-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(3): 197-207

doi:10.5923/j.ijfa.20140303.07

Relevance of Goodwill Reporting to Post-merger Performance: Case Studies of Technology-driven Multinationals

1School of Professional Education & Executive Development, College of Professional & Continuing Education, The Hong Kong Polytechnic University, Kowloon, Hong Kong

2Department of Accountancy & Law, Hong Kong Baptist University, Kowloon, Hong Kong

Correspondence to: Artie W. Ng, School of Professional Education & Executive Development, College of Professional & Continuing Education, The Hong Kong Polytechnic University, Kowloon, Hong Kong.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This study examines issues about reporting of goodwill as an intangible asset with relevance to post-merger performance. It suggests a framework to articulate the financial reporting of goodwill in terms of its usefulness in reflecting post-merger performance under the emerging international standards. A multiple-case study approach is adopted to look into three multinationals with continuing dependency on technological innovation. Their disclosures on goodwill and compliance with their respectively adopted international financial reporting standards during post-merger operations are analysed. The authors argue that regulations on international financial reporting need to be designed and implemented consistently across borders in order to enhance relevance of goodwill reporting to post-merger performance.

Keywords: Goodwill, Disclosure, Financial Reporting, Intangible Asset, Mergers and Acquisitions, Post-merger Performance

Cite this paper: Artie W. Ng, Peter Lau, Relevance of Goodwill Reporting to Post-merger Performance: Case Studies of Technology-driven Multinationals, International Journal of Finance and Accounting , Vol. 3 No. 3, 2014, pp. 197-207. doi: 10.5923/j.ijfa.20140303.07.

Article Outline

1. Introduction

- During the rapid economic globalization in the recent decades, there have been more multinationals seeking growth and development opportunities through cross-border mergers and acquisitions (M&As). Despite recognition of the value relevance of acquired intangible assets for technology-driven firms, there is uncertainty regarding the transferability of goodwill, which is not created through organic, internal development processes but through M&As between two arm’s length entities. To examine such financial reporting issues, there were studies about potential manipulation in the continuing measurement of goodwill and their effects on the value of the combined firms [1, 2, 3]. These prior studies suggest the underlying uncertainty in recognized goodwill during a period of post-merger integration and the difficulties to review accountability of management for post-merger performance through such disclosures. In light of the emergence of International Financial Reporting Standards (IFRS) and its convergence with US Generally Accepted Accounting Principles (US GAAP), goodwill reporting could be further complicated due to potential discrepancies in standard interpretations, measurements, disclosure requirements and related compliance. It would thereby create misinformation on the relevance of goodwill as a key class of intangible asset and on the level of comparability among the disclosures on goodwill. As unveiled in a study by Kvaal and Nobes [4], there are in fact different national versions of IFRS practice. Such convergence, if not dealt with prudently, could cause further potential manipulation because the required annual impairment test for goodwill as an asset may continue to rely on subjective judgments regarding post-merger performance. This paper aims to contribute to the existing literature in two areas. First of all, it reviews interdisciplinary studies pertinent to contemporary M&As and explores the nature of goodwill in technology-driven firms. Second, it proposes a framework to articulate the financial reporting of goodwill in terms of its usefulness in evaluating post-merger performance given the current deficiencies in the emerging international standards. A multiple-case study approach is adopted to evaluate the conceptual framework and goodwill reporting in these post-merger cases. Three multinationals in the PC industry that have gone through M&As sharing the dependency on technological innovation are examined over their disclosures on goodwill and compliance with adopted international financial reporting standards. Deficiencies in the current reporting of goodwill and usefulness of the disclosures of post-merger performance are examined. Owing to the complexity embedded in the nature of goodwill, this paper argues that international financial reporting standards on goodwill reporting need to be further developed and implemented consistently across borders with more structured disclosures before accountability for post-merger performance can be revealed with meaningful usefulness.

2. Literature Review

2.1. An Interdisciplinary Approach

- Although there have been numerous M&As completed in the past, their post-merger performances have not been entirely positive. Bradley et al. [5, 6] argued that M&As would create synergies among firms, including economies of scale, improved effectiveness of management and production as well as the combination of complementary resources. Among the driving forces for M&A activities, Weston et al. [7] identified technological change as a major component in development of computers, software, servers, the advances in information systems and the Internet; other driving forces include the need to improve the efficiency of operations through economies of both scale and scope, whereas globalization and free trade is considered as a catalyst for cross-border transactions. Nevertheless, there is scepticism about the motives for M&As, as noted by Weston et al. [7]:“..M&A activity represents the machinations of speculators who reflect the frenzy of a casino society. This speculative activity is said to increase debt unduly and to erode equity, resulting in an economy highly vulnerable to economic instability.”To examine these issues pertinent to post-merger performance and reporting of goodwill, an interdisciplinary literature review is performed for this study. The following section focuses on prior studies about concerns over reporting goodwill as an intangible asset and is followed by a summary of other insights about complications in post-merger performance.

2.2. Expectations and Potential Accounting Manipulations of Goodwill as an Intangible Asset

- As a form of intangible asset, goodwill itself is defined as something that could generate future economic benefits to a company that recognizes it. Over the past two decades, there have been studies of the accounting treatments of goodwill and their relevance to equity values. There are controversial views on the experience with goodwill among listed companies as articulated in the following:

2.2.1. Undue Expectations

- First, prior studies suggest that there are expectations about value relevance of reported goodwill. Jennings et al. [8] find that there is significant and positive cross-sectional correlation between the amount of recognized goodwill and equity values. This study however also suggests that the investors’ positive expectation of goodwill as an economic resource might decline in value at various rates. More recently, a study reveals the significance of both recognition and disclosure of goodwill among U.K. companies to their market value [9]. Examining the effects of subsequent write-offs of goodwill as a consequence of mandated annual tests for goodwill impairment and loss recognition, Hirschey and Richardson [10] however show that there could be adverse impacts on stock values after writing off goodwill, implying that an excess premium might have been paid in a transaction. Despite the non-cash nature of goodwill, the study demonstrates the adverse effect from potentially overpriced transactions, as demonstrated by the need to write off the previously recognized goodwill. The study observes that the original expectations of goodwill as an economic resource for these firms may not be unrealized.

2.2.2. Potential Manipulations

- Second, previous studies find the potential manipulation in the reporting of goodwill by managers under different international accounting systems. Choi and Lee [1] reveal that the higher premium differences on the part of U.K. bidders than those in the U.S. are apparently caused by their not having to amortize goodwill in reporting earnings under the U.K. accounting method. As a result, U.K. acquirers tend to be more aggressive in bidding at the expense of their shareholders because the cost of goodwill was not strictly reflected in their subsequent financial statements. Lee and Choi [2] subsequently investigate similar issues in firms of other developed nations, such as Germany and Japan, and observe that there were key differences in taxation and accounting treatments for goodwill that would in turn affect these managers’ decision in allowing merger premiums. Further, Hayn and Hughes [11] examined the leading indicators that would imply a potential impairment of goodwill. These leading indicators include acquisition indicators that measure the premium paid to create goodwill and performance indicators that reflect post-merger financial performance. The study of U.S. listed companies by Hayn and Hughes [11] conclude that available disclosures would not help the users of financial information to predict future write-offs. It is further noted that there could be a manipulated deferral of goodwill write-off for several years, as demonstrated in the study [11].In another study by Beatty and Weber [3], the authors examine economic incentives that firms face while making accounting choices, particularly in the areas of goodwill impairment charges, and they suggest that firms’ equity market considerations affect their decisions to accelerate or delay expense recognition under SFAS142 of the US GAAP. The article provides evidence of economic incentives to delay “above the line expense recognition” and that the estimated fair values appear to be unverifiable under the complicated annual impairment tests. In particular, Carlin and Finch [12] examined the proposition that the impairment test of goodwill under the current convergence of IFRS would increase potential opportunism in preparing financial statement because it is subject to “subjective and unverifiable nature of a range of judgments” in the testing; furthermore, decline in comparability would take place as a result of non-compliance in related disclosures.

2.3. Uncertainty of Goodwill in Relation to Post-merger Performance

- The main characteristic of goodwill in accounting is that it is largely created through an M&A transaction between two arm’s length parties. However, Johnson and Petrone [13] argue that recorded goodwill has a number of components and only part of it would reflect the synergies arising from a business combination – part of it would reflect the internally generated goodwill. Intangible assets acquired externally are recognized at their cost of acquisition, as explained by Powell [14]; acquired intangible assets might not meet the recognition criteria if the future economic benefits associated with these assets become significantly uncertain after a merger. In exploring the nature of internally generated, identifiable intangible assets, Johanson et al. [15] further point out the need to maintain organizational routines with the measurement of intangibles as performance drivers to sustain their significance. As demonstrated in past M&As, these internally generated intangibles are subject to successful post-merger integration between two separate firms and to overcoming the differences in cultures and systems. A merged organization needs to effectively recombine the internal resources while dealing with the changing demands of the marketplace. Researchers are sceptical about the transferability of the intangibles underlying the goodwill created through mergers. Those acquired, unidentifiable intangibles developed internally by another firm could include market access, customer capital, human capital, innovation capital and organizational capital within the acquired firms [16]. The sustainability of the financial value of identifiable intangible asset would depend on the degree of synergy created in an M&A transaction [17]. As explained in Section 2.1 about the complications in performance of M&As, there is little assurance that a post-merger integration would successfully sustain the value of the acquired goodwill as an unidentifiable intangible asset. In order to deal with such post-merger performance risk, it is critical for a merged organization to allocate appropriate resources to ensure that such intangible asset could be preserved and would not deteriorate too soon during the integration process. As Lev [18] articulated such post-merger performance risk, “If the acquisitions were considered assets, such failure would have required a public write-off of the investment in financial report, triggering questions about the reasonableness of the acquisition and, possibly lawsuits”.The expected operational synergy and assumed future economic benefits embedded in the value of goodwill are subject to a successful post-merger integration and subsequent performance. Such challenges in measuring post-merger performance as affected by a wide range of factors have been noted in more recent studies [19, 20]. Failure in post-merger integration would then lead to an impairment of the goodwill to be recognized under the current international standards.

2.4. Technology-driven Multinationals in Cross-border M&As

- Among technology-driven multinational firms, their effectiveness at transferring knowledge and technology could determine their success, especially when an integrated organization needs to transfer knowledge across borders [21]. In a subsequent study, Zander and Kogut [22] suggested that the ability to codify knowledge and the speed to recombine capabilities continuously leading to unique improvement of products would enhance organizational capabilities competing across new markets. Under current globalization, these multinationals seeking growth through cross-border M&As are posed to deal with such challenges. Studying the acquisition of Compaq by HP, Burgelman and McKinney [23] revealed the criticalness of the post-merger operational integration tasks, including the information technology integration of two, very complex IT environments, the deployment of a revised structure and operational model as well as the nurturing of a new corporate culture. In fact, Weber et al. [24] observe that cultural fit was an important consideration in determining which differences in national cultures could predict difficulties in international M&As, such as attitudes towards mergers and actual cooperation. The study noted that the problems associated with combining teams from different cultures could be greater in horizontal mergers than in conglomerates. During the post-merger integration process, a deficiency in cultural fit might even adversely affect the prospect of synergy through a merger [24].

3. Multiple-case Study of the Multinationals in the PC industry

3.1. Research Method

- Multiple-case study approach is adopted to examine three PC multinationals that have gone through sizable cross-border M&As. Entering the new millennium, three major M&A transactions took place in the PC industry, resulting in the “Big-4” players, namely HP, Dell, Acer and Lenovo. Although Dell remains the key player that continues to grow organically, the other three have acquired peer companies in the same industry both horizontally and vertically to acquire new distribution channels, technological know-how and product brands, among other goals. Each of these three PC multinationals is analyzed in depth with respect to its rationale for the acquisitions, challenges in its post-merger integration, post-merger performance as well as the recognition method and related disclosures on goodwill. Yin [25] noted that the case study methodology can be adopted in a number of situations to explore new knowledge of organizational, social, political, and related phenomena. This case study strategy is adopted as there is no requirement on the control of behavioral events but rather a focus on contemporary events.Analysis is made on the financial disclosures of three selected companies. Specifically, through examining the public disclosures of these three listed enterprises and third-party reports, the study seeks to reveal their relevant business information, post-merger performance, financial reporting and qualitative disclosures on goodwill from the time of transaction closure to a post-financial tsunami period.

3.2. An Integrative Disclosure Framework

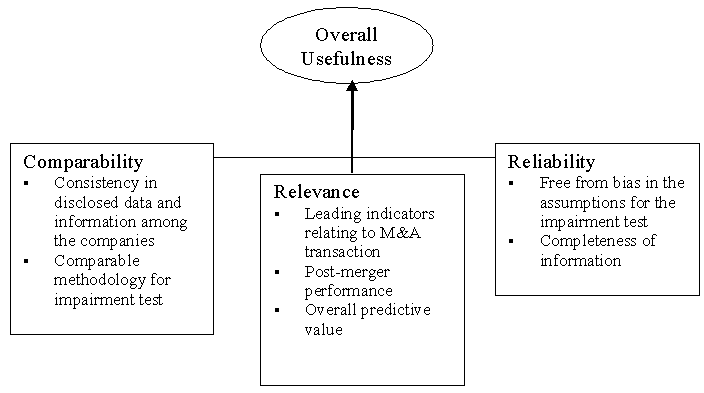

- Harnessing the prior studies on disclosures of goodwill, we propose a framework of disclosure for the specific nature of goodwill. In particular, this framework attempts to integrate qualitative factors regarding relevance, comparability and reliability based on contemporary financial reporting theory while informing the end-users about the value sustainability of goodwill. These pertinent factors, as reflected in prior studies, are composed of a range of information about the past and present that could be of useful for the purpose of an impairment test. A summary of these key indicators embedded in this framework is provided in Figure 1.

| Figure 1. Framework of disclosure usefulness for goodwill |

3.3. Research Objectives

- This research study aims to explore the following three propositions regarding the decision usefulness of disclosures for investors to evaluate performance in the three acquiring PC multinationals after their acquisitions of another PC firm:(1) Extent of variations in relevance, particularly predictive quality, of the information disclosed on the reported goodwill among the three cases of PC multinationals. (2) Comparability of the disclosures of the reported goodwill among the three cases of PC multinationals given their compliance requirements.With reference to prior studies on uncertainties of reported goodwill, there is a risk of manipulation over the impairment tests of goodwill, given the potential impacts on reported financial performance and expectations with the capital market [3, 10, 11, 12]. It is difficult to determine the overall reliability of the reported financial information. Due to the uncertainty and complications in determining the reported value of goodwill and the choice of assumptions available within impairment test, management would tend to project confidence and thereby reliability of disclosures about its value sustainability in post-mergers among the selected cases. This study aims to further explore the following:(3) Quality of disclosures on post-merger performance and assumptions used in impairment tests.

4. Case in Point

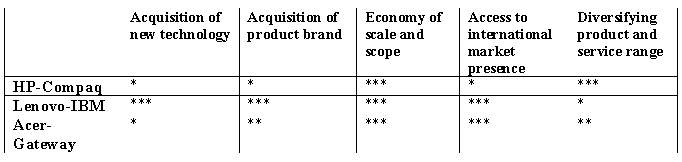

4.1. Rationales for the Mergers

- Each of the three M&As under investigation has its own rationales for pursuing its M&A transaction. The merger between HP and Compaq took place because of the need to compete with the other major players in the PC industry with improved scale and scope as well as of the increasingly service-oriented networking computing markets, namely, Dell and IBM. By combining the strategic assets of HP and Compaq, the merged enterprise would be able to become the leader in the PC business. At the same time, HP would be able to increase its number of service professionals and therefore be able to position itself for delivering increasingly important services in addition to selling hardware. Another key rationale for the HP-Compaq merger was to enable higher operational efficiency so as to improve the cost management and profitability of the combined entity. A main rationale for the acquisition of the IBM PC division by Lenovo was Lenovo’s aspiration to become a global company. According to the acquisition agreement with IBM, Lenovo had the right to use the IBM brand for a period of five years and to permanent ownership of the renowned “Thinkpad” trademark. Upon completion of the transaction, Lenovo was positioned to be a leader in the global PC market, with approximately 8 percent of the worldwide PC market. As disclosed, the management team expected that Lenovo’s globalization of operations would allow Lenovo to drive costs down and maximize its efficiencies. More importantly, they intended to maximize the benefits of its innovative technologies from IBM to differentiate their products from competitors and to enhance its overall brand status.In the case of the subsequent Acer-Gateway acquisition, Acer as the acquirer was expected to be able to capitalize on two main advantages. First of all, despite Acer’s prior strong presences in both Asia and Europe, the acquisition of Gateway, which captured 14% of the U.S. consumer PC market, was expected to enable Acer to increase its overall global market share. The combined enterprise would become the fourth largest PC player in the world, next to Lenovo, HP and Dell. Moreover, Acer aimed to realize significant economies of scale and operational efficiency through this acquisition.

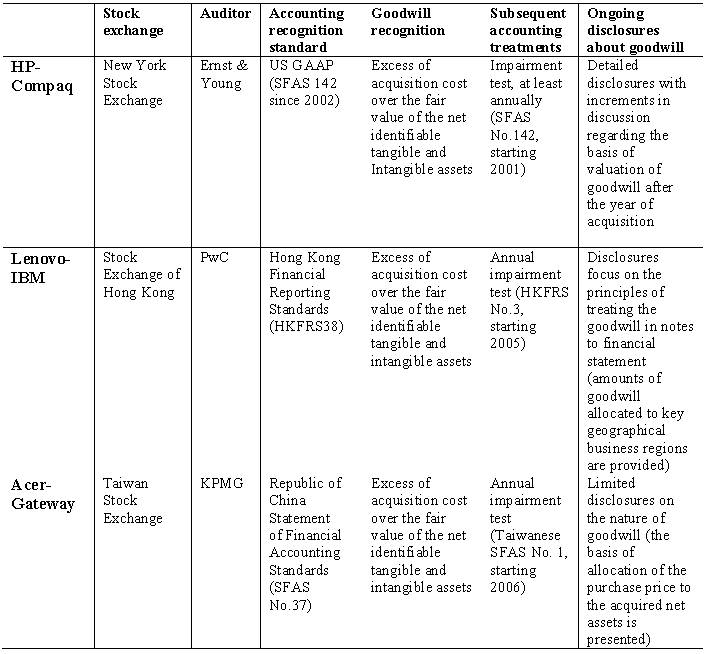

4.2. Compliance Environments and Goodwill Reporting

- Because the acquiring firms are listed in three stock exchanges of different accounting jurisdictions, their respective recognition methods are discussed in this section. Their respective characteristics in goodwill reporting are summarized in Table 2.In the recognition and subsequent treatments of goodwill, the table shows that there is certain convergence of international accounting standards among the three merged enterprises despite the differences in respective regulatory bodies and compliance environments. Such growing similarities in more recent years appeared on the use of annual impairment tests of goodwill instead of using an annualized amortization method. While both Hong Kong and Taiwan have adopted the IAS standards on goodwill, the U.S. continues to maintain its GAAP, which provides relatively more detailed guidelines, coded SFAS 142. Under IAS 36 regarding impairment test, it is required to disclose detailed information about the estimates used to measure recoverable amounts of cash generating units containing goodwill or intangible assets with indefinite useful lives.

|

|

4.3. Uncertainties in the Post-merger Period

- The main challenges of these three mergers ought to be focused on the success of their post-merger integration. For the merger between HP and Compaq, it was reportedly revealed that HP had to work diligently at the beginning of the merger to achieve both strategic integration and operational integration. These two areas were viewed as very critical for the success of the merger. Despite the early development of an integration plan, some of the original assumptions for the merger were no longer relevant after the merger and required timely revision due to uncertainties in the external environment caused by continuous technological innovation and vigorous global competition, therefore requiring adjustments in the course of the integration process. Another key challenge faced in these mergers was the cultural fit of the two merging organizations. Post-merger “cultural clash” between two organizations is in fact not an unusual problem. Especially in the cases of Lenovo-IBM and Acer-Gateway, the acquirers, with their original Chinese management, would have very different management styles and decision making processes from those in a U.S. company. In the course of becoming a global PC enterprise, Lenovo after the merger increased the number of people who were of non-Chinese ethnicities, largely of western origins, in both the board of directors and the senior management team. The effectiveness of this multi-cultural arrangement has yet to be determined.Among the mergers of these technology-intensive enterprises, another key issue for the merged management team is the complementarities of intangible assets between the technology-driven organizations. In particular, all three of the mergers had to address the issues of product brand management and the ability of the merged company to sustain the value of the product brand(s) being acquired in light of the development of a new portfolio of products after the mergers. More importantly, the management needed to capitalize carefully on the range of acquired technologies and know-how and to determine the effective ways to preserve these intangible assets, whether or not they had been recognized adequately through the transaction. This particular issue needs to be dealt with carefully in the case of Lenovo because seeking technological innovation was a main driver for their acquisition of IBM’s PC Division.These post-merger challenges and uncertainties could adversely affect the value sustainability of goodwill on different scales. Because it is subject to post-merger performance risk, the success of post-merger integration might cause an impairment of the goodwill acquired.

4.4. Usefulness of Disclosures Relating to Annual Impairment Tests

- Although the three PC multinationals experienced volatility in their market values in their respective post-merger periods, none of them reported any post-merger impairment of goodwill. During the financial crisis between 2008 and 2009, the capital market experienced a drastic downturn in overall market capitalization, which could trigger write-off goodwill among these PC multinationals if they had overpaid in their prior acquisitions and were unable to achieve anticipated post-merger performance. All three companies however confirmed zero impairment of goodwill during the same period of time.The following summarizes the issues with relevance, comparability and reliability of disclosures on goodwill.

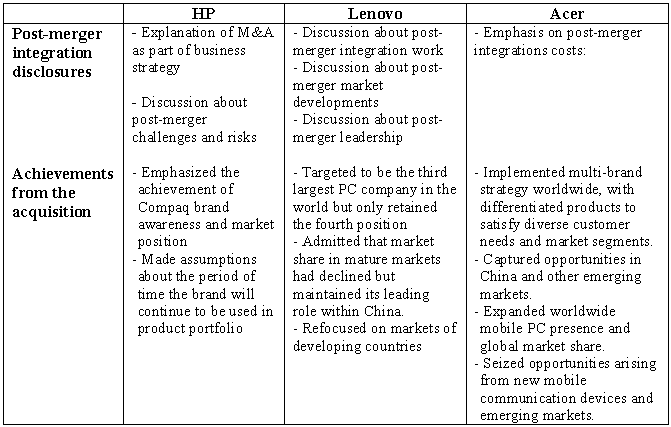

4.4.1. Relevance of Disclosures

- Since post-merger integration is considered to be critical in determining the success of a merger, disclosures about such performance during such a period would be relevant to the overall disclosure of goodwill. The three PC multinationals are found to have various emphases over non-financial, qualitative disclosures regarding post-merger integration and realization of their original merger plans as reflected in their respective annual reports during the same reporting period. Although HP provides detailed descriptions about its key business activities that were important during post-merger integration, it also discusses its treatment of the acquired brand. Lenovo focuses on the changes in its leadership in the midst of integration, the critical role of leadership in post-merger integration and the shift in market focus from the original plan to emerging markets. Acer, however, pinpoints the costing and financial information in relation to its post-merger restructuring and its global multiple-branding strategy. While each of them reveals its own course of action, none of them tends to provide very relevant information about the continuing efforts for post-merger integration and how the value of goodwill would be sustained.

4.4.2. Comparability of Disclosures

- All three companies noted in their respective disclosures their adoption of annual impairment tests. Lenovo and Acer provide the definition of goodwill and how it is recognized in the first place. HP and Lenovo provide a more explicit discussion on the use of the discounted cash flow method in estimating the value of goodwill for the annual impairment test. Furthermore, Lenovo discloses the specific discount rate adopted and a 5-year period with a terminal value, whereas there is no such mention by HP and Acer. HP, however, takes a relatively conservative approach in describing the “reasonable” assumptions adopted for the annual impairment test and the two-step approach involved. HP also expresses the “judgmental nature” of the impairment test and explicitly notes that such assumptions are “unpredictable and inherently uncertain”. Despite their common disclosures regarding impairment tests, the three PC multinationals have various degrees of transparency on the assumptions used, style and structure of disclosures as well as depth of discussion. These variations in disclosures on make direct comparison of their bases not feasible.

4.4.3. Reliability of Reported Goodwill

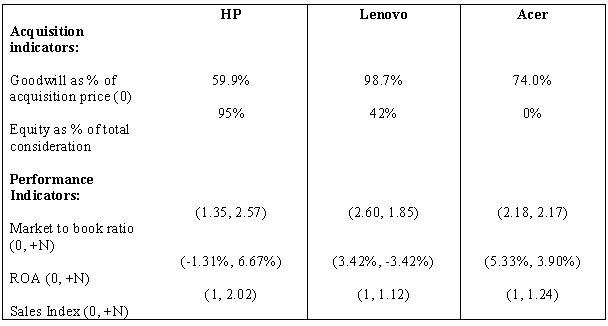

- In terms of reliability, the impairment tests are supposed to reflect a prudent methodology to assess the value of the reported goodwill based on a set of “reasonable” economic assumptions. Although there is a commonality among the three acquirers in adopting an annual impairment test to review whether there is a need to record an impairment loss, there are noticeable differences in the methodology of performing the impairment tests among the three cases. For instance, HP appears to provide the most detailed discussion of its method based on a weighing of income and market approaches. Both approaches, in fact, rely on estimates of future performance in terms of the present value of the future cash flow. In comparison with the other two, HP provides much more detailed explanations and supplementary information regarding its post-merger integration activities, which are also identified as a risk factor. To provide a more objective analysis, HP supplements with sensitivities to further its impairment test and to evaluate variations in fair value with hypothetical adjustments as required by SFAS 142. However, there are noticeable differences in the methodologies presented by the other two acquirers -- Lenovo and Acer, which are subject to the more detailed disclosure requirements under IAS 36. In comparison, Lenovo tends to provide more information on the technical assumptions than Acer on the overall calculation of the present value. Basis for the allocation of goodwill to Cash Generating Unit (CGU) is explained in Lenovo’s disclosure. Lenovo also notes that a sensitivity analysis is performed based on a discount rate to evaluate its effect on the “recoverable amount” although an exact business growth rate is not provided for such disclosures. Nevertheless, there is extended non-compliance by Acer with respect to the required disclosures on the assumptions used in the adopted valuation method, including the timeline of expected cash flows and the growth rates. There is no disclosure on the basis of allocating goodwill to or group of CGUs. Furthermore, there is no discussion whether any sensitivity analysis has been performed at all despite such requirement under IAS 36. Specific disclosures and observed areas of non-compliance of the three cases are summarized in Table 4.To reveal the underlying performance risk during post-merger, Table 5 further provides a summary of the reconstructed leading indicators that have been suggested in prior studies [11, 13] perceived as relevant to the potential impairment of goodwill. These indicators, based on the data extracted from the annual reports in the year of merger and the reporting year subsequent to the financial crisis of 2008, highlight the risk of goodwill write-offs among the three PC multinationals. Lenovo’s relatively higher premium paid and weaker post-merger operational and financial performance would indicate a greater risk of goodwill write-offs should similar post-merger performance linger or deteriorate.

|

|

|

5. Discussion

5.1. Variation in Relevance and Predictability

- In terms of the relevance of accounting information, HP provides relatively more structured information among the three, including complementary details relating to their post-merger integration activities and branding strategy that would uphold the value of the goodwill recognized. Although such information may not provide elaborate indications of predictability of future economic benefits from goodwill, it enhances disclosure quality with comparatively more relevant information about performance during its post-merger period that would sustain the value of goodwill. However, Lenovo and Acer appear to disclose qualitative information that is based on overviews with forward looking languages but lack of specific details about management commitment to post-merger performance.

5.2. Comparability of Disclosure

- With the recent convergence of international financial reporting standards, the three cases have adopted similar bases for goodwill recognition and impairment tests. This enables a degree of comparability of the recorded goodwill among the acquirers on their common adoption of the annual impairment test on goodwill. Nevertheless, such comparability does not extend to the disclosures about the underlying assumptions used in the impairment tests for goodwill. The impairment tests performed for listed companies in Hong Kong and Taiwan throughout the post-merger period across the critical financial crisis between 2008 and 2009 have yet to be explained with explicit assumptions to support the sustained goodwill values. Such discrepancies in disclosures in comparison with the U.S. case would suggest the existing differences in disclosures between SFAS 142 and IAS 36. The varying extent of compliance between Acer and Lenovo, despite the adoption of IAS 36 in their jurisdictions, also makes comparability not possible. Such discrepancies in comparability among HP and the two Chinese multinationals could be compounded by the an underlying characteristic of “secrecy” in Chinese accounting systems, despite the supposed convergence of international financial reporting standards, as explored by Gray [26] and Chow et al. [27].

5.3. Reliability of Methodologies

- Shortcomings are found in the existing qualitative disclosures and potential discrepancies in the methodology adopted for the impairment test of goodwill as reflected in the current process of harmonizing IFRS. First, the value of goodwill has been determined by the assumptions regarding the future prospects of the merged operations made at the point in time of the M&A execution. However, these assumptions for anticipated performance and future cash flow might no longer be valid during the post-merger period, as influenced by external economic and market factors, such as the recent financial crisis. There is no consistency in justifying the revised assumptions as well as the range and type of tests performed. The reliability of the methodology used for the impairment tests remains questionable given these variations. Second, disclosures about post-merger integration progress as well as on-going management commitments would be complementary in enhancing the reliability of a reported zero impairment. Such disclosures about post-merger integration efforts are however uneven among all three cases despite their confidence about maintaining the current value of goodwill. Disclosed information in the existing form is neither complementary nor effective in explaining the decision for justifying their continuing zero impairment on the value of goodwill.

6. Conclusions

6.1. Challenges in Goodwill Reporting

- Through analysing the cases, this study examines the challenges in goodwill reporting and that its sustainability of value would be subject to a firm’s ability to fulfil its commitment to creating values from its post-merger operations. After a merger, a firm needs to prove that the premium paid is well supported in its continuous post-merger performance. Users of financial information who attempt to examine the sustainability of goodwill should be given to understand the rationale and plan for an original M&A transaction so as to assess specific post-merger performance. However, the cases demonstrate that the adverse externality has not created a condition for recognition of any goodwill impairment but suggest potential sustainability of value over the years to come. The value of goodwill remains as a material intangible asset recorded in the balance sheets during post-merger. Such value is yet to be substantiated with useful disclosures under the revised IFRS rules. This uncertainty in value would be compounded by the complexity of a merger and the necessary post-integration between two technology-driven multinationals. Goodwill reporting under the current approach may extend opportunism in the overall financial statement preparation as goodwill is still subject to “unverifiable nature of a range of judgments” [12]. Any necessary write-off of goodwill may continue to be deferred beyond its actual economic impairment [11].

6.2. Variations in Compliance and Continuing Disharmony

- Second, this study reports on the continuing disharmony in the application of international accounting standards among different nations as suggested in prior studies about such inconsistency [4]. The cases suggest that these sizable multinationals have not been assured with consistency in qualitative disclosures. Due to the existing discrepancies between the US GAAP and IFRS, the range of minimum disclosure requirements is yet to be harmonized and standardized for better comparability. Standards setters may need to reconsider the clarity of specific disclosure requirements under existing IAS 36 given the upcoming harmonization with the corresponding standard in US GAAP.

6.3. Post-merger Performance of Management

- At Last, to harmonize the differences and to mitigate such uncertainties about goodwill, more structured qualitative disclosure requirements, complemented by leading indicators, could enable users of the financial information to make thorough assessments of any potential impairment of goodwill that might adversely affect the overall economic value of an acquirer. Through relevant and comparable disclosures, users of financial information could review the post-merger performance in light of the goodwill created through the price paid in an M&A transaction. Proper disclosures and compliance of reporting standards must be improved in order for the end users to evaluate such information concerning post-merger performance delivered by management. In the absence of such disclosure on post-merger performance and transparency on the methodology adopted for an impairment test, management could otherwise be left unmonitored and free to exercise their discretion and potentially manipulate the impairment test of goodwill, as noted in previous studies [3, 11]. Accountability for performance during a post-merger period could hardly be revealed when there is insufficient monitoring and review of progress on post-merger integration. To enhance the alignment of interests between management and shareholders over an extended period of time, there should be proper disclosures through goodwill reporting that can reflect performance of management who have not only initiated a merger but also of those who are responsible for post-merger operations.

6.4. Limitation

- This is a multiple-case study that aims to explore in-depth the problems of goodwill reporting during a post-merger period under the recent developments of international financial reporting standards. The results from this study may not be generalized nor give elaborate conclusions. Additional cases and extensive data collection from multinationals engaged in M&A transactions would enable further examination of the problems involved.

ACKNOWLEDGEMENTS

- The authors would like to express their sincere thanks to the reviewers of the earlier versions of this paper.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML