-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(5): 310-315

doi:10.5923/j.ijfa.20140305.05

The Major Role Accountants Play in the Decision Making Process

Samer Tout 1, Khalil Ghazzawi 2, Sam El Nemar 3, Radwan Choughari 4

1Chairman of Finance, School of Business, Lebanese International University, Lebanon

2Assistant Professor, School of Business, Lebanese University, Lebanon

3School of Business, Lebanese International University, Lebanon

4Lebanon Assistant Professor of Management, Jinan University of Lebanon JUL

Correspondence to: Khalil Ghazzawi , Assistant Professor, School of Business, Lebanese University, Lebanon.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

From a broad perspective, reporting is one of the significant objectives for an accountant, due to its major effect in highlighting and examining the financial information of a company. The quality of reporting financial information is an international issue and the decision making skills of the accountant plays a major role in reaching the overall company objectives. Our aim for this study is examining the role Lebanese Accountants play in the decision making process. This paper will contribute to the understanding of an accountants’ role in the formulation of company decisions. This research will reveal the most important factors that lead to increasing accountant’s involvement in the managerial process of Lebanese companies. A survey was administered in order to associate what managerial contribution do Lebanese accountants make. A statistical analysis was applied in order to identify and examine key factors that influence their participation in the decision making process.

Keywords: Accountants, Decision making process, Lebanese accounting system, Quantifiable information

Cite this paper: Samer Tout , Khalil Ghazzawi , Sam El Nemar , Radwan Choughari , The Major Role Accountants Play in the Decision Making Process, International Journal of Finance and Accounting , Vol. 3 No. 5, 2014, pp. 310-315. doi: 10.5923/j.ijfa.20140305.05.

Article Outline

1. Introduction

- Accountants have a very important role in decision making, especially when related to investments. Reason being, accountants are involved in the explanation of financial statements, preparation of budgets, identification of measurable outcomes, and any other quantifiable information and statements (Rawlinson, D. and B. Tanner, 1989). By providing the necessary quantitative information about the business, including financial statements and other forms of quantitative evidences, accountants show an important role in taking relevant decisions (Gray, 1990, Owen and Bebbington, 1993). Although many agree about the important role of accountants in decision making, certain studies show a certain lack of involvement by accountants. Even though quantifiable information is important for decision making, accountants are not engaged in it because of the absence of the appropriate techniques. “They are not perceived as having a positive contribution to decision-making, unless the contribution is to legitimize decisions arrived at through a political process” (Bowerman and Hutchinson, 1998).

2. Research Objective

- This paper presents a unique Lebanese prospective “the Role of Accountants in Decision Making”. This study gives an opportunistic advantage, as well as insights about the implementation of accounting decision making and character of accountants. It’s the first time such a research was conducted on diverse types of businesses in Lebanon and the Arab world. It’s known internationally that accountants, are responsible for financial information in most companies, have a certain role in the decision making process. That role differs from company to another, depending on the skills and qualities a person has and earned over the years.

3. Literature Review

- Kaplan (1984) claims that “the development of management accounting was to isolated from the other disciplines and was thus losing its importance in the organizational structure, yet today this description no longer seems appropriate” (Chenhall, 2008; Rowe et al. 2008). In fact, according to Cravens and Guilding (2001) the last two decades have shown a renaissance in managerial accounting. A large number of critics and practitioners state that modern accountants are playing a major and important role in the decision-making process (Fern, Tipgos 1988; Oliver 1991; Bhimani, Keshtvarz 1999; Nyamori et al. 2001; Rowe et al. 2008). In addition, evidence shows that the involvement of management accountants in decision-making processes will lead to more efficient and effective decisions (Scott, Tiessen 1999; Rowe et al. 2008). Moreover, previous evidence reveals that “the active involvement and participation of managerial accountants in this decision-making processes contributes to more effective decisions (Scott, Tiessen 1999; Rowe et al. 2008) and therefore, this greater involvement in strategic management will in turn lead to higher organizational performance” (Dixon, 1998). Furthermore, this changing role of managerial accountants in different companies is contributing in changing their behavior and their thinking patterns. “It is argued, that ‘strategic’ accountants differ from their ‘conventional’ counterparts in terms of the following characteristics” (Oliver 1991; Coad 1996). Firstly, conventional accountants are more practical in analyzing business issues and have the ability to relate them to financial and other strategic outcome. Secondly, they are market oriented or are able to provide counsel to users (managers). Thirdly, they have a constant incentive to learn and accumulate knowledge. Finally, they are specialized by effective communication skills in order to fulfill their cooperative role. The relationship between the accountant and the development of a new product has been always an issue of discussion among authors. Finding a direct role for the accountant in the process of developing new products is not an easy task. Johne (1985) notes that the New Product Development (NDP) has been replaced as a line department that involves a cross- functional team approach. Bobrow and Shafer (1987) observed a clear conflict between the finance function and the innovation of new products. They elaborated that the accountants’ strict rationales for spending, pricing to cover costs, and preparation of hard budgets may be in conflict with the preferences of product designers and the ambitious plans of marketing managers. Nixon and Innes (1997) believed that the NPD managers have started to ask for the assistance of cost engineers to help them in defending their proposals against accountants’ views. Di Benedetto (1999) asserted that, under most situations, accountants are markedly omitted from NPD discussions despite their acknowledgment as to the shift towards the cross-functional teams in developing new products. In 2001, Rabin noted that the responsibility for developing new products has shifted from the traditional framework, which assumed the sole involvement of the product manager, to team work. On the other hand, Rabino stated that his review of literature has revealed just an ancillary role for accountants in such development teams. In 2006, in an article titled “The Accountant’s Contribution to New Product Development”, Huges and Pierce concluded that a more detailed relationship exists between the accountant and the NPD process. More specifically, the authors elaborated that the accountant contributes in various ways to the eight stages of NPD. Moreover, managerial accountants are considered by some to be “too late, too aggregated, and too distorted to be relevant for decision making to be involved in planning and controlling” (Johnson & Kaplan, 1992). However, differences exist between independent and dependent companies when it comes to perceptions of managerial accountants. Accountants in dependent companies are under a constraint from the parent company, which makes them act according to different principles and norms than those in independent companies (Yazdifar, Askarany, &Askary, 2008). In the new millennium, managerial accountants in independent companies are more supportive of “Cost/ Financial control”, “Working-capital and short-term finance management”, “productivity improvement”, “Managing IT” than those in dependent companies. Nonetheless, accountants in dependent companies lean more towards “presenting/interpreting management accounts” and “Strategic planning/decision making” more (Yazdifar, Askarany, & Askary, 2008).Additionally, in family firms, managerial accountants plays a restricted role, due to the family’s governance over the firm, compared to non-family firms (Lutz et al., 2010; Lutz and Schraml, 2012; Hiebl, 2012). Nevertheless, this constrained role of managerial accountants is limited to small and middle sized firms. Large family businesses depend on managerial accountants and tools as much as non-family businesses (Giovannoni et al., 2011). Using a quantitative method, Hiebl, Duller and (Durstmuller, 2012) examined if managerial accountants in family firms relies more on soft skills (including include communication, teamwork, leadership and change management) than in non-family firms, as well as if they perform in a more traditional way (Duller, Hiebl, &Feldbauer-Durstmuller, 2012). However, studies didn’t prove the previous statement, but they indicated a significant role of managerial accountants in “Change management” for family firms (Duller, Hiebl, & Feldbauer-Durstmuller, 2012). Stambaugh and Carpenter (1992) have studied the role of accounting and accountants in Executive Information Systems (EIS). An executive information system is a bunch of tools that are planned to aid an organization very carefully. It controls and monitors an organization’s current status and position; it also assesses the growth of this organization towards achieving its goals and objectives (Fireworker and Zirkel, 1990). Ijiri's (1967) defines accounting as "a system for communicating the economic events of an entity”. This reflects the important role that accountants can give and how they supply significant data for executive decisions under different levels of uncertainty. As EIS is spreading widely and growing faster, accountants' contribution towards executive decision making is increasing (Stambaugh & Carpenter, 1992). Accountants are able to perform major roles in the implementation of EISs, where they have most of the needed skills such as guidance, planning, data providers and keepers, system developers and project coordinators to monitor the responsibilities (Stambaugh & Carpenter, 1992). The knowledge of accountants in financial operations and transactions is of a high relevancy to understand the data and its qualities, where in EIS understanding and analyzing data is the key for significance (Pinella 1991). Internal and external auditors are of a critical importance to the EIS's executive decisions ensuring and reviewing the quality of information (Stambaugh & Carpenter, 1992). Accountants are engaged in "creating, collecting, maintaining, analyzing or publishes information" (Armstrong 1990b). Burchell et al. (1980) identified the four roles that accountants can be used for different types of decisions: an answer machine, an answer/learning machine, an ammunition machine and rationalization machine. Accountants are found to help and aid in many of these roles: single, complex decisions, and specifically when there are a multiple contradictory goals (Stambaugh & Carpenter, 1992).

4. Methodology

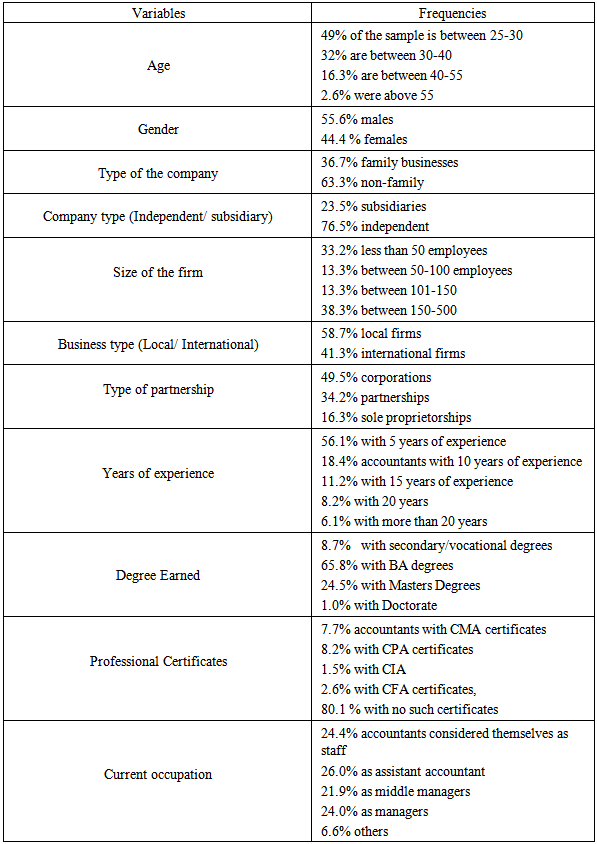

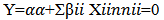

- In order to collect the most relevant amount of information that indicates to what extent Lebanese accountants are involved in the decision making process, two major steps were performed in conducting this quantitative research: The first step, a literature review was conducted by searching articles and studies that support the main idea of the accountants’ roles. Several variables affected the decision making, like the new product development skills, leadership skills, teamwork skills, and many others. The next step was having questionnaires distributed throughout different regions in Lebanon. Enterprises ranging from banks, insurance, media, hotels, hospitals, universities, schools, NGOs, transportation, rental, magazines, engineering companies and many more were selected. The companies were chosen randomly to convey all types of businesses. Focus was on accountants that have reasonable experience and older than 25 years old. The questionnaire was divided into two sections, the first section was based on a 5 point Likert scale (strongly agree -> strongly disagree), and the second section was to identify respondents demographics. Moreover, a number of these questionnaires were sent via email to different companies to expand our scope. A frequency analysis was conducted. Then, a correlation statement for all the significant variables was conducted. Finally, a regression analysis was necessary to find out the independent variables of significance or the dependent variables. We have used a linear regression model being:

Where: Y is “I, as an accountant, have a major role in decision making” – Dependent Variable α represents the coefficients of the formula X1 is “I am involved in the process of NPD” X2 is “My skills help me to get involved in the decision process” X3 is “I as an accountant play a role in the financial analysis in the firm’s data” X4 is “The firm encourages me to advice on business decisions” X5 is “I have a major role in the implementation of EIS” X6 is “I feel my role is highly dependent on the parent’s company directions” X7 is “As an accountant, I can see the big picture of the firm’s business in addition to my direct responsibilities” X8 is “I rely on accounting information system within the firm to take most of my decisions” X9 is “The Company has adequate budget to train and develop accounting professionals”

Where: Y is “I, as an accountant, have a major role in decision making” – Dependent Variable α represents the coefficients of the formula X1 is “I am involved in the process of NPD” X2 is “My skills help me to get involved in the decision process” X3 is “I as an accountant play a role in the financial analysis in the firm’s data” X4 is “The firm encourages me to advice on business decisions” X5 is “I have a major role in the implementation of EIS” X6 is “I feel my role is highly dependent on the parent’s company directions” X7 is “As an accountant, I can see the big picture of the firm’s business in addition to my direct responsibilities” X8 is “I rely on accounting information system within the firm to take most of my decisions” X9 is “The Company has adequate budget to train and develop accounting professionals”5. Skewness

- This study focused on the degree of skewness of the demographic data, with the exception of three variables (type of the company, Level of experience, and Professional Certificates) all examined data frequencies were normally distributed. As for the skewed variables, it must be noted that “type of company” with a skewness of -1.26, independent companies were found to be more than subsidiaries. In addition, the presence of a parent company is found to be responsible for taking the decisions on the behalf of the subsidiary. As for the second variable “Level of experience” with a skewness of 1.22, this reflected a younger generation of accountants, since the accounting profession is ever growing and in need of new accountants. As for the third variable “Professional certificates”, which is of a skewness of -1.84, most of our accountants do not hold professional accountant certificates, because it takes time and hard work, therefore only a few employees are willing to apply for a professional certificate.

6. Data Analysis

- Frequency Analysis− Correlation Statistics revealed nine variables that are considered of significance. The variables “I as an accountant have a major role in the decision making process” and “I am involved in the process of new product development” are highly correlated with (Significance of 0.00, positively correlated). This demonstrates a relationship between accountant’s involvement in the New Product Development and greater role in decision making.In addition, the two highly correlated variables, that resulted in significance of 0.00, positively correlated, are “I, as an accountant, have a major role in the decision making process” and “My skills helped me to get involved in the decision process”. This indicates that the higher the accountant’s skills, the higher his/her influence in the decision making process. Moreover, there is a high correlation between “I as an accountant have a major role in the decision making process” and “I have a major role in the implementation of the Executive Information System”. Significance of 0.00, positively correlated demonstrates that the more roles the accountant plays in implementing the EIS, the more involvement the accountant has in managerial decision making. Furthermore, “I as an accountant have a major role in the decision making process” and “I as an accountant play a role in the financial analysis of the firm’s data” have a high correlation with significance of 0.00, positively correlated. The greater the role an accountant has in financial analysis, the more effectiveness he/she would have in decision making.

|

7. Conclusions

- This research identified several variables that were classified to be correlated with the dependent variable “I, as an accountant, have a major role in the decision making process” with significance level of 0.00. In addition to that, after applying the linear regression analysis and eliminating the insignificant variables, the study was limited to the four most significant variables which are “I am involved in the new product development”, “my skills help me get involved in the decision process”, “I as an accountant play a major role in financial analysis”, “the firm encourages me to give advice on business decisions”, indicating that the changes in the dependent were partially explained by the changes of the independent variables.

8. Limitations

- Several limitations were faced. The low rate of responses, many companies could not fill the questionnaire due to time constraints, and thus didn’t participate in the survey. Moreover, more than 300 questionnaires were distributed to different companies, to be collected in ten days. The response rate was, on the first week, less than 30%. During the three remaining days, more questionnaires were distributed, and the final outcome was 196 questionnaires. A number of questionnaires were sent to 500 companies via email, and the response rate was less than 1%, by getting only three questionnaires in response. Furthermore, the survey had financial constraints that limited the ability to get the efforts of the contributors.

9. Recommendations for Further Research

- In conducting this research, several useful conclusions were uncovered. However, this research has also uncovered many gaps that need further studies and researches. These areas were recognized in the early stages of data analysis. For instance, further studies should highlight the importance, and take into consideration, both the young- and old-generation accountant, to reveal the importance of accountants’ age and years of experience in their role in decision making. Furthermore, additional research should be performed to emphasize the causal relationship between accountants having professional certificates, and their role in decision making.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML