-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(3): 162-173

doi:10.5923/j.ijfa.20140303.03

Management and Internal Control System: An Analysis of Accounting Offices Located in Belo Horizonte, MG, Brazil, and Its Metropolitan Area, Using the Four-Stage Model of Kaplan and Cooper

Wendel Alex Castro Silva, Adriana Maria Rocha, Alfredo Alves de Oliveira Melo

Masters Program in Business Administration, Novos Horizontes Faculty, Belo Horizonte, 30.180-121, Brazil (FNH)

Correspondence to: Wendel Alex Castro Silva, Masters Program in Business Administration, Novos Horizontes Faculty, Belo Horizonte, 30.180-121, Brazil (FNH).

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

The objective of this study is the analysis of the level of management and internal control of accounting firms using the four-stage typology developed by Kaplan and Cooper (1998) for designing management systems. Specifically, we sought to identify the level of integration between the areas on the aspects of data quality, reporting, and strategic and operational controls. The survey was conducted in 112 accounting firms located in the city of Belo Horizonte, MG, Brazil, and its Metropolitan Area, all registered in CRC-MG, the Regional Accounting Body. For collecting the data, it was used a questionnaire with multiple-choice objective questions, and other questions using the Likert scale. The respondents were the accountants who worked as administrators of their offices. In the data analysis, the bivariate technique was used for the issues related to the integrated system and the internal control. The multivariate technique, using the Stepwise method, was used to rank the offices for the four levels of management. The results allowed defining the structure and the profile of the sample and, from there, characterizing the accounting offices, as well as the level of integration of their information systems and the internal control implemented between the areas surveyed. It was found that 32.84% were at Stage I characterized by containing offices that show low reliability in financial reporting and accounting; 30.55% were at Stage II, which defines the offices that provide financial and accounting reports periodically, with a certain degree of reliability; 23.35% were at Stage III, which comprises offices that use computerized systems for producing financial and accounting reports, and use these data to the operational and managerial control; and 13.34% were at Stage IV, which indicates the use of integrated information systems for the preparation of all financial and accounting reports that are that generally are used both for decision-making and meeting the demands of customers.

Keywords: Internal Control, Management System, Accounting Offices, Kaplan and Cooper’s Four-Stage Model

Cite this paper: Wendel Alex Castro Silva, Adriana Maria Rocha, Alfredo Alves de Oliveira Melo, Management and Internal Control System: An Analysis of Accounting Offices Located in Belo Horizonte, MG, Brazil, and Its Metropolitan Area, Using the Four-Stage Model of Kaplan and Cooper, International Journal of Finance and Accounting , Vol. 3 No. 3, 2014, pp. 162-173. doi: 10.5923/j.ijfa.20140303.03.

Article Outline

1. Introduction

- When providing outsourced accounting, the great challenge of the offices is offering services with reliability, quality and excellence personalized to each customer profile. In addition to the complexity of the services brought by the wide variety of customers the offices usually have, there is also the difficulty of maintaining updated internal controls for carrying out the routines of bookkeeping in its different areas.In turn, the improvement of accounting standards and new technologies have led the offices to promote continuous improvements in management processes and routines they perform, in order to reduce costs, minimize errors and/or failures, and increase reliability in the services provided. Customers of accounting services, seeking for the best cost-benefit relationship, may make the option for the contracted internal accounting to be performed in their own facilities, using its integrated information system, or not: they also may prefer that the contracted services are performed on the premises of the customer, using the same database, and optionally exchanging files for the data integration.In general, the managers of these contracting companies use the information provided by accounting as a support for decision-making, control and analysis of the current situation, and for short-term and long-term strategic planning (e.g. [45]). Besides the traditional financial reports, such as the balance sheet, the result statement, the statement of changes in shareholders' equity and the cash flow, there are several other managerial reports drawn up in accordance with the individual requirements and the complexity of each business.So, despite the permanent efforts of the offices to keep updated, it should be noted that, due to the large volume of information necessary for the fulfillment of its main routines, it wouldn't be surprising the existence, in these organizations, of inadequate systems, with little consistency, for the purpose of generating several reports, internal control monitoring of their customers transactions, information recording, and also supporting their customers’ decision-making process.In order to enlarge the knowledge about such aspect, in this study we investigate the level of management of internal controls and integrated systems in those accounting offices and seek to highlight aspects that would help categorizing them into the four-stage model developed by [24]. According to this model, Stage I comprises the offices that have low reliability in financial reporting and accounting; Stage II includes the offices that provide financial and accounting reports periodically with a certain degree of reliability; at Stage III are the offices that use computerized systems for the generation of financial and accounting reports and use these data for the operational and managerial control; and, finally, at Stage IV, the ones which use integrated information systems for the preparation of all financial and accounting reports that are used for decision-making (e.g. [24]).

2. Theoretical Reference

2.1. Corporate Management, Control and Information System

- There is a vast literature which deals with the management of companies and relates it to decision-making and to the issues of strategic planning and the decision-making process. Among the several studies on this theme, we point out [4]; [8]; [35]. Other authors relate it to information technology, as is the case of [14]; [7]; [15]; [37]. Others associate management to the different types of services provided by the companies: among these are included [33]; [37]; [38]; [20]; [3].Organizational Management and Control are topics of high affinity, and some old works were important to their implantation at the academy. They are: [9]; [10]; [11]; [21]; 42], which defined the management control as an organic function of administration which goal is to guide a company beginning from the regulation of its activities; [12], which focused on the point of view of the budget analyst, when approaching the main perspectives of budget control; [13], which explained the control instruments and methods as tools for the performance evaluation, through the use of standards, relating management control to cost analysis; [36], which associated control to planning, drawing attention to the strong relationship between these two variables. The research by [18], which showed the management control as a primary responsibility of the senior managers in a sample of 31 industrial companies, deserves a particular emphasis: in this study, the authors realized that management control is a process that involves basically three elements: a) objectives: to determine what is desired; b) procedures: to plan how and when a task should be carried out, to scan the organization to determine who is responsible for what, and to establish patterns to determine what constitutes good performance, and c) assessment: to determine the level of the product obtained from each performed task.The study of managerial controls has gained special attention and incentive in the research works developed in recent years. It is possible to find researches that dealt with the importance of variables involving the operational practices and the performance of companies, among which are included [6]. There are also works that associate the management controls with the quality and the reliability of the information and the integrated systems, such as [17; 25; 40]. Some other studies have tried to identify the importance of internal control as a support for the management of the companies, as is the case of [32]. Finally, the studies by [26], [30], [22], [43], [44] and [46] associated control to internal audit.In what concerns the provision of accounting services, it is note worthy the contribution of some studies, such as [16], which examined the management control from the point of view of the accounting, taking control as an instrument that ensures compliance to business plans; [32], which provided evidence of the necessity of internal control for the operations performed by the offices through the implementation of activities in accordance with the specificities of each one; and finally, [5], which demonstrated how the internal control could ensure the integrity of the records and the financial statements, thus making the decision-making process more rational.Among other things, it is recognized that the management controls also have a collective dimension in companies, because they involve the participation of the entire team, and the way information is used by different types of users. In the vision of [19], internal control is seen not only as a means to obtain and use the information to coordinate planning and to control decisions in a company, but also to guide the employees behavior. For [28], the main objective of the control in the companies is to safeguard the assets and define the direction of the company, ensuring its continuity and the fulfillment of its mission.It is believed that implementing a good managerial control contributes to the growth and competitiveness of companies, ensuring that resources are obtained and applied effectively in achieving the specific objectives of the routines performed by the various areas ([2]; [27]; [19]). For [27], control systems go beyond simple managerial and operational procedures, and take on a strategic aspect. For the management of accounting offices, managerial control is best suited because it focuses the routines performed by administrative, accounting, fiscal and personnel areas. Thus, it is assumed that an implemented internal control ensures the offices managers a higher quality in the information provided and a greater safety in the services performed, and has as goal the reduction of errors and an increased reliability.With regard to information management, accounting plays a key role by means of the issuance of its reports, since one of its objectives is to provide useful and reliable information to assist managers in the decision-making process, especially in what concerns management control ([28]). The information provided by the accounting contributes to the operational and strategic performance management of companies. However, this is criticized, mainly based on the argument that accounting information are generally processed by the various areas of an office and that, in order to maximize its usefulness, the information should be processed via integrated systems. [1] call attention, however, to the need of a proper planning, in addition to a previous survey on the various suppliers of such systems, to avoid the risk of the integration bring no contribution to the improvement of the organization's processes, if poorly implemented.[31] Recommends that a system of accounting information should be fully aligned and integrated with the other company’s information subsystems. But the system becomes a great ally in the decision-making process ([42]), once it gets to provide useful information in short time. According to [41], the information systems and the comptroller should be closely connected to the management of the companies. [29] asserts that the process of transformation of data that are used in the company's decision-making structure takes on a key role for the management of the information that can be analyzed on the basis of the records of past information, generated in the present, or enabling the possibility of projecting them in the future, as per the administration's interest.[31] Also reasons that the use of a management information system to provide reports for decision-making brings also the possibility of joining and consolidating the information, and a greater dynamism to the flow of information, thus providing better management of all areas of the company. The generation and use of information by means of management information system for planning and support in the decision-making process promote strategies for short-term and long-term, which, according to [34], would make it easier for the companies to work with changing situations, thus becoming an excellent management tool.In this aspect, it is understood that the accounting information generated by computerized systems, and allied to the management controls, are relevant factors for managers to use in their decision-making and especially in their companies managing processes.This research does not aim to identify a conceptual model within the systemic approach, but the degree of integration of the various accounting offices herein under survey. To achieve it, we rely on the methodological approach of the four-stage model to identify levels of systems integration presented by [24].

2.2. Four-stage Model of Kaplan and Cooper

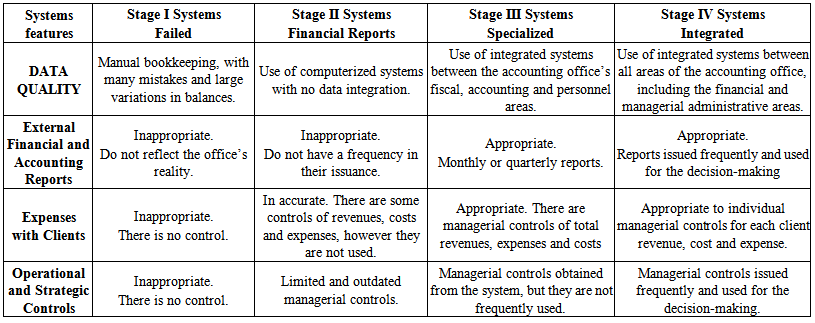

- The four-stage model for designing cost and performance systems came to light in the decade of 1970, from studies by Kaplan and Cooper in companies that did not use informational resources able to contribute to the proper management of costs and improving operational efficiencies. According to [39] the first publication that addresses this model was an article by [23] entitled: "The Four-stage Model of Cost System Design". The model evaluates four characteristics that can be identified in accounting services: a) use of data processing systems; b) definition of services in accordance with customer expectations; c) continuous improvement in the performance of routines in search of quality, efficiency and speed; d) structuring of efficient and effective processes of services suited to the profile of the portfolio of customers ([24]). In this way, companies are classified according to the analysis of the management system on the aspects of data quality, financial reporting, expenses with customers and strategic and operational control.In this study, the same aspects were considered in the analysis of four stages to identify levels of management systems of accounting offices, focusing on the process of information management via computerized system. However, it is proposed an adaptation to the model to track the management of accounting offices from their specificities regarding their structure, the use of computerized systems in the provision of services and the integration between the accounting, fiscal, personnel, administrative, financial and managerial areas. Compared to the original model, this proposal keeps the concern regarding the aspects of systems such as data quality, management and financial reports, and operational and strategic control. However, while the model of [24] focuses on the costs, the adapted model focuses on internal control and the management of information (e.g. Figure 1).

| Figure 1. Four-stage model for designing a management system of accounting offices. Source: adapted from [24] |

3. Methodology

- In order to check at what stage of integration the accounting offices were, from the point of view of [24] proposal, in terms of internal controls and management information systems, a survey was carried out in accounting firms located in the city of Belo Horizonte and its Metropolitan Area, and registered in the Regional Accounting Body. As a methodology, it was adopted the descriptive study, by means of the survey-type quantitative field research. At the time of the survey, the total population comprised of 1,172 accounting offices registered in CRC-MG in Greater Belo Horizonte. Out of them, it was extracted a random sample of 112 offices. The technique of sampling was probabilistic and the margin of error corresponding to one standard deviation was 4.74%, and to two standard deviations (95.5 probability) was 9.44%.The data were collected using questionnaires answered by the accountants who worked as administrators of the accounting offices. It is assumed that these respondents knew in depth all the dimensions researched as well as the variables that would be present in the management processes. The questionnaire contained 52 questions divided into three blocks, which used multiple-choice questions and Likert type scale. In the first block, the aim was to categorize the accounting offices’ profiles and structure. The questions of the second block aimed to analyze the characteristics of operational internal control, of the integrated system, and the process of management of information for the decision-making by the accounting offices’ accountants. Finally, the third block intended to identify at which of the four management levels the accounting offices of Belo Horizonte and its Metropolitan Area were, using the four-stage model of [24].The data analysis was carried out in three stages, each with specific procedures. In the first step, it is presented a descriptive statistics of initial exploratory analysis of the database. In this step, cross tables were constructed by attaching the joint relationship of integrated system and internal control with the other qualitative variables from the questionnaire. The second step – multivariate analysis –tried to ascertain the joint relationship of variables that are important to explain the variable-answers "internal control" and "integrated system", using as association measures two options of chi-squared (χ2) for the verification of the results to be exposed: Pearson and the likelihood ratio test.After that, it was statistically chosen the most relevant explanatory variables, by means of the Stepwise method. It was possible to jointly analyze all statistically significant explanatory variables and, in addition, to identify, for each qualitative explanatory variable, the categories that are most important to explain the behavior of the accounting offices’ levels of integration and internal control. To assess the quality of the ordinal regression adjustment that enabled to identify the explanatory variables, it was used the coefficient of determination or McFaddens pseudo R2 that corresponds to the dependent variable’s proportion of variation explained by the explanatory variables. The higher its value, the more the variability of the dependent variable (i.e., integrated system or internal control), is explained by the variability of the explanatory variables. To choose the final ordinal regression model it was used the Akaike Information Criterion (AIC).Knowing the statistically significant explanatory variables, either with positive or negative effects on the level of integration and internal control of the accounting offices analyzed, it was identified at which phases they were situated, according to the third block of questions of the questionnaire. The objective was to check if such variables would determine (or not) at which of the stages categorized by the model of [24] the offices were.

4. Analysis and Discussion of the Results

4.1. Structure and Profile of the Accounting Offices

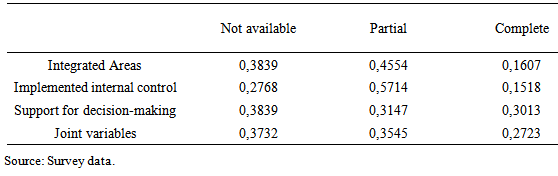

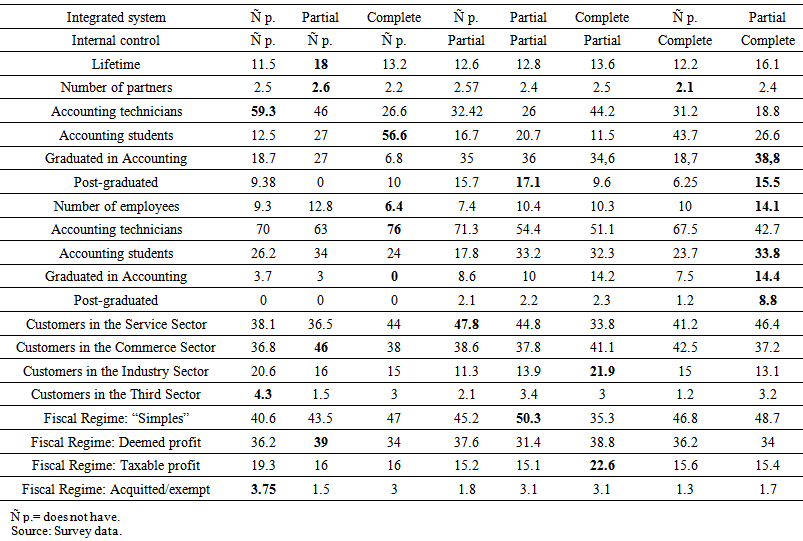

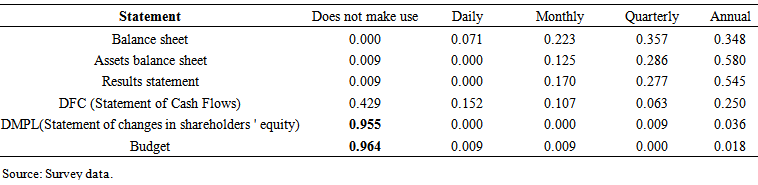

- The data obtained allow a quantitative analysis of the surveyed accounting offices’ structure and profile. Thus, 27.7% of the offices did not have an implemented internal control, 57.1%hadit partially implemented and only 15.2 had internal control completely implemented, as indicated by the survey respondents. In what concerns integrated systems, 38.4% of the offices were said not to have integrated management systems, 45.5% were partially integrated, and 16.1% had their systems completely integrated.In Table 1, we present a joint analysis of categorical variables, in which "proportion of integrated areas" is crossed with "existence of internal control" and "support for decision-making". Out of the total sample, 37.32% claim not to hold any of these categories. On the other hand, 27.23% of the offices claim to possess all three categories.

|

| Table 2. Average quantities and percentages of the variables conditioned to the existence (or not) of internal control and implemented integrated system |

| Table 3. Average frequency of issuance of accounting and financial statements |

4.2. Ordinal Regression Results

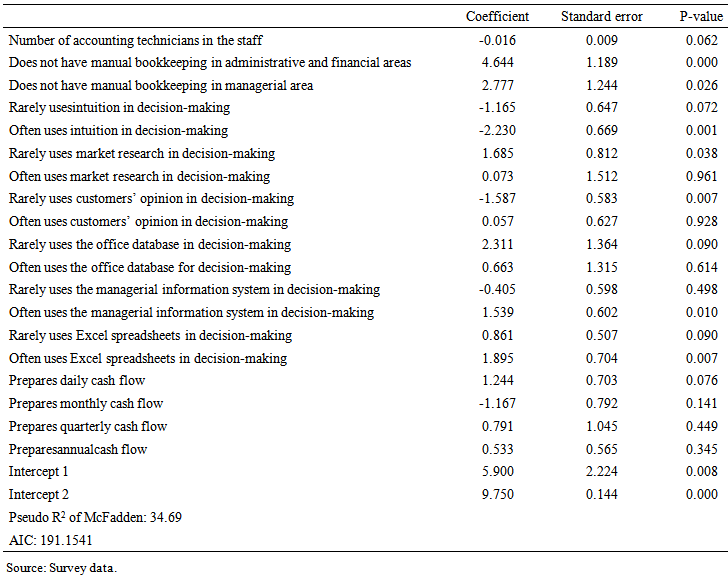

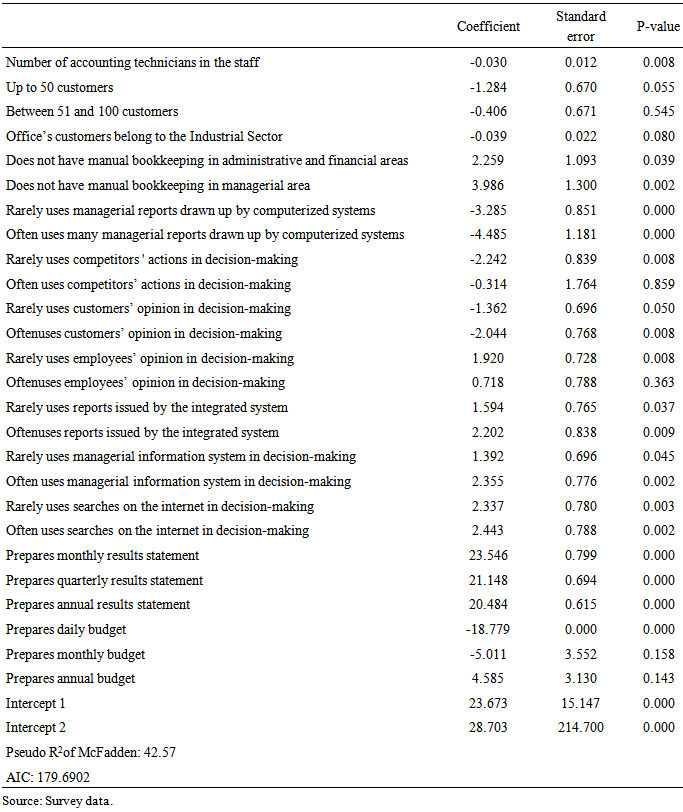

- After the descriptive analysis, multivariate associations were found in order to analyze if the characteristics of the accounting offices explain, in a combined way, the level of integration or internal control implemented. For completion of such objective, it was estimated the ordinal regression, since the dependent variables are qualitatively ordinal in nature. The Stepwise method was used to choose which out of the main variables that should be contained in the template. Once identified the variables that produced the best adjustments, they were united in a single final model. It is known that, due to the presence of multicollinearity, the standard errors of coefficients are altered, and, in extreme cases, it is impossible even to estimate the coefficients due to the singularity of the matrix of explanatory variables. Thus, it was observed the strong presence of multicollinearity among the explanatory variables of the model by means of the Variance Inflation Factor (VIF).After using the Stepwise method and evaluating the VIFs, we chose to withdraw from the set the variables "preparation of management reports and budget" when the explained variable was the offices’ integrated system. Also were withdrawn the variables "integrated reports" and "office lifetime" for not being statistically significant even at 10%.In the case of categorical variables, if one category is considered significant, all the others should be kept in the model for comparison. Table 4 contains the estimated results to explain the variable “integrated system”.

| Table 4. Estimated results for the explained variable “integrated system” |

| Table 5. Estimated results for the explained variable “internal control” |

4.3. The Management System of Accounting Offices in Accordance with the Approach of the Model of Kaplan and Cooper (1998)

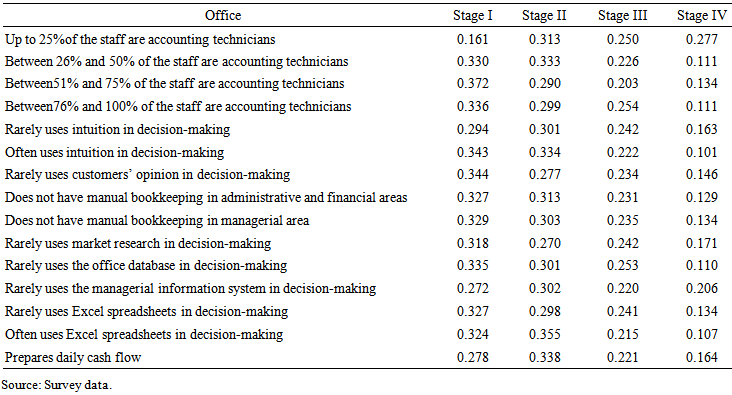

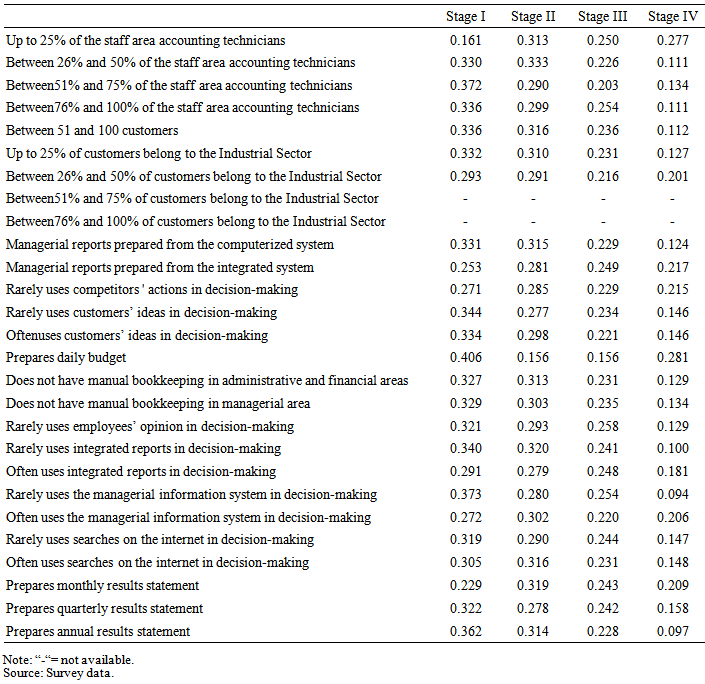

- To finalize the analysis of the results, this section presents the approach of the four-stage model developed by [24] to categorize the levels of management systems of accounting offices.As for the results, it was found that, out of the total of the 112 accounting offices surveyed, 32.84%were at Stage I. That stage is characterized by offices that present low reliability in financial and accounting reporting; 30.55% were at Stage II, which defines offices issuing financial and accounting reports periodically, with a certain degree of reliability; 23.35%were at Stage III, which includes offices that use computerized systems for the generation of financial and accounting reports and use these data for the operational and managerial control, and 13.34% were at Stage IV, which indicates the use of integrated information systems for the preparation of all financial and accounting reports that are used in the decision-making process ([24]).Most of the offices were at Stages I and II (63.39%) and the remaining at Stages II and III (36.61%). However, in this study it was noticed a trend of migration to Stages III and IV. It can be seen that these offices have similar characteristics to companies, regarding the need to ensure appropriate management systems. However, there must be reservations about the generalizations of these results, because probably there are different assumptions regarding the understanding, on the part of the respondents, in regard to the quality and levels of integration of systems. But, on the other hand, these evidences were based on the assumptions of the management model of [24]. Motivated by the same interest, [34] also noted that 80% of the processing industries of the State of Pernambuco were at Stage I or II of the model.Finally, limiting the universe of variables only to those that have positive or negative effects on the level of integration of the accounting offices, a classification was made to identify at which of the four stages these offices were. An initial consideration is related to the variable "accounting technician", which had to be categorized into the four levels, for a best viewing of each phase of the model (e.g. Table 6).

| Table 6. Stages of the accounting offices, according to the statistically significant variables used to explain the integrated information system |

| Table 7. Stages in which the accounting offices are, according to the statistically significant variables used to explain the implemented internal control |

5. Conclusions

- This study aimed at analyzing the level of management and internal control of accounting firms, using the four-stage typology developed by [24] for the design of management systems. It was possible to identify the level of integration between areas on the aspects of data quality, reporting, and strategic and operational controls, finding out the degree of use of internal control and integrated systems. Finally, the offices were classified into one of the four stages of management developed in accordance with the model of [24].The data were collected through questionnaires answered by the accountant partners who worked as administrators of the accounting offices. These respondents deeply knew all the dimensions surveyed as well as the variables that would be present in the management process. So, from the sample consisting of 112 accounting offices, it could be observed that 32.84% of them were at Stage I, 30.55% at Stage II, 23.35% at Stage III, and 13.34% at Stage IV.At Stage I, as according to the assumptions of the model, the offices have low reliability in financial and accounting reporting and have features like some sort of bookkeeping that requires time and resources for the consolidation of the different sources of reports and for closing the books at the end of each accounting period. Unexpected variations of the balances at the end of each accounting period and many adjustments entries are common. There is no control of the customers’ neither in what concerns revenues nor individualized expenses, and no strategic and operational control is made.At Stage II, the offices meet the requirements of financial reporting, but there is no frequency; they present synthetic results accounts with distorted balances; they do not have control of revenues, costs or expenses with clients, and show limited feedback, without reasonable time for the decision-making. Managerial controls are out dated and limited.At Stage III, the offices use computerized systems for the generation of financial and accounting reports and for operational control. In general, they use systems that run the accounting functions, prepare monthly or quarterly financial statements and use conventional methods of allocation of costs and expenses. These offices assess with greater precision the cost of activities, services, and clients, and have some type of strategic and operational control, but do not use it frequently.Stage IV, where only 13.34% of the offices fitted, indicates the use of integrated information systems for the preparation of all financial and accounting reports that are used in decision-making. It is defined as the integration of the management of financial reports, the most advanced stage, and with information generated with reliability and in short time, and the one that prepares periodic statements from the managerial systems; it presents data integration among all organizational areas, including the office’s customers; reports are issued frequently; the systems information is used for operational and strategic control, supporting the decision-making.The results also suggest a lesser concern of some accounting offices with internal controls both in the areas managed by the business owners and in the areas directly related to the service provided. It is to note that this type of organization tends to better manage their processes and thereby to obtain greater reliability on the information produced by the computerized systems, when they have an implemented internal control. In addition, the use of integrated systems between the areas of the office contributes to decrease of rework, increases the possibility of management of information in the short term and provides various reports to support the decision-making.Finally, it is understood that the management of accounting offices contributes to the improvement of the services they provide and to the increase of the quality and reliability of the information provided, by means of the generation and submission of financial, accounting and managerial reports to their many types of users. This study leaves room for new researches and clarifications on the subject, despite some limitations such as: the offices are located only in the region of Belo Horizonte; the difficulty in validating the four-stage model of Kaplan and Cooper in the offices that have little information about their internal controls and the difficulty of identifying how the decision-making process of the accountants and manager partners works, due to the small size of this type of company. Therefore, we suggest further investigations that try to identify at which of the four stages of management are other accounting offices in Brazil, and the application of the four-stage model to track the migration from a stage to another.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML