-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(4): 235-243

doi:10.5923/j.ijfa.20140304.03

An Empirical Analysis of the Relationship between Government External Borrowings and Economic Growth in Nigeria

Garba Salisu Balago

(B.Sc., MSc., MBA, FCCA, ACA, ACIB), Ph.D Student at Department of Accounting, Nasarawa State University, Keffi

Correspondence to: Garba Salisu Balago , (B.Sc., MSc., MBA, FCCA, ACA, ACIB), Ph.D Student at Department of Accounting, Nasarawa State University, Keffi.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

The study examines whether or not a relationship exists between external debt and economic growth in Nigeria. Time series data from 1981-2012 were fitted into the regression equation using various econometric techniques such as Augmented Dickey Fuller (ADF) test and Ordinary Least Square Regression. The result of the OLS model showed that external debt has a fairly significant positive relationship with the gross domestic product. This result is consistent with a number of earlier studies reviewed in the literature that found external debt and gross domestic product to have a positive relationship.

Keywords: External Debt, Economic Growth, Gross Domestic Product (GDP)

Cite this paper: Garba Salisu Balago , An Empirical Analysis of the Relationship between Government External Borrowings and Economic Growth in Nigeria, International Journal of Finance and Accounting , Vol. 3 No. 4, 2014, pp. 235-243. doi: 10.5923/j.ijfa.20140304.03.

Article Outline

1. Introduction

- Borrowing internally or externally could be the only option in some cases for government to finance deficit where its capability to tax is limited and does not intend to print more money in view of its consequences on the macroeconomic stability. Governments borrow to fill the vacuum created by the fiscal gaps in the proposed expenditure and expected revenue within a fiscal period. If government does not want to compromise macroeconomic stability by printing more money and government taxation capability is limited, then debt option becomes the only available avenue that the government can explore to provide services to the citizens. Governments borrow in principle to finance public goods that increase welfare and promote economic growth. The spending has to be financed either through taxation, through seigniorage, or with debt.Where a government decides to use borrowings to finance its deficit, the question then is should the government borrow domestically or externally from other countries? While government could print money to repay debt denominated in local currency, it however cannot do same for external debt. This therefore, calls for more caution when borrowing from external sources. External debt is the amount of disbursed funds and outstanding contractual liabilities of residents of a country to repay principal and other related obligations to non-residents (IMF external debt statistics guide for compilers and users 2003). The Nigerian external debt has been on the increase since 2006 when the country exited from London and Paris Club. With the recent rebasing of our GDP, it is likely for the country to borrow more externally as a result of additional window that could be opened to us in view of the expected low debt to GDP ratio arising from the “bigger rebased GDP”. However, the primary reasons for borrowing externally by any responsible government should be for growth and development rather than for consumption. This therefore poses a major concern for policy makers and consequently the need to understand the relationship between external debt and economic growth.Nigeria who advanced loans to International Monetary Fund (IMF) during the oil boom of mid 80s was later between year 2000 and 2005 listed among the leading nations of the world with serious external debt problem. The debt stock in 1971 was $1 billion. By 1991, it had risen to $33.4 billion and rather than decreased, it has been on the increase particularly with the in surmounting regime of debt servicing and the insatiable desire of political leaders to obtain frivolous loans for the execution of dubious projects (Daniel, 2010). The debt burden which the country carries has not only served to worsen the general depression in the Nigerian economy, but also has exerted various social, political and economic costs. Apart from its social costs, the Nigerian domestic debt crisis has led to escalating inflationary pressures in the face of falling real incomes, budgetary deficits and the deterioration of social services and infrastructure (Nnoli, 2003). Previous studies on the relationship between debt and growth on the Nigerian economy such as Ariyo (1996), Adams & Bankole (2000), Iyoha (2000), Ezeabasili et al (2011), Boboye & Ojo (2012) and Erhieyovwe & Onovwoakpoma (2013) have not explained the relative growth patterns of the variables i.e. GDP and external debt. This paper seeks to determine the long run relationship between external debt and economic growth as well as determine the growth patterns of each of the variables over the period of the study. It also seeks to make use of a broad data set (as recommended by previous studies like Schclarek (2004)) covering 32 years from 1981 to 2012. A successful outcome of the research will assist political office holders and policy makers in taking appropriate decision on financing government deficits from borrowings as to whether additional tax or external borrowings should be used. The research question and hypothesis for the study is therefore:What are the growth patterns of Gross Domestic Product (GDP) and external debt in Nigeria?Ho: There is no significant relationship between government external borrowing and economic growth in Nigeria.HA: There is significant relationship between government external borrowing and economic growth in Nigeria.The rest of the paper is organized as follows: The following part provides the conceptual and theoretical framework; section II deals with the literature; section III is the methodology, section IV contains results and discussion while section V is summary and conclusion.

1.1. Conceptual Framework

- Eaton (1993) made simple distinction with the various stock and flows associated with debt. Regarding stocks a major distinction is made between disbursed and undisbursed debt. Whereas undisbursed debt is composed of mere commitment made by lenders and are, therefore, not accumulating interest, disbursed debt consists of commitment made by the lender that have been drawn on and have accumulated unpaid interest. Thus, debt essentially refers to disbursed debt. When a government borrows, the debt is a public debt. Public debts either internal or external are debt incurred by the government through borrowing in the domestic and international market so as to finance domestic investment. Debts are classified into two i.e productive debt and dead weight debt. When a loan is obtained to enable the state or nation to purchase some sort of assets, the debt is said to be productive e.g money borrowed for acquiring factories, electricity, and refineries etc. however, debt undertaking to finance war and expenses on current expenditure are dead weight debt.When a country obtains loan from abroad, it means that the country can import from abroad goods and services to the value of the loan without having to export anything for exchange, when capital and interest have to be repaid, the same country will have to get the burden of exporting goods and services. These two types of debts however require that the borrowers, futures saving must cover the interest and principal payment (Debt Servicing). Therefore, debt finance investment need to be productive and well manage enough to earn a rate of return higher than the cost of debt servicing.

1.2. Theoretical Framework

- Various theories have been propounded by scholars in an attempt to explain the subject of external debt. The theory includes the dual gap analysis which explained that development is a function of investment and that such investment which requires domestic savings, is not sufficient to ensure that development take place. There must be the possibility of obtaining from abroad the amount that can be invested to fill the gap. In national income accounting, an excess of investment over domestic saving is equivalent to excess surplus of import over export. Income = consumption + import + savings Output = consumption + export + investment Income = output Then Investment – Saving = Import – Export This is the basis of dual gap analysis, assures that there is a country that requires saving and investment, goods import to achieve a particular rate of growth. If the available domestic saving fall short of the level necessary to achieve the target rate of growth, a savings-investment gap is said to exist, on a similar note, if the maximum import requirement needed to achieve the growth target are greater than the maximum possible level of export, then these is an export-import of origin exchange gap.

2. Review of Empirical Studies

- External debt is widely believed to enhance economic growth and development (Osinubi & Olaleru, 2006; Hirschman, 1958). That is the basic reason why the debt is usually borrowed in the first place. Both developed and developing nations seek for external debt to boost their economic performance (Kletzer & Wright, 1999; Eaton & Gersovitz, 1981). Available statistics have shown that the United States of America is the biggest debtor country in the world but yet the country enjoyed significant economic growth and development taken the global financial meltdown aside (Blakely & Leigh, 2009).Fosu (1996) tested the relationship between economic growth and external debt in sub Saharan African countries over the period 1970-1986 using O.L.S method. The study examined the direct and indirect effect of debt hypothesis. Using a debt- burden measure, the study reveals that direct effect of debt hypothesis shows that GDP is negatively influenced via a diminishing marginal productivity of capital. The study also finds that on the average a high debt country faces about one percent reductions in GDP growth annually. Fosu (1999) also employed an augmented production function to investigate the impact of external debt on economic growth in sub Saharan African countries for the period 1980-1990. The author tested whether external debt has negative effect on economic growth and the findings shows that debt exhibits a negative coefficient. The study which employed similar model to the one proposes for this study revealed an existence of relationship between the variables.Karagol (2002) investigated the long run and short run relationship between external debt and economic growth for Turkey during 1956-1996 and the Granger causality test results showed a unidirectional causality from debt to economic growth lending support to the fact that relationship exist between external debt and economic growth.Rogof’s (1990) proposition by finding the cause and effect relationship between external debt and economic slowdown in 7 Asian countries for the period 1970 - 1988. The results of the Granger causality tests show that the Bullow and Rogof (1990) propositions that external debt of developing countries are a symptom rather than a cause of economic slowdown was rejected. The results confirm a feedback or bi-directional relationship between debt and growth for Malaysia and Philippines. This study also lends support to the existence of relationship between the external debt and economic growth.Warner (1992) tried to measure the size of debt crisis effect on investment with Least Square estimation for 13 less developed countries over the period 1982-1989. He affirmed that the reasons behind the decline of investment in many heavily indebted countries are declining export prices, high world interest rates and sluggish growth in developed countries. Rockerbie (1994) criticized Warner (1992) of various shortcomings. Rockerbie (1994) used O.L.S for each of the 13 countries over a sample period 1965-1990 and the results affirm that the debt crisis of 1982 had significant effects in terms of dramatic slowdown of domestic investment in less developed countries.Cohen (1993) estimated an investment equation for a sample of 81 developing countries over three sub-periods using Ordinary Lease Square (OLS) method. The author shows that the level of debt does not explain the slowdown of investment in highly rescheduling developing countries. In another study showing an insight from cross-country regression analysis by Hasen (2001) on the impact of aid and external debt in growth and investment the regression result were suggestive of a series of interesting relationships. This then is to say as a result of the explanatory regression there is quite strong evidence of positive impact of aid both on the growth rate in GDP per capital and the investment rate.Ojo (1989), was of the belief that it is no exaggeration to claim that Nigeria huge external debt is one of the hard knots of the Structural Adjustment Programme (SAP) introduce in 1986 to put the economy on a sustainable path of recovery. The corollary of this statement is that of only the high level of debt service payment could not reduce significantly, Nigeria would be in a position to finance larger volume of domestic investments, which would enhance growth and development, but more often than not, a debtor has only limited room to manage a debt crisis to advantage.Iyoha (1999) in his econometric analysis of the effect of external debt on economic growth in Sub-Saharan African countries found empirical support for the negative effect of debt overhang. The analysis showed that Sub- Saharan Africa’s external debt stock and debt service payments act to depress investment and lower the rate of economic growth. Indeed, gross domestic investment collapsed in Africa in the 1980’s and 1990’s. Not only has external debt overhang depressed incomes, investment and living standards, it has also seriously constrained the scope of macro-economic policy making and has damaging effects on economic and financial institution (Green & Kahn 1990).Using macro-economic data for a panel of 100 developing countries over the period of 1980-2002 (which include per capital GDP measured at purchasing power parity, population growth, fiscal balance, investment, Aid, primary education, exports and import, terms of trade, inflation, domestic credit, urbanization and debt stock) and institutional variables covering 1984-1997, Presbitero (2004) found from his growth model regression that the crowding out effect is due to debt service payment, while the stock debt works in a more complex way, since it has generally a non- linear relation with investment and a strong negative effect on growth. In his concluding remark, Presbitero (2005) observed that debt stock reduction should enhance economic growth since a reduction of Net Present Value of debt to exports ratio is found to increase per capital GDP growth rate by 0.9-1.8% while a greater relevance to debt service reduction should be required whether the target is in a higher investment ratio, because the crowding out effect is estimated to range between 0.15 to 0.27.External debt has become a major drain on transfer of external resources from African countries and majority experience large negative transfers, and it has been argued that large debt service payments made by indebted Less Developed Countries retard their growth (World Bank, 1989).Mukhopadhyay (1995), constructed a disequilibrium framework to evaluate the relationship between this macro-economic variables, his comprehensive study draws data from nine developing countries; Argentina, Brazil, Chile, Columbia, Ecuador, Mexico, Philippines, Thailand and Uruguay from 1971-1992. The result estimate reveals that rapid growth of external debt and service\GDP ratio compressed private investment through their effects on both the demands for and supply of credit.Studying 81 countries Cohen (1990) regressed the investment ratio on a number of variables, including debt to export ratio. The coefficient of the debt service ratio was not statistically significant, thereby repudiating the conclusion that it is not the growing external indebtedness of the 1980 which explained diminished profile of investment in the countries investigated.Salop and Spitaller (1980) observed two key issues on debt capacity. The first addresses what the optimal level of debt should be in order not to run into debt service difficulty. The second relates to the sustainability of debt situations and policies. The optimizing framework dominated much of theoretical literature. This concerns analysis of marginal cost and benefits of borrowing which should be equal at the optimal level of debt. This approach does not provide a simple formula that would make it possible to ascertain in more operational detail the debt capacity stance of individual country (Hjertholm, 1999). The non-optimizing model examines the sustainability of particular debt situations and policies in the light of the expected growth path of the economy. In this case, the emphasis has largely been on foreign borrowing for investment purposes in order to fill the gap between domestic savings and investment (King, 1968, Solomon, 1977). Though simple and readily understandable, the model suffers from a number of conceptual problems and the rigidity of its basic assumptions. While it focuses on investment gap, less consideration was given to whether the investment will generate foreign exchange to service debt at maturity (Mc Donald, 1982).Furthermore, Abdullahi, Aliero & Abdullahi (2013) analyses the relationship between external debt and economic growth in Nigeria, using time series data for the period 1970–2009. The study concludes that the non-existence of long run relationship between external debt and economic growth in Nigeria indicates that increase in external debt could result to decrease in GDPGenerally, from the review, we found that there are three different conclusions from the various empirical researches conducted on the relationship between external borrowings and economic growth using individual country data, cross sectional data and panel techniques for a number of countries. While some found a positive relationship others, found a negative relationship. Another set of authors found no relationship between the external borrowings and the proxies of economic growth.

3. Methodology

- The study relies mainly on published time series data obtained from CBN statistical bulletin, volume 23 of December 2012. The data covers Gross Domestic Product (GDP) and External Debt (ED) between 1981 and 2012 in Nigeria. The variables were subjected to econometric tests using E-views version 8.0.

3.1 The Model

- The model for this study uses Ordinary Least Square (OLS) Regression test to ascertain the existence or otherwise of relationship between GDP and external debt in Nigeria between 1981 and 2012. Other econometric tests such as unit root test and error correction mechanism were also performed to determine the stationarity of the data and the long run relationship between the variables. Finally, the stability of the equation and their estimated parameters were tested using cumulative sum of recursive residual (CUSUM).

| (1) |

3.2. Justification of the Methods

- The choice of the published data is due to the nature and requirement of the topic which requires reliable time series data. The CBN statistical bulletin is chosen as the source of data for this study in view of the fact that other sources like IMF and NBS also obtained their data regarding the variables under consideration from CBN. The estimation period is selected as 1981 – 2012 due to data availability, as it is the only period covered in the latest statistical bulleting of Vol. 23 of December, 2012. OLS is selected in view of the number of variables involves in the analysis. The analysis involve only two variables viz: GDP as dependent variable and external debt as independent variable and OLS is considered sufficient to establish the existence of any relationship between them.

4. Result and Discussions

- In this section, data collected through secondary sources were presented and analysed using ordinary least square regression model. The dependent variable which is gross domestic product is regressed with external borrowings (independent variable) to establish if any relationships exist in other to test the research hypothesis.

4.1. Growth Patterns of External Borrowings and Economic Growth

- The growth of each of the two variables in this study is measured by the changes in its magnitude in naira. The aggregate figure in naira at the end of each year of the study is compared with that of the subsequent year to ascertain the increase or decrease as the case may be. The variables are combined in a chart for the purpose of observing the trend and patterns of their growth.As can be seen from the chart, the growth patterns can be divided into about five different periods. The first stage covering 1981 to 1990 during which the growth in external debt consistently exceeded that of GDP. The second stage covering 1991 to1993 had the variables moving in relatively similar rate. However, between 1993 and 1997 the growth in GDP exceeded that of the external debt. In 1999, external debt recorded the highest increase of over 300% with the GDP having only about 17%. The growth of GDP has been relatively stable over the remaining period 2000 to 2012 except for the small hike in 2010. However, within the same period, external debt has recorded fluctuating movement with its highest decline in 2006 representing the period when the country exited from London and Paris club debt.Overall, the growth patterns of the GDP appears more stable compared with external debt over the period 1981 to 2012. The significant fluctuation recorded by external debt signifies periods of debt repayment for major declines and re-contracting of new loans for periods of significant increase.

| Figure 1. Growth Patterns of External Borrowings and Gross Domestic Product |

4.1. Test for Relationship between External Borrowings and Economic Growth

4.1.1. Time Series Properties of the Data

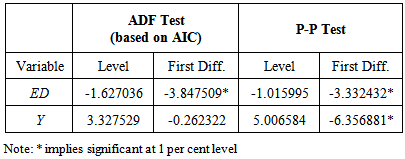

- Since carrying out regressions on non-stationary time series data would lead to spurious regression outcomes, the properties of the time series data for the period of the study covering 1981 – 2012 were investigated in order to test its stationarity. Table 1 shows the result of unit root test. The test is based on the semi-parametric testing procedures of Augmented Dickey Fuller (ADF) and Phillips-Perron (PP). The ADF considers Akaike Information Criterion (AIC).

|

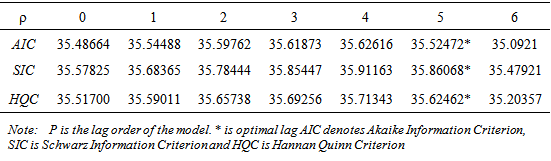

4.1.2. Determination of the Optimal Lag Length of the Model

- Having determined the stationarity of the variable, next we determine the optimal lag length of the model.From table 2, the information criteria (i.e. AIC, SIC and HQC) were unanimous on 5 as the optimal lag of the model. Therefore, the model is estimated at lag 5 after which the parsimony was achieved as reported in Table 3.

|

|

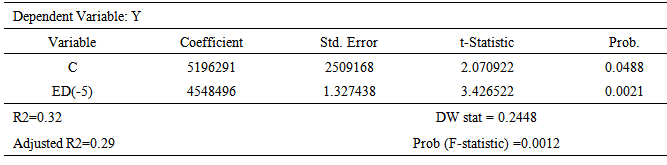

4.1.3. Estimated Long-run Equation – OLS

- Table 3 indicates that there is an ordinary relationship between external debt and GDP. The relationship is a positive one and R-square of 0.32 implies that the independent variables explained about 32.0 per cent variation in the dependent variable. The Durbin-Watson statistics of 0.2448, however, shows evidence of the existence of autocorrelation.The coefficient of external debt at lag 5 turned out positive and statistically significant implying the effect of external debt on the economic activities in Nigeria becomes prominent with a lag of five years. In other words, the debts incurred in the last five years have a relatively more resounding impact on Nigeria’s growth rate. The reason could be that when the debts are incurred it takes a while for a large portion of the debt to get into productive resources.

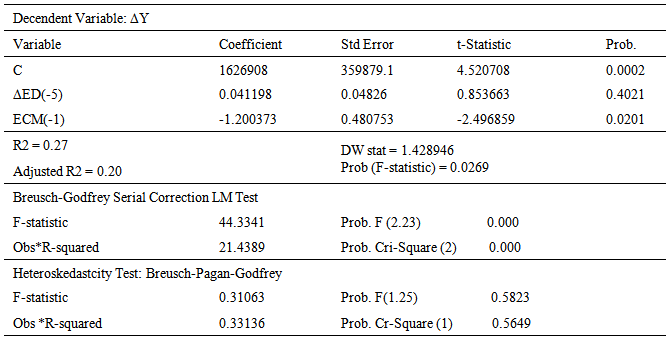

4.1.4. Error Correction Model

- The results of the error correction model (ECM) presented in Table 4 is estimated to determine the adjustment of the long run variables towards equilibrium.

|

- The error correction term appears with a negative sign and statistically significant at 5.0 per cent. This shows that the series is non-explosive and that long-run equilibrium is indeed attainable. It is important to note that in the short run, although the relationship between external debt and growth remained positive at the same lag but statistically insignificant and that adjustment towards long-run equilibrium, in case of shock in the economy (1-α) is amazingly slow.

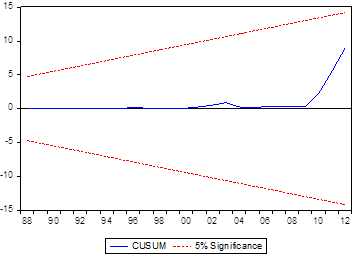

4.1.5. Determination of the Stability of the Equation and Estimated Parameters

- The stability of the equation and their estimated parameters are tested using cumulative sum of recursive residual (CUSUM). The result is presented as figure 2. CUSUM uses the cumulative sum of the equation errors in the regression together with the critical lines of 5.0 percent. The parameters are said to be stable if the sum of recursive errors lies largely within the two critical lines. On the whole, graphs of CUSUM shows that the parameters of the estimated equation is stable at 5.0 per cent, given that the recursive errors lie within the two critical lines of the CUSUM.

| Figure 2. Cumulative sum of recursive residual |

4.2. Discussion of the Findings

- Before regressing the variables to determine if relationship between them exists or not, it is preconditioned that we determine stationarity test of the data by conducting unit root test. Using Augmented Dickey-Fuller test as presented in Table 1, the result show that the gross domestic product and the external debt time series data were both stationary at first difference I(1) and significant at 1.0 per cent.Having affirmed the stationarity of the series, next we determined the optimal lag length of the model (as shown in Table 2) and then proceeded to determine if relationship exist between the variable using Ordinary Least Square regression model. The result as shown in Table 3 supported that, a long-run relationship exist between economic growth proxied by GDP and external debt but at lag length 5 with R-square of 0.32. This implies that about 32 per cent of the GDP growth is explained by external debt but with a lag of five years. In other words, the debts incurred in the last five years have a relatively more resounding impact on Nigeria’s gross domestic product. Having determined the long-run relationship, in Table 4 we estimated the error correction model (ECM) to determine the adjustment of the long run variables towards equilibrium. From the result, the error correction coefficient appears with a negative sign and statistically significant at 5.0 per cent. This shows that the series is non-explosive and that long-run equilibrium is indeed attainable. The adjustment towards long-run equilibrium (1-α) in case of shock in the economy is however slow.In order to determine the stability of the equation and its estimated parameters, we tested them using cumulative sum of recursive residual (CUSUM). From the result as shown in Figure 1, the parameters of the estimated equation is stable at 5.0 per cent, given that the recursive errors lie within the two critical lines of the CUSUM.Overall, the result portrays a fairly significant influence of external debt on economic growth in Nigeria. However, this result has to be cautiously interpreted as both the long and short run show evidences of serial correlation although the short run is heteroskedacity free. The reason could simply be due to the simplification of the model. The variables explaining the variations in the level of economic activity in a country goes beyond external debt. It is recommended that more independent variables be considered in subsequent studies.Having established that a relationship exist between the variables, the question then is what is the implication of this findings? The implication of this result is that, increase external borrowing will increase domestic investment which will consequently increase the domestic output and gross domestic product thereby translating into economic growth. The finding of this study is in support of earlier findings both from Nigeria and other developing countries where they found a positive relationship between the variables, Erhieyovwe & Onovwoakpoma (2013), Shehu, U. H. & Aliyu, M. (2013) in Nigeria, Karagol (2002) in Turkey, Schclarek (2004) based on panel of 59 developing countries and 24 industrial countries.However, the finding of this research contradicts the findings by Abdullahi, Aliero & Abdullahi (2013) where they concludes that the non-existence of long run relationship between external debt and economic growth in Nigeria indicates that increase in external debt could result to decrease in GDP.

5. Conclusions and Recommendations

- This paper investigated the relationship between external borrowings and economic growth in Nigeria as well as the growth patterns of the variables over the period of the study. The result showed that there is fairly significant relationship between government external borrowings and economic growth in Nigeria over the 32 years covered by the study. It also revealed that gross domestic product had a more stable growth over the period compared with external borrowings which recorded significant fluctuations. The significant fluctuations recorded by external debt signify periods of debt repayment for major declines and re-contracting of new loans for periods of significant increase. In order to enhance the robustness of the model used, future studies may consider adding variables (independent) at the right hand side of the equation.From the findings and conclusion of the study, it is recommended that:a) A framework for external borrowings should urgently be developed to guide the nation’s future borrowings that will ensure that, all externally borrowed funds are only applied to viable projects that will generate benefits to the economy over and above the cost of the borrowing. This will impact positively on the gross domestic product and consequently on economic growth as supported by the findings of the study.b) The GDP re-basing exercise recently concluded, which has significantly increased the size of our GDP will consequently lower our current debt to GDP ratio. The lower ratio should not be taken as an opportunity to borrow more externally except based on an approved framework (as recommended in (a) above) that will ensure that such funds when borrowed will be applied in productive investment that will impact gross domestic product and translate into economic growth of the nation.

ACKNOWLEDGEMENTS

- The author wish to acknowledge the immense contributions of Professor Aminu Mikailu of University of Sokoto and Associate Professor S. A. S. Aruwa of Department of Accounting, Nasarawa State University to the success of this research. Also, my appreciation goes to Mr. Yaaba Baba Nmadu of statistics department of the Central Bank of Nigeria, whose contribution to the analysis of the research’s data cannot be overlooked.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML