-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(6): 335-340

doi:10.5923/j.ijfa.20140306.01

Direct, Indirect, or Both Methods of Reporting Operating Statement of Cash Flows

Bassam M. Abu-Abbas

Princess Sumaya University for Technology, Amman, Jordan

Correspondence to: Bassam M. Abu-Abbas, Princess Sumaya University for Technology, Amman, Jordan.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

Both IAS 7 and SFAS 95 allow the option of reporting either the direct or indirect method when preparing statement of cash flows. Both the IASB and the FASB consider the direct method as the preferred method of presenting cash flows from operations. Different studies in the literature find that the majority of the companies are using only the indirect method. The purpose of this study is to support one argument of the following: when preparing statement of cash flows, the preparers should use the direct method, the indirect one, or both. This study summarizes the advantages of direct and indirect methods, studies the possibility of using the information available to convert a statement of cash flows using indirect method to direct method, studies the possibilities of using the information available in the financial statement to prepare statement of cash flows using direct method, studies the effect of cost using either method compared with the other one. The results show that we can estimate either the direct method or the indirect method of statement of cash flows but the estimated statement does not give 100% accurate results. If the users of financial statements accept less than 100% accuracy in the statements, then companies can prepare either an indirect or a direct method of statement of cash flows. Otherwise, the company should ask prepares to prepare both methods or use a cost-benefit analysis to determine which method that should be used. My argument ends with maximizing the benefits is achieved by providing statement of cash flows using both direct and indirect methods.

Keywords: Cash flows, Direct, Indirect

Cite this paper: Bassam M. Abu-Abbas, Direct, Indirect, or Both Methods of Reporting Operating Statement of Cash Flows, International Journal of Finance and Accounting , Vol. 3 No. 6, 2014, pp. 335-340. doi: 10.5923/j.ijfa.20140306.01.

Article Outline

1. Introduction

- Debating the form of disclosure of operating cash flows has been central in the development of all cash flows reporting standards over the past three decades. At the heart of this debate has been whether to mandate or allow firms the choice of reporting operating cash flows using the indirect or direct method (Clacher et al., 2013). The International and US reporting requirements are similar. The IAS 7 states that "An entity shall report cash flows from operating activities using either: (a) the direct method …; or (b) the indirect method … entities are encouraged to report cash flows from operating activities using the direct method." (IAS 7, par. 18-19). Similarly, SFAS 95 encourages enterprises to report cash flows from operating activities directly by showing major classes of operating cash receipts and payments (the direct method). Enterprises that choose not to show operating cash receipts and payments are required to report the same amount of net cash flows from operating activities indirectly by adjusting net income to reconcile it to net cash flows from operating activities (the indirect or reconciliation method). Even though both standards encouraged the direct method, Bahnson et al. (1996) report that 97.5% of sample companies in the 1991 Accounting Trends and Techniques publication used the indirect method alone (AICPA, 1992). Krishnan and Largay (2000) find that 97% - 98% of firms report their operating cash flows by the indirect method. They find that only about 2%-3% of firms use the direct method. Foster et al. (2012) indicates that the direct method is more desirable and useful to third-party users; however, most firms report using an indirect method. Brahmasrene et al. (2004) find that, in the manager category, 82% of CEOs, CFOs, and managers preferred the indirect method, compared with 70.3% of investors and analysts. Overall, 78.9% of users prefer the indirect method. Although investors reported a preference for the indirect method, they showed a greater preference for the direct method than managers (29.7% versus 18%).The direct method reports the major items of cash receipts and cash payments in the operating section of the statement. It provides gross inflows and outflows components of cash flows from operations (i.e., cash from customers and cash paid to suppliers). The operating cash flows section of the statement of cash flows under the direct method would include: cash receipts from customers; cash paid to suppliers; cash paid to employees; interest paid; income taxes paid; and cash paid for other operating expenses. The indirect method adjusts accrual basis net profit or loss for the effects of non-cash transactions. It reconciles net income with the cash flows from operations. The operating cash flows section of the statement of cash flows under the indirect method is determined by adjusting profit or loss for the effects of: (a) changes during the period in inventories and operating receivables and payables; (b) non-cash items such as depreciation, provisions, deferred taxes, unrealized foreign currency gains and losses, undistributed profits of associates, and non-controlling interests; and (c) all other items for which the cash effects are investing or financing cash flows (IAS 7, par. 20). Therefore, ‘direct’ and ‘indirect’ refer to methods of presentation of cash flows statements.

2. Advantages of Direct Method

- 1. The direct method is more consistent with the objective of a statement of cash flows "to provide information about cash receipts and cash payments - than the indirect method, which does not report operating cash receipts and payments" (FASB, 1987, par. 111). 2. Assists in prediction models: Empirical studies conclude that direct method disclosures assist with prediction models (e.g., Orpurt and Zang, 2009; Cheng and Hollie, 2008; Clinch et al., 2002; and Krishnan and Largay, 2000). If direct method information is important, sophisticated users may be able to use their influence to obtain the needed information from reporting entities. Orpurt and Zang (2009) conclude that the improved stockprice informativeness of the direct method provides investors with a useful basis for estimating future earnings and cash flows. This information is incremental to the information presented in indirect cash flows.3.Tells the reader whether cash collections from customers are increasing or (decreasing), (Foster et al., 2012).4. Ability to compare similar types of cash receipts and payments across companies at least annually (Richardson, 1991).5.Better representation of an entity's cash cycle for credit-grantors and more user-friendly format for managers not possessing substantial accounting knowledge (O'Leary, 1988). 6. Helpful in cash flows variance analysis as the cash budget can be tied into the cash flows report thereby drawing attention to the real source of any problems (Trout et al., 1993). 7. Facilitates sensitivity analysis of cash flows to volume changes as gross cash receipts and cash payments may respond differently to changes in activity (Cornell and Apostolou, 1992).8. Provides more useful information to both creditors and investors than does the indirect method (Paton, 1963; Sorter, 1982; Thomas, 1982; Nurnberg, 1983; and Heath, 1987). In summary, the direct method is more consistent with the objective of a statement of cash flows, improves the prediction ability of future operating cash flows, and Provides more useful information to both creditors and investors.

3. Advantages of Indirect Method

- 1. Provides more meaningful information (FASB, 1987, par. 113).2. Tells the reader if sales are increasing or (decreasing), (Foster et al., 2012).3. Easier for preparers to create: Golub and Huffman (1984) argue that the indirect method is easier for preparers to create.4. Simple for users to analyze: Rosen and DeCoster, (1969) argue that the indirect method is simple for users to analyze.5. Highlighting the differences between net income and net cash from operating activities (the FASB, 1987, par. 108, states that the indirect method is most useful in extracting the lead and lag between cash flows and income information). 6. Highlighting the operating changes in noncash working capital accounts (Krishnan and Largay, 2000).7. Less cost to implement (Krishnan and Largay, 2000).8. Assists the users in determining the reasons for the difference between net income and associated cash receipts and payments to provide a basis for evaluating the quality of income (Carslaw and Mills, 1991).In summary, the indirect method is easier for preparers to create, simple for users to analyze, highlights the differences between net income and net cash from operating activities, and less cost to implement.

4. Can We Use the Information Available to Convert an Indirect Method Operations Section to a Direct Method?

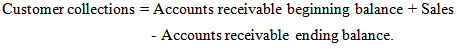

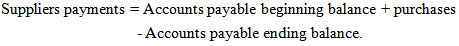

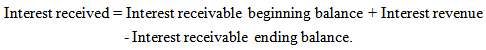

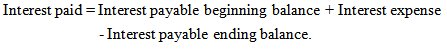

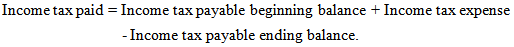

- Since most companies prepare the statements of cash flows using indirect method even though the accounting standards (IAS 7 and SFAS 95) encourage using direct method, the question is: Can we use the information available to convert an indirect method operations section to a direct method? In other words, if the company prepares the statement of cash flows using indirect method, can the users develop the direct method presentation from the indirect presentation? The statement of cash flows using direct method is including "major classes of gross cash receipts and gross cash payments" (IAS 7, para 18). Most likely, the major items that are included in operating section are: cash received from customers, cash paid to suppliers, cash paid to employees, interest received, interest paid, income tax paid, and any other operating cash components that are not included in the above. First, cash received from customers may be calculated using equation (1) below:

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

5. Does It Accurate?

- If accurate forecasts of cash collections and cash payments can be developed using information contained in the financial statements, then the users will not have problems when preparers use the indirect method presentation. In other words, the direct cash flows disclosures are redundant. Krishnan and Largay (2000) provide evidence on the validity a FASB assertion that direct method cash flows information can be determined indirectly without incurring unduly burdensome costs (FASB 1987, pars. 116-118). The authors argue that evidence on this assertion is important because, if accurate forecasts of gross cash collections and cash payments can be developed using information contained in the income statement and balance sheet, then users of financial statements may not be at a loss when preparers do not use the direct method presentation. They find that the median measurement error for cash collected from customers is less than one percent for the pooled sample. For cash paid to suppliers and employees, it is 4.40%. For nearly two-thirds of the sample, the measurement error for cash paid to suppliers and employees is greater than 3%.Krishnan and Largay (2000) results supports the FASB assertion that direct method cash flows information can be determined indirectly but the numbers are not accurate 100%. Bahnson et al. (1996) refute the widespread presumption that the direct method presentation can be easily developed from the indirect presentation. Bradbury (2011) finds that operating cash flows and direct cash flows components (cash from customers and cash paid to suppliers) cannot be reliably estimated from mechanical balance sheet (accruals reversal) procedures. Furthermore, the errorrates are greater when firm-specific events arise (such as acquisitions, discontinued operations and asset growth). Bradbury (2011) argues that studies employing data from the indirect method suffer from estimation and articulation problems leading to unreliable estimates of direct cash flows. Clinch et al. (2002) find that reported direct cash flows components have incremental explanatory power of returns compared to estimates of these components (using accrual reversal methods). Golub and Huffman (1984) show that analysts cannot accurately estimate reported direct cash components.In summary, we can say that estimating the direct method of statement of cash flows does not give accurate results. If, as information users, we accept 95% accuracy in the data, then we can prepare a direct method of statement of cash flows using the indirect method and other data available in the financial statements.

6. Can Users Prepare Statement of Cash Flows Using Indirect Method if it is not Disclosed?

- If the answer is yes, this means that the direct cash flows statement is redundant and there is no benefit for making the direct cash flows statement mandatory. In other words, if analysts can estimate direct cash flows information from the income statement, the change in balance sheet items and notes, then there is no benefit for making the direct cash flows statement mandatory. While if the answer is ‘no’, this will support the argument: “. . . direct method provides information which may be useful in estimating future cash flows and which is not available under the indirect method” (IAS 7 para 19).Some evidence supporting the indirect method is provided by Rue and Kirk (1996), who find that direct cash flows disclosures are not significantly different from estimates made using other available financial statement information, suggesting that the direct cash flows disclosures are redundant.Bradbury (2011) finds that operating cash flows and direct cash flows components (cash from customers and cash paid to suppliers) cannot be reliably estimated from mechanical balance sheet (accruals reversal) procedures. Furthermore, the error rates are greater when firm-specific events arise (such as acquisitions, discontinued operations and asset growth).In summary, 1 find that the results are mixed relating to the ability of estimating direct cash flows information from financial statements. Similar to the results above, we can say that estimating the indirect method of statement of cash flows does not give accurate results. If the users of financial statements accept less than 100% accuracy in the statements, then we can prepare an indirect method of statement of cash flows using the direct method and other data available in the financial statements.

7. Does Cost Matter?

- The FASB is concerned about costs and benefits of accounting standards. Users of financial statements incur costs of collecting, processing, analyzing and interpreting information. The FASB (1987, par. 133-140) states that from society's perspective, such costs should be minimized where possible. Users of financial statements not disclosing direct method information incur additional costs by estimating and collecting this information (Krishnan and Largay, 2000). Golub and Huffman (1984) find that there is not much evidence on the cost of preparing the direct cash flows statement relative to the indirect method. The ‘too costly’ argument should account for the analysts’ costs of processing information. If firms provide the information, there are potentially large savings relating to analysts’ processing costs. For firms that already report the direct method, the marginal cost of retaining the direct cash flows statements is zero. While the marginal cost to the preparer of voluntarily switching to the indirect method might be low, the collective cost of financial analysts wishing to use direct cash flows data will be high.Under the cost, I am raising two issues: First, is it costly for the preparers to develop both direct and indirect methods presentation? The answer is easy. The cost will be higher (but not much) for the preparers but lower for the users. The question now is the priority for minimizing the cost will be given to the preparers or to the users? Definitely the users are more important. In paragraph 12 of the section entitled “The Objective of financial Statements”, International Accounting Standard Board's Conceptual Framework (IASB’s CF) stated that "The objectives of financial statements is to provide information about financial position, performance and changes in financial position of an entity that is useful to a wide range of users in making economic decisions" (IASB, 2006, p. 36).The objectives of financial statements according to the AICPA is "to provide users with information for predicting, comparing, and evaluating enterprise earning power (AICPA, 1973, p. 21)". In addition, SFAC No. 1 states that “Financial reporting should provide information to help present and potential investors and creditors and other users in assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the sale, redemption, or maturity of securities or loans” (FASB, 2008, objective No. 2, par. 37, p.11). According to this issue, we can conclude that preparers should provide the statement of cash flows to users using both direct and indirect methods. Second, if the company decides to use one method, direct or indirect, is it costly for the users to develop the direct method presentation from the indirect or vice versa? If the users are internal with enough excess to the company database, the cost will be almost zero given that the company has a computerized accounting system and the systems contains a report writer software that helps in preparing similar reports. If the users are external or without excess to the company database, the cost will be low since it is easy to develop the direct method presentation from the indirect presentation or vice versa but the problem will be in the accuracy. Prepares will get problem if they are looking for 100% accuracy in their data.

8. Conclusions

- Both the IASB and the FASB consider the direct method as the preferred method of presenting cash flows from operations. The IAS 7 states that "An entity shall report cash flows from operating activities using either: (a) the direct method …; or (b) the indirect method … entities are encouraged to report cash flows from operating activities using the direct method." (IAS 7, par. 18-19). Similarly, SFAS 95 encourages enterprises to report cash flows from operating activities directly by showing major classes of operating cash receipts and payments (the direct method). Previous literature find that the direct method is more consistent with the objective of a statement of cash flows, improve the prediction ability of future operating cash flows, and provides more useful information to both creditors and investors. On the other hand, the indirect method is easier for preparers to create, simple for users to analyze, highlights the differences between net income and net cash from operating activities, and less cost to implement.The purpose of this study is to support one argument of the following: when preparing statement of cash flows, the preparers should use the direct method, the indirect one, or both. The FASB (1987, para. 110) concluded that neither method provides benefits sufficient to justify requiring one and prohibiting the other and that both the direct and the indirect methods provide potentially important information (FASB 1987, para. 119). However, the Board believes that the direct method provides more useful information and encourages firms to follow the direct method (Krishnan and Largay, 2000).The FASB requires that a reconciliation of net income to net cash flows from operating activities be reported in a separate supplementary schedule when using the direct method. The indirect method of reporting operating cash flows, which is identical to the required supplementary schedule in the direct method, reconciles net income to net cash flows from operations (Flecher and Ulrich, 2010). This reconciliation is considered as a preparation of statement of cash flows using indirect method. This means that if the companies choose the direct method, they have to prepare using indirect method.This paper provides evidence that the disclosures available in indirect method of statement of cash flows, income statement, comparative balance sheet and notes disclosures are enough in order to develop the direct method presentation from the indirect presentation. On the other hand, previous literature find some evidence supporting that direct cash flows disclosures are not significantly different from estimates made using other available financial statement information. Overall, the results show that we can estimate either the direct method or the indirect method of statement of cash flows but the estimated statement does not give 100% accurate results. If the users of financial statements accept less than 100% accuracy in the statements, then companies can prepare either an indirect or a direct method of statement of cash flows. Otherwise, the company should ask prepares to prepare both methods (even though this may increase the cost for preparers but decrease it for users because both IASB and FASB give users priorities over preparers)or use a cost-benefit analysis to determine which method that should be used. In summary, we can say direct or indirect or both is a dilemma but it seems that maximizing the benefits is achieved by providing statement of cash flows using both direct and indirect methods. The limitation of this study is that it is only a descriptive analysis study that does not provide empirical evidence to support part of the conclusions. Because providing empirical evidence is not one of the objectives of this study, it will be forthcoming in a separate paper.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML