-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(4): 266-275

doi:10.5923/j.ijfa.20140304.06

The Monitoring Role of Institutional Ownership on the Relationship between Free Cash Flow and Assets Efficiency

Mohammad Hassani1, Azam Sadat Torabi2

1Head of Accounting Department, Islamic Azad University-Tehran North Branch, Tehran, Iran

2Accounting Department, Islamic Azad University-Tehran North Branch, Tehran, Iran

Correspondence to: Mohammad Hassani, Head of Accounting Department, Islamic Azad University-Tehran North Branch, Tehran, Iran.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This study investigated the moderating effect of institutional ownership on the relationship between free cash flow and assets efficiency in Tehran Stock Exchange over the period 2008-2012. The results showed that there is a significant and negative relationship between free cash flow and asset efficiency. It means that in those firms which have a high level of free cash flow, managers are opportunists. Therefore, it caused to decrease in asset efficiency and increase in agency costs. The evidence showed that institutional ownership has not a meaningful moderating effect on the negative relationship between free cash flow and asset efficiency; it means that institutional ownership could not monitore the use of the firms' assets. Those firms which have a high level of free cash flow and high level of institutional ownership, have not experienced high level of asset efficiency and low level of agency costs.

Keywords: Free Cash Flow, Assets Efficiency, Institutional Ownership

Cite this paper: Mohammad Hassani, Azam Sadat Torabi, The Monitoring Role of Institutional Ownership on the Relationship between Free Cash Flow and Assets Efficiency, International Journal of Finance and Accounting , Vol. 3 No. 4, 2014, pp. 266-275. doi: 10.5923/j.ijfa.20140304.06.

Article Outline

1. Introduction

- Economic entities continually face numerous investment opportunities requiring them to make rational decisions for the optimal investment. Decisions about investment opportunities will be made by managers. The importance of free cash flows is due to the fact that it allows managers to identify the appropriate growth opportunities and thus invest available funds in investment projects with high returns in order to increase value for shareholders. Positive free cash flows occur when cash is available following investments made by the company and the settlement of all expenses; and negative free cash flows means that the revenue is not sufficient for covering the expenses and doing investment activities. Considering the fact that information asymmetry and agency problems are ever present in inefficient markets; the possibility of biased decisions made by managers on the utilization of free cash flows exists. In other words, in the absence of efficient monitoring, instead of investing free cash flows in projects with a positive net present value, managers may, in an attempt for short term personal gain, use the cash in projects containing negative net present values resulting in negative outcomes such as an increase in agency costs, reduction in shareholder value and possibly a decrease in asset efficiency.According to the generalities described above, the absence of an efficient monitoring pattern in instances where free cash flow levels are high may result in opportunistic behaviors by managers in utilizing free cash flows thus intensifying the conflict of interests between owners and managers and increasing agency costs. Various criteria exist for measuring agency costs; namely the asset turnover ratio. This ratio is used for measuring and evaluating agency costs. The asset turn over ratio measures asset efficiency and how managers use assets to increasing sales levels, given the resources available to them. It is also used as a reverse criterion for agency costs; such that as the ratio values increase (decrease), agency costs fall (rise).In recent years, the role of institutional owners has increased as a one of the corporate governance mechanisms due to focus on managers performances. The ever expanding presence and ownership of these shareholders, turns them into professional investors who can efficiently monitor company management; results of such monitoring are namely a reduction in agency problems and the conflict of management and shareholder interests. Some evidences indicate that institutional ownership has a monitoring role in preventing of opportunistic behaviors displayed by managers. In this research, the specific effect of institutional ownership on the relationship between free cash flows and assets efficiency shall be discussed.

2. Background

- The free cashflow may increase or decrease company value depending on how it is used (Mc. Cabe and Yook, 1997). The effective and efficient usage of assets leads to an increase in company value, while on the other hand inefficiency in using up assets would result in a reduction in company value. When managers refrain from following an appropriate planning pattern and fail to disagree with the execution of projects containing a negative net present value, they are in fact displaying an inclination towards investing free cash flows in projects designated to fulfill their own personal needs and gains (Chang et al, 2005). Such investment activities would result in an average return much lower than the investment cost incurred. Empirical evidence suggest that companies with higher free cash flows have a increased tendency to invest their cash in activities with low return, compared to companies with lower free cash flow levels (Griffin, 1988; Shin & Kim, 2002). The free cash flow theory predicts that managers of companies with high levels of surplus cash experience a decrease in asset efficiency due to their tendency to fulfill personal needs and to invest in non profitable projects (Jensen, 1986). Managers of these companies face not only the absence of optimal performance but also the inefficiency of utilizing free cash flows in appropriate investment activities (Ang et al, 2000). Takia et al (2012) observed a negative significant relationship between free cash flows and assets efficiency. According to the agency cost theory of free cash flows introduced by Jensen (1986), the possibility of shareholders monitoring opportunistic behaviors of managers decreases in times when managers spend company cash merely for personal gain instead of directing their efforts towards optimizing company value, resulting in a conflict of interests. The theory claims that, the higher the free cash flow levels, the higher the possibility of occurrence of agency problems; this leads to higher agency costs on one hand and lower asset efficiency on the other (Harford, 1999; Opler et al, 1999; Fanolacender and Wang, 2006).Past studies indicate the effectiveness of the monitoring role within the ownership structure in preventing opportunistic behaviors by managers (Jensen and Mc. Ling, 1976). Moreover, certain evidence support the fact that the possibility of investing free cash flows in unproductive projects in the absence of an effective corporate governance mechanisms or the presence of a weak one (Ditmar and Mart Smith, 2007; Pincowitz et al, 2006). The absence of effective monitoring in situations where there is a high level of free cash flows may result in the adoption of opportunistic behaviors in managers when handling cash and intensify the conflict of manager and shareholder interests leading to an increase in agency costs and a reduction in asset efficiency. It is expected to utilize ownership structure monitoring as a corporate governance mechanisms, to promote the relationship between free cash flows and assets efficiency. Owners have the required ability and motives for monitoring asset consumption (Ang et al, 2000). Moreover, monitoring the performance of owners leads to a reduction in agency costs arising from information asymmetry and the separation of ownership and management (Wats and Zimmerman, 1983). Chen et al (2011) found that in companies involved in agency problems of free cash flows, the monitoring role of shareholders and owners stand out in the reduction of capital costs. While investigating the effects of agency costs arising from free cash flows on capital costs, they discovered that companies with institutional and effective shareholders, agency costs from free cash flows are lower and subsequently the cost of capital is lower while their ability in controlling free cash flows is higher. Wang et al (2007) claimed that institutional and effective investors are able to reduce capital costs arising from free cash flows and to increase company value. Nowravesh et al (2009) studied the relationship between corporate governance mechanisms (institutional investors and the ratio of non-executive board members) and agency costs (interaction among company growth opportunities and free cash flows). Findings indicated that a negative significant relationship exists between institutional investors and the percentage of non-executive members of the board and agency costs. The results, in fact, represent the decreasing effects of corporate governance mechanisms on agency costs. Valipoor and Khorram (2011) researched the effectiveness of corporate governance mechanisms (institutional stockholders, management shareholders and the ratio of non-executive board members) in reducing agency costs (ratio of operational to salesexpenses). Results indicate the effectiveness of corporate governance mechanisms in the reduction of agency costs and thus the increase in company value. Mojtahedzadeh (2011) studied the relationship between the agency theory and management ownership and discovered that no relationship exists between management ownership and agency costs, independence auditors and management salaries. Mahdavi and Monfared Maharlooyi (2011) studied the structure of the board of directors and agency costs and discovered that non-executive board members have no significant influence on agency costs. Hassani and Mohseni (2012) researched the influence of corporate governance mechanisms and agency costs on company performance. Corporate governance was studied from two viewpoints namely, ownership structure (percentage of stock owned by institutional investors) and board structure (percentage of non-executive members). Results illustrated a negative and significant influence by ownership structures on company performance; while the influence of board structure on agency costs was considered positive and significant. Takia et al (2012) investigated the modifying effects of ownership structures on the relationship between free cash flows and asset utilization and discovered that a negative significant relationship exists between the two. They then evaluated the modifying effects of foreign, government and managerial ownership on the relationship. Results indicated that foreign and managerial ownership perform well in the monitoring role in handling assets, while no evidence has been provided on the monitoring and modifyingrole of government ownership. Hassani and Najd (2013) claimed the existence of a significant negative relationship between agency costs and earnings management. Accordingly, managers do not direct earnings for personal gain and that earnings management within these companies is quite useful and efficient. Mahmoodabadi et al (2013) studied the influence of free cash flows and agency costs (asset efficiency ratio) on company performance. Results indicate a positive significant relationship between free cash flows and performance evaluation criteria and the absence of a significant relationship between agency costs and the latter. Hassani and Rajabi (2014) illustrated that a significant and negative relationship exists between free cash flows and investment opportunities; the relationship is significant and positive in companies with lower agency costs while no significant relationship was observed in those with higher such costs.

3. Hypotheses

- Free cash flows provide a criterion for measuring firm performance and indicate the amount of cash available in the company following holding and investing in assets. Free cash flows have very important uses in evaluation of financial health for shareholders. It is quite significant for managers to efficiently direct available resources towards investments in projects with the highest returns in order to increase shareholder wealth and promote entity growth, however, the conflict of interests between managers and owners and numerous difficulties faced by shareholders in monitoring management performance, may result in biased decisions made by managers on the utilization of free cash flows. In other words, in the absence of efficient monitoring, instead of investing free cash flows in projects with a positive net present value, managers may, in an attempt for short term personal gain, use the cash in projects containing negative net present values resulting in negative outcomes such as an increase in agency costs, reduction in shareholder value and possibly a decrease in asset efficiency. Accordingly, the present research attempt to investigate in the first phase, whether or not a significant relationship is present between free cash flows and asset efficiency? Asset efficiency, for purposes of this research, refers to evaluations offered by fixed asset turnover ratio as one of the efficiency ratios. These ratios used as a reverse criterion for agency costs; such that as the ratio values increase (decrease), agency costs fall (rise). Efficiency ratios, measure company efficiency from the asset management viewpoint. Specifically, fixed asset efficiency is used to evaluate the efficiency of managers in utilizing fixed assets and planning for new investments in those assets. This ratio, measures the efficiency of investments in fixed assets (property, plant and equipment) in generating sales revenues. The calculation and evaluation of this ratio, is quite significant in manufacturing companies where large investments are made in these groups of assets. The high or low value of this ratio contains informational content and communicates positive or negative indications of the company’s position; for instance, a high value for this ratio may indicate an appropriate investment in these assets, production at maximum capacity and the appropriate marketing and sales strategies, while a low value would signal overinvestment in these assets, producing lower than the company’s capacity and low sales revenues.H1: There is a significate relationship between free cash flow and asset efficiency.Past studies present evidence on the monitoring role of ownership structures as preventive means for opportunistic behaviors by managers. Some evidences indicate that institutional owners can force managers to focus on economic performance and prevent from opportunistic behaviors; it is due to the fact that institutional owners have ability to monitore the performance of managers. It is expected to use the monitoring procedures in reducing the agency costs and confilict of interest between owners and managers. In this research, the specific effect of institutional ownership on the relationship between free cash flows and assets efficiency shall be discussed. The ever expanding presence and ownership of these shareholders, turns them into professional investors who can efficiently monitor company management; results of such monitoring are namely a reduction in agency problems and the conflict of management and shareholder interests. Thus in the second phase, the question addressed would be whether or not institutional ownership modifies the significant relationship between free cash flows and asst efficiency.H2: Institutional ownership can modify the significant relationship between free cash flows and asset efficiency.Also, in the third phase of the research, the question addressed is whether or not the significant relationship between free cash flows and asset efficiency is stronger in firms with high level of institutional ownership rather than low level ones.H3: The significant relationship between free cash flows and asset efficiency is stronger in firms with high level of institutional ownership rather than low level ones.

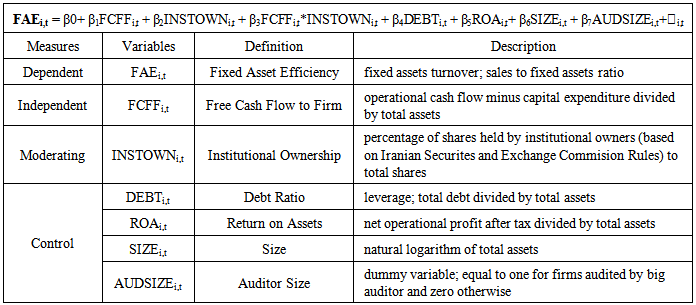

4. Model and Variables

- The regression model of this research based on hyphotheses is stated as following in table (1); also the definition and description of variables is explained in table (1):

|

5. Statistical Population and Sample

- The statistical population of the research involves companies listed in the Tehran Stock Exchange from 2008 to 2012. The sample was selected from companies fulfilling the following criteria:* Having been active in the Tehran Stock Exchange from the year 2008 to 2012.* Not having made changes in their fiscal year * Not having extended their commercial in activity for more than 6 months* To be involved in manufacturing (required to include sales of goods in asset efficiency calculations in manufacturing companies)Ultimately, the systematic deletion sampling method was used to select sample companies; such that 207 companies from those listed in the Tehran stock Exchange were selected and tested for a 5 year period based on specific criteria.

6. Research Findings

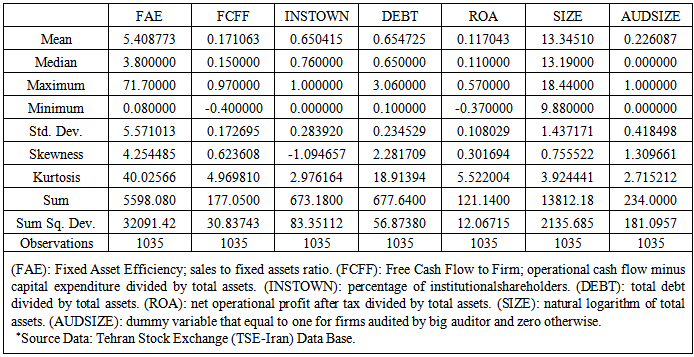

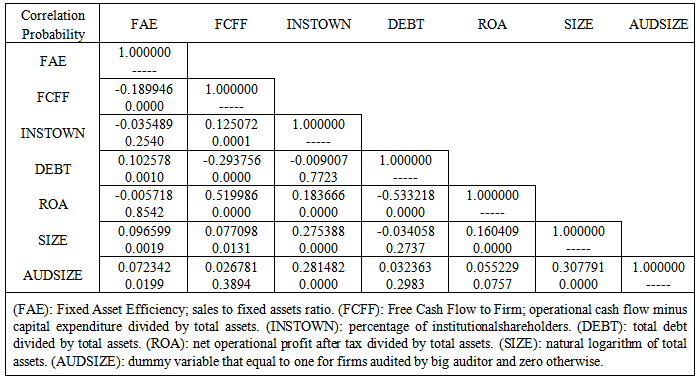

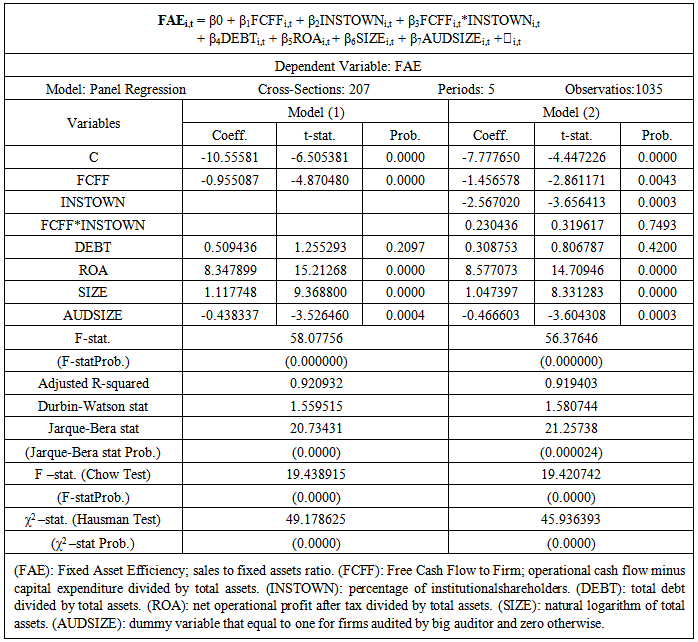

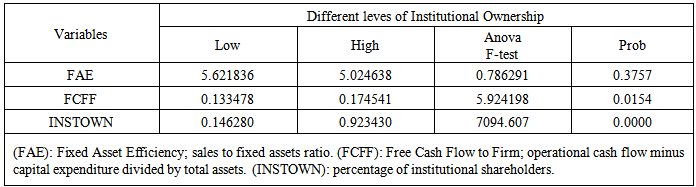

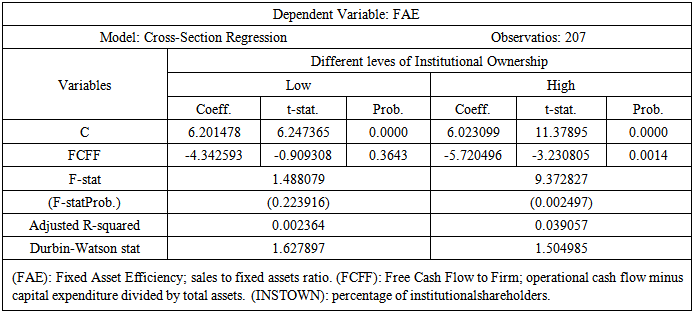

- Descriptive statistics of the research variables have been presented in table (2). These statistics have been separately offered for four different groups, including dependent, independent, moderation and control variables. The dependent variable of research is fixed asset efficiency as a reverse measure of agency costs. Average fixed asset efficiency is approximately 5.5 which indicate that revenues from net sales are 5.5 times the book value of tangible fixed assets. In other words, sample companies have generated Rials 5.5 in sales revenues for each Rial of investment in fixed assets. The fixed asset turnover ratio has been used as a reverse criterion for agency costs; meaning that the higher the ratio, the lower the agency costs. Free cash flow is the independent variable of research. In sample companies the average value for free cash flows is positive and comprises approximately 17 percent of their assets. The positive value indicates that cash flows from operations in these companies are higher on average than cash flows invested in capital assets. The modifying variable is institutional ownership. In sample companies approximately 65 percent of shares in average are owned by institutional owners. It means that institutional owners have a high level of ownership in firms.Control variables include the debt ratio, return on assets, firm size and auditor size. Debt ratio indicates the ratio of debts to assets of a company. In sample companies, debt comprises approximately 65 percent of assets. The figure indicates that debts form a higher portion of financing structure of a company as compared to equity. Return on assets present the operational profitability generated from assets. In sample companies, operational profit after tax forms approximately 12 percent of the assets. Firm size is equivalent to the natural logarithm of assets which is used to measure the size of a company. A high value indicates the largeness of the company and its volume of activities. In sample companies, size is approximately 13.5 units. Auditor size has been considered as a symbol of audit quality, in the present research. On average 22 percent of sample companies have had their audits performed by the big auditor (Iranian Audit Organization), while 77 percent have been audited by other auditors.

|

|

|

|

|

7. Conclusions and Discussion

- According to the theory of agency cost of free cash flows, the higher the level of free cash flows, the higher the possibility of agency problems arising in the company; which leads to the incurrence of higher agency costs on one hand and lower asset efficiency on the other. As mentioned in the section relating to results of testing the hypotheses, a significant and negative relationship was observed between free cash flows and fixed asset efficiency; in other words, according to evidence obtained from the Tehran Stock Exchange, as free cash flow levels rise in sample companies, fixed asset efficiency decreases, reflecting an increase in agency problems and costs. These results conform to those obtained from past studies and researches. Previous researches indicate the effectiveness of the monitoring role of ownership structures in preventing opportunistic behaviors by managers. Other evidence support an increase in chances of investing free cash flows in non-profitable projects in the absence of an effective corporate governance mechanisms or the presence of a weak one. In the absence of an effective monitoring system, high levels of free cash flows may lead to opportunistic behaviors displayed by managers in utilizing free cash flows and the intensification of the conflict between manager and shareholder interests, thus resulting in an increase in agency costs and reduction of asset efficiency. It is expected to use institutional ownership monitoring as a corporate governance mechanism in order to promote the relationship between free cash flows and asset efficiency. In the preset research, upon observing the presence of a significant and negative relationship between free cash flows of a company and fixed asset efficiency, the monitoring and modifying role of institutional ownership was tested. Evidence suggested that institutional ownership has not a significant influence in modifying the negative relationship between free cash flows and fixed asset efficiency. This means that institutional ownership in companies covered in this research has not been able to perform well in its monitoring role to limit personal motives in utilizing free cash flows and its adverse effects on asset efficiency; In the present research, however, no evidence was obtained on the significance of the modifying effects of institutional ownership on the significant and negative relationship between free cash flows and fixed asset efficiency which may be due to the absence of this type of owners in decisions made by the board of directors; since decisions related to company sales and assets are made at the board level. This means that institutional ownership as studied in the present research has not been able to perform well in their monitoring role in limiting personal motives of managers in utilizing free cash flows and their adverse effects on asset efficiency. These results do not conform to those of past researches indicated in the section of research history.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML