-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(5): 303-309

doi:10.5923/j.ijfa.20140305.04

Impact of Non-Oil Tax Revenue on Economic Growth: The Nigerian Perspective

Akwe James Ayuba

Securities and Exchange Commission, Nigeria

Correspondence to: Akwe James Ayuba, Securities and Exchange Commission, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This study analyses the impact of Non-oil Tax Revenue on Economic Growth from 1993 to 2012 in Nigeria. To achieve this research objective, relevant secondary data were used from the 2012 Statistical Bulletin of the Central Bank of Nigeria (CBN). These data were analyzed using the Ordinary Least Squares Regression. The result from the test shows that there exists a positive impact of Non-oil Tax Revenue on economic Growth in Nigeria. From the study, it was recommended that efforts should be intensified by the government at all levels towards increased collection of non-oil taxes especially from the informal sector since this increase has the capacity to growth the economy. Also, it was recommended that the administrative machinery of the Federal Inland Revenue Service (FIRS) and other Relevant Tax Authorities be strengthened with a view to eliminating weaknesses and internal control lapses in the assessment and collection of Non-oil Taxes in Nigeria. Tax Audit and Investigation departments are specialized departments and therefore should be manned by professional officers with requisite skills and qualifications. The FIRS and other Relevant Tax Authorities should engage professionals to undertake public enlightenment on the benefits of payment of tax. Government should also be seen to use taxpayers’ monies in the provision of infrastructural facilities.

Keywords: Non-oil Tax Revenue, Economic Growth, Ordinary Lease Squares

Cite this paper: Akwe James Ayuba, Impact of Non-Oil Tax Revenue on Economic Growth: The Nigerian Perspective, International Journal of Finance and Accounting , Vol. 3 No. 5, 2014, pp. 303-309. doi: 10.5923/j.ijfa.20140305.04.

Article Outline

1. Introduction

- For development and growth of any society, the provision of basic infrastructure is quite necessary. This perhaps explains why the government shows great concern for a medium through which funds can be made available to achieve their set goals for the society (Fagbemi and Noah, 2010). Government needs money to be able to execute its social obligations to the public and these social obligations include but not limited to the provision of infrastructure and social services. According to Murkur (2001), meeting the needs of the society calls for huge funds which an individual or society cannot contribute alone and one medium through which fund is derived is through taxation. Tax is a major source of government all over the world. Government use tax proceeds to render their traditional functions, such as the provision of public goods, maintenance of law and order, defense against external aggression, regulation of trade and business to ensure social and economic maintenance (Azubike, 2009; Edame, 2008:14).A tax system offers itself as one of the most effective means of mobilizing a nation’s internal resources and it lends itself to creating an environment conducive to the promotion of economic growth. Nzotta (2007) argues that taxes constitute key sources of revenue to the federation account shared by the federal, state and local governments. This is why Odusola (2006) stated that in Nigeria, the government’s fiscal power is divided into three-tiered tax structure between the federal, state and local governments, each of which has different tax jurisdictions. The system is lopsided and dominated by oil revenue. Taxation as defined by Ogundele (1999) is the process or machinery by which communities or groups of persons are made to contribute in some agreed quantum and method for the purpose of the administration and development of the society. It can be inferred that the payment of tax will in turn be beneficial to the entire citizenry. This view is similar to the definition of Soyode and Kajola (2006) who defined tax as a compulsory exaction of money by a public authority for public purposes. Nightingale (1997) described tax as a compulsory contribution imposed by the government. These various authors concluded that it is possible for tax payers not to receive anything identifiable for their contribution but that they have the benefit of living in a relatively educated, healthy and safe society. However, the infrastructure which tax payers are supposed to enjoy is in a deplorable condition (Fafunwa, 2005), educational system is in disarray (Obaji, 2005) and the health system is in a worrisome condition (Lambo, 2005).In Nigeria, tax revenue has accounted for a small proportion of total government revenue over the years. This is because the bulk of revenue needed for development purposes is derived from oil. Crude oil export has continued to account for over 80% of the total federal government revenue, while the remaining 20% is contributed by non-oil sector in which taxation (direct and indirect) is a part. For instance, Oil sector share in total revenue was 54.4% in 1972 against 45.6% share from non oil sector the same year. By 1974 oil share of total revenue had reached 82.1% while only 17.9% accrued from non oil sector. Following the glut in the world oil prices in the later part of the 1970s, the oil share in total revenue fell to 61.8% in 1978 while non oil sector’s share rose to 38.2%. And since 1984, the oil sector share in total revenue has continued to rise, though with occasional falls in between periods. By 2006, oil share of total revenue had reached 88.6% against non oil share of 11.4%. As at 2009, oil sector share in total revenue stood at 78.8% while non-oil sector accounted for just 21.3% of the total revenue (CBN, 2010). The choice between direct and indirect tax has elicited serious debate in terms of economic benefits and limitations that characterized each. Thus, most studies have reached substantially different conclusions on the relative impact of direct and indirect taxes on economic growth with multiplicity of problems ranging from inconclusive findings, chaotic generalization of results and findings in developed countries to developing countries [see Avi-Yonah and Margalioth (2006) and Burgess and Sten (1993)]. According to Avi-Yonah and Margalioth (2006), direct taxation accounts for about two third of the total tax revenue generated in developed countries. But proponents of the conventional wisdom hypothesis are advocating for the use of indirect taxation. To them, developing countries should focus on indirect taxation [Burgess and Sten (1993)]. Indeed, the results of most studies are saddled with inconsistencies. While some researchers like Lee and Gordon (2005), Jones, Manuelle and Rossi (1993), Li and Sarte (2004), Kneller et al (1999), Wildmam (2001), Avi-yonah and Margolioth (2006), reported a positive relationship between indirect tax and economic growth, others such as Emran and Stigliz (2005), Gordon and Li (2005), Baunsgaard and Keen (2005), Abizadelh (1979), Chelliah (1989) disputed the above finding and instead reported the relative importance of direct taxation as the driver of economic growth. The empirical studies on the subject matter for developing countries are relatively few. The few were carried out in South Africa, Turkey and OECD countries. A situation where results of cross country researches in developed economies are generalized to developing countries often induce knowledge gap. From the literatures reviewed, no mention was made of the relationship between non-oil tax revenue and economic growth in Nigeria. This study therefore, seeks to close this knowledge gap by examining the relationship between non-oil tax revenue and economic growth in Nigeria.

2. Direct Taxation and Economic Growth

- Myles (2000) empirically ascertained that direct tax policy is a stimulant to economic growth. Barry and Jules (2008) found that direct taxes impacted negatively on economic growth in the US. Margalioth (2003) reported that direct taxation is harmful to growth in endogenous growth models. The results of Mamatzakis (2005) hold that direct taxes have significant positive impact on economic growth in South Africa. Tosun and Abizadeh (2005) reported that the share of personal income tax responded positively to economic growth. McCarten (2005) found that the ratio of direct tax to GDP and the ratio of direct tax to total tax stimulated real GDP growth in Pakistan. Tosun and Abizadeh (2005) reported that corporate income taxes are the most harmful to growth as well as personal income taxes. Lee and Gordon (2005) using cross-country data found that statutory corporate tax rates are significantly and negatively correlated with cross-sectional differences in average economic growth rates having controlled for other determinant of economic growth. Djankor et al (2009) found strong negative effect of personal income tax on output growth. Scarlett (2011) established empirically that an increase in the share of taxes from personal taxable income has the greatest harm on per capital GDP over time and correction to equilibrium from such an impact would take up to nine years. Arnold (2011) found that personal income taxes are progressive with marginal tax rates that are higher than their average rate with the implication of discouraging savings and labour supply. Arisoy and Unlukaplan (2010) tested the effect of direct-indirect tax composition on economic growth in Turkey. The empirical finding of their study holds that direct taxes have no significant effect on economic growth. Aamir, Qayyum, Nasir and Hussain (2011) found significant impact of direct taxation on the total revenue of the economy of India.

3. Indirect Taxation and Economic Growth

- The relationship between indirect taxation and economic growth has been examined severally by different researchers. Few, if any have examined this line of research in Nigeria. Chelliah (1989) observed that an increase in indirect taxation compared to direct taxation reduces economic growth more than direct taxation does. Their research finding supports the position of Harbenger (1964). Aamir et al (2011)’s research findings had it that increasing revenue from indirect taxes is more conducive for economic growth in the long run in Pakistan. Ajakaiye (1999) found that VAT has a negative effect on economic growth in Nigeria. In a more broad study, Romer and Romer (2000) resolved that progressive taxation affords policy makers the opportunity to pursue counter-cyclical fiscal policies which drives economic growth. Specifically, they are of the view that VAT can only increase growth when enforcement and implementation procedures are effective. This position was strengthened by McCarten (2005). According to Bird (2003), the most effective tax for developing countries is one that produces the largest amount revenue in the least costly and disproportionate manner. He identified broad based VAT as an ideal tax that suits the situation. Emran and Stiglitz (2005) argued that the recent resolution that favours the gradual reduction and the subsequent elimination of sales taxes in favour of VAT as an instrument of indirect taxes in developing economies is worrisome. According to him, it is built on a fragile result derived from an incomplete model that relegates the presence of active informal sector.

4. Nature and Scope of Taxes

- According to Nzotta (2007), four key issues must be understood for taxation to play its functions in the society. First, a tax is a compulsory contribution made by the citizens to the government and this contribution is for general common use. Secondly, a tax imposes a general obligation on the tax payer. Thirdly, there is a presumption that the contribution to the public revenue made by the tax payer may not be equivalent to the benefits received. Finally, a tax is not imposed on a citizen by the government because it has rendered specific services to him or his family. Thus, it is evident that a good tax structure plays a multiple role in the process of economic development of any nation which Nigeria is not an exception (Appah, 2010). Musgrave and Musgrave (2004) note that these roles include: the level of taxation affects the level of public savings and thus the volume of resources available for capital formation; both the level and the structure of taxation affect the level private saving. A system of tax incentives and penalties may be designed to influence the efficiency of resource utilization; the distribution of the tax burdens plays a large part in promoting an equitable distribution of the fruit of economic development; the tax treatment of investment from abroad may affect the volume of capital inflow and rate of reinvestment of earnings there from; and the pattern of taxation on imports relative to that of domestic producers affect the foreign trade balance. However, Anyanwu (1993) pointed out that there are three basic objectives of taxation. These are to raise revenue for the government, to regulate the economy and economic activities and to control income and employment. Also, Nzotta (2007) noted that taxes generally have allocational, distributional and stabilization functions. The allocation function of taxes entails the determination of the pattern of production, the goods that should be produced, who produces them, the relationship between the private and public sectors and the point of social balance between the two sectors. The distribution function of taxes relates to the manner in which the effective demand over economic goods is divided, among individuals in the society. According to Musgrave and Musgrave (2006), the distribution function deals with the distribution of income and wealth to ensure conformity with what society considers a fair or just state of distribution. The stabilization of function of taxes seeks to attain high level of employment, a reasonable level of price stability, an appropriate rate of economic growth, with allowances for effects on trade and on the balance of payments. Nwezeaku (2005) argues that the scope of these functions depends, inter alia, on the political and economic orientation of the people, their needs and aspirations as well as their willingness to pay tax. Thus, the extent to which a government can perform its functions depend largely on the ability to design tax plans and administration as well as the willingness and patriotism of the governed.According to Anyanfo (1996), the principles of taxation mean the appropriate criteria to be applied in the development and evaluation of the tax structure. Such principles are essentially an application of some concepts derived from welfare economists. In order to achieve the broader objectives of social justice, the tax system of a country should be based on sound principles. Jhingan (2004), Bhartia (2009) and Osiegbu, Onuorah and Nnamdi (2010) listed the principles of taxation as equality, certainty, convenience, economy, simplicity, productivity, flexibility and diversity.Equity principle: states that every taxpayer should pay the tax in proportion to his income. The rich should pay more and at a higher rate than the other person whose income is less (Jhingan, 2004). Anyanfo (1996) states that it is only when a tax is based on the tax payer’s ability to pay can it be considered equitable or just. Sometimes this principle is interpreted to imply proportional taxation. Certainty principle: of taxation states that a tax which each individual is bound to pay ought to be certain, and not arbitrary. The time of payment, the manner of payment, the quantity to be paid ought to all be clear and plain to the contributor and every other person (Bhartia, 2009).Convenience principle: of taxation states that the time and manner should be convenient to the taxpayer. According to Anyanfo (1996), this principle of taxation provides the rationale for Pay - As - You - Earn (PAYE) system of tax payable system of tax collection. Economy principle: states that every tax should be economical for the state to collect and the taxpayer to pay (Appah, 2004; Jhingan, 2004; Bhartia, 2009). Anyanfo (1996) argues that this principle implies that taxes should not be imposed if their collection exceeds benefits.Productivity principle: states that a tax should be productive in the sense that it should bring large revenue which should be adequate for the government. This is the major reason why governments in all parts of the globe continuously employ tax reforms.Simplicity principle: states that the tax should be plain, simple and intelligible to common taxpayer. Anyanfo (1996) argue that there should be no hidden agenda in the tax law.Flexibility principle: implies that there should be no rigidity in taxation. Diversity Principle of taxation states that there should be different variety of taxes. Bhartia (2009) argue that it is risky for state to depend upon too few a source of public revenue.

5. Theoretical Framework on Taxation

- According to Bhartia (2009), a taxation theory may be derived on the assumption that there need not be any relationship between tax paid and benefits received from state activities. In this group, there are two theories, namely, 1. Socio-political theory 2. The expediency theory1. Socio political theory: This theory of taxation states that social and political objectives should be the major factors in selecting taxes. The theory advocated that a tax system should not be designed to serve individuals, but should be used to cure the ills of society as a whole.2. Expediency theory: This theory asserts that every tax proposal must pass the test of practicality. It must be the only consideration weighing with the authorities in choosing a tax proposal. Economic and social objectives of the state as also the effects of a tax system should be treated irrelevant (Bhartia, 2009).Also, a taxation theory may be based on a link between tax liability and state activities. This reasoning justifies the imposition of taxes for financing state activities and also providing a basis for apportioning the tax burden between members of the society. This reasoning yield the benefit received theory and cost of service theory. There is also the faculty theory of taxation.1. Benefit received theory: This theory proceeds on the assumption that there is basically an exchange relationship between tax-payers and the state. The state provides certain goods and services to the members of the society and they contribute to the cost of these supplies in proportion to the benefits received (Bhartia, 2009). Anyanfo (1996) argues that taxes should be allocated on the basis of benefits received from government expenditure.2. Cost of service theory: This theory is similar to the benefits received theory. It emphasizes the semi commercial relationship between the state and the citizens to a greater extent. In this theory, the state is being asked to give up basic protective and welfare functions. It is to scrupulously recover the cost of the services and therefore this theory implies a balanced budget policy.3. Faculty theory: According to Anyanfo (1996), this theory states that one should be taxed according to the ability to pay. It is simply an attempt to maximize an explicit value judgment about the distributive effects of taxes. Bhartia (2009) argue that a citizen is to pay taxes just because he can, and his relative share in the total tax burden is to be determined by his relative paying capacity.

6. Methodology

- Analysis is the systematic and careful examination of variable/facts so that certain conclusions can be drawn from it. This research utilizes the annual time series data from the Central Bank of Nigeria Statistical Bulletin (real Gross Domestic Product (RGDP)] and the Federal Inland Revenue Service (non-oil tax revenue) for the sample period of 1993-2012. Ordinary Least Squares Regression was used to establish the relationship between the independent (Non-oil Tax Revenue) and the dependent (Real Gross Domestic Product) variables.

7. Results and Discussion

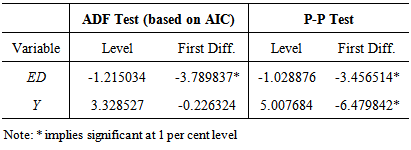

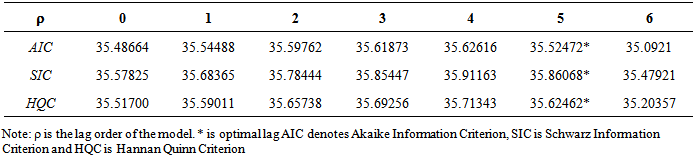

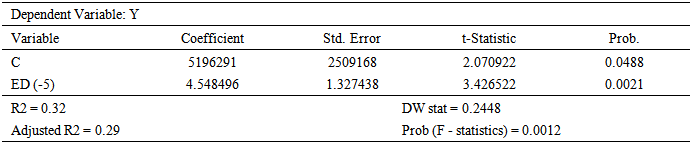

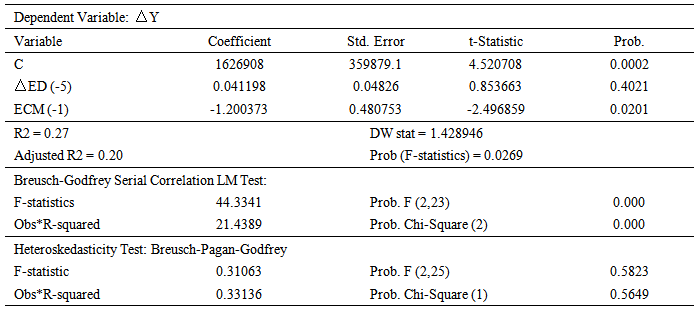

- This section of the study examines results and discusses relevant findings from the Ordinary Least Squares RegressionTable 1 shows the result of unit root test. The test is based on the semi-parametric testing procedures of Augmented Dickey Fuller (ADF) and Phillips-Perron (PP). The ADF considers Akaike Information Criterion (AIC. The results show that both series are I(1) variables and significant at 1.0 per cent.

|

|

|

|

8. Conclusions and Recommendations

- The objective of this study is to investigate the impact of non-oil tax revenue on economic growth in Nigeria.Results from the empirical tests show the statistical significance of economic growth effects of non-oil tax revenue. The economic growth was proxied by real gross domestic product whilst non-oil tax revenue was proxied by taxes such as companies’ income tax, personal income tax, capital gains tax, stamp duty, valued added tax, customs & excise duties, amongst others. To capture this, time series data were used from 1993 – 2012. The Ordinary Lease Squares Regression was used to determine the impact of non-oil tax revenue on economic growth in Nigeria. The above results confirm that an increase in non-oil tax revenue will lead to a proportionate increase in real gross domestic product, thereby growing the economy. Based on the empirical findings obtained from this study, we hereby recommend that efforts should be intensified by the government towards increased collection of non-oil tax revenue. This can be done through blocking all loopholes in our tax laws as well as bringing more prospective tax payers into the tax net (especially the informal sector). Also, the administrative machinery of Federal Inland Revenue Service (FIRS) and other Relevant Tax Authorities should be improved to eliminate weaknesses and internal control lapses in the assessment and collection of Non-oil Taxes. Tax Audit and Investigation departments are specialized departments and therefore should be manned by professional officers with requisite professional qualifications. The FIRS and other Relevant Tax Authorities should engage professionals to undertake public enlightenment on the benefits of payment of tax. Government should also be been to use taxpayers’ monies in the provision of infrastructural facilities. This will in no doubt boost the citizenry morale to pay more. Staff that work with the Tax Authorities should be adequately motivated in order to enhance revenue generation.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML