-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(3): 157-161

doi:10.5923/j.ijfa.20140303.02

The Contributions of Primary Mortgage Institutions (PMIS) to Real Estate Development in Nigeria

Anthonia Uduak Ubom , Uduak Bernard Ubom

Uduak Bernard Ubom, Department of Banking, Finance & Insurance, University of Uyo, Uyo

Correspondence to: Anthonia Uduak Ubom , Uduak Bernard Ubom, Department of Banking, Finance & Insurance, University of Uyo, Uyo.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This article examined the contributions of Primary Mortgage Institutions (PMIs) to real estate development in Nigeria. Specifically, the work sought to assess the role of primary mortgage institutions in housing delivery in the country, and to establish the relationship that exist between the investments and loans granted by the PMIs and real estate development in Nigeria from 1992-2012. The desk, narrative and descriptive research designs were used and the data collected from existing documents and materials mainly from the Central Bank of Nigeria, and other publications. An analysis of the characteristic movements of PMIS loans and investments was made and it was discovered that their investments were highly directed to the provision of commercial buildings at the detriment of the residential houses. It was also discovered that rigid regulatory policies and insufficient fund hinder the smooth operations of the PMIs and their contributions to real estate development in the economy. On the basis of this, it was recommended that the PMIs should redirect their loans to cater more for residential buildings and regulatory authorities should relax their rigid policies to give these institutions operational flexibility to enhance smooth operations, improved performance and induce more contributions to real estate development in Nigeria.

Keywords: Primary Mortgage Institutions (PMIs), Housing Facilities, Real Estate Development, Loans and Investments

Cite this paper: Anthonia Uduak Ubom , Uduak Bernard Ubom , The Contributions of Primary Mortgage Institutions (PMIS) to Real Estate Development in Nigeria, International Journal of Finance and Accounting , Vol. 3 No. 3, 2014, pp. 157-161. doi: 10.5923/j.ijfa.20140303.02.

Article Outline

1. Introduction

- Real estate development is multidimensional in nature. It ranges from converting ideas on papers into real properties to renovation of existing buildings, purchase of new parcels of land, developing such lands, sales of such lands, among others. The real estate developers finance the real estate deals. In other cases, they buy land, build projects, create, imagine, control and encourage the process of development. The projects could be residential buildings, commercial buildings, etc. Our major concern in this work has been on residential buildings commonly designated as housing facilities.Housing is one of the basic needs of man. From the ancient days till now, human beings always seek for an abode. From the rural settings to the urban areas, the provision of shelter is highly envisaged by the public. One may attempt to satisfy the other needs of life, but if there is no house either in the village or in the town, such a person is considered to be irresponsible. The fact is that everyone tries to provide himself or herself and/or the family with the modest accommodation irrespective of the type. That is why you see some tribes living in the bush under some kinds of shade made up of logs of woods, bamboos and sometimes with canopies, some living in settlements under shades while others live in mud houses (usually called hut). Those claiming to be rich live in block houses made of cements and other costly building materials.The story is even different when one must have acquired more cash and moves into the city. Such people acquire more acres of land and build up residential structures that are very costly for a common man to rent. The structures are rented or sold at very high (skyrocketed) prices such that residing in the buildings, only recycle among the rich. The federal government of Nigeria has made efforts through the National Housing Scheme to assist and encourage citizens of the country to acquire and own houses; yet no serious impact has been made. State governments in Nigeria have also made attempts to provide shelter. In some states, we have the one hundred unit housing scheme in most of the local governments, yet many more Nigerians do not have houses to live in. For instance, 72 million Nigerians (i.e. 44%) out of a total inhabitant of 165 million Nigerians are homeless. This implies that only 66% of the country’s total population are been accommodated in one form of houses or the other. Some of those people that are homeless live under bridges and flyovers. Many others hang out at drinking spots especially in the cities. Others make use of abandoned vehicles their houses. Many sleep in stores, to mention but a few. For those that can acquire a room or one to stay, you may find more than twenty people sleeping in a 4x4 room. The major problem is that most Nigerians cannot afford to pay for accommodation, house rents are so high that the salary of a common man (an average working class person) cannot afford. This is as a result of lack of residential structures at affordable prices and lack of funds on the part of individuals to develop and use their residential properties. Even the effort of the government to provide houses at affordable prices have been thwarted at various stages of implementation making it difficult for the funds raised by the government to be channeled properly into real estate development. For instance, out of the ₦40 billion raised by the National Housing Fund as at 1997, only ₦26.5 billion was committed to real estate development (Ojewumi, 1997; 13).It was on these notes that primary mortgage institutions were established to provide housing facilities to the people. The Federal Mortgage Bank of Nigeria was established to assist customers by providing them with loan facilities for the acquisition of accommodation. Notwithstanding these efforts, the housing problem is still persisting. It is worse in the cities, where people mainly job seekers, artisans; hawkers among other lower class of people migrate into. A good number of these people hang up in joints. Others just keep moving to rest under trees or beside kiosks or mechanic workshops or anything that can act as shelter till the next day; probably early morning. The most unfortunate thing is that the rich build mansions only for those who can afford such expenses. Available hotels that may serve as alternatives to those who can afford them are always booked in advance for periods ranging from months to years just for one particular person to hang up for reasons best known to them. It is worthy to state that residential accommodation goes for bait especially for the young jobless female graduates who move into towns newly. In some cases, houses are found in environments with very high security risk, unkempt and very untidy places with no basic infrastructural facilities such as roads, electricity and portable water, among others. This is why housing provision deserves special attention. It is one of the most important basic needs of mankind, and exerts serious impacts on productivity, as decent houses significantly increase worker’s health, wellbeing and growth (Sanusi, 2003 ; 2) and (Bichi, 1997; 3-6). According to Alebiosu, (2009:47) housing is one of the basic needs of man ranking next to food. Therefore, lacking access to quality housing is tantamount to poverty. Experts in the housing industry also decried poor state of most of the houses sold to civil servants in the country, especially those on grade levels six and below (Anule, 2006:1). It is on the basis of the aforementioned that this work examines the contributions of the Primary Mortgage Institutions (PMIs) to Housing Development in Nigeria. Specifically, the paper seeks to:i. Examine the trend of housing facilities in Nigeria from 1992 to 2012.ii. Establish the relationship that exists between the loan facilities provided by the Primary Mortgage Institutions (PMIs) and their total investments for the period.iii. Find out the relationship that exist between PMI loans, investments and real sector indicators such as industrial production index and manufacturing capacity utilization rate.iv. Find out the challenges and prospects of providing houses in Nigeria.This work is classified into four sections. Section one is the introduction. In section two, the conceptual and theoretical issues are addressed while section three presents the methodology and design of the work. Section four makes an empirical review and analysis of data. In section five, the summary, recommendations and conclusions are presented.

2. Theoretical Framework

- This section reviews related literature as put forward by various authors. It covers the nature and concept of a house, types of houses, the role of the Primary Mortgage Institutions (PMIs), challenges of PMIs in providing adequate housing facilities, establishment of the Nigeria Mortgage & Refinancing Corporation (NMRC)-what hope?

2.1. The Nature, Concept and Types of Houses

- Technically, a house could be defined as any facility that serves as an abode or simply put, a living place. The BBC English dictionary defines a house as a building in which people live. There are various definitions of the word house. The definition that relate to this study is a building or any facility/construction that people live in. In the context of this study, a house refers to a comfortable, affordable and convenient building that one lives in. It is comfortable in the sense that all or almost all facilities are available within or outside it, affordable in terms of price and convenient in terms of environment and location. This definition is necessary because there are different types of houses. In the open desert, people live in shades in the form of settlements and among animals such as goats, cows, cattle, donkeys, etc. In some other places, people live in tents in the open field or in a bush or forest. In some villages, the houses are not better than yam barns where the houses are built in the form of small muddy huts with red earth. In other villages, majority of buildings are made of blocks from cement. These are the various types of houses available mostly in the rural and semi urban areas. In the township like capital cities, there are very strong and good accommodations not available for all and amongst them you can still sight those living in slumps around these called big and fine mansions.

2.2. The Role of and Challenges of the Primary Mortgage

- Institutions in the Provision of Housing:A Primary Mortgage Institution (PMI) is a company licensed to carry out mortgage business in Nigeria. Such businesses include granting of loans or advances to any person for building, improvement or extension of a dwelling and commercial house, and the purchase of a dwelling or commercial house among others (Guidelines for PMI and OFID, 2003: 1). It is also defined as an institution that is usually a bank, either commercial or savings and loans. It could be locally owned, privately owned or corporation. This institution is a lender of money to potential homeowners who uses such loans to purchase a house, paying back the loan on monthly installments to the mortgage institution.The primary mortgage institutions operate under the coffers of the National Housing Fund Decree of 1992, revised in1996 and further revised in 2006. The federal mortgage bank serves as its apex regulatory authority. The PMIs are authorized to raise funds through borrowings from the National Housing Fund unit of the federal mortgage bank, which should not exceed fifty percent (50%) of its shareholders fund. Such loan must be secured by a block of existing mortgages previously granted by a mortgage institution. In addition, the PMI must execute a sale and administration of agreement and deed of assignment with the bank, prevent misallocation and deviation of loans, disbursed the loan after presentation of acceptable security, demand for immediate repayment of loan with interest and payment of two hundred percent penalty of interest for PMIs that misallocate their loans or be suspended from further borrowing until it complies with the regulations earlier stated (Oduwaye, Oduwaye & Adebamowo, 2003, : 5-7). From CBN report in 2003, out of about three hundred and fifty (350) PMIs licensed, only eighty one (81) were then declared healthy. In 2008, a study conducted by Oduwaye et al showed that at of sixty five primary mortgage institution in Lagos, forty three were owned privately, eighty of them were government owned, ten were owned by commercial banks, two by insurance companies and others owned the remaining two. In addition to all these, the federal mortgage bank charges fees for services rendered in granting a loan and other administration charges.Apart from the tight arrangements for PMIs as discussed above, other factors like the poverty level in the country, cost of raising a good building, poor savings, highly changing macroeconomic policies, processes in land acquisition and the complex structure of the mortgage financing in Nigeria culminate to render the services of the PMIs invaluable.

2.3. Institutional Framework for Housing Delivery in Nigeria

- In housing delivery in the country some institutions are involve. These institutions include The Federal, State, and Local Governments in Nigeria, the Federal Housing Authority, The Federal Mortgage Banks, and the Primary Mortgage Institutions. The major functions of these institutions include policy formulation, implementation, coordination and control as well as the provision of the mechanism for fund sourcing and disbursement to the various beneficiaries in the real estate projects (Acha 2007:71). For instance, the Federal Housing Authority prepares and submit to the Federal Government of Nigeria all proposals for national housing programs. They make recommendations to government on urban and regional housing developments, urban planning, sewage, water supply, transportation and communication as may be relevant to housing programs approved by the government. They also execute such housing programs as approved by the government (www.manufacturingtodaynigeria.com). The Federal Mortgage Bank of Nigeria (FMBN) serves as the apex mortgage institution in the country. It is the only institution at the source of housing financing.The state governments establish appropriate agencies to execute the housing program, establish committees for facilitation, promotes formation of building societies and housing cooperation among others while the local governments provide residential layout for low-income housing, assist in the formation of housing cooperatives, determine housing needs of the rural populace and make available the needed infrastructure that enhance real estate development (Kabir and Bastani, 2012: 4-6) and (www.manufacturingtodaynigeria.com). On its own part, the Federal Mortgage Bank of Nigeria (FMBN) provides the loans for housing schemes and projects in the country. However, the actual disbursement of such funds from the FMBN to the beneficiaries for housing development is through the Primary Mortgage Institutions (PMIs). Also, the FMBN supervises and regulates the activities of the PMIs to ensure smooth operations and to provide level playing ground for the operators in the industry. However, it should be noted that some of the regulatory policies adopted by the apex institution are somewhat too rigid. This alongside some bureaucratic bottlenecks make the operations, performance, and the contributions of the PMIs to real estate development in the country very low (www.aksgonline.com).

3. Research Methodology/Design

3.1. Research Design, Types and Sources of Data

- In this article, the desk, narrative and descriptive research designs were used. Secondary data were used in the study. The data were collected from existing documents including The Central Bank of Nigeria (CBN) Statistical bulletin, Annual abstract of statistics from the National Bureau of Statistics (NBS), internet websites and Journals, among others. The data were collected on loans and investments of the primary mortgage institutions in Nigeria from 1992-2012. The data were presented in tables and analyzed using the simple percentages and ratios. The analyses were made to address the research question posted as below:

3.2. Research Questions

- The following research questions were generated in the study:i. What is the trend of investments and loans granted by the primary mortgage institutions to the economy for real estate development from 1992-2012?ii. Is there any relationship between the loans granted by the PMIs and the total investment of these institutions in the country for the period stated above?iii. What are the challenges faced by Primary Mortgage Institutions (PMIs) in Nigeria in their operations, housing delivery and contributions to real estate development?

4. Empirical Review

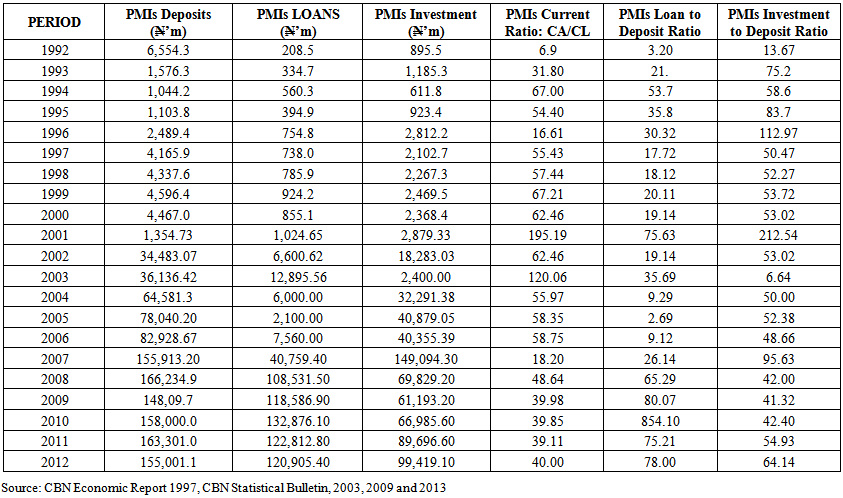

- This section presents and analysis the data collected on the operations and performance of the PMIs in Nigeria from 1992 to 2012. The data cover the volume of deposits mobilized, loans, and investment made by these institutions for the period stated above. The value of loans show how much the primary mortgage institutions could really offer to the public for housing facilities and the investment shows their real investment in housing facilities, mostly commercial buildings.

4.1. Relationship/Trend Analysis

| Table 1. Relationship between Primary Mortgage Institutions (PMIs), Loans, Investments, Deposit, Current Ratio, and Loan to Deposit 1992 to 2012 |

5. Summary and Conclusions

- Real estate development constitutes a major or significant part of economic development. Economic development is depicted by the standard of living among others. One of the major indices of standard of living is shelter. Access and or ownership of comfortable accommodation and or housing facilities increases health and the wellbeing of the citizenry. Government in Nigeria at all levels have made efforts by designing programs to provide housing facilities or shelter to the Nigerian populace yet the problem of housing deficit is still insurmountable. The role of the PMIs in solving this problem as obtainable in other countries of the world is paramount. However, these institutions are confronted with a number of problems such as paucity of funds, regulatory policy rigidity, bureaucratic bottlenecks in administration, and poor savings among others. This aside, these firms have diverted their operational focus and scope from the provision of facilities for house development to other ventures. This makes it difficult for them to make funds available at more favorable terms and conditions for development and or purchases of housing units. These have impeded their smooth operations, performance and their contributions to real estate development in the country.To this end, we recommend that regulatory authorities such as the Federal Mortgage Bank of Nigeria should relax some of the regulations guiding the operations of the PMIs and liberalize the subsector for more effective performance. Also, they should be compelled to focus more on the provision of housing facilities instead of diversifying into non-housing businesses. Above all, the Primary Mortgage Institutions should redirect major parts of their loanable funds to building and renovation of residential buildings instead of concentrating on commercial buildings and neglecting residential properties. Such focus redirection is expected to increase their impact on provision of housing and enhance their contributions to real estate development in Nigerian economy.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML