-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(4): 227-234

doi:10.5923/j.ijfa.20140304.02

Reading in the History of Islamic Banks Bankruptcy: The Jordanian Case

Rashed M. S. Salameh

Head –Business Administration Department, Shaqra University, Saudi Arabia

Correspondence to: Rashed M. S. Salameh, Head –Business Administration Department, Shaqra University, Saudi Arabia.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

Islamic banks emerged in Jordan during 1978 while commercial banks were inaugurated since the country's independence. At that time, the Central Bank of Jordan has no legislations supervisory standards governing Islamic banks activities. Therefore the Central Bank of Jordan adapted the commercial banks regulations on Islamic banks. Islamic banks legislations introduced by Central Bank of Jordan for the first time in the year 2000. During that period two Islamic banks out of the four Jordanian Islamic banks went bankrupt and liquidated. This study aims to investigate the causes of those two banks bankruptcy; and determine whether they were due to the adoption of the commercial banks legislations applied on Islamic banks or due to other reasons. To achieve the objectives of the study, the objective analytical approach, which include quantitative and qualitative analysis will be followed to analyze the available data which will be collected from various sources. The study concluded that there was no evidence that the legislation supervisory standards have any role in the bankruptcy of any of these two Islamic banks; their bankruptcy is mainly due to other reasons. The bankruptcy of the Islamic Investment House is due to the mismanagement of the bank per say, while the failure of the Islamic National Bank is due to the erroneous steps that took place before it was finally established, during the bank foundation the appropriate scientific procedures has not been followed.

Keywords: Islamic banks, Bankruptcy, Central bank of Jordan, Legislation, Usury, Reba, Islamic Sharia, Ruins, Equity stocks

Cite this paper: Rashed M. S. Salameh, Reading in the History of Islamic Banks Bankruptcy: The Jordanian Case, International Journal of Finance and Accounting , Vol. 3 No. 4, 2014, pp. 227-234. doi: 10.5923/j.ijfa.20140304.02.

Article Outline

1. Introduction

- The commercial banks working philosophy is based on interest, receiving and Paying, a growing number of Islamic scholars considered interest whether it's been received by banks or paid to their depositors is a forbidden usury (or Reba) according to Islamic religion. Islamic law (Sharia) called for a ban on dealing with commercial banks as they are considered as usurious banks and Muslims should not deal with them [1-4]. So, Islamic banks emerged to provide an acceptable (Halal) financial dealings, and to serve as a legitimate alternative to the commercial banks. Islamic banks have succeeded through their modest efforts, in the development and introduction of methods and tools for processing and handling of transactions in consistent with the provisions of Islamic Sharia, such as the activities of murabaha [5], [6], mudaraba [7], [8], participation [9], [10], and assets financial lease [11]. Revenue derived from these activities is seen like a legitimate (Halal) profit. Nowadays, Islamic banks operate alongside commercial banks in Arabic and Muslim countries, including Jordan. It seems, that Islamic banks, has not been able to replace the commercial banks, or even be a strong contender to them, and commercial banks remained in control of the financial transactions in various economic sectors in these countries. With the exception of the Islamic countries that have opted Islamic sharia for all different walks of life, such as Iran, Pakistan, Bangladesh and Sudan, where only Islamic banks are allowed to operate and commercial banks have disappeared.

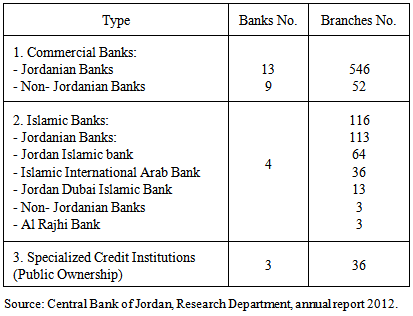

2. The Problem of the Study

- The emergence of commercial banks in Jordan accompanied by the state independence in the late 1940s, but the emergence of Islamic banks came a long time later; the founding of the first Jordanian Islamic Bank emerged in 1978. In accordance with private law No. 13/1978, the Central Bank of Jordan (CBJ) approved the establishment of the Jordan Islamic Bank for Finance and Investment (JIBFI), followed in 1981 by the foundation of another Islamic bank, the Islamic Investment House (IIH), which did not last long, as there were signs of faltering emerging since early 1986, forcing the CBJ to resolve its board of directors in September 1986 and took over direct supervision of the conduct of its affairs. In 1989 a third Islamic bank, the Islamic National Bank (INB), was established on the ruins of the IIH, but unfortunately, the INB also did not succeed and placed into liquidation in February 1991. In 1997 a fourth Islamic bank was established in Jordan, the Islamic International Arab Bank (IIAB), which was based on the ruins of a usury based investment bank named Amman Investment Bank. The Arab Bank, a major interest-based Jordanian commercial bank, owns 97% of the equity stocks of the newly established Islamic bank. This clearly indicated that a usury bank can owns an Islamic bank. The IIAB managed by the expertize of its mother company was able to operate successfully since its inauguration bringing the total number of its branches in the Kingdom of Jordan to thirty six branches at the end of 2012 as shown in table 1 at the statistical appendix. In 2009, a new Islamic Bank was launched in Jordan; the Dubai Islamic Bank, a United Arab Emirates bank, acquired the Jordanian Industrial Development Bank, which was having financial difficulties, and turned it into an Islamic bank, named Jordan Dubai Islamic Bank (JDIB). The new bank started its activities in mid- 2010 and succeeded to open thirteen branches in the country during its first three years of activities. The CBJ gave his approval in 2010 to Al-Rajhi Islamic Bank (RIB), a Saudi Arabian bank to conduct its activities in Jordan as a foreign Islamic Bank. During his first three years in operation Al-Rajhi Islamic Bank succeeded in opening three branches in Jordan.The early emergence of the commercial banks has its impact on the financial legislation which regulates the banking activities in Jordan. The laws that have been developed to ensure the control and supervision of the CBJ on the banking system was based on the working philosophy of the commercial banks and addressed in that direction; and it did not include any provisions regulator for discrimination between commercial banks and Islamic banks. The legislative ignorance for the developments of Islamic banks in Jordan continued until the amended banking law No. 28 was introduced in the year 2000 which came including a special section on Islamic banks activities.Based on the previous discussion we conclude that before the year 2000 four Islamic Jordanian banks emerged in Jordan, two of them have failed; namely the Islamic Investment House, and the Islamic National Bank while the other two succeeded, though one of them (IIAB) is owned by a usury commercial bank. Another two Islamic banks emerged in Jordan after the new legislations toward the Islamic banks, the newly emerged banks are indeed owns by other Arab Islamic banks (Dubai Islamic and Al-Rajhi Islamic bank); both are managed to exercise their activities successfully. At present, the Jordanian banking system includes four Islamic banks operating side by side with twenty-two usurious banks, in addition to three specialized lending institutions publically owned and operating on interest / usury philosophy as shown in table 1 at the Statistical Annex. This study is an attempt to identify the factors that led to the bankruptcy of two Jordanian Islamic banks (namely IIH and INB) established before the inaugurations of the legislations toward Islamic banking activities. It is beyond the scope of the study to discuss the reasons which led to the success of some other Islamic banks (namely JIB and IIAB) established before the introduction of the Islamic banks legislation in the year 2000. Therefore, the problem of the study could be summarized by the following four questions: 1. Are these two Islamic banks going bankrupt due to the absence of the appropriate legislations toward the working nature of the of Islamic banks? 2. Or is their bankruptcy due to the poor understanding of the operational philosophy of Islamic banks which has led individuals and investors to distancing themselves from dealing with Islamic banks?3. Or both Islamic banks failure is due to their poor or bad management?4. Or are there other factors that led to their failure?

3. Significance

- The significance of the study is as follows: 1. The study is an outgrowth of some limited number of studies which began to address the activities of Islamic banks in Jordan. However it is the first English study, as to the researcher knowledge, that deals specifically with the bankruptcy of Jordanian Islamic banks.2. The Government of Jordan, as well as other Arab and Islamic countries can benefit from the results which we reach in the development of their banking industry and banking operations supervision.3. Islamic banks in Jordan and in many other countries may consider the results reached of great interest to them, and could contribute to the developments of their business environment internally and externally.4. Some scholars of Islamic Economics and scientific research centers may also find the study of importance to their own interest.

4. Hypotheses

- The study will examine the following three null hypotheses: H01: There is no evidence that the absence of legislation directed toward Islamic banks activities is the cause of these two Islamic banks failure.H02: There is no evidence that the poor understanding of the operational philosophy of Islamic banks led individuals and investors to distancing themselves from dealing with Islamic banks.H03: There is no evidence that the poor management of these two Islamic banks is the cause of the bank's failure.

5. Methodology

- In order to identify the reasons that led to the failure of the two Jordanian Islamic banks, the study methodology is based on the use of the descriptive analytical approach which combines aspects of narrative and other statistical analysis. Quantitative and qualitative analysis will be used, in terms of the quantitative analysis we will examine the available financial statements accounts published by these banks and we will use the financial ratios to measure the banks performance and achievements before their failure. Qualitative analysis will also be conducted to analyze the circumstances that accompanied the establishment of the two bankrupted Islamic banks, as well as the circumstances surrounding their business environment which may have a role in their failure. However, due to the long history of the failure of these two Islamic banks we will be looking to gather and analyze historical data concerned the early 1980's, we might face too many difficulties concerning the shortages of data needed to the analyses. But to document these two Jordanian cases, the benefits of the study far exceed the efforts to be spent on the data collection and analyses.

6. The Analysis

6.1. The Islamic Investment House (IIH)

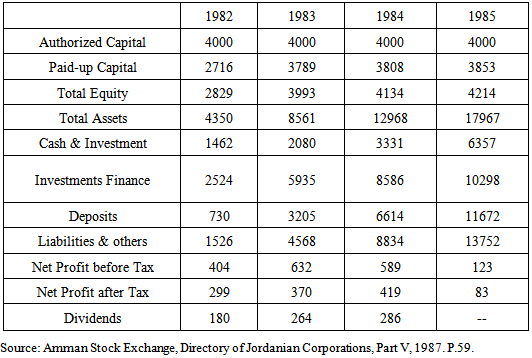

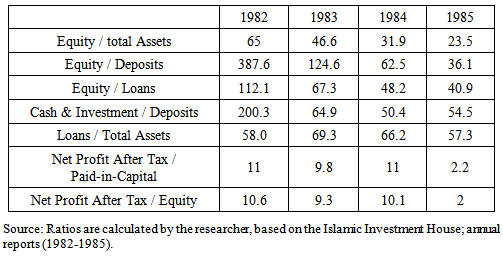

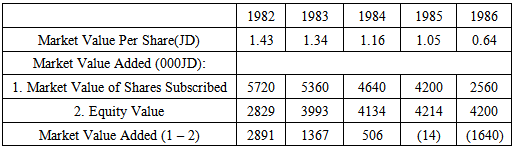

- The idea of founding the (IIH) a rose during the early 1980's, it emerged as a result of a joint effort between a number of Jordanian expatriates working in Kuwait and a group of Kuwaiti investors, share the idea of establishing a specialized financial institutions, operating in accordance with the provisions of Islamic law (sharia), and avoid dealing with the religiously forbidden usury (interest), and to be a substitute for usury commercial banks.The foundation of the IIH was on 09.10.1981 with a capital of 4 million Jordanian dinars (JD), (each JD =US$1.41), the founders subscribed in the amount of 2.1 million JD, the remaining part was to cover by offering the equity stocks for public subscriptions, Jordanians have accounted for 75% of the ownership of the bank's capital. The IIH got on 28/12/1981 the Central Bank of Jordan (CBJ) approval to act under his supervision as a specialized bank, operates according to the principles and methods of Islamic sharia. The IIH began its activities on 4/1/1982. Since its first day in operation, the IIH sought to pursue the investment methods which have been recently developed by other Islamic banks namely Murabaha; Morabaha; Participation; Ististna'a; and assets Financial Lease ended with acquisitions of the leased asset. These are all methods agreed on that they comply with the provision of Islamic sharia, and it is far from the concept of usury or Reba which is religiously prohibited.During the first three years of its operations, the IIH achieved a remarkable turnout of customers. Customers ' deposits, as shown in table 1 below, increased from 0.7 million JD in 1982, to 11.7 million JD in 1985, an increase of 1571 percent over three years period. Total assets rose from 2.7 million JD to 17.97 million JD during the same period, also a remarkable increase of 566 percent [12].

|

|

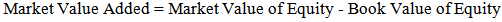

| (1) |

|

6.2. The Islamic National Bank (INB)

- The major two parties expressed interest in being major stockholders in the newly established Islamic bank are the Bank of Jordan (BJ) and the Jordanian Engineers Association (JEA) hoping that they will control its management, while JIBFI was reluctance to participate in the capital of new INB to be founded. To move forward in the establishment process of the new Islamic bank, a memorandum of understanding signed on the 6th of March 1989 between four parties: CBJ; BJ; JEA and companies controller at the ministry of trade, were all parties agreed to establish the INB to operate in accordance with the provisions of the Islamic sharia, and becomes the successor to IIH of all his rights and obligations, and delete the IIH out of official government records. It was also agreed that the BJ and the JEA will be the major stockholders in the capital of INB which stands at 6 million JD, (JD = $ 1.41), divided into six million stocks to be allocated as follows [19]:- 3 060 000 stocks allocated to the BJ, and to be paid in cash.- 1 500 000 stocks allocated to the JEA, and to be paid in two forms; the JEA deposit with the IIH of 556 588 JD to be capitalized as part of the equity of the new Islamic bank, the remaining 943 412 JD to be paid in cash. - 539 567 stocks to be allocated to the IIH small stockholders as compensation and to be distributed according to a specific quota.- 900 433 stocks will be allocated to the IIH depositors who are willing to capitalize their deposits and convert it to equities in whole or in part. In case of an increase of the capitalization process above the number of the available stocks, a percentage allocation will be conducted among depositors, if the stocks are not cover a private placement will take place. The INB began fitfully since its first day. The absolute majority of the IIH depositors refused to approve the capitalization of their deposits in the capital of the new Islamic bank, in addition, the expected major stockholders refused to pay the value of their equity stocks. Thus, it became clear to the CBJ that the new INB will not be able to conduct the expected normal banking operations. During that time several government agencies, such as Queen Alia Fund and the Orphans Fund, have shown their interest in the new Islamic bank and express their willingness to subscribe at its equity stocks. Therefore three months after the establishment of the INB and a continuous cooperation between the CBJ and the ESC, the committee amended its decision about the new Islamic bank and decided on 16/03/1989 to increased its capital to seven millions JD, by allowing the entry of new major stockholders, and reduce the amount assigned to the small stockholders of the IIH capital. As thus, on 29/03/1989 the CBJ agreed on principle to license the INB and entrusted its management to a seven member's board of directors. After the CBJ felt that the INB has fulfilled the required conditions of the CBJ law, the CBJ granted the new Islamic bank on 2/7/1989 a license to get started, and to be the successor of the IIH [20]. The major stockholders of the new Islamic bank such as the BJ refused to pay the value of their equity stocks, in addition, Queen Alia Fund and the Orphans Funds are also declined to pay the cash value of their stocks. Under these circumstances, the newly borne INB has not been able to conduct its normal banking activities. In addition, the parties represented on the bank's board of directors disagreed with each other on a business strategy to be followed by the bank [21], and therefore the board decided on April 1990 to freeze the bank activities.The failure of the new INB to start its operations enforced the ESC to take its decision No. 2/91 of 28/2/1991 provides the following:1. Dissolve the management committee for the INB, while retaining its full legal repercussions.2. Revoke the license of INB, and placed it under liquidation as of the date of the resolution.3. Write-off of the IIH stockholders equity in the new Islamic bank capital, and pay to the IIH stockholders any equity left after turning off all the bank's losses.4. Giving priority to the CBJ charging interest on loans provided for the INB.5. The CBJ obliged to fulfil the rights of depositors at both the IIH and the INB.6. The INB liquidation process must be ended within two years of its begun and it can be extended at any time for one or more times by a resolution of the board of the CBJ. The Governor of the CBJ issued a resolution No. 61/91 of 28/2/1991 established a commission to liquidate the INB; the committee began its work on 3/3/1991.The bank total assets reached when placed under liquidation of 18.6 million JD, during the first year the worth 8.5 million dinars has been liquidated, and the rights of the stockholders of the IIH of 0.5 million JD were removed. During the following three years another 4.6 million dinars were liquidated, and the liquidation Committee was able to pay the last part of the balances of IIH customer deposits, amounting to 0.2 million dinars [22]. Since the issuance of the decision to liquidate the INB, the CBJ estimated the value of the loss that might be incurred by the State Treasury as a result of the INB liquidation at about 4.1 million JD [11]. After twenty three years of the start of INB liquidation process the bank is still classified at the CBJ records as a bank under liquidation, as there are 4.1 million JD still outstanding and were not liquidated, this amount is equivalent to the estimated value of the loss that will be incurred by the CBJ. It seems though that the CBJ got stuck with this expected loss, and CBJ officials are refusing to write-off this sum mainly because they believe that the CBJ money is public money and they shall not compromised it in any way. Therefore the classification of the INB as a bank under liquidation is expected to continue for many years to come, unless the CBJ management takes a strategic decision to write off the value of the INB assets which has not been liquidated yet, and consider its value as a loss incurred by the state treasury. Based on the previous discussions we can conclude that the INB was established by a government decision, based on the ruins of the IIH, but its banking activities has been stalled since the first day. The decision to create the bank and call for the IIH depositors to capitalize their deposits in the capital of the new INB was based on the use of Islamic slogans that the new bank will operate in accordance with the provisions of Islamic sharia away from the forbidden usury. But the call has gone unheeded, when money is involved in any decisions the debate must address the minds of investors, rather than their emotions [24].In addition, the major founders of the INB refused to pay the cash value of their equity stock, which led to the rapid vanishing of the INB. Theoretically, the estimated duration of the INB working existence since its inception to freeze its activities was ten months, but in reality, the bank has not been able to exercise at all any banking activity. We can explain major investor's refusal to pay the value of their subscriptions at the capital of the INB in two ways:First: Those investors did not have a precise prior agreement about the strategy of the bank's operational activities, and therefore they failed to agree on specific business strategy for the new Islamic bank.Second: The consent to participate in the capital of the new INB is based primarily on the type of courtesy of the government, especially as some major investors are already government institutions.As thus we accept the first and the second null hypotheses and state that there is no evidence that neither the prevailing banking legislation in Jordan at that time, nor the poor understanding of the operational philosophy of Islamic banks had any role in the bankruptcy of the INB. Meanwhile we reject the third null hypotheses and accept the alternative hypotheses that bad management caused its bankruptcy.

7. Conclusions

- 1. The problem of the IIH has not been diagnosed properly since the beginning; all parties such as the CBJ and the ESC have dealt with the IIH problem as if the IIH is having a temporary liquidity problem which could be easily overcome by providing the IIH with cash loans from the CBJ. But it turned out that this solution is not useful, and the IIH problem was a problem of financial solvency. If the problem had been correctly diagnosed since the beginning, the CBJ may refrain from providing cash loans to the IIH. In addition the ESC resolution No. 20/88 to extinguish the IIH losses was not based on any sound financial bases.2. Jordanian judiciary dealt with the IIH issue of utmost transparency, and it was tough and decisive in the imposition of criminal penalties on those found guilty.3. Banking business is based on trust between all different parties; banks; customers and government, if there is a lack of trust, the banking institutions begin to stumble. For example, a rumor of a liquidity problem at a specific bank, whether it is an Islamic or commercial bank might be sufficient to initiate its collapse.4. There is no evidence that the prevailing banking legislations, at that time, have any negative effect on the bankruptcy of any of the two Jordanian Islamic banks. The bankruptcy of the IIH was due primarily to the lack of integrity of its management and staff and the bankruptcy of the INB is due to not following the appropriate procedure's incorporation of companies by some governmental institutions and organizations. 5. Islamic banks do not give the goal of the profits maximization the utmost importance, such as usury banks, but has sought to contribute to the achievement of economic stability, and to avoid any economic shocks that may adversely affect many economic sectors. Therefore, the JIBFI sacrifices of the potential profit which could be achieved on its additional deposit with the CBJ came in line with the philosophy of Islamic banks. 6. The INB was established by a government decision and a series of continuous erroneous government decisions has led to its failure. Indeed the approval of the CBJ to grant a license to the INB to start its operation was not supposed to be issued before all stockholders pay the cash value of their stocks.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML