-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(5): 295-302

doi:10.5923/j.ijfa.20140305.03

Economic Implications of Foreign Loans on Real Sector Development in Nigeria

Anthonia Ubom

Department of Banking, Finance and Insurance, University of Uyo, Uyo, Nigeria

Correspondence to: Anthonia Ubom, Department of Banking, Finance and Insurance, University of Uyo, Uyo, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This article examined the economic implications of foreign loans on real sector development in Nigeria. Specifically, the work sought to assess the relationship that exist between loans granted by various countries and clubs and real sector development in Nigeria, from 1970 to 2012. The desk, investigatory, descriptive and analytical research designs were used. Relationship analysis of the various sources of foreign loans and the real sector development variables such as manufacturing outputs, growth rate of gross domestic products and unemployment rate were made using the multiple regression models. It was discovered that significant relationships exist between the growth rate of gross domestic product, manufacturing output, and loans from Paris and London clubs of creditors, among others. In other words, these loans contributed significantly to the development of these subsectors irrespective of the observed marginal relationship between unemployment rates and loans from Paris club. It was concluded that judicious use of foreign loans is necessary in the realization of the development and growth of the economy specifically the real sector emphasized in this article. On the basis of this, this article recommends among others that foreign loans should be used mostly in productive assets to inspire real sector development and growth.

Keywords: Foreign Loans, Real Sector, Real Sector Development and Domestic Outputs

Cite this paper: Anthonia Ubom, Economic Implications of Foreign Loans on Real Sector Development in Nigeria, International Journal of Finance and Accounting , Vol. 3 No. 5, 2014, pp. 295-302. doi: 10.5923/j.ijfa.20140305.03.

Article Outline

1. Introduction

- Countries just like individuals borrow money for various purposes including consumption and investment. The sources of such loans are the domestic and foreign sources. When the loans are raised from within the country, it is said to be domestic loans or debts. Loans from external sources constitute foreign loans. As stated above, one of the major purposes of borrowing is for execution of investment plans or development projects. When loans are raised and used judiciously for the purpose it was meant for, it is therefore possible for effective servicing of such loans and for realization of the loan objectives. On the contrary when loans obtained are not put into use as planned, it therefore becomes very difficult for payment of the principal and interest upon maturity and realization of the objectives. This means that foreign loans have implications. This work is designed to examine the economic implications of foreign loans on real sector development in Nigeria.It is evidenced from many research reports and findings including those of Adepoju, et al, 2007: 1-6), Rieffel, (2005: 2) and Nwankwo, (2010:2) among others that many developing countries of the world have been able to make effective and efficient use of foreign loans to achieve their economic development and growth aspirations. For instance, countries like China, Singapore, India, Philippines among others have reaped heavily from the use of foreign loans in developing their economy, mainly the real sector comprising the manufacturing, agriculture, mining, construction, etc.However, in Nigeria starting from pre-independence era to the post civil war era, until today, the history of foreign debt or loan abound. Yet the economy with its rich human and natural resources and high market potentials, has recorded minimal level of development and growth in the real sector. This is evidenced by the growth rates of the gross domestic product, manufacturing outputs and unemployment rates. As observed from available data, while the growth rate of gross domestic product (gdpr) and manufacturing outputs increased marginally year by year, unemployment rate rather rose at high proportions. For example, between 1973 and 1974 when the growth rate of gross domestic product (gdpr) rose from 59.09% to 60.00%, unemployment rate increased sharply from 4.9% to 7.2%. Again, between the years 1999 and 2002, the gdpr fluctuated between 2.80% and 3.50% while unemployment rate rose from 4.9% to 6.0%.Although, many researches have been carried out on the challenges of growth and development in the real sector in Nigeria, most of these works focus more on infrastructure deficits, corruption, poor technology, and poor management as the major factors militating against the development and growth of the real sector of the economy. Specific research information linking economic implications of foreign loans with the real sector in Nigeria is rather scanty. Even the findings of related works such as those of Aluko and Arowolo, (2010:5) and Kehinde and Awotundun, (2012:21) are contestable. It is therefore on these bases that this article has been designed to address the salient issues having direct link between economic implications of foreign loans and real sector development and growth in Nigeria.Particularly, this work seeks to establish the relationship that exists between the variables of real sector development and the types, sources and volumes of foreign loans raised by the government of Nigeria from 1970 to 2012. This article has five sections. Section one is the introduction. In section two, the literature related to the study is reviewed while section three presents the methodology and design. In section four, empirical details and analysis are presented. Section five covers discussions, conclusion and recommendations.

2. Literature Review

- This section reviews literature as put forward by various authors on the subject matter. Specifically the nature and concept of loans, types and sources of foreign loans and real sector developments in Nigeria are discussed.

2.1. Concept and Nature of Loans

- Technically, a loan could simply be described as borrowed funds. It is that part of the money used for financing by an individual, a business or the government which does not belong to the borrower. A loan could also be described as a debt, entailing the redistribution of financial asset over time, between the lender and the borrower. In a loan, the borrower initially receives or borrows money from the lender and is obligated to pay back to the lender at a later and appropriate time. The loan is given at a cost usually referred to as the interest. In a legal loan, the obligations are enforced by agreements or contracts. The money may be paid back in block, in regular installments or in partial installments (Adepoju, Salau & Obayelu, 2007:1).By the time a borrower (be it an individual, a business firm or the government) enters into a contract of borrowing from the lender, a debt is credited. Thus, ‘Oyejide, Soyede, and Kayode, (1985:2) describes a loan as a resource or money in use which is not contributed by its owners and does not in any way belong to them. It is a liability represented by a financial instrument or other formal equivalent. The debt is regarded as that which one person legally owe to another or an obligation that is enforceable by legal action to make payment of money. When governments borrow, the debt becomes a public debt. The source for borrowing could be internal or external, when it is internal, that means the sources of borrowing are domestic and when it is external, the sources of borrowing is foreign. This paper focuses on external borrowing by the Nigerian government and its impact on the performance of the economy’s real sector development.Thus a foreign loan is described as a loan issued by a foreign government in the form of money, bonds or other certificates of debt. The term is also applicable to a loan obtainable in a foreign country permitting the borrower to draw against the loan with collaterals such as bonds, bills and stocks. In international economics relations, foreign loans are financial obligation that ties the debtor country to the lender country. It is called incurred debt that is payable in foreign currencies. It includes all short terms debts which mature between one and two years or whose payment would be settled within a fiscal year in which the transaction is conducted (Adepoju, Salau, and Obayelu, (2010:2).External loans exclude grants and loans granted by friendly governments in their currencies but repayable in the borrower’s currency. They are classified as reproductive debt and dead weight debt. A productive debt is a loan obtained to purchase or acquires some sort of assets while the dead weight debt is a loan obtained to finance goods services, war and expenses on current expenditures. External loans could be owed to creditors outside the country such as government, corporations or citizens of another country or international financial institutions.

2.2. Origin and Trend of External Loan and its Crises in Nigeria

- The origin of external loans in Nigeria could be traced back to 1958 when the sum of US$28 million was contracted for railway construction. This was followed by a loan of twelve billion pounds (

12m) in 1960 for revamping the economy. Thereafter, the level of external loans were minimal as loans contracted during the period were the concessional loans from bilateral and multilateral sources e.g. the Paris Club, the London Club etc, with longer repayment periods and lower interest rates. From 1978 following the collapse of oil prices which exerted considerable pressure on government finances, it became necessary to borrow for balance of payments support and project financing. This led to promulgation of Decree No. 30 of 1978, authorizing the Federal Government to raise external loans to a maximum of 5 billion (Kehinde & Awotundun, 2012:17-18).Consequently, the first major borrowing which was (US$ 1.92 billion) referred to as the “Jumbo Loans” was contracted from the international Capital Market in 1978 increasing the total debt stock to US $ 2.2 billion. Thereafter, the spate of borrowing increased with the entry of state governments into external loan contractual obligations. The share of loan from bilateral and multilateral sources declined substantially while borrowing from the private sources increased considerably (Rieffel, 2005:2). The ownership structure indicated that a greater portion of about 75% of the loans accrue to Paris Club. However, Nigeria has continued to service that category of debt as at when due.In 2013, the outstanding of Nigeria’s external debt amounted to

12m) in 1960 for revamping the economy. Thereafter, the level of external loans were minimal as loans contracted during the period were the concessional loans from bilateral and multilateral sources e.g. the Paris Club, the London Club etc, with longer repayment periods and lower interest rates. From 1978 following the collapse of oil prices which exerted considerable pressure on government finances, it became necessary to borrow for balance of payments support and project financing. This led to promulgation of Decree No. 30 of 1978, authorizing the Federal Government to raise external loans to a maximum of 5 billion (Kehinde & Awotundun, 2012:17-18).Consequently, the first major borrowing which was (US$ 1.92 billion) referred to as the “Jumbo Loans” was contracted from the international Capital Market in 1978 increasing the total debt stock to US $ 2.2 billion. Thereafter, the spate of borrowing increased with the entry of state governments into external loan contractual obligations. The share of loan from bilateral and multilateral sources declined substantially while borrowing from the private sources increased considerably (Rieffel, 2005:2). The ownership structure indicated that a greater portion of about 75% of the loans accrue to Paris Club. However, Nigeria has continued to service that category of debt as at when due.In 2013, the outstanding of Nigeria’s external debt amounted to  8,614.40 billion. This huge external debt constitutes major impediment to the revitalization of Nigeria shattered economy as well as alleviating the country of poverty.Nigeria’s debts crisis could be traced to economic policies concentration in the oil sector since the buoyancy of the oil market in early 1970s which resulted in an outright neglect of the non-oil sector of the economy especially agriculture. As a result of this, the oil sector provided over 90% of government national revenue, so fluctuations that occurred in the oil market in 1978 and 1980s distorted the projected revenue estimates of the federal government. Hence, the government had to borrow to fill the gaps created by the fluctuations and also meet the increasing expenditures. The debt situation was intensified by large public deficits caused by inefficient control over private capital out flows and over valuation of the exchange rate of naira to other world currencies etc.In essence, what matters most is not the amount of the foreign loan but the ways and manner in which the loans are used for productive purposes. If these loans are used for current consumption, they will have minimal impact on future economic growth and the real sector at large but if the loans are invested rationally in productive ventures, they will contribute positively to real growth and enhance the productive capacity of the economy.

8,614.40 billion. This huge external debt constitutes major impediment to the revitalization of Nigeria shattered economy as well as alleviating the country of poverty.Nigeria’s debts crisis could be traced to economic policies concentration in the oil sector since the buoyancy of the oil market in early 1970s which resulted in an outright neglect of the non-oil sector of the economy especially agriculture. As a result of this, the oil sector provided over 90% of government national revenue, so fluctuations that occurred in the oil market in 1978 and 1980s distorted the projected revenue estimates of the federal government. Hence, the government had to borrow to fill the gaps created by the fluctuations and also meet the increasing expenditures. The debt situation was intensified by large public deficits caused by inefficient control over private capital out flows and over valuation of the exchange rate of naira to other world currencies etc.In essence, what matters most is not the amount of the foreign loan but the ways and manner in which the loans are used for productive purposes. If these loans are used for current consumption, they will have minimal impact on future economic growth and the real sector at large but if the loans are invested rationally in productive ventures, they will contribute positively to real growth and enhance the productive capacity of the economy. 2.3. Types and Sources of Foreign Loans

- Just like domestic loans, foreign loans are classified into various groups based on their nature, purposes, arrangements and the way the loans are being settled. These loans are classified as trade arrears, balance of payment support loans, project tied loans, loans for socio-economic purposes, arrears of dues and levies and foreign bonds. Trade arrears arise from import of goods and services which are yet to be paid for. Balance of payments support loans are short or long term loans contracted by a country for the purpose of rectifying temporary or persistent unfavourable balance of payments position. Multilateral institutions undertaking bilateral arrangement such as the International Monetary Fund provide such loans. Project tied loans are foreign loans tied to government projects which are expected to be viable. They are self-liquidating since inflows from the project should be sufficient to repay the loans. (Sanusi, 1997: 2-7).Loans for socio-economic purposes are basic infrastructure loans which are expected to move the economy forward in areas like education, health, electricity and rural development. These loans are usually soft in the sense that the interest charges are usually small and repayment period extended (http://www.investopedia.com/terms/external-debt.asp.) and (Okororie: 2007: 75). Arrears of dues and levies to international organizations which the country is a member is consolidated to form part of the country’s external debt. A country could also float bonds that are designated in foreign currencies and traded in foreign capital market. These bonds could be converted to serve as means of settling the external loan of the issuing country.The sources of foreign loans are the World Bank, the International Monetary Fund, and their affiliates such as the International Development Association, The International Finance Corporation, European Investment Bank and the International Fund for Agricultural Development. Other sources are the promissory note creditors, Paris Club of Creditors, and London Club of Creditors. Foreign Loans can also come in the form of trade, contract, finance credit supplies and private investments (Okororie, 2007: 75) and (Nwoke, 1990:42-61) and (Kehinde & Awotundun, 2012:13).The loan gotten from the World Bank, International Monetary Fund “IMF” and their affiliates are regarded as senior loans and are always promptly settled. These institutions are known as the multilateral creditors. Debt owed to the multilateral institutions are subject to refinancing through the purchase of such debts by a third party at a discount with a mechanism that will reduce the debt burden of the debt distressed countries. Paris club of creditors is an informal group of creditor countries with no permanent members who meet to negotiate debt rescheduling for borrowing countries. Such debts are usually guaranteed by various export credit agencies of the creditor countries. During any debt re-scheduling with a debtor country, the World Bank, European Union, International Monetary Fund, Organisation of Economic Co-operation and Development and the United Nations Conference on Trade and Development are usually invited. Their presence ensures reasonable considerations for debt ridden third world economics.London club of creditors is a cartel of International Commercial banks who handles private debts and other commercial debts and operates strictly on commercial terms. This club insists on some form of adjustment programme moderated by the International Monetary Fund before going into business or before the end of the consolidation period. The common terms for rescheduling of debt with the London club are loans falling due over the next one to two years with a short moratorium on arrears, eighty percent (80%) or less, of the debt during the consolidation period and in some cases, the entire amount and interest rate linked to the three to six months London inter bank rate for the US dollar and the United States prime rate (IMF Report, 1983) and (Nwankwo, 2010:2).Promissory note creditors are holders of Central Bank of Nigeria (CBN) promising notes issued in respect of verified and reconciled private sector uninsured trade debt arrears. These are finance under bills for collection and open accounts. For instance, trade arrears of between 1982 and 1988 were financed by the issuance of promissory notes to the creditors (Okororie, 2007: 75), and (Adepoju et al 2007:5-6).

2.4. Real Sector Developments in Nigeria

- The real sector plays strategic role in a developing economy like Nigeria. The sector produces and distributes tangible goods and services required to satisfy demand. Its performance measures the standard of living of the populace and the effectiveness of the macroeconomic policies. This sector creates more linkages in the economy and thereby reduces the pressure of the external sector. By its functions, the real sector is supposed to build capacity, generates employment and distributes income. However, this sector has underperformed as a result of poor access to credit, high cost of credit and infrastructural challenges. The global financial crises had also affected this sector as loanable funds reduced drastically (CBN Annual Report, 2010:124).Due to these problems, the Central Bank of Nigeria initiated the

200 billion commercial agricultural credit scheme, the

200 billion commercial agricultural credit scheme, the  200 billion small and medium scale enterprises guaranteed scheme, refinancing fund,

200 billion small and medium scale enterprises guaranteed scheme, refinancing fund,  300 billion power and aviation intervention fund, among others. In the industrial sector, a ten year national strategic industrial development master plan was instituted to increase employment and enhanced output from this sector. In maritime services, the federal government Port Reform Programme was implemented to make Nigerian ports favorably competitive and the Nigerian railway modernization project resuscitated among several other programmes. A huge success has been made on the current market prices of gross domestic product but its growth rate is highly fluctuating (CBN Annual Report, 2010:125-142) and (www.indusedu.org). These observations necessitated a study of other variables that may affect the development in this sector of the economy.

300 billion power and aviation intervention fund, among others. In the industrial sector, a ten year national strategic industrial development master plan was instituted to increase employment and enhanced output from this sector. In maritime services, the federal government Port Reform Programme was implemented to make Nigerian ports favorably competitive and the Nigerian railway modernization project resuscitated among several other programmes. A huge success has been made on the current market prices of gross domestic product but its growth rate is highly fluctuating (CBN Annual Report, 2010:125-142) and (www.indusedu.org). These observations necessitated a study of other variables that may affect the development in this sector of the economy.3. Methodology

3.1. Research Design

- The research methods used in this article are the desk, investigatory, descriptive and analytical methods. The secondary data were collected from existing documents such as the Central Bank of Nigeria (CBN) statistical bulletin, CBN annual report, text books, journals and internet websites among others. The data collected were on the growth rate of gross domestic product, manufacturing output, unemployment rate, total value of loans from Paris club, London club, multilateral creditors, promissory notes creditors and other loans to Nigeria from 1970 to 2012.

3.2. Research Hypotheses

- 1. H0: Loans from Paris club, London club, multilateral creditors and promissory notes creditors and other loans have no significant effect on growth rate of gross domestic product.2. H0: Loans from Paris club, London club, multilateral creditors, promissory notes creditors and other loans have no significant effect on unemployment rate.3. H0: Loans from Paris club, London club, multilateral creditors, promissory notes creditors and other loans have no significant effect on manufacturing output.

3.3. Regression Models

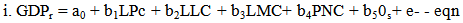

- The multiple regression model given as y = a0 + b1x1 + b2x2 + b3x3 + b4x4 - - - + bnxn + e is used to analyse the relationship that exist between foreign loans and real sector development The models are expressed as

| (1) |

| (2) |

| (3) |

4. Empirical Review

- This work examines the economic implications of foreign loans on real sector development in Nigeria. Foreign loans have implications on real sector development in terms of promoting its performance or inhibiting it. In this sector data on the variables of foreign loans and those of the real sector development were presented and analysed.In the table 4.1 above, data on real sector development variables and the various sources of foreign loans are presented. From the table, it is observed that between the years 1970 and 1984, when the growth rate of gross domestic product (gdpr) fluctuated between 59.09% and 2.36%, loans from Paris club rose from

136.0 million to

136.0 million to  6, 360.4 million while the loan from London club rose from

6, 360.4 million while the loan from London club rose from  1, 981.7million to

1, 981.7million to  5, 443.7million. Within this period, multilateral loans, promissory notes creditors and other loans stood at

5, 443.7million. Within this period, multilateral loans, promissory notes creditors and other loans stood at  1, 271.2million,

1, 271.2million,  1, 155.1million and

1, 155.1million and  578.3million, respectively. However, the unemployment rate between the years 1970 and 1984 continued to rise at very high fluctuating rates from 4.9% to 10.8%. This shows that the increased loans from Paris club and London club were not invested productively to have created substantial employment opportunities.

578.3million, respectively. However, the unemployment rate between the years 1970 and 1984 continued to rise at very high fluctuating rates from 4.9% to 10.8%. This shows that the increased loans from Paris club and London club were not invested productively to have created substantial employment opportunities. 205, 971.44million in 1986 to

205, 971.44million in 1986 to  312, 183.48million in 1999. However, it is observed that the foreign loans were always on the increase. For instance, Paris clubs loan rose from N7, 726.4million in 1985 to N1, 885, 664.8million in the year 1999 while London club loans rose from N6, 164.3million to N187, 627.1million. The other loans kept increasing in the same pattern.From the year 2000 to 2012, the increase in the growth rate of gross domestic product was not so significant as compared to the period from 1970 to 1996 as it ranged from 3.5% to 10.2% respectively. Unemployment rate rather increased from 3.9% in 2000 to 23.9% in the year 2012. The loans also kept rising except for promissory notes that reduced to

312, 183.48million in 1999. However, it is observed that the foreign loans were always on the increase. For instance, Paris clubs loan rose from N7, 726.4million in 1985 to N1, 885, 664.8million in the year 1999 while London club loans rose from N6, 164.3million to N187, 627.1million. The other loans kept increasing in the same pattern.From the year 2000 to 2012, the increase in the growth rate of gross domestic product was not so significant as compared to the period from 1970 to 1996 as it ranged from 3.5% to 10.2% respectively. Unemployment rate rather increased from 3.9% in 2000 to 23.9% in the year 2012. The loans also kept rising except for promissory notes that reduced to  85, 526.7million and

85, 526.7million and  64832.6million in the years 2005 and 2006. The implication here is that the rise in the volume and mount of loans is not commensurate with the growth level in the variables of real sector development, meaning that all the increased loans were not used for productive purposes that would have significantly improved the domestic market. They were probably used for current consumption which reflects the low short run increases in the gross domestic product growth rates.In order to examine the strength and the direction of the relationship that exist between and among the variables studied in this work, the hypotheses formulated earlier in section 3.2 were tested using the multiple regression models and the result extracts presented in table 4.2 below.

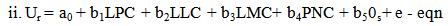

64832.6million in the years 2005 and 2006. The implication here is that the rise in the volume and mount of loans is not commensurate with the growth level in the variables of real sector development, meaning that all the increased loans were not used for productive purposes that would have significantly improved the domestic market. They were probably used for current consumption which reflects the low short run increases in the gross domestic product growth rates.In order to examine the strength and the direction of the relationship that exist between and among the variables studied in this work, the hypotheses formulated earlier in section 3.2 were tested using the multiple regression models and the result extracts presented in table 4.2 below. | Table 4.2. Regression Results Extracts |

5. Discussion, Conclusions and Recommendations

5.1. Discussion

- The real sector occupies a critical and strategic position in any economy. The various products both tangible and intangible consumed in any economy are produced from the real sector of the economy. This sector requires huge investments in long term assets and technology required for the production of good and services. Some of these assets and/or technology are not available in the local economy, hence the need to purchase them from the foreign markets. This implies that foreign loans need to be raised in order to acquire these productive assets. It is therefore expected that with the increase in the stock of these assets funded by the external loans, there is bound to be increase in real sector development and growth.These aside, the foreign loans obtained from the various sources also provide the source for funding investment in infrastructure such as electricity, good road networks, transportation, communication, pipe-borne, water among others. With the improved quantity and quality of infrastructure, real sector outputs, unemployment rate and the growth rate of gross domestic products are expected to grow. In addition, improved infrastructure base and real sector development and growth lead to increase in the consumption of goods and services, viz-a-viz, enhanced market potentials.Following from the above expositions, and analysis, it was established that:i. A high positive relationship exists between the growth rate of gross domestic product and loans from Paris club. In other words, Paris club loans have contributed positively to the production of goods and services in Nigerian economy.ii. An inverse relationship exists between the growth rate of gross domestic product, multilateral creditors’ loan and promissory notes creditors; implying that these loans were not used directly in the productive sectors of the economy. It is possible that they were used for current consumption; thus a one naira increase in the loans, reduced the growth rate of gross domestic product by -21.8%.iii. A marginal relationship exists between unemployment rate, loans from Paris club and loans from “other” sources. This shows that loans from these institutions were not directed at productive industries and investments that would have created more employment opportunities in the country.iv. Loans from Paris club, London club and other sources (os) contributed positively to the growth of the manufacturing subsector outputs, meaning that the loans were directed at manufacturing.v. The inverse relationship that exists between the multilateral creditors, promissory notes creditors and manufacturing outputs shows that these loans were not put into productive use in this subsector.The findings above are however in contrast with the research findings of Kehinde & Awotundun, (2012: 21) and James (2006) in Kehinde & Awotundun (2012:19) as well as Aluko and Arowolo, (2010:5-7) whose findings are that there is no positive relationship between Nigeria debt portfolio and domestic investment. It is worthy to note here that James, (2006) took into consideration the total of all public debt (i.e. domestic and foreign) without considering the impacts of each of the sources of loans on domestic investment. Similarly, Kehinde & Awotundun (2012:21) considered the combined impact of both domestic loans and foreign loans on investments while in this paper individual sources and volumes of foreign loans and their relative impact on real sector development and growth were analysed.

5.2. Conclusions

- The need for a country to borrow cannot be overemphasized. Countries borrow to finance their investment deficits to achieve macroeconomic objectives including real sector development and growth measured by the gross domestic product growth rate, aggregate output of goods and services from the sector and unemployment rates. Judicious use of foreign loans is necessary both from the perspective of effective and efficient servicing of such debts and contribution of such loans to the realization of the development and growth aspirations of the economy specifically the real sector emphasized in this article. With the high positive relationship between Paris club loans and the real sector development, foreign loans obtained from sources with liberal terms and servicing conditions when put into productive uses have high potentials for improving real sector performance and the economy as a whole. Based on these, the recommendations obtained below were made.

5.3. Recommendations

- On the bases of the forgone analyses, it was recommended that:i. Foreign loans should be used mostly for investment in productive assets expected to inspire improved real sector development and growth.ii. The Federal government of Nigeria should continue to raise foreign loans from Paris and London clubs but however, effective and efficient debt serving measures should be adopted in other not to accumulate overtime.iii. Efforts should be made by the government of Nigeria to retire the debts owed to multilateral and promissory notes creditors as they are exerting negative influences on real sector development and growth as indicated by the retarding effects on the growth rate of gross domestic product and unemployment rate.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML