-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(5): 277-285

doi:10.5923/j.ijfa.20140305.01

An Empirical Examination of Firm Characteristics and Its Impact on Listing Day Return

Poonam Rani

National Institute of Financial Management, Faridabad, Haryana, 121005, India

Correspondence to: Poonam Rani, National Institute of Financial Management, Faridabad, Haryana, 121005, India.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

Importance of prospectus cannot be ignored in any public issue. In India there is a set of guidelines, which has to be followed by the issuer in context of prospectus document. These guidelines were formulated by Securities Exchange Board of India (SEBI) to make the firm specific information equally available to different groups of investors and to minimize the information asymmetry. Information asymmetry contributes to ex-ante uncertainty. Ex-ante uncertainty around equity issue spurs underpricing. The objective of the study was to examine the impact of firm specific characteristics on underpricing. Out of various proxies of ex-anteuncertainty; age of firm, turnover, pre IPO leverage; share held by promoters recognised as firm specific characteristics with reference to objective of the study. Initial public offers that were floated from 2007 to 2012 sampled for the purpose of the study. Using multiple regression techniques it was found that age of firm, pre IPO leverage, turnover as well as fraction of share held by the promoter’s of private sector firms in India do not have any statistically significant impact on the level of undepricing. Findings of the present study are quite contradictory to the findings of Ritter (1984), however similar to the findings emerged from the studies (Sahoo & Prabina, 2012; Jain & Padamavati, 2012) that have already been conducted in Indian context. It is concluded that, although firm specific characteristic have correlation with initial day return but firm specific characteristics, do not cause any statistical significant impact on underpricing. On the other hand statistical findings of the present study, have justified the initiative and efforts of SEBI in minimization of information asymmetry at the public issue of equity instruments.

Keywords: Ex-ante uncertainty, Underpricing, Initial public offer

Cite this paper: Poonam Rani, An Empirical Examination of Firm Characteristics and Its Impact on Listing Day Return, International Journal of Finance and Accounting , Vol. 3 No. 5, 2014, pp. 277-285. doi: 10.5923/j.ijfa.20140305.01.

Article Outline

1. Introduction

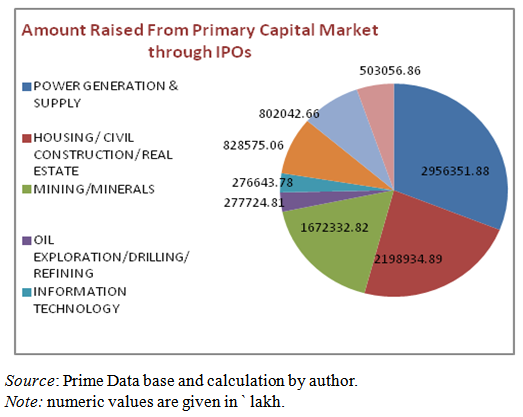

- The Indian capital market is one of the most regulated capital markets and provides maximum protection to investors. In India corporate securities market; primary as well as secondary, abide by the rules laid down by SEBI. In Indian corporate securities market, financial instrument called equity shares are traded intensively and now became a pedestal for other financial products. The level of the returns on financial instruments, in a capital market always attracts investors toward that market. Returns generated on fresh equity instruments in previous period usually have an influence on activities of initial public offers in the present period (lowery, 2002).The holder of the newly issued equity instrument can have returns by selling their holding on the very first day of listing or by keeping it for a specific period (Neupane & Poshakwale, 2012). Return that the holder of equity instruments can obtain by selling it on very first day of listing termed as underpricing. Transparency in IPO process made it difficult to retail investors to generate positive initial return. Now their participation is limited to those IPOs that attract above average demand from QIBs.The level of underpricing varies from country to country and sector to sector. Difference in regulation and type of investors also makes it to fluctuate from country to country and segment to segment. A vast majority of the studies on IPOs have been carried out in context of U.S. Traditionally, Indian IPOs used to be fixed price offerings, wherein prices of the stocks on offer were determined prior, to seeking investors. Historically a large number of IPOs were found underpriced. Over subscription to a public issue is normal phenomenon in book building mechanism. However due to this mechanism the level of underpricing has been reduced in India over a period of time (Bubna & Prabhala, 2006). Now, 100 percent book-building mechanism is mandatory at subscription stage in process of making initial public offers. It’s not only the book-building mechanism but the demand of retail investors also influenced by grading. Initial day return fluctuate significantly in post listing period, because highly graded IPO attracts greater liquidity and reveal lower risk side of public issue (Deb & Marisetty, 2008). Certification (grade of equity instrument) and subscription mechanism both have brought down the level of underpricing in India. A good number of studies in context of newly issued equity instrument dealt with the phenomenon of short run under pricing and have also pointed out the factors that influence it (Shah, 1999; Madan, 2003; Bubna & Prabhala 2007, Padey & Vaidyanathan2009; Sahoo & Rajib 2009; Neupane & Poshakwale, 2009; Sahoo & Rajib, 2010; Bansal & Khanna, 2013). But these factors were never organized under different group so that they can represent a single variable. Amendments in the process and procedures of new issue have made the regulation dynamic for new equity instruments. Hence it can ‘not be said perfectly, the factor that had proved significant at a particular point of time in a particular study will possess the uniform explanatory power. As a result factor that influence underpricing may vary over the period and over the sector. For making return role of the regulator cannot be ignored explicitly in any capital market.IPO market in IndiaCorporate securities segment of the primary capital market in India is regulated by SEBI. IPOs in India either came from NSE (National Stock Exchange), BSE (Bombay Stock Exchange) or from both platforms. Among these two major stock exchanges BSE is the oldest stock exchange in India.In India before 90’s all public issues, were floated from Bombay Stock Exchange (BSE). Some special provision in context of new equity instruments makes Indian IPO segment unique. Grading of equity instruments is compulsory in India since 2007. In each, initial public offer subscription from the side of Qualified Institutional Buyers (QIBs) is mandatory since 2009. Apart from it now every initial public offer priced and subscribed under 100 percent book building mechanism. The behavior of initial public offers varies from sector to sector. From 2007 to 2012 IPOs came from various sector of the economy like power generation & supply (11, IPOs), Housing/Civil Construction/ Real Estate (25, IPOs), Mining/Minerals (5, IPOs), IT (26, IPOs), Banking & Financial (24, IPOs), telecommunication (8, IPOs) and oil exploration sector (1, IPO) etc. Total ` 180,996 lakh were mobilized into these sectors from primary capital market (see; figure no. 1) through equity instruments. Maximum amount channelized in power generation sector with only 11 IPOs. During the sample period maximum number of IPOs came from IT sector (26 IPOs) in India but the amount mobilized to the sector was only ` 276643.78 lakh. With just 8 IPOs telecommunication sector raised a great amount of `2,956,351.88 lakh. In India power generation & supply sector falls in domain of government while IT sector is totally privatized. On the basis of these figure (see; figure no. 1) we hold that government sector in India can raise huge amount with little number of issues while same is not true for private sector companies in India.

| Figure 1. Amount Raised From Primary Capital Market through IOPs |

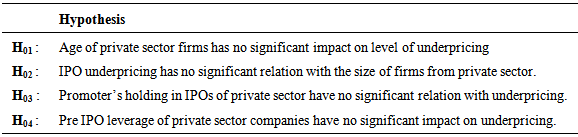

2. Background of the Study and Hypothesis

- Private sector unit usually fulfill their financial needs through indigenous bankers, bank loans or through personal resources. To satisfy the capital requirements, equity financing is the last resort to finance. Prospectus plays an important role in raising finance through equity instruments. Indicators of financial performance as well as other firm specific information occupies substantial place in the prospectus. Final draft of the prospectus contains a brief description of capital requirement and fund utilization. To bring transparency in the procedure of initial public offers and to protect investors, SEBI (Securities Exchange Board of India) making its consistent effort since its incorporation. Introduction of book building mechanism in 1998, grading of equity instrument in 2007, mandatory subscription from QIB were some of the steps taken by SEBI. In India firms, those have at least 3 years track record after their incorporation, are eligible to float their equity instruments. Firms can be old or young at the time of making a public offer. Minimum age content is same for all firms; want to make initial public offer. All firm comes on same scale in terms of financial disclosures. An old firm has to disclose the similar type of, financial as well as non financial information, as a young firm (firm with minimum age of 3years) has to report in its prospectus. In developed capital market such as USA, China etc. there is no minimum age limit for making a public offer. Consequently in capital market like USA, age of the firm plays an important role on public issue. In the capital market of USA, age of the firm has an inverse relation with listing day return (Ritter, 1984; Megginson and Weiss, 1991). On the basis of above discussion it is hypothesized that H0 : Age of private sector firms has no significant impact on level of underpricing Mature firms are more likely to have a good share in the product market because the old firm possesses a better knowledge about product differentiation and market segmentation. These firms can generate a good volume of sales in future also. As a result by investing in equity instruments of such firm’s appropriate return can be enhanced. Prior to IPO, growth in sales reduces ex-ante uncertainty. As a result initial public offer became lucrative and avarice of positive initial return makes an investor to pay more for such issues and an inverse relationship between volume of sales and listing day return arises. Historical sales can be utilized as a barometer of future performance. Older firms are less likely to fail after their IPOs (Schultz, 1993). A inverse relation between firm size (sales used as a proxy of firm size) and risk has robustly been supported in many studies (e.g., Titman and Wessels, 1988; Schultz, 1993). Large firms have better access to capital market , have diversified product lines, and have better corporate governance because they are more likely to be backed by informed investors consequently uncertainty around the IPOs of such firms remain minimal.H0: IPO underpricing has no significant relation with the size of firms from private sector. The likelihood of corporate entities to step in the capital market increases as the bank credit became more costly. To bring these corporate entities to the capital market promoter plays an important role. In India as per ‘SEBI, issue of capital and disclosure requirements regulations, 2009’ promoters of the issuer shall contribute in the public issue in following manner:(a) in case of an initial public offer, not less than twenty percent of the post issue capital;(b) in case of a further public offer, either to the extent of twenty percent of the proposed issue size or to the extent of twenty percent of the post-issue capital;(c) in case of a composite issue, either to the extent of twenty percent of the proposed issue size or to the extent of twenty percent of the post-issue capital excluding the rights issue component.In net shell, in public issue of an unlisted company, promoter’s contribution shall not be less than 20% of the post issue capital. It is similar to the norms as given in Chapter- IV of the SEBI Act, 1992. However entire contribution should have been made before the opening of the issue. In addition to it the minimum promoter’s contribution will be locked in for a period of 3 years. In any public issue promoter holding goes beyond the minimum specified limit in disseminate a positive signal. A large retention ratio also indicates issuer willingness in new venture and its significance for expected cash flows. Large retention ratio disseminates higher value of an entity and vice- a - versa. Shoo and Rajib (2010) found that large post issue share holding by promoter in Indian context leads to higher underpricing. Zheng, Ogden and Jen (2005) conducted a study on IPOs of U.S. firms floated from January 1976 to December 1998 and found underpricing foster liquidity in short and long run, and negatively related to share held by pre issue ownership. In addition to it they found a positive relationship between IPO underpricing and share retention is comparatively stronger among the IPOs that came with lockup restriction then IPOs without lockup restriction. They argued in order to generate liquidity in the market, initial public offer of those firms are intentionally underpriced where retention is high. Considering the same we are expecting rational buyer can have some insight into level of underpricing by looking at retention ratio of promoters holding.H0: Promoter’s holding in IPOs of private sector do not have any significant relation with underpricing. Promoter hold more shares, only in those firms where growth expectations are quite higher in comparison to other firms. If the same holds true as per pecking order theory (or pecking order model) cost of financing will increase with asymmetric information. Indian private sector corporate entities rely on three sources of finance internal funds, debt and new equity. Internal financing is used first; when that is depleted, then debt is issued; and when it is no longer sensible to issue any more debt, equity is issued. In any firm if likelihood of positive returns is strong than in such type of firm, amount of debt in past will definitely be high as well as promoter holding will also be high. Hence on the basis of pecking order theory it has been assumed that high leverage firm have high agency costs, financial distress and lack of means of internal financing, in turn these firm valued less by market. Hence on the day of listing market will not be ready to pay much consequently spread between issue price and listing day price will be low. Hence we are expecting a negative relation between pre IPO leverage and IPO underpricing.H0: Pre IPO leverage of private sector companies have no significant impact on underpricing.Similar to other capital markets underpricing also exists in Indian capital market. In a recent study (Janakiramanan, 2008) market adjusted initial return was reported 17.2% on IPOs sampled from year 2000 to 2001.

|

3. Research Methodology

- BSE and NSE are two major stock exchanges in India. National stock exchange (NSE) was the first fully demutualized stock exchange in India. Since its incorporation both government as well as private sector commercial enterprises has been listed on NSE platform. Government sector enterprises in India got financial support from government itself. For financial support private sector corporate entities heavily relies upon their own visibility in capital market and performance in the product market. In the light of the background of the study and to test the formulated hypothesis the whole research work has been organized in three parts; first part of the research work exhibit the objectives of the study, second part converses the sample construction, third part point outs the firm specific characteristics with reference to pre IPO period, forth part deals with measurement of underpricing and the last part presents the empirical findings.

3.1. Objective of the Study

- The objective of the study is to examine the impact of firm specific characteristics on level of underpricing.

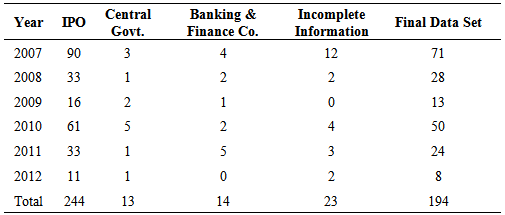

3.2. Sample Construction and Source of Data

- The sample consists of IPOs of Indian private sector firms for which information exists in PRIME database (new-issues database). Financial information of the same IPOs was collected from PROWESS database. It was assumed, before listing date information collected from PROWESS data base is similar to the information given in the final draft document (prospectus) of sampled IPOs. As reported by PRIME database, from 2007 to 2012 total 244 IPOs were floated from NSE platform. In the same time period 13 IPOs came from the side of central government’s commercial enterprises and 14 IPOs came from banking and finance sector. These IPOs were excluded from the sample because central government’s commercial enterprises IPOs, were floated by the government to disinvestment the central government’s stake. on the other hand IPOs from banking and finance sector are relaxed from some listing requirement. Finally our sample gets reduced to 217 IPOs. Out of these IPOs, 23 IPOs excluded due to insufficient information (see table no. 2) and finally 194 IPOs fall within the scope of study.

|

3.3. Firm Specific Characteristics

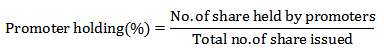

- There are several proxies of ex ante uncertainty. These proxies were grouped by Jenkinson & Ljungqvist (2001) into five categories company characteristics, offering characteristics, prospectus disclosure, certification and after-market variables. Firm age, sales volume, promoters holding and IPO leverage exhibits characteristics of a firm that came in primary market with initial public offer.We measured age of firm by subtracting year of incorporation from the year of listing (Madan, 2003). As per the evidences from USA market old firm underpriced less in comparison to those of young ones. We took an average of the sales of two consecutive years prior to the IPO year as firm specific characteristic. Taking motivation from the earning management hypothesis we assumed that prior to the year of the IPO year a firm tend to manipulate its sales. Average amount of sales will iron out the effect of any kind of exaggerated figure in the year prior to the IPO year.Promoter holding in equity share of any firm plays an important role. More promoters holding in post issue share capital leads to higher under pricing (Sahoo & Rajib 2010). The fraction of their holding in each sampled firm is calculated in following manner

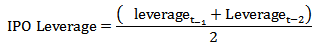

IPO leverage represents the amount of long loan taken up by a firm with respect to its total assets. High profit generating concern keeps the level of debt low in their capital structure. These firms have capacity to finance their future investment projects internally (Myer and Majluf, 1984). Similar to sales, leverage of two consecutive years prior to IPO year was calculated then average of the leverage used as pre IPO leverage.

IPO leverage represents the amount of long loan taken up by a firm with respect to its total assets. High profit generating concern keeps the level of debt low in their capital structure. These firms have capacity to finance their future investment projects internally (Myer and Majluf, 1984). Similar to sales, leverage of two consecutive years prior to IPO year was calculated then average of the leverage used as pre IPO leverage.  Here‘t’ is the IPO year.

Here‘t’ is the IPO year.3.4. Measurement of IPO Underpricing

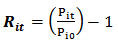

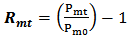

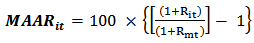

- IPO underpricing in the present study is calculated by using standard method. The standard method of calculation is called market-adjusted initial return. The market-adjusted initial return is calculated as follows:The return of stock ‘i’ at the end of the first trading day ‘t’ is calculated as:

| (1) |

| (2) |

| (3) |

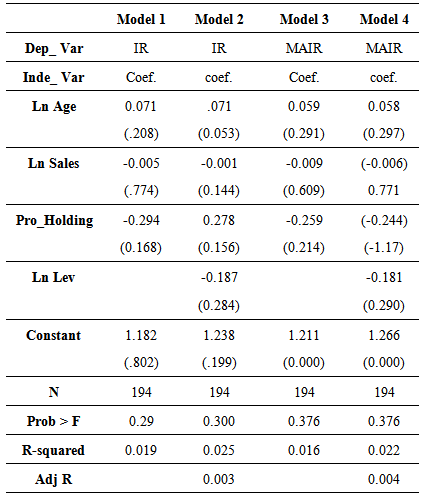

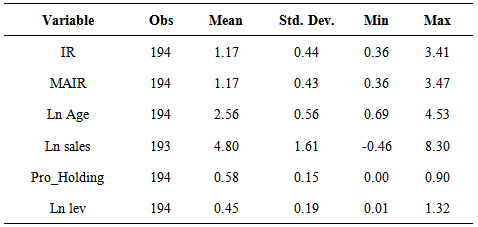

4. Empirical Findings

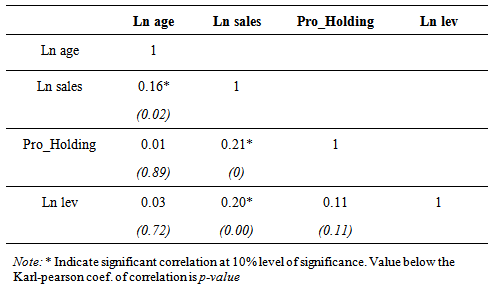

- The variables used as explanatory variables are those which represent the firm characteristic at the time of initial public offer. In order to analyse the impact of these variables on listing day return, two version of listing day return IR (raw initial return), MAIR (underpricing) respectively have been used in the study. In first attempt we tried to capture the impact of firm’s age, its sales volume and promoter holding on market adjusted initial return (underpricing). The logic behind this was to find out whether firm having experience and knowledge of their product market as well competition became ready to leave some money on the table for their equity unit holder or not. We found that private sector firms, whether they are young or old, when they float their equity instruments they never compensate their equity holder in very short run in terms of underpricing. Due to SEBI guidelines on minimum age of IPO firm, (minimum age to float equity instrument is 3 yrs) ex-ante uncertainty in context of market experience and market share have been reduced a lot. Due to which firms are not ready to leave money on the table. Investor also remain confident about the prospect of firm and do not demand compensation in term of underpricing.The same hold true when we regressed IR (initial raw return) and MAIR (underpricing) on age, sales, and promoter holding (See table no. lll) and developed Model 1,2,3,4. We got statistically insignificant coefficient for age variable in each model. Hence we hold on the basis of statistical data that a slight percentage of change in age variable will not bring any percentage change in IR or MAIR. In the similar line we had statistically insignificant coefficient for promoter holding that are -0.005, -0.001, -0.009, -0.006 in model no. 1, 2, 3, 4 (See table no. III). Hence it is concluded that in India promoter holding is regulated and there is a mandatory lock in period of this holding which has eliminated the ex-ante uncertainty. Our findings are contradictory to the findings of Zheng, Ogden and Jen (2005), because they conducted their study on U.S firm where lock in period of promoters holding depends on company not on the regulator. Our finding are also contradictory to the findings of Sahoo and Rajib (2010) because they conducted their study on the data set of IPOs which were floated from 2002 to 2006. While Securities and Exchange Board of India formulated guidelines in context of promoter holding and its lock in period under issue of capital and disclosure requirements regulations, 2009. The sample period (2007 to 2012) to which our study exactly belongs to, contain the IPOs which falls in the scope of the mentioned regulation. Hence on the basis of statistical findings and these regulatory changes, we concluded in India promoter’s holding in IPOs of private sector companies do not contribute toward underpricing or in simple terms promoter holding do not posses any explanatory power to study the level of underpricing after implementation of new regulation. Capital requirement brought corporate entities to corporate securities market. Till the time SEBI hasn’t framed any rule in context of pre-issue long term loan. As we also know equity is last resort to finance and before equity corporate entity always prefer long term loans. In order to judge the impact of leverage on IR (raw initial return on IPO) and on MAIR (underpricing) we developed Model 1, Model 3 and Model 2, Model 4 respectively (see table no. lll). Residuals of each model are tested for meeting the required assumptions of simple linear regression model i.e. linearity, constant variance (homoscedasticity) and normality (see Annexure). The final results of the models are given below:

|

5. Conclusions

- On the basis of sampled firms (from 2007 to 2012) it is concluded that SEBI’s guidelines toward disclosures in prospectus has made the initial public offers of private sector more transparent due to which excessive gain cannot be expected by relying on firm specific characteristics. As a result underpricing of private sector’s IPOs can’t be explained by firm specific characteristics. The analysis indicates that the impact of firm specific characteristic on undepricing have been changed in Indian context. Earlier firm specific characteristics had an significant impact on underpricing but now these characteristic have no impact on underpricing. Great amount of changes brought in by SEBI in context of initial public offers from 2007 to 2012. During the period, SEBI did a successful effort, in lessening the information asymmetry as well as ex-ante uncertainty, at the time of initial public offer.

Annexure

- Descriptive Statistics variable wise

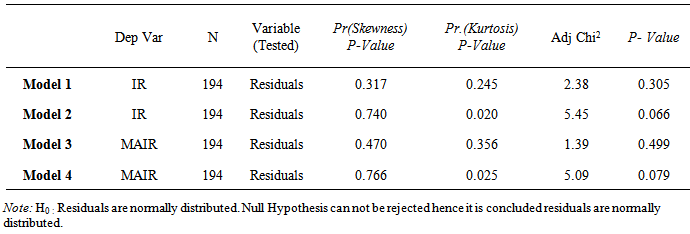

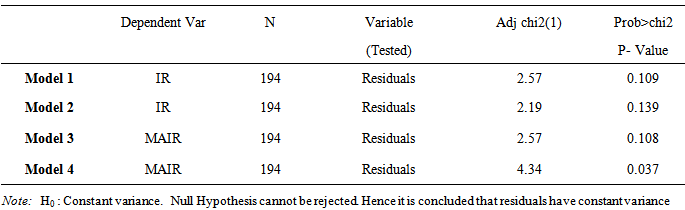

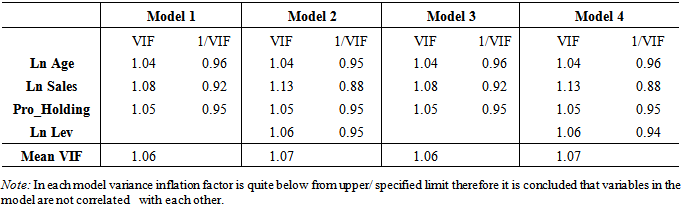

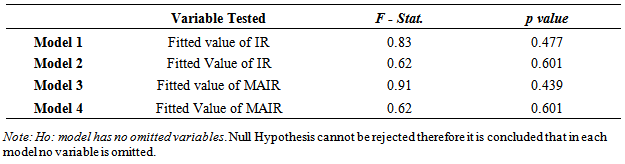

Test for assumptions of regression model

Test for assumptions of regression model

|

|

|

|

|

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML