-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(5): 316-326

doi:10.5923/j.ijfa.20140305.06

Interactions between Retained Earnings and Provision for Depreciation in Nigeria Brewery Industry

Oliver Ike Inyiama

Department of Accountancy, Enugu State University of Science and Technology, Enugu State, Nigeria

Correspondence to: Oliver Ike Inyiama, Department of Accountancy, Enugu State University of Science and Technology, Enugu State, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

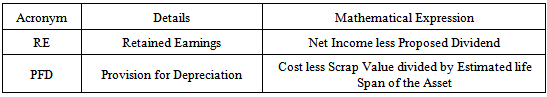

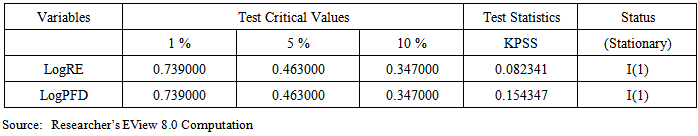

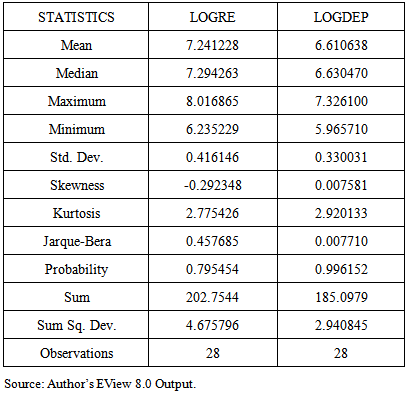

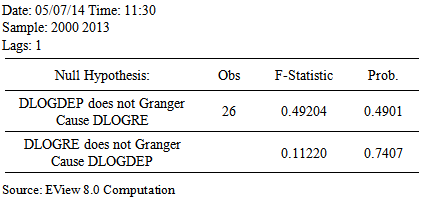

The aim of the study is to determine the direction and significance of the interactions between retained earnings and provision for depreciation in creating a pool of internal funds for asset replacement, investment and growth of the Nigeria brewery industry from 2000 to 2013. Engle and Granger 2-step cointegration and correlation approach was adopted in the analysis with an estimation of an error correction model. Stationarity of time series data were tested adopting the Augmented Dickey Fuller (ADF), Phillips-Perron (PP) and the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) procedures. All the study variables were integrated of the same order I(1), signaling cointegration. Provision for Depreciation has a short term positive and significant effect on retained earnings while the long run coefficient shows a negative and significant influence at 5 percent level of significance, in line with a priori expectations. The error correction mechanism suggests that deviations from equilibrium are corrected at approximately 44% per annum, implying that the distortions affecting retained earnings in the long run could be corrected in approximately two years and three months. There is no causality running from either retained earnings to provision for depreciation or otherwise, both at 1 year and 2 years lagged periods; implying that retained earnings do not granger cause provision for depreciation and vice versa. Adequate provision for depreciation is recommended because it is part of corporate retentions which does not involve actual cash movement; hence it significantly provides an internal source of funds for replacement of fixed assets, expansion and growth of the brewery industry.

Keywords: Retentions, Depreciation, Brewery, Cointegration, Correlations, Causality

Cite this paper: Oliver Ike Inyiama, Interactions between Retained Earnings and Provision for Depreciation in Nigeria Brewery Industry, International Journal of Finance and Accounting , Vol. 3 No. 5, 2014, pp. 316-326. doi: 10.5923/j.ijfa.20140305.06.

Article Outline

1. Introduction

- Breweries and other companies may retain part of their annual earnings after dividend payout to ordinary shareholders for reinvestment in shares of other companies, debt settlement, acquisition of plant and machineries, establishment of new production lines, diversification of products and business, establishment of new branch offices and acquisition of an existing company to widen its production or distribution base. Okwo, Ugwunta and Agu (2012) stated that the industry contributes about a quarter of Manufactured Value Added in Nigeria and it has about four listed companies namely Nigerian Breweries Plc, Guinness Nigeria Plc, Champion Breweries Plc and International Breweries Plc which shares are presently and actively being traded on the floor of Nigerian Stock Exchange. The industry produces beer and other non-alcoholic drinks such as juice. In Nigeria, the industry is one of the oldest economic institutions. The firms within the industry attract huge foreign investments which enhance industrial output and indirect employment in Nigeria (Ola, 2001). Production ofbeer in commercial quantity commenced in Nigeria by 1949, with Nigeria Breweries Limited building its first brewery at Igunlu, Lagos State (Okwo and Ugwunta, 2012). They argued that Nigerian Breweries Limited had monopoly of beer production until 1962. Golden Guinea, Guinness, West Africa Breweries and North Breweries were built in 1962, 1963, 1964 and 1970, respectively to compete with Nigeria Breweries Limited.Wright (2014) points out that retained earnings of companies become equity and consequently appear on the balance sheet as a component of owners' equity which also includes initial investment capital and additional paid-in capital. In order words, a company should make use of available opportunities to create reserves through retained earnings to boost investments and grow corporate earnings. Horkan (2014) in his study explained that retained earnings are retained capital, which is the portion of net income that management keeps to fund future growth and to pay down company debt. On his own account, Merritt (2014) submits that retained earnings represent value "locked up" in the company, which do not represent cash on hand but could be theoretically released to the owners if the company were liquidated. Managers could manipulate earnings upwards by (among other things) accelerating recognition of revenue, deferring recognition of expenses, altering inventory accounting methods, changing estimates of bad debt, and revising assumptions related to pension assets (Daniel, Denis and Naveen, 2007) but shareholders must resist this because of their reversal implications. Depreciation provisioning is another level of corporate retention. Expenditure on assets of the business like buildings, furniture, fixtures and fittings, motor vans, machines and equipments, which gives service to the business for many years and thus called fixed assets, are neither expenditure on purchase of goods nor expenses (STS Tutorials, 2013). Provision for depreciation accounts for the reduction in value of these fixed assets as a result of usage, passage of time, changes in technology and other environmental factors. The value of each class of fixed assets is lowered each year on financial statements and on tax returns for a set period of time representing its useful life (McNulty, 2014). However, Onojah and Unegbu (2013) opines that the theory and practice of depreciation provisioning have not generally unified the fixed amount to be charged as annual expenses in the income statement and balance sheet for each class of fixed asset due to different meanings and computations occasioned by environmental and technological differences. They added that the word depreciation has been grossly over worked, over used, over stressed and above all has varying senses with different connotations even among intra and inter group disciplines. Man and Dima (2011), in line with the International Accounting Standards, supports that depreciation represents the size of the positive difference between the accounting value of an asset and its retrievable value and this is the case when the asset is considered to be depreciated. In addition, they explained that when retrievable value is higher than accounting value, the asset value is said to appreciate, and such appreciation is not captured in the financial statements by accountancy profession due to the principle of prudency; unless the asset is professionally revalued. Iga (2008) argues that an understanding of an organization’s depreciation expense is vital when making decisions about the level and nature of services to provide based on a sound knowledge of the full costs of providing all services, while ensuring that all costs are included in pricing decisions. These reserves provide a cushion to deal with operating deficits that may arise because of unexpected events, economic uncertainties or lean funding periods (Thornton, 2010). In terms of policy decisions, Doepke (2004) submits that retained earnings also matter for the transmission of monetary policies because they affect the overall balance between different uses of funds in an organization.The intention to fulfill the expectations of investors and financial markets increasingly dominates reserve accumulation motives which, as Shayne (2013) opines, is the cornerstone of financial flexibility. Wu and Yeung (2010) stated that the tradeoff between retentions and distribution of profits that motives the lifecycle theory of dividends is largely consistent with the disciplining explanation, and is important to firms that potentially have agency problems. Citing Myers and Majluf (1984), Kim and Suh (2010) posits that according to the pecking order theory, firms do not seek to maintain a particular leverage but, because of adverse selection costs, firms prefer internal financing (retained earnings and other retentions) and prefer debt to equity when raising external financing. They argued that although retained earnings are a key item in shareholders’ equity, existing finance literature has paid little attention to the variable. The study by DeAngelo, DeAngelo and Stulz (2006) only examined the extent to which dividend is determined by retained earnings.This study, therefore, aims at examining the interactions between retained earnings and provision for depreciation among selected firms in the Nigeria brewery industry. The remaining part of the paper is arranged into four sections. Section 2, reviews literature in related areas, section 3 states the methodology applied for analysis of data, section 4 discusses the empirical results as presented while section 5 concludes after summarizing the research outcome.

2. Review of Related Literature

- Companies all over the world are increasingly becoming aware of the importance of financial management, with emphasis on investment and retention policies, as a veritable tool for efficient business management. It is the responsibility of the management to establish these corporate policies for effective and efficient internal control, performance evaluation and reserve management. Business managers evolve flexible and feasible financial policies to ensure the realization of its corporate targets (Nwude, 2007). Breweries in Nigeria especially the Nigeria Breweries Plc and Guinness Nigeria Plc create capital reserve for long-term capital investment projects or other large anticipated future expenditures. The reserve is made to guarantee availability of fund to finance their anticipated projects which might include fixed asset replacements that were neither expenditure on purchase of goods nor period expenses. The two breweries mentioned above are the leaders of the highly capital intensive industry in Nigeria which largely automated their production lines. They invest so much on heavy equipments and fixed assets resulting in huge capital outlay which has to be accumulated over time.Segal and Spivak (1986) did a study on firm size and optimal growth rate through reinvestment of retentions and concluded that by retaining earnings and reinvesting them in the firm, the firm can change the parameters governing the stochastic process, increasing the probability of multiplication and reducing the probability of disappearance. Thus the firm’s decision variable is the size of the retained earnings. In compliance with the signaling theory, Khan (2009) examined the Determinants of Share Price Movements in Bangladesh with emphasis on Dividends and Retained Earnings. The study strives to establish the relative importance of dividends, retained earnings, and other determinants in the explanation of stock prices in Bangladesh with particular stock price of the companies associated with Dhaka Stock Exchange, an emerging capital market of Bangladesh. The study applied dividend theory, information contents, theory of information asymmetry, signaling theory, clientele effect theory to explain the basic concepts that is used to analyze the results. The study found that dividends, retained earnings and other determinants have dynamic relationship with market share price. Findings also suggest that the overall impact of dividend on stock prices is comparatively better that that of retained earnings and that expected dividends play an important role in the determination of stock prices whatever determinants, like lagged price earnings ratio or lagged price, are considered.Dutta and Reichelstein (2001) examined a multi period principal-agent model in which a divisional manager has superior information regarding the probability of an investment project available to his division. They argued that the manager’s effort is assumed to increase the periodic cash flows of his division. By adopting a depreciation method which matches periodic project cash flows with an appropriate share of the initial investment expenditure, they believed that the principal creates robust investment incentives for the fund managers. The bonus coefficients attached to residual income can then be freely adjusted to address the underlying moral hazard problem without altering the agent’s investment incentives. This is expected to impact positively on financial performance of the firm as such flexibility is also essential in order for the same performance measure to accommodate an entire range of agency problems.In a study carried out by Thornton (2010), he explained that for not-for-profit organizations, and indeed, for all organizations, maintaining adequate retentions is essential to establishing financial stability as these retentions provide a cushion to deal with operating deficits that may arise because of unexpected events, economic uncertainties or lean funding periods. He observed that a number of organizations that did not put aside sufficient funds in the past few years to withstand financial shortfalls and deliver on their missions, no longer exist today. He emphasized that maintaining insufficient reserves can put an organization at risk, but maintaining excessive reserves can also be problematic. He submits that a number of organizations have been criticized for retaining excessive reserves. To ensure the long-term viability of the organization and the sustainability of the programs it provides, he suggests a balance between profitability and liquidity for safety and that Boards and management that have not already done so need to assess what levels of reserves their organizations require given their missions and plans, facilities, structures, funding sources, and a number of other considerations.Thirumalaisamy (2013) observed that growth of corporate firms in India is to a large extent financed by retained earnings and this creates growth opportunities. The study posits that there are no transaction and bankruptcy costs associated with retained profits and this makes retained earnings a major source of finance for brewery firms. The study analyses potential variables, with the help of correlation and multiple regression, that would affect retained earnings and change in retention behavior among companies differing in their growth levels. The outcome suggests that cash flow and dividend were found to be the most influencing variables on retained earnings. This is because companies with low investment opportunities for growth and expansion prefer to distribute much of their earnings as dividend. Since potential investment opportunities for these companies may arise far off in the future, profit retained may not be invested over a long period of time or utilized in short-term investment opportunities which would yield low return on investment. Such companies prefer to pay out the earnings and raise capital whenever needed. Hence, he posits that the level of earnings retained is very much influenced by the growth rate of the companies.The study by Kim and Suh (2010) presents evidence of a distinctive inverted-U-shaped relation between leverage and retained earnings (RE). They identified, along the dimension of retained earnings, three groups of firms: (i) low-RE firms that are low-levered because of a heavy reliance on external equity, (ii) medium-RE firms that are high-levered because of active use of debt in funding fast growth, and (iii) high-RE firms that are low-levered because internal funds exceed funding needs. Data analysis reveals that retained earnings convey information about asset growth and internal funds and that the inverted-U-shaped relation is an outcome of the interplay between these two factors. They pointed out that the relation between leverage and profitability is also inverted-U-shaped and reflects a similar interplay between funding needs and internal funds in line with the pecking order theory.The empirical literature on monetary policy shocks by Doepke (2004) documents that contractionary shocks are followed by a persistent rise in interest rates and a persistent fall in output. The study posits that standard monetary business cycle models can account for the initial effects of monetary shocks, but have difficulty generating persistence. He examined whether frictions that affect the asset allocation decisions of households can lead to persistent effects. The study found that another key feature of the economy is that the business sector accumulates retained earnings and credits profits to the consumers only with a delay. A large part of fixed assets depreciate with time, a fact that requires their replacement, usually, through amortization (Man and Dima, 2011). They pointed out that amortization appears as a value equivalent of the irreversible deterioration of an asset as a result of its functioning, of the effects of natural factors, of technical progress and of other causes while a part of the assets, whose use is temporally unlimited, as, for example, lands and financial investments, is not amortized; a possible depreciation of them is covered through adjustments (provisions). Conclusively, they study posits that maintenance self-financing has an important consequence upon the performance of an economic entity because amortization provides for the renewal of the fixed assets that are fully depreciated.Onojah and Unegbu (2013) opines that depreciation is a complex, intricate and confusing term in the fields of engineering, social and management sciences which has been over used, over stressed, and over worked by the accountants and professional valuers. Complexity may arise when it is viewed as a fall in price, physical deterioration, allocation of cost, fall in value, valua-tion technique and asset replacement, more so when accountants employ various methods of providing for depreciation on the same or similar assets of different life span. The study recognises straight line, reducing balance, sum of the year’s digit, revaluation, annuity, output and sinking fund methods as depreciation methods which will definitely give different values in the financial statement. They acknowledged that the consequential effect is either to undermine or overstate the reported profit or distributable profit in the hands of the stakeholders, hence the absurdity of the financial reports. The study therefore recommends that depreciation be provided with caution especially when the anticipated economic useful lives of the fixed asset is minimized by new technology thereby making it very difficult to recover or replace the net book value of the asset.Wu and Yeung (2010) show that while firms that typically pay dividends already have high ratios of retained earnings-to-total-equity (RE/TE) and high propensities to pay (PTP) early on, firms that typically do not pay dividends have persistently low RE/TE and low PTP even after 20 years of growth. They proposed a growth type view, in which low growth type can accommodate the popular distribution-retention tradeoff argument in the lifecycle explanation for high RE/TE and PTP, but high growth type is responsible for persistently low RE/TE and PTP. They pointed out that the growth type view can explain why low RE/TE and PTP can be surprisingly long-lived. The study posits that typical non-payers deliberately do not pay dividends even when they can, because doing so may confuse the market.Reserves are made by companies mainly for investment into areas that promises some growth opportunities. Mikkelson and Partch (2003) documents that managers of cash-rich firms cite the benefits of having cash on hand as a reserve to fund large capital investments and expenditures, resulting from less internal financing costs. The intention to fulfill the expectations of investors and financial markets increasingly dominates reserve accumulation motives which, as Shayne (2013) opines, is the cornerstone of financial flexibility.Companies are expected to strategically allocate their assets/wealth to meet its long term investment need that could guarantee stability and growth and optimize the risk/ return trade-off. In support, Dominguez (2011) affirms that, although it is to be expected that a strategic asset allocation decision will be effective over the medium to long term, the allocation might be reviewed and revised in the light of changing investment opportunities. Asset allocation decisions could however be pursued through sound retention and investment policies in terms of the magnitude and nature of reserves and provisions to be created. Breweries in Nigeria especially the Nigeria Breweries Plc and Guinness Nigeria Plc create capital reserve for long-term capital investment projects or other large anticipated future expenditures. The reserve is made to guarantee availability of fund to finance their anticipated projects which might include fixed asset replacements that are neither expenditures on purchase of goods nor period expenses. The two breweries mentioned above are the leaders of the highly capital intensive industry in Nigeria which largely automated their production lines. They invest so much on heavy equipments and fixed assets resulting in huge capital outlay which has to be accumulated over time.Considering that some of these retentions could exert significant impact on financial performance and shareholder’s equity of firms in Nigeria brewery industry, the study attempts to ascertain whether there is an interaction between these corporate retentions as they influence financial performance. Such a quantitative process, in our opinion, will be of tremendous importance in determining the nature and magnitude of corporate retentions with emphasis on retained earnings and depreciation provisions as they individually and collectively influence performance and investments in Nigeria brewery industry. The above review of related literature reveals clearly that studies in this research area of interactions between corporate retentions and firm performance is scanty and unavailable in the case of Nigeria brewery sector and even globally. Where a related study exists, the methodology centers on multiple regression; establishing only the relationship among the variables. This study examines generally the extent to which retained earnings interact with provision for depreciation and specifically, the relationship, strength of the relationship, nature and magnitude as well as the causalities and sustainability of the short run interactions.

3. Methodology

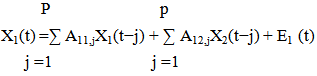

- The study adopts the Ferson and Harvey (1998) Asset Pricing Model as the theoretical Framework. The Engle-Granger (1987) two-step error correction model procedure discussed in Rao (2005); cited and adopted in Abraham (2013) is employed for model estimation. The models are as specified below:

| (1) |

| (2) |

|

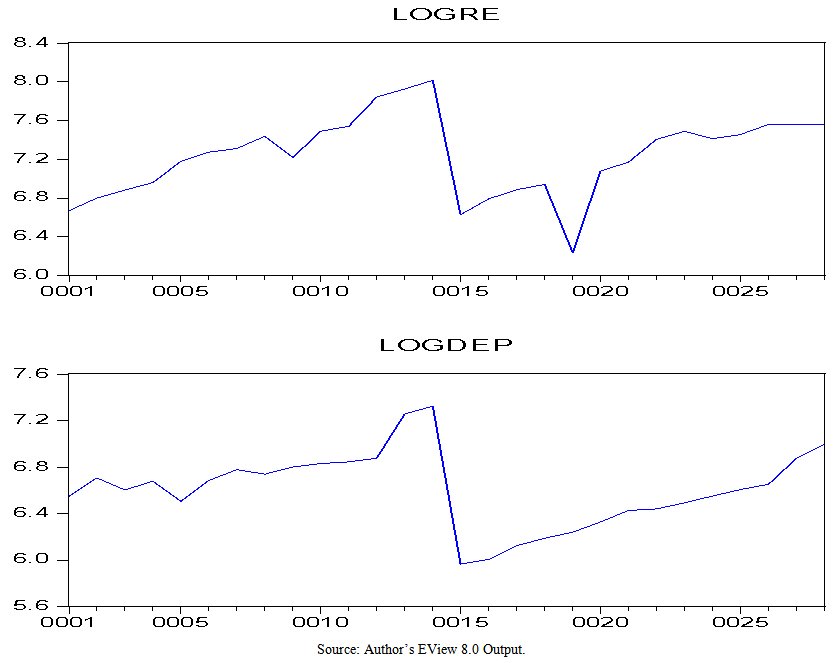

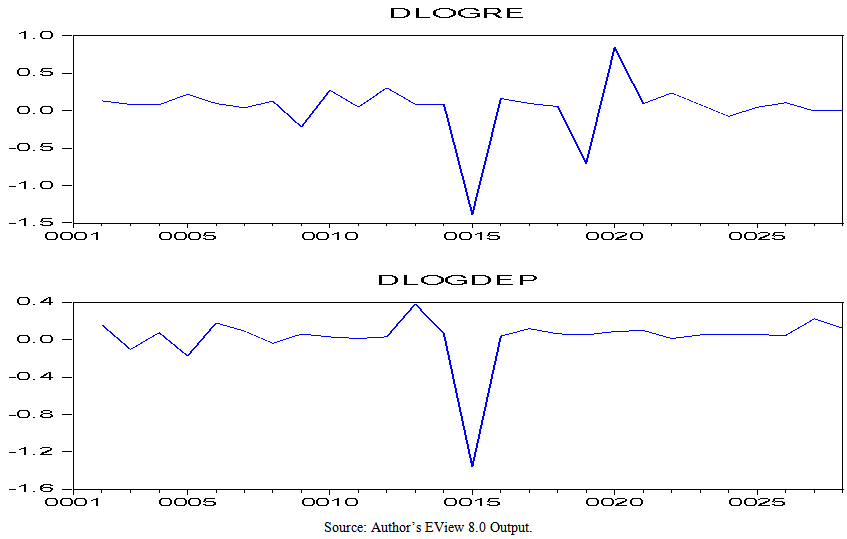

| Figure 1. Graphical Representation of the Variables with Unit Root Issues |

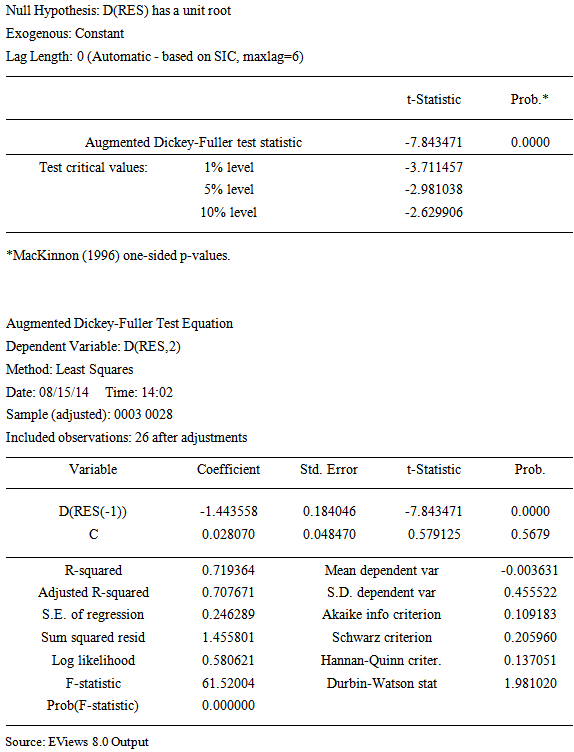

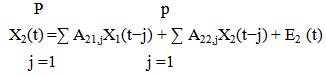

4. Unit Root Test

- The Augmented Dickey Fuller (ADF), Phillips-Perron (PP) and the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) procedure were applied in testing for existence of unit root or stationarity of time series data and the order of integration of both variables.

|

|

|

| Figure 2. Graphical Representation of the Variables after differencing at I(1) |

|

| (5) |

| (6) |

|

|

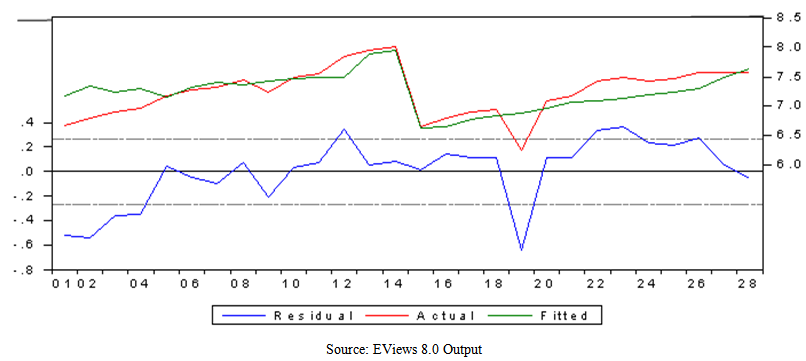

| Figure 3. Residual graph of the parsimonious model |

|

|

|

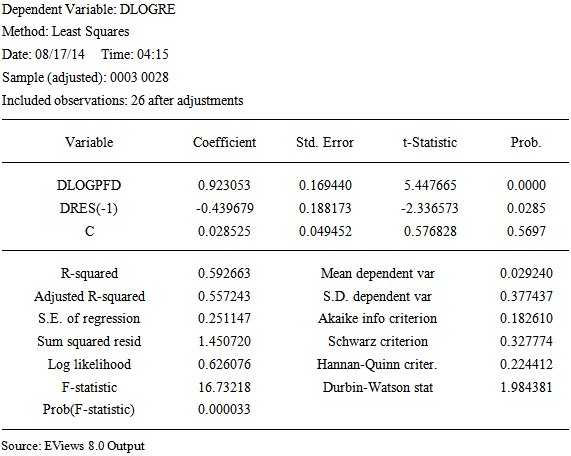

5. Summary and Conclusions

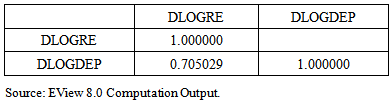

- The study aims at determining the extent to which retained earnings are influenced by annual provision for depreciation and the nature and magnitude of their granger causalities. The researcher applied the 2-step cointegration and error correction model of Engle and Granger (1985) in a simple regression framework. Provision for Depreciation has a short term positive and significant effect on retained earnings while the long run coefficient shows a negative and significant influence at 5 percent level of significance. On causalities, there is no causality running from either retained earnings to provision for depreciation or otherwise, both at 1 year and 2 years lagged periods. The implication is that retained earnings do not granger cause provision for depreciation and vice versa. The long term negative and significant relationship is in line with our a priori expectation that an increase in provision for depreciation in a year is expected to reduce the size of the retained earnings for that year. When production machineries are new, maintenance costs will be low and the fixed assets produce at optimal capacity, but as the machineries advance in age, maintenance costs rise and quantity produced starts to reduce. At the early stage (short run), more revenue accrues to the firm at a reduced production cost, amounting to increase in retained earnings; provided there is effective demand for its products. However, as the asset advances in age (long run), revenue dwindles, maintenance cost rises and production diminishes. This accounts for the decline in retained earnings, at the long run, against depreciation. Though, depreciation provisions are still part of corporate retentions; as provision does not involve actual cash movements but a source of internal funds for expansion and growth of the brewery industry.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML