-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(6): 356-371

doi:10.5923/j.ijfa.20140306.04

A Comparative Analysis on Working Capital Management of Brewery Companies in Nigeria

Soyemi Abosede Abiodun, Olawale Luqman Samuel

Department of Accounting, Banking and Finance, Olabisi Onabanjo University, Ago-Iwoye, Nigeria

Correspondence to: Olawale Luqman Samuel, Department of Accounting, Banking and Finance, Olabisi Onabanjo University, Ago-Iwoye, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This research work carry out a comparative analysis on working capital management of brewery companies in Nigeria. The study aimed to examine the cost of working capital and the effect on firm performance and to take a critical view of the adopted liquidity measures of the Nigeria firm and attempt to see how it has been achieved. Secondary data were employed in this study from journals, textbooks and annual reports of the selected companies. However, ratio analysis was used to analyze the data collected which is the best statistical techniques for working capital management. The result of the test analyzed indicates Guinness Nigeria possessed huge amounts of current assets than Consolidated breweries. It was also deduced that inventories and debtors were very high in case of the Guinness Nigeria whereas current liabilities where still on the moderate level except in 2013 which recorded a higher current liabilities than the current asset. Cash balances were comparatively high in both cases. On the behalf of Receivable Management for the companies, it can be concluded that, undoubtedly, the Guinness Nigeria was much more efficient in the management of cash as compared to the Consolidated breweries which was laming in this regard and was way behind it. On the behalf of study of payables management it was observed and concluded that the consolidated breweries was better off than Guinness Nigeria as regard liquidity and payment to creditors as their credit periods were much shorter than the Guinness Nigeria, nevertheless the Guinness Nigeria derived benefits from the massive credit periods. The major recommendation of this study is that working capital management should be the concern of all the manufacturing sectors firms and need to be given due importance. The collection and payment policies of the firms in manufacturing sectors, in general, need to be thoroughly reviewed. It is generally argued that firms need to accelerate their cash collections and slowdown their payments. This can only be possible with some professional advice and supervision. The findings indicate that firm managers/executives can enhance performance of the firms by reducing the number of days in inventories, Cash Conversion Cycle and Net Trade Cycle to a reasonable minimum.

Keywords: Working Capital, Inventory, Receivables, Payables

Cite this paper: Soyemi Abosede Abiodun, Olawale Luqman Samuel, A Comparative Analysis on Working Capital Management of Brewery Companies in Nigeria, International Journal of Finance and Accounting , Vol. 3 No. 6, 2014, pp. 356-371. doi: 10.5923/j.ijfa.20140306.04.

Article Outline

1. Introduction

- Working capital management, which deals with management of current assets and current liabilities, directly affect profitability and market valuation of firms (Sunday, Abiola and Lawrencia 2012).Working capital is said to be the life blood of a business. Working capital signifies funds required for day-to-day operation of the firm. In financial literature, there exist two concepts of working capital namely: gross and net. According to gross concept, working capital refers to current assets, viz: cash, marketable securities, inventories of raw materials, work-in-process, finished goods and receivables. According to net concept, working capital refers to the difference between current assets and current liabilities.An organization is required to maintain a balance between liquidity and organization’s performance while conducting its day to day operations. Liquidity is a precondition to ensure that organizations are able to meet its short-term obligations and its continued flow can be guaranteed from a profitable venture. The importance of cash as an indicator of continuing financial health should not be surprising in view of its crucial role within the business. This requires that business must be run both efficiently and profitably. In the process, an asset-liability mismatch may occur which may increase organization’s performance in the short run but at a risk of its insolvency. On the other hand, too much focus on liquidity will be at the expense of organization’s performance and it is common to find finance textbooks (for e.g see Gitman, 1984 and Bhattacharya, 2001) begin their working capital sections with a discussion of the risk and return tradeoffs inherent in alternative working capital policies. Thus, the manager of a business entity is in a dilemma of achieving desired tradeoff between liquidity and organization’s performance in order to maximize the value of an organization through an effective working capital management (Adeleke and Mukolu 2013). Business organizations are viewed as an essential element of a healthy and vibrant economy. They are seen as vital to the promotion of an enterprise culture and to the creation of jobs within the economy (Bolton Report, 1971). An aspect of business organization specifically Small Medium-Sized Enterprises (SMEs) are believed to provide an impetus to the economic progress of developing countries and its importance is gaining widespread recognition. Equally in many developing the SMEs occupy a central place in the economy, accounting for 90% of business stock (those employing up to 50 employees) and employing approximately 25% of private sector employees (Wignaraja and O’Neil, 1999; CSO, 2003; NPF, 2004). Storey (1994) notes that small organizations, however, they are defined, constitute the bulk of enterprises in all economies in the world. Again, the multinational companies also are very essential in creation of employment opportunities and promotion of overall economic growth of the economy. Therefore the performance of these businesses is very germane to the growth of the economy. However, given their reliance of many business organizations on short-term funds, it has long been recognized that the efficient management of working capital is crucial for the survival and growth of these organizations (Grablowsky, 1984; Pike and Pass, 1987). A large number of business failures have been attributed to inability of financial managers to plan and control properly the current assets and current liabilities of their respective organizations (Smith, 1973). Working capital management is of particular importance to the business organizations. Some business organizations have limited access to the long-term capital markets, these organizations tend to rely more heavily on owner financing, trade credit and short-term bank loans to finance their needed investment in cash, accounts receivable and inventory (Chittenden et al, 1998; Saccurato, 1994). However, the failure rate among these types of businesses is very high compared to that of large businesses. Studies in the UK and the US have shown that weak financial management - particularly poor working capital management and inadequate long-term financing - is a primary cause of failure among businesses (Berryman, 1983; Dunn and Cheatham, 1993). The success factors or impediments that contribute to success or failure are categorized as internal and external factors. The factors categorized as external include financing (such as the availability of attractive financing), economic conditions, competition, government regulations, technology and environmental factors. While the internal factors are managerial skills, workforce, accounting systems and financial management practices. Some research studies have been undertaken on the working capital management practices of both large and small organizations in India, UK, US and Belgium using either a survey based approach (Burns and Walker, 1991; Peel and Wilson, 1996) to identify the push factors for organizations to adopt good working capital practices or econometric analysis to investigate the association between working capital management and organization’s performance (Shin and Soenen, 1998; Anand, 2001; Deloof, 2003). Specific research studies exclusively on the impact of working capital management on corporate organization’s performance of the small manufacturing companies are scanty, especially for the case of Nigeria. Keeping this in view and the wider recognition of the potential contribution of the business organization as a key player in the real sector of the economy of developing countries, the performance of these organizations is key to a country’s economic growth and working capital management is very germane to accelerating their performance (Adeleke and Mukolu 2013).The four financing decisions which the financial manager makes in the day-to-day running of the firm are investment decisions (long-term asset mix); financing decisions (capital-mix); dividend decisions (profit allocation) and the liquidity decisions (short-term asset-mix). None of these four decisions is more important than the other; hence a good financial manager should attach equal importance to these decisions as the firm strives to maximize its value. However, the corporate finance literature had traditionally focused on the study of long-term financial decisions, particularly investments, capital structure, dividends or company valuation decisions (Nazir and Afza, 2009). Short-term assets and liabilities are important components of the total assets of the firm hence; need for their carefully analysis. The management of these short-term assets and liabilities warrants a careful investigation since it plays an important role in firm’s profitability, risk as well as ensuring maximization of the firm’s value (Smith, 1980). Efficient management of working capital is thus a fundamental part of the overall corporate strategy of the firm in creating the shareholders’ value, keeping in mind that an optimal level of working capital will maximize the firms’ value (Deloof, 2003; Howorth and Westhead, 2003). Lack of liquidity (or illiquidity) in extreme situations can lead to firm’s insolvency (Pandey, 2007). However, a conflict exists between profitability and liquidity while managing the current assets of the firm. Where the firm does not invest sufficient funds in current assets, it may become illiquid and therefore risky and could lose profitability as idle current assets would not earn anything, hence, a proper trade-off must be achieved between profitability and liquidity. This requires the development of sound techniques of managing the working capital. There are two main types of working capital policies of the firm viz: aggressive and conservative working capital policies. While the aggressive working capital policies is said to be followed by the firm when it uses more short-term financing than warranted by the matching plan, the firm uses funds for permanent fixed assets for short-term financing, the conservative approach involves and depends more on long-term funds for the financing needs of the firm (Pandey, 2007).However, working capital management is considered to be a very important element to analyze the organizations’ performance while conducting day to day operations, by which balance can be maintained between liquidity and profitability. Maintaining liquidity on daily base operation to make sure it’s running and meets its commitment is a crucial part required in\ managing working capital. It is a difficult task for mangers to make sure that the business functions and runs in well-organized and advantageous manner. There are chances of inequality of current assets and current liability during this procedure Organization’s growth and profitability will be affected if this occurs and organization manger wouldn’t be able to manage it efficiently. According to Harris (2005) Working capital management is a simple and straightforward concept of ensuring the ability of the organization to fund the difference between the short term assets and short term liabilities. Nevertheless, complete mean and approach preferred to cover all its company’s activities related to vendors, customer and product. (Hall, 2002). Now a day working capital management is considered as the main central issues in the organizations and financial managers are trying to identify the basic drivers and level of working capital management (Lamberson, 1995).The purpose of this study is to identify whether the performance of organizations are affected by working capital management in some selected companies quoted on Nigerian Stock Exchange (NSE). It has to establish the relationship between liquidity and organization’s performance considering Return on Assets (R.O.A) and Return on Equity (R.O.E). This study is very important for the managers of many business organizations as it will help them to set tradeoff between their liquidity and their performance of organizations. Specific research studies exclusively on the impact of working capital management on corporate performance of the business organizations appears to be scanty, especially for the case of Nigeria. Consequently, our study is a modest attempt to measure and analyse the trend of working capital investment and needs of business organizations. The major problem of working capital management in a profit making organization is its optimization which is inherently complex, It is a matter of balancing each component and each organization need to manage it carefully in order to maintain low working capital and the resources they need to fund product development, make and deliver products and offer high levels of customer services. It was observed that poor working capital management in many profit making organizations has resulted into distress in profitability and erosion of equity.This study, therefore, attempts to carry out a comparative analysis on working capital management of brewery companies in Nigeria.

2. Literature Review

- Prior studies reported that working capital management may have an important effect on the organization’s profitability. Shin and Soenen (1998), Lazaridis and Tryfonidis (2006), Raheman and Nasr (2007), among others, measured working capital with cash conversion cycle, which consists of stockholding period, debtors’ collection period and creditors’ payment period. These researchers supported that greater investment in working capital (the longer cash conversion cycle) leads to reduction in the organization’s profitability (Banos-Caballero et al, 2010, and Nazir and Afza, 2003, 2009). Deloof (2003) used a sample of Belgian organizations and found that organizations can increase their profitability by reducing the debtors collection period and the days-in-inventory period. He also found that less profitable organizations wait longer to pay their bills. Wang (2002) used a sample of Japanese and Taiwanese organizations and found that a shorter cash conversion cycle would lead to a better organization’s operating performance. Teruel and Solano (2007) took samples of small to medium-sized Spanish organizations for the 1996-2002 period and found that the organizations can create value by reducing the days-in-inventory period and the debtors collection period, thus leading to the reduction in the cash conversion cycle. On the other hand, though, other researchers support that investing more in cash conversion cycle (conservative policy) may lead to increased profitability since maintaining high inventory levels is expected to increase sales, reduce supply costs, reduce cost of possible interruption in production and protect against price fluctuations (Blinder and Maccini, 1991). A higher debtors’ collection period may also strengthen the relationship with customers and hence may lead to an increase in sales revenue (Ng et al, 1999). Deloof (2003) showed that a relatively huge amount of organizations’ assets are reserved for working capital. Summers and Wilson (2000) also stated that more than 80% of the daily business transactions in the UK corporate sector is on credit terms. As it can be seen from the aforementioned empirical evidence, there are inconclusive and inconsistent results with regard to the role of working capital management on organizations’ financial performance. This is due to the fact that researchers used either the conversion cycle as it relates to the organization’s profitability or they examined only part of the components of the conversion cycle. Dong (2010) reported that the organizations’ profitability and liquidity are affected by working capital management in his analysis. Pooled data are selected for carrying out the research for the era of 2006-2008 for assessing the companies listed in stock market of Vietnam. He focused on the variables that include profitability, conversion cycle and its related elements and the relationship that exists between them. From his research it was found that the relationships among these variables are strongly negative. This denote that decrease in the profitability occur due to increase in cash conversion cycle. It is also found that if the number of days of account receivable and inventories are diminished then the profitability will increase numbers of days of accounts receivable and inventories. Mohammad Neab and Noriza BMS (2010) worked on crating the relationship between Working Capital Management (WCM) and performance of organizations. For their analysis they chose the Malaysian listed companies. They administered the perspective of market valuation and profitability. They used total of 172 listed companies from the databases of Bloomberg. They randomly selected five year data (2003-2007). This research likewise the researches quoted before studied the impact of the dimensions of working capital component i.e. C.C.C., current ratio (C.R.), current asset to total asset ratio (C.A.T.A.R), current liabilities to total asset ratio (C.L.T.A.R.), and debt to asset ratio (D.T.A.R.) in effect to the organization’s performance whereby organization’s value dimension was taken as Tobin Q (T.Q.) and profitability i.e. return on asset (R.O.A.) and return on invested capital (R.O.I.C). They applied two different techniques for analyzing the data that are multiple regression and correlations. They found that there is a negative relationship between working capital variables and the organization’s performance.As one of the basic decisions in corporate finance, besides the capital structure decisions and capital budgeting decisions, working capital management is a very important component of corporate finance since efficient working capital management will lead a firm to react quickly and appropriately to unanticipated changes in market variables, such as interest rates and raw material prices, and gain competitive advantages over its rivals (Appuhami, 2008). Managers spend a considerable time on day-to-day working of capital decisions since current assets are short lived investments that are continually being converted into other asset types (Rao, 1989). In the case of current liabilities, the firm is responsible for paying obligations mentioned under current liabilities on a timely basis.Liquidity for the on-going firm is reliant, rather, on the operating cash flows generated by the firm’s assets (Soenen, 1993). As a result, working capital management of a company is a very sensitive area in the field of financial management (Abuzayed, 2012).Working capital management is concerned with the problems that arise in attempting to manage the current assets, the current liabilities and the interrelationship that exists between them. Not being able to maintain a satisfactory level of working capital, it is likely to become insolvent and may even be forced into bankruptcy. Altman’s (1968) multivariate predictor model based on US companies includes working capital as one of the model components. Using data drawn from the UK companies, Taffler (1982) developed a four variable model of failure prediction. All the four variables include a variant on working capital as a component. The current assets should be large enough to cover its current liabilities in order to ensure a reasonable margin of safety. Each of the current assets must be managed efficiently in order to maintain the liquidity of the firm while not keeping too high a level of any one of them. Each of the short-term sources of financing must be continuously managed to ensure that they are obtained and used in the best possible way. The basic ingredients of the theory of working capital management focused on the trade-off between profitability and risk which is associated with the level of current assets and liabilities.Subsequently, working capital management decisions are not taken as long-term decisions (Abuzayed, 2012). Managers apply different criteria in decision making: the main considerations are cash flow or liquidity and profitability or return on capital (of which cash flow is probably the more important).The previous literature of working capital management has concluded that companies can increase their profitability by shortening the CCC (Shin and Soenen, 1998; Deloof, 2003; Lazaridis and Tryfonidis, 2006; Grosse-Ruyken et al., 2011), but there are also arguments against a short CCC. A long cycle time of inventories reduces the risk of delivery interruptions, price fluctuations and business losses due to scarcity of products (Blinder and Maccini, 1991; Wang, 2002), and a company can sometimes achieve higher sales and strengthen its customer relationships with a generous trade credit policy (Long et al., 1993; Deloof and Jegers, 1996; Shah, 2009). Most of the empirical studies support the traditional belief about working capital and profitability that reducing working capital investment would positively affect the profitability of firm (aggressive policy) by reducing proportion of current assets in total assets.While a large number of studies examined factors affecting working capital management less number directly examined the affect on firms’ performance. The empirical question whether a short cash conversion cycle is beneficial for the company profitability has been questioned in the previous literature. Shin and Soenen (1998) argued that firm can have larger sales with a generous credit policy, which extends the cash cycle. In this case, the longer cash conversion cycle may result in higher profitability. However, the traditional view of the relationship between the cash conversion cycle and firms’ profitability is that, ceteris paribus, a longer cash conversion cycle hurts the profitability of a firm. Deloof (2003) found that the way working capital is managed has a significant impact on the profitability of businesses. He used a sample of 1,009 large Belgian non-financial firms for the period of 1992-1996. However, used trade credit policy and inventory policy are measured by number of days accounts receivable, accounts payable and inventories, and the cash conversion cycle as a comprehensive measure of working capital management. He founds a significant negative relation between gross operating income and the number of day’s accounts receivable, inventories and accounts payable.Thus, he suggests that managers can create value for their shareholders by reducing the number of day’s accounts receivable and inventories to a reasonable minimum. He also suggests that less profitable firms wait longer to pay their bills.Lazaridis and Tryfonidis (2006) investigated the relationship of corporate profitability and working capital management for firms listed at Athens Stock Exchange. They reported that there is statistically significant relationship between profitability measured by gross operating profit and the Cash Conversion Cycle. Furthermore, Managers can create profit by correctly handling the individual components of working capital to an optimal level.Padachi (2006) has examined the trends in working capital management and its impact on firm’s performance for 58 Mauritian small manufacturing firms during 1998 to 2003. He explained that a well designed and implemented working capital management is expected to contribute positively to the creation of firm’s value. The results indicated that high investment in inventories and receivables is associated with low profitability and also showed an increasing trend in the short term component of working capital financing.Akinwande (2010) averred that the management of working capital impacts on liquidity, investment portfolio and profitability. All these three factors are decisive in the growth or failure of a business. Hence, good performances in working capital management affects these decisive factors favourably and thus, contribute to growth and success of the business.His work is based on the theory that efficient management of working capital is very vital for a business survival.This is premised on the fact that having too much working capital signifies inefficiency, whereas too little cash at hand signifies that the survival of the business is shaky.Abel (2008) examines the impact of working capital management on cash holdings of small and medium-sized manufacturing enterprises in Sweden. The aim of the work is to theoretically derive significant factors relating to working capital management which have an influence on the cash level of manufacturing firms. He tested these with a large sample of Swedish manufacturing SMEs. The theoretical framework for his study consists of a treatise of motives for holding cash, working capital management and cash level. He discovered that efficient working capital is positively related to cash holding.Generally, working capital policy is somewhat related to manufacturing firms in terms of its operations. In relation to the profit motive reasons for which an owner-manager operates a business, there is no obligation to account for their actions in regard of working capital management. Thus, the management of working capital is influenced by this style of running the small enterprise. Operations of manufacturing firms in Nigeria were found to relate to the working capital policy in the quest to be efficient and timely.

2.1. The Concept and Definition of Working Capital

- The importance of efficient working capital management is not new to the finance literature. The efficient management of working capital is more vital in small and medium enterprises than it is for large organizations particularly as they are not likely to have access to financial expertise like the large enterprises (Peel and Wilson 1994). Different people use the term “working capital” differently, Khan, Jain (2007) argue that there are two concepts of working capital; gross and net. The term gross capital also referred to as working capital means the total current assets of a business. The term net working capital can be defined in two ways (1) net working capital (NWC) is the difference between current assets and current liabilities; (ii) that portion of current assets which is financed with long-term funds. Working capital is usually defined as the current assets less current liabilities. The major elements of current assets are inventories, accounts receivables and cash (in hand and at bank) while that of current liabilities are accounts payable and bank overdrafts. According to Atrill (2006) working capital represents a net investment in short term assets. These assets which are continually flowing (circulating) into and out of the business are essential for day-to day operations.

2.1.1. Working Capital Management

- According to Machiraju (1999), working capital management involves administration of current assets and current liabilities which consists of optimizing the level of current assets in partial equilibrium context. Working capital management involves the relationship between a firms‟s short –term assets and its short- term liabilities. Osisioma (1977) also describe working capital as regulation, adjustment, and control of the balance of current asset. In order to manage working capital efficiently, he notes that there must exist two elements as necessary components and desirable quantities. He further demonstrated that good working capital management must ensure acceptable relationship between components of a firm so as to make an efficient mix, which guarantee capital adequacy. Thus, working capital management should make sure that the desirable quantities of each component of working capital are available for management. Khan and Jain (2007) also stress that working capital management is concerned with the problems that arise in attempting to manage the current assets, the current liabilities and the interrelationship that exists between them. Working Capital Management involves the relationship between a firms‟s short –term assets and short –term liabilities. The goal of working capital management is to ensure that a firm is able to continue its operations and that it has sufficient ability to satisfy both maturing short-term debt and upcoming operational expenses. Working Capital Management also refers to the decisions relating to working capital and short-term financing and it involves managing the relationship between a firm‟s short-term assets and its short-term liabilities. The goal of working capital management is to ensure that the firm is able to continue its operations and that it has sufficient cash flow to satisfy both maturing short-term debt and upcoming operational expenses. Working capital entails short-term decisions generally relating to the next one year period which are “reversible”. These decisions are therefore not taken on the same basis as Capital Investment Decision (NPD) rather they will be based on cash flow and or profitability. Management will use a combination of policies and techniques of working capital. These policies aim at managing the current assets (generally cash and cash equivalent, inventories and debtors). Khan and Jain (2007) also stress that working capital management is concerned with the problems that arise in attempting to manage the current assets, the current liabilities and the interrelationship that exist between them. The goal of working capital management is to manage the firm's current assets and liabilities in such a way that satisfactory level of working capital is maintained in the business. According to Horne (2000) working capital management is the administration of current assets in the name of cash, marketable securities, receivables, inventories. Block and Hirt (1992) are of the view that, working capital management involves the financing and management of the current assets of the firm.

2.1.2. Working Capital Policy

- Working capital policy is basically about how much working capital the company should maintain should they go for zero risk management, or can they try a bit of daredevilry in their working capital management. Working capital policy involves decisions about company’s assets and liabilities- what they consist of, how they are used, and their mix affect the risk versus return characteristics of the company. Working capital policies, through their effect on the firms expected future returns and risk associated with these returns, untimely have an impact on shareholder wealth. Effective working capital policies are crucial to a firm's long-run growth and survival (Meyer et al 1992). According to Western and Copland (1989) there are two policies of working capital. The first policy deals with the determination of the level of total current assets that should be held by the firm. The option available under this policy boarder on aggressive, conservatism or average management of a firm's working capital. The second policy confronting management concerns the relationships among types of assets and the way these assets are financed. Typical working capital policy decisions involve a determination of the appropriate level of cash, accounts receivable, and inventory that the firm should maintain. On the financing side, we must determine whether to carry these through credit extension from our supplier, short-term bank loans, or longer-term credit arrangement (Block, & Hirt 1989).

2.1.3. Working Capital Cycle

- In a business cycle, cash flows into, around and out of the business. Cash is life blood of a business, and a manager's key mission is to assist in keeping it to flow and to take the advantage of the cash-flow in making profits. A business that is operating profitably, in theory is generating cash surpluses. If it does not generate surpluses, then the business ultimately will run out of cash and expire. The more speedily the business gets bigger the further cash it will need for working capital and investment. The cheapest and best sources of cash exist as working capital right within business. Better management of working capital generates cash, and will assist in improving profits and lessen risks. Hence, it is imperative to note that the cost of offering credit to customers and holding stocks may signify a significant percentage of a company's total profits.There are two elements in a business cycle that absorb cash, these are - receivables (debtors that owe you money) and inventory (stocks and work-in-progress). Major sources of cash are Payables (payment from your creditors), and Equity and Loans.

2.1.4. Element of Working Capital

- InventoryThe supplies, work in process merchandise and finished goods that are ready for sale in the market. The inventory is the part of assets of the firm. A specific part of inventory is very necessary to keep with him because it is the source of our revenue and earnings. The linkage between the elements of working capital management (WCM) shows that decision about any of these elements affect the remaining elements and performance of other units of the firm (Sartoris et., 1983). The decision making about inventory value a lot about firm performance, if a firm takes high level of inventory, it will face risk of unused inventory so in this case other WCM elements (payables and receivables) will contribute to the risk and respond to decrease the level of finished goods to increase the profit. According to McInnes (2000), 94 percent of firms never build linkage between their WCM elements. One of the important scales for the efficient management of inventory is turnover. We calculate turnover by dividing annual sales with the average inventory. It specifies that how efficiently our invested cash in that inventory are generating benefits for us (Rose, 1979). The strength of working in the investment of inventory depends on strength of relation with turnover. Larger turnover results into larger efficiency. Therefore, by reducing the level of holding inventory we can increase turnover rates. Sometimes the reduction in the inventory level may cause shortage of inventory to customers in the required time (Coyle et., 1992).Returns on Assets Return on assets means how much a firm generates profits and effectiveness with given resources. It is also called return on investment (ROI). A study was made on the correlation of operating performance and liquidity in two countries (Japan plus Taiwan) (Wang, 2002). He also checks it out the correlation among value of firm plus liquidity. He takes the results and found that there was indirect relationship between return on equity, return on assets and CCC. He pointed out that although there must be dissimilarity into monetary structure as well as constitution distinctiveness of both states. Nevertheless, if the liquidity is high then the performance is also better that direct affected the firm’s value.Sales The term sales means selling a product or service for returns of money or reward. Shin and Soenen (1998) argued that by adopting efficient credit policy, organizations can increase their sales and increasing in sales may results into larger cash cycle and larger cash cycle increase the profitability of the organization. However, usually the long cash conversion cycle affects the profitability of the organizations.Size Size means how much a company retains of resources. The firm’s volume extent to their functions in developing and progressing countries that is significant to the firms working in growing markets. In growing markets, the firms are typically low size with incomplete contact to longer period capital markets. Those firms are likely to depend on extra serious proprietor financing, trade on debt and short time debt funding to their desirable savings cash, receivables and inventories (Chittenden et al, 1998; Saccurato, 1994).Numbers of day’s receivable (NDR) Sales are made on credit and recovery of the payments of these sales in the period is called number of day’s receivable (NDR). The accomplishments of business greatly depend lying on the capability of financial managers to control cash conversion cycle (Filbeck and krueger, 2005). Organization can minimize firm’s debt cost and raise the capital for obtainable ventures through reducing the amount of short term resources. If the firm have more current assets so that it directly affect the profitability. This is because negative relationship between excessive of short term assets and profitability. Gitman (1974) introduced the idea of cash conversion cycle is a critical management component of working capital. Cash conversion cycle is to describe the collection period that firm give for buying of main figure of stock period in which organization attain its sales of completed goods. Richards and Laughlin (1980) operational zed the thought by reflecting the cash cycle that net time gap among cash expenses on buying’s and the final recovery revenue from the sale of goods. The positive method of cash conversion cycle is the number of days means stock in hand and collections negatively the number of day’s costs to the suppliers. The combination of old learning is the parts among the cash conversion cycle. There are three forms. Combination among gains and stock ( Sartoris et al., 1983), combine stock due (see Hadley, 1964; and Haley and Higgins, 1973), and combine parts of working capital (see Damon and Schramm, 1972; Crum et al., 1983). The parts link of working capital means to take action that one part affect another part of the organization (Sartoris et al., 1983). For example, stock managers are to take action at the stage of goods production. The large quantity of stock in other parts working capital (collections and payments) is to contribute as a threat that must be responding a decrease in quantity of final products to draw out an earnings edge. As an outcome, fruitless stock administration will have a cause on company’s prosperity, by scheming payments and danger of not utilizing goods. Unluckily the relationship of researchers among the working capital management latter does not give positive results, McInnes (2000).Numbers of day’s inventory (NDI) An economic evaluation of a firm’s performance to provides financiers an inspiration of how lengthy it gets a business to revolve its stock into sales. Usually, the lesser the number of days the good for firm. However, it is essential to keep in mind that the average inventory is change according to firm to firm and industry to industry. By maintaining the working capital, we also increase our liquidity. By this increasing our liquidity firm value also, increase. When we settle the inventory level more than our need, our production department must be in disturbance. By this, our delivering cost increase (Blinder and Maccine, 1991). Number of day’s receivable, number of day’s payable and number of days inventory as a complete measure of WCM that used for forming trade credit policy and inventory management policy. Deloof (2003) founds number of day’s inventory (NDI), number of day’s receivables and number of day’s payables as significantly negatively correlated with gross operating income. Hence, he proposed that by decreasing the number of day’s receivables and the number of day’s inventory up to a certain level managers of firms can give value to their equity holders.Leverage Leverage means funds take from outsider parties’ likes banks, capital market, money market and other financial institutions. If a business is leveraged, we can say that firm takes loans to purchase assets. Raheman and Nasr (2007) made the research of ninety-four firms listed in KSE and take the results on WCM and profitability. He judged that there is the indirect correlation among profitability and WCM. In addition, they founded that leverage and liquidity have indirect correlation with WCM but size of the firm has direct relationship with profitability. Therefore, WCM is very important component in any type and size of the firm. If we want to increase the firm’s performance then we must check it out those elements that directly or indirectly effect on the working capital. Wilner, (2000) view that the majority firms briefly utilize trade credit in spite of its clear larger cost and trade debt interest rates normally go beyond 16 percent. In 1993, Pakistani firms comprehensive their debts towards clients by investment. Deloof (2003) originate to analyze information from the National Bank of Pakistan that in 1997 no. of days accounts payable are 16 percent to total assets and no. of day’s accounts receivables and no. of day’s inventory are accounted for 21 percent and 24 percent correspondingly. Summers and Wilson, (2000) give arguments on KSE in chemical industry that is more than 80 percent of everyday business dealings based on credit.

3. Methodology

- The research method to be applied in this study is quantitative. Besides, both the historical and ex-post facto research design shall be adopted. The population of this study is the entire brewery companies quoted on the Nigeria Stock Exchange Market. The researcher randomly select sample of two breweries companies out the seven breweries companies quoted in the Nigeria Stock Exchange (NSE). The selection was however justify due to the publicly availability and accessibility of needed data for the selected period. These companies are Guinness Breweries and Champion Breweries. Most of the information and data needed for the study would be gathered from existing literature, relevant journals and from annual reports of the selected companies from 2009 to 2013. Annual data coverage of various years shall be used for the empirical analysis in this research.

3.1. Measurement of Variables

- Ratio Analyses: Ratio analysis is one of the most important and widely used tools of analysing the working capital and its management.The various ratios that will be calculated are as follows:1) Liquidity Ratios: These ratios threw light on the liquidity position of the concern. The following ratios were calculated:i. Current Ratio: Current Ratio = Current Assets/ Current Liabilitiesii. Quick Ratio: Quick Ratio = Current Assets – Inventory/ Current Liabilities2) Activity Ratios: These ratios measure the effectiveness with which an organisation manages its resources on assets.They are also called the turnover ratios because they indicate the speed with which assets are converted or turned over into sales. The various ratios calculated are as follows:a) Debtors Turnover Ratio: = Total Sales/Average Debtorsb) Average Collection Period: = 365/Debtors Turnover Ratioc) Inventory Turnover in days: = Inventory/cost of goods sold*3653) Profitability Ratio: The Net Profit Ratio, calculated, reflects the efficiency of management in manufacturing, selling, administrative and other activities of the concern.i) Profit Before Tax Ratio = Profit Before Tax/Net Salesii) Net Profit Ratio = Net Profit After Tax/Net Sales4) Others: a) Gross Working capital Turnover Ratio= Net sales/ current assetsb) Current Asset to Total Asset Ratio= Current assets/Total AssetCurrent Liabilities to total Asset Ratio= Current Asset/ Total Liabilities

4. Data Analysis

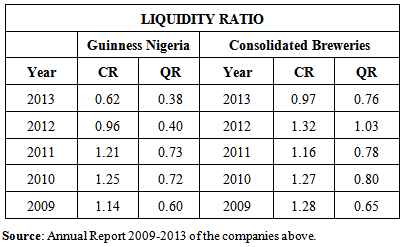

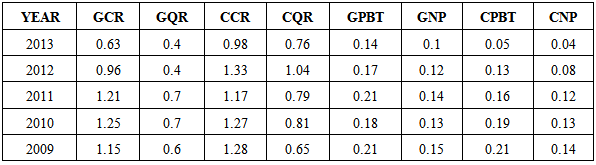

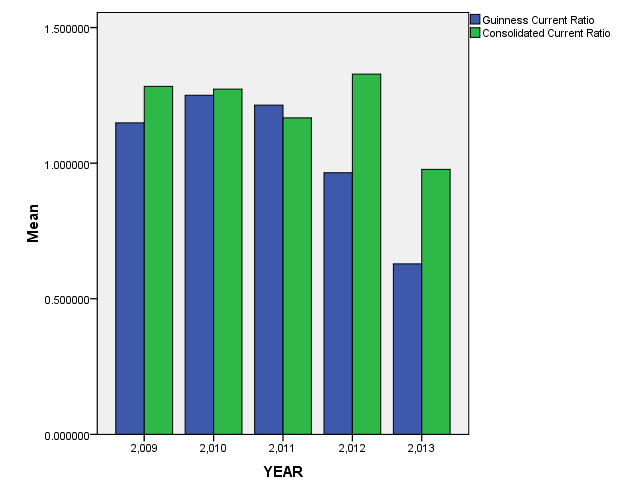

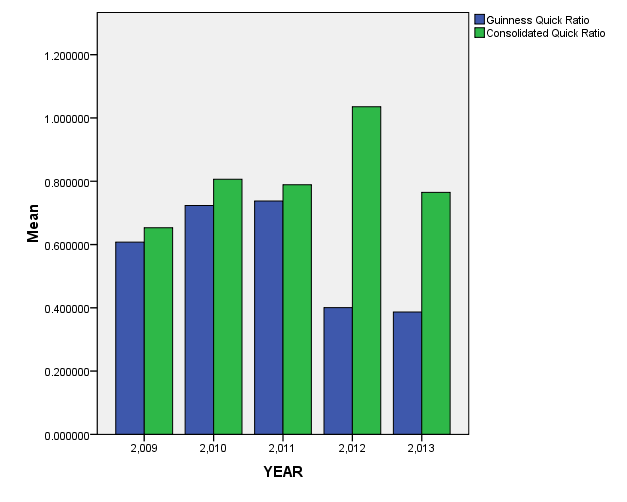

- Interpretations: From table 1 below shows the liquidity ratios of Guinness Nigeria and Consolidated breweries. It shows the current ratio and Quick ratio of the two companies between the period of 2009-2013. Guinness Nigeria record the highest current ratio in 2010 with a ratio of 1.25 while the highest quick ratio was in 2011 with a ratio of 0.73. For Consolidated breweries, the highest current ratio was recorded in 2012 with a ratio 1.32 while the highest quick ratio was in 2012 as well with a ratio 1.03.

|

| Figure 1. Guinness and Consolidated Breweries Current ratio |

| Figure 2. Guinness and Consolidated Breweries Quick ratio |

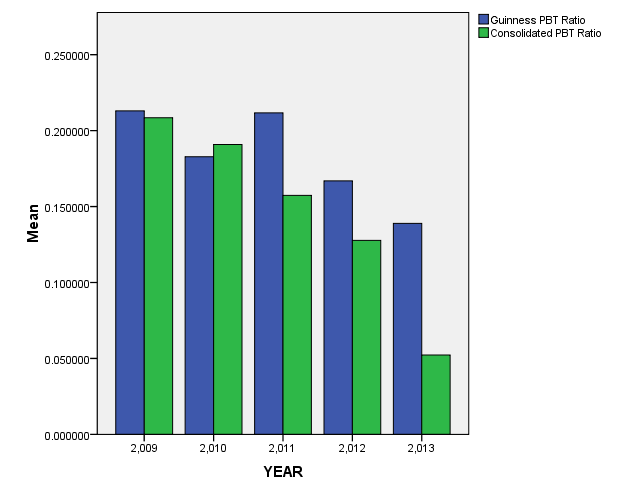

| Figure 3. Guinness and Consolidated Breweries PBT ratio |

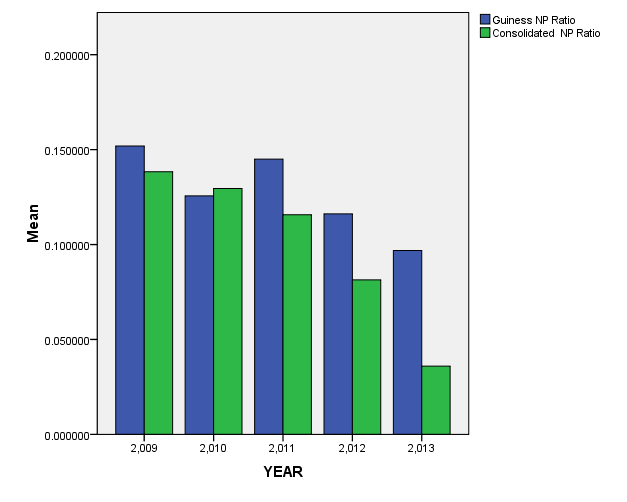

| Figure 4. Guinness and Consolidated Breweries Net Profit ratio |

|

|

|

|

|

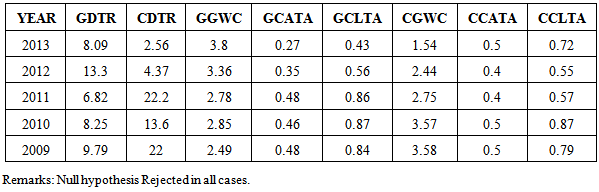

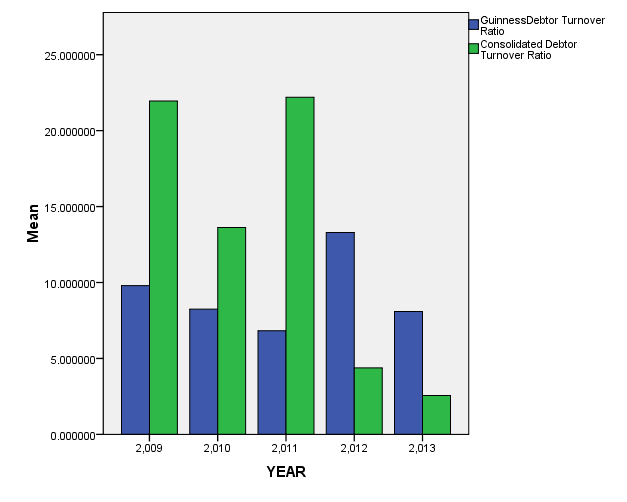

| Figure 5. Guinness and Consolidated Breweries Debtor turnover ratio |

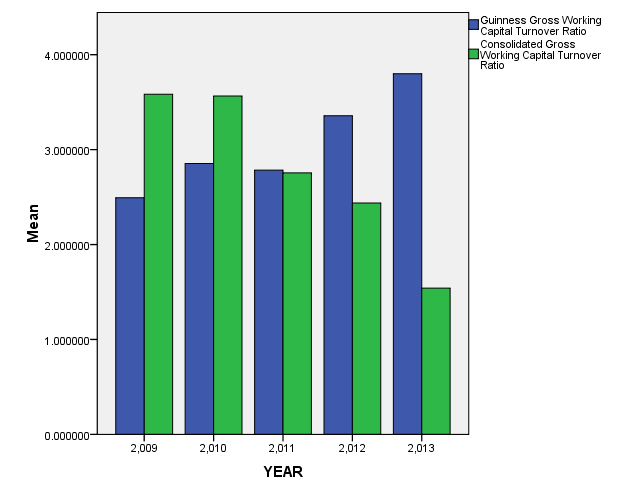

| Figure 6. Guinness and Consolidated Breweries Gross Working Capital Turnover ratio |

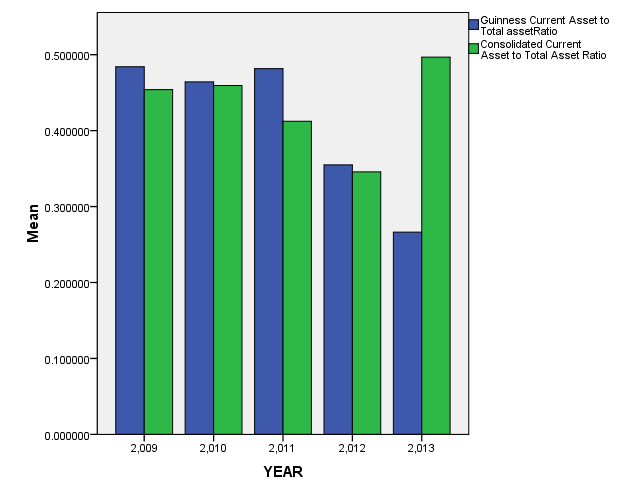

| Figure 7. Guinness and Consolidated Breweries Current Asset to Total Asset Ratio |

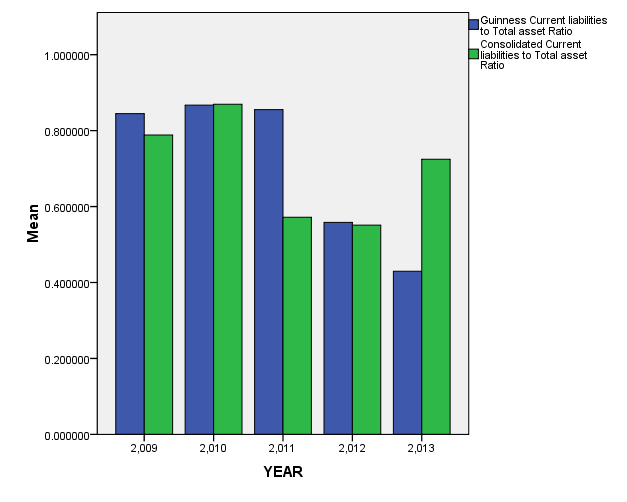

| Figure 8. Guinness and Consolidated Breweries Current Liabilities To Total Asset Ratio |

4.1. Test of Hypothesis

- H0: There is no significant variations in the working capital management of the selected companies (Null Hypothesis)H1: There is significant variations in the working capital management of the selected companies. (Alternate Hypothesis).

4.2. Discussion of Findings

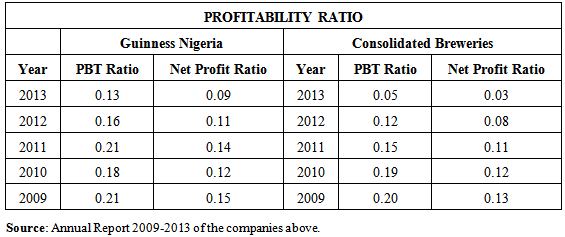

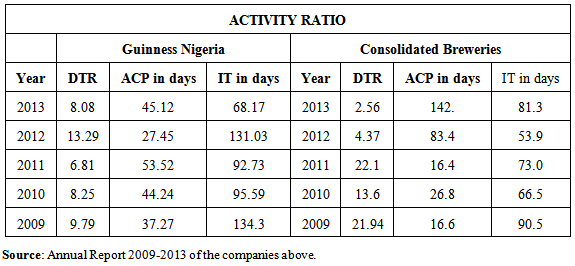

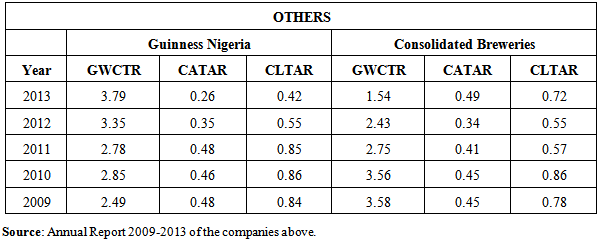

- On the behalf of Working Capital Management it was observed that the working capital amount an average was higher than all other concerns as followed in Guinness Nigeria and Consolidated Breweries. Guinness Nigeria possessed huge amounts of current assets than Consolidated breweries. It was also deduced that inventories and debtors were very high in case of the Guinness Nigeria whereas current liabilities where still on the moderate level except in 2013 which recorded a higher current liabilities than the current asset. Cash balances were comparatively high in both cases. On the behalf of Receivable Management for the companies, it can be concluded that, undoubtedly, the Guinness Nigeria was much more efficient in the management of cash as compared to the Consolidated breweries which was laming in this regard and was way behind it. On the behalf of study of payables management it was observed and concluded that the consolidated breweries was better off than Guinness Nigeria as regard liquidity and payment to creditors as their credit periods were much shorter than the Guinness Nigeria, nevertheless the Guinness Nigeria derived benefits from the massive credit periods.

5. Conclusions

- The Cash Conversion Cycle and Net Trade Cycle offer easy and useful way to check working capital management efficiency. For value creation of shareholders, brewery firm must try to keep these numbers of days to minimum level. The negative association of Average Collection Period with Net Operating Profitability has not been validated using fixed effect model. This shows problems with the collection policy in general for the firms. There exists negative association between Inventory Turnover in Days and Net Operating Profitability for the firm as a whole, which implies that keeping lesser inventories will increase profitability.

5.1. Recommendations

- In order to establish a well-structured working capital management, the following steps are recommended as follows.Working capital management should be the concern of all the manufacturing sectors firms and need to be given due importance. The collection and payment policies of the firms in manufacturing sectors, in general, need to be thoroughly reviewed. It is generally argued that firms need to accelerate their cash collections and slowdown their payments. This can only be possible with some professional advice and supervision. The findings indicate that firm managers / executives can enhance performance of the firms by reducing the number of days in inventories, Cash Conversion Cycle and Net Trade Cycle to a reasonable minimum. This is only possible if the components of Cash Conversion Cycle and Net Trade Cycle (ACP, ITID and APP) may be dealt individually and an optimal / effective policy is formulated for these components. Furthermore, efficient Management and financing of working capital (current assets and current liabilities) can increase the operating profitability of firms.For efficient working capital management, specialized persons in the fields of finance should be hired by the firms for expert advice in the because there are number of firms where there is only one department and one person who is looking after all financial activities of firms including handling of accounts etc.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML