-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(5): 286-294

doi:10.5923/j.ijfa.20140305.02

Investment Portfolio of Insurance Firms and Economic Development in Nigeria

Uduak B. Ubom

Dept. Of Banking and Finance, University of Uyo, Uyo, Nigeria

Correspondence to: Uduak B. Ubom, Dept. Of Banking and Finance, University of Uyo, Uyo, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This article was designed to examine the link between investment portfolio of insurance firms and the variables of economic development such as the growth rate of gross domestic product (GDP), unemployment, capacity utilization and inflation rates in Nigeria from 1990 to 2011. Blends of desk, exploratory and descriptive research design were used. Data were analyzed using descriptive and inferential tools. The discoveries were that insurance companies in Nigeria got over 95% of income on yearly basis from premium and accumulated large sum of funds after expenditures on claims but invest less than 1% of such funds. Stock and bonds, government securities as well as real estate properties and mortgages dominated the investment portfolio of these financial institutions with heavy concentration in the assets of quoted companies. Hence, small and medium scale enterprises were not funded. As such, insurance firms were not making any significant influence on economic development in the country as evidenced in the marginal growth rates of gross domestic products (GDP) and capacity utilization, among others. Therefore, the recommendations were that insurance companies should increase their wealth allocations to investments with proper spread and mix to cover small and medium scale enterprises and short term loans and to introduce finance and insure products to broaden their income base. This is expected to enhance their investment positions and contributions to economic development and growth in the country.

Keywords: Investment Portfolio, Investment Assets, Insurance Firms and Economic Development

Cite this paper: Uduak B. Ubom, Investment Portfolio of Insurance Firms and Economic Development in Nigeria, International Journal of Finance and Accounting , Vol. 3 No. 5, 2014, pp. 286-294. doi: 10.5923/j.ijfa.20140305.02.

Article Outline

1. Introduction

- Insurance firms constitute one of the major segments of financial system in all economies of the world. As financial institutions, they are involved in financial intermediation; mobilizing financial resources and channeling them into the economy for productive uses.The main objective of insurance companies is to protect their customers against insured risks by selling insurance policies to them. The policy holders pay premium to the insurance firms while expecting compensation from them in event of the occurrence of the insured risks.By doing this, these financial institutions pool and manager risk on behalf of their customers. Hence, insurance provides a risk transfer mechanism for household individuals, business firms and governments. The operation of insurance firms is guided by the law of large number. This law enables these enterprises to make approximate estimate of the level of losses they are likely to suffer every year. According to Akpakpan (1999:236), since insurance companies often collect more money from the premiums than they lose on account of claims, they generally accumulate large amounts of money. As such, they constitute a major source of funds for investment. In a further analysis, the expert observes that: where the huge funds accumulated by insurance firms are invested, the economy is bound to benefit from their activities: existing jobs will be sustained and new ones created, output will be increased and price fluctuations may be minimized. Where they are not invested, the benefits of the operations of the companies will be limited to fat incomes for the few rich people who own such businesses.It is therefore evident from the above exposition that insurance firms have significant role to play in employment generation, increase in output of goods and services, price stability and improved standard of living in the economy (depending on their investment practices). These are the key issues and challenges of economic development in most developing countries of the world including Nigeria.In Nigeria, just like in most countries of the world, insurance companies constitute the next largest mobilizers of funds for investment after banks. Insurance premium income is a veritable tool for boosting activities at the money and capital markets and for the acquisition of real assets (Onoh, 2002:102).The growth of insurance companies in the country in terms of the number rising from less than 30 (both life and non-life) in 1970 to 187 in 1997 was rapid. This led to the increase in gross premium income from

4,741.5million in 1995 to

4,741.5million in 1995 to  4,792 million in 1999. In the year 2000, aggregate asset base of insurance firms in Nigeria stood at

4,792 million in 1999. In the year 2000, aggregate asset base of insurance firms in Nigeria stood at  43,424 million. One would have expected that with the number of insurance companies stabilized at 73 in 2010, and the volume of funds mobilised by them, a remarkable improvement in the level of economic development would have been recorded in the country. This has been an illusion and very little or no efforts have been made to research on investment practice and portfolio of these firms in Nigeria and the way forward in their role in enhancing improved level of economic development in the country. This article is therefore an attempt to investigate the investment portfolio of insurance companies and its implications on economic development in Nigeria.In particular, the work seeks to trace the history, and evolution of insurance, the trend of premium income of insurance firms in Nigeria and to examine investments portfolio of these companies in order to establish its relationship with the variables of economic development in the country such as, gross domestic product (GDP), unemployment and inflation rates, among others in the country.This article is divided into five sections. Section I is the introduction while section II is set aside for conceptual and theoretical review. The third section presents the methodology. In section IV, statistical details are presented and analyzed and section V, covers the discussion, recommendations and conclusion.

43,424 million. One would have expected that with the number of insurance companies stabilized at 73 in 2010, and the volume of funds mobilised by them, a remarkable improvement in the level of economic development would have been recorded in the country. This has been an illusion and very little or no efforts have been made to research on investment practice and portfolio of these firms in Nigeria and the way forward in their role in enhancing improved level of economic development in the country. This article is therefore an attempt to investigate the investment portfolio of insurance companies and its implications on economic development in Nigeria.In particular, the work seeks to trace the history, and evolution of insurance, the trend of premium income of insurance firms in Nigeria and to examine investments portfolio of these companies in order to establish its relationship with the variables of economic development in the country such as, gross domestic product (GDP), unemployment and inflation rates, among others in the country.This article is divided into five sections. Section I is the introduction while section II is set aside for conceptual and theoretical review. The third section presents the methodology. In section IV, statistical details are presented and analyzed and section V, covers the discussion, recommendations and conclusion.2. Conceptual and Theoretical Review

2.1. The Concept of Insurance and Insurance Institutions

- Every activity of individuals, business organizations and the society as a whole has some risk elements. That is, the possibility of misfortune, disaster, unfavourable outcomes, danger and/or adverse situations causing injuries, damages and loss of income, properties and/or lives (Ubom, 2010:67). Risks threaten human existence and business investments imposing fears on household and corporate individuals. Insurance therefore exists to provide the avenue and mechanism of transferring risk from the person likely to suffer loss to the experts who specialise in the management of risk. These experts are the insurance firms. In this segment, the conceptual views of insurance and insurance firms are examined.According to Isimoya (2013:17), insurance is a social scheme which provides financial compensation for the effects of a misfortune. The financial compensation is provided from the pool of accumulated contributions of all members participating in the scheme. Insurance is a technique in which a person shifts the risk or risk management responsibilities to another person or firm specialising in risk management.Insurance companies or institutions are the firms that specialize in risk management. The practice of transferring risk to insurance companies is through the purchase of appropriate insurance policies from the companies and payment of the prescribed premium. By this, the policy holders (ie insured) seek protections and coverage from the insurer (insurance firm) against the risks specified in the policy (Ubom, 2010:70).As observed above, risks are threat to life and property. Thus, insurance exists to provide coverage to the risks affecting life and non life. Hence, insurance is classified into life and non life.Life insurance provides for one’s funeral expenses and for one’s dependants after life. The scope of life insurance has expanded over the years to include assortment of policies. In the views of Isimoya (2007:53), life insurance contracts fall into term assurance, whole life assurance, endowment assurance and annuities. Apart from taking care of the dependants after life, life policies such as endowment and annuities provide the means of accumulating capital for establishment of a business after retirement and for expansion of existing businesses. In contrast, non-life insurance includes marine insurance, fire insurance, motor insurance and accident insurance. Each form of insurance is designed for a specific purpose. For instance, marine insurance is designed to provide financial compensation for injury on persons, loss or damage to property, and losses arising from maritime trade and ventures. The perils covered under marine insurance include; collision, fire, theft, stranding, wrecking, sinking, jettison and damage to ship, vessels, cargo, crew and passengers on board. This is different from the fire insurance which provides compensation for the fire damage to the property insured (Isimoya, 2007:43).The main object of insurance is to provide compensation or indemnify and restore the insured to his/her economic and financial position prior to the occurrence of the event (Ikon, 2004:45). Insurable interest (ie the financial loss the insured is exposed to) is at the center of every insurance policy. With insurable interest, the insured is expected to exhibit due care and diligence to his life and property.Different insurance institutions exist to provide the needed services covering both life and non life. Thus, two main types of insurance companies exist. These include life insurance and general (or property and casualty insurance). General insurance does not involve death as the main risk. It rather includes home, vehicle and various commercial risks such as aviation. A company that undertakes both life and non-life insurance is known as a composite insurance company (Casu, Girardone and Mosyneux, 2006:395). The central business activity of insurance institutions relates to the evaluation of risk and the spreading of risk over those individuals and institutions facing risk and wishing to protect themselves against it (Goacher, 2006:64).

2.2. History and Development of Insurance

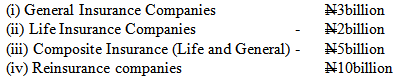

- The establishment and operation of insurance companies in the world started in the middle of the sixteen century in United Kingdom with marine risk insurance. This made sailors the first set of people to have their lives insured since they were afraid of being captured by Turks or Corsairs and sold into slavery. These early assurances lasted for only one voyage at a time and were mainly intended to provide ransom money, should that be needed (Ekezie, 1997:76).As further explained by Ekezie (1997:76), the Great Fire of London in 1666 compelled people to start thinking of how to protect themselves against such losses. This gave rise to fire insurance coverage and the first fire insurance company was established in London in 1680.According to Alabi (1987:316), in Nigeria there existed many forms of insurance practices before the advent of modern insurance. These traditional forms of insurance arrangement were entirely indigenous. They existed in the forms of extended family systems, age-grade associations, and cultural unions such as Ajo or Esusu in Yoruba land. Members of these associations provided some kinds of insurance protections to their members especially during periods of adversity. For instance, if a breadwinner died prematurely, the cultural group will arrange for his burial and upkeep of his dependants until they can fend for themselves.Modern insurance in the country however started with the establishment of trading posts among the West Coast of Africa by British Merchants in late 20th century. The main aim was to protect the interest of the expatriates and their businesses. The business of insurance as at then was carried out through agents. But later on, branch offices of oversea insurance companies were established to take over the business. The first major insurance company in Nigeria was established in Lagos with the name Royal Exchange Assurance in 1921 (Alabi, 1987:316).With the establishment of the Royal Exchange Assurance, the insurance industry started to develop and grow. Hence, the number of insurance firms rose from 1 in 1921 to 4, 28 and 80 in 1949, 1960 and 1975, respectively. However, the industry was dominated by foreign companies within these periods. The first indigenous insurance companies namely: the Great Nigerian Insurance Company, the Nigeria General Insurance Company and the Universal Insurance Company were established and became operational in 1960. This was followed by the establishment of the National Insurance Corporation of Nigeria (NICON) in 1969 by the Federal Government of Nigeria. Since then, the number of insurance companies in the country kept on increasing especially following the oil boom of 1970s. Within these periods, there was no effective laws to regulate the operation and activities of insurance firms in Nigeria even though they were some legislations such as the Insurance Companies Act of 1961, Insurance (Miscellaneous provision) Act of 1964, Insurance Decree of 1976 and the Nigerian Re-insurance Corporation Act of 1977. The insurance Decree of 1976 was the first effective legislation promulgated to regulate insurance business in Nigeria (Onoh, 2002:101). Following this were the Insurance Decree No.58 of 1991 and Insurance Decree No.2 of 1997.The National Insurance Commission was established in the country through the National Insurance Commission (NAICOM) Act 1997. The commission was set up to address the issue of ineffective regulation, supervision and control of insurance business in the economy which were largely in the hands of indigenous investors since the enactment of the Nigerian Enterprises Promotion Decree, 1977.The industry increased on daily basis as the number of insurance firm rose from 28 in 1975 to 187 in 1996. The number however declined from this figure in 1996 to 104 in 1999 and rose again to 118 in 2000. With the recapitalization exercise in the industry in 2007 in which the capital base of insurance firms was increased the number of insurance companies declined drastically in the country. The new capital base for all categories of insurance is as shown below:

As at 2010, 73 insurance companies were operated in Nigeria. However, in 2012 only 58 insurance companies existed in the country with over 500 Insurance brokers, 33 Loss Adjusters and a host of Insurance agents close to 30,000 serving as field workers (Ahmed, 2012:17).

As at 2010, 73 insurance companies were operated in Nigeria. However, in 2012 only 58 insurance companies existed in the country with over 500 Insurance brokers, 33 Loss Adjusters and a host of Insurance agents close to 30,000 serving as field workers (Ahmed, 2012:17).2.3. Types, Characteristics and Operation of Insurance Business

- Two broad types of insurance business are common in most economies of the world. These are the general insurance and long term insurance (Goacher, 2006:65). General insurance business comprises insuring items such as buildings and contents, motor vehicle, ships and aircraft. It also includes insurance to protect against injury to people. Therefore, individuals and organizations purchase cover to protect themselves against specific eventualities such as fire, theft and accident. This form of insurance is usually short term business, with renewable policies which are often up-rated annually. The exceptions in this category are the permanent health insurance and critical illness insurance which have longer-term period.In contrast to the general insurance business considered to be predominantly short term, the long-term insurance otherwise known as life insurance business is associated with risks relating to life expectancy and having longer period of maturity. Four main types of long term insurance policy exist. They include whole life assurance, term assurance, endowment assurance and annuity. The classification of insurance business above is consistent with the provision of Insurance Act 2003 which is the major instrument regulating the business of insurance in Nigeria (Adekunle, 2009:3).Insurance businesses are characterized mainly by intangible products and services. These products and services are futuristic and contractual in nature. Hence, insurance institutions are denoted as contractual financial institutions. The contract of insurance is initiated and become binding upon the purchase of appropriate insurance policy and the payment of prescribed premium. The premium paid by the policy holders constitutes the major source of income or funds to insurance companies. Such funds are used by the firms to pay claims to the unfortunate few who suffer losses (as a result of the occurrence of the insured event(s)) and for investments.As noted earlier, the operation of insurance business is based on the Law of large numbers. The law of large numbers states that, “There should be a large group roughly similar but not necessarily identical exposures units that are subject to the same peril or group of perils” (Adekunle, 2009:6). This is to enable the insurers predict losses that may likely occur within the insured group at any point in time. Some key principles such as the principle of utmost good faith (Uberima fide), insurable interest, indemnification and subrogation, among others form the pillars in the operation of insurance business.By selling policies to their customers and receiving premium in return, insurance firms are able to mobilize funds enough and far in excess of claims and other operational expense. As such, these financial institutions undertake series of investments. Such investments are expected to enhance economic development and growth. In the sections that follow the investment assets and portfolios of insurance firms and the link between investments portfolio of insurance companies and economic development are examined.

2.4. Investment Assets and Portfolio of Insurance Institutions

- Insurance firms are contractual financial institutions that specialize in providing insurance cover or protection to their customers against insurable risk. They mobilize large amounts of financial resources from the premium paid by the policy holders (Iyiegbuniwe, 1998:26) and use part of the funds to invest after payment of claims.Insurance firms as institutional investors invest in government securities, loans and housing or real estate development, among others (Ojo, 2010:60). For insurance, the National Housing Funds, Decree No. 3 of 1992 made it mandatory for all registered insurance companies operating in Nigeria to contribute not less than 20% of their funds to real property development (Onoh, 2002:102). The various reforms in the finance sector and insurance subsector of Nigeria have expanded the scope of investment of insurance companies. Hence, insurance companies hold assets in government securities, stock, shares and bonds, mortgages and loans, cash and bills receivable and miscellaneous items (Aderibigbe, 2004:1). Hence, they hold portfolio of assets comprising mainly government securities, shares, bonds mortgages and loans, etc.The investment objectives of insurance companies are mainly safety, liquidity and growth. These objectives which form the framework of investment portfolio structure of these firms are based on the nature of liabilities of the insurance firms, their operational focus and guidelines of the industry regulators which vary from one country to another and the stages of development in the various countries.In view of the investment practices and of portfolio insurance firms, Ahmed (2012:17) describes them as creator of wealth and mobilizer of funds for National Development. National development revolves around economic development and growth discussed below.

2.5. Economic Development and Growth

- Generally, Nigeria and most other developing countries of the world are still characterized by unemployment, poverty and low standard of living (Akpakpan and Okpokpong, 2010:2). As such, the ultimate objective of every modern society in the world is how to achieve improvement in economic and social conditions. These improvements come as a result of some positive changes in the society. Such changes include; a reduction in the level of unemployment, a general rise in incomes, reduction in poverty and personal and regional inequalities, increase capacity utilization, improved technology capabilities, increased output of goods and services, (i.e economic growth) and improvement in the quality of life in the society as a whole (Akpakpan, 1999: 208).Economic development is a process in which a country’s real national income increases over a long period of time. It is also concerned with the achievement of higher level of per capita income by poor countries and improved conditions of living for people. In the technical sense, economic development refers to a process of economic growth within an economy. The central objective of the process being higher and rising real per capita income for that economy (Ojo, 2010 :3). Development therefore is considered in terms of aggregate output, the quality of labour force, net national income and the growth in per capita income and output. For any meaningful development to take place, growth must occur in the various sectors of the economy.Rostow (1960:3), described the preconditions necessary for a country to move from low level of development to a level of sustained industrialization and growth. The major focus here being on development strategies of building middle class of entrepreneurs, literate work force, adequate infrastructure investments and appropriate institutional environment (Henderson and pole, 1991:1197).Economic development and growth as discussed here require adequate stock and allocation of capital to the various sectors of the economy. These resources are needed to strengthen the operational capacity of entrepreneurs, firms and provision of infrastructure to encourage private sector investments, initiatives and growth. Insurance companies as mobilizers of funds are expected to play significant role in this process through their investment practices and portfolios.

3. Methodology and Design

3.1. Research Design

- In this article, the desk research design with blends of exploratory, investigatory and descriptive technique were used. These methods were employed in order to capture the investment practices, portfolio and activities of insurance companies in Nigeria and to establish the link between the variables of investments of these firms and those of economic development in the economy.

3.2. Variables Identification

- The key variables used in this work are those of the operations and investments portfolios of insurance firms and those of economic development in Nigeria from 1990 to 2011. The variables of investment portfolios of insurance companies include the sources of income and expenditures, and total insurance business investments. The main source of insurance income and expenditure are premium and claims payment respectively. The excess of the income over expenditure is expected to be invested in different assets by these financial institutions thereby forming their investment portfolios.On the other hand, the variables of economic development are the growth rate of gross domestic product, capacity utilization, unemployment and inflation rates. These variables are the common indicators of economic development and growth.

3.3. Types and Sources of Data

- Generally, secondary data were used in this work. These data were time series and cross section. The data reflected the income, expenditure, and investments of insurance companies and the growth rate of gross domestic product (GDP), capacity utilization and unemployment rates in Nigeria on yearly basis for the period covered in the work (i.e 1990-2011).The data were sourced and extracted from existing documents and materials. These include the Central Bank of Nigeria (CBN) statistical Bulletin, CBN Annual Report and Statement of Account, CBN Bullion, National Insurance Commission (NAICOM) Annual Reports, text books, journals, and internet sources, among others.

3.4. Method of Data Analysis

- The data collected for this work were presented in tables indicating the series of observations, the trend and movement of the variables studied. Percentages (%ages) and ratios were computed to analyse the characteristic trend movement of the income, expenditure, and investment of insurance firms as compared to the variables of the economic development in the country for the various years. These tools made it possible to carry out empirical analysis describing the trend and movements of investment of these financial institutions and their implications on economic development of Nigeria. Thus, the tools used in the article were descriptive and inferential in nature.

4. Empirical Details and Analysis

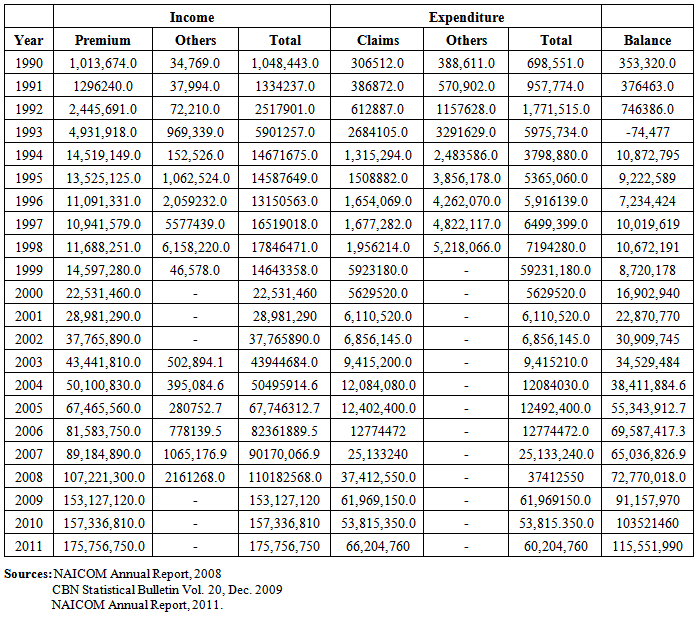

- The main focus of this work is on examination of investment Portfolio of insurance firms and economic development in Nigeria. Insurance firms here are seen as mobilizer of funds and institutional investors expected to contribute significantly to economic development in the economy through investment of the funds accumulated predominantly from premium. Therefore, this section is set aside to present and analyse the data on the key variables examined in the article including source of income and expenditure and investment portfolio of insurance firms as well as economic development indicators highlighted above in section 3.2.In table 4.1 above, the trend of income and expenditure of insurance firms in Nigeria from 1990 to 2011 was presented. As shown in the table, the major sources of income and expenditure of these firms are the premium and claims respectively. Other sources of income are interest, dividend and rents. These represent the proceeds or returns from their investments. On the other hand, other sources of expenditure of the insurance companies are management expenses and net commission.

|

1,048,443.0 million. Out of this amount,

1,048,443.0 million. Out of this amount,  1,013,674.0 million representing 96.68% was premium income. A total expenditure of

1,013,674.0 million representing 96.68% was premium income. A total expenditure of  698,551.0 million was made in which

698,551.0 million was made in which  306512.0 million (i.e. 43.88%) was paid as claims to their customers. This left a balance of

306512.0 million (i.e. 43.88%) was paid as claims to their customers. This left a balance of  353,320.00 million expected to be invested in various assets including government securities, corporate stock and bonds, real estate, among others.As shown in the table above, the total income realized by insurance firms in the economy increased from

353,320.00 million expected to be invested in various assets including government securities, corporate stock and bonds, real estate, among others.As shown in the table above, the total income realized by insurance firms in the economy increased from  1,048,443.0 million in 1990 to

1,048,443.0 million in 1990 to  13,150,563.0 million

13,150,563.0 million  22,531,460 million,

22,531,460 million,  67,746,312.7 and

67,746,312.7 and  175,756,750.0 million in 1996, 2000, 2005 and 2011 respectively. This represented 1154.29%, 2049.04%, 6361.61% and 16663.59% increment respectively for the years. Within these years, expenditure of these financial institutions rose from

175,756,750.0 million in 1996, 2000, 2005 and 2011 respectively. This represented 1154.29%, 2049.04%, 6361.61% and 16663.59% increment respectively for the years. Within these years, expenditure of these financial institutions rose from  698551.0 million to

698551.0 million to  5,916139.0 million,

5,916139.0 million,  5,629,520 million,

5,629,520 million,  12,402,400 million and

12,402,400 million and  60,204,760.0 million, respectively. This left the firms with a balance of

60,204,760.0 million, respectively. This left the firms with a balance of  7,234,424 million,

7,234,424 million,  16,902,940.0 million,

16,902,940.0 million,  55,343,913.7 million and

55,343,913.7 million and  115,551,990.0 million for the years 1996, 2000, 2005 and 2011 respectively. The insurers use part of the balances to invest in the various assets forming investment portfolio as presented in table 4.2 below.

115,551,990.0 million for the years 1996, 2000, 2005 and 2011 respectively. The insurers use part of the balances to invest in the various assets forming investment portfolio as presented in table 4.2 below.

|

4,047.81 million in stock and bonds,

4,047.81 million in stock and bonds,  2523.20 million in real estate properties and mortgages,

2523.20 million in real estate properties and mortgages,  3,347.06 million in fixed deposits,

3,347.06 million in fixed deposits,  1,546.16 in government securities and

1,546.16 in government securities and  119.30 million in bills of exchange thereby making a total investment of

119.30 million in bills of exchange thereby making a total investment of  12,379.46 million. The investment in stock and bonds by the companies experienced some fluctuations between 1996 and 2003. It rather maintained an astronomical growth pattern from 2005 when it moved from

12,379.46 million. The investment in stock and bonds by the companies experienced some fluctuations between 1996 and 2003. It rather maintained an astronomical growth pattern from 2005 when it moved from  61,800.00 million to

61,800.00 million to  121,813.13 million,

121,813.13 million,  232,166.8 million and

232,166.8 million and  242,494.5 in 2006, 2009 and 2011 with a total investment of

242,494.5 in 2006, 2009 and 2011 with a total investment of  121,844.22 million,

121,844.22 million,  343,894.20 million and

343,894.20 million and  359,192.20 respectively.Similarly, rapid increase was experienced in the firms’ investment in real estate properties and mortgages as it jumped from

359,192.20 respectively.Similarly, rapid increase was experienced in the firms’ investment in real estate properties and mortgages as it jumped from  33,788.15 million in 2005 to

33,788.15 million in 2005 to  49,454.7 in 2011 representing 46.36% rise in wealth allocation to it within the period. Cash/fixed deposits and investments in government securities experienced almost the same trend as they ranged between

49,454.7 in 2011 representing 46.36% rise in wealth allocation to it within the period. Cash/fixed deposits and investments in government securities experienced almost the same trend as they ranged between  1,546.16 million and

1,546.16 million and  24,555.8 million. This trend was consistent with the liquidity management strategy of financial institutions involving transfers from cash account to investments and vice-versa depending on the firms’ liquidity needs and/or position.As shown in table 4.2 above loans and bills of exchange were the least patronized investment assets in investment portfolio of insurance firms in Nigeria for the period under review. The value of these assets in the portfolio of the companies ranged between

24,555.8 million. This trend was consistent with the liquidity management strategy of financial institutions involving transfers from cash account to investments and vice-versa depending on the firms’ liquidity needs and/or position.As shown in table 4.2 above loans and bills of exchange were the least patronized investment assets in investment portfolio of insurance firms in Nigeria for the period under review. The value of these assets in the portfolio of the companies ranged between  119.30 million and

119.30 million and  14,123.20 million with loans leading at an average investment worth of

14,123.20 million with loans leading at an average investment worth of  7,660.48 million for the period of 16 years.Conventionally and operationally, investment portfolios and practices of financial institutions such as insurance firms are expected to make significant contributions to economic development and growth in any economy. Hence, table 4.3 below was developed to present the trend movement of economic development indicators in Nigeria from 1990 to 2011 as compared with the value of total investment portfolios of insurance firms for the period.

7,660.48 million for the period of 16 years.Conventionally and operationally, investment portfolios and practices of financial institutions such as insurance firms are expected to make significant contributions to economic development and growth in any economy. Hence, table 4.3 below was developed to present the trend movement of economic development indicators in Nigeria from 1990 to 2011 as compared with the value of total investment portfolios of insurance firms for the period.

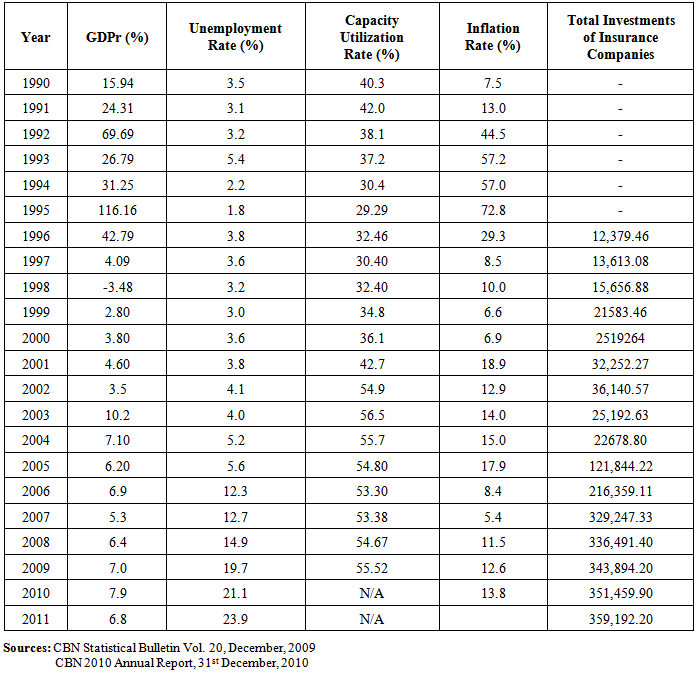

|

12,379.46 million was made by insurance firms in the country. The capacity utilization rate declined from 40.3% in 1990 to 32.46% in 1996 leading to a rise in inflation rate from 7.5% in 1990 to 72.8% in 1995. However, it later declined to 13.8% in 2011 as the investments of insurance firms roses to

12,379.46 million was made by insurance firms in the country. The capacity utilization rate declined from 40.3% in 1990 to 32.46% in 1996 leading to a rise in inflation rate from 7.5% in 1990 to 72.8% in 1995. However, it later declined to 13.8% in 2011 as the investments of insurance firms roses to  359,192.22 million. By 2003, the capacity utilization rate reached its peak at 56.5% and declined slightly to 55.52% in 2009. This was not consistent with the movement of unemployment rate which increased from 4.0% in 2003 to 23.9% in 2011. On aggregate, the growth rate of GDP was not impressive as it ranged between 3.5% and 10.2% from 2000 to 2011 when compared with the increase in investment of these firms from

359,192.22 million. By 2003, the capacity utilization rate reached its peak at 56.5% and declined slightly to 55.52% in 2009. This was not consistent with the movement of unemployment rate which increased from 4.0% in 2003 to 23.9% in 2011. On aggregate, the growth rate of GDP was not impressive as it ranged between 3.5% and 10.2% from 2000 to 2011 when compared with the increase in investment of these firms from  25,192.64 million to

25,192.64 million to  359,192.20 million during these periods. This implies a very minimal contribution of investments of insurance firms to economic development in the country.

359,192.20 million during these periods. This implies a very minimal contribution of investments of insurance firms to economic development in the country.5. Discussion, Recommendations and Conclusions

5.1. Discussion

- Several researches and reports have been conducted and made respectively on the influences or the link between the operations and variables of financial institutions such as banks and insurance firms and economic development and growth. In most of these works including those of Cheng (1999:23), Dele (2007:10), Levine (1997:688), (Kling and Levine, 1993:20), Goldsmith (1969:48), the focus had been on the asset base, capital base and volume of credits.Very Little or no specific works have been carried out to establish a link between the structure or components of investment portfolio of insurance institutions and economic development in developing countries such as Nigeria. This article was therefore an attempt to investigate and establish the link between the investment portfolio of insurance companies and economic development in Nigeria.The variables of investment portfolio of insurance firms were insurance income, expenditure and investments in various assets such as government securities, stock and bonds, loans, real estate and mortgages, among others. On the other hand, the growth rate of gross domestic product (GDP), unemployment, capacity utilization and inflation rates were used as the variables of economic development.As mobilizer of funds and economic development agents insurance firms are expected to make significant contribution to economic development through their investment activities and portfolios. The hope is that, as the mobilise funds through premium, the balance of such funds after expenditure on claims and other payments should be invested in different sectors of the economy. The spread of these investments has the potentials of increasing productivity, economic performance, development and growth.However, it is discovered from this work that insurance companies invest just a small fraction of the balance of their funds after payment of premium and other expenses. For instance, in 1996 only

12, 379.46 million was invested by these financial institutions out of a balance of

12, 379.46 million was invested by these financial institutions out of a balance of  7,234,424.0 million. This represented 0.17%. In 2006, total investment of these firms stood at

7,234,424.0 million. This represented 0.17%. In 2006, total investment of these firms stood at  216,359.91 million from the balance of

216,359.91 million from the balance of  69,587,417.5 million (i.e. 0.31%). Similarly, in 2011 the firms had a balance of

69,587,417.5 million (i.e. 0.31%). Similarly, in 2011 the firms had a balance of  115,551,990.0 million but invested only

115,551,990.0 million but invested only  359,192.20 million representing 0.31%. This implies that for the period under review insurance firms in Nigeria invested less than 1% of their funds on yearly basis. This low level of investment is difficult to exert meaningful influences on economic development in the country.Also, it was found out that the little funds invested by these financial intermediaries were concentrated on the assets of quoted companies and government securities at the detriment of small and medium scale enterprises (SMEs). These SMEs are the bedrock of economic development if properly funded and managed.Again, the funds invested in government securities may not be used in the productive sectors of the economy such as manufacturing and agriculture, etc. These sectors have direct impact on economic development. Furthermore, traditionally insurance firms rarely grant short term loans. Most companies operating in the country need such loans to satisfy their working capital needs for smooth operations. Some business enterprises close their shops as a result of inadequate or outright lack of working capital after their investments in long term assets. Hence, they find it difficult to operate at full capacity thereby contributing to the low capacity utilization rates experienced in the country over the years.

359,192.20 million representing 0.31%. This implies that for the period under review insurance firms in Nigeria invested less than 1% of their funds on yearly basis. This low level of investment is difficult to exert meaningful influences on economic development in the country.Also, it was found out that the little funds invested by these financial intermediaries were concentrated on the assets of quoted companies and government securities at the detriment of small and medium scale enterprises (SMEs). These SMEs are the bedrock of economic development if properly funded and managed.Again, the funds invested in government securities may not be used in the productive sectors of the economy such as manufacturing and agriculture, etc. These sectors have direct impact on economic development. Furthermore, traditionally insurance firms rarely grant short term loans. Most companies operating in the country need such loans to satisfy their working capital needs for smooth operations. Some business enterprises close their shops as a result of inadequate or outright lack of working capital after their investments in long term assets. Hence, they find it difficult to operate at full capacity thereby contributing to the low capacity utilization rates experienced in the country over the years.5.2. Recommendations and Conclusions

- Following from the above, the recommendations were that insurance companies should increase their wealth allocations to investments with proper spread and mix of such investment portfolio to cover small and medium scale enterprises and short term loans to business firms that qualify for such facilities and to incorporate finance and insure products to broaden their income base. There is an outright need for paradigm shift in the operations and investment portfolio of insurance firms. This is expected to increase their income outlets, enhance their investment positions and contributions to economic development and growth in the country.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML