-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(3): 185-191

doi:10.5923/j.ijfa.20140303.05

The Relationship between Public Social Expenditure and Economic Growth in Nigeria: An Empirical Analysis

Akwe James Ayuba

Nasarawa State University, Keffi, Nigeria

Correspondence to: Akwe James Ayuba, Nasarawa State University, Keffi, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

The sustainability and viability of a country’s economic and social growth depend largely on vibrant and sound healthcare and educational systems of that nation. Just as the physical and social development of the average child is beset with many problems, so the development of education and healthcare systems in Nigeria is hampered by a variety of problems ranging from poor funding in educational sector and lack or near absence of quality healthcare in Nigeria. These problems when resolved are believed to translating into reviving the economy and stimulating growth. This study examines the causal relationship between public social expenditure (education and health) and economic growth in Nigeria for the period of 1990 to 2009 by applying the Vector Error Correction (VEC) Model Based Causality. This study uses stationarity, co-integration and causality test of data and variables. The study finds that there is a unidirectional causality running from economic growth to health expenditure, which supports the Wagner’s Law. This study also discovers that causality runs from economic growth to education and aggregate social expenditure. The study concludes that public social expenditure amplify economic growth at bivariate (aggregated) levels. This study recommends increased in budgetary allocations both for education and health sectors, exploring other sources of financing education in Nigeria such as strengthening the education tax collection mechanisms, accessing donations from international agencies such as the United Nations, The International Monetary Fund, The World Bank, Non-Governmental Organizations as well as other spirited individuals. Also, allocative efficiency of resources to enhance economic growth in Nigeria should be entrenched.

Keywords: Education and Health Expenditures, Economic Growth, Causality, Co-integration

Cite this paper: Akwe James Ayuba, The Relationship between Public Social Expenditure and Economic Growth in Nigeria: An Empirical Analysis, International Journal of Finance and Accounting , Vol. 3 No. 3, 2014, pp. 185-191. doi: 10.5923/j.ijfa.20140303.05.

Article Outline

1. Introduction

- Education and health occupy important place in most plans for economic and social development. Whichever way one looks at it, the education and health sectors are important in human development as suppliers of the trained manpower and prerequisites for the accomplishment of other development goals.Education is one of the important factors that determine the quality of human capital. Moreover, Hartshorne (1985) and Olayiwola (2007) suggest that formal education plays an important positive role in economic growth. Consequently, the human capital with physical capital, are key elements of the nation’s wealth. The former is considered to be an independent factor of production that is indispensable to achieve high and sustainable economic growth rates. Accordingly, developing countries have attempted to enhance the human capital through public education expenditure as well as government spending on health and other social services.Many researchers such as Yesufu (2000), Sakthivel & Inder Sekhar (2007) and Adamu (2003) assume that education; training, health care, and all investments in social services enhance and improve the human capacity and consequently the economic growth. Moreover, Ni and Wang (1994), Beauchemin (2001), and Blankenau and Simpson (2004) provide models that take into account the public spending in the process of human formation and its influence on economic growth. They provided an empirical evidence of the positive correlation between educational spending of the government and economic growth. Most developing countries suffer from poor expenditure on health care. The majority of public expenditure on health care is on hospitals and expensive medical care that benefit a small minority of the population living in the cities. A high proportion of the poor is far from this service especially those living in rural areas. They usually rely on home remedies and traditional medicine (Griffin and McKinley, 1992).There has been mixed findings on the relationship between public social expenditure (education and health) and economic growth in finance literatures. Many researchers are of the view that there still exists great dichotomy between government social expenditure and sustainable economic growth in the long-run. Series of studies have been carried out to address this dichotomy.Some studies have been carried out in analyzing Federal Government expenditure on education in Nigeria. The ordinary least squares (OLS) technique was employed to carry out some of these studies. These studies include those carried out by Phillips (1971), Enweze (1973), Omoruyi (1979), Ubogu (1981), Orubu (1989), and Imobighe and Orubu (1999) among others. They found out that increase in government expenditure in Nigeria causes economic growth in the short-run. Education has a link with economic development as discovered by Ola, (1998). Psacharopoulos (1973), Combs (1985) and Aboribo (1999) have all revealed that increase in national income and per capita income is a function of education and that differences among nations can better be explained by differences in the endowments of human, rather than physical capital. There have been several researches on public social expenditure and economic growth. However, most of them consider one component of aggregate public social expenditure (education or health) in relation to economic growth. Many studies have been conducted on education expenditure and economic growth as well as health expenditure and economic growth. The use of one component of the aggregate public social expenditure like education or health as a representative of government expenditure on social sector is inadequate and in appropriate. This is because the growth of the economy vis-à-vis aggregate public social expenditure cannot be properly measured or explained using one component (education or health). In recent years, researchers have explored the long run consequences of the historical pattern of health spending growth continues unabated (Chernew, Richard & David, 2003; and Follette & Sheiner, 2005). However, these investigations found that long run medical spending growth, is simply a fixed percentage faster than GDP growth. That is, an increase in public health expenditure causes economic growth. These studies captured long run medical projection. Previously, only a handful of studies like Warshawski (1999), Jones (2004), and Hall and Jones (2005) had attempted to put long run medical spending projections in the context of households’ responses to changing economic conditions.Some recent studies by Wagstaff (1989), Zuckerman (1994), Gupta & Verhoeven (2001), Afonso, Shuknecht & Tanzi (2003), and Afonso & St. Aubyn (2004) try to measure the efficiency of public expenditure in the health sector using Data Envelopment Analysis (DEA) or Free Disposable Hull (FDH) techniques that have been borrowed from production theory of the firm. Most of these studies are concentrated on OECD countries, while Gupta & Verhoeven (2001) try to extend the analysis to developing countries in general, and Africa in particular, for three time periods. They find out that public expenditure on health will enhance economic growth in the short run.Therefore, some of the gaps that have driven this study include; Firstly, all researches conducted previously in Nigeria on public social expenditure and economic growth used only one component of the aggregate public social expenditure such as health expenditure and economic growth or education expenditure and economic growth. Taking one component of the public social expenditure to represent the aggregate will not be an adequate sample of the public social expenditure. This is because to generalize findings, more than one component should be adopted. To fill the gap therefore, this study considered two components of public social expenditure (representing over 98% of the aggregate) comprising expenditures on health and education.Secondly, this research uses a different model of data analysis from the one used in previous. For example Phillips (1971), Enweze (1973), Omoruyi (1979), Ubogu (1981), Orubu (1989), and Imobighe & Orubu (1999) among others employed Ordinary Least Squares regression (OLS) in their studies of public education expenditure and economic growth in Nigeria. This study however, uses Vector Error Correction model based causality between the variables (social expenditure and economic growth). Thirdly, the dominance of the historical time series data used differs from previous studies as this study covers a period of twenty years from 1990 to 2009. In this, we use time series because they are considered to be more revealing compared to cross-country analyses using the OECD countries carried out by other researchers. This study therefore, may likely be one of the most current on the topic in terms of time. Fourthly, while other researches attempted to find the relationship between a component of social public expenditure such as health expenditure and economic growth, this study uncovers the direction of causality that is, which of the variables (education expenditure, health expenditure and real GDP) is causing which? For example, is it education expenditure that is causing economic growth or vice versa? Fifthly, there are contrary views as to the nature of the relationship between each of the components of social expenditure and economic growth. For example Phillips (1971), Enweze (1973), Omoruyi (1979) and Ubogu (1981), Orubu (1989), and Imobighe & Orubu (1999) among others find that increase in government expenditure in Nigeria causes economic growth in the short-run. While Ni & Wang (1994), Yesufu (2000), Beauchemin (2001), Adamu (2003), and Blankenau & Simpson (2004) find long-run relationship between education expenditure and economic growth, studies undertaken by, Warshawski (1999), Jones (2004), Chernew, et al (2003), Hall & Jones (2005) and Follette & Sheiner (2005) find long-run relationship between health expenditure and economic growth. Whereas, researches by, Wagstaff (1989), Zuckerman (1994), Gupta & Verhoeven (2001), Afonso et. al. (2003) and Afonso & St. Aubyn (2004) find short-run relationship between health expenditure and economic growth. Therefore, this study intends to breach these existing gaps.

2. Public Education Expenditures and Economic Growth

- Education has evolved in Nigeria even prior to amalgamation of the Northern and Southern protectorate in 1914. The most active period of the development however began from 1950 when the constituent part of the country (Northern, Eastern and Western region) became self-governing (Sambo, 2005). Following the division of Nigeria into Northern, Eastern and Western regions when Richard’s constitution came to effect in 1947, Nigerians became the sole policy makers for the educational system. The three geo-political regions had Ministry of Education under the leadership of Minister of Education who were mainly responsible for educational policies in each region. Director of Education in each region handled the implementation of the policies. At the national level, the Director General of Education was coordinated by the regional educational systems. In 1955, the Joint Consultative Committee on education (JCC) was established as a major organization directly involved in educational activities in the country.The importance of education in national development cannot be overemphasized hence its cardinal position in various objectives of most developing countries. In Nigeria over the years, elements of uncertainty have beclouded this sector both in nominal and in real terms. Incessant strikes, closure of schools and other vices account for poor quality teaching and quality of products. An inquiry into the fiscal operations and developments of Nigeria revealed that Federal Government expenditure on education is categorized under the social and community services sector. The implication is that education is an impure public good (Orubu, 1989). The importance of education is reminiscent in its role as a means of understanding, controlling, altering and redesigning of human environment (CBN, 2000). Education also improves health, productivity and access to paid employment ((Anyanwu, Oyefusi, Oaikhenam & Dimowo, 1999). Education has a link with economic development. As once remarked by Ola (1998: 14) “If you see any economy that is not doing well, find out what is spent on education”. Psacharopoulos (1973), Combs (1985), Aruwa (2010) and Aboribo (1999) have all revealed that increase in national income and per capita income is a function of education and that differences among nations can better be explained by differences in the endowments of human, rather than physical capital. This underscores the reason why the ‘Asian Tigers’ in the past three decades allocated between 25-35% of their annual budgets to their education sector (Aboribo, 1999: 61).The significance of education in nation building cannot be overemphasized since its economic contribution benefits both the individual directly and the society indirectly (Enueme, 1999). A common structural pattern has been given on the basis of monumental definitions of education (La Fafunwa, 1974; Farrant, 1985; Igwebuike and Ekwejunior-Etchie, 1993; O’ Connell, 1994; and Anyanwu et al., 1999). The denomination is improving the individual to be useful and desirable in his society. In explaining some significant roles of education in nation building, Enueme (1999) opined that formal education position farmers in developing countries to appreciate and accept boosters of agricultural production through mechanized farming, use of fertilizers, crop rotation etc rather than belief in the gods of harvest. According to her, education also attracts direct financial returns in form of earning differentials among graduates relatively to others with lesser educational qualifications.

3. Public Health Expenditures and Economic Growth

- There is a growing concern about the economic impact of health care expenditure on households who face illness, particularly in areas where pre-payment mechanisms do not exist and households have to make out of pocket expenditures to use health services. In Nigeria, private expenditure accounts for almost 70% of total expenditure on health of which 90% is out-of-pocket. This high level of out-of-pocket expenditure implies that health care can place a significant financial burden on households.The growth of public health expenditure is at the forefront of the health policy debates in most Western economies. After the seminal paper by Newhouse (1977), the examination of the determinants of health care expenditure has been a matter of extensive debate over the last two decades. The progressively large availability of international data on health care has led to the development of a vast array of studies disentangling the underlying factors that determine health care expenditure, such as income, aging, time effects and availability of factors. Another factor examined is that of technology progress (Newhouse, 1992). However, most studies are based on cross-country data to disentangle the extent to which income – measured by gross domestic product (GDP) – and other determinants, such as demographics and heterogeneity of health care inputs, explain differences in health expenditure. In the light of the long-lasting studies on whether health care is a luxury good, as pointed out by Di Matteo and Di Matteo (1998), restricting the analysis to single countries with multiple jurisdictions providing health care might, to an extent, reduce part of the existing heterogeneity on health care expenditure across countries attributable to differences in the extent of health converge and internal design. Similarly, Gionannoni and Hittris (2002) attempt to examine the determinants of regional health expenditures in Italy and find significant regional specific effects. Both studies use jurisdiction-level data and account for demographic and health care system determinants of public health expenditure. However, they do not examine the extent to which public expenditure in one jurisdiction is affected by the expenditure spillovers from neighbouring jurisdictions; although both theoretical and empirical studies suggest that the hypothesis of spatial interactions may not be ruled out (Revelli, 2002, 2001). Indeed, expenditure in one jurisdiction can provide beneficial or harmful effects over residents in other jurisdictions (Gordon, 1983). On the other hand, prior studies do not account for political characteristics, which arguably stand at the forefront of the health care decision-making in countries where the mainstream health insurer is the public sector. Besley and Case (1995) provides an explanation on the basis of political agency where constituents and politicians respond to events in other jurisdictions. Spain expend about 7.6% of GDP on health care, and about 5.6% of GDP on public health care in 2001, which implies that the public sector funds about 75% of total health expenditure. Two major features have defined health care reform in Spain. On the one hand, the consolidation of the National Health System (NHS), which has remained largely politicized (Lopez, Costa-Font and Planas, 2005). On the other hand, the setting up of a gradual process of health care decentralization from the early eighties, whereby an increasing number of region-states (so-called Comunidades Autonomas, henceforth ACs) have taken over health care responsibilities.

4. Methodology

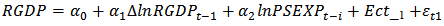

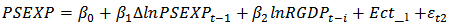

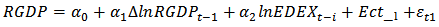

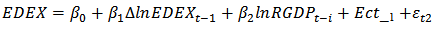

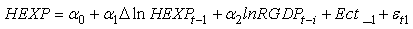

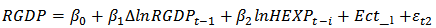

- The research design adopted for this study is the descriptive research design. In designing this study, the type of data collected, nature of variables and technique of analyses were taken into consideration. The population of this study is the federal government expenditures which include administrative expenditures (ADEX), economic services expenditures (ECEX), social and community services expenditures (SOCEX), Transfers expenditures (TREX), productive expenditures (PRODEX), protective expenditures (PROTEX), capital expenditures (CAPEX) and recurrent expenditures (RECUREX). However, in spite of the fiscal federalism practiced in the country (Nigeria), the study covers only federal government expenditures on health and education as its sample. The sample period is 20 years; from 1990-2009. The study is based on secondary data. The main source of the data is the Central Bank of Nigeria Statistical Bulletin. Economic techniques were to investigate the stationarity properties of data, the long-run relationships between the variables and the direction of causality. The models specifications are:Model 1 Aggregate Public Social Expenditures and RGDP

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

is the error correction term, α is a constant,

is the error correction term, α is a constant,  represents the error term and time and βi represent the slope and coefficient of regression. The error, εi, is incorporated in the equation to cater for other factors that may influence the variables.

represents the error term and time and βi represent the slope and coefficient of regression. The error, εi, is incorporated in the equation to cater for other factors that may influence the variables. 5. Results and Discussion

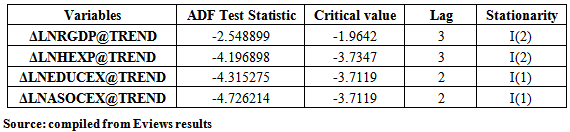

- Investigation of the Stationarity Properties of the DataThe stationarity properties of the time series for the periods 1990 – 2009 on annual basis was investigated using Augmented Dickey – Fuller (ADF) test statistic. The number of lags used was selected using Akaike Information Criterion (AIC). Table 1 shows the results of the ADF tests for all the time series data. The results show that the null hypothesis (Ho) of a unit root can be rejected in the first difference I(1) for education and aggregate social expenditures and in the second difference I(2) for Real GDP and health expenditure respectively. All the series (i.e. RGDP, HEXP, EDUCEX and ASOCEX) are stationary and therefore their regression will not be a spurious regression. All the variables (Real GDP, aggregate social expenditure, health and education expenditures) are stationary at a critical value or level of 5%.

|

|

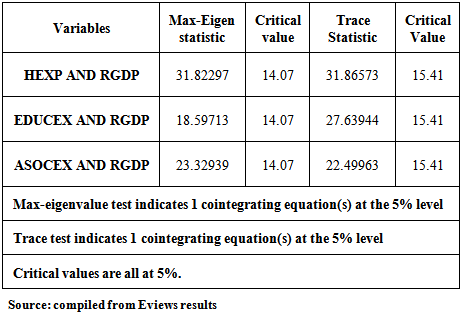

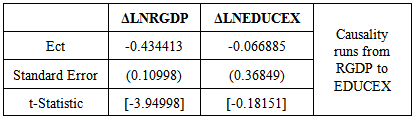

Causality runs from Real Gross Domestic Product to Pubic Education Expenditure. This means that economic growth causes a proportionate increase in public education expenditure. We therefore, conclude that there is a significant causal relationship between public education expenditure and Real Gross Domestic Product.Public Health Expenditure and Economic Growth

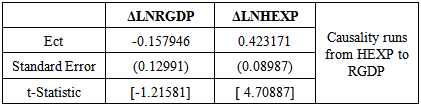

Causality runs from Real Gross Domestic Product to Pubic Education Expenditure. This means that economic growth causes a proportionate increase in public education expenditure. We therefore, conclude that there is a significant causal relationship between public education expenditure and Real Gross Domestic Product.Public Health Expenditure and Economic Growth The estimated co-integrating vector indicates that causality runs from public health expenditure to Real Gross Domestic Product. The conclusion that emerges from this finding is that real Gross Domestic Product impacts significantly on public health expenditure. Aggregate Public Social Expenditure and Economic Growth

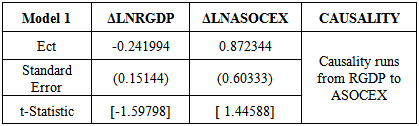

The estimated co-integrating vector indicates that causality runs from public health expenditure to Real Gross Domestic Product. The conclusion that emerges from this finding is that real Gross Domestic Product impacts significantly on public health expenditure. Aggregate Public Social Expenditure and Economic Growth Causality runs from Real Gross Domestic Product to aggregate public social expenditure. This means that economic growth causes a proportionate increase in aggregate social expenditure. We therefore, conclude that there is a significant causal relationship between aggregate public social expenditure and Real Gross Domestic Product.

Causality runs from Real Gross Domestic Product to aggregate public social expenditure. This means that economic growth causes a proportionate increase in aggregate social expenditure. We therefore, conclude that there is a significant causal relationship between aggregate public social expenditure and Real Gross Domestic Product.6. Conclusions and Recommendations

- The result of the study reveals that all the variables are stationary meaning that their combinations will not lead to spurious/false regression. The cointegration test also shows that there is long run relationship between these variables (i.e public social expenditure and real GDP) and that there is a positive relationship between aggregate social expenditure, education expenditure as well as health expenditure and real Gross Domestic Product. The results of the study support Wagner’s law and reject the hypothesis that public expenditures amplify the economic growth at both aggregate and disaggregate levels.The following recommendations arising from the findings are made; Federal government should increase allocations on education. Although increase in government revenue seems to have positive effect in the funding of education sector, it is recommended that since Nigeria is highly a mono-product economy, efforts must be made by the government to sustain and enrich other sources of financing the sector like the Education Tax Fund, while policies aimed at diversifying and broadening the Nigerian economy rekindled. Government can explore donations from international donor agencies (such as the United Nations, the International Monetary Fund, the World Bank, etc), local Non-governmental Organizations as well as spirited individuals. Education tax collection mechanisms in Nigeria can be further strengthened with a view to increasing the tax revenue that should be channeled to the education sector. It is also recommended that federal government should increase its annual budgetary allocations on health especially the capital expenditure as it is often said that a healthy nation is a wealthy nation. The fundamental problem with the public education system in Nigeria is the absence of an appropriate incentive framework, which is based on a system of both rewards and sanctions that ensures that managers at all levels of the education system as well as teachers/lecturers themselves maximize their efforts to deliver good and/or quality education to all children/students in spite of huge expenditures on education. As noted earlier, poor accountability with limited transparency are at the heart of this problem and must, therefore, be seriously tackled in order to achieve economic growth in Nigeria. Whether education in general and human development in particular is looked upon as a right, or from the goals of a social contract between the state and its citizens to enhance the well-being of all individuals in the society, there is a need for government and public intervention. Public interventions in education can lead to an improvement in the future income stream of individuals, enabling equitable distribution of wealth and help reduce poverty.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML