Ime T. Akpan1, Queensley Chukwudum2

1Department of Banking and Finance, University of Uyo, PMB 1017, Uyo Akwa Ibom State, Nigeria

2Department of Insurance, University of Uyo, PMB 1017, Uyo Akwa Ibom State, Nigeria

Correspondence to: Ime T. Akpan, Department of Banking and Finance, University of Uyo, PMB 1017, Uyo Akwa Ibom State, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

Abstract

This paper examines the impact of interest rate changes on the Nigerian stock market- two very key aspects of the economy of a country. It studies the behavior of the Nigerian Stock Exchange All Share Index (NSE ASI) to the changes in the central bank of Nigeria’s (CBN) interest rate over a period of 25 years (1986-2011). The problem identified indicated that the All Share Index responded differently to interest rate hikes and cuts. The objective, therefore, is to study the relationship which exists between the All Share Index and the changes in interest rates. Data obtained from the CBN and NSE was analyzed based on a six-month and twelve-month percentage change basis with their respective averages taken. The paper makes use of the bivariate and multivariate regression analysis models for periods of interest rate hikes and cuts.The study finds that the impact of interest rate is not significant when other variables affecting stock prices are controlled.

Keywords:

Interest rate, Inflation, Economic Development, Stock market, All Share Index, Monetary Policy Rate

Cite this paper: Ime T. Akpan, Queensley Chukwudum, Impact of Interest Rates on Stock Prices: An Analysis of the All Share Index, International Journal of Finance and Accounting , Vol. 3 No. 2, 2014, pp. 96-101. doi: 10.5923/j.ijfa.20140302.06.

1. Introduction

The Nigerian Central Bank's monetary tightening policies of 2011 impacted adversely on the economy of Nigeria. In a bid to support the weakening naira and curb high inflation, the interest rate was jacked up to 12 percent by the end of 2011. According to [12], the hiking in interest rates also affected the stock market.The scenario prompted the following problem statements:

2. Statement of Problem

1. How does the stock market respond to interest rate hikes?2. What could happen to the stock market when the Central Bank begins to cut rates in an attempt to increase the stimulus in the economy?3. How does interest rate variable fare when other variables affecting stock prices are controlled?Questions and problems arising prompted this article to examine the market's reaction during periods of rising and falling rates over a period of 25 years from 1986-2011.

3. Objective

The primary objective is to determine the impact of interest rate on the share prices with the case study being the All Share Index. Other specific objectives include: to examine the relationship between the monetary policy rate and the All Share Index of the Nigerian stock exchange and to assess the guideline for interpreting the behavior of the market's movement when interest rates rises or falls.

4. Theoretical Review

Stock market is an important economic indicator of any country. [13] Writes that share market makes it possible for the economy to ensure long-term commitments in real capital. [6] States that the central objective of the stock exchange worldwide remains the maintenance of the efficient market with attendant benefit of economic growth. Thus a substantial decline in the stock market gives reason to fear that a recession may be around the corner as noted by [10]. So measuring the efficiency form of stock market is very important to policy makers. A stock market index is a statistical parameter to reflect the composite value of a market characteristic. It is a quick measure to judge the overall direction of the market and the scope of its movement.The Nigerian Stock Exchange (NSE) was established in 1960 as the Lagos Stock Exchange. As of December 31, 2012, it has about 198 listed companies with a total market capitalization of about N8.9 trillion ($57 billion). All listings are included in the Nigerian Stock Exchange All Shares index.It started operations in Lagos in 1961 with 19 securities listed for trading. In December 1977 it became known as The Nigerian Stock Exchange, with branches established in some of the major commercial cities of the country.The NSE is regulated by the Securities and Exchange Commission, which has the mandate of Surveillance over the exchange to forestall breaches of market rules and to deter and detect unfair manipulations and trading practices. The Exchange has an automated trading System. Data on listed companies' performances are published daily, weekly, monthly, quarterly and annually.In order to encourage foreign investment into Nigeria, the government has abolished legislation preventing the flow of foreign capital into the country. This has allowed foreign brokers to enlist as dealers on the Nigerian Stock Exchange, and investors of any nationality are free to invest. Nigerian companies are also allowed multiple and cross border listings on foreign markets.The Exchange maintains an All-Share Index formulated in January 1984 (January 3, 1984 = 100). Only common stocks (ordinary shares) are included in the computation of the index. The index is value-weighted and is computed daily. The highest value of 66,371.20 was recorded on March 3, 2008 [5]. Also, The Exchange has introduced the NSE-30 Index, which is a sample-based capitalization-weighted index plus four sectorial indices. Similarly, four sectorial indices have been introduced to complement existing indices. These are NSE-Food/Beverages Index, (Later renamed NSE – Consumer Goods Index) NSE Banking Index, NSE Insurance Index and NSE Oil/Gas Index. [5]The All Share Index and the market capitalization capture activities and performance on the NSE [3]. [2] stressed that one percent increase in stock market capitalization ratio would lead to about thirty three percent raise in real GDP growth rate. His findings emphasize the need for a healthy positive growth in the stock market. In order to promote outstanding growth in the Nigerian stock market, the interest rate is a very important factor that must be considered because interest rates decide where we invest. [4]For an example: An investor who is given the option to choose between a 12 percent interest in fixed deposit in a bank or the stock market will most likely deposit his money in the bank than invest in stocks. Why? Because he has the chance of earning higher returns at a very low risk.Generally, interest rate is considered as the cost of capital means, the price paid for the use of money for a period of time. From the point of view of a borrower, interest rate is the cost of borrowing money (borrowing rate). From a lender's point of view, interest rate is the fee charged for lending money (lending rate) [17]. [16] Defines it as the return or yield on equity or opportunity cost of deferring current consumption into the future. Thus, [1] writes that any economy that wishes to grow must pay proper attention to the changes in interest rate. Generally, financial analysts agree that there is an inverse relationship between interest rates and stock markets. Studies conducted by [7] on the Bogota stock market and [18] reveals that stock price and interest rates are inversely correlated.This study also looks at the impact of interest rate on the ASI and assesses its effect when other significant variables like Inflation rate, Unemployment rate and Gross Domestic Product (GDP) that also affect stock prices come into play.

5. Hypothesis

The hypothesis this study aims to test is as follows:H0: interest rates has no effect on the Nigerian stock marketH1: interest rates has an effect on the Nigerian stock marketHypothesis testing is carried out with a significance level of 0.05.

6. Research Methodology

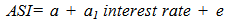

This study incorporates the descriptive statistics techniques. It involves calculating the mean of the All Share Index percentage change based on 6 months and 12 months analysis. Their respective charts are plotted to facilitate clear comparison of the effect of interest rate hikes and cuts on the ASI.The bivariate linear regression model tests the relationship between the ASI and the Interest rate as the only predictor variable. The model is given below: | (1) |

The multiple linear regression model is also adopted to control for other important variables. Although stock prices are impacted by many factors, the research incorporates three very basic economic indicators that affect stock prices into the multivariate model. They are the Inflation rate, Unemployment rate and the GDP of Nigeria with the period of 25 years.We have: | (2) |

For models I and II:a, b = constants of the modelsa1, b1,b2, b3, b4 = coefficients of the modelse, e1= error termsThe matrix correlation between the ASI percent changes and the four predictor variables is calculated to determine the degree of relationship between the variables.

7. Data Presentation and Analysis

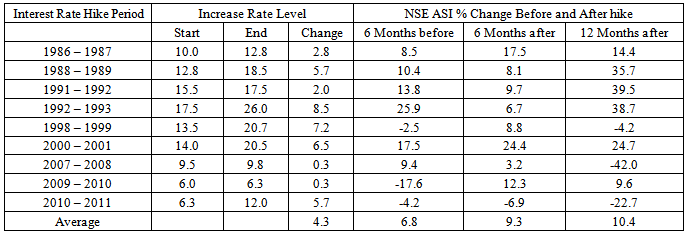

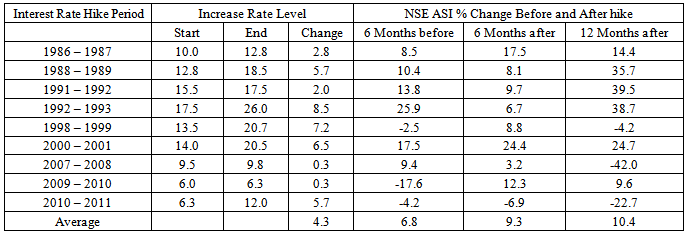

Table 1.1. ASI% change during interest rate hike

|

| |

|

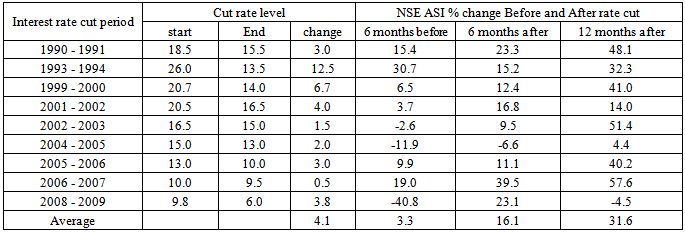

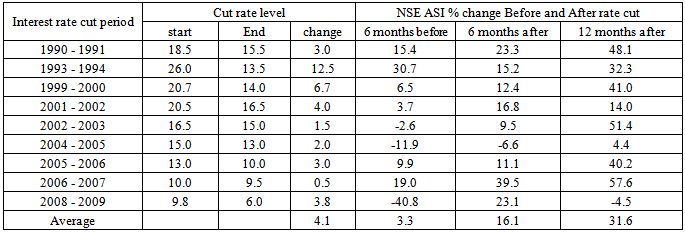

Table 1.2. ASI% Change during Interest Rate cut period

|

| |

|

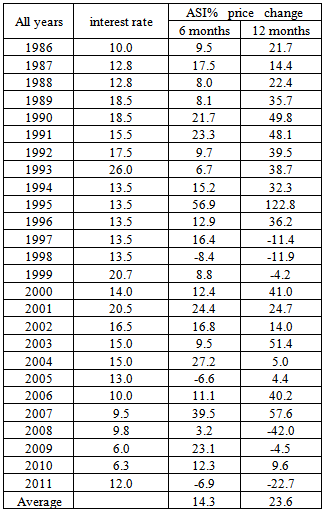

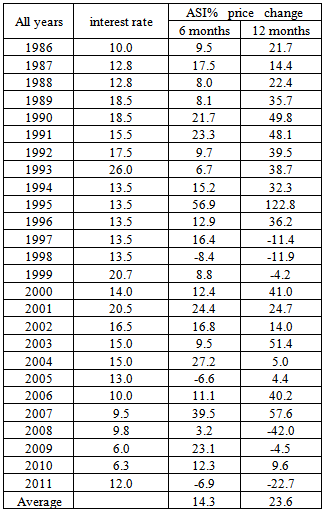

Table 1.3. ASI% change for all 25 years

|

| |

|

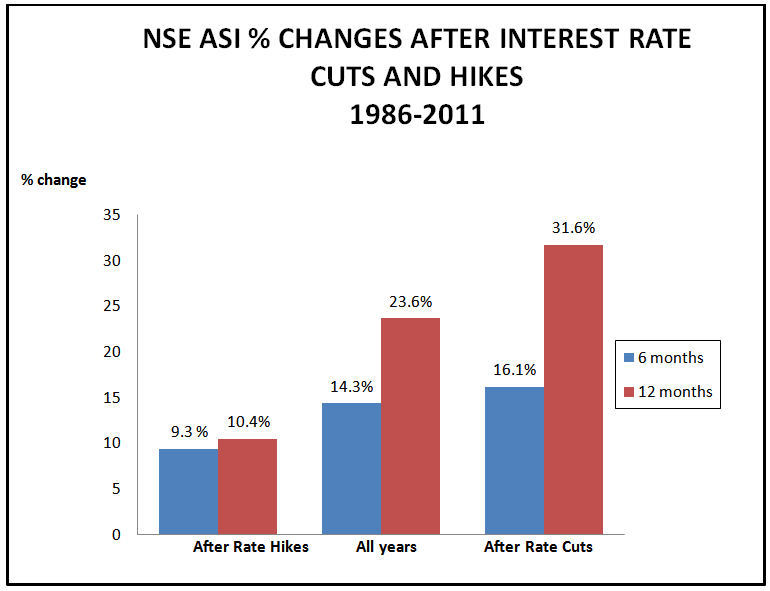

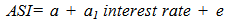

| Figure 1. NSE ASI % changes after interest rate cuts and hikes 1986-2011 |

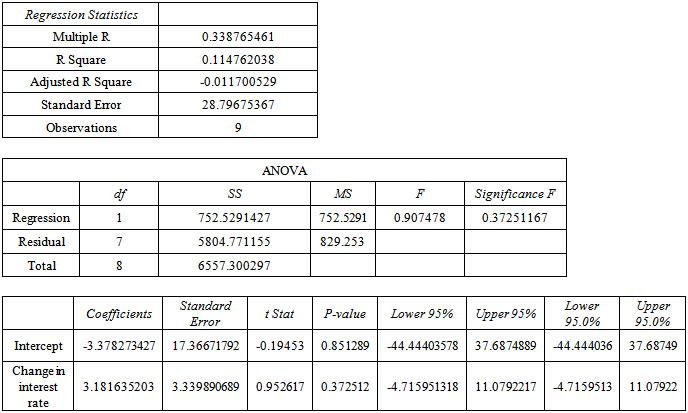

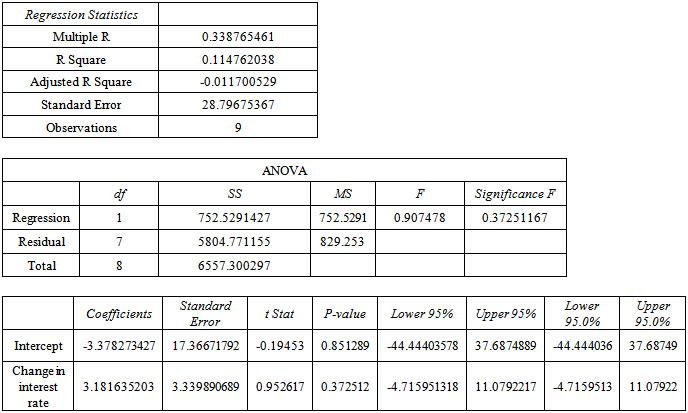

Table 2.1. Single regression analysis-ASI on interest rate (hike periods)

|

| |

|

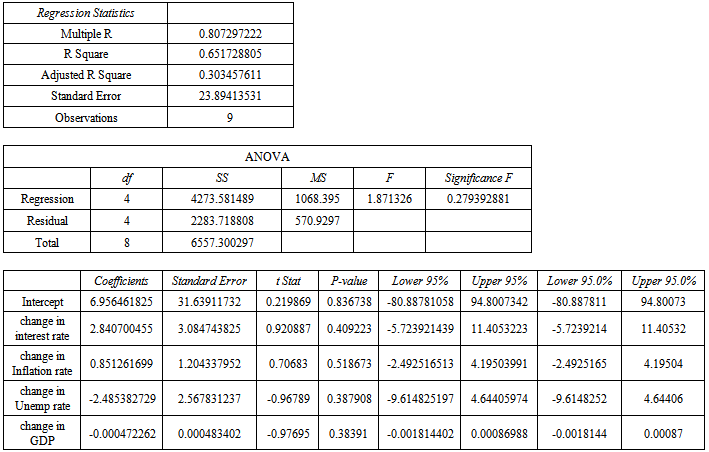

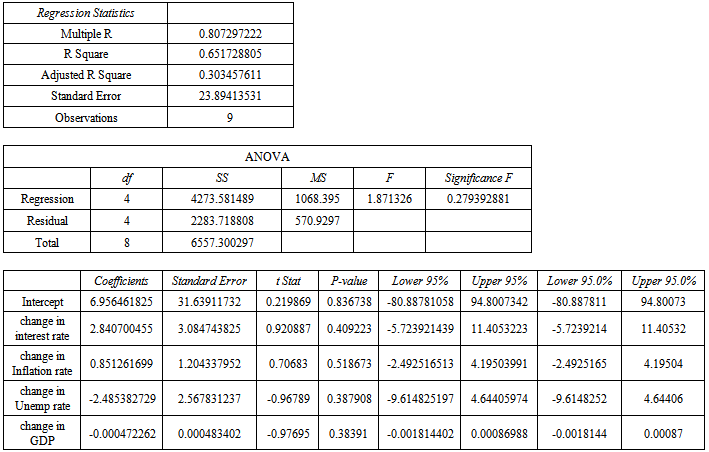

Table 2.2. Multiple regression analysis for control-ASI on 4 variables (hike periods)

|

| |

|

8. Discussion of Findings

From the six and twelve month percentage change analysis, the CBN has initiated a rate tightening program 9 times since 1986. Coincidentally, within the same period, there has been 9 interest rate cut phases. During all the 25 years, the ASI rose an average of 23.6% annually or approximately 14.3% in every six month period.After rate hikes the ASI's average for 6-month price rise was 9.3% and 12 months after, the stock prices rose with an average of 10.4%. This margin is very minimal. Based on the data analysis, the difference between the long term average annual price percent change and the annual price percent change during the rate hike period is 13.2%, this translates to a 1320 basis points. This significant difference further supports the fact that stock market returns after rate hikes is dismal. In contrast, the outcome following interest rate cuts is a different one. We see the ASI soaring to an average of 16.1% after 6 months and almost doubling its value after 12 months - an average price rise of approximately 31.6%. This also surpasses the 6 month and 12 month normal growth observed throughout the whole 25 years.In other words, during rate cut cycles, the market's response is impressive.The bivariate regression analysis further confirms in table 1.5 that interest rate, as a stand-alone predictor variable, has a negative impact on the ASI. The F-test has a p value less than α= 0.05. The p value for the interest rate is also less than 0.05. This implies that the null hypothesis does not hold when the focus variable is only interest rate changes. The predictive equation for the single regression model I becomes: A completely different result, however, comes to fore when other significant factors are brought into the scenario. This is a better reflection of what takes place in the real world. The correlation matrix in table 1.7 provides some insights into which of the independent variables are related to the ASI. It shows that the interest rate has a moderate negative correlation (-0.51) with the ASI while the highest correlation with the ASI is GDP (0.81).Table 1.6 gives the results of the multiple regression analysis for control of the three other variables incorporated into the model. The overall F-test for the model is 12.21 with a p-value of 0.000028. This means that our model is statistically significant. The R squared value of 69.9% further indicates that the fit has really improved over the simpler regression model. A look at the p-values of each variable reveals that interest rate has a p-value of 0.87. This is greater than the significance level of 0.05, hence it is not statistically significant.Regression analysis for periods of interest cuts and interest rate hikes were also carried out separately. Results of the output can be found in tables 2.0-2.3. The results show that the overall F-test is not statistically significant.

A completely different result, however, comes to fore when other significant factors are brought into the scenario. This is a better reflection of what takes place in the real world. The correlation matrix in table 1.7 provides some insights into which of the independent variables are related to the ASI. It shows that the interest rate has a moderate negative correlation (-0.51) with the ASI while the highest correlation with the ASI is GDP (0.81).Table 1.6 gives the results of the multiple regression analysis for control of the three other variables incorporated into the model. The overall F-test for the model is 12.21 with a p-value of 0.000028. This means that our model is statistically significant. The R squared value of 69.9% further indicates that the fit has really improved over the simpler regression model. A look at the p-values of each variable reveals that interest rate has a p-value of 0.87. This is greater than the significance level of 0.05, hence it is not statistically significant.Regression analysis for periods of interest cuts and interest rate hikes were also carried out separately. Results of the output can be found in tables 2.0-2.3. The results show that the overall F-test is not statistically significant.

9. Re-stated Hypothesis/Result Summary

H0: interest rates has no effect on the Nigerian stock marketH1: interest rates has an effect on the Nigerian stock marketGiven that interest rate no longer plays a significant role when we control for variables in the model II. It implies that we fail to reject the null hypothesis H0. In simple terms, the effect of interest rate on the ASI is very insignificant.

10. Policy Implication and Recommendations

The finding from the paper reveals that the historical relationship between CBN's interest rate and the ASI of the NSEis an inverse one. However, interest rate is not an important determinant when considering the changes in stock prices. Nevertheless, a continuous hike in interest rates will not be in the best interest of the economy of which the stock market is a part of. In view of this, a downward review of the current level of interest (12%) should be considered by the CBN.

References

| [1] | Acha I. and .Acha C. (2011) ‘Interest Rates in Nigeria: An Analytical Perspective Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 Vol 2, No 3. |

| [2] | Adebiyi, M. A. (2005). Capital Market Performance and the Nigerian Economic Growth Management in Nigeria Lagos: University Press. |

| [3] | Ajakaiye O. and T. Fakiyesi (2009) Global Financial Crisis Discussion Series Paper 8: Nigeria. Overseas Development Institute London. |

| [4] | Akpan I. T (2013) The Extent of Relationship between Stock Market Capitalization and Performance on the Nigerian Economy. Research Journal for finance and Accounting. Vol 4, No. 19. 181 – 187. www.iiste.org. |

| [5] | Akpolock, anon, Usman et al (2013) Nigerian Stock Exchange. Wikipedia, the Free Encyclopaedia. |

| [6] | Alile, H. (1997). Government must Divest. The Business Concord of Nigeria 2nd December, p8. |

| [7] | Arango, Luis E., A. Gonzalez, and C. E. Posada (2002) Returns and interest rate: A nonlinear relationship in the Bogotá stock market Applied Financial Economics vol.12(11), pp. 835-42, November. |

| [8] | Daferighe, E.. and Charlie S. (2012) The impact of inflation on stock market performance in Nigeria. American Journal of Social and Management Sciences. |

| [9] | James Enejo (2013) CBN Leaves Interest Rate Unchanged at 12%. This Day Live, Wednesday 25, September. |

| [10] | Mankiw, N. Gregory (1999) Macro Economics, 4th Edition, pp.472, UK: Macmillan Press Ltd. |

| [11] | Nigerian Capital Market Statistical Bulletin 2010Securities and Exchange Commission, Nigeria. |

| [12] | Okechukwu N. (2012) CBN’s Monetary policy Stifling Real Sector-Analysts. Punch, Saturday 21, April. |

| [13] | Ologunde, A.O., D.O. Elumilade, T. O. Asaolu (2006) Stock Market Capitalization and Interest Rate in Nigeria: A Time Series Analysis, International Research Journal of Finance and Economics, Issue 4, pp.154-166. |

| [14] | Oscar N. (2012) 2011 Market Review& 2012 Outlook. The Nigerian Stock Exchange. |

| [15] | Sam Stovall (2010) Industry Surveys Trends and Projections, Standard and Poor’s. |

| [16] | Uchendu,O.A (1993) Interest rate policy, savings and investment in Nigeria. CBN Quarterly Review 31(1) 34-52. |

| [17] | Uddin, M.G.S., and Alam, M.M. (2007) The Impacts of Interest Rate on Stock Market: Empirical Evidence from Dhaka Stock Exchange, South Asian Journal of Management Sciences, Vol.1 (2) pp.123-132. (ISSN 2074-2967; Publisher- Iqra University, Karachi, Pakistan. |

| [18] | Zordan, Don J. (2005) Stock Prices, Interest Rates, Investment Survival. Econometrica USA Chicago, Illinois. |

A completely different result, however, comes to fore when other significant factors are brought into the scenario. This is a better reflection of what takes place in the real world. The correlation matrix in table 1.7 provides some insights into which of the independent variables are related to the ASI. It shows that the interest rate has a moderate negative correlation (-0.51) with the ASI while the highest correlation with the ASI is GDP (0.81).Table 1.6 gives the results of the multiple regression analysis for control of the three other variables incorporated into the model. The overall F-test for the model is 12.21 with a p-value of 0.000028. This means that our model is statistically significant. The R squared value of 69.9% further indicates that the fit has really improved over the simpler regression model. A look at the p-values of each variable reveals that interest rate has a p-value of 0.87. This is greater than the significance level of 0.05, hence it is not statistically significant.Regression analysis for periods of interest cuts and interest rate hikes were also carried out separately. Results of the output can be found in tables 2.0-2.3. The results show that the overall F-test is not statistically significant.

A completely different result, however, comes to fore when other significant factors are brought into the scenario. This is a better reflection of what takes place in the real world. The correlation matrix in table 1.7 provides some insights into which of the independent variables are related to the ASI. It shows that the interest rate has a moderate negative correlation (-0.51) with the ASI while the highest correlation with the ASI is GDP (0.81).Table 1.6 gives the results of the multiple regression analysis for control of the three other variables incorporated into the model. The overall F-test for the model is 12.21 with a p-value of 0.000028. This means that our model is statistically significant. The R squared value of 69.9% further indicates that the fit has really improved over the simpler regression model. A look at the p-values of each variable reveals that interest rate has a p-value of 0.87. This is greater than the significance level of 0.05, hence it is not statistically significant.Regression analysis for periods of interest cuts and interest rate hikes were also carried out separately. Results of the output can be found in tables 2.0-2.3. The results show that the overall F-test is not statistically significant. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML