s size, etc.Before the global convergence to International Financial Reporting Standards (IFRS), different countries of the world has had their respective accounting standards, developed, issued and regulated by their respective local bodies. In Nigeria for instance, the Nigerian Accounting Standards Board (NASB) was responsible for developing, issuing and regulating of accounting standards since 1982 till July 20th, 2011 when the Financial Reporting Council Bill was signed into law. Recently, globalization and internationalization of the capital market have popularized IFRS. The standards which have now become a world standard is a set of principles-based accounting standards developed and issued by the International Accounting Standards Board (IASB) for the preparation of public company financial statements. Every country is expected to converge to IFRS. As at December, 2013, over 150 countries had converged to IFRS. All European Union countries were mandatorily required to converge to IFRS since 2005. In China, all listed firms are compulsorily reporting under IFRS since 2007. Nigeria formally adopted the new standard in 2010. The implementation in Nigeria was organized such that all companies use IFRS by January 2014. Following this adoption, all commercial banks operating in Nigeria were mandatorily required to adopt and report under IFRS by January 2012. From all indications, expectations are high that IFRS will improve the quality of reported accounting information and enhance the overall reporting standards in Nigeria. However, with the few years of implementation, what are the realities on ground, in terms of its overall impact? This important question about IFRS attracts the attention of academics, regulators and practitioners.In view of the strategic importance of the banking sector to economic development in Nigeria, as it accounts for almost 31% of the total market capitalization, that is N3.91tn out of N18.95tn [2], and the fact that banking sector was the first among the listed public entities in Nigeria to fully adopt IFRS, a study on the value relevance of financial statements of commercial banks in Nigeria becomes important in order to examine the effects of the mandatory adoption of IFRS on the value relevance (quality) of financial statements of commercial banks in Nigeria. Besides, a set of financial statements are meant for diverse users; ranging from management, owners, creditors, employees, government agencies, regulatory authorities, investors, analysts, etc. Particularly, investors wish to know which items in the financial statement are values relevant for investment decisions. Specifically, our findings contribute to the argument that shareholder-focused accounting principles such as IFRS are more value relevant for investment decisions than the Nigerian Statements of Accounting Standards. Our findings are particularly relevant to Financial Reporting Council (FRC) of Nigeria and other standard setters. The research findings provide feedback on whether the change to IFRS has improved accounting quality. This study aspires to contribute to the enrichment of both Nigerian and international literature that relates to the adoption and implementation of IFRS and value relevance. This research will be of vital interest to standard setters, regulators, researchers, policy-makers and other stakeholders.The purpose of this study is to empirically examine whether the mandatory adoption of IFRS has improved the value relevance of financial information in the financial statements of commercial banks in Nigeria. Specifically, the objectives of the study are to compare the value relevance of book value of equity and earnings in determining the share price of commercial banks in Nigeria before and after the mandatory adoption of IFRS.The rest of this paper is organised as follows. Section two reviews the relevant literature on developments in accounting standards in Nigeria, disparities between NGAAP and IFRS and impact of IFRS adoption on value relevance of accounting information. Section three discusses the research methodology while section four presents the analysis of data and research findings. Section five concludes the research by summarising the salient aspects of the findings and providing useful recommendations for users, preparers and regulators of financial statements.

2. Literature Review

2.1. Nigeria and IFRS Adoption

- Nigeria is situated in Western Africa, bordering the Gulf of Guinea, between Benin and Cameroon. It has an estimated population of over 175 million; it has the largest market for goods and services in Africa. Its gross domestic product (purchasing power parity) is $444.3 billion (2012 est) [3]. It has an active Nigerian Stock Exchange which has 257 listed companies with a combined market capitalization of Nigerian Naira (NGN) 18.949 trillion (about US$115.68 billion) as at September, 2014 [2].The practice of Accountancy worldwide is guided by sets of guidelines and rules. The rules and guidelines are compiled into accounting standards. They are statements of principle that discusses the accounting treatment and disclosure of a particular item or group of items. Before 2012, the Statements of Accounting Standards was used in accounting practice in Nigeria. The local accounting standards are issued in Nigeria by the Nigerian Accounting Standard Board (NASB) till 2011. NASB was established in 1982 as a private sector initiative and became a government agency in 1992, reporting to the Federal Minister of Commerce. The NASB was given a legal backing by its inclusion in Section 335(1) of the Companies and Allied Matters Act of 1990 which mandates all companies to prepare financial statements that complies with the Statement of Accounting Standards (SAS) as developed and issued by NASB from time to time. The NASB in 2003 was given the full autonomy as a legal entity with the enactment of the NASB Act of 2003. The Nigerian Accounting Standards Board Act of 2003 provided the legal framework under which NASB set accounting standards. The primary functions as defined in the Act of 10 July 2003 were to develop, publish and update Statements of Accounting Standards to be followed by companies when they prepare their financial statement, and to promote and enforce compliance with the standards.In the wake of financial crises in late 1990s, the international community emphasized the major role that the observance of international standards and codes of best practices in order to strengthen global financial systems. The international community called for the preparation of Reports on the Observance of Standards and Codes (ROSC), an assessment of the degree to which an economy observes internationally recognized standards and codes. It was observed by the World Bank about Nigeria, that the NASB lacks the financial and human resources as well as the infrastructure for monitoring and enforcing compliance with its standards. The ROSC team observed from a review of published financial statements that there are compliance gaps between the SAS and actual practice. Among the recommendations of the ROSC team was the creation of a new independent oversight body called the Financial Reporting Council which would monitor and enforce accounting and auditing requirements with respect to general-purpose financial statements. The FRC Bill was signed into law on 20 July 2011. The FRC is a unified independent regulatory body for accounting, auditing, actuarial, valuation and corporate governance. It is expected that more meaningful and decision enhancing information can now be arrived at from financial statements issued in Nigeria because accounting, actuarial, valuation and auditing standards, used in the preparation of these statements, shall be issued and regulated by this Financial Reporting Council. Although the Nigerian Statements of Accounting Standards (SAS) are similar to IFRS in certain respects, many differences exist. SAS promulgated by NASB were largely based on past IAS promulgated by IASC. Due to the increasing complexity of financial reporting requirements, some of the original IASs were reviewed resulting in their amendment or withdrawal. The SASs were not reviewed or updated with the IASs/IFRSs. The significant disparities between the Nigerian SASs and IFRSs have resulted in the SAS being regarded as outdated and incomplete as an authoritative and internationally accepted guide to the preparation of financial statements. This has significantly diminished the degree of confidence on Nigerian Standards especially by international users of financial statements produced in Nigeria.The Nigerian SAS seems to be sub-standard in that the requirement of many SASs accords substantially with the requirement of its equivalent IFRSs that had been withdrawn or outdated. Some SASs does not have equivalent IASs/IFRSs. For example SAS 1 (Disclosure of Accounting Policies) accords substantially with IAS 1 (Disclosure of Accounting Policies) which had been reformatted in 1994. Also, SAS 2 (Information to be disclosed in Financial Statements) agrees with IAS 5 (Information to Be Disclosed in Financial Statements) originally issued October 1976, which has been superseded by IAS 1, Presentation of Financial Statements in 1997. Another example is SAS 9 (Accounting Depreciation) which is in accord with IAS 4 (Depreciation Accounting) which has been withdrawn in 1999. There are sixteen (16) IFRSs/IASs with no equivalent SASs: IFRS 1 (First time Adoption of International Financial Reporting Standards), IFRS 2 (Share-based Payment), IFRS 5 (Non-current Assets Held for Sale and Discontinued Operations), IFRS 7 (Financial Instruments: Disclosures), IFRS 9 (Financial Instruments), IFRS 13 (Fair Value Measurement), IFRS 14 Regulatory Deferral Accounts, IFRS 15 Revenue from contracts with customers, IAS 18 (Revenue), IAS 20 (Accounting for Government Grants and Disclosure of Government Assistance), IAS 23 (Borrowing Costs), IAS 24 (Related Party Disclosures), IAS 29 (Financial Reporting in Hyperinflationary Economies), IAS 32 (Financial Instruments: Presentation), IAS 36 (Impairment of Assets) and IAS 41( Agriculture). Also SICs (1-33) and IFRICs (1-21) have no equivalent Nigerian interpretations.Based on the premise of NASB to promote general acceptable published financial reports and high quality accounting standards that are consistent with international practices, inaugurated a Stakeholders’ Committee on the Roadmap to the Adoption of IFRS in Nigeria on October 22, 2009. In July 2010, the Nigerian Federal Executive Council approved the Roadmap to the Adoption of IFRS in Nigeria [4], it was iterated in the report that, that it will be in the interest of the Nigerian economy for reporting entities in Nigeria to adopt globally accepted, high-quality accounting standards by fully converging Nigerian national accounting standards with International Financial Reporting Standards (IFRS) by following a Phased Transition effective January 1, 2012. It is a three phase transition programme. Phase 1 relates to the publicly listed entities and significant public interest entities. They are to prepare their financial statements using applicable IFRS by January 1, 2012. Phase 2 relates to other public interest entities, which are expected to mandatorily adopt IFRS, for statutory purposes, by January 1, 2013. Phase 3 relates to Small and Medium-Sized Entities (SMEs) which are expected to mandatorily adopt IFRS for SMEs by January 1, 2014. The Nigerian banking sector is made up of commercial banks and other financial institutions such as finance companies, micro-finance companies, discount houses and mortgage institutions. The Central Bank of Nigeria (CBN) regulates their activities. The CBN has authorized only 21 commercial banks to transact business in Nigeria. Out of these 14 are listed banks. Nigerian listed banks and other public and significant public interest entities were required to adopt IFRS for years beginning on or after January 1, 2012. Among the listed companies, the listed banks were the first to complete the transition and have adopted the standard for their reporting.

2.2. Review of Prior Literature

- Value relevance is one of the measures used in determining accounting quality. Sequel to IFRS adoption researches on value relevance have been conducted by several researchers in various countries: for example [5] for United States; [6] for Finland; [7] for Germany and United States; [8] for China; [9] for United Kingdom:, [10] for Germany; [11] for Greece; [12] for Spain; [13] for Sweden; [14] for Greece; [15] for Bangladesh; [16] for Indonesia and [17] for Sri Lanka.Findings on these researches are very mixed; some studies show that the change to IFRS positively impacts value relevance. For example [7], [8], [9], [11], [16] and [17]. Some other studies find that it negatively impacts value relevance. For example [8], [10], [13], and [15]. Yet others find no conclusive evidence. For example [6], [12], and [14].The comparative value relevance among IFRS, US and German accounting standards was examined by [7]. The sample included 417 German companies listed on local stock markets during the period 1998–2000. They conclude that the value relevance of IAS and US based earnings is higher than that of German GAAP-based earnings suggesting higher accounting quality under an IAS or US accounting regime. [8] investigate the market valuation of earnings and book value figures prepared under IFRS and US-GAAP using earnings and Ohlson models. The research sample was for the period 1992–1996 in which 89 non-US companies employs IFRS in their primary accounts with a reconciliation to US GAAP. They find that IFRS amounts are more (less) closely associated with prices-per-share (security returns) than US GAAP amounts. They also conclude that US GAAP earnings reconciliation amounts are value-relevant after controlling for IFRS amounts in market value and return models.[6] employ event study methodology and a market value model to examine the market reaction to and value relevance of reconciliation adjustments from UK companies in the transition to IFRS compliance. The sample comprises of 85 firms from the London Stock Exchange FTSE 350 for 2005. They find the reconciliation adjustment from UK GAAP to IFRS not to be value relevant to shareholders’ equity but has value relevant with respect to earnings.For Greece, [11] test the effect of the mandatory adoption of IFRS upon the value relevance of earnings and book values. Using data from the Athens Stock Exchange that covered a period of two years before and two years after the mandatory adoption of IFRS, they find that the adoption of IFRS positively affected the value relevance of consolidated net income and book value of assets.[16] provide empirical evidence concerning value relevance of earnings and book values to stock prices in Indonesia Stock Exchange. The sample comprises of 73 firms for the year 2000-2009. The research shows that earnings and book values individually are relevance in explaining stock prices and it further analysis shows that earnings and book values simultaneously are relevant information in explaining stock prices variance.[17] examine the empirical relationship between share prices and explanatory variables such as NAVPS, EPS, P/E, ROE for the period 2007-2011 at Columbo Stock Exchange at Sri Lanka. Twenty companies were selected for this study. They conclude that value relevance of accounting information has significant impact on share price and value relevance of accounting information is significantly correlated with share price.[5] investigate the incremental value relevance obtained from reconciling accounts prepared under Chinese accounting standards to IFRS. The sample consists between 53 and 79 companies per year listed on Chinese stock markets for the period 1995–2000. Using the returns model and Ohlson model they find that earnings and the book values of equity determined under Chinese GAAP provide additional relevant accounting information for the purpose of determining the prices of shares than IFRS. The value relevance of earnings under German accounting standards and IFRS are studied by [10]. The research sample include 12 companies publishing exclusively German GAAP consolidated reports for the period 2000–2004 and 12 companies publishing exclusively IFRS consolidated reports for the period 2000–2004). Using simple linear regression analysis, he finds that German GAAP are significantly more value relevant than IFRS.In Sweden, [13] explores whether the quality of financial reporting has increased after the mandatory adoption of IFRS. The analysis of accounting quality includes measures of earnings smoothing, timeliness and association to share prices. Surprisingly, the results of all these measures suggest a decrease to the accounting quality of the IFRS adoption.[15] investigates the extent of association between stock price and two influential accounting variables (i.e. earnings-per-share and net asset value per share) to measure the relevance of accounting information. The study is based on accounting information which are available in DSE data base and published annual reports of 105 companies from 2000 to 2010. It is found that only 6.5% of changes in share price can be explained by changes in defined accounting variables and here is a negative correlation between share price and NAVPS of the sample company.[6] examine the value relevance of earnings under Finnish accounting standards and their reconciliations to IFRS. The sample consists of 18 Finnish firms that disclose earnings under local GAAP and IFRS (1984–1992) using an earnings model. The result shows that the change in local GAAP earnings, as well as the level and change in aggregate reconciliation to IFRS, are value irrelevant.After the adoption of IFRS in Spain, [12] investigate the book-to-market ratio of Spanish companies before and after the IFRS adoption. They interpret the disparity between market value of shareholders equity and book values as value relevance. They report no improvement in Spanish reporting quality after IFRS adoption. [14] examine the combined value relevance of book value of equity and net income before and after the mandatory transition to IFRS in Greece. Contrary to their expectations, they find no significant change in the explanatory power of value relevance regressions between the two periods. The coefficients on book value of equity and net income are positive and significant in both the pre-IFRS and post-IFRS periods.To conclude, while one should fairly expect that the impact of IFRS adoption should be more obvious in countries where local GAAP and IFRS have a great disparity particularly in Nigeria. Prior literature has produced inconsistent and mixed findings. A study on value relevance is needed in Nigeria, particularly for the banking sector due to the strategic importance of the Nigerian banking sector to economic development. Specifically, the objectives of the study are to compare the value relevance of book value of equity and earnings in determining the share price of commercial banks in Nigeria before and after the mandatory adoption of IFRS.In the light of the above, the following hypotheses will guide the study:H1: The value relevance of book value of equity and earnings in banks’ financial statement is higher in post IFRS periods than in the pre IFRS periods.

3. Methodology

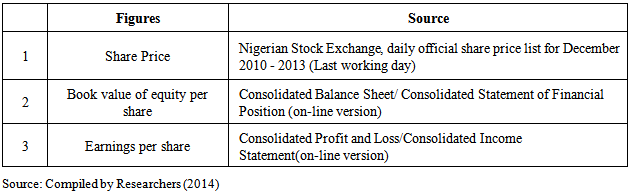

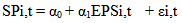

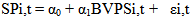

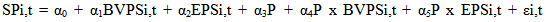

- There are twenty one (21) commercial banks in Nigeria, out of these fourteen (14) are listed (CBN, 2014). All the fourteen listed banks in the Nigerian Stock Exchange (NSE) form the population and sample of this study. Two (2) banks were excluded as their complete information was unavailable online. The final sample therefore consisted of 12 banks and 48 bank year observations. Financial statements for 2010 and 2011 (two years immediately before the mandatory IFRS adoption) will be compared with those of 2012 and 2013(two years immediately after the mandatory IFRS adoption). This study evaluates the effect of IFRS adoption in Nigeria on financial reporting quality among listed commercial banks through value-relevance tests using a relative and incremental research design. This study adopts the Ohlson model framework, which provides a link between share price and two accounting variables, but with a modification to capture the effect of the IFRS adoption as stated in [18]. Book value of equity and earnings per share are the two accounting variables that are used in this study. While share price constitutes the dependent variable, book value of equity and earnings per share constitute the independent variables. This study adopts the adjusted coefficient of determination (adj. R2) as the unit to measure the value relevance of book value and earnings using least-square regression. Two metrics for value relevance will be examined. The first value relevance metric will be based on the explanatory power from a regression of the share price on the book value of equity and earnings per share. This metric will be determined from the understated equation (1).

| (1) |

| (2) |

| (3) |

| (4) |

|

4. Results and discussion

4.1. Data Presentation: Descriptive Statistics

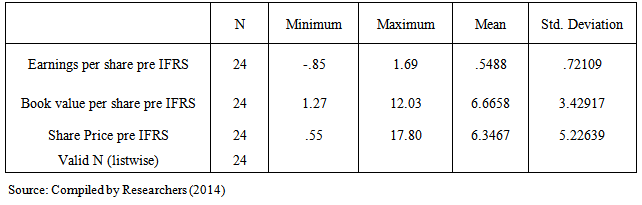

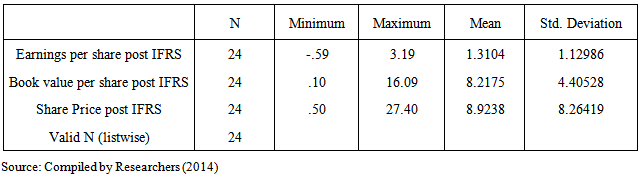

- The general characteristics of the earnings per share, book value per share and market share price pre-IFRS and post-IFRS are as presented in Tables 2 and 3. For the pre-IFRS period, the earnings per share varies from (N0.85) to N1.69, with a mean of N0.55 and a standard deviation of N0.72. The book value of equity per share ranged from N1.27 to N12.03 with a mean of N06.67 and a standard deviation of N3.43, while the share price has a minimum of 0.55 and a maximum of N17.80 with a mean of 6.35 and a standard deviation of N5.23.

|

|

4.2. Regression Models

4.2.1. Relative Value Relevance

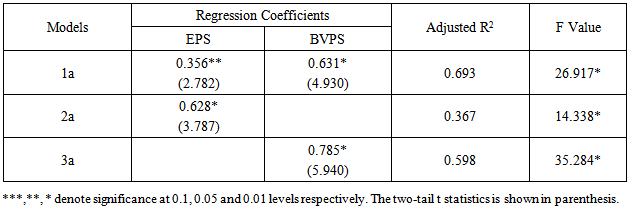

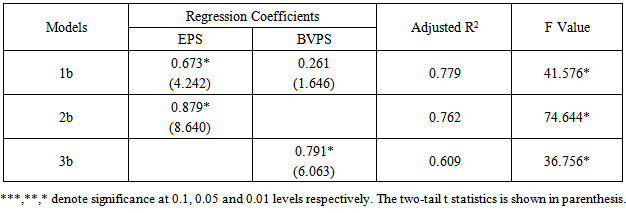

- Tables 4 and 5 show the result of the regression for pre- and post - IFRS periods. Models 1a and 1b reveal an increase in adjusted R2 between the pre-IFRS and post-IFRS period from 69.3% to 77.9%. This implies that the book value of equity per share and earnings reported under IFRS explains more about share prices as compared to the amounts being reported under Nigerian SAS. This implies that the value relevance of IFRS is significantly high compared to the Nigerian SAS. The coefficients of earning per share increased considerably from 0.356 to 0.673 and book value of equity decreased from 0.631 to 0.261 respectively. This suggests that the market participants have changed the way in which they price their shares and these two accounting variables may now be relevant or irrelevant. This calls for a separate analysis of each of the accounting variables.

|

|

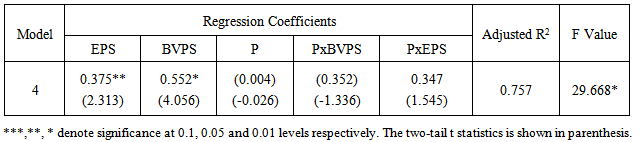

4.2.2. Incremental Value Relevance

- Table 6 presents the coefficients, adjusted R2 and F values of model 4. The adjusted R2 is 75.7%. The coefficients of EPS and BVPS are 0.375 and 0.552 respectively. The coefficients for the interactive variables PxEPS and PxBVPS are and 1.347 and -0.352 respectively. The coefficients of EPS and BVPS are significant while the coefficients of the interactive variables are not significant. The coefficient of PxBVPS is negative while the coefficient of PxEPS is positive. This result suggests that book value of equity was relevant in pre-IFRS period and this relevant decreased in post-IFRS period. Earnings per share was also relevant in the pre-IFRS period and the relevance increased in the post-IFRS period. This is consistent with the result in 4.2.1 above. This is similar to the result obtained from the studies of [8], [10], [13] and [15]. The result indicates that the equity value of banks is not more sensitive to share price under IFRS than under the previous Nigerian SAS while earnings per share is more sensitive. This may also imply that earnings reported by Nigerian Commercial banks have become more informative to equity investors in determining the value of firms following IFRS adoption.

|

5. Conclusions

- This study has investigated the value relevance of financial information of listed commercial banks in Nigeria. The overall results on accounting numbers presented in this study indicate that the earning per share, book value of equity and share prices of commercial banks have significantly improved following IFRS adoption. The study further suggests that earnings per share and book value of equity are relevant in determining the value of shares in Nigerian commercial banks in the post IFRS era. Moreover, results indicate that earnings per share is incrementally value relevant during post-IFRS period while book value of equity per share is incrementally less value relevant during the post-IFRS period. However, this study is limited since it is not generalizable beyond the limits of the listed commercial banks. In addition, the study only examines the effect of IFRS adoption on reported earnings and book values of equity. Accounting numbers other than earnings and book values of equity, such as net assets, cash flow from operations might be considered in further research.It is therefore recommended that FRC and other accounting standards setters should incorporate more measures to enhance the quality of the financial reporting in order to increase the value relevance of financial statements.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML